J. Bradford DeLong's Blog, page 1170

July 29, 2014

Noted for Your Afternoon Procrastination for July 29, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Bianca Marquez: Poor rate of return on for-profit universities | Washington Center for Equitable Growth

Afternoon Must-Read: Tim Pawlenty (2011): US Headed for Double-Dip | Washington Center for Equitable Growth

Afternoon Must-Read: Paul Gigot (2009): The Bond Vigilantes | Washington Center for Equitable Growth

Well, a Nice-to-See Consensus on Fiscal Stimulus...: Wednesday Focus for July 30, 2014 | Washington Center for Equitable Growth

Morning Must-Read: Philippa Skett: Ebola outbreak: What you need to know about its spread | Washington Center for Equitable Growth

Over at Project Syndicate: The Internet's Next Act: Tuesday Focus for July 29, 2014 | Washington Center for Equitable Growth

Evening Must-Read: Emily Badger: How big cities that restrict new housing harm the economy | Washington Center for Equitable Growth

Plus:

Things to Read on the Afternoon of July 29, 2014 | Washington Center for Equitable Growth

On Twitter:

@MichaelSLinden: Alberto Alesina, the go-to guy for austerity backers, is the only economist on the IGM panel to disagree that ARRA reduced unemployment.

.@MichaelSLinden (1/3) Curiously, back in 2012 Alesina said the ARRA did reduce unemployment.

.@MichaelSLinden (2/3) Alesina is thus the only economist I am aware of to have become less confident in the power of

.@MichaelSLinden (3/3) fiscal policy at the ZLB since 2012. A remarkable example of swimming against the empirical current cc:

.@MichaelSLinden (4/3) other shifts in the panel: Hoxby: no —> no answer. Judd: uncertain —> yes. Lazear: no —> off the panel

.@arindube do you understand what shifted Alesina from ARRA-effective in 2012 to ARRA-ineffective today?

Should-Reads:

David Beckworth: The Other Important Legacy of World War One: "An important point I... could not find.... WWI shattered the classical gold standard of 1870-1914, which had worked relatively well, and replaced it with an incredibly flawed one to which many attribute... the severity and global reach of the Great Depression in the 1930s. And the Great Depression... brought the Nazis to power.... Barry Eichengreen and Peter Temin.... 'At some level... the Nazis were the party of the Depression. They were a fringe group in the 1920s and grew to electoral prominence only in 1930 when economic conditions deteriorated. They gained even more seats in the Reichstag in the first election of 1932, but lost seats in the second election later that year as economic conditions appeared to improve.... Almost any model would say that better economic conditions would have decreased political support for the Nazis and therefore the probability that Hindenburg would have asked Hitler to be chancellor.' So far all the problems WWI created, the flawed interwar gold standard was probably one of the the more important ones. It led to the Great Depression which, in turn, guaranteed the rise of the Nazis and another world war. The big lesson, then, is getting the international monetary system right matters a lot."

Walter Shapiro: Hillary for Liberals: "Hillary has been through two disastrous disorganized White Houses under Bill Clinton and Obama.... She would come into the White House with a greater understanding of White House dysfunction than anyone in Democratic Party history... steel you against creating a White House where people believe they’ve invented the wheel, that they’re geniuses.... At this point, NSA spying and drone attacks are just not voting issues for liberals. Getting tough with Wall Street--like single-payer health insurance--was something much more likely to trigger an adrenaline rush for the left in 2009 than in 2016..."

Jonathan Chait: I Have Mocked Ross Douthat One Time too Many: "for his fatal flaw of detecting signs of ideological moderation in a succession of Republican figures like Sarah Palin, Eric Cantor, Tim Pawlenty, and others. Now he has finally snapped.... My piece notes that Douthat praises Ryan for his moderation, while dismissing the 2012 GOP ticket as hopelessly plutocratic, yet he defended Romney and Ryan against exactly this charge at the time. Douthat points out that he also devoted numerous items to complaining about Romney’s upper-class tilt. And yeah, he certainly did.... I argued... with Douthat--me insisting Romney’s plan cut taxes for the rich; he insisting it did not.... [And] the situations are fairly analogous. Ryan now, like Romney-Ryan then, is making a series of irreconcilable promises. Douthat is treating the more mainstream version of those premises as binding, and the more extreme promises as null and void.... What he calls 'cherry-picking', I call 'condensing'. But a less patient person would have lashed out years ago..."

Kevin Kelly: You Are Not Late: "Can you imagine how awesome it would have been to be an entrepreneur in 1985 when almost any dot com name you wanted was available? All words; short ones, cool ones. All you had to do was ask. It didn’t even cost anything to claim.... Thirty years later the internet feels saturated, bloated, overstuffed.... Even if you could manage to squeeze in another tiny innovation, who would notice it?.... But, but... here is the thing. In terms of the internet, nothing has happened yet.... Most of the greatest products running the lives of citizens in 2044 were not invented until after 2014.... Here is the other thing the greybeards in 2044 will tell you: Can you imagine how awesome it would have been to be an entrepreneur in 2014? It was a wide-open frontier! You could pick almost any category X and add some AI to it, put it on the cloud. Few devices had more than one or two sensors in them, unlike the hundreds now. Expectations and barriers were low. It was easy to be the first. And then they would sigh, 'Oh, if only we realized how possible everything was back then!' So, the truth: Right now, today, in 2014 is the best time to start something on the internet.... Today truly is a wide open frontier. It is the best time EVER in human history to begin. You are not late."

Paul Krugman: How Prophets Get Lonely: "At Bloomberg View, Leonid Bershinksy weeps over the cruel world that for some reason isn’t listening to Jaime Caruana of the BIS, who warns that we must raise interest rates now now now. Why is this prophet so lonely? Well, it might have something to do with the fact that three years ago Caruana and the BIS warned that interest rates must rise to avert a surge of inflation. That didn’t happen.... Now, everyone gets things wrong sometimes. But when that happens, you’re supposed to think about why you were wrong, and reconsider your policy views. If the BIS did any soul-searching, nobody else noticed.... Why, exactly, should anyone take its views seriously?... But being a hard-money guy seems to mean never having to reconsider..."

And:

Tim Murphy: "Oh Magog! Why End-Times Buffs Are Freaking Out About Syria. Novelist Joel Rosenberg has the ear of Rick Santorum, Rick Perry, and the Heritage Foundation. He thinks conflict in Syria was foretold by the Old Testament..."

*Robert Rubin: * How ignoring climate change could sink the U.S. economy

Brian Beutler: Why Are Conservative Health Journalists Covering for Halbig Truthers?

Mallory Ortberg:Ayn Rand's Harry Potter and the Goblet of Fire

And Over Here:

Obedience, Embracing, Normalcy and Failure: Ariel Rubenstein on the Bombs and the Missiles: Live from Tel Aviv University CCXXVIII: July 29, 2014 (Brad DeLong's Grasping Reality...)

Over at Project Syndicate: The Internet's Next Act (Brad DeLong's Grasping Reality...)

Liveblogging World War I: July 29, 1914: Kaiser Wilhelm of Germany and Czar Nicholas of Russia Exchange Telegrams (Brad DeLong's Grasping Reality...)

Tuesday Hoisted from the Non-Internet from 600 Years Ago: Tom O'Bedlam (Brad DeLong's Grasping Reality...)

Should Be Aware of:

Philippa Skett: Ebola outbreak: What you need to know about its spread: "The recent Ebola epidemic in West Africa has so far claimed more than 670 lives.... Now it has reached Lagos in Nigeria.... Ebola... causes extensive internal bleeding, and can lead to those infected dying from shock. Initially, those infected experience a sudden onset of fever, muscle pain, weakness, headaches, a sore throat and vomiting and diarrhoea.... Ebola is highly contagious and can be transmitted even after those infected have died, because the virus is transmitted via bodily fluids. It has a 90% fatality rate.... Bausch thinks it is unlikely that the outbreak will spread through Europe or the US if someone infected gets on an international plane.... Currently there is no cure..."

Lars Syll: What to do to make economics a relevant and realist science: "What shall neoclassical economists do when the modeling assumptions made are shown to be harmful and not even remotely matching reality?... (1) Stop pretending that we have exact and rigorous answers.... (2) Stop the childish and exaggerated belief in mathematics.... (3) Stop pretending that there are laws.... (4) Stop treating other social sciences as poor relations.... (5) Stop building models and making forecasts of the future based on totally unreal microfounded macromodels with intertemporally optimizing robot-like representative actors equipped with rational expectations. This is pure nonsense. We have to build our models on assumptions that are not so blatantly in contradiction to reality. Assuming that people are green and come from Mars is not a good--not even as a 'successive approximation'--modeling strategy."

Already-Noted Must-Reads:

Tim Pawlenty (2011): US headed for double-dip: "I think we're headed for a double-dip. That's my personal view.... It may look like there is temporary improvement because they have artificially infused the economy with government money, but the consequences of that will, as sure as we're sitting here, will rear its head..."

Emily Badger: How big cities that restrict new housing harm the economy: "For the last couple of years San Francisco has been erupting with periodic protests aimed, rather imprecisely, at a nexus of grievances related to gentrification, affordable housing, transportation, the tech industry, newcomers to the city, its changing skyline and Silicon Valley to the south. The city is screaming, although at what its protestors seem a little confused. 'In my view, the whole debate here misses the point', says Enrico Moretti.... 'People are marching against Google buses when they should be marching for more housing permits.' At the root of San Francisco's tension is a mismatch of supply and demand: Affluent workers have been flocking to the area for its tech jobs, but as the number of jobs in the region has grown, the number of housing units to accommodate people taking them hasn't remotely kept pace. As a result, rents are going up. Low-income residents are pushed out. Landlords who see more lucrative opportunity in condo conversions have ramped up evictions. 'Once I started seeing what was going on in the San Francisco public debate, I got appalled by the lack of understanding of basic economics among the general public, the protesters', Moretti says. 'And it’s even more problematic among policymakers.' The culprit here isn't really the tech industry. It's much-harder-to-protest land-use policy. And from Moretti's point of view, the rest of us should care... because the economic repercussions of such local decisions stretch nationwide..."

Paul Gigot (2009): The Bond Vigilantes: "The disciplinarians of U.S. policy makers return. They're back.... The vigilantes... appear to be returning with a vengeance now that Congress and the Federal Reserve have flooded the world with dollars to beat the recession. Treasury yields leapt again yesterday at the long end, with the 10-year note climbing above 3.7%.... Investors are now calculating the risks of renewed dollar inflation. They have cause to be worried, given Washington's astonishing bet on fiscal and monetary reflation.... Chinese and other dollar asset holders are nervous. They wonder--as do we--whether the unspoken Beltway strategy is to pay off this debt by inflating away its value.... The Fed is desperate to keep mortgage rates low to reflate the housing market, and last week it promised to inject hundreds of billions of dollars.... This week the bond vigilantes are showing what they think of that offer, bidding up yields even higher. It's not going too far to say we are watching a showdown between Fed Chairman Ben Bernanke and bond investors, otherwise known as the financial markets. When in doubt, bet on the markets."

Greg Sargent: Senate documents and interviews undercut ‘bombshell’ lawsuit against Obamacare: "Documents from the Senate committees that worked on versions of the bill in 2009--combined with a close look at the history of the phrase itself, and interviews with staffers directly involved in the drafting of the statutes--strongly undercut the argument that the law did not intend or provide subsidies to those on the federal exchange..."

Obedience, Embracing, Normalcy and Failure: Ariel Rubenstein on the Bombs and the Missiles: Live from Tel Aviv University CCXXVIII: July 29, 2014

Ariel Rubenstein: Four Comments on the Situation: Obedience, Embracing, Normalcy and Failure: Obedience: Contempt for obedience...

Ariel Rubenstein: Four Comments on the Situation: Obedience, Embracing, Normalcy and Failure: Obedience: Contempt for obedience...

...I take pride in the fact that when the sirens go off, I demonstratively refrain from heading to a protected space. It's not because I'm courageous. I have my fears. But rationality is not necessarily a dirty word. The chance of being injured by the “flying pipes” in Gush Dan are immeasurably lower than the chances of being hurt on the sidewalks of Tel Aviv during times of calm, not to speak of the risk of catching a fatal virus when entering a hospital. The chances are so low that the fact that Israelis are responding en masse to the directives of the Home Front Command does not reflect a reasonable means of protection; rather, it is primarily an expression of participation in a national carnival.

All blind conformity to directives from above, from any authority, is contemptible in my view. Even if this behavior saves a tiny number of injuries, I flinch from the joy in which the masses of Israelis submit to the directives that mainly fabricate a dubious "togetherness."

Everyone embraces everyone: The battle front embraces the home front, the home front embraces the battle front. The media channels manufacture drama when there is drama, and primarily when there is no drama. In my neighborhood, they were collecting food for IDF soldiers until midnight yesterday. I hope that the food finds its way to the elderly, including Holocaust survivors, whose cupboards are not cornucopias and whom, of course, we all embrace, always.

One journalist, who was formerly a member of a Jewish terrorist organization, writes:

The summer of 5774 is becoming a summer of sobriety and unity ... in the face of mournful tidings and missile barrages, a huge and quiet demonstration has assembled here of millions of determined Jews, arm in arm from all of the camps.

In fact, the durability of this unity is about as strong as the solidarity at the airport counters in Athens, where the embracers pummeled each other to get a seat on a flight back to Israel. This is a fake unity that is not really being tested now. This is not the War of Independence or the Yom Kippur War. For most of those who are embracing (though not everyone, of course), this war is exhilarating at the danger level of a roller coaster at an amusement park. These are deluxe conditions in which to embrace and exhilarate. No one should think that Israel's next wars (and it's reasonable to expect there will be such wars since we are stuck in the throat of a hostile world) will look like this "war." Those who don't understand what a real war looks and feels like should ask his parents and grandparents.

Normalcy: The embracing Israeli also feels like a victim. One of the statements I can't bear is that our children deserve a more normal life. To those bemoaning the lack of normalcy: Please note that for most human beings, over the course of most of human history, the proximity of death has been a routine experience. Abnormal life is actually that of Norway and New Zealand. Our children have a pretty good life, all in all. Most of them will remember the sirens as a warm and exciting event. They generally do not see the pictures of the children in Gaza.

Failure: Some are speaking about our failure in allowing Hamas to develop mighty offensive capabilities. Hamas and Israel have an interest in aggrandizing the strength of Hamas. Netanyahu is not ashamed to mention in the same breath the firing of rockets and the blitz on London in World War II. True, it is not reasonable to allow continuous shooting on Sderot, and puffs of smoke in the skies of Tel Aviv are also unacceptable. On the other hand, a bit of proportion in regard to the relative strength of Hamas would not hurt.

Little David is the king of high‐tech, the world champion in defense industries and holds the patent on the Jewish genius. The Philistine Goliath uses tunnels and catapults, technologies that were also known in biblical times. And perhaps our real failure is that for many years we read about the blockade on the population in Gaza and turned the next page. Today too we know that in the name of security and the right to the land we will continue to expand settlements and hold millions of Palestinians under occupation and siege, and we do not internalize the fact that we are also partners in nurturing the next generations of haters and avengers.

Over at Project Syndicate: The Internet's Next Act

Over at Project Syndicate Ten years ago we had ridden the bust of the internet bubble, picked ourselves up, and continued on. It was true that it had turned out to be harder than people expected to profit from tutoring communications technologies. That, however spoke to the division of the surplus between consumers and producers--not the surplus from the technologies. The share of demand spent on such technologies looked to be rising. The mindshare of such technologies looked to be rising much more rapidly. READ MOAR at Equitable Growth

Over at Project Syndicate Ten years ago we had ridden the bust of the internet bubble, picked ourselves up, and continued on. It was true that it had turned out to be harder than people expected to profit from tutoring communications technologies. That, however spoke to the division of the surplus between consumers and producers--not the surplus from the technologies. The share of demand spent on such technologies looked to be rising. The mindshare of such technologies looked to be rising much more rapidly. READ MOAR at Equitable Growth

Thus a decade ago we—or at least I—could look forward semi-confidently to more of the measured North Atlantic prosperity-frontier productivity growth rates characteristic of the 1950s, 1960s, and 1990s, and the fading of the anemic Nixonian 1970s and Reaganite 1980s into memory. Virtual experiences and information would become an increasing part of what we cared about and become essentially free. Stuff would become hyper-cheap. And capabilities would be pulled along in the gravity of the other two. Nearly all citizens of the North Atlantic would then find the material world, at least, to be a cornucopia.

How have we gone awry?

First, the virtual-experiences-and-information part is coming true. Gossiping with and about our imaginary friends, frenemies, and enemies; voyaging to and seeing things that may or may not exist; protecting our imaginary allies; and vanquishing our imaginary enemies--all of these dreams are becoming not just easier and cheaper to dream but the talent, skill, energy, and technology equipping us to dream more interesting dreams inspires and will continue to inspire ever-more awe. I have put it in a way to make you ask: "So what?" But since before Homer began to sing around the hearthfire about the wrath of Akhilleus and what followed therefrom, our dreams have been our primary recreation. It is one of the major things that wealth is for.

Second, the stuff-becoming-hyper-cheap part is coming true. Simply go to a WalMart, or a CostCo, or any of their analogues outside the United States and compare to a generation or two ago. The first consequence of the computer and communications revolution was to put every factory in the world cheek-by-jowl with its market, and thus to allow workers very far from California or New York State or Britain or Germany to bid for the business of making even sophisticated manufactures for the consumers of Los Angeles and New York City and London and Frankfurt. And the next consequence Will be the robotization of global manufacturing.

But even as the real prices of virtual experiences, information, and stuff have collapsed and continue to collapse relative to other scarce and desired commodities, value of human labor located in the North Atlantic has been going down as well. North Atlantic labor is and will be no longer valued so much for its location, its ability to move things with large muscles, its ability to manipulate things with small muscles, and even the ability of the half-a-shoebox 50-watt supercomputer that are human brains to serve as basic cybernetic components in process control loops. And this has meant that capabilities--in many cases the capabilities that are in the sea of middle-class status--appear and are increasingly out of reach for what may be becoming the bulk of the North Atlantic population. A job in which one is a valuable part of the useful production team that fits into a career. The ability to keep medical catastrophes from also becoming household financial catastrophes. A dwelling place that does not transform getting where you need to go into a huge shlepp. Affordable education for your children then give them opportunity for upward mobility. The bulk of the population, especially in the United States, greatly feels that our economy is vastly underperforming along this dimension of providing capabilities relative to what we confidently expected two generations ago.

For those who primarily value the virtual experiences, the information, and the stuff, modern North Atlantic society is a cornucopia, a paradise. And the same is true for those lucky enough to have been able to capture an inordinate share of the value created as abundance and politics have put enormous downward pressure on the rewards of labor. But for everybody else who primarily value the capabilities that are the indicia of what they used to think of as middle-class status? What they want to demand--although they really do not know it--is that their politicians and plutocrats figure out a way to connect and use hyper-cheap stuff and effectively-free information and virtual experiences to provide what are the key middle-class capabilities.

771 words

Liveblogging World War I: July 29, 1914: Kaiser Wilhelm of Germany and Czar Nicholas of Russia Exchange Telegrams

Kaiser Wilhelm of Germany and Czar Nicholas of Russia exchange telegrams:

In the early hours of July 29, 1914, Czar Nicholas II of Russia and his first cousin, Kaiser Wilhelm II of Germany, begin a frantic exchange of telegrams regarding the newly erupted war in the Balkan region and the possibility of its escalation into a general European war.

One day prior, Austria-Hungary had declared war on Serbia, one month after the assassination in Sarajevo of Austrian Archduke Franz Ferdinand and his wife by a Serbian nationalist. In the wake of the killings, Germany had promised Austria-Hungary its unconditional support in whatever punitive action it chose to take towards Serbia, regardless of whether or not Serbia's powerful ally, Russia, stepped into the conflict. By the time an ultimatum from Vienna to Serbia was rejected on July 25, Russia, defying Austro-German expectations, had already ordered preliminary mobilization to begin, believing that Berlin was using the assassination crisis as a pretext to launch a war to shore up its power in the Balkans.

The relationship between Nicholas and Wilhelm, two grandsons of Britain's Queen Victoria, had long been a rocky one. Though Wilhelm described himself as Victoria's favorite grandson, the great queen in turn warned Nicholas to be careful of Wilhelm's "mischievous and unstraight-forward proceedings." Victoria did not invite the kaiser, who she described to her prime minister as "a hot-headed, conceited, and wrong-headed young man," to her Diamond Jubilee celebration in 1897, nor her 80th birthday two years later. Czar Nicholas himself commented in 1902 after a meeting with Wilhelm: "He's raving mad!" Now, however, the two cousins stood at the center of the crisis that would soon escalate into the First World War.

"In this serious moment, I appeal to you to help me," Czar Nicholas wrote to the kaiser in a telegram sent at one o'clock on the morning of July 29:

An ignoble war has been declared to a weak country. The indignation in Russia shared fully by me is enormous. I foresee that very soon I shall be overwhelmed by the pressure forced upon me and be forced to take extreme measures which will lead to war.

This message crossed with one from Wilhelm to Nicholas expressing concern about the effect of Austria's declaration in Russia and urging calm and consideration as a response.

After receiving the czar's telegram, Wilhelm cabled back:

I... share your wish that peace should be maintained. But... I cannot consider Austria's action against Serbia an 'ignoble' war. Austria knows by experience that Serbian promises on paper are wholly unreliable. I understand its action must be judged as trending to get full guarantee that the Serbian promises shall become real facts.... I therefore suggest that it would be quite possible for Russia to remain a spectator of the Austro-Serbian conflict without involving Europe in the most horrible war she ever witnessed.

Though Wilhelm assured the czar that the German government was working to broker an agreement between Russia and Austria-Hungary, he warned that if Russia were to take military measures against Austria, war would be the result.

The telegram exchange continued over the next few days, as the two men spoke of their desire to preserve peace, even as their respective countries continued mobilizing for war. On July 30, the kaiser wrote to Nicholas:

I have gone to the utmost limits of the possible in my efforts to save peace....Even now, you can still save the peace of Europe by stopping your military measures.

The following day, Nicholas replied:

It is technically impossible to stop our military preparations which were obligatory owing to Austria's mobilization. We are far from wishing for war. As long as the negotiations with Austria on Serbia's account are taking place my troops shall not make any provocative action. I give you my solemn word for this.

But by that time things had gone too far: Emperor Franz Josef had rejected the kaiser's mediation offer, saying it came too late, as Russia had already mobilized and Austrian troops were already marching on Serbia.

The German ambassador to Russia delivered an ultimatum that night—halt the mobilization within 12 hours, or Germany would begin its own mobilization, a step that would logically proceed to war. By four o'clock in the afternoon of August 1, in Berlin, no reply had come from Russia. At a meeting with Germany's civilian and military leaders—Chancellor Theobald Bethmann von Hollweg and General Erich von Falkenhayn—Kaiser Wilhelm agreed to sign the mobilization orders.

That same day, in his last contribution to what were dubbed the "Willy-Nicky" telegrams, Czar Nicholas pressed the kaiser for assurance that his mobilization did not definitely mean war. Wilhelm's response was dismissive:

I yesterday pointed out to your government the way by which alone war may be avoided.... I have... been obliged to mobilize my army. Immediate affirmative clear and unmistakable answer from your government is the only way to avoid endless misery. Until I have received this answer alas, I am unable to discuss the subject of your telegram. As a matter of fact I must request you to immediatly [sic] order your troops on no account to commit the slightest act of trespassing over our frontiers.

Germany declared war on Russia that same day.

Tuesday Hoisted from the Non-Internet from 600 Years Ago: Tom O'Bedlam

From the hag and hungry goblin,/That into rags would rend ye,

The spirit that stands/By the naked man

In the Book of Moons, defend ye,

That of your five sound senses,/You never be forsaken,

Nor wander from/Yourselves with Tom,

Abroad to beg your bacon.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

Of thirty bare years have I,/Twice twenty been enraged,

And of forty been/Three times fifteen,

in durance soundly caged,

In the lordly lofts of Bedlam,/With the stubble soft and dainty,

Brave bracelets strong,/Sweet whips ding-dong,

With wholesome hunger plenty.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

With a thought I took for Maudlin,/And a cruse of cockle pottage.

With a thing thus tall,/Sky bless you all,

I befell into this dotage.

I slept not since the Conquest,/Till then I never waked.

Till the roguish boy/Of love where I lay

Me found and stripped me naked.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

When short I have shorn my sow's face,/And swigged my horny barrel,

In an oaken inn,/I pound my skin

As a suit of gilt apparel.

The Moon's my constant mistress,/And the lonely owl my marrow.

The flaming drake/and the night crow make

Me music to my sorrow.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

The palsy plagues my pulses,/When I prig your pigs or pullen.

Your culvers take,/or matchless make

Your Chanticleer or Sullen.

When I want provant, with Humphry/I sup, and when benighted,

I repose in Paul's/with waking souls,

Yet never am affrighted.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

I know more than Apollo,/For oft when he lies sleeping

I see the stars/at mortal wars

In the wounded welkin weeping.

The moon embrace her shepherd,/And the Queen of Love her warrior,

While the first doth horn/the star of morn,

and the next the heavenly Farrier.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

The Gypsies, Snap and Pedro,/Are none of Tom's comradoes,

The punk I scorn,/and the cutpurse sworn

And the roaring boy's bravadoes.

The meek, the white, the gentle,/Me handle not nor spare not;

But those that cross/Tom Rynosseross

Do what the panther dare not.

While I do sing "Any food, any feeding?/Money, drink, or clothing?

Come dame or maid,/Be not afraid--

Poor Tom will injure nothing."

With an host of furious fancies,/Whereof I am commander.

With a burning spear/And a horse of Air,

To the wilderness I wander.

By a knight of ghosts and shadows,/I summoned am to tourney

Ten leagues beyond/The wild world's end--

Methinks it is no journey.

..."

July 28, 2014

Noted for Your Evening Procrastination for July 28, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Afternoon Must-Read: Danny Vinik: Richard Fisher Has Wrongly Warned of Inflation 5 Times Since 2011 | Washington Center for Equitable Growth

Is U.S. at Immediate Risk of Becoming "Argentina"?: Monday Smackdown/The Honest Broker for the Week of July 12, 2014 | Washington Center for Equitable Growth

Monetarist, Keynesian, and Minskyite Depressions Once Again: Yes, Lloyd Metzler Was the Greatest Chicago Macroeconomist Ever: The Honest Broker for the Week of July 19, 2014 | Washington Center for Equitable Growth

Morning Must-Read: Gabriel Chodorow-Reich: Financial Stability and Monetary Policy | Washington Center for Equitable Growth

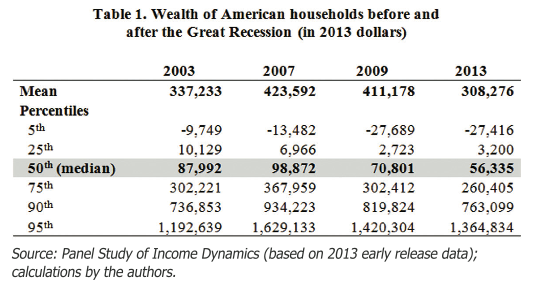

Morning Must-Read: Fabian Pfeffer et al.: Wealth Levels, Wealth Inequality, and the Great Recession | Washington Center for Equitable Growth

Lunchtime Must-Read: Simon Wren-Lewis: Synthesis!? David Beckworth's Insurance Policy | Washington Center for Equitable Growth

Nick Bunker: The retail sector and the future of American wages | Washington Center for Equitable Growth

Plus:

Things to Read on the Evening of July 28, 2014 | Washington Center for Equitable Growth

Should-Reads:

Yuriy Gorodnichenko: MH17: "The separatists, or more appropriately terrorists, have by now killed hundreds of people in Slovyansk, Kramatorsk, Donetsk, Luhansk and many other cities in Eastern Ukraine. And their violence and brutality has only been escalating.... The separatists firmly believed that they had shot down another military airplane and quickly claimed credit for it in social media. However, slowly they realized that the airplane was a civilian one.... This would have never happened if Russia’s President Vladimir Putin did not give BUKs, tanks, guns and other arms to the terrorists.... This would also never have happened if the international community had not been so complacent about Putin’s aggression against Ukraine.... The time has come for the international community to show leadership and put together a united front to stop this evil. It could not be any more black and white than it is now."

David Atkins: The four basic American reactions to record inequality: "Those on the progressive left understand that at some level the takings of the top 4% constitute a theft from the other 96% who have lost over a third of their net worth.... Those in the neoliberal/center-left camp do believe that modern inequality is a problem, but that this too shall pass and we can trudge along as usual after a recovery.... Then you have the center-right. They take rational market theory as an article of faith, believing with religious fervor that if the labor and capital markets are allowed to act unimpeded, then both labor and capital will find a comfortable, fair and balanced price. No amount of evidence can convince them that both human life and dignity are priced incredibly cheap on the open market, or that that late 19th century was not, in fact, the model of a moral or economically functional society.... Finally, there is the far right. These are the True Believers: the ones who not only buy into the center-right line, but also the raw Objectivism of Ayn Rand and Fox News that says that the only economic injustice in society is the one being perpetrated by the government itself, taking money from the 'deserving' and giving it to the 'undeserving'. In this view, the only inequality that matters to them is redistributive taxation to “others” in society..."

Danny Vinik: Richard Fisher Has Wrongly Warned of Inflation 5 Times Since 2011: "This isn't the first time Fisher has been at odds with his colleagues. When the Fed undertook 'Operation Twist' in 2011, Fisher was one of three members of the Federal Open Market Committee... to dissent. He's... been the committee’s staunchest inflation hawk... Monday’s... was just the latest of many warnings.... April 8, 2011: 'Having done our job, I see many risks to the Federal Reserve overstaying its position...' September 27, 2011: 'I might conclude by sharing my concerns about the prospect of temporarily allowing more inflation as a means of unlocking expansion in final demand.... [O]nce unleashed, inflation combines with stagnation to make stagflation...' April 10, 2012: 'I’m just reporting what I hear on the street, which is a real concern that with our expanded balance sheet, we are just a little bit in an ember of what could become an inflationary fire.' September 20, 2012: 'I do not see an overall argument for letting inflation rise to levels where we might scare the market...' 5. June 4, 2013: 'I argue that the Fed is, at best, pushing on a string and, at worst, building up kindling for speculation and eventually, a massive shipboard fire of inflation.' So take Fisher's predictions with a grain of salt. More than anyone else on the FOMC, he has been wrong about the economic implications of Fed policy...

And:

Brad DeLong (2006): Is Macroeconomics Hard? (Brad DeLong's Grasping Reality...)

Brad DeLong (2012): Readings for: Why Have We Changed Our Minds on Fiscal Policy?

Julia Belluz: The business model for antibiotics is broken. Here are three alternatives you didn't know about

'Galaxy Quest': The Oral History

Jared Bernstein: Don’t kid yourself: North Carolina likely hurt people when it cut unemployment benefits

And Over Here:

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Afternoon Must-Read: Danny Vinik: Richard Fisher Has Wrongly Warned of Inflation 5 Times Since 2011 | Washington Center for Equitable Growth

Is U.S. at Immediate Risk of Becoming "Argentina"?: Monday Smackdown/The Honest Broker for the Week of July 12, 2014 | Washington Center for Equitable Growth

Monetarist, Keynesian, and Minskyite Depressions Once Again: Yes, Lloyd Metzler Was the Greatest Chicago Macroeconomist Ever: The Honest Broker for the Week of July 19, 2014 | Washington Center for Equitable Growth

Morning Must-Read: Gabriel Chodorow-Reich: Financial Stability and Monetary Policy | Washington Center for Equitable Growth

Morning Must-Read: Fabian Pfeffer et al.: Wealth Levels, Wealth Inequality, and the Great Recession | Washington Center for Equitable Growth

Lunchtime Must-Read: Simon Wren-Lewis: Synthesis!? David Beckworth's Insurance Policy | Washington Center for Equitable Growth

Nick Bunker: The retail sector and the future of American wages | Washington Center for Equitable Growth

Plus:

Things to Read on the Evening of July 28, 2014 | Washington Center for Equitable Growth

Should-Reads:

Yuriy Gorodnichenko: MH17: "The separatists, or more appropriately terrorists, have by now killed hundreds of people in Slovyansk, Kramatorsk, Donetsk, Luhansk and many other cities in Eastern Ukraine. And their violence and brutality has only been escalating.... The separatists firmly believed that they had shot down another military airplane and quickly claimed credit for it in social media. However, slowly they realized that the airplane was a civilian one.... This would have never happened if Russia’s President Vladimir Putin did not give BUKs, tanks, guns and other arms to the terrorists.... This would also never have happened if the international community had not been so complacent about Putin’s aggression against Ukraine.... The time has come for the international community to show leadership and put together a united front to stop this evil. It could not be any more black and white than it is now."

David Atkins: The four basic American reactions to record inequality: "Those on the progressive left understand that at some level the takings of the top 4% constitute a theft from the other 96% who have lost over a third of their net worth.... Those in the neoliberal/center-left camp do believe that modern inequality is a problem, but that this too shall pass and we can trudge along as usual after a recovery.... Then you have the center-right. They take rational market theory as an article of faith, believing with religious fervor that if the labor and capital markets are allowed to act unimpeded, then both labor and capital will find a comfortable, fair and balanced price. No amount of evidence can convince them that both human life and dignity are priced incredibly cheap on the open market, or that that late 19th century was not, in fact, the model of a moral or economically functional society.... Finally, there is the far right. These are the True Believers: the ones who not only buy into the center-right line, but also the raw Objectivism of Ayn Rand and Fox News that says that the only economic injustice in society is the one being perpetrated by the government itself, taking money from the 'deserving' and giving it to the 'undeserving'. In this view, the only inequality that matters to them is redistributive taxation to “others” in society..."

Danny Vinik: Richard Fisher Has Wrongly Warned of Inflation 5 Times Since 2011: "This isn't the first time Fisher has been at odds with his colleagues. When the Fed undertook 'Operation Twist' in 2011, Fisher was one of three members of the Federal Open Market Committee... to dissent. He's... been the committee’s staunchest inflation hawk... Monday’s... was just the latest of many warnings.... April 8, 2011: 'Having done our job, I see many risks to the Federal Reserve overstaying its position...' September 27, 2011: 'I might conclude by sharing my concerns about the prospect of temporarily allowing more inflation as a means of unlocking expansion in final demand.... [O]nce unleashed, inflation combines with stagnation to make stagflation...' April 10, 2012: 'I’m just reporting what I hear on the street, which is a real concern that with our expanded balance sheet, we are just a little bit in an ember of what could become an inflationary fire.' September 20, 2012: 'I do not see an overall argument for letting inflation rise to levels where we might scare the market...' 5. June 4, 2013: 'I argue that the Fed is, at best, pushing on a string and, at worst, building up kindling for speculation and eventually, a massive shipboard fire of inflation.' So take Fisher's predictions with a grain of salt. More than anyone else on the FOMC, he has been wrong about the economic implications of Fed policy...

And:

Brad DeLong (2006): Is Macroeconomics Hard? (Brad DeLong's Grasping Reality...)

Brad DeLong (2012): Readings for: Why Have We Changed Our Minds on Fiscal Policy?

Julia Belluz: The business model for antibiotics is broken. Here are three alternatives you didn't know about

'Galaxy Quest': The Oral History

Jared Bernstein: Don’t kid yourself: North Carolina likely hurt people when it cut unemployment benefits

And Over Here:

Is U.S. at Immediate Risk of Becoming "Argentina"?: Monday Smackdown/The Honest Broker for the Week of July 12, 2014 (Brad DeLong's Grasping Reality...)

Stephen Moore (Heritage, of Course) Can't Even Cherry-Pick Data Right: Live from the Roasterie CCXXVII: July 28, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War I: July 28, 1914: The Austrian Declaration of War and Manifesto (Brad DeLong's Grasping Reality...)

Monetarist, Keynesian, and Minskyite Depressions Once Again: Yes, Lloyd Metzler Was the Greatest Chicago Macroeconomist Ever: The Honest Broker for the Week of July 19, 2014 (Brad DeLong's Grasping Reality...)

Monetarist, Keynesian, and Minskyite Depressions Once Again: Yes, Lloyd Metzler Was the Greatest Chicago Macroeconomist Ever: The Honest Broker for the Week of July 19, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War I: July 27, 1914: Edward Grey Fears Austria Does Not Understand the Situation (Brad DeLong's Grasping Reality...)

Weekend Reading: "Reason's" Special Revisionism Issue (Brad DeLong's Grasping Reality...)

Should Be Aware of:

Peter Beinart: Paul Ryan and the Cycle of Compassionate Conservatism: "1. A Democrat wins the presidency and expands the size of government. 2. Republicans mobilize to prevent big government from destroying the American way of life. 3. Republicans take Congress. 4. Congressional Republicans battle the Democratic president over the size of government. They cut spending and reduce the deficit, but in the process become wildly unpopular. 5. The Democratic president uses the unpopularity of the Republican Congress to help win reelection. 6. Republican presidential candidates ditch their assault on big government and become compassionate conservatives. We’re now back at Stage Six.... Potential GOP presidential candidates are falling over one another to run as Bush did in 2000: as compassionate conservatives. Rand Paul is arguing for shorter prison sentences. Republican Governors John Kasich and Mike Pence are expanding Medicaid. Marco Rubio recently said it was time for Republicans to stop trying to balance 'the budget by saving money on safety-net programs'. Even budget cutter extraordinaire, Paul Ryan, wants to 'remove it [the fight against poverty] from the old-fashioned budget fight'.... If history is any guide, stage seven of the Republican cycle is that a presidential candidate professing compassionate conservatism loses the popular vote by a half-million votes but is handed the presidency by the Supreme Court..."

D.R. Tucker: Tyson’s Knock-Out: "Tell me, what did Neil DeGrasse Tyson do to be targeted by the wingnuts at National Review?... Cooke’s demonization of Tyson is reminiscent 'of recent remarks by Jeb Bush that scientists and those that believe in what science says, are "sanctimonious"'. Of course, there’s another pretty influential motivating factor. For years, National Review has been heavily dependent on advertising from the fossil fuel industry..."

Maria Grazia Attinasi and Alexander Klemm: The Growth Impact of Discretionray Fiscal Policy Measures: "18 EU countries... 1998-2011... a dataset of fiscal measures based on the yield of actual legislative and budgetary measures, rather than approximations.... We find that fiscal consolidation can be a drag on economic growth in the short-term... expenditure-based adjustment tends to be less harmful than revenue-based adjustment.... Reductions in government investment and consumption are found to be growth reducing... indirect tax increases are found to have a particularly strong negative impact..."

Walter Jon Williams: Amazonia: "Now remember that Amazon’s business plan is to Conquer the World. And once they’ve succeeded... you won’t be nearly as useful.... They could chop your royalty from 70% to 35% (which they’ve already done in Japan and India).... If you’re in the writing business, you should be aware that it’s a business. Amazon doesn’t love you any more than Macmillan or Hachette or HarperCollins. They’re in business to make money for stockholders, or to Rule the World, or for some other reason that seems logical to them. So it behooves us to make ourselves useful to as many publishing titans as possible.... Variety is good, options are good, competition is good. And our decisions on which options to take should be as ruthless and rational as those of anyone else in the business, because that’s in our interest, not in theirs..."

Already-Noted Must-Reads:

Gabriel Chodorow-Reich: Financial stability and monetary policy: "In the winter of 2008, the Federal Reserve began an unprecedented campaign to combat the economic downturn.... A near zero federal funds rate, explicit communication regarding the forward path of the funds rate, and a balance sheet that ballooned to more than $4 trillion as of this writing. With memories of the 2008-09 financial crisis still fresh, the policies have prompted concern for their effect on financial stability.... The policies pursued by the Federal Reserve since late 2008 have... [had a] cumulative effect on life insurance companies appears to have been stabilising, as the benefit to legacy asset values and demand for new products outweighed any reaching for yield. While some money market funds did engage in reaching for yield in 2009-11, the compression in spreads in recent months has sharply limited the scope for such behaviour.... Financial-stability concerns for monetary policy should not stem from concerns about the riskiness of these sectors."

Simon Wren-Lewis: Synthesis!? David Beckworth's Insurance Policy: "I really like David Beckworth’s insurance proposal against ‘incompetent’ monetary policy. Here it is.... 1) Target the level of nominal GDP (NGDP). 2) 'The Fed and Treasury sign an agreement that should a liquidity trap emerge... they would then quickly work together to implement a helicopter drop. The Fed would provide the funding and the Treasury Department would provide the logistical support to deliver the funds to households. Once NGDP returned to its targeted path the helicopter drop would end and the Fed would implement policy using normal open market operations. If the public understood this plan, it would further stabilize NGDP expectations and make it unlikely a helicopter drop would ever be needed.'... Jonathan Portes and I proposed something very like it.... Now this does not mean that Market Monetarists and New Keynesians suddenly agree about everything.... For David this is an insurance against incompetence by the central bank, whereas Keynesians are as likely to view hitting the ZLB as unavoidable if the shock is big enough. However this difference is not critical..."

Fabian Pfeffer et al.: Wealth Levels, Wealth Inequality, and the Great Recession

Fabian Pfeffer et al.: Wealth Levels, Wealth Inequality, and the Great Recession

Stephen Moore (Heritage, of Course) Can't Even Cherry-Pick Data Right: Live from the Roasterie CCXXVII: July 28, 2014

Ken Thomas: Middle Class Political Economist: Stephen Moore (Heritage, of course) can't even get his cherry-picked data right: "If you have had the stomach to read the malarkey that the Heritage Foundation puts out...

Ken Thomas: Middle Class Political Economist: Stephen Moore (Heritage, of course) can't even get his cherry-picked data right: "If you have had the stomach to read the malarkey that the Heritage Foundation puts out...

...you have no doubt noticed that many of their publications are, well, fact-challenged.... Today, I turn from Obamacare godfather Stuart Butler to the new Heritage chief economist, Stephen Moore.... SantaFeMarie sums up the sordid story of Moore's July 7 column in the Kansas City Star where, trying to defend himself and Arthur Laffer from the well-deserved ire of Paul Krugman, he claims that 0/low-tax states have seen better job growth than high-tax states. In the original article, he wrote:

No-income-tax Texas gained 1 million jobs over the last five years, California, with its 13 percent tax rate, managed to lose jobs. Oops. Florida gained hundreds of thousands of jobs while New York lost jobs. Oops.

I hope you're sitting down.

Although this article was written in July 2014 (and the original version, in Investors Business Daily, appeared July 2), the "last five years" Moore is referring to are: December 2007, the first month of the recession, to December 2012.... He didn't use that 16 or 17 months' worth of data.... As Star editorial writer Yael T. Abouhalkah (who has long covered everything from fiscal policy to tax increment financing) points out, since Moore's ending date of December 2012, California has added 541,000 jobs, while Texas has an additional 523,400. "So, high taxes are good?" he quipped.... Within Moore's chosen "last five years," he still managed to misstate job performance by over 1.2 million jobs. #2: Texas did not gain "1 million jobs," but only 497,400 (off by 502,600). #3: Florida did not gain "hundreds of thousands of jobs," but lost 461,500, just 30,000 less than the much large California economy (off by at least 661,000). #4: And New York did not lose jobs at all, but added 75,900 (off by 75,900, being generous).

On July 24, the Star published a corrected version of Moore's article which, according to Abouhalkah, Moore signed off on. Moore does not acknowledge that the corrections destroy his argument. On Friday afternoon, July 25, I sent a contact form to the editors at Investors Business Daily asking if we could expect a similar correction there. I'll keep you posted.

Liveblogging World War I: July 28, 1914: The Austrian Declaration of War and Manifesto

Ischl, July 28.

Dear Count Stürgkh:

I have resolved to instruct the Ministers of my Household and

Foreign Affairs to notify the Royal Serbian Government of the

beginning of a state of war between the Monarchy and Serbia. In

this fateful hour I feel the need of turning to my beloved peoples.

I command you, therefore, to publish the inclosed manifesto.

MANIFESTO.

To my peoples! It was my fervent wish to consecrate the years

which, by the grace of God, still remain to me, to the works of

peace and to protect my peoples from the heavy sacrifices and

burdens of war. Providence, in its wisdom, has otherwise decreed.

The intrigues of a malevolent opponent compel me, in the defense of

the honor of my Monarchy, for the protection of its dignity and its

position as a power, for the security of its possessions, to grasp

the sword after long years of peace.

With a quickly forgetful ingratitude, the Kingdom of Serbia, which,

from the first beginnings of its independence as a State until

quite recently, had been supported and assisted by my ancestors,

has for years trodden the path of open hostility to

Austria-Hungary. When, after three decades of fruitful work for

peace in Bosnia and Herzegovina, I extended my Sovereign rights to

those lands, my decree called forth in the Kingdom of Serbia, whose

rights were in nowise injured, outbreaks of unrestrained passion

and the bitterest hate. My Government at that time employed the

handsome privileges of the stronger, and with extreme consideration

and leniency only requested Serbia to reduce her army to a peace

footing and to promise that, for the future, she would tread the

path of peace and friendship. Guided by the same spirit of

moderation, my Government, when Serbia, two years ago, was

embroiled in a struggle with the Turkish Empire, restricted its

action to the defense of the most serious and vital interests of

the Monarchy. It was to this attitude that Serbia primarily owed

the attainment of the objects of that war.

The hope that the Serbian Kingdom would appreciate the patience and

love of peace of my Government and would keep its word has not been

fulfilled. The flame of its hatred for myself and my house has

blazed always higher; the design to tear from us by force

inseparable portions of Austria-Hungary has been made manifest with

less and less disguise. A criminal propaganda has extended over the

frontier with the object of destroying the foundations of State

order in the southeastern part of the monarchy; of making

the people, to whom I, in my paternal affection, extended my full

confidence, waver in its loyalty to the ruling house and to the

Fatherland; of leading astray its growing youth and inciting it to

mischievous deeds of madness and high treason. A series of

murderous attacks, an organized, carefully prepared, and well

carried out conspiracy, whose fruitful success wounded me and my

loyal peoples to the heart, forms a visible bloody track of those

secret machinations which were operated and directed in Serbia.

A halt must be called to these intolerable proceedings and an end

must be put to the incessant provocations of Serbia. The honor and

dignity of my monarchy must be preserved unimpaired, and its

political, economic, and military development must be guarded from

these continual shocks. In vain did my Government make a last

attempt to accomplish this object by peaceful means and to induce

Serbia, by means of a serious warning, to desist. Serbia has

rejected the just and moderate demands of my Government and refused

to conform to those obligations the fulfillment of which forms the

natural and necessary foundation of peace in the life of peoples

and States. I must therefore proceed by force of arms to secure

those indispensable pledges which alone can insure tranquillity to

my States within and lasting peace without.

In this solemn hour I am fully conscious of the whole significance

of my resolve and my responsibility before the Almighty. I have

examined and weighed everything, and with a serene conscience I set

out on the path to which my duty points. I trust in my peoples,

who, throughout every storm, have always rallied in unity and

loyalty around my throne, and have always been prepared for the

severest sacrifices for the honor, the greatness, and the might of

the Fatherland. I trust in Austria-Hungary's brave and devoted

forces, and I trust in the Almighty to give the victory to my arms.

FRANZ JOSEPH

July 27, 2014

Monetarist, Keynesian, and Minskyite Depressions Once Again: Yes, Lloyd Metzler Was the Greatest Chicago Macroeconomist Ever: The Honest Broker for the Week of July 19, 2014

Over at Equitable Growth: I have said this before. But I seem to need to say it again...

The very intelligent and thoughtful David Beckworth, Simon Wren-Lewis, and Nick Rowe are agreeing on New Keynesian-Market Monetarist monetary-fiscal convergence. Underpinning all of their analyses there seems to me to be the assumption that all aggregate demand shortfalls spring from the same deep market failures. And I think that that is wrong.

Simon Wren-Lewis writes:

I really like David Beckworth’s Insurance proposal against ‘incompetent’ monetary policy. Here it is: 1) Target the level of nominal GDP (NGDP). 2) "The Fed and Treasury... agree... should a liquidity trap emerge anyhow... quickly work together to implement a helicopter drop...." Market Monetarists and New Keynesians [do not] suddenly agree about everything... for David this is an insurance against incompetence by the central bank, whereas Keynesians... view hitting the ZLB as unavoidable if the shock is big enough. However this difference is not critical... READ MOAR

And Nick Rowe concludes:

How much money should the central bank print and buy things with? As much as is necessary to hit the NGDP target. And if it runs out of... government bonds [to buy]... it should buy newly-produced things.... What particular things should be bought and held on the asset side of the consolidated balance sheet of the government plus central bank? That is a micro public finance question. What particular things should be held on the unconsolidated central bank's balance sheet rather than on the government's balance sheet? That is a public choice question.... I don't think there's anything left to argue about. Except a lot of micro public finance and public choice stuff.

But I'm sure we will think of something.

I, however, find myself unsatisfied with this convergence. Finally summarize it, it seems to go like this: In a depression in which the problem is that not enough stuff is being bought, (i) the central bank should buy bonds for cash in order to put more cash in people's pockets so that they will buy more stuff, and (ii) if that doesn't work--if for some reason people still don't buy enough stuff even though the Federal Reserve has driven interest rates to zero--the central bank should print money and give it away so that people will buy more stuff, and (iii) if that doesn't work, the central bank and government should jointly print money and buy more stuff.

This seems to me to be largely unexceptionable. But I think it misses a couple of subtleties. And I think these subtleties are important because they undermine the lexicographic preference for (1) open-market operations, (2) helicopter drops, and (3) fiscal expansion in that order that is at the base of this Oxford-Bowling Green-Ottawa compact. I suspect that the reason that Simon, David, and Nick are able to reach agreement is that they do not foreground the issues that I learned when Olivier Blanchard forced me to study that key paper of the greatest of University of Chicago macroeconomists, ["Wealth, Saving, and the Rate of Interest" by Lloyd Metzler][4].

Whether you want to use fiscal or monetary (or banking!) policy to fix the depression depends critically on why not enough stuff is being bought--on where the market failure is.

The problem could be Monetarist. If the problem is a scarcity of liquid cash money (with associated sticky-price and nominal-debt-contract market failures, so that dropping the price level to instantaneously raise real money balances to their first-best level just isn't a good option), then, yes, conventional open-market operations can do the job--but whether you want to use monetary or fiscal policy hinges on what you want the post-depression real interest rate to be.

The problem could be Keynesian. If the problem is a scarcity of savings vehicles for transferring purchasing power from the present into the future (with the same associated sticky-price and nominal-debt-contract market failures)--a shortage of money-plus-bonds--then conventional open-market operations will not do the job: they get you to the zero lower bound, and once there your swapping of cash for bonds has no effect on anything. What you need to do is either (a) increase the supply of bonds by summoning the Confidence Fairy and getting private entrepreneurs to issue more bonds as they borrow-and-spend, (b) decrease demand for bonds by summoning the Inflation Expectations Imp and thus imposing a tax on nominal assets, or (c) increase the supply of bonds directly by having the government buy stuff. And there are a host of issues as to which is the best to do.

The problem could be Minskyite. If the underlying market failure is that the credit channel has broken down, so that savers do not trust the securities that financial intermediaries originate to be of the safety that they seek, then there are definite drawbacks to summoning the Inflation Expectations Imp or indeed to keeping interest rates low: the economy then winds up with an incentive to produce too many long-duration assets and to invest too little in risky projects. A better solution is to have the government bear risk. And the best solution is to restore the credit channel.

So let us start with Metzler's basic model: three commodities and two prices, one of them sticky;

Commodity: liquid cash money M--in order to create the trust that you need to transact.

Commodity: bonds B--savings vehicles for transferring purchasing power from the present into the future.

Commodity: currently-produced goods and services Y.

Price: the sticky price of currently-produced goods and services in terms of money P.

Price: the interest rate i, the inverse of the price of nominal bonds in terms of money.

A Monetarist depression is then when there is not enough money M in the system. The interest rate i is then high--the price of bonds is low because the marginal utility of holding the scarce money is high--and is high enough to equalize supply and demand for bonds at that i. But because P is sticky, there is an excess demand for money and so, by Walras's Law, an excess supply of currently-produced goods and services.

You can fix a Monetarist depression by having the central bank buy bonds for cash until the stock of money M is high enough to balance supply and demand. But is that what you want to do? You could also (a) summon the Confidence Fairy and so get private businesses to issue more bonds, (b) summon the Inflation Expectations Imp and so reduce demand for both money M and bonds B relative to currently-produced goods and services, or (c) have the government issue more bonds. Such expansions of B would drive the interest rate i up further, and with enough bonds the interest rate would be high enough that the sticky value of P would also be the Walrasian equilibrium value of P, and there would be neither excess demand nor excess supply for money M or for currently-produced goods and services Y.

In order to decide whether you want to fix a depression characterized by a high interest rate i on bonds via monetary expansion or fiscal expansion (or by summoning the Confidence Fairy and getting a private investment boom going), you need a way to rank full-employment equilibria. What share of production on currently-produced goods and services Y should take the form of government purchases G? What cost should we put on businesses undertaking private capital formation I via the value of the interest rate i? Robert Solow's chapter for the 1962 Economic Report of the President argued, I think wisely, for easy money and tight fiscal policy--that there was no obvious reason for an anti-depression policy to have the side effect of reducing the post-depression capital stock below what it would otherwise be. But it is possible to imagine situations in which the Wicksellian natural rate of interest consistent with full employment when the government's budget is balanced is below the proper social rate of time preference, and induces private investments that do not cover their properly-measured social costs. It's not a slam dunk.

A Keynesian depression is then when there is not enough money plus bonds M+B in the system, when businesses are not confident enough to undertake enough investment projects to back enough bonds to meet private-saver demand for savings vehicles. Because bonds are scarce people bid their price up to par, and bid the interest rate i down to zero. And there the price of bonds becomes sticky too--it cannot go any higher, and money and bonds become perfect substitutes, and open market operations do nothing because they simply swap a zero-interest asset for another. Then there is an excess demand for the aggregate that is money-plus-bonds M+B, and an excess supply for currently-produced goods and services Y.

Since open-market operations no longer do anything, policies are down to:

(a) summon the Confidence Fairy and so get private businesses to issue more bonds.

(b) summon the Inflation Expectations Imp.

(c) have the government issue more bonds.

Summoning the Confidence Fairy to get private businesses to print up more bonds and so increase the supply of M+B will work, as long as you can actually summon spirits from the vasty deep. Raise M+B enough, and there will be no excess demand for M+B at the sticky price P, and so no excess supply of currently-produced goods and services. Raise B even more and i will start to rise and the infinite elasticity of demand between B and M will break.

Summoning the Inflation Expectations Imp to reduce the demand for the money-and-bonds aggregate M+B will also work--once again, as long as you can actually summon spirits from the vasty deep.

Having the government issue more bonds, however, works directly on the supply of the aggregate M+B.

Which is preferable? Well, how good are your spirit-summoning skills? What are the costs of accumulating government debt? What are the costs of raising the inflation target if you can summon the Inflation Expectations Imp?

We have by now a number of balls in the air: a (sticky) price of currently-produced goods and services in terms of money P, an expected rate of inflation π, a degree of business confidence, an interest rate on bonds, a supply of money M, a supply of bonds B, and a division of the bond supply between bonds that fund private investment and government debt. And there is a shadowy concept of the "first best"--of what the full-employment economy ought to look like in terms of the proper incentive to invest, the proper supply of liquidity services, and the proper inflation target.

But we have still more: we have a Minskyite depression, in which on top of our other market failures--our sticky-wages and our nominal-debt contracts that make deflation impossible or unwise, and our zero lower bound that makes the price of bonds become sticky too--we also have a collapse of the credit channel, an inability of financial intermediaries to do the risk transformation and so turn claims on the risky investment projects that make up the private capital stock into bonds of a high-enough quality for private savers to want to hold. We now have a fourth commodity: in addition to money M, (safe) bonds B, and currently-produced goods and services Y, we now have junk bonds J. Now our economy gets wedged with an interest rate i=0 at the zero lower bound and a price level P such that there is an excess demand for the perfect-substitutability aggregate M+B, with a high interest rate j on the junk J, and by Walras's Law with an excess supply of currently-produced goods and services Y.

Now our admissible policies are:

(b) summon the Inflation Expectations Imp.

(c) have the government issue more (safe) bonds.

(d) summon a different Confidence Fairy and restore saver confidence in the ability of financial intermediaries to properly do the risk transformation and originate not junk J but safe bonds B.

(e) reform and recapitalize the financial intermediaries so that they can in fact do the risk transformation and originate not junk J but safe bonds B.

(f) use the government as a loan guarantor and use its own (or, rather, the taxpayers') risk-bearing capacity to do the risk transformation.

And what about (a), summoning the (business) Confidence Fairy? It is not a solution: getting businesses to issue more debt does not help matters as long as financial intermediaries are unable to sell it as safe bonds B rather than junk J.

Now note that our first-best has required an additional dimension. We had been thinking about the proper incentive to invest, the proper supply of liquidity services, and the proper inflation target. Now we are thinking about the proper inflation target the proper supply of liquidity services, the proper real societal rate of time preference (the interest rate on safe bonds), and the proper risk spread between safe bonds and junk.

And if the root market failure is the collapse of the credit channel--a greatly enhanced spread between B and J, or, indeed, credit rationing--that (b)-(d) no longer look as attractive. When the problem is an inability of financial intermediaries to do the risk transformation, restoring full employment by reducing the real rate of time preference on safe bonds (which is what (b) does) provides the economy with too-great an incentive to produce long-duration assets. Having the government issue more (safe) debt (c) produces an economy with too much current government spending on social welfare or on infrastructure and too little on risky private investment projects. And (d) restoring saver confidence in financial intermediaries is not a good thing unless savers should in fact have confidence in financial intermediaries.

There is a very large number of different positions you can take on what set of macroeconomic policies will get the economy closest to its first-best when it is subject to what kinds of shocks--Monetarist shocks to liquidity demand and supply, Keynesian shocks to business investment committee animal spirits, or Minkyite shocks to the ability of financial intermediaries to do the risk transformation. And to sideline them--as Nick Rowe does--as "micro public finance and public choice stuff" seems to me to overlook several large elephants that are not just in the room but on the couch and pressing the remote...

[4]: "http://delong.typepad.com/1825743.pdf" title="1825743.pdf (Lloyd Metzler (1951): "Wealth, Saving, and the Rate of Interest", Journal of Political Economy 59:2 (April), pp. 93-116. Cf. also James Tobin, passim.)

2368 words

Liveblogging World War I: July 27, 1914: Edward Grey Fears Austria Does Not Understand the Situation

Count Mensdorff told me by instruction to-day that:

the Serbian Government had not accepted the demands which the Austrian Government were obliged to address to them in order to secure permanently the most vital Austrian interests.

Serbia showed that she did not intend to abandon her subversive aims, tending towards continuous disorder in the Austrian frontier territories and their final disruption from the Austrian Monarchy. Very reluctantly, and against their wish, the Austrian Government were compelled to take more severe measures to enforce a fundamental change of the attitude of enmity pursued up to now by Serbia.

As the British Government knew, the Austrian Government had for many years endeavoured to find a way to get on with their turbulent neighbour, though this had been made very difficult for them by the continuous provocations of Serbia. The Serajevo murder had made clear to every one what appalling consequences the Serbian propaganda had already produced and what a permanent threat to Austria it involved.

We would understand that the Austrian Government must consider that the moment had arrived to obtain, by means of the strongest pressure, guarantees for the definite suppression of the Serbian aspirations and for the security of peace and order on the southeastern frontier of Austria. As the peaceable means to this effect were exhausted, the Austrian Government must at last appeal to force.

They had not taken this decision without reluctance. Their action, which had no sort of aggressive tendency, could not be represented otherwise than as an act of self-defence. Also they thought that they would serve a European interest if they prevented Serbia from being henceforth an element of general unrest such as she had been for the last ten years.

The high sense of justice of the British nation and of British statesmen could not blame the Austrian Government if the latter defended by the sword what was theirs, and cleared up their position with a country whose hostile policy had forced upon them for years measures so costly as to have gravely injured Austrian national prosperity.

Finally, the Austrian Government, confiding in their amicable relations with us, felt that they could count on our sympathy in a fight that was forced on them, and on our assistance in localizing the fight, if necessary.

Count Mensdorff added on his own account that:

as long as Serbia was confronted with Turkey, Austria never took very severe measures because of her adherence to the policy of the free development of the Balkan States. Now that Serbia had doubled her territory and population without any Austrian interference, the repression of Serbian subversive aims was a matter of self-defence and self-preservation on Austria's part. He reiterated that Austria had no intention of taking Serbian territory or aggressive designs against Serbian territory.

I said that I could not understand the construction put by the Austrian Government upon the Serbian reply, and I told Count Mensdorff the substance of the conversation that I had had with the German Ambassador this morning about that reply.

Count Mensdorff admitted that, on paper, the Serbian reply might seem to be satisfactory; but the Serbians had refused the one thing--the cooperation of Austrian officials and police--which would be a real guarantee that in practice the Serbians would not carry on their subversive campaign against Austria.

I said that it seemed to me as if the Austrian Government believed that, even after the Serbian reply, they could make war upon Serbia anyhow, without risk of bringing Russia into the dispute. If they could make war on Serbia and at the same time satisfy Russia, well and good; but, if not, the consequences would be incalculable.

I pointed out to him that I quoted this phrase from an expression of the views of the German Government. I feared that it would be expected in St. Petersburg that the Serbian reply would diminish the tension, and now, when Russia found that there was increased tension, the situation would become increasingly serious.

Already the effect on Europe was one of anxiety. I pointed out that our fleet was to have dispersed to-day, but we had felt unable to let it disperse. We should not think of calling up reserves at this moment, and there was no menace in what we had done about our fleet; but, owing to the possibility of a European conflagration, it was impossible for us to disperse our forces at this moment.

I gave this as an illustration of the anxiety that was felt. It seemed to me that the Serbian reply already involved the greatest humiliation to Serbia that I had ever seen a country undergo, and it was very disappointing to me that the reply was treated by the Austrian Government as if it were as unsatisfactory as a blank negative.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers