J. Bradford DeLong's Blog, page 1146

September 25, 2014

Over at Equitable Growth: What Should Monetary Policy Be?: Thursday Focus for September 25, 2014

Over at Equitable Growth: Chicago Federal Reserve Bank President Charles Evans's position seems to me to be the position that ought to be the center of gravity of the Federal Open Market Committee's thoughts right now, with wings on all sides of it taking different views as part of a diversified intellectual portfolio. Charles Evans:

Charles Evans: Patience Is a Virtue When Normalizing Monetary Policy: "At the end of the second quarter of 2014...

...the labor force participation rate was between 1/2 and 1-1/4 percentage points below trend... as much as 3/4 of a percentage point below predictions based on its historical relationship with the unemployment rate.... Virtually all the gap during this cycle has been due to withdrawal from the labor market of workers without a college degree.... If skills mismatch were an ongoing problem, we’d expect to see wages rising for those with the skills in demand.... Pools of potential workers other than the short-term unemployed, notably the medium-term unemployed and the involuntary part-time work force, substantially influence wage growth at the state or metropolitan statistical area level.... Current circumstances and a weighing of alternative risks mean that a balanced policy approach calls for being patient in reducing accommodation.... The biggest risk we face today is prematurely engineering restrictive monetary conditions.... If we were to... reduce monetary accommodation too soon, we could find ourselves in the very uncomfortable position of falling back into the ZLB environment.... There are great risks to premature liftoff.... And the costs of being mired in the zero lower bound are simply very large...

Yet Evans is out there on his own--with perhaps Narayana Kocherlakota beside him.[[1]][3] READ MOAR

[3]: http://www.federalreserve.gov/monetar... (Percent

Economic Projections of Federal Reserve Board Members and Federal Reserve Bank Presidents, September 2014: Advance release of table 1 of the Summary of Economic Projections to be released with the FOMC minutes)

As I see it:

The past decade has demonstrated that to properly reduce the risks of hitting the zero nominal lower bound on safe short-term interest rates, we need not a 5%/year but at least a 6.5%/year business-cycle peak safe short nominal rate.2 With a 3%/year short-term peak real natural interest rate, we need not a 2%/year but a 3.5%/year inflation target instead.

It is likely that the safe natural real rate of interest has fallen by 1%-point/year. That means that a healthy economy properly distant from the ZLB requires not a 3.5%/year but a 4.5%/year inflation target.

It is very important when the economy hits the zero lower bound on nominal interest rates that expectations be that the time spent at the ZLB will be short. To build those expectations, it is important that when the economy emerges from the ZLB it undergo a period in which the long-run inflation target is overshot.

The likelihood is that downward movements in labor force participation that are cementing into structural impediments to employment can be reversed if high demand pulls workers back into the labor force before the cement has set, but only with difficulty otherwise. The benefit-cost analysis thus calls for an additional inflation overshoot in order to satisfy the Federal Reserve's dual mandate.

If the Federal Reserve aims at a 2%/year inflation target and fails to raise interest rates sufficiently early, it may wind up with 4%/year inflation and have to raise short-term real interest rates to 6%/year--a nominal interest rate of 10%/year--to return the economy to its inflation target. If the Federal Reserve prematurely raises interest rates, it may wind up with 0%/year inflation and wish to lower short-term real interest rates to -2%/year to return the economy to its inflation rate. With inflation at 0%/year, it cannot do that. Thus the risks are asymmetric: raising interest rates later than optimal under perfect foresight carries much lower risks than does raising interest rates earlier than optimal.

Since 1979 the Federal Reserve has built up enormous credibility as the guardian of price stability and has wrecked whatever credibility it had as the guardian of low unemployment. A situation in which the general expectation is that the Federal Reserve will do too little to guard against high unemployment is worse than a situation in which the general expectations is that the Federal Reserve will too little to guard against inflation--"it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier".[3]

The PCE price index is now undershooting its pre-2008 trend by fully 5%: the proper optimal-control response to a large negative real demand shock is not a price level track that falls below but rather one that rises above the previously-anticipated trend path.

IMHO, you need to reject all 7 of the above points completely in order to think that the FOMC's goal of returning inflation to 2%/year and keeping it there is anywhere close to an optimal-control path for an institution governed by its dual mandate. I really do not see how you can reject all seven.

Moreover, financial markets right now believe that the Federal Reserve's policy is not going to attain 2%/year inflation--not now, not over the next five years. Since June the on-track-to-recovery Confidence Fairy--to the extent that she was present--has flown away:

Thus right now justifying the Federal Reserve's policy track seems to me to require rejecting all seven of the points above, plus rejecting the financial markets' read on monetary policy, plus rejecting the consideration that depressed financial markets--even irrationally-depressed financial markets--should be offset with additional demand stimulus.

Yet only two of the seventeen FOMC participants are with me. Am I off my rocker? Have they been consumed by groupthink? How am I to understand all this?

970 words

September 23, 2014

Godwin's Law Violation in Kansas! Vulnerable Kansas Senator Pat Roberts: We Are Heading Toward 'National Socialism': Live from the Roasterie

Wow! Kansas Senator Pat Roberts is getting really desperate. Haven't heard a Senator call Obama a Nazi before...

Dylan Scott: Vulnerable Kansas Senator: We Are Heading Toward 'National Socialism': "Incumbent Sen. Pat Roberts (R-KS)...

...facing an unexpectedly fierce challenge for re-election, warned Monday at a campaign stop that the United States is heading for "national socialism."... American Bridge, the liberal opposition research group that tracks Republican candidates, posted the video of Roberts's remarks at a Dodge City event.

There's a palpable fear among Kansans all across this state that the America that we love and cherish and honor will not be the same America for our kids and grandkids, and that's wrong. That's very wrong.... We have to change course because our country is heading for national socialism. That's not right. It's changing our culture. It's changing what we're all about...

The Kansas Wingnuts May Have Done So Much Damage to Their State as to Undermine Their Political Dominance...: Live from The Roasterie

This is not good news--it is, in a sense, "mission accomplished" for the wingnuts to have managed to do so much damage so quickly that it reverses their natural partisan political advantage in Kansas. But it is remarkable that the consequences of their policies have been so negative as to make Kansas competitive at all levels...

We see that Pat Roberts has given up arguing that he would be a good senator:

Thomas Beaumont: Sen. Roberts Takes Partisan Tone Campaigning In Crucial East Kansas: "Sen. Pat Roberts of Kansas took his conservative re-election message into the state's swing-voting east...

...Saturday in his latest effort chip away any advantage from independent candidate Greg Orman in a U.S. Senate race that has unexpectedly become one of the most hotly contested in the nation.... Roberts stuck to his argument that the election is a referendum on President Barack Obama and the Democratic-controlled Senate.

That really is the issue: whether (Senate Majority Leader) Harry Reid continues to be a one-man rules committee in the Senate.... Orman is a liberal Democrat and a vote for Harry Reid. That really is the issue....

Orman ran for Senate in 2008 as a Democrat but dropped out of the primary. He has also made financial contributions to President Obama and others. He had also been a registered Republican and made contributions to GOP candidates.

Senator Roberts' increasingly desperate campaign is turning to the only playbook his new handlers from Washington, DC know: throw out a lot of baseless negative attacks, and continue to try to divide people along partisan lines. Kansans of all parties are fed up with the broken system in Washington. They want an independent voice in the Senate, and that's why every day more and more Republicans, Democrats and Independents are supporting Greg Orman for Senate...

Josh Barro explains the train wreck produced by Governor Brownback's reliance on Arthur Laffer as his fiscal policy advisor:

Josh Barro: Kansas Tax Cut Leaves Brownback With Less Money: "Kansas has a problem...

...In April and May, the state planned to collect $651 million from personal income tax. But instead, it received only $369 million. In 2012, Kansas lawmakers passed a large and rather unusual income tax cut. It was expected to reduce state tax revenue by more than 10 percent, and Gov. Sam Brownback said it would create “tens of thousands of jobs.” In part, the tax cut worked in the typical way, by cutting tax rates and increasing the standard deduction. But Kansas also eliminated tax on various kinds of income, including income described commonly--and sometimes misleadingly--as “small-business income”--a Form 1099-MISC instead of a W-2....

Consider me. I draw a salary from The New York Times; if I lived in Kansas, I’d pay state income tax on it. I also earn income from other news outlets, including MSNBC, where I am not a payroll employee. That makes me a “small-business owner” in the eyes of the government, and if I lived in Kansas, my income from MSNBC would be tax-free. By creating this preference for some types of income over others, Kansas has run into at least five problems:

It’s sometimes possible to turn taxable salary income into untaxed “business” income....

A lot of the beneficiaries of the tax break won’t be small businesses. Many are sole proprietors like me, who are fundamentally engaged in labor, not entrepreneurship, and aren’t likely to hire anybody just because they receive a tax break. At the other end of the spectrum, there’s no size limit on “small businesses” as defined by Kansas and the Internal Revenue Service.... As of 2005, only 0.2 percent of business partnerships--which Kansas counts as small businesses--had earnings of more than $50 million, but they accounted for 57 percent of all partnership earnings....

It’s not clear that there’s anything special about small businesses for the purpose of job creation....

Some of the revenue loss doesn’t even benefit taxpayers.... >5. The state budget is suffering.

Of course, lawmakers in Kansas knew when they passed the tax cuts that this would happen; the question is whether they will lose even more revenue than they expected over the long run.... According to data collected by the Rockefeller Institute, of 17 states that produce public monthly income tax revenue projections, Kansas’ April error — off by 28 percent--was by far the largest. No other state missed by more than 16 percent, suggesting that a failure to anticipate falling capital gains tax revenue was not the only problem in Kansas...

And miracle visa, Brownback might actually lose:

Daniel Strauss: Poll: GOP Kansas Gov. Brownback Trails Democratic Opponent: "The poll found Davis beating Brownback...

...47 percent to 41 percent while Libertarian candidate Keen Umbehr got 5.... Brownback's troubles seem to be, at least partially, based on education policy. The poll found that 73 percent of supporters for Davis said education was their top issue. Davis has actually made education one of his campaign's primary policy topics and his campaign has highlighted endorsements from teachers organizations. He's also repeatedly noted that he is the son of two teachers. The new SurveyUSA poll was conducted among 2,200 Kansas adults between June 19 and June 23. For the general election question, the margin of error was plus or minus 3.1 percentage points.

Jonathan Katz surveys the climate change--ooops! Not supposed to say those words in Kansas, are we?

Jonathan Katz: Kansas voters grow tired of Republican revolution: "Once a long shot, Kansas Democrat Paul Davis’ campaign...

...to unseat this conservative state’s Republican governor, Sam Brownback, has become surprisingly serious.... Brownback... got his start in politics as state agriculture secretary. He went to the U.S. Congress in 1994.... Two years later, when Bob Dole ran for president, Brownback won his vacated Senate seat, thanks in no small part to a last-minute $400,000 ad blitz paid for by an organization linked to Wichita’s billionaire brothers Charles and David Koch. As a senator, Brownback became nationally known for his opposition to abortion, gay rights and gangsta rap. He also helped train the next generation of Washington conservatives. In the 1990s, future vice presidential candidate and GOP budget guru Rep. Paul Ryan served as Brownback’s legislative director. After a failed bid to secure the 2008 GOP presidential nomination, Brownback returned to Kansas in 2010 to win the governorship in a landslide, carrying 103 of the state’s 105 counties. In the race, he outspent his opponent by 406 percent. Many expected him to sail on to a second term and then resume his quest for the presidency. Yet Brownback trails Davis in recent statewide polls by as many as 10 points. In part that’s because Davis, the current minority leader in the Kansas House of Representatives, has reached across the aisle, securing the endorsements of more than 100 current and former Republican officials.

But the biggest thing going for the Democrat is what’s going against Brownback and the rest of Kansas: the condition of the state budget. For the past three years, the governor has carried out an aggressive plan to remake the state economy. Under a plan co-designed and -promoted by the architect of Ronald Reagan’s supply-side economic policy, Arthur Laffer, the Republican-controlled statehouse slashed the top income tax rate by more than a quarter, from 6.45 percent to 4.8 percent. It also created enormous tax loopholes for businesses. By some readings, an executive could avoid paying any tax on profits or salaries by converting a corporation to a limited-liability company, or LLC.

Brownback told Kansans in 2012 that over five years the new tax policy would create more than 22,000 jobs beyond normal growth and attract more residents. The governor described the effort on MSNBC’s Morning Joe as a “real, live experiment”; given Brownback’s national ambitions, many wondered if his real goal was expanding his laboratory to include the other 49 states.

Then the results started coming in.... Kansas job growth has lagged all its neighboring states’ except Nebraska’s, according to the U.S. Bureau of Labor Statistics. Its population has grown at half the national rate.

Rather, the most immediate effect of the tax cuts has been the more predictable one: less money for state services. Kansas collected $310 million less in revenue than planned during the April and May tax season. The state’s nonpartisan legislative research division estimated when the tax cuts were passed that the state would collect $4.5 billion less through 2018. To make up for some of the losses, the state government targeted the pocketbooks of low-income consumers, reducing a planned sales tax cut and eliminating tax rebates for items like food, child care, access for the disabled and alternative-fuel equipment.

And:

Jonathan Katz: A Kansas twister: Wind energy politics complicate governor’s race: "Increasingly, Kansans are finding that wind from the west...

...may be yet another golden resource of the state — able to generate huge amounts of electricity and make them money in the process. A growing awareness of that windfall is cutting across partisan lines, winning adherents to a green energy source in a state otherwise dominated by deep red oil-and-cattle conservatives.... The Wartas still make most of their money from wheat, soybeans and their herd of muscular black-and-brown beef cattle. But the extra money from the electricity generated on his land (about 3 percent of the cost per megawatt), is a welcome addition.... At full capacity it would be generate more wind energy than any state except Texas, according to the U.S. Energy Department’s National Renewable Energy Laboratory.... Yet... the state’s producers only generated... 0.3 percent of the potential.

That’s in part because a small but politically influential group of Kansans is in the way. One hundred fifteen miles south of Warta’s ranch stands the Wichita headquarters of one of the most powerful energy corporations in the country, Koch Industries.... The Koch-funded advocacy group Americans for Prosperity is leading the fight to repeal a federal tax credit for wind energy producers.... Opposition to the credit in Congress has been championed by Rep. Mike Pompeo, a Republican whose district includes Wichita and whose top campaign contributors are oil and gas in general and Koch Industries in particular.

Extending the wind [tax credit] is a key priority for the Obama administration and its efforts to prop up wind and other favored green energy technologies,

Pompeo and 53 other Republicans wrote in a letter to the GOP House leadership last month.

Growth in wind energy is not driven by market demand, but instead by a combination of state mandates and a federal tax credit that is now more valuable than the actual market price of the electricity these plants generate....

Americans for Prosperity and the Kansas Chamber of Commerce (another major recipient of Koch money) spent months trying to get the Republican-controlled state legislature to repeal a state renewable-energy standard that requires about 10 percent of electricity in the state to be purchased from renewable resources, including wind; the requirement will rise to 20 percent by 2020. But the legislature refused.... The exact reasons why the Koch-funded empire has been dead set against wind energy aren’t clear. In a 2012 op-ed in The Wall Street Journal, Charles Koch said that tax breaks for wind, solar and biofuels were distorting the U.S. energy market... alternative energy tax breaks are dwarfed by billions of dollars in annual subsidies to the oil industry.... Brownback has close ties to the anti-wind forces.... As for the governor, Warta said his advice would be clear: “He better be for it, because it’s good for Kansas.”

And:

Jonathan Katz: Kansas governor gets schooled over cuts to education budget: "You can still buy the T-shirt of the beloved Marquette Elementary School Wolverines...

...at the Capital Sundries store on Washington Street, the main strip in this Kansas prairie town. But the school — the last one in this town of 650 people — no longer exists. It shut down earlier this year. “We all saw this coming,” superintendent Glen Suppes told reporters on the day Marquette Elementary closed its doors in May. “If you watch what’s happening at the state level, budgets are going down. We can’t [just] cut little things that don’t affect kids.”...

What’s “happening at the state level,” as Suppes put it, is this: Three years ago, Kansas’ Republican Gov. Sam Brownback arrived in office promising to restore the economy by slashing income taxes to attract more investment, jobs and people to the state. Those cuts, initiated in 2012, left Kansas with hundreds of millions of dollars less in revenue to pay for services. And by far the most politically sensitive area affected by those shortfalls has been education.

Kansans have long prided themselves on a strong public school system, which educates some 95 percent of the state’s children. The rising anger over cuts — and threatened further cuts — in the education budget has turned what was expected to be an easy re-election for Brownback, leading to a likely presidential run, into one of the closest gubernatorial races in the country.... Mark Tallman, the associate executive director for the Kansas Association of School Boards, wrote in an August analysis that, when adjusted for inflation, total school funding “has essentially been flat,” while operating funds are down $290 million since 2011. Classroom spending has fallen 12 percent since 2009, to roughly $3,800 per pupil, according to the state Department of Education. State universities have been forced to raise tuition to make up for budget cuts. Earlier this year, the courts stepped in to force legislators to appropriate more money to the state’s school districts....

“Our schools simply are underfunded right now, and Gov. Brownback made the single largest cut to school funding in state history. People are seeing the larger class sizes, the fees that parents are having to pay. The test scores are going down,” Davis, who led the governor in three August polls, said in an interview later that day....

Topeka is very sensitive to the anger in places like Marquette that fear their schools might be next. Lawmakers just aren’t sure what to do. Fearful of a backlash, Republican lawmakers looking to cut education costs were advised last year to refer to consolidation proposals as “common-sense reorganization.” Brownback is in a similar position. “I oppose consolidation,” he told the Topeka crowd. “Lots of times for a town, if they lose their school, you just as well close the town up too. It’s just not going to work.” The line drew applause. Reporters chased the governor afterward, asking for his specific plan for avoiding additional school closures. He dodged the question and climbed into his waiting car. “It’s not really a policy decision,” his spokesman explained as the governor drove away.

Liveblogging World War II: September 23, 1944: FDR: "Fala"

Well, here we are together again - after four years - and what years they have been! You know, I am actually four years older, which is a fact that seems to annoy some people. In fact, in the mathematical field there are millions of Americans who are more than eleven years older than when we started in to clear up the mess that was dumped in our laps in 1933.

We all know that certain people who make it a practice to deprecate the accomplishments of labor - who even attack labor as unpatriotic - they keep this up usually for three years and six months in a row. But then, for some strange reason they change their tune- every four years- just before election day. When votes are at stake, they suddenly discover that they really love labor and that they are anxious to protect labor from its old friends.

I got quite a laugh, for example - and I am sure that you did - when I read this plank in the Republican platform adopted at their National Convention in Chicago last July: "The Republican Party accepts the purposes of the National Labor Relations Act, the Wage and Hour Act, the Social Security Act and all other Federal statutes designed to promote and protect the welfare of American working men and women, and we promise a fair and just administration of these laws."

You know, many of the Republican leaders and Congressmen and candidates, who shouted enthusiastic approval of that plank in that Convention Hall would not even recognize these progressive laws if they met them in broad daylight. Indeed, they have personally spent years of effort and energy - and much money - in fighting every one of those laws in the Congress, and in the press, and in the courts, ever since this Administration began to advocate them and enact them into legislation. That is a fair example of their insincerity and of their inconsistency.

The whole purpose of Republican oratory these days seems to be to switch labels. The object is to persuade the American people that the Democratic Party was responsible for the 1929 crash and the depression, and that the Republican Party was responsible for all social progress under the New Deal.

Now, imitation may be the sincerest form of flattery - but I am afraid that in this case it is the most obvious common or garden variety of fraud.

Of course, it is perfectly true that there are enlightened, liberal elements in the Republican Party, and they have fought hard and honorably to bring the Party up to date and to get it in step with the forward march of American progress. But these liberal elements were not able to drive the Old Guard Republicans from their entrenched positions.

Can the Old Guard pass itself off as the New Deal? I think not.

We have all seen many marvelous stunts in the circus but no performing elephant could turn a hand-spring without falling flat on his back.

I need not recount to you the centuries of history which have been crowded into these four years since I saw you last.

There were some - in the Congress and out - who raised their voices against our preparations for defense - before and after 1939 - objected to them, raised their voices against them as hysterical war mongering, who cried out against our help to the Allies as provocative and dangerous. We remember the voices. They would like to have us forget them now. But in 1940 and 1941- my, it seems a long time ago - they were loud voices. Happily they were a minority and - fortunately for ourselves, and for the world - they could not stop America.

There are some politicians who kept their heads buried deep in the sand while the storms of Europe and Asia were headed Our way, who said that the lend-lease bill "would bring an end to free government in the United States," and who said, "only hysteria entertains the idea that Germany, Italy, or Japan contemplates war on us." These very men are now asking the American people to intrust to them the conduct of our foreign policy and our military policy.

What the Republican leaders are now saying in effect is this: "Oh, just forget what we used to say, we have changed our minds now - we have been reading the public opinion polls about these things and now we know what the American people want." And they say: "Don't leave the task of making the peace to those old men who first urged it and who have already laid the foundations for it, and who have had to fight all of us inch by inch during the last five years to do it. Why, just turn it all over to us. We'll do it so skillfully - that we won't lose a single isolationist vote or a single isolationist campaign contribution."

I think there is one thing that you know: I am too old for that. I cannot talk out of both sides of my mouth at the same time.

The Government welcomes all sincere supporters of the cause of effective world collaboration in the making of a lasting peace. Millions of Republicans all over the Nation are with us - and have been with us - in our unshakable determination to build the solid structure of peace. And they too will resent this campaign talk by those who first woke up to the facts of international life a few short months ago when they began to study the polls of public opinion.

Those who today have the military responsibility for waging this war in all parts of the globe are not helped by the statements of men who, without responsibility and without' the knowledge of the facts, lecture the Chiefs of Staff of the United States as to the best means of dividing our armed forces and our military resources between the Atlantic and Pacific, between the Army and the Navy, and among the commanding generals of the different theaters of war. And I may say that those commanding generals are making good in a big way.

When I addressed you four years ago, I said, "I know that America will never be disappointed in its expectation that labor will always continue to do its share of the job we now face and do it patriotically and effectively and unselfishly."

Today we know that America has not been disappointed. In his Order of the Day when the Allied armies first landed in Normandy two months ago, General Eisenhower said: "Our home fronts have given us overwhelming superiority in weapons and munitions of war."

The country knows that there is a breed of cats, luckily not too numerous, called labor-baiters. I know that there are labor baiters among the opposition who, instead of calling attention to the achievements of labor in this war, prefer to pick on the occasional strikes that have occurred - strikes that have been condemned by every responsible national labor leader. I ought to say, parenthetically, all but one. And that one labor leader, incidentally, is certainly not conspicuous among my supporters.

Labor-baiters forget that at our peak American labor and management have turned out airplanes at the rate of 109,000 a year; tanks - 57,000 a year; combat vessels - 573 a year; landing vessels, to get the troops ashore - 31,000 a year; cargo ships - 19 million tons a year - and Henry Kaiser is here tonight, I am glad to say; and small arms ammunition- oh, I can't understand it, I don't believe you can either - 23 billion rounds a year.

But a strike is news, and generally appears in shrieking headlines - and, of course, they say labor is always to blame. The fact is that since Pearl Harbor only one-tenth of one percent of man-hours have been lost by strikes. Can you beat that?

But, you know, even those candidates who burst out in election-year affection for social legislation and for labor in general, still think that you ought to be good boys and stay out of politics. And above all, they hate to see any working man or woman contribute a dollar bill to any wicked political party. Of course, it is all right for large financiers and industrialists and monopolists to contribute tens of thousands of dollars - but their solicitude for that dollar which the men and women in the ranks of labor contribute is always very touching.

They are, of course, perfectly willing to let you vote - unless you happen to be a soldier or a sailor overseas, or a merchant seaman carrying the munitions of war. In that case they have made it pretty hard for you to vote at all - for there are some political candidates who think that they may have a chance of election, if only the total vote is small enough.

And while I am on the subject of voting, let me urge every American citizen - man and woman- to use your sacred privilege of voting, no matter which candidate you expect to support. Our millions of soldiers and sailors and merchant seamen have been handicapped or prevented from voting by those politicians and candidates who think that they stand to lose by such votes. You here at home have the freedom of the ballot. Irrespective of party, you should register and vote this November. I think that is a matter of plain good citizenship.

Words come easily, but they do not change the record. You are, most of you, old enough to remember what things were like for labor in 1932.

You remember the closed banks and the breadlines and the starvation wages; the foreclosures of homes and farms, and the bankruptcies of business; the "Hoovervilles," and the young men and women of the Nation facing a hopeless, jobless future; the closed factories and mines and mills; the ruined and abandoned farms; the stalled railroads and the empty docks; the blank despair of a whole Nation--and the utter impotence of the Federal Government.

You remember the long, hard road, with its gains and its setbacks, which we have traveled together ever since those days. Now there are some politicians who do not remember that far back, and there are some who remember but find it convenient to forget. No, the record is not to be washed away that easily.

The opposition in this year has already imported into this campaign a very interesting thing, because it is foreign. They have imported the propaganda technique invented by the dictators abroad. Remember, a number of years ago, there was a book, Mein Kampf, written by Hitler himself. The technique was all set out in Hitler's book - and it was copied by the aggressors of Italy and Japan. According to that technique, you should never use a small falsehood; always a big one, for its very fantastic nature would make it more credible - if only you keep repeating it over and over and over again.

Well, let us take some simple illustrations that come to mind. For example, although I rubbed my eyes when I read it, we have been told that it was not a Republican depression, but a Democratic depression from which this Nation was saved in 1933 - that this Administration this one today - is responsible for all the suffering and misery that the history books and the American people have always thought had been brought about during the twelve ill-fated years when the Republican party was in power.

Now, there is an old and somewhat lugubrious adage which says: "Never speak of rope in the house of a man who has been hanged." In the same way, if I were a Republican leader speaking to a mixed audience, the last word in the whole dictionary that I think I would use is that word "depression."

You know, they pop up all the time. For another example, I learned - much to my amazement - that the policy of this Administration was to keep men in the Army when the war was over, because there might be no jobs for them in civil life.

Well, the very day that this fantastic charge was first made, a formal plan for the method of speedy discharge from the Army had already been announced by the War Department - a plan based on the wishes of the soldiers themselves.

This callous and brazen falsehood about demobilization did, of course, a very simple thing; it was an effort to stimulate fear among American mothers and wives and sweethearts. And, incidentally, it was hardly calculated to bolster the morale of our soldiers and sailors and airmen who are fighting our battles all over the world.

But perhaps the most ridiculous of these campaign falsifications is the one that this Administration failed to prepare for the war that was coming. I doubt whether even Goebbels would have tried that one. For even he would never have dared hope that the voters of America had already forgotten that many of the Republican leaders in the Congress and outside the Congress tried to thwart and block nearly every attempt that this Administration made to warn our people and to arm our Nation. Some of them called our 50,000 airplane program fantastic. Many of those very same leaders who fought every defense measure that we proposed are still in control of the Republican party - look at their names - were in control of its National Convention in Chicago, and would be in control of the machinery of the Congress and of the Republican party, in the event of a Republican victory this fall.

These Republican leaders have not been content with attacks on me, or my wife, or on my sons. No, not content with that, they now include my little dog, Fala. Well, of course, I don't resent attacks, and my family doesn't resent attacks, but Fala does resent them. You know, Fala is Scotch, and being a Scottie, as soon as he learned that the Republican fiction writers in Congress and out had concocted a story that I had left him behind on the Aleutian Islands and had sent a destroyer back to find him - at a cost to the taxpayers of two or three, or eight or twenty million dollars- his Scotch soul was furious. He has not been the same dog since. I am accustomed to hearing malicious falsehoods about myself - such as that old, worm-eaten chestnut that I have represented myself as indispensable. But I think I have a right to resent, to object to libelous statements about my dog.

Well, I think we all recognize the old technique. The people of this country know the past too well to be deceived into forgetting. Too much is at stake to forget. There are tasks ahead of us which we must now complete with the same will and the same skill and intelligence and devotion that have already led us so far along the road to victory.

There is the task of finishing victoriously this most terrible of all wars as speedily as possible and with the least cost in lives.

There is the task of setting up international machinery to assure that the peace, once established, will not again be broken.

And there is the task that we face here at home - the task of reconverting our economy from the purposes of war to the purposes of peace.

These peace-building tasks were faced once before, nearly a generation ago. They were botched by a Republican administration. That must not happen this time. We will not let it happen this time.

Fortunately, we do not begin from scratch. Much has been done. Much more is under way. The fruits of victory this time will not be apples sold on street corners.

Many months ago, this Administration set up the necessary machinery for an orderly peacetime demobilization. The Congress has passed much more legislation continuing the agencies needed for demobilization - with additional powers to carry out their functions.

I know that the American people - business and labor and agriculture - have the same will to do for peace what they have done for war. And I know that they can sustain a national income that will assure full production and full employment under our democratic system of private enterprise, with Government encouragement and aid whenever and wherever that is necessary.

The keynote of all that we propose to do in reconversion can be found in the one word jobs. We shall lease or dispose of our Government-owned plants and facilities and our surplus war property and land, on the basis of how they can best be operated by private enterprise to give jobs to the greatest number.

We shall follow a wage policy that will sustain the purchasing power of labor - for that means more production and more jobs.

You and I know that the present policies on wages and prices were conceived to serve the needs of the great masses of the people. They stopped inflation. They kept prices on a relatively stable level. Through the demobilization period, policies will be carried out with the same objective in mind -to serve the needs of the great masses of the people.

This is not the time in which men can be forgotten as they were in the Republican catastrophe that we inherited. The returning soldiers, the workers by their machines, the farmers in the field, the miners, the men and women in offices and shops, do not intend to be forgotten.

No, they know that they are not surplus. Because they know that they are America. We must set targets and objectives for the future which will seem impossible - like the airplanes - to those who live in and are weighted down by the dead past.

We are even now organizing the logistics of the peace, just as Marshall and King and Arnold, MacArthur, Eisenhower, and Nimitz are organizing the logistics of this war.

I think that the victory of the American people and their allies in this war will be far more than a victory against Fascism and reaction and the dead hand of despotism of the past. The victory of the American people and their allies in this war will be a victory for democracy. It will constitute such an affirmation of the strength and power and vitality of government by the people as history has never before witnessed.

And so, my friends, we have had affirmation of the vitality of democratic government behind us, that demonstration of its resilience and its capacity for decision and for action - we have that knowledge of our own strength and power - we move forward with God's help to the greatest epoch of free achievement by free men that the world has ever known.

Noted for Your Morning Procrastination for September 23, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Heather Boushey: Building a strong foundation for the U.S. economy - Washington Center for Equitable Growth

It Really Seems as Though Dallas Fed President Richard Fisher Doesn't Want Real Wages to Increase, or Doesn't Believe Real Wages Can Increase, or Something: Tuesday Focus for September 23, 2014 - Washington Center for Equitable Growth

Potential Output and Total Factor Productivity since 2000: Marking My Beliefs to Market: The Honest Broker for the Week of September 26, 2014 - Washington Center for Equitable Growth

Morning Must-Read: Andy Jalil: A New History of Banking Panics in the United States, 1825–1929: Construction and Implications - Washington Center for Equitable Growth

Lunchtime Must-Read: David M. Byrne, Stephen D. Oliner, and Daniel E. Sichel: Is the Information Technology Revolution Over? - Washington Center for Equitable Growth

Lunchtime Must-Read: Paul Krugman: The Temporary-Equilibrium Method - Washington Center for Equitable Growth

Morning Must-Read: Lemin Wu et al.: Entertaining Malthus: Bread, Circuses and Economic Growth - Washington Center for Equitable Growth

Morning Must-Read: Daniel Davies: Every Single IT guy, Every Single Manager… - Washington Center for Equitable Growth

Morning Must-Read: Kevin Bryan: “Aggregation in Production Functions: What Applied Economists Should Know,” J. Felipe & F. Fisher (2003) - Washington Center for Equitable Growth

Morning Must-Read: Alan S. Blinder: Behind the Fed's Dovish Turn on Rates - Washington Center for Equitable Growth

Plus:

Things to Read on the Morning of September 23, 2014 - Washington Center for Equitable Growth

Must- and Shall-Reads:

Jill Lepore: Wonder Woman’s Secret Past

Jörg Wuttke: The Future of China’s Economy

Michael Hiltzik: Census data on poverty show results of economic policy gone wrong

David M. Byrne, Stephen D. Oliner, and Daniel E. Sichel: Is the Information Technology Revolution Over?: "Given the slowdown in labor productivity growth in the mid-2000s, some have argued that the boost to labor productivity from IT may have run its course. This paper contributes three types of evidence to this debate. First, we show that since 2004, IT has continued to make a significant contribution to labor productivity growth in the United States, though it is no longer providing the boost it did during the productivity resurgence from 1995 to 2004. Second, we present evidence that semiconductor technology, a key ingredient of the IT revolution, has continued to advance at a rapid pace and that the BLS price index for microprocesssors may have substantially understated the rate of decline in prices in recent years. Finally, we develop projections of growth in trend labor productivity in the nonfarm business sector. The baseline projection of about 13⁄4 percent a year is better than recent history but is still below the long-run average of 21⁄4 percent. However, we see a reasonable prospect — particularly given the ongoing advance in semiconductors — that the pace of labor productivity growth could rise back up to or exceed the long-run average. While the evidence is far from conclusive, we judge that 'No, the IT revolution is not over'."

Paul Krugman: The Temporary-Equilibrium Method: "David Glasner has some thoughts... that I mostly agree with, but not entirely. So, a bit more. Glasner is right to say that the Hicksian IS-LM analysis comes most directly not out of Keynes but out of Hicks’s own Value and Capital, which introduced the concept of 'temporary equilibrium'... using quasi-static methods to analyze a dynamic economy... simply as a tool.... So is IS-LM really Keynesian? I think yes--there is a lot of temporary equilibrium in The General Theory, even if there’s other stuff too. As I wrote in the last post, one key thing that distinguished TGT from earlier business cycle theorizing was precisely that it stopped trying to tell a dynamic story.... The real question is whether the method of temporary equilibrium is useful. What are the alternatives? One... is to do intertemporal equilibrium all the way... DSGE--and I think Glasner and I agree that this hasn’t worked out too well.... Economists who never learned temporary-equiibrium-style modeling have had a strong tendency to reinvent pre-Keynesian fallacies (cough-Say’s Law-cough), because they don’t know how to think out of the forever-equilibrium straitjacket.... Disequilibrium dynamics all the way?... I have never seen anyone pull this off.... Hicks... often seems to hit a sweet spot between rigorous irrelevance and would-be realism that ends up being just confused.... Glasner says that temporary equilibrium must involve disappointed expectations, and fails to take account of the dynamics that must result as expectations are revised.... I’m not sure that this is always true. Hicks did indeed assume static expectations... but in Keynes’s vision of an economy stuck in sustained depression, such static expectations will be more or less right. It’s true that you need some wage stickiness to explain what you see... but that isn’t necessarily about false expectations.... In the end, I wouldn’t say that temporary equilibrium is either right or wrong; what it is, is useful..."

Lemin Wu et al.: Entertaining Malthus: Bread, Circuses and Economic Growth: "We augment a simple Malthusian model by allowing agents to consume something besides food. Whereas food (in our case: bread) is both enjoyable and necessary for survival, the other good, circuses, is pure entertainment: it has absolutely no impact on survival, but does enhance the quality of life. With this very simple modification, we show that, whereas food supply may remain at subsistence, technological change will have a great impact on the consumption of everything else. Most strikingly, though the population remains bound by a Malthusian constraint, sustained improvements to living standards can no longer be ruled out. We also argue that our model better fits the known historical facts–the widely-held belief that growth prior to the Industrial Revolution was flat is based largely on historical measures of food production. Although food supply throughout history may have been (and for most individuals still is) at or near subsistence levels technological advancements have brought greater convenience and comfort to wealthy and poor alike, a possibility that Malthus himself conceded in his later (and often ignored) work. Therefore, our model not only describes historical growth patterns and demographic transitions better than traditional 'Malthusian' models, but is also more in line with Malthus’ later thinking."

Daniel Davies: Every single IT guy, every single manager…: "In the general debate on email spying and... NSA/Snowden... people who want to dismiss the whole thing as 'no big deal' are... totally underestimating the... blind trust... required of them.... Even opponents of ubiquitous surveillance... assume that the institution which has access to your information is the institution which collected it. But that’s not necessarily the case at all. The Leveson Inquiry... demonstrated that the Police National Computer could be accessed by more or less any tabloid journalist with a phone and an account with a crooked detective agency.... Manning and Snowden... have made it clear that mid-level employees can get access to huge amounts of top secret data as long as they’ve got the wit to smuggle it out on a thumb drive. So the question is not so much 'do you trust the CIA/NSA/MI6/etc?'. It’s “Do you trust every single sysadmin... analyst... middle manager?”. The CIA might not be interested at all in my dull mobile phone conversation metadata, but someone else might--the Leveson inquiry was told how the UK’s PNC was used by one copper to check out his daughter’s new boyfriend.... The policies which might prevent [our data] from being accessed by blackmailers, tabloid journalists, nosey neighbours and basically anyone else, are themselves top secret and not subject to any sort of legal oversight. This isn’t a conspiracy theory.... It’s based on the fact that big and complicated systems are set up to malfunction, particularly if they are able to declare themselves above any regulation.... And the way in which this particular system is set up to malfunction is easily predictable and potentially very damaging to innocent people. I am personally not at the stage where I trust every single person who might be hired for a low level IT job in a security agency, and I’m not sure that I trust an entirely opaque set of safeguards with no accountability either."

Nick Bunker: How Rising Income Inequality Affects State Tax Revenue: "S&P’s job is to assess the risk of bonds or other fixed-income investments and the creditworthiness of the governments.... According to the new report, rising income inequality is a factor that affects the creditworthiness of state governments, and thus their cost of borrowing and the tax revenue required to pay off their bonds. Over the past several decades, incomes have shifted upward while the tax code hasn’t responded. The result: states are collecting less tax revenue.... [State] spending cutbacks don’t just affect growth and stability. They also have implications for economic inequality. A paper by economists Laurence Ball, of Johns Hopkins University, and Davide Furceri, Daniel Leigh, and Prakash Loungani—all at the International Monetary Fund—finds that fiscal consolidation, or attempts to reduce budget deficits, ends up raising inequality. Particularly noteworthy is their conclusion that focusing primarily on cutting government spending results in larger increases in economic inequality."

Dylan Scott: This Classic GOP Anti-Obamacare Meme Has Officially Imploded: "Last week... [was] the end of one of the GOP's favorite anti-Obamacare memes.... It was just a few months ago that Republicans were... theorizing that a third or more of Obamacare sign-ups weren't paying their bills.... 'I don't know how many have actually paid for it', House Speaker John Boehner (R-OH) said... he believed that fewer people were now covered than before the law. 'I actually do believe that to be the case'.... Boehner wasn't alone.... 'We don’t know how many have paid'... spokesman for Senate Minority Leader Mitch McConnell.... '20 percent to 33 percent are signing up and then not paying', Rep. Darrell Issa (R-CA) said.... 'Im told a low %--perhaps as low as 15%--of people who "enrolled" in #Obamacare actually paid first premium. Will be A LOT of attrition' — Scott Gottlieb, MD (@ScottGottliebMD) December 6, 2013.... 'Report: 1/3 of #ObamaCare "enrollees" haven't paid premiums. How does not paying the premium constitute enrollment? http://t.co/OkkUhsJGyt' — Reince Priebus (@Reince).... Last week's news, however, was effectively met with crickets..."

Eric Wemple: Alessandra Stanley’s Contempt for New York Times Readers: "The piece launched a thousand tweets with a single-sentence lede: 'When Shonda Rhimes writes her autobiography, it should be called "How to Get Away With Being an Angry Black Woman"'.... New York Times Public Editor Margaret Sullivan... [wrote] that the piece was 'astonishingly tone-deaf and out of touch'. No critique, however, was so damning as the one delivered by … Alessandra Stanley.... 'I didn’t think Times readers would take the opening sentence literally because I so often write arch, provocative ledes that are then undercut or mitigated by the paragraphs that follow'. Only a gifted critic can pack so much sin into a single sentence. Sin No. 1: Over-healthy self-regard: What Stanley appears to be saying here is that Times readers read her stuff with such care and joy that they know her as the woman who writes self-mitigated ledes. Ahhh, yes, that’s her trademark! Sin No. 2: Deliberate obfuscation: Just what is the purpose of mitigating your own lede? That must be an art form that Stanley and her culture-critic pals delight in executing. From this point onward, the Erik Wemple Blog will start reading Stanley’s work from the third or fourth paragraph. Sin No. 3: Why write a lede at all if your goal in the body of the piece is to undercut it?..."

Kevin Bryan: “Aggregation in Production Functions: What Applied Economists Should Know,” J. Felipe & F. Fisher (2003): "What conditions are required to construct an aggregated production function Y=F(K,L), or more broadly to aggregate across firms an economy-wide production function Y=F(K,L)? Note that the question is not about the definition of capital per se, since defining 'labor' is equally problematic when man-hours are clearly heterogeneous, and this question is also not about the more general capital controversy worries, like reswitching.... The conditions under which factors can be aggregated are ridiculously stringent... that the marginal rate of substitution between different types of factors in one aggregation, e.g. capital, does not depend on the level of factors not in that aggregation, e.g. labor. Surely this is a condition that rarely holds: how much I want to use... different types of trucks will depend on how much labor I have at hand.... Why, then, do empirical exercises using, say, aggregate Cobb-Douglas seem to give such reasonable parameters, even though the above theoretical results suggest that parameters like 'aggregate elasticity of substitution between labor and capital' don’t even exist?.... Since ex-post production Y must equal the wage bill plus the capital payments plus profits, Felipe notes that this identity can be algebraically manipulated to Y=AF(K,L) where the form of F depends on the nature of the factor shares. That is, the good fit of Cobb-Douglas or CES can simply reflect an accounting identity.... It doesn’t strike me that aggregate production functions are measuring arbitrary things. However, if we are using parameters from these functions to do counterfactual analysis, we really ought know better exactly what approximations or assumptions are being baked into the cake..."

Alan Blinder: Behind the Fed's Dovish Turn on Rates: "The battle at the Federal Open Market Committee is now on. Score the previous meeting in late July for the inflation hawks, but last week's meeting went for the doves.... The committee's hawks would like the phrase 'significant underutilization of labor' removed from the statement.... They want the FOMC to stop declaring that interest rates will remain at their current superlow levels 'for a considerable time'.... The hawks want the Fed to stop saying that it expects to keep interest rates low 'for some time'.... Plosser dissented again... this time Fisher joined him.... Yet another indicator of rampant disagreement appeared.... Opinions on where the [Federal Funeds] rate should be... for the end of 2016 [range] from 0.25-0.50% to 4%. This is a remarkable degree of disagreement..."

And Over Here:

Over at Equitable Growth: It Really Seems as Though Dallas Fed President Richard Fisher Doesn't Want Real Wages to Increase, or Doesn't Believe Real Wages Can Increase, or Something: Tuesday Focus for September 23, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging the American Revolution: September 22, 1776: Execution of Nathan Hale (Brad DeLong's Grasping Reality...)

This Is Not the First Time We Have Seen Alessandra Stanley, Is It? (Brad DeLong's Grasping Reality...)

Over at Equitable Growth: Potential Output and Total Factor Productivity since 2000: Marking My Beliefs to Market: The Honest Broker for the Week of September 26, 2014 (Brad DeLong's Grasping Reality...)

Should Be Aware of:

Christine Hyung-Oak Lee: I Had a Stroke at 33: On New Year’s Eve 2007, a clot blocked one half of my brain from the other; my reality would never be the same again

Jennifer Kingston: On a Warmer Planet, Which Cities Will Be Safest?: Portland Will Still Be Cool, but Anchorage May Be the Place to Be

Julia Belluz: The worst case scenario for Ebola

Reuters cans experimental e-mail and linkblog service

Nick Bunker: Financing the rise in income inequality: "Joaane Lindley... and Steven McIntosh... show... a worker moving into... the U.K finance industry... sees their wages increase by 37 percent.... Finance executives make more than non-finance executives and customer service representatives for financial firms make more than representatives for non-financial firms.... The authors’ preferred explanation is the firm sharing 'rents' with its workers.... The large premium for finance workers... results in the industry’s overrepresentation at the very top.... In 2005, about 14 percent of taxpayers in the top 1 percent and 18 percent of those in the top 0.1 percent were employed in the finance industry, compared to just under 8 percent of the top 1 percent and 11 percent of the top 0.1 percent in 1979..."

Jared Bernstein: If the lagging labor force rate doesn’t still embody considerable slack, then why does it increasingly predict wage growth?: "Most work suggests the cyclical part of the [output] gap is falling over time and is now quite minimal, as both the recovery takes hold and 'scarring' effects make it tougher for labor force exiters to find their way back into the job market. However, a look at the relationship between the LFPR and wage trends suggests this conclusion may be premature.... Goldman Sachs economists showed... using just unemployment [to forecast wage growth] leads to an upwardly biased forecast in recent data.... Add[ing] the labor force participation rate (LFPR) to the model... tracks the wage trends more closely.... LFPR coefficients... start out insignificant but gain significance as the weak recovery proceeds..."

Over at Equitable Growth: It Really Seems as Though Dallas Fed President Richard Fisher Doesn't Want Real Wages to Increase, or Doesn't Believe Real Wages Can Increase, or Something: Tuesday Focus for September 23, 2014

Over at Equitable Growth: Tim Duy: Fisher on Wages: "Richard Fisher said Friday the US economy was threatened...

...by higher wages. Via Reuters:

Fisher said on Friday he worries that further declines in unemployment nationally could lead to broader wage inflation. To head that off, and also to address what he called rising excesses in financial markets, Fisher said he prefers to raise rates by springtime, sooner than many investors currently anticipate....

I wondered if he was not misquoted or misinterpreted. But he definitely warns that wage growth is set to accelerate in his Fox News interview.... READ MOAR

The crux of his argument is that wage growth accelerates when unemployment hits 6.1%.... He seems genuinely concerned that wage growth is negative outcome--that wage growth in Texas is a precursor to a terrible outcome for the US economy as a whole. His entire tone is odd, and I feel compelled to clean up his argument.... It is reasonable to expect that wage growth will accelerate as unemployment moves below 6%... [although] this is... a test of... [whether] alternative measures of under-utilization more accurately... [measure] slack.... That said, why should Fisher fear wage growth? I don't see how one can expect real wages to rise in the absence of nominal wage growth in excess of inflation. And once you accept the possibility of real wage growth, you recognize the link between wage growth and inflation could be very weak. And so it is....

The past 20 years give no reason to believe that 4% wage inflation cannot happily coexist with 2% price inflation. So if wage inflation does not necessarily translate into price inflation, why worry at all? Why is Fisher even worried about wages? The key is really just this quote:

This is like duck hunting, you shoot ahead of the mallard rather than try to get it from behind, otherwise you can't hit it.

It is all about the timing.... Rather than act disgusted by higher wage growth, he should say that the Fed needs to ensure that such growth translates into real wage growth, and the Fed accomplishes this by adjusting accommodation to maintain its price inflation target. The Fed wants to hold unemployment in a zone consistent with both real wage growth and low and stable inflation. This requires nominal wage growth in excess of 2%. It follows then that given the unemployment rate is already near 6%, it is not reasonable for the Fed to suggest that the first rate hike is a 'considerable period' off.... Stated like this, I suspect a large portion of the FOMC would be sympathetic.... That said, most members lack Fisher's certainty that wages gains are set to accelerate and indicate that labor market slack has dwindled to the point that it is appropriate to remove financial accommodation. There remains the concern that the unemployment rate is not the best measure of labor market slack.... Moreover, as we now know, showing their anti-inflationary resolve did not do the Fed any favors in 2006 and 2007.... It is reasonable to thus conclude that on average, the Fed has been too tight, not too loose. Hence again why the FOMC is willing to be patient in the normalization process....

I suspect that Fisher has pivoted to concerns about wage inflation because his much feared price inflation has never emerged...

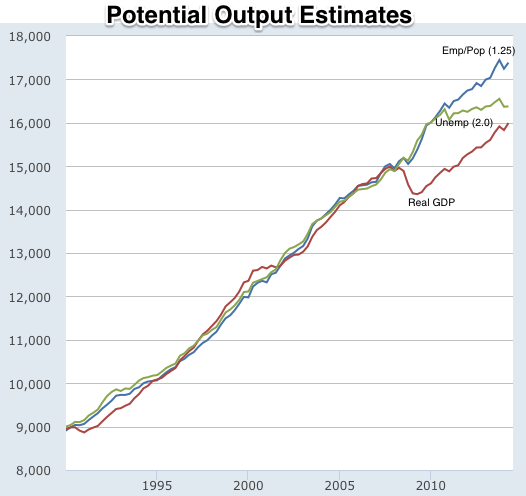

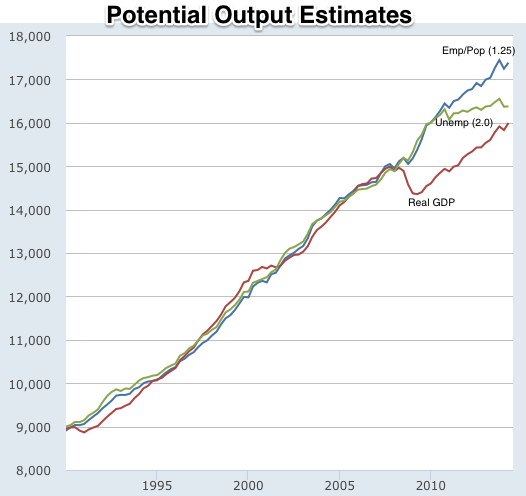

As I said yesterday, there is great uncertainty right now whether the right measure of current macroeconomic slack is something like the unemployment rate or something like the employment-to-population ratio. And the two possibilities produce, via Okun's Law, very different pictures of how much slack there currently is between current levels of output and employment and potential output and full employment:

4% per year nominal wage growth is not a problem as long as it is accompanied by 2%/year increases in prices. In fact, that is the configuration we want to see. And that is the configuration we saw in 1989-1990, 1997-2000, and 2006-2008. And in all three of those episodes it turned out after the fact that urgent tightening of monetary policy then was not what the economy needed--the Fed tightened in 1990-91, and found that it had overdone it when the S&L bankruptcy shock hit financial markets; the Fed tightened in 1999 and refused to loosen in 2000, and found that it had overdone it as tech investment collapsed; the Fed tightened in 2006-2007, and...

By contrast, 2%/year nominal wage growth is a problem: it is accompanied either by sharply widening income inequality or by downward pressure pushing inflation toward and perhaps below 0%/year. And an inflation rate that continually undershoots the Federal Reserve's 2%/year target (which really ought to be 3% or 4%/year) leaves the economy very vulnerable to any additional negative shocks that might occur, and they will. Federal Reserve policymakers who fear the risks associated with prolonged intervals of very low interest rates really should, right now, by stridently advocating for monetary policies that will get us to 4%/year wage inflation as fast as possible. But they are not. It is a puzzlement...

September 22, 2014

Liveblogging the American Revolution: September 22, 1776: Execution of Nathan Hale

:

:

After the Battle of Harlem Heights, a Connecticut officer, a former schoolmaster named Nathan Hale, volunteered to conduct espionage behind the British lines to secure intelligence concerning troop movements. He was captured on Long Island, identified as a spy (some sources say that he was fingered by his own cousin, Samuel Hale—but it is also true that he carried incriminating documents on his person), and summarily hanged on September 22, 1776. There is considerable difference of opinion as to the site of his execution, which may have been at the present intersection of 66th Street and Third Avenue in Manhattan; at City Hall Park in Lower Manhattan, or at the present location of the Yale Club at 44th Street and Vanderbilt Avenue, across from Grand Central Terminal. Frederick Mackenzie, a British captain, recorded the execution in his diary on the day of the event.

Sept. 22. A person named Nathaniel Hales [sic], a lieutenant in the Rebel army and a native of Connecticut, was apprehended as a spy last night upon Long Island; and having this day made a full and free confession to the Commander in Chief of his being employed by Mr Washington in that capacity, he was hanged at 11 o'clock in front of the park of artillery. He was about 24 years of age, and had been educated at the College of Newhaven [Yale College] in Connecticut. He behaved with great composure and resolution, saying he thought it the duty of every good officer to obey any orders given him by his Commander in Chief; and desired the spectators to be at all times prepared to meet death in whatever shape it might appear.

This Is Not the First Time We Have Seen Alessandra Stanley, Is It?

Perhaps Margaret Sullivan could read her predecessor?

Margaret Sullivan: An Article on Shonda Rhimes Rightly Causes a Furor: "Alessandra Stanley['s]... first paragraph--with a reference to Ms. Rhimes as an 'Angry Black Woman'...

...struck many readers as completely off-base. Many called it offensive. Some went further, saying it was racist. Another reference to the actress Viola Davis as 'less classically beautiful' than lighter-skinned African American actresses immediately inspired a mocking hashtag.... I have asked Ms. Stanley for further comment (she has said that her intentions were misunderstood, and seemed to blame the Twitter culture for that.... Culture editor, Danielle Mattoon.... 'There was never any intent to offend anyone and I deeply regret that it did', Ms. Mattoon said. 'Alessandra used a rhetorical device to begin her essay, and because the piece was so largely positive, we as editors weren’t sensitive enough to the language being used'. Ms. Mattoon called the article 'a serious piece of criticism', adding, 'I do think there were interesting and important ideas raised that are being swamped' by the protests. She told me that multiple editors--at least three--read the article in advance but that none of them raised any objections...

The Nytpicker (August 2009): How Does Alessandra Stanley Get To Keep Her Job As TV Critic? That's One Question Clark Hoyt Neglects To Ask. "Under the headline 'How Did This Happen?' Public Editor Clark Hoyt...

...today purports to address Alessandra Stanley's famously-flawed appraisal of Walter Cronkite on July 18, and to explain how the TV critic could end up with a whopping 8-error correction. But while Hoyt names several editors who failed to catch the mistakes in Stanley's piece, he ignores the deeper question on readers' minds. How does a television critic who has had 91 corrections of her work in just six years get to keep her job? Nowhere in Hoyt's 1,228-word essay today does the Public Editor address the question of what consequences Stanley has faced as a result of her epic fail on July 18. By focusing on the mechanics of the screw-up--which includes naming editors who read the piece and who didn't fact-check it--Hoyt bypasses the issue of a systemic breakdown at the NYT that led to the error-riddled essay.

Over at Equitable Growth: Potential Output and Total Factor Productivity since 2000: Marking My Beliefs to Market: The Honest Broker for the Week of September 26, 2014

Over at Equitable Growth: I am still thinking about the best assessment of potential output and productivity growth that we have--that of the extremely-sharp John Fernald's "Productivity and Potential Output Before, During, and After the Great Recession". And I am--slowly, hesitantly, and unwillingly--coming to the conclusion that I have to mark my beliefs about the process of economic technological change to market, and revise them significantly.

Let's start with what I wrote last July: READ MOAR

U.S. labor and total-factor productivity growth slowed prior to the Great Recession. The timing rules out explanations that focus on disruptions during or since the recession, and industry and state data rule out 'bubble economy' stories related to housing or finance. The slowdown is located in industries that produce information technology (IT) or that use IT intensively...

But when I look at this graph:

I see, from 2003:I to 2007:IV, a healthy growth rate of 3.2%/year according to Fernald’s potential-output series. Then after 2007:IV the growth rate of Fernald’s potential-output series slows to 1.45%/year. The slowdown from the late 1990s era of the internet boom to the pace of potential output growth prior to the Lesser Depression is small potatoes relative to the slowdown that has occurred since. Thus Fernald’s claim that the “timing rules out explanations that focus on disruptions during or since the recession”. As I see it, the timing is perfectly consistent with:

a small slowdown in potential output growth that starts in the mid-2000s as the tide of the infotech revolution starts to ebb, and

a much larger slowdown in potential output growth with the financial crisis, the Lesser Depression, and the jobless recovery that has followed since.

I say this with considerable hesitancy and some trepidation. After all, John Fernald knows and understands these data considerably better than I do. Perhaps it is simply that I spend too much time down in Silicon Valley and so cannot believe that the fervor of invention and innovation that I see there does not have large positive macroeconomic consequences.

Nevertheless, I have come to believe that macroeconomists think that their assumption the trend is separate from and independent of the cycle are playing them false. This assumption was introduced for analytical convenience and because it seemed true enough for a first cut. I see no reason to imagine that it is still true.

That's what I said last July. And now I have been trying to think about it some more...

There are actually two ways to read Fernald's potential series. The first--the one I gravitated to--is this:

More-or-less smooth growth from 2003 to 2009, with a serious slowdown in potential output growth starting in 2009 as serious hysteresis from the Lesser Depression hits the long-run growth potential of the American economy.

The second way to look at it is this:

A sharp drop in the rate of potential output growth starting in 2005, with the Lesser Depression having had--so far--little negative hysteretic effect on potential output growth: basically, that another 1970s-magnitude productivity growth slowdown hit the U.S. economy in 2005, and that even without the financial crisis and the Lesser Depression we would today be more-or-less where we in fact are.

The second reading of the time series has to take the 2009 potential output estimate as an anomaly: a measurement error. The first reading of the time series has to take 2005 and 2008 as (smaller) measurement-error anomalies. The first reading suggests enormous headroom for cyclical recovery provided we can overcome effects of hysteresis. The second reading suggests that there is no such headroom--that what we have is only a little bit less than the best we can reasonably expect.

An alternative approach to the data is to use Okun's Law--to assume cointegration between potential GDP, actual real GDP, and either the unemployment rate or the employment-to-population ratio, with an Okun's Law coefficient of 1.25 for the employment-to-population ratio (a 1% fall in the employment-to-population ratio reduces real GDP below potential by an extra 1.25%) and of 2.0 for the unemployment rate (a 1%-point fall in the employment-to-population ratio reduces real GDP below potential by an extra 2.0%). This assumption allows us to construct potential output series for the employment-to-population ratio (assuming that full employment-to-population is 63%) and for the unemployment rate (assuming that full employment is attained at a 5% unemployment rate):

Both the employment-to-population ratio-based and the unemployment rate-based Okun's Law potential output series tell the same story about the output gap and the business cycle from 1990-2010, and it is a reasonable story: the recession of the early 1990s and the subsequent "jobless recovery" producing an output gap that was not especially large but that was long-lasting; productivity-growth acceleration in the late-1990s as the high-tech sector reaches critical mass; "overheating" with output above potential in 2000 and 2001; small but persistent output gaps in the first half of the 2000s; growth with production at more-or-less potential output from 2005 through 2007; the collapse and the emergence of the enormous output gaps of the Lesser Depression in 2008-2009. And then, starting in 2010, the stories the two measures tell diverge markedly. The unemployment rate-based Okun's Law potential output series tells the same story as Fernald potential interpretation (2) above: of a collapse in potential output growth due to hysteresis starting after 2009. The employment-to-population ratio-based Okun's Law potential output series telling us that potential has continued at its pre-2008 pace: that if only we could get employment back up to 63% of adults we would find no shift in potential growth at all (a story that, given the aging of the population, is surely too optimistic).

The preferred-Fernald (1) story of a growth slowdown starting in 2005 can be seen in the Okun's Law potential output estimates: you can draw a line from 2005 potential through 2007 potential and extend it to get to today's unemployment rate-based Okun's Law potential output estimate:

But such a procedure magnifies the 2009-2010 anomaly noted in the discussion of the preferred-Fernald (1) story above.

Once again, what you conclude depends very much on what priors you started out with.

The magnitude of the analytical puzzle we fact is well-expressed in Fernald's Figure 1:

which shows well the collapse in total factor productivity and the reduction in capital deepening comparing 1948-1973 with 1973-1995, and the subsequent return of total factor productivity growth and of (real) capital deepening over 1995-2003. And then the mystery of what happened afterwards. We have stories--quantitatively inadequate stories, I agree--of what happened to turn 1948-1973 to 1973-1995. But at least we have stories, and we have a lot of them. We have a story--the Byrne-Oliner-Sichel story--of how the high-tech sector attained critical mass both for total factor productivity growth and for real capital-deepening channels in the mid-1990s, and so a pretty good explanation of what turned 1973-1995 into 1995-2003.

But after 2003?

We didn't have a collapse in the high-tech sector. The engine of Silicon Valley continues to hum and purr much as it had before. We do have the standard problems of measurement and appropriability. If you want to get all techno-utopian (and I do) your estimates of real economic growth should take account of the fact that while the extra consumer surplus derived from the production of rival and excludible goods might be thought of as roughly equal to the GDP-account value, the extra consumer surplus derived from the production of non-rival and not-very-excludible goods is a much larger multiple of the GDP-account value--five times?, ten times?--because the eyeballs and the ancillary services that producers like Google sell to get their revenue are worth much less to those who pay to buy them than the free commodities Google gives away to create the eyeballs and the valuable ancillary services are worth to those who benefit from the free commodities, which are what Google really makes. But did those problems suddenly become bigger after 2003? The appropriability crisis had always been there: it did not emerge after 2003.

Fernald has a very nice graph of what his total factor productivity growth estimates tell him by broad tech-intensivity sector: the IT-producing industries, the IT-using industries, and the non-IT-intensive industries:

The picture painted is of (a) nothing happening in non-IT-intensive industries, (b) a large but transitory wave of productivity in the IT-producing industries, and (c) eight years later an echoing wave of productivity in the IT-intensive using industries, followed by a post-2006 return to lower than the previous 1973-1995 normal. But what actual, observable, patterns and stories of organization and narrative out here in the real world correspond to these striking moves in the numbers that underpin the GDP and productivity accounts? I have a hard time seeing any of them.

My problem is that I believe in the slow diffusion of technology, the importance of incremental improvements, the usefulness of the incentives provided by the fact that it is easy to make a lot of money by figuring out a cheaper way to produce and supply things that people are willing to pay a lot of money for, and the law of large numbers. These make me think that--modulus the business cycle and measurement error--total factor productivity should be smooth in the level and smooth in the growth rate as well: whatever processes were going on last year that led to invention, innovation, deployment, and thus higher productivity in a potential-output sense ought to be almost as strong or only a little stronger this year. An oil shock, the entrance into the labor force of a baby-boom generation, a redirection of investment to controlling rather than increasing pollution, a decline in union power that makes it worthwhile to redirect investment from increasing the productivity of the workers you have to enabling the value chain to function even should one have to carry through the threat of a mass layoff--all these ought to be able to produce relatively large shifts in total factor productivity growth relatively quickly. But we should be able to see them. And we see them in the 1970s and 1980s. But I do not see them in the 2000s, do we?

It is clear that the failure of the numbers that the--extremely smart--John Fernald calculates from the data we have to conform to my prior beliefs about the smoothness of aggregate total factor productivity growth is a problem. It is not clear to me whether it is a problem with me, a problem with whether our data accurately reflects the universe, or a problem with--or rather a fact that--the universe does not conform to my Visualization of the Cosmic All.

I asked John Fernald. And he emailed back his--well-informed--view that it was a problem with my expectations, and a fact about how the world works that I need to wrap my mind around and accept.

John Fernald: Yes, it’s a problem with the universe...