J. Bradford DeLong's Blog, page 1140

October 7, 2014

Noted for Your Morning Procrastination for October 7, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Afternoon Must-Read: Paul Krugman: Why Weren’t Alarm Bells Ringing? - Washington Center for Equitable Growth

Afternoon Must-Watch: Thomas Piketty, Heather Boushey, Anwar Shaikh - Washington Center for Equitable Growth

Afternoon Must-Read: Simon Wren-Lewis: Is Keynesian Economics Left-Wing? - Washington Center for Equitable Growth

Lunchtime Must-Read: Roger Farmer: NAIRU Theory-Closer to Religion than Science - Washington Center for Equitable Growth

Lunchtime Must-Read: Mohamed El-Erian: US Midterm Elections Offer Limited Prospect for Economic Change - Washington Center for Equitable Growth

Morning Must-Read: Tim Duy: Is There a Wage Growth Puzzle? - Washington Center for Equitable Growth

Morning Must-Read: Robert Waldmann: Phillips curves with Anchored Expectations - Washington Center for Equitable Growth

Plus:

Things to Read on the Morning of October 7, 2014 - Washington Center for Equitable Growth

Must- and Shall-Reads:

Jérémie Cohen-Setton: The Fed and the Secular Stagnation Hypothesis

Ian Millhiser: The Glaring Falsehood That Could Steal Health Care Away From Millions Of Americans

Jamie Condliffe: Earth Has Been Getting Warmer Way Faster Than We Thought

Sarah Kliff: "CHOICE Project's teenage participants had significantly lower abortion and birth rates than women nationwide. They use better contraceptives, too.... There's actually a financial challenge for clinics to offer the most effective birth control. And you need a clinic to be stable.... Clinics have to be okay when teens are half an hour late, and not cancel their appointment. The idea is really taking down any barriers that exist right now. I'm hoping the momentum builds enough where people start chipping away at these barriers."

Hefei Wen et al.: The Effect of Substance Use Disorder Treatment Use on Crime: Evidence from Public Insurance Expansions and Health Insurance Parity Mandates

Paul Krugman: Voodoo Economics, the Next Generation

Roger Farmer: NAIRU theory--closer to religion than science

Mohamed El-Erian: US midterm elections offer limited prospect for economic change

Tim Duy: Is There a Wage Growth Puzzle?

Alessandro Speciale: German Factory Orders Slump Most Since 2009

Robert Waldmann: Phillips curves with Anchored Expectations

Simon Wren-Lewis: More Asymmetries: Is Keynesian Economics Left-Wing?

Paul Krugman: Why Weren’t Alarm Bells Ringing?

Thomas Piketty, Heather Boushey, Anwar Shaikh:

And Over Here:

Afternoon Must-Watch: Thomas Piketty, Heather Boushey, Anwar Shaikh (Brad DeLong's Grasping Reality...)

Bloomberg Politics: Dead on Arrival or Just in Intensive Care?: Mark Helperin: Clinically Insane, or Phoning-It-in Con Man?: Live from the Roasterie... (Brad DeLong's Grasping Reality...)

Over at Equitable Growth: Lunchtime Must-Read: Mohamed El-Erian: US Midterm Elections Offer Limited Prospect for Economic Change (Brad DeLong's Grasping Reality...)

Roger Farmer: NAIRU theory--closer to religion than science: "According to the NRH, unemployment differs from its natural rate only if expected inflation differs from actual inflation.... The probability that average expected inflation over a decade will be different from average actual inflation should be small. If the NRH and rational expectations are both true simultaneously, a plot of decade averages of inflation against unemployment should reveal a vertical line at the natural rate of unemployment.... This prediction fails dramatically.... Defenders of the Natural Rate Hypothesis might choose to respond to these empirical findings by arguing that the natural rate of unemployment is time varying. But I am unaware of any theory which provides us, in advance, with an explanation of how the natural rate of unemployment varies over time. In the absence of such a theory the NRH has no predictive content. A theory like this, which cannot be falsified by any set of observations, is closer to religion than science."

Mohamed El-Erian: US midterm elections offer limited prospect for economic change: "The main question is not whether the midterms will change the gridlock in Washington that undermines economic growth, accentuates inequalities, and holds back prosperity; it is whether companies and individuals can decouple even more forcefully from yet another 'do-little' Congress.... There is little chance of change in the polarisation and dysfunction paralysing Congress.... The fiscal stance would not be altered to provide for higher and better balanced aggregate demand; supply responsiveness would not be enhanced by stepped-up investments in infrastructure, education, labour market strengthening and other areas that improve productivity; medium-term operational uncertainty would not be reduced by greater clarity on corporate tax reform; and damaging debt overhangs would not be lifted.... For stock markets to continue to prosper, the private sector would have to decouple even more from Washington.... It would require much bigger emphasis on longer-term investments in areas that, notwithstanding the continued shortfalls in Congress, unleash underused resources and expand longer-term potential. And the scale and scope would need to validate the current level of excessive risk-taking by financial markets lest that, in itself, becomes a consequential headwind to economic growth and stability..."

Tim Duy: Is There a Wage Growth Puzzle?: "It would appear that in the face of severe contractions, wage adjustment is slow. Now consider the 1985-1990 period... wage growth is stagnant until unemployment moves below 6%.... Thus, it is premature to believe that there has been a breakdown in this relationship. So far, the response of wages is exactly what you should have expected in light of the 1980's dynamics.... After 1992, wage growth tends to move sideways until unemployment sinks below 6%.... Oh--and real wage growth has reverted to the pre-Great Recession trend--pretty much exactly where you would expect it to be given the level of unemployment. Honestly, this one surprised me. Which suggests that labor market healing has progressed much further than many progressives would like to admit. Many conservatives as well.... Bottom Line: Be cautious in assuming that this time is different. The unemployment and wage growth dynamics to date are actually very similar to what we have seen in the past. Low wage growth to date is not the 'smoking gun' of proof of the importance of underemployment measures. There very well may have been much more labor market healing that many are willing to accept, even many FOMC members. The implications for monetary policy are straightforward--it suggests the risk leans toward tighter than anticipated policy."

Alessandro Speciale: German Factory Orders Slump Most Since 2009: "Deteriorating confidence is undermining a rebound in Germany’s economy from a second-quarter slump. The 18-nation euro region is struggling to sustain its recovery amid rising political tension with Russia over its support of separatists in Ukraine and inflation that’s running at a fraction of the European Central Bank’s definition of price stability. 'Geopolitical risks, especially the crisis in Eastern Ukraine, have made companies cautious about their investment plans, despite very favorable fundamental and funding conditions', said Christian Schulz, senior economist at Berenberg Bank in London. 'Once these uncertainties fade confidence and thus investment should rebound'..."

Robert Waldmann: Phillips curves with Anchored Expectations: "I will assume that unemployment is a function of actual inflation minus expected inflation. I will also assume that people are smart enough that no policy will cause them to make forecast errors of the same sign period after period after period.... I will assume that perfect inflation forecasting causes unemployment to be 5%... [and] unemployment is linear in the inflation expectations error.... Under bounded rationality with hypothesis testing.... Forecasting rules are ordered from a first rule to a second, etc. When agents use rule n they also test the null that rule n gives optimal forecasts against the alternative that rule n+1 gives better forecasts. They switch to rule n+1 if the null is rejected at the 5% level.... I will assume that rules are also ordered so if rule n gives persistent underestimates of future inflation, rule n+1 gives higher forecasts.... Learning about the Fed Open Market Committee restarts each time a new Fed chairman is appointed.... The data used to test the current rule against the next one are only those accumulated with the current chairman... [who] are replaced at known fixed intervals...'

Simon Wren-Lewis: More Asymmetries: Is Keynesian Economics Left-Wing?: "I’m often perplexed by those who dispute Keynesian ideas.... A whole revolution in macroeconomic theory was based around a movement that wanted to overthrow Keynesian ideas.... The people who built these models did not describe them as assuming monetary policy worked perfectly: instead they said it was all about assuming markets worked. As a description this was at best opaque and at worst a deliberate deception. So why is there this desire to deny the importance of Keynesian theory coming from the political right?... Monetary policy is state intervention.... To someone of a neoliberal or ordoliberal persuasion they are discomforting. At the macroeconomic level, things only work well because of state intervention. This was so discomforting that New Classical economists attempted to create an alternative theory of business cycles where booms and recessions were nothing to be concerned about, but just the optimal response of agents to exogenous shocks.... Keynesian theory is not left wing, because... it is just about how the macroeconomy works. On the other hand anti-Keynesian views are often politically motivated, because the pivotal role the state plays in managing the macroeconomy does not fit the ideology. Is this asymmetry odd? I do not think so--just think about the debate over climate change.... To claim that the majority of anti-Keynesian views were innocent of ideological preference would be like--well like trying to pretend that monetary policy has no role in stabilising the business cycle..."

Paul Krugman: Why Weren’t Alarm Bells Ringing?: "Focusing, as Martin Wolf does, on the measurable factors--the 'shifts'--that increased our vulnerability to crisis is incomplete.... Rising... debt... shadow banking... international imbalances... helped set the stage.... But intellectual shifts--the way economists and policymakers unlearned the hard-won lessons of the Great Depression, the return to pre-Keynesian fallacies and prejudices--arguably played an equally large part.... Say’s Law--the false claim that income is automatically spent--made a comeback. So, incredibly, did liquidationism, the view that any effort to ameliorate the pain of depression would postpone needed adjustment.... When policymakers rejected orthodox economics, what they did by and large was to reject it in favor of doctrines like 'expansionary austerity'.... And this makes me a bit skeptical about Wolf’s proposals.... The Shifts and the Shocks is an excellent survey of how we arrived at the mess we’re in, and Wolf’s substantive proposals... wide deposit insurance, higher inflation so that the burden of adjustment is better share... are all worthy and laudable. But the gods themselves contend in vain against stupidity. What are the odds that financial reformers can do better?"

Thomas Piketty, Heather Boushey, Anwar Shaikh:

Should Be Aware of:

John Scalzi: Aiming for the Market

Serena Ryder

Alex O'Brien: Retired NSA Technical Director William Binney Explains Snowden Docs

Frank Bruni: The Catholic Church’s Gay Obsession

Noah Smith: On "Asian Values"

David Kravets: At 650% interest, that online payday loan is a steal

Charlie Stross: Cameron v Churchill: "The European Convention on Human Rights was intended to enshrine the UN Universal Declaration of Human Rights in law for Europe. The UN UDHR was passed by the UN General Assembly in December 1948 as a response to the horrors of the second world war. In no small part, the ECHR was pushed for by a fellow called Winston Churchill, who said: 'In the centre of our movement stands the idea of a Charter of Human Rights, guarded by freedom and sustained by law. It is impossible to separate economics and defence from the general political structure. Mutual aid in the economic field and joint military defence must inevitably be accompanied step by step with a parallel policy of closer political unity. It is said with truth that this involves some sacrifice or merger of national sovereignty. But it is also possible and not less agreeable to regard it as the gradual assumption by all the nations concerned of that larger sovereignty which can alone protect their diverse and distinctive customs and characteristics and their national traditions all of which under totalitarian systems, whether Nazi, Fascist, or Communist, would certainly be blotted out for ever.' So. Conservative-in-name Prime Minister David Cameron today promised to repeal the Human Rights Act, the legislation enshrining in UK law a chunk of supranational legislation put in place by notable former Conservative prime minister Winston Churchill as an anti-totalitarian measure. Coinciding with Home Secretary Theresa May's attempt at reintroducing a universal surveillance regime of which the Stasi or KGB would have been proud, and her avowed desire to gag unpalatable political views from the media, you've got to wonder where all this is intended to go..."

Anna Spiegel: Back to Hell: Ray's Hell-Burger Is Reborn: "'We’re rolling out the welcome mat for vegetarians', says Landrum, who’s added a selection of 'hot and buttered' grilled cheeses made with brioche Texas toast. Simple, griddled American or more elaborate combinations such as pepper jack, avocado, and charred jalapeños can all be ordered with house-made tomato soup for dunking. Carnivores can always opt to add a slab of bacon or get a sidecar of chili instead of soup. The good burger news doesn’t stop here. Guests at Ray’s the Steaks can try a new lineup of patties fashioned out of meat specially dry-aged for the dish. The 'inferno burger' menu takes on a Dante theme. There’s a good chance you’re going to taste heaven—followed by some level of inner torment—when ordering the 'third circle' topped with foie gras, bone marrow, and porcini mushrooms Hell-Burger. 1650 Wilson Blvd., Arlington..."

Christopher Mims: Tech World Vexed by Slow Progress on Batteries: "There is no Moore’s law for batteries. That is, while the computing power of microchips doubles every 18 months, the capacity of the batteries on which ever more of our gadgets depend exhibits no such exponential growth. In a good year, the capacity of the best batteries in our mobile phones, tablets and notebook computers—and increasingly, in our cars and household gadgets—increases just a few percent. It turns out that storing energy safely and reliably is hard in a way that miniaturizing circuits is not. A pound of gasoline contains more than 20 times as much energy as a pound of lithium-ion batteries. And then there’s the expense: The battery pack in a Tesla Model S costs approximately $30,000..."

Simon Wren-Lewis: More Asymmetries: Is Keynesian Economics Left-Wing?: "In the textbooks it is suggested that Keynesian economics is what happens when ‘prices are sticky’. Sticky prices sound like prices failing to equate supply and demand, which in turn sounds like markets not working. Hence whether you believe in Keynesian theory depends on whether you think markets work, so it obviously maps to a left/right political perspective.... [But] output appears to be influenced by aggregate demand at least in the short run, which is at the heart of what most economists think of as Keynesian theory. So where do sticky prices come in?... [In] an imaginary world where the monetary authority fixes the money supply... [and firms] to stimulate demand for their goods, cut prices... interest rates will fall to encourage people to hold more money.... Lower interest rates provide an incentive to consumers and firms to increase demand, which in turn raises output.... [If] prices adjusted very quickly... [this] mechanism would work very quickly.... If prices were extremely flexible, we could ignore aggregate demand altogether.... Hence aggregate demand matters only if ‘prices are sticky’.... [In] the real world... monetary authorities... fix short term interest rates... are directly in charge of the correction mechanism.... [With] perfect knowledge... they could make sure aggregate demand equalled supply without any need for prices to change at all.... If prices were very flexible but the monetary authority... fail[ed] to stimulate... demand would still matter.... We could re-establish the link between Keynesian theory and price flexibility by assuming the monetary authority follows a rule which would make policy perfect if and only if prices moved very fast, but the key point remains.... Keynesian economics is not left wing, but it is about how the economy actually works, which is why all monetary policymakers use it..."

October 6, 2014

Afternoon Must-Watch: Thomas Piketty, Heather Boushey, Anwar Shaikh

Bloomberg Politics: Dead on Arrival or Just in Intensive Care?: Mark Helperin: Clinically Insane, or Phoning-It-in Con Man?: Live from the Roasterie...

Mark Halperin: The Truth About Jeb Bush's Presidential Ambitions: "Finally, the most macro significant question...

Mark Halperin: The Truth About Jeb Bush's Presidential Ambitions: "Finally, the most macro significant question...

...for any Republican putting him or herself forward to beat Clinton is this: what states can you win that Romney lost? For [Jeb] Bush, the easy answer includes Florida, Ohio, Colorado, Iowa, Wisconsin, New Hampshire, and Virginia. If he runs a strong campaign, Bush could perhaps compete in California and possibly New Jersey and Michigan.

In response to this:

Is there a reason why Mark Halperin thinks that Jeb Bush could not take Pennsylvania? Or is Halperin just a bullshit artist who couldn't be bothered to consult his notes? Any Republican who runs strong against a Democrat will in all likelihood win Florida and Ohio, and make Virginia, Colorado, Pennsylvania, Iowa, New Hampshire, Nevada, and Wisconsin competitive. How--aside from this omission of Pennsylvania--is this list of additional states that Jeb Bush could win different from the list of states that any Republican nominee could win if things broke their way?

California? A Republican who takes California in all likelihood has 474 electoral votes. If you are going to claim that Jeb Bush could compete in California, why not claim Massachusetts, Delaware, and Maryland as well? If you are going to claim that Jeb Bush could compete in New Jersey, why not claim Connecticut and Illinois too? And why Michigan rather than Minnesota and New Mexico?

Bloomberg Politics has managed a remarkable launch: a day-one declaration of analytical and intellectual bankruptcy...

Over at Equitable Growth: Lunchtime Must-Read: Mohamed El-Erian: US Midterm Elections Offer Limited Prospect for Economic Change

Over at Equitable Growth: I think Mohamed El-Erian makes two analytical errors:

He argues that a faster American recovery requires that the private sector "decouple even more from Washington" and undertake "longer-term investments... [to] unleash underused resources and expand longer-term potential... [at the] scale and scope... need[ed] to validate the current level of excessive risk-taking by financial markets lest that, in itself, becomes a consequential headwind to economic growth and stability..." This morning's earnings yield is 5.1%. This morning's 5-year TIPS yield is 0.1%. That five percentage-point spread does not suggest a financial market in which demand for risky assets has outrun supply and pushed risky-asset valuations to levels that are inviting a crash and subsequent financial crisis triggered by the potential bankruptcy of institutions with normal equity cushions. And are there an unusually large number of institutions right now with normal or subnormal equity cushions whose business model is to sell unhedged out-of-the-money puts on a large scale, pocket their winnings until the strategy goes bust, and then declare bankruptcy and walk away? I'm watching. I don't see any concentration of such institutions...

El-Erian assumes that Washington can do nothing. That is not true. Washington may do nothing--it probably well do nothing. But it could do a lot. FHFA head Mel Watt has the power to offer every homeowner in America a refi at conforming-loan rates with an equity-option kicker attached to mortgages that do not have the 20% equity cushion or exceed appropriate conforming-loan limits. Federal Reserve head Janet Yellen has the power to do a Paul Volcker and undertake a regime change to the Federal Reserve's operating procedures and so alter the expected and actual future path of nominal GDP. Either or both of those could powerfully jumpstart the economy over the next two years. The FHFA and Federal Reserve regime change options should be on the table. El-Erian should not overlook them...

Mohamed El-Erian: US midterm elections offer limited prospect for economic change: "The main question is not whether the midterms will change the gridlock in Washington...

...that undermines economic growth, accentuates inequalities, and holds back prosperity; it is whether companies and individuals can decouple even more forcefully from yet another 'do-little' Congress.... There is little chance of change in the polarisation and dysfunction paralysing Congress.... The fiscal stance would not be altered to provide for higher and better balanced aggregate demand; supply responsiveness would not be enhanced by stepped-up investments in infrastructure, education, labour market strengthening and other areas that improve productivity; medium-term operational uncertainty would not be reduced by greater clarity on corporate tax reform; and damaging debt overhangs would not be lifted.... For stock markets to continue to prosper, the private sector would have to decouple even more from Washington.... It would require much bigger emphasis on longer-term investments in areas that, notwithstanding the continued shortfalls in Congress, unleash underused resources and expand longer-term potential. And the scale and scope would need to validate the current level of excessive risk-taking by financial markets lest that, in itself, becomes a consequential headwind to economic growth and stability...

Noted for Your Morning Procrastination for October 6, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Nick Bunker: Weekend reading - Washington Center for Equitable Growth

Nick Bunker: Waiting for wage growth - Washington Center for Equitable Growth

Nick Bunker: All American youth need opportunities to grow our economy - Washington Center for Equitable Growth

Robert Lynch: U.S. Census highlights rising economic inequality - Washington Center for Equitable Growth

Nick Bunker: Who are the top 1 percent and 0.1 percent of income earners? - Washington Center for Equitable Growth

In Which I Am Once Again Puzzled by Martin Feldstein: Monday Focus for October 6, 2014 - Washington Center for Equitable Growth

Afternoon Must-Read: Daniel Riera-Crichton et al.: Procyclical and Countercyclical Fiscal Multipliers - Washington Center for Equitable Growth

Afternoon Must-Read: Adam Ozimek: Part-Time Work Is Up Even Among the Self-Employed - Washington Center for Equitable Growth

Afternoon Must-Read: Antonio Fatas: The (Very Large) Permanent Scars of Fiscal Consolidation: - Washington Center for Equitable Growth

Paul Krugman Has His Ming the Merciless Attitude on This Morning... - Washington Center for Equitable Growth

Morning Must-Read: Joseph G. Altonji et al.: Cashier or Consultant? Entry Labor Market Conditions, Field of Study, and Career Success - Washington Center for Equitable Growth

Paul Krugman Has His Ming the Merciless Attitude on This Morning... - Washington Center for Equitable Growth

Plus:

Things to Read on the Morning of October 6, 2014 - Washington Center for Equitable Growth

Must- and Shall-Reads:

Wolfgang Münchau: If Europe insists on sticking to rules, recovery will be a dream

Edward Luce: Blinded EU can learn from one-eyed US

Slava Gerovitch: InterNyet: why the Soviet Union did not build a nationwide computer network

Yorkshire Ranter (2010): Review: Francis Spufford’s Red Plenty

Joseph G. Altonji, Lisa B. Kahn, Jamin D. Speer: Cashier or Consultant? Entry Labor Market Conditions, Field of Study, and Career Success

Daniel Riera-Crichton et al. Procyclical and Countercyclical Fiscal Multipliers: Evidence from OECD Countries

Adam Ozimek: Part-Time Work Is Up Even Among the Self-Employed

Antonio Fatas: The (Very Large) Permanent Scars of Fiscal Consolidation

Paul Krugman Plays Ming the Merciless: Gross Gone

And Over Here:

DeLong Smackdown Watch: Paul Krugman Accuses Me on Inventing an Imaginary and Idealized Bill Gross... (Brad DeLong's Grasping Reality...)

Liveblogging World War II: October 6, 1944: Nuclear Files: (Brad DeLong's Grasping Reality...)

Equitable Growth Focus: In Which I Am Once Again Puzzled by Martin Feldstein (Brad DeLong's Grasping Reality...)

Liveblogging World War II: October 5, 1944: Audie Murphy Gets Second Silver Star in Three Days (Brad DeLong's Grasping Reality...)

Paul Krugman Has His Ming the Merciless Attitude on This Morning... (Brad DeLong's Grasping Reality...)

Liveblogging World War I: October 4, 1914: Manifesto of the Ninety-Three (Brad DeLong's Grasping Reality...)

Weekend Watching: Bárðarbunga (Brad DeLong's Grasping Reality...)

For the Weekend: "Gird Up Now Thy Loins..." (Brad DeLong's Grasping Reality...)

Joseph G. Altonji, Lisa B. Kahn, Jamin D. Speer: Cashier or Consultant? Entry Labor Market Conditions, Field of Study, and Career Success: "We analyze the early labor market outcomes of U.S. college graduates from the classes of 1974 to 2011, as a function of the economic conditions into which they graduated. We have three main findings. First, poor labor market conditions substantially disrupt early careers. A large recession at time of graduation reduces earnings by roughly 10% in the first year, for the average graduate. The losses are driven partially by a reduced ability to find employment and full-time work and partially by a roughly 4% reduction in hourly wage rates. Second, these effects differ by field of study. Those in majors with typically higher earnings experience significantly smaller declines in most labor market outcomes measured. As a result, the initial earnings and wage gaps across college majors widen by almost a third and a sixth, respectively, for those graduating into a large recession. Most of these effects fade out over the first 7 years. Those in higher paying majors are also slightly less likely to obtain an advanced degree when graduating into a recession, consistent with their relative increase in opportunity cost. Our third set of results focuses on a recent period that includes the Great Recession. Early impacts on earnings are much larger than what we would have expected given past patterns and the size of the recession, in part because of a large increase in the cyclical sensitivity of demand for college graduates. The effects also differ much less by field of study than those of prior recessions."

Daniel Riera-Crichton et al.: Procyclical and Countercyclical Fiscal Multipliers: Evidence from OECD Countries: "It is not always the case that government spending is going up in recessions.... The 'true' long-run multiplier for bad times (and government spending going up) turns out to be 2.3 compared to 1.3 if we just distinguish between recession and expansion. In extreme recessions, the long-run multiplier reaches 3.1."

Adam Ozimek: Part-Time Work Is Up Even Among the Self-Employed: "The U.S. unemployment rates is nearing levels normally associated with full employment.... [But] the number of people who say they would rather have full-time jobs and cite economic reasons for why they don't... rose from around 4 million before the recession to 9 million at its peak, and is now down to around 7 million.... Those favoring structural explanations argue that the increased use of complicated staffing software has allowed firms to be more flexible, and thus to employ more part-timers. Another structural explanation is that higher benefit costs—particularly for healthcare under the Affordable Care Act.... Several factors suggest the rise in involuntary part-time work is cyclical, including the fact that it has occurred across industries and demographics groups.... Even more telling, the same rise in involuntary part-time work has occurred among the self-employed. This can't be a result of staffing software or a desire to avoid healthcare or other benefit costs...

Antonio Fatas: The (Very Large) Permanent Scars of Fiscal Consolidation: "I... look at the actual change in potential output during those years (2010-11) as presented in the April 2014 IMF World Economic Outlook. Comparing this figure to the forecast done back in April 2010, we can calculate for each country the forecast error associated to potential output growth. Most models assume that there should be no correlation between these two numbers. Fiscal consolidations affect output in the short run but not in the long run.... Fiscal consolidations have led to a large change in our views on potential output... around -0.75.... This number is very large and it provides supporting evidence of the arguments made by DeLong and Summers regarding the possibility of fiscal contractions leading to increases in debt via the permanent effects they have on potential output..."

Paul Krugman Plays Ming the Merciless: Gross Gone: "I don’t know anything about what’s been going on internally at Pimco; I just read the same stories as everyone else. I have, however, written a lot about Pimco’s macroeconomic analysis (which drove its bond-investment decisions). The interesting thing is the Pimco was initially a bond bull, based on the correct understanding that deficits don’t crowd out lending when the economy is in a liquidity trap; but it then went off the rails, with Bill Gross insisting that rates would spike when the Fed ended QE2. I tried to explain why this was wrong, and got a lot of flak from people insisting that the great Gross knew more than any ivory-tower academic. But I knew what I was talking about!" * Nobody Understands the Liquidity Trap, Still: "A correspondent points me to Bill Gross in 2010, declaring that we are in a liquidity trap--and that therefore the Fed’s expansionary policies won’t create jobs, but will simply cause inflation. There’s only one thing to say: AAUUGGHHHH! But a lot of people seem to have fallen into that curious fallacy, as I pointed out in the same year.... The liquidity trap... is a situation in which increasing the monetary base has no effect on aggregate demand, because you’re substituting one zero (or very low) interest asset--monetary base--for another.... Conventional monetary policy is completely sterile on all fronts. I don’t know why this very simple point is so hard to grasp, but people keep making a hash of it. I have no idea why Cullen Roche thinks that the TED spread has anything at all to do with the question of whether we’re in a liquidity trap; nor do I know what I can do, after all the times I’ve written about it, to make the point more clearly." * Bill Grosses, Idealized and Actually Existing: "Brad DeLong tries at some length to rationalize Bill Gross’s insistence in 2011 that interest rates were about to spike. But while it’s nice to be charitable, to attempt to put the best face on someone else’s arguments, it’s also important to look at the argument someone was actually making. And the reasoning of Gross and others was much cruder and a lot more foolish than Brad acknowledges. I know because I was involved in the debate in real time..." * 2011 and All That: "All would have been forgiven, indeed never mentioned, but for [Bill Gross's] utter misjudgment of the bond market in 2011--a misjudgment based on his failure, or more accurately refusal, to acknowledge the realities of a liquidity trap world.... Gross was by no means alone... 2011 was a sort of banner year for bad macroeconomic analysis by people who had no excuse for their wrong-headedness. And here’s the thing: aside from Gross, hardly any of the prominent wrong-headers have paid any price for their errors.... BS are still given reverent treatment.... Paul Ryan warned Ben Bernanke that he was 'debasing' the dollar, arguing that rising commodity prices were the harbinger of runaway inflation; the Bank for International Settlements made a similar argument, albeit with less Ayn Rand. They were completely wrong, but Ryan is still the intellectual leader of the GOP and the BIS is still treated as a fount of wisdom. The difference is, of course, that Gross had actual investors’ money on the line." * The Pimco Perplex: "It’s fairly clear that the events of 2011 are a large part of the story of Bill Gross’s abrupt departure.... But why was Gross betting so heavily against Treasuries? Brad DeLong tries to rationalize Gross’s behavior in terms of a coherent story about an impending U.S. recovery, which would lift us out of the liquidity trap. But Gross wasn’t saying anything like that. Instead, he was claiming that the Fed’s asset purchases--QE2--were holding rates down.... So why did he believe all that? It all comes down, I’d argue, to liquidity trap denial. Since 2008 the basic logic of the economic situation has been that the private sector is trying to run a huge surplus, and the public sector isn’t willing to run a corresponding deficit. The result is an economy awash in desired savings with nowhere to go. This in turn means that budget deficits aren’t competing with private borrowing, and therefore need not drive up interest rates. This isn’t hindsight; it’s what I and others have been saying since the very beginning. But a lot of people--politicians, of course, but also a lot of people in finance--have just refused to accept this account. They have clung to the view that budget deficits must lead to higher interest rates. You might think the failure of higher rates to materialize, year after year, would cause them to reasses--indeed, would have caused them to reassess years ago. Instead, however, many of them made excuses. Above all, the big excuse was that rates would have gone higher if only the Fed weren’t buying up the stuff. So QE2 acquired a much bigger role in their thinking than it deserved.... And he was wrong. QE2 ended, and nothing happened to rates." * The Pimco Perplex: You can see why I found Gillian Tett’s apologia for Gross--that he was blindsided by central bank intervention--frustrating. For one thing, that’s accepting a model that has failed with flying colors; but beyond that, Gross’s really bad call was almost exactly the opposite, his claim that rates would soar when the Fed’s intervention ended. As I’ve said, Gross of all people shouldn’t have fallen into this trap, since his own chief economist understood liquidity trap logic better than almost anyone. But finance people seem weirdly determined to believe in a macro canon whose hold on their perceptions appears to be completely unbreakable, no matter how much money it causes them to lose." * Nobody Could Have Predicted, Bill Gross Edition: "Gillian Tett feels sorry for BIll Gross, who was caught unaware by the sudden shift in bond market behavior. Who could have predicted that interest rates would stay low despite large budget deficits? Um, how about Pimco’s own chief economist, Paul McCulley?... The truth is that the quiescence of interest and inflation rates was predicted by everyone who understood the obvious--that we had entered a liquidity trap--and thought through the implications. I explained it more than five years ago.... And Paul McCulley understood all this really well.... Strikingly, Tett’s version of what went wrong with Gross’s predictions makes no mention of deleveraging and the zero lower bound; it’s all a power play by central banks, which have been 'intimidating' bond investors with unconventional monetary policy. This is utterly wrong, and in fact Gross’s own mistakes show that it’s wrong: one of his big failures was betting that rates would spike when the Fed ended QE2, which they predictably didn’t. As an aside, whenever I hear people explaining away the failure of interest rates to spike as the result of those evil central bankers artificially keeping them down, I want to ask how they think that’s possible. Surely the same people, if you had asked them a few years ago about what would happen if the Fed tried to suppress interest rates by massively expanding its balance sheet, would have predicted runaway inflation. That didn’t happen, which should make you wonder what exactly they mean by saying that rates are artificially low. Oh, and Tett ends the piece by citing the Bank for International Settlements as a voice of wisdom. That’s pretty amazing, too; the sadomonetarists of Basel have a remarkable track record of being wrong about everything since 2008, but always finding some reason to call for higher rates. The thing is, Tett is a smart observer who talks to a lot of people in finance; seeing her present a discredited theory as obviously true, without so much as mentioning the kind of analysis that has been worked all along, says bad things about the extent to which anyone who matters has learned anything." * Knaves, Fools, and Quantitative Easing: "When the going gets tough, the people losing the argument start whining about civility. I often find myself attacked as someone who believes that anyone with a different opinion is a fool or a knave; as I’ve tried to explain, however, that’s mainly selection bias. I don’t spend much time on areas where reasonable people can disagree, because there are so many important issues where one side really is completely unreasonable.... There are a lot of bad people engaged in economic debate--and I don’t mean that they’re wrong, I mean that they argue in bad faith. Which brings us to today’s installment of oh-yes-they’re-that-bad, courtesy of Bloomberg... the infamous open letter to Ben Bernanke warning that his efforts to boost the economy 'risk currency debasement and inflation'.... Bloomberg... ask[ed] the signatories whether they would concede that they were wrong. Not a chance.... And this is far from the only example of inflationistas and bond worriers bobbing and weaving, refusing to acknowledge having said what they said, being completely unwilling to admit mistakes. I try hard not to behave that way.... No doubt there have been times when I rewrote history to make myself look better, but I try to avoid that--it’s a major intellectual and moral sin. And boy are there a lot of sinners out there." * Ordoarithmetic: "Francesco Saraceno is furious and dismayed at Hans-Werner Sinn, who says among other things that deflation in southern Europe is necessary to restore competitiveness. Why not inflation in Germany, he asks? But Saraceno fails to understand German logic here. As they see it, their economy was in the doldrums at the end of the 1990s; they then cut labor costs, gaining a huge competitive advantage, and began running gigantic trade surpluses. So their recipe for global recovery is for everyone to deflate, gaining a huge competitive advantage, and begin running gigantic trade surpluses. You may think there’s some kind of arithmetic problem here, but in Germany they have their own intellectual tradition." * Charlatans and Cranks Forever: "Back when Paul Ryan released his first big-splash budget--the one that had the commentariat cooing over its “seriousness”--it included a link to an absurd Heritage Foundation analysis claiming, among other things, that the plan would drive the unemployment rate down to 2.8 percent. (Heritage then tried, unsuccessfully, to send its nonsense down the memory hole and pretend it never happened.) Ryan defenders tried to claim that the plan didn’t actually rely on that Heritage stuff; but as some of us tried to explain, the plan actually didn’t add up, relying on a multi-trillion-dollar magic asterisk on tax receipts. And we predicted that sooner or later Ryan would embrace magical theories about how tax cuts increase revenue. And here we are. One disturbing effect if Republicans take the Senate, by the way, may be that the Congressional Budget Office becomes a purely partisan operation--effectively a department of Heritage."

Should Be Aware of:

The Book Smugglers: Joint Review: Ancillary Sword

KAYAK: Cheap Flights, Hotels, Airline Tickets, Cheap Tickets, Cheap Travel Deals

Paul Krugman: Wages and the Fed: "My inbox is already starting to fill up with predictions and demands that the Fed accelerate the pace of'“normalization' because today’s jobs report was better than expected. But the case for wait-and-see actually remains as strong as ever, and maybe a bit stronger.... We really, really don’t know how much slack there is.... Sorry, but that’s reality. We really won’t know until after the fact, if and when we finally see a notable pickup in inflation, and in particular in wages.... So, what did we learn about inflation from the latest employment report?... If you’re puzzled that a falling unemployment rate hasn’t translated into faster wage growth, well, that just reinforces the point that we truly don’t know how much slack there is. And does anyone think that wage growth was wildly excessive before the financial crisis? If you don’t, then you should believe that we need an extended period of tight labor markets just to get back to where we were. There is nothing in this report to suggest that it makes sense to hike rates any time soon. In fact, I find it very hard to understand why anyone thinks rates should rise even in 2015."

Daniel Kuehn: Forty Years After the Hayek Nobel: "Thoughts on Israel Kirzner.... I don't entirely buy this revisionist history, but what I do like about it is that it refocuses us on the work on knowledge, subjectivism, and economic calculation. I suspect the lull in interest in the Austrian school had far more to do with the failure of Austrian macroeconomics than the failure of the mainstream to appreciate this other work.... What bothers me about the revisionist account is that it relies too heavily on an implausible story about how mainstream economics is full of dunces. Kirzner argues that mainstream economists are preoccupied with equilibrium models where genuine competition and discovery doesn't really go on and most importantly nobody talks about how you get to equilibrium. There is a germ of truth to this... but the idea that the market process is lost on them strikes me as misleading at best and borderline libelous at worst.... Every economist has these market process stories in mind when they think about why getting to equilibrium (even if it's a constantly moving target) is reasonable.... I think his vision of his own research program is deeply problematic and too easily discounts how interesting and intelligent his fellow economists are."

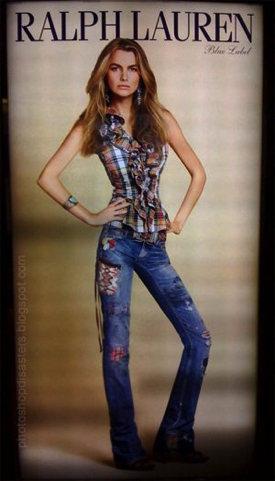

Cory Doctorow: The criticism that Ralph Lauren doesn't want you to see!: "Last month, Xeni blogged about the photoshop disaster that is this Ralph Lauren advertisement, in which a model's proportions appear to have been altered to give her an impossibly skinny body ('Dude, her head's bigger than her pelvis'). Naturally, Xeni reproduced the ad in question. This is classic fair use: a reproduction "for purposes such as criticism, comment, news reporting," etc. However, Ralph Lauren's marketing arm and its law firm don't see it that way. According to them, this is an 'infringing image'.... Instead of responding to their legal threat by suppressing our criticism of their marketing images, we're gonna mock them. Hence this post.... So, to Ralph Lauren, GreenbergTraurig, and PRL Holdings, Inc: sue and be damned. Copyright law doesn't give you the right to threaten your critics for pointing out the problems with your offerings. You should know better. And every time you threaten to sue us over stuff like this, we will: a) Reproduce the original criticism, making damned sure that all our readers get a good, long look at it, and; b) Publish your spurious legal threat along with copious mockery, so that it becomes highly ranked in search engines where other people you threaten can find it and take heart; and c) Offer nourishing soup and sandwiches to your models."

Cory Doctorow: The criticism that Ralph Lauren doesn't want you to see!: "Last month, Xeni blogged about the photoshop disaster that is this Ralph Lauren advertisement, in which a model's proportions appear to have been altered to give her an impossibly skinny body ('Dude, her head's bigger than her pelvis'). Naturally, Xeni reproduced the ad in question. This is classic fair use: a reproduction "for purposes such as criticism, comment, news reporting," etc. However, Ralph Lauren's marketing arm and its law firm don't see it that way. According to them, this is an 'infringing image'.... Instead of responding to their legal threat by suppressing our criticism of their marketing images, we're gonna mock them. Hence this post.... So, to Ralph Lauren, GreenbergTraurig, and PRL Holdings, Inc: sue and be damned. Copyright law doesn't give you the right to threaten your critics for pointing out the problems with your offerings. You should know better. And every time you threaten to sue us over stuff like this, we will: a) Reproduce the original criticism, making damned sure that all our readers get a good, long look at it, and; b) Publish your spurious legal threat along with copious mockery, so that it becomes highly ranked in search engines where other people you threaten can find it and take heart; and c) Offer nourishing soup and sandwiches to your models."

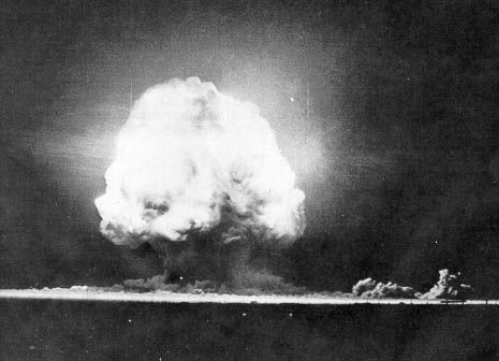

Liveblogging World War II: October 6, 1944: Nuclear Files:

Nuclear Files: Library: Correspondence: Robert Oppenheimer: Letter, October 6, 1944

Nuclear Files: Library: Correspondence: Robert Oppenheimer: Letter, October 6, 1944

Los Alamos

October 6, 1944

Dear General Groves:

I am glad to transmit the enclosed report of Captain Parsons, with the general intent and spirit of which I am in full sympathy. There are a few points on which my evaluation differs somewhat from that expressed in the report and it seems appropriate to mention them at this time.

1 believe that Captain Parsons somewhat misjudges the temper of the responsible members of the laboratory. It is true that there are a few people here whose interests are exclusively "scientific" in the sense that they will abandon any problem that appears to be soluble. I believe that these men are now in appropriate positions in the organization. For the most part the men actually responsible for the prosecution of the work have proven records of carrying developments through the scientific and into the engineering stage. For the most part these men regard their work here not as a scientific adventure, but as a responsible mission which will have failed if it is let drop at the laboratory phase. I therefore do not expect to have to take heroic measures to insure something which I know to be the common desire of the overwhelming majority of our personnel.

I agree completely with all the comments of Captain Parsons' memorandum on the fallacy of regarding a controlled test as the culmination of the work of this laboratory. The laboratory is operating under a directive to produce weapons; this directive has been and will be rigorously adhered to. The only reason why we contemplate making a test, and why I have in the past advocated this, is because with the present time scales and the present radical assembly design this appears to be a necessary step in the production of a weapon. I do not wish to prejudge the issue: it is possible that information available to us within the next months may make such a test unnecessary. I believe, however, that the probability of this is extremely small.

The developmental program of the laboratory, whether or not it has been prosecuted with intelligence and responsibility, is still far behind the minimal requirements set by our directive. This fact, which rests on no perfectionist ideals for long-range development, means that there must in-evitably be some duplication of effort and personnel if the various phases of our program - scientific, engineering and military - are to be carried out without too great mutual interference. It is for this reason that I should like to stress Captain Parsons' remark that a very great strengthening in engineering is required. The organizational experience which the last year has given us is no substitute for competent engineers.

Sincerely yours,

J. R. Oppenheimer

DeLong Smackdown Watch: Paul Krugman Accuses Me on Inventing an Imaginary and Idealized Bill Gross...

Now that's more like it, internet!

You all are going to have to wait at least a week more for my to continue my death-march close reading of chapter 11 of David Graeber's Debt: The First 5000 Mistakes--a chapter which I think whose bankruptcy goes well beyond chapter 11 into chapter 7.

For today we have Paul Krugman:

Paul Krugman: Bill Grosses, Idealized and Actually Existing: "Brad DeLong tries at some length to rationalize Bill Gross’s insistence in 2011 that interest rates were about to spike...

...But while it’s nice to be charitable, to attempt to put the best face on someone else’s arguments, it’s also important to look at the argument someone was actually making. And the reasoning of Gross and others was much cruder and a lot more foolish than Brad acknowledges.... Gross wasn’t arguing that rates would rise sharply once people understood that the economy would normalize.... He was arguing that rates were being suppressed right now by the Fed’s purchases of Treasuries, and would spike as soon as those purchases ended.... Not only did it ignore the fundamental reasons rates tended to stay low in a deleveraging world, not only did it overestimate the impact of QE, but it also assumed that the rate of Fed purchases--the flow of QE--was what mattered, when sensible people argued that the stock of assets the Fed held mattered. I wrote all about this at the time. If you find it hard to believe that such a smart guy could make such a poor argument, well, that’s the world we’re living in.

Let me try to rephrase my rational reconstruction of Gross's argument back at the end of 2010-start of 2011, as something like this:

Just as in every other recession episode since World War II, the economy Will quickly normalize.

Forward-looking 10 and 30 year bond yields ought to already be pricing in that normalization.

They are not. Why not? Well, the only possibility is that the Federal Reserve is in the market bigtime making non-fundamental trades--trades that do not reflect a desire to make money in the context of a rational assessment of fundamentals.

The Fed will no more be able to maintain its position if my peers and I bet heavily against it than the Bank of England was able to maintain its non-fundamental position when George Soros and company bet heavily against it back in 1992.

As Krugman correctly says, Gross was wrong.

As Krugman correctly says, Gross was wrong in thinking that most bond holdings were inertial and only the narrow flow mattered--smarter and more-sensible people understood that a lot of the stock was in play via rebalancing. As Krugman correctly says, Gross's belief that normalization would be rapid was wrong--and paid no attention to the example of Japan in front of his face. As Krugman does not say but would if we gave him an extra moment, there is a huge difference between a central bank which intervenes by spending the small quantity of harder-currency reserves it has to diminish and a central bank which intervenes by printing cash to expand the money stock. As Krugman says, Gross fundamentally misread the world. As Krugman does not say but would if we gave him another moment, he had correctly diagnosed this situation as a possible and indeed likely scenario when back in the mid-1990s he took a hard look at Japan, Mexico, and East Asia, and wrote The Return of Depression Economics.

Have I tried too hard to impose coherence in constructing my rational account of what Gross and company were (or should have been) thinking? Perhaps. But it also feels inadequate to me to say: "He just didn't do his homework on this." Why didn't he--and so many other people--fail to do their homework? What did they think their homework was? They did do something, after all...

October 5, 2014

Equitable Growth Focus: In Which I Am Once Again Puzzled by Martin Feldstein

Over at Equitable Growth: I look at the track of the past twelve months' core PCE chain-index inflation:

And I look at the annualized month-to-month changes:

And this is what I see: Over the past 50 months, only 11 have seen core inflation above 2%/year. Of the past 25 months, only 5 have seen core inflation above 2%/year. Of the past 12 months, only 2 have seen core inflation above 2%/year. Any reasonable time-series smoothing-and-forecasting algorithm tells us that PCE core inflation right now is about 1.4%/year. READ MOAR

Any reasonable estimate of the core-PCE inflation Phillips Curve tells us that to raise the inflation rate by 0.5%-points/year requires that the unemployment rate spend 2%-point-years below the NAIRU. Were the unemployment rate over the next four years to average 5.0% that would do it in expectation if the NAIRU were 5.5%. The Federal Reserve forecasts that if it remains on its current policy path that the average unemployment rate over the next four years will be 5.4%--enough to get us to 2.0%/year inflation in expectation by 2018 if the NAIRU is 5.9%, but not if it is any lower.

Thus I really do not understand what time-series analysis underlies Martin Feldstein with his claims not just that the Federal Reserve's current monetary policy path is too loose but that the Federal Reserve will recognize that it is too loose and raise interest rates faster than the market or it currently expects over the next fifteen months:

Martin Feldstein: Why the Fed Will Go Faster: "The midpoint of the opinions recorded at most recent FOMC meeting...

...implies a federal funds rate of 1.25-1.5% at the end of 2015... by the end of 2016... less than 3%.... Inflation is already close to 2% or higher.... The Fed’s own analysis points to a long-term rate of about 4% when the long-term inflation rate is 2%. The... consumer price index was up 1.7% year-on-year... would have been even higher but for the anomalous decline in the most recent month. In the second quarter of this year, the annualized inflation rate was 4%.... PCE inflation at just 1.5% for the 12 months to August.... But PCE inflation has also been rising, with the most recent quarterly value at 2.3% year on year in the April-June period.

So if price stability were the Fed’s only goal, the federal funds rate should now be close to 4%....

The Fed is certainly correct that current labor-market conditions imply significant economic waste and personal hardship. But economists debate the extent to which these conditions reflect a cyclical demand shortfall or more structural problems.... Increases in demand that would cause a further reduction in the current unemployment rate would boost the inflation rate.... Alan Krueger... showed that the inflation rate reflects the level of short-term unemployment... rather than the overall unemployment rate.... With short-term unemployment currently at 4.2%, the inflation rate is indeed rising.... I would not be surprised by a continued rise in the inflation rate in 2015... [and] the Fed... rais[ing] the federal funds rate more rapidly and to a higher year-end level than its recent statements imply.

Three things have to be true about the world for Feldstein's forecast of interest rates at the end of 2015 to be a good one:

The current underlying rate of core inflation has to be 2.0% rather than (as the Federal Reserve thinks) 1.5%.

The current NAIRU has to be north of 6.0% rather than (as the Federal Reserve thinks) south of 5.5%.

The current majority on the FOMC have to be sufficiently uncertain of their analysis that--even after six years of data that have broadly supported it rather than Feldstein's analysis--they will turn on the dime of a year's worth of data in which inflation slightly overshoots their expectations.

Now I would say that each of these is at most a one-third chance--which means that my assessment of Feldstein's scenario is that it is a 0.04 chance. It could happen--weirder things have happened than interest rates by the end of 2015 significantly higher than the Federal Reserve's current projected policy path. But...

I wonder if I can persuade Noah Smith to make another bet?

Liveblogging World War II: October 5, 1944: Audie Murphy Gets Second Silver Star in Three Days

From World War II Today: Audie Murphy:

The troublesome spot is finally recognized for what it is: a point, consisting of a few acres of ground, so strategically located and fanatically defended that nothing short of a full-scale assault can eliminate it. While we hold the lines, phases of the attack are co-ordinated by tired, worried officials of the division.

Our armor pours five hundred rounds of high explosives into the quarry. At the same time a saturation mortar barrage is laid on the area. When the fire lifts, we drive up the slopes and are again hit hard by the fanatical enemy.

A battalion, heavily supported by artillery, tries a flanking movement while we remain in a blocking position. For a whole afternoon and night, the battle rages. The next day my company gets its orders to jump off. Under a creeping mortar barrage, we scramble up the hill, by-pass the quarry proper, and go over the crest. The ugly job of cleaning out the quarry has been assigned to other units.

But the Germans are full of surprises. Before night, my company is pinned to a hillside. The krauts, who usually choose elevations for defensive stands, have fooled us in this instance. They have dug in by a dry stream bed at the base of the slope. Trees, cut and arranged in haphazard crisscross patterns, completely conceal their positions. They let us move over the hilltop, and then tear into our ranks with rifle and machine-gun fire.

Mist gathers in the lowland, further hindering visibility. Crawling over the slope on our bellies, we try to pry out the enemy locations. But the camouflage is perfect. There is but one thing to do. I borrow a walkie-talkie radio and start maneuvering a patrol down the hill.

A tense silence comes over the area. Phantomlike, we slip through the trees with senses alert for an ambush. Brrrrrp. A man carrying two cases of machine-gun ammo is hit in the side. He lets out a scream and collapses. The metal cases clatter on the rocky ground.

Immediately our position is swept with fire from five machine guns. The bullets zip three feet from the ground. We lie on our backs, seize our trench shovels, and frantically start scooping holes in the stony soil.

The Germans lower their angle of fire. A man is hit in the chest. Pieces of his lungs spatter the ground. His flesh quivers; and he gurgles, “Oh God, oh God.” Two men rip off his shirt. A blast catches them. They sink over the wounded man and are still.

October 4, 2014

Paul Krugman Has His Ming the Merciless Attitude on This Morning...

Needless to say, he has good reason:

Needless to say, he has good reason:

Paul Krugman Plays Ming the Merciless: Gross Gone: "I don’t know anything about what’s been going on internally at Pimco...

I just read the same stories as everyone else. I have, however, written a lot about Pimco’s macroeconomic analysis (which drove its bond-investment decisions). The interesting thing is the Pimco was initially a bond bull, based on the correct understanding that deficits don’t crowd out lending when the economy is in a liquidity trap; but it then went off the rails, with Bill Gross insisting that rates would spike when the Fed ended QE2. I tried to explain why this was wrong, and got a lot of flak from people insisting that the great Gross knew more than any ivory-tower academic. But I knew what I was talking about!

Nobody Understands the Liquidity Trap, Still: A correspondent points me to Bill Gross in 2010, declaring that we are in a liquidity trap--and that therefore the Fed’s expansionary policies won’t create jobs, but will simply cause inflation. There’s only one thing to say: AAUUGGHHHH! But a lot of people seem to have fallen into that curious fallacy, as I pointed out in the same year.... The liquidity trap... is a situation in which increasing the monetary base has no effect on aggregate demand, because you’re substituting one zero (or very low) interest asset--monetary base--for another.... Conventional monetary policy is completely sterile on all fronts. I don’t know why this very simple point is so hard to grasp, but people keep making a hash of it. I have no idea why Cullen Roche thinks that the TED spread has anything at all to do with the question of whether we’re in a liquidity trap; nor do I know what I can do, after all the times I’ve written about it, to make the point more clearly.

Bill Grosses, Idealized and Actually Existing: Brad DeLong tries at some length to rationalize Bill Gross’s insistence in 2011 that interest rates were about to spike. But while it’s nice to be charitable, to attempt to put the best face on someone else’s arguments, it’s also important to look at the argument someone was actually making. And the reasoning of Gross and others was much cruder and a lot more foolish than Brad acknowledges. I know because I was involved in the debate in real time...

2011 and All That: All would have been forgiven, indeed never mentioned, but for [Bill Gross's] utter misjudgment of the bond market in 2011--a misjudgment based on his failure, or more accurately refusal, to acknowledge the realities of a liquidity trap world.... Gross was by no means alone... 2011 was a sort of banner year for bad macroeconomic analysis by people who had no excuse for their wrong-headedness. And here’s the thing: aside from Gross, hardly any of the prominent wrong-headers have paid any price for their errors.... BS are still given reverent treatment.... Paul Ryan warned Ben Bernanke that he was 'debasing' the dollar, arguing that rising commodity prices were the harbinger of runaway inflation; the Bank for International Settlements made a similar argument, albeit with less Ayn Rand. They were completely wrong, but Ryan is still the intellectual leader of the GOP and the BIS is still treated as a fount of wisdom. The difference is, of course, that Gross had actual investors’ money on the line.

The Pimco Perplex: It’s fairly clear that the events of 2011 are a large part of the story of Bill Gross’s abrupt departure.... But why was Gross betting so heavily against Treasuries? Brad DeLong tries to rationalize Gross’s behavior in terms of a coherent story about an impending U.S. recovery, which would lift us out of the liquidity trap. But Gross wasn’t saying anything like that. Instead, he was claiming that the Fed’s asset purchases--QE2--were holding rates down.... So why did he believe all that? It all comes down, I’d argue, to liquidity trap denial. Since 2008 the basic logic of the economic situation has been that the private sector is trying to run a huge surplus, and the public sector isn’t willing to run a corresponding deficit. The result is an economy awash in desired savings with nowhere to go. This in turn means that budget deficits aren’t competing with private borrowing, and therefore need not drive up interest rates. This isn’t hindsight; it’s what I and others have been saying since the very beginning. But a lot of people--politicians, of course, but also a lot of people in finance--have just refused to accept this account. They have clung to the view that budget deficits must lead to higher interest rates. You might think the failure of higher rates to materialize, year after year, would cause them to reasses--indeed, would have caused them to reassess years ago. Instead, however, many of them made excuses. Above all, the big excuse was that rates would have gone higher if only the Fed weren’t buying up the stuff. So QE2 acquired a much bigger role in their thinking than it deserved.... And he was wrong. QE2 ended, and nothing happened to rates.

The Pimco Perplex: You can see why I found Gillian Tett’s apologia for Gross--that he was blindsided by central bank intervention--frustrating. For one thing, that’s accepting a model that has failed with flying colors; but beyond that, Gross’s really bad call was almost exactly the opposite, his claim that rates would soar when the Fed’s intervention ended. As I’ve said, Gross of all people shouldn’t have fallen into this trap, since his own chief economist understood liquidity trap logic better than almost anyone. But finance people seem weirdly determined to believe in a macro canon whose hold on their perceptions appears to be completely unbreakable, no matter how much money it causes them to lose.

Nobody Could Have Predicted, Bill Gross Edition: Gillian Tett feels sorry for BIll Gross, who was caught unaware by the sudden shift in bond market behavior. Who could have predicted that interest rates would stay low despite large budget deficits? Um, how about Pimco’s own chief economist, Paul McCulley?... The truth is that the quiescence of interest and inflation rates was predicted by everyone who understood the obvious--that we had entered a liquidity trap--and thought through the implications. I explained it more than five years ago.... And Paul McCulley understood all this really well.... Strikingly, Tett’s version of what went wrong with Gross’s predictions makes no mention of deleveraging and the zero lower bound; it’s all a power play by central banks, which have been 'intimidating' bond investors with unconventional monetary policy. This is utterly wrong, and in fact Gross’s own mistakes show that it’s wrong: one of his big failures was betting that rates would spike when the Fed ended QE2, which they predictably didn’t. As an aside, whenever I hear people explaining away the failure of interest rates to spike as the result of those evil central bankers artificially keeping them down, I want to ask how they think that’s possible. Surely the same people, if you had asked them a few years ago about what would happen if the Fed tried to suppress interest rates by massively expanding its balance sheet, would have predicted runaway inflation. That didn’t happen, which should make you wonder what exactly they mean by saying that rates are artificially low. Oh, and Tett ends the piece by citing the Bank for International Settlements as a voice of wisdom. That’s pretty amazing, too; the sadomonetarists of Basel have a remarkable track record of being wrong about everything since 2008, but always finding some reason to call for higher rates. The thing is, Tett is a smart observer who talks to a lot of people in finance; seeing her present a discredited theory as obviously true, without so much as mentioning the kind of analysis that has been worked all along, says bad things about the extent to which anyone who matters has learned anything.

Knaves, Fools, and Quantitative Easing: When the going gets tough, the people losing the argument start whining about civility. I often find myself attacked as someone who believes that anyone with a different opinion is a fool or a knave; as I’ve tried to explain, however, that’s mainly selection bias. I don’t spend much time on areas where reasonable people can disagree, because there are so many important issues where one side really is completely unreasonable.... There are a lot of bad people engaged in economic debate--and I don’t mean that they’re wrong, I mean that they argue in bad faith. Which brings us to today’s installment of oh-yes-they’re-that-bad, courtesy of Bloomberg... the infamous open letter to Ben Bernanke warning that his efforts to boost the economy 'risk currency debasement and inflation'.... Bloomberg... ask[ed] the signatories whether they would concede that they were wrong. Not a chance.... And this is far from the only example of inflationistas and bond worriers bobbing and weaving, refusing to acknowledge having said what they said, being completely unwilling to admit mistakes. I try hard not to behave that way.... No doubt there have been times when I rewrote history to make myself look better, but I try to avoid that--it’s a major intellectual and moral sin. And boy are there a lot of sinners out there.

Ordoarithmetic: Francesco Saraceno is furious and dismayed at Hans-Werner Sinn, who says among other things that deflation in southern Europe is necessary to restore competitiveness. Why not inflation in Germany, he asks? But Saraceno fails to understand German logic here. As they see it, their economy was in the doldrums at the end of the 1990s; they then cut labor costs, gaining a huge competitive advantage, and began running gigantic trade surpluses. So their recipe for global recovery is for everyone to deflate, gaining a huge competitive advantage, and begin running gigantic trade surpluses. You may think there’s some kind of arithmetic problem here, but in Germany they have their own intellectual tradition.

Charlatans and Cranks Forever: Back when Paul Ryan released his first big-splash budget--the one that had the commentariat cooing over its “seriousness”--it included a link to an absurd Heritage Foundation analysis claiming, among other things, that the plan would drive the unemployment rate down to 2.8 percent. (Heritage then tried, unsuccessfully, to send its nonsense down the memory hole and pretend it never happened.) Ryan defenders tried to claim that the plan didn’t actually rely on that Heritage stuff; but as some of us tried to explain, the plan actually didn’t add up, relying on a multi-trillion-dollar magic asterisk on tax receipts. And we predicted that sooner or later Ryan would embrace magical theories about how tax cuts increase revenue. And here we are. One disturbing effect if Republicans take the Senate, by the way, may be that the Congressional Budget Office becomes a purely partisan operation--effectively a department of Heritage.

And needless to say, Paul Krugman knows what he is talking about. In general:

Paul Krugman is right.

If you think Paul Krugman is wrong, refer to (1).

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers