J. Bradford DeLong's Blog, page 106

October 12, 2019

Weekend Reading: Dietz Vollrath: Deep Roots of Development

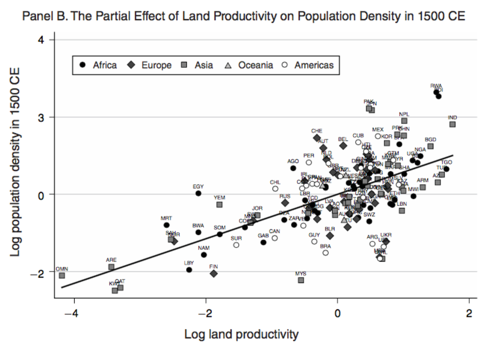

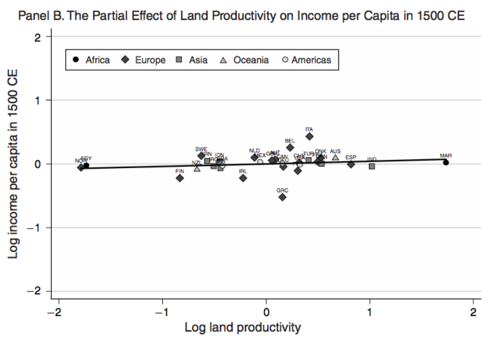

Dietz Vollrath: The Deep Roots of Development: "Think statistically, rather than in absolutes.... It is plausible that ethnic groups in areas where there were large returns to long-run investment in agricultural production may end up more patient in the long-run as well.... There is a significant relationship of productivity with patience... but the R-squared is about 10%.... [And] the results don���t mean that ethnic group A with higher productivity had to have higher patience than group B with lower productivity.... Lots of other things affect the patience of an ethnic group over and above the productivity level, and hence lots of things could have changed over the course of history to explain patience.... The findings... do not mean it is impossible to change the development level of countries or groups today. But the deep-rooted nature of development may mean we have to find other policy levers to push, as we cannot go back in time and roll back colonization, or change inherent agricultural productivity...

...It will seem presumptuous to explain cross-cultural patience as a function of agricultural productivity around the time of the Neolithic Revolution. And I think that researchers within this field do have a tendency to take big swings at big questions, and at times the prose in the papers will reflect that. Don���t let that put you off. The question still remains whether there is a valid empirical link established, and whether that link can be interpreted causally or just as a correlation. I think you���ll see that there is an accumulation of papers establishing strong links between deep roots and current development, and that this is not just a few odd results....

The cross-country empirical work on institutions that started around the mid-1990s as part of the cross-country growth regression literature, and was carried forward by the Acemoglu, Johnson, and Robinson study that used settler mortality as a source of exogenous variation in institutions.... The TL;DR version of them is that I don���t find the empirical work convincing in establishing the proposition that institutions are the fundamental determinant of comparative development. The main criticisms were as follows:

The scales of institutional quality (e.g. ���protection against expropriation��� or ���constraints on executives���) are used improperly in regressions....

In many cases institutional scales are just functioning as regional dummies. If you code a measure of institutional quality for European countries in 1750, and get that the Netherlands and England have a ���3���, while Spain and Portugal have a ���1���, and use this in a regression, then you may as well be using an indicator for ���gray winters��� versus ���sunny winters���.

Instrumenting for the quality of institutions in colonies using the mortality rates of European settlers doesn���t satisfy the condition that the instrument (settler mortality) have an effect on living standards only through its effect on institutions.... Settler mortality is like a summary statistic for biological/geographic conditions, which almost certainly have other routes to influence living standards.

Hence I don���t spend a lot of time in class going through the body of literature on these cross-country institutional studies. Nevertheless, I do spend time talking a lot about institutions....

Let's take the 7 point index for "constraint on the executive" used by Acemoglu and Johnson in their 2005 paper. 1 is "not so many constraints" and 7 is "lots and lots of constraints".... Does Australia (7) have seven times as many constraints at Cuba (1)? Does the one-point gap between Luxembourg (7) and South Korea (6) have a similar meaning to the one-point gap between Liberia (2) and Cuba (1)? Using this as a continuous variable presumes that the index values have some actual meaning, when all they are is a means of categorizing countries. So what happens if you use the constraint on executive scores simply as categorical (i.e. dummy) variables rather than as a continuous measure? You'll find that all of the action comes from the category for the 7's (Western developed countries) relative to the 1's (Cuba, North Korea, Sudan, and others).... Countries with 2's, 3's, 4's, and 5's are not significantly richer than 1's (2's, 3's, and 4's are actually estimated to be poorer than 1's). Country's with 6's have marginally significant higher income than 1's. The finding is that having Western-style social-democracy constraints on executives is what is good for income per capita, but gradations in constraints below that are essentially meaningless.

But there is a more fundamental empirical problem once we use constraints on executive to categorize countries. Regressions are dumb, and don't care that we have a particular interpretation for our categories. They just load any differences in income per capita onto those categorical variables.... Empirically, the best I can conclude is that Western-style social democracies are different from poor countries. Well, duh. One aspect of that may be constraints on executives, but we cannot know that for sure. Other indices of institutions are just as bad.... You want to tell me Governance is good in Switzerland and bad in Uganda, I guess I'd have to agree with you, not having any specific experience to draw on. But if I ask you what exactly you mean by that, what kind of answer would I get?... The institutions that get coded as "good" are the institutions people find in rich countries, because those must be good institutions, right? These measures are inherently endogenous.... Another big problem with the empirical cross-country institutions work is courtesy of Glaeser et al (2004). Their point is that our institutional measures are generally measuring outcomes, not actual institutional differences. One example is Singapore, which scores (and scored) very high on institutional measures like risk of expropriation and constraints on executives. Except under Lee Kwan Yew, there were no constraints. He was essentially a total dictator, but happened to choose policies that were favorable to business, and did not arbitrarily confiscate property. But he could have, so there is no actual institutional limit there. The empirical measures of institutions we have are not measuring deep institutional, but transitory policy choices....

The whole issue of incredibly small sample sizes, often times in the 50-70 country range.... And don't forget publication bias.... It may be that institutions do matter fundamentally for development. But the cross-country empirical literature is not evidence of that....

Next up will be 2nd-generation cross-country empirical work that uses instrumental variables. Spoiler alert: those don't work either....

They are still using an arbitrary measure of institutions as a continuous variable....

It is nearly impossible to believe that their instrument (settler mortality) has no separate correlation with the dependent variable (income per capita)....

The estimated effect of institutions doesn't make sense. Their IV results show a coefficient for institutions that is twice as large as the OLS coefficient. This is problematic. The whole reason we want IV estimates is because we think there is some kind of endogeneity between income per capita and institutions-specifically, that higher income leads to better institutions. This implies that the basic correlation of institutions and income per capita is biased upwards, or the OLS results are too big. But when they run IV, they get even bigger effects for institutions. This implies that income per capita has a negative effect on institutions, and that is hard to believe.... In the end, the simplest explanation for why their IV results are larger than the OLS is that there is a correlation of their instrument with the error term. We know settler mortality is negatively related to expropriation risk. If settler mortality is independently and negatively related to income per capita, then the IV results are going to be larger than the OLS....

The data are probably wrong. David Albouy's paper is the central reference here. Let me review the main issues. First, of the 64 observations, they do not have settler mortality data for 36 of them. For those 36, they infer a value from some other country. This inference could be plausible, but in many cases is not. For example, they use mortality data from Mali to infer values of mortality for Cameroon, Uganda, Gabon, and Angola. Gabon is mostly rainforest, and about 2300 miles away from Mali, a desert or steppe. Second, the sources vary in the type of individuals used to make mortality estimates. Most relevantly, in some countries the mortality rates of soldiers on campaign are used, and in others the mortality rates of laborers on work projects. In both cases, mortality rates are outliers relative to what settlers would have experienced. Most importantly, the use of the higher mortality rates from campaigning soldiers or laborers is correlated with poor institutions. That is, AJR use artificially high mortality rates for places with currently bad institutions. Hence their results are already baked in before they go to run regressions. Albouy's paper shows that making any of a number of equally plausible assumptions about how to code the data will eliminate the overall results.... So in the end the settler mortality evidence that institutions matter just does not stack up. It certainly does not have the kind of robust, replicable features we would like in order to establish the importance of something like institutions for development. If you want to argue that institutions matter, then by all means do so, but the AJR evidence is not something you should cite to support your case.

Next up I'll talk about why 3rd generation empirical studies of specific institutions aren't actually about institutions, but about poverty traps.... Dell (2010): Household consumption and child health are lower in areas in Peru and Bolivia subject to the Spanish mita-forced labor in mines-than in areas just outside the mita... .Nunn (2008): The number of slaves taken from an African country is negatively related to income per capita today. Banerjee and Iyer (2005): Agricultural output and investments in education and health are currently lower in areas of India where the British invested property rights in landlords as opposed to cultivators. Iyer (2010): Areas of India subject to direct British colonial rule have lower investments in schooling and health today than areas ruled indirectly through Indian governors. Michalopoulos and Papaioannou (2013). Pre-colonial ethnic political centralization in Africa is related to current levels of development within Africa:

These papers demonstrate is that economic development is persistent. If you like, they are evidence that there are poverty traps. If something happens to knock you below some threshold level of development-slaving activity, the mita, arbitrary borders, bad landlords-then you can't get yourself out of that trap. You are too poor to invest in public goods like human capital or infrastructure because you are spending all your money just trying to survive. So you stagnate. Pushing you into the trap was the result of an "institution", if we call these historical experiences institutions, but it isn't institutions that keep you poor, it's the poverty itself that prevents development.

Dell shows that education is lower and road networks are less dense in [former] mita areas than in their close neighbors.... Was some other institutional structure left behind by the mita that limited development[?]. But we have no evidence of any institutional difference between the mita areas and others. We simply know that the mita areas are poorer, and that could be evidence of a poverty trap rather than any specific institution. The papers on India have a similar flavor. The British no longer are in charge in India, but there are some differences today related to how they did govern. With regards to the effects of direct British rule, we don't actually know what the channel is leading to the poor outcomes.... With regards to the effect of landlords or cultivator property rights, this isn't about institutions, it's about the distribution of wealth. Think of the question this way. What specific policy change do any of these papers suggest would lead to economic development? "Don't get colonized, exploited, or enslaved by Europeans" seems like it would be hard to implement retroactively.

Understanding how a country/region/ethnicity got poor is not the same thing as understanding what will make them rich. "Institutions mattered" is different from "institutions matter". I think the better conclusion from the 3rd generation of institutions research is that economies can fall into poverty traps from which escape is difficult if not impossible. Would better institutions allow these places to escape these traps? I don't think we can say that with any confidence, partly because we have no idea what "better institutions" means.

I think the right null hypothesis regarding existing institutions is that they likely solving a particular issue for a particular group. Let's call this the Elinor Ostrom hypothesis. I don't think that the existing empirical institutions literature has provided sufficient evidence to reject the null at this point. Certainly not to the point that we can pinpoint the "right" institutions with any confidence....

All the other reading and thinking I've done on this subject suggests to me that they do matter. But the existing empirical evidence is not sufficient to strongly reject the null that they do not.... Given the empirical evidence, then, I'm uncomfortable making broad pronouncements that we have to get institutions "right" or "improve institutions" to generate economic development. We do not have evidence that this would work. Further... Acemoglu and Robinson did not lay out a theory of what constitutes good institutions, they laid out a theory of why institutions are persistent. Their work shows that being stuck in the bad equilibrium is the result of a skewed distribution of economic power that grants some elite a skewed amount of political power. The elite can't credibly commit to maintaining reforms, and the masses can't credibly commit to preserving the elite's position, so they can't come to an agreement on creating better institutions (whatever those might be).

The implication of the institutions literature is that redistributing wealth towards the masses will lead to economic development (and vice versa, that redistributing it towards the elites will slow economic development). Only then will the elite and masses endogenously negotiate a better arrangement. You don't even have to know precisely what "good institutions" means, as they will figure it out for themselves. The redistribution need not be explicit, but may arise through changes in technology, trade, or population. Douglass North has the same underlying logic in his work. It was only with changes in the land/labor ratio favoring workers in Europe that old institutions disintegrated (serfdom) and new institutions arose (secure property rights). A good example is South Korea. In 1950, Korea was one of the poorest places on earth, falling well below many African nations in terms of development. It had also been subject to colonization by Japan from 1910 to 1945. Korea had the same history of exploitive institutions as most African nations.

So why didn't South Korea get stuck in the same trap of bad institutions and under-development as Africa? One answer is that is had a massive redistribution of wealth. In 1945, the richest 3 percent of rural households owned 2/3 of all land, and about 60 percent of rural households had no land. This should have led to bad institutions and persistent underdevelopment. (See Ban, Moon, and Perkins, 1980, if you can find a copy). But starting in 1948 South Korea enacted wholesale land reform. By 1956, only 7 percent of farming households were tenants, and the rest owned their land. According to the FAO Agricultural Census of 1962, South Korea had zero farms larger than 5 hectares. Not a small number, not just a few, but zero. Agricultural land in South Korea, probably the primary source of wealth at that point, was distributed with incredible equity across households. According to North or Acemoglu and Robinson, this redistribution changed the relative power of elites and masses. It would have allowed them to reach a deal on "good institutions".... If you want to generate economic development, the implication of the institutions literature is that you have to reform the underlying distribution of economic power first. Once you do that institutions will endogenously evolve towards the "good" equilibrium, whatever that may be.

Dietz Vollrath (2017): Who Are You Calling "Malthusian"?: "I���m not sure how to reply. I���m not a Malthusian 'believer', because that isn���t a thing. But I do think that several of Malthus��� assumptions about how economies function, in particular prior to the onset of sustained growth during the 1800���s, are well founded. And those assumptions have implications that help make sense of the world in that period of time:

Dietz Vollrath: Involution and growth: "This is a long-promised, long-simmering, longer-than-necessary post on the concept of involution. This term comes up often in discussions of Asian and/or Chinese development, or the lack thereof relative to western Europe. You can find several definitions, which is one of the problems with the concept. Perhaps the best way to give you a sense of what it means is that the Platonic use of the term would be ���Rather than developing like western Europe, the Yangzi Delta involuted.���... The classic referenc... comes from Clifford Geertz���s Agricultural Involution: The Processes of Ecological Change in Indonesia. Geertz borrowed the term from an anthropologist, Alexander Goldenweiser, who used it to describe a situation in which the crafts or art of a society stuck with the same fundamental patterns, only making them more and more intricate over time....

Geertz adopted the word as a description of how village society in... the... paddy rice-growing heartland of Java... adapted to the growth in population, colonization by the Dutch, and the introduction of sugar as an export crop.... Villages did not change in a fundamental way during all this, even as they incorporated sugar production alongside paddy rice, but simply refined their existing social structures to further support small scale intense labor use. Those social structures included how land and labor was rented, hired, and shared across families.... What did not come along with all this refinement in agricultural relationships was growth in output per worker.... Village life in Indonesia did not become more market-oriented or commercialize in a way that one familiar with western European or English economic history might have expected.... The relationship with the Dutch, and the idea that Indonesia was an effective agricultural hinterland for Amsterdam. Thus money and goods flowed back and forth, but there was almost no flow of people. For Geertz, the importance of this showed up in a comparison of Java and Japan:

Japanese peasant agriculture came to be complementarily related to an expanding manufacturing system.... Javanese peasant agriculture came to be complementarily related to an expanding agro-industrial structure under foreign management.... Most of the invigorating effect of the flourishing agro-industrial sector was exercised upon Holland, and its impact upon the peasant sector was... enervating...

Philip Huang���s work on Chinese development... There were technological and market changes taking place in the Chinese economy.... Huang identifies the outcome as involution.... He identifies changes in the type of crops produced (e.g. cotton, tobacco, maize, silk) and in family work relationships (e.g. an expansion of women���s role in producing goods for sale).... Here the concept of involution is really about how per-worker or per-capita outcomes could stagnate or fall despite expansions in absolute output, and at the same time as significant technological and commercial changes. This observation of involution is argued to run back through Chinese history to at least 1350, the scope of Huang���s book.... Is the term involution useful as an analytical concept for understanding why this occurred? No, as far as I���m concerned.... We���ve got a reasonable analytical model-Malthus-that allows one to think about the relationship of output per worker, population density, and the effect of changes in technology. It has the advantage of being clear on how those things are related, while also highlighting that the response of family formation and fertility to changes in output per worker is central to the story.... I���d reserve the term involution for Geertz���s specific idea that-as part of a Malthusian outcome-the agrarian or social relationships within an economy may evolve to a more refined or hyper-specialized version of themselves...

Most of Europe up until the late 1800s could still be explained within the context of a Malthusian model.... That said, there were places within Europe that saw commercial and market development which did lead to growth in living standards, urbanization, and ultimately sustainollrath**: ed growth earlier than this occurred in most of Asia. Why or how did they accomplish that, if they were stuck inside the same Malthusian framework?... Let me reach back to those two specifics that Geertz talked about with respect to Indonesia... paddy... rice cultivation, and the absence of an urban outlet within Indonesia itself.... The Chinese experience included urban areas, so it was not a ���pure��� Malthusian economy like Indonesia, in that sense. Despite that, it still ended up in a Malthusian situation of stagnant or falling output per worker, and the urbanization rate did not appear to change much. Here I think... paddy rice production, played a role, at least for the development of the Yangzi.... The marginal product of labor in rice production does not fall by much as additional labor is applied. That means output per worker in those agricultural areas is insensitive to growth in the number of workers. This turns out to be both good and bad for those areas.... Here���s Huang:

The involuted peasant economy was able to support very large and complex cities, and, by extension, also a highly advanced elite and urban culture, even if the surplus above subsistence produced by the average cultivator shrank from the diminished marginal returns that came with involution. The paradox is poorly understood. Large cities and advanced urban cultures are commonly associated with rural prosperity, but I would like to suggest that the opposite was actually the case in much of Chinese history...

How does this compare to Europe, and why does it explain the lack of crude involution? In European agriculture, there are reasons to think that the marginal product of labor is very sensitive to the amount of labor used. This is both bad and good. It is bad, because any population growth in agriculture leads to significant loss of output per worker. But that means population growth slows down quickly, and hence the transition to the Malthusian stagnant equilibrium is very fast. So one reason Europe may not have looked like it ���involuted��� is that it did not have long, drawn-out, transitions towards the Malthusian equilibrium, as in China..... [Plus] relative to rice-growing areas of China, Europe had an advantage in that any urbanization it generated created this follow-on effect of improving rural output per worker.... And I haven���t even touched on differences in family formation and fertility patterns, which would add a whole other layer on top of this...

Dietz Vollrath (2014): Solitary, Poor, Nasty, Brutish, Short...and Happy?: "I have no idea how happy these hunter-gatherers really were.... But let me suggest two negatives.... One, they had to witness a brutal rate of infant and child mortality.... And let's not forget that those kids led unhappy lives, dying early, likely from some kind of infectious disease. Two, according to table 5 from the GK paper... close to one-in-five deaths occurred on the end of a spear, knife, arrow, or whatever weapon was at hand. One in five. For comparison, in the U.S. in 2010 (p. 11) only 0.4%, or 1 in 250, deaths are from homicide.... Hobbes may have been wrong about life being 'solitary', as my guess is that you stuck as close as possible to your trusted family network, but 'poor, nasty, brutish, and short' is a good first approximation...

Dietz Vollrath: Papers https://growthecon.wordpress.com/papers/: "If you are new to the field then the following papers provide a nice entry point:

Chang-Tai Hsieh and Peter J. Klenow (2010): Development Accounting http://ideas.repec.org/a/aea/aejmac/v2y2010i1p207-23.html...

Mancur Olson (1996): Big Bills Left on the Sidewalk: Why Some Nations Are Rich, and Others Poor http://ideas.repec.org/a/aea/jecper/v10y1996i2p3-24.html...

Nathan Nunn (2009): The Importance of History for Economic Development http://ideas.repec.org/a/anr/reveco/v1y2009p65-92.html...

Oded Galor (2005): From Stagnation to Growth: Unified Growth Theory http://ideas.repec.org/h/eee/grochp/1-04.html...

Xavier Sala-i-Martin (2006): The World Distribution of Income: Falling Poverty and... Convergence, Period http://ideas.repec.org/a/tpr/qjecon/v121y2006i2p351-397.html...

Chris Blattman: Should We Believe the Institutions and Growth Literature? https://chrisblattman.com/2014/11/26/believe-institutions-growth-literature/: "Dietz Vollrath... you should read these posts, and follow the blog.... The institutions literature��has focused too much on constraints and not on capacity. Constraints on power matter a lot. But the capacity of the state to get things done is equally or more important.... The slightly less-read stuff that should be more read, in my opinion.... North, Wallis and Weingast... Tim Besley and Torsten Persson... on state capacity... small-sample comparative case study work in Latin America, such as Jeffrey Paige or��James Mahoney... John Ishiyama���s short textbook...

Ricardo Hausmann (2013): The Tacit-Knowledge Economy https://www.project-syndicate.org/commentary/ricardo-hausmann-on-the-mental-sources-of-productivity-growth: "Know how resides in brains, and emerging and developing countries should focus on attracting them, instead of erecting barriers to skilled immigration. Because knowledge moves when people do, they should tap into their diasporas, attract foreign direct investment in new areas, and acquire foreign firms if possible.... Recent research at Harvard University���s Center for International Development (CID) suggests that tacit knowledge flows through amazingly slow and narrow channels. The productivity of Nuevo Le��n, Mexico, is higher than in South Korea, but that of Guerrero, another Mexican state, resembles levels in Honduras. Moving knowledge across Mexican states has been difficult and slow. It is easier to move brains than it is to move tacit knowledge into brains, and not only in Mexico. For example, as the CID���s Frank Neffke has shown, when new industries are launched in German and Swedish cities, it is mostly because entrepreneurs and firms from other cities move in, bringing with them skilled workers with relevant industry experience.... Knowledge moves when people do...

Timothy Besley and Torsten Persson: The Origins of State Capacity: Property Rights, Taxation, and Politics http://econ.lse.ac.uk/staff/tbesley/papers/originsofstatecapacity.pdf: "'Policy choices' in market regulation and taxation are constrained by past investments in the legal and fiscal capacity of the state. We study the economic and political determinants of such investments and find that legal and fiscal capacity are typically complements. Our theoretical results show that, among other things, common interest public goods, such as fighting external wars, as well as political stability and inclusive political institutions, are conducive to building state capacity of both forms. Our preliminary empirical results uncover a number of correlations in cross-country data which are consistent with the theory...

Douglass C. North, John Joseph Wallis, and Barry R. Weingast: A Conceptual Framework for Interpreting Recorded Human History https://www.nber.org/papers/w12795: "Beginning 10,000 years ago, limited-access social orders developed that were able to control violence, provide order, and allow greater production through specialization and exchange... using the political system to limit economic entry to create rents, and then using the rents to stabilize the political system and limit violence.... This type of political economy arrangement... appears to be the natural way that human societies are organized.... In contrast, a handful of developed societies have developed open-access social orders. In these societies, open access and entry into economic and political organizations sustains economic and political competition. Social order is sustained by competition rather than rent-creation. The key to understanding modern social development is understanding the transition from limited- to open-access social orders, which only a handful of countries have managed since WWII...

Robert I. Moore (2000): The First European Revolution: c. 970-1215 https://books.google.com/books?isbn=0631184791: "This book provides a radical reassessment of Europe from the late tenth to the early thirteenth centuries.... The period witnessed the first true revolution in European society, characterized by a transformation in the economy, in family structures, and in the sources of power and the means by which it was exercised. Together these changes brought into being for the first time an autonomous city-supporting civilization in non-Mediterranean Europe. The circumstances and outcome of this transformation, he demonstrates, not only shaped medieval and modern Europe but established enduring and fundamental characteristics which differentiated Europe from other world civilizations. The process at the heart of change involved social, cultural and institutional transformations whose implementation required extensive popular participation. On occasion it required the use or threat of popular violence, in part consciously sanctioned and led by some of those challenging for power within the social elite; once the revolution had been achieved this popular enthusiasm had to be subdued and contained. These developments were far from simple and anything but uniform. The differences which resulted both within Europe and between Europe and other world civilizations were of lasting significance...

Michael Mitterauer: Why Europe?: The Medieval Origins of Its Special Path https://books.google.com/books?isbn=0226532380: "While most historians have located the beginning of Europe���s special path in the rise of state power in the modern era, Mitterauer establishes its origins in rye and oats. These new crops played a decisive role in remaking the European family, he contends, spurring the rise of individualism and softening the constraints of patriarchy. Mitterauer reaches these conclusions by comparing Europe with other cultures, especially China and the Islamic world, while surveying the most important characteristics of European society as they took shape from the decline of the Roman empire to the invention of the printing press. Along the way, Why Europe? offers up a dazzling series of novel hypotheses to explain the unique evolution of European culture...

#economicgrowth #economichistory #weekendreading #2019-10-12

No, We Don���t ���Need��� a Recession

Project Syndicate: No, We Don���t ���Need��� a Recession https://www.project-syndicate.org/commentary/myth-of-needed-recession-by-j-bradford-delong-2019-10: Business cycles can end with a "rolling readjustment" in which asset values are marked back down to reflect underlying fundamentals, or they can end in depression and mass unemployment. There is never any good reason why the second option should prevail: BERKELEY ��� I recently received an email from my friend Mark Thoma of the University of Oregon, asking if I had noticed an increase in commentaries suggesting that a recession would be a good and healthy purge for the economy (or something along those lines). In fact, I, too, have noticed more commentators expressing the view that ���recessions, painful as they are, are a necessary growth input.��� I am rather surprised by it.

Of course, it was not uncommon for commentators to argue for a ���needed��� recession before the big one hit in 2008-2010. But I, for one, assumed that this claim was a decade dead. Who in 2019 could say with a straight face that a recession and high unemployment under conditions of low inflation would be a good thing?

Apparently, I was wrong. The argument turns out to be an example of what Nobel laureate economist Paul Krugman calls a ���zombie idea ��� that should have died long ago in the face of evidence or logic, but just keeps shambling forward, eating peoples��� brains.��� Clearly, those who claim to welcome recessions have never looked at the data. If they did, they would understand that beneficial structural changes to the economy occur during booms, not during busts.

Obviously, shifting workers from a low-marginal-product activity to a zero-marginal-product activity is not progress. Nor is there any theoretical or empirical reason to think that people and resources cannot be pulled directly from low- to high-marginal-product activities during upswings, as if it takes a full washout to create the conditions for such movements.

Those who cheer loudest for recessions usually are not consumers, workers, or employers. They are most often financiers. After all, workers themselves are rarely unhappy to be working during booms.

To be sure, in the 1970s, the Nobel laureate economist Robert Lucas speculated that in the aftermath of a boom, workers would actually end up being unhappy for having worked during the good times. Having misperceived the prices of the goods they were buying, he argued, they would discover that they had overestimated their real (inflation-adjusted) wages: they had not been earning as much as they thought they were. But Lucas never explained why workers would have more information about wages than about the prices they were paying for groceries, rent, and so forth. Even as an abstract description of some unspecified process, the overall conjecture made very little sense.

By the same token, consumers rarely misperceive the utility of what they purchase. And firms, likewise, are rarely unhappy to have produced during a boom. They, too, have as much information about the prices at which they are buying as the prices at which they are selling. They, too, are subject to what Lucas called ���nominal misperceptions.��� Monopoly (and monopsony) power can drive a wedge between prices and marginal revenues (and between wages and marginal labor costs). But, generally speaking, firms prefer to hire more workers and make more stuff at whatever the current wage/price. They will seize known opportunities in the present rather than wait around for some unknown future.

So, who is really the most blinkered during booms? It is all of those who invested in outright scams like Theranos, or in risky bets like WeWork and Bitcoin. They are the ones who are sorry after the fact, and who wish that the central bank had taken away the punch bowl much earlier. If only they hadn���t succumbed to a fit of positive-feedback trading. If only they hadn���t been deranged by irrational exuberance, falling for what they heard in the financial-gossip echo chamber. As the twentieth-century economic historian Charles P. Kindleberger famously joked, ���There is nothing as disturbing to one���s wellbeing and judgment as to see a friend get rich.���

Envy and greed are the muses that always convince some to buy at the peak of a bubble. Only afterwards will these greater fools wonder why there hadn���t been more hints of the risks, or reach for some other argument to keep them in their right minds.

Yet even from this perspective, the conviction that a period of liquidation and contraction is needed after a boom remains incomprehensible. Business cycles can end with a rolling readjustment in which asset values are marked back down to reflect underlying fundamentals, or they can end in depression and mass unemployment. There is never any good reason why the second option should prevail.

#economicsgonewrong #highlighted #macro #projectsyndicate #2019-10-12

One quibble with the sharp Hunter Blair here: the argumen...

One quibble with the sharp Hunter Blair here: the argument that the supply of savings to fund private investment was highly elastic with respect to the after-tax interest rate has never been economically-respectable for anything other than a small open economy with a fixed exchange rate system. It was not respectable back in 2017 when it was made. The solid preponderance of evidence then was that the supply of savings was inelastic. And so it has proved:

Hunter Blair: It���s Not Trickling Down: New Data Provides No Evidence that the TCJA Is Working as Its Proponents Claimed It Would: "The strongest economically-respectable argument from proponents of the Trump administration���s Tax Cuts and Jobs Act (TCJA) was that... higher dividends incentivize households to save more, or attract more savings from abroad. The increased savings push down interest rates, so that it���s easier for corporations to borrow money to invest in new plants and equipment. And this new capital stock gives workers more and better tools to work with, boosting their productivity, and eventually that increased productivity should boost wages.... We now have 18 months of data on investment since the passage of the TCJA, plenty of time for its increased incentives for private investment to have taken hold. But the data doesn���t come close to supporting the story told by TCJA proponents...

#noted #2019-10-12

The "elasticity of substitution" is an emergent property....

The "elasticity of substitution" is an emergent property. It has very little to do with "technology" if only because there is not one single technology in the economy. There are lots of different types of machines and lots of ways to use workers and machines to produce things. And "rigid organization" is not quite right either here: Suresh Naidu (2014): Notes from Capital in the 21st Century Panel: "Perhaps a useful analogy is that this is the "Free to Choose" or ���Capitalism and Freedom��� for our time, from the left. I can���t think of a book that emerged from economics for a mass audience with as much reception since then. And what good news this is for economics! For 50 years Milton Friedman was the public face of partisan economics, and stamped it with a conservative public face that persisted. Maybe now Piketty���s book will give my discipline another public face...

...But let me push back against the book a bit. I think there is a "domesticated" version of the argument that economists and people that love economists will take��away. Then there is a less domesticated one, one that is more challenging to economics as it is currently done. I'm curious which one Thomas believes more. I worry that the impact of the book will be blunted because it becomes a ���Bastard Piketty-ism��� and allows macroeconomics to continue in its modelling conventions, which are particularly ill-suited to questions of inequality.

The domesticated version is a story about technology and the world market making capital and labor more and more substitutable over time, and this is why r does not fall very much as wealth accumulates. It is fundamentally a story about market forces, technology and trade making the demand for capital extremely elastic. We continue to understand r as the marginal contribution of capital to the production of the economy. I think this is story that is told to academic economists, and it is plausible, at least on the surface.��

There is another story about this, one that goes back to Keynes. And the idea here is that the rate of return on capital is set much more by institutions, norms and expectations than by supply and demand of the capital market. Keynes writes that "But the most stable, and the least easily shifted, element in our contemporary economy has been hitherto, and may prove to be in future, the minimum rate of interest acceptable to the generality of wealth-owners." Keynes footnotes it with the 19th century saying that ���John Bull can stand many things, but he cannot stand 2 percent.���

The book doesn't quite take a stand on whether it is brute market forces and a production function with a high elasticity of substitution or��instead relatively rigid organization of firms and financial institutions that lies behind the stability of r. ��

I think the production approach is less plausible...

#noted #2019-10-12

Ever since I stopped being a wee'un, I have heard that on...

Ever since I stopped being a wee'un, I have heard that one should not use expansionary fiscal policy to rebalance the economy because of the dangers of public debt accumulation. Somehow, there was never an analogous focus on how rebalancing the economy through monetary policy might produce greater dangers of private debt accumulation. Until now: Martin Wolf: How Our Low Inflation World Was Made: "If we are to make sense of where the world economy is today and might be tomorrow, we need a story about how we got here. By 'here', I mean today���s world of ultra-low real and nominal interest rates, populist politics and hostility to the global market economy. The best story is one about the interaction between real demand and the ups and then downs of global credit. Crucially, this story is not over...

...We should not be that surprised by this world of persistently weak inflation and ultra-aggressive monetary policies, including outright asset purchases by central banks and favourable long-term lending to banks. Ray Dalio of Bridgewater has laid out the logic in his important recent book Principles for Navigating Big Debt Crises.... Governments of countries whose debts are denominated in their own currencies can manage the aftermath of a crisis caused by excessive credit... spread out the adjustment over years... ���beautiful deleveraging���... [via] austerity; debt restructuring and outright default; money ���printing��� by central banks, not least to sustain asset prices; and other transfers... keeping long-term interest rates below growth of nominal incomes. That has in fact been done, even for Italy....

Where has this left us today? Not where we would like to be.... While financial and household debt have fallen relative to incomes... that is not true for debts of governments or non-financial corporates.... Offsetting debt explosions.... Crisis-hit economies are still far below pre-crisis trend output levels, while productivity growth is also generally low.... Populist politics of left and right remain in full force.... Big debt crises... have always thrown long shadows into the future...

#noted #2019-10-12

This is not a paper where I have ever understood what fea...

This is not a paper where I have ever understood what features of the data are interacting with the model to produce the conclusions. It would be nice if I could crack this: Marjorie A. Flavin: The Joint Consumption/Asset Demand Decision: A Case Study in Robust Estimation: "The Michigan Survey of Consumer Finances... whether... consumption tracks current income more closely than is consistent with the permanent income hypothesis can be attributed solely or partially to borrowing constraints.... The paper uses a robust instrumental variables estimator, and argues that achieving robustness with respect to leverage points is actually simpler, both conceptually and computationally, in an instrumental variables context than in the OLS context.... Households do use asset stocks to smooth their consumption.... There is no evidence that the excess sensitivity of consumption to current income is caused by borrowing constraints.... Robust instrumental variables estimates are more stable across different subsamples, more consistent with the theoretical specification of the model, and indicate that some of the most striking findings in the conventional results were attributable to a single, highly unusual observation...

#noted #2019-10-11

Federal Reserve Bank of New York: Nowcasting Report https...

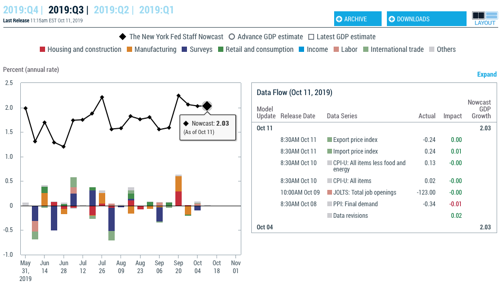

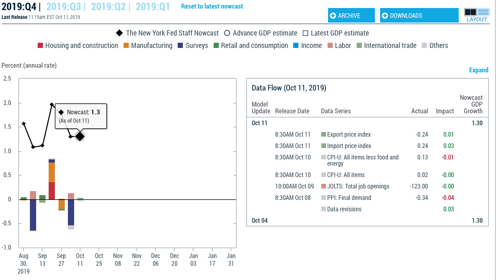

Federal Reserve Bank of New York: Nowcasting Report https://www.newyorkfed.org/research/policy/nowcast: "Oct 11, 2019.... The New York Fed Staff Nowcast stands at 2.0% for 2019:Q3 and 1.3% for 2019:Q4. News from the JOLTS, PPI, CPI, and export and import prices releases were small, leaving the nowcast for both quarters broadly unchanged:

#noted #2019-10-11

For the past decade Robert Gordon has written about The R...

For the past decade Robert Gordon has written about The Rise and Fall of American Growth, praising the first in our past that was and lamenting the second in our present that is. Now comes Dietz Vollrath with a lively, accurate, and essential corrective to Gordon's pessimism: growth is slow today, he demonstrates, not because our economy is failing but because our economy has succeeded: Dietz Vollrath: Optimal Stagnation: Why Slower Economic Growth Is a Sign of Success: "In 1940 you might have spent your money installing plumbing for running water, or a toilet.... The same went for air conditioning, a TV, or a computer at other points in time during the 20th century. But once we had those goods, then what did we spend our money on?... Goods became cheaper and we filled up our houses with them.... Spending turned towards services... longer and better vacations... classes... medical specialists... physical therapy... data... Netflix and Hulu.... The flow of workers out of producing goods didn���t signal some kind of failure.... In the 21st century... these shifts became a drag on economic growth...[for] most service industries have relatively low productivity growth.... As we shifted our spending from goods to services, this pulled down aggregate productivity growth, which is just a weighted average of productivity growth across different industries.... Baumol.... Labor is necessary to produce goods, but it is not part of the product itself. The person who assembled your fuel injector doesn���t have to be there for you to drive your car. On the other hand, for services labor is part of the product... you need to interact with a doctor, or lawyer, or waiter, or personal trainer, or financial advisor, or teacher.... It isn���t some kind of failure that service productivity growth is low, it is rather an inherent feature of those kinds of activities.... Choices born of success had the unintended consequence of putting a drag on the growth rate in the 21st century...

#noted #2019-10-11

October 11, 2019

We have had financial crises for nearly 200 years now. Ye...

We have had financial crises for nearly 200 years now. Yet our handling of those of the mid-nineteenth century was certainly no worse, and arguably better, than our handling of 2007-2010. All parts of "lend freely at a penalty rate on collateral that is good in normal times" were understood. Why weren't they understood in 2008?:

Karl Marx: Neue Rheinische Zeitung Revue: "The years 1843-5 were years of industrial and commercial prosperity, a necessary sequel to the almost uninterrupted industrial depression of 1837-42. As is always the case, prosperity very rapidly encouraged speculation. Speculation regularly occurs in periods when overproduction is already in full swing. It provides overproduction with temporary market outlets, while for this very reason precipitating the outbreak of the crisis and increasing its force. The crisis itself first breaks out in the area of speculation; only later does it hit production. What appears to the superficial observer to be the cause of the crisis is not overproduction but excess speculation, but this is itself only a symptom of overproduction. The subsequent disruption of production does not appear as [what it really is,] a consequence of its own previous exuberance, but merely as a setback caused by the collapse of speculation...

[...]

The crisis reached its peak between 22 and 25 October, when all commercial transactions had come to a standstill. A deputation from the City then brought about a suspension of the Bank Act of 1844, which had been the fruit of the deceased Sir Robert Peel's sagacity.... Since his death Peel himself has been apotheosized in the most exaggerated fashion by almost all parties as England's greatest statesman. One thing at least distinguished him from the European 'statesmen' ��� he was no mere careerist.... His power over the House of Commons was based upon the extraordinary plausibility of his eloquence. If one reads his most famous speeches, one finds that they consist of a massive accumulation of commonplaces, skillfully interspersed with a large amount of statistical data...

[Capital]: Chapter 25: The course characteristic of modern industry, viz., a decennial cycle (interrupted by smaller oscillations), of periods of average activity, production at high pressure, crisis and stagnation, depends on the constant formation, the greater or less absorption, and the re-formation of the industrial reserve army or surplus-population.... The expansion by fits and starts of the scale of production is the preliminary to its equally sudden contraction... the simple process that constantly ���sets free��� a part of the labourers... the constant transformation of a part of the labouring population into unemployed or half-employed hands.

The superficiality of Political Economy shows itself in the fact that it looks upon the expansion and contraction of credit, which is a mere symptom of the periodic changes of the industrial cycle, as their cause...

[Capital]: Chapter 25: It will be remembered that the year 1857 brought one of the great crises with which the industrial cycle periodically ends. The next termination of the cycle was due in 1866. Already discounted in the regular factory districts by the cotton famine, which threw much capital from its wonted sphere into the great centres of the money-market, the crisis assumed, at this time, an especially financial character. Its outbreak in 1866 was signalised by the failure of a gigantic London Bank, immediately followed by the collapse of countless swidling companies. One of the great London branches of industry involved in the catastrophe was iron shipbuilding. The magnates of this trade had not only over-produced beyond all measure during the overtrading time, but they had, besides, engaged in enormous contracts on the speculation that credit would be forthcoming to an equivalent extent. Now, a terrible reaction set in, that even at this hour (the end of March, 1867) continues in this and other London industries...

#noted #2019-10-11

Very good advice for California now���and for future cong...

Very good advice for California now���and for future congressional majority leaders and speakers and presidents who might represent the large majorities of American voters who want these problems addressed sensibly and substantially:

Heather Boushey: Equitable Growth CEO's Written Testimony at California Future of Work Commission: "The monopoly power problem... exacerbates inequality, contributes to wage stagnation, limits entrepreneurship, increases the cost of living, and stifles innovation.... Industry concentration and declining economic dynamism reduces wages by limiting workers��� employment options and opportunities for advancement, and allows firms to use their increasing power to squeeze worker compensation in favor of greater profits. Workplace fissuring, through the rise of independent contractors, franchisors, and contingent hiring, prevents workers from accessing career ladders, matching into the jobs they are best suited for, and gaining sufficient bargaining power to unlock wage increases. Persistent historical disparities such as wage discrimination and social norms reinforce occupational segregation into jobs that don���t pay well enough and offer little room for advancement. Yet policymaking over the past several decades has been moving in the wrong direction. Specifically: Antitrust law now allows firms to accrue and abuse monopoly power, not just over consumers but also in many cases over workers. Successive rounds of tax cuts, including the Tax Cuts and Jobs Act of 2017 and several tax cuts under the George W. Bush administration, have lowered the progressivity of the tax code and greatly decreased taxes on wealth, capital, inheritances, and corporate profits. Outdated labor law provides insufficient protection of workers and has facilitated the long decline of unions, traditionally the most vocal and ardent advocates for the middle class. We have an opportunity right now to take a step back to look at the scale and scope of the problems and develop real solutions...

#noted #2019-10-11

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers