J. Bradford DeLong's Blog, page 100

October 23, 2019

The Berkeley History Department slavery studies group, pl...

The Berkeley History Department slavery studies group, plus David Blight on Yale, on how much of what we see as "scientific labor management" from the business side and "deskilling Taylorization" from the labor side has its roots in slaveholding society ideas of the worker as an "instrumentum mutum" in the words of Roman statesman Cato the Elder���merely a "tool that speaks": David Blight, Stephanie Jones-Rogers, Caitlin Rosenthal, and Jennifer D. King: The Business of Brutality: Slavery and the Foundations of Capitalism:

#noted #2019-10-23

October 22, 2019

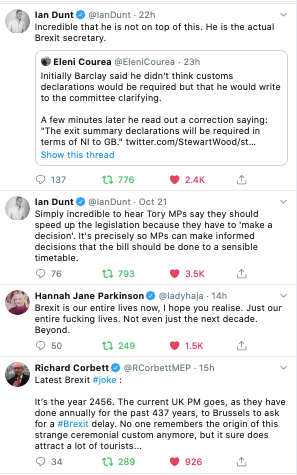

On Twitter: Week of October 22, 2019

Ricardo's Big Idea, and Its Vicissitudes: Hoisted from the Archives

Hoisted from the Archives: Ricardo's Big Idea, and Its Vicissitudes https://www.bradford-delong.com/2017/10/ricardos-big-idea-and-its-vicissitudes-inet-edinburgh-comparative-advantage-panel.html:

INET Edinburgh Comparative Advantage Panel

Ricardo's Big Idea, and Its Vicissitudes

https://www.icloud.com/keynote/0QMFGpAUFCjqhdfLULfDbLE4g

Ricardo believes in labor value prices because capital flows to put people to work wherever those things can be made with the fewest workers. This poses a problem for Ricardo: The LTV tells him that capitalist production should take place according to absolute advantage, with those living in countries with no absolute advantage left in subsistence agriculture.The doctrine of comparative advantage is Ricardo���s way out. For him, the LTV holds within countries. Countries��� overall price levels relative to each other rise and fall as a result of specie flows until trade balances. And what is left is international commodity price differentials that follow comparative advantage. Merchants profit from these differentials, and their demand induces specialization.

Thus Ricardo reconciles his belief in the LTV with his belief in Hume���s ���On the Balance of Trade��� and with the fact that capitalist production is not confined to the industry-places with the absolute advantage. His doctrine reconciles his conflicting theoretical commitments with the reality he sees, as best he can.

By now, note that we are far away from the idea that ���comparative advantage��� justifies the claim that free trade is for the best in the best of all possible worlds. There are a large number of holes in that argument:

Optimal tariffs.

The fact of un- and underemployment.

Externalities as sources of economic growth, in any of the ���extent of the market���, ���economies of scale���, ���variety���, ���learning-by-doing���, ���communities of engineering practice���, ���focus of inventive activity���, or any of its other flavors.

Internal misdistribution means that the greatest profit is at best orthogonal to the ���greatest good of the greatest number��� that policy should seek.

Given these holes, the true arguments for free trade have always been a level or two deeper than ���comparative advantage���: that optimal tariff equilibrium is unstable; that other policy tools than trade restrictions resolve unemployment in ways that are not beggar-thy-neighbor; that countries lack the administrative competence to successfully execute manufacturing export-based industrial policies; that trade restrictions are uniquely vulnerable to rent seeking by the rich; and so forth.

The only hole for which nothing can be done is the internal misdistribution hole. Hence the late 19th C. ���social Darwinist��� redefinition of the social welfare function as not the greatest good of the greatest number but as the evolutionary advance of the ���fittest������that is, richest���humans.

Hence ���comparative advantage��� takes the form of an exoteric teaching: an ironclad mathematical demonstration that provides a reason for believing political-economic doctrines that are in fact truly justified by more complex and sophisticated arguments. And, I must say, arguments that are more debatable and dubious than a mathematical demonstration that via free trade Portugal sells the labor of 80 men for the products of the labor of 90 while England sells the labor of 100 men for the products of the labor of 110.

But even if you buy all the esoteric arguments that underpin the exoteric use of comparative advantage on the level of national political economy, there still is the question of the global wealth distribution. Stipulate that the Arrow-Debreu-Mackenzie machine generates a Pareto-optimal result. Stipulate that every Pareto-optimal allocation maximizes some social welfare function. What social welfare function does the Arrow-Debreu-Mackenzie machine maximize.

It maximizes the social welfare function with Negishi weights. When individual utilities are weighted before they are added, each individual���s is waited by the inverse of their marginal utility of wealth. If the typical individual utility function has curvature that corresponds to a relative risk aversion of one, then Negishi weights are proportional to each individual���s wealth. For a relative risk aversion of three, Negishi weights are proportional to the cube of each individual���s wealth.

���Comparative advantage��� is the market economy on the international scale. And the market economy is a collective human device for satisfying the wants of the well-off. And the well-off are those who control scarce resources useful in producing things for which the rich have a serious Jones.

Thank you.

2017-10-22 :: 673 words

This File: https://www.bradford-delong.com/2019/10/hoisted-from-the-archives-_httpswwwbradford-delongcom201710ricardos-big-idea-and-its-vicissitudes-inet-edinbu.html

Edit This File: https://www.typepad.com/site/blogs/6a00e551f08003883400e551f080068834/post/6a00e551f0800388340240a4be1daf200b/edit

#economicsgonewrong #globalization #highlighted #hoistedfromthearchives #politicaleconomy #publicsphere #2019-10-22

Panel: Gains from Trade: Is Comparative Advantage the Ideology of the Comparatively Advantaged?:

Hoisted from the Archives: From Eight Years Ago: The Way the World Looked to Me in the Summer of 2011

Hoisted from the Archives: The Way the World Looked to Me in the Summer of 2011: Back in the summer of 2009, Barack Obama had five economic policy principals on the Treasury Bench:

Tim Geithner, who thought that the administration and the Fed had done enough to stabilize the economy, that we were on track for a rapid recovery, and that the principal economic policy problems were going to be dealing with the long-run budget.

Ben Bernanke, who thought that the administration and the Fed had done enough to stabilize the economy, that we were on track for a rapid recovery, and that the principal economic policy problems were going to be avoiding an unwanted uptick in inflation and dealing with the long-run budget.

Peter Orszag, who thought that the economy probably needed some (relatively small) additional fiscal, banking, and monetary stimulus to boost demand, but that the path to getting to that stimulus was to make it part of a package with policies to deal with the long-run budget.

Larry Summers, who thought that the economy probably would need some additional fiscal, monetary, and banking-side stimulus--if only as insurance--and that dealing with the long-run budget could wait until the recovery was well-established (although in an ideal world Washington would be able to do more than one thing at a time and so it would not have to wait).

Christy Romer, who thought that the economy probably needed (much) more additional fiscal, monetary, and banking-side stimulus--especially as insurance should things break badly--and that dealing with the long-run budget crisis probably should wait until the recovery was well-established: that the key point was "no 1937s!"

Opposite the Treasury Bench was the Right Opposition, with its guiding principle: never mind everything we have said in the past, whatever Obama proposes we reject.

And over in the corner was the Left Opposition, represented by:

Paul Krugman, who thought not quite "we are all going to die!" but rather that without five-alarm stimulus the risks were very high of a jobless recovery stemming from a combination of labor-market changes that had eliminated the temporary layoff and so the economy's ability to rapidly bounce-back on the labor side and of the fact that a financial-crisis solvency and safety squeeze was different from a monetary liquidity squeeze along the lines argued by Koo, Reinhart, Rogoff, and before them Bagehot, Minsky, and Kindleberger. And that Christy Romer was a wild-eyed optimist.

At the time I was, IIRC, somewhere between Christy and Larry--thinking that the risks of a jobless recovery were there and certainly demanded action as insurance, but that nobody wanted to see 1937 again, and that even without the cooperation of Congress the administration and the Federal Reserve had powerful tools and could and would stabilize aggregate demand.

The key, after all, is to get people to spend. Three things could keep people from spending:

A shortage of liquidity--and the Fed had and would continue to keep there from being any shortage of liquidity.

A shortage of savings vehicles--but that did not seem to be the case as the bonds of even good companies were not selling for the high prices you would have then expected to see.

A shortage of safety or an excess of risk in their portfolios--both on the debit and the credit side.

The first of these had been solved by the Fed. The second of these was not an issue. And the Fed and the Treasury had mighty tools to solve the third. The Fed via quantitative easing could take as much risk as it wanted to onto its balance sheet and replace the risky assets it bought with safe assets that the private sector wanted to hold--the Fed could push its balance sheet up from $2 trillion to $3, $4, $5, or even $6 trillion if needed. The Treasury could use its HAMP money to grease the refinancing of troubled mortgages. If HAMP wasn't enough the Treasury owned Fannie and Freddie: they could borrow at nearly the Treasury rate and refinance every house in the nation if necessary in order to get mortgage risk off of banks' books where it constrained lending and off of households' obligations where it constrained spending. The Treasury could use additional TARP money as the grease via the PPIP to take tail risk onto its books and so transform risky into safe assets. The Fed could take the TALF program and use it as a wrapper to make the long-run infrastructure projects we needed to undertake sources of the safe assets the private sector wanted to hold.

Even with a Congress gridlocked and neutralized, the Fed and the executive had enough power through their ownership of Fannie and Freddie, through the Federal Reserve act, and through the TARP to do everything necessary to guarantee a strong recovery.

But the problem I did not see in the summer of 2009 was that the stimulus skeptics were the operational managers of the government, while the stimulus advocates were staff without line responsibilities.

Hence nothing happened.

And Peter, Larry, and Christy left.

And their successors--Jack, Gene, and Austen--are very smart men and dedicated civil servants, but they lack the strong substance-matter knowledge and aggressive policy views of their predecessors.

So the only strong policy views in the administration's internal debate mix right now are those of people who were wrong in the summer of 2009.

And when I talk to their staffs, the message I hear is not "we were wrong about how the world works, and are rethinking the issues from the ground up to figure out what to do" but instead "we were unlucky: our policies were good".

#fiscalpolicy highlighted #hoistedfromthearchives #macro #monetarypolicy #2019-10-22

Ian Dunt: "Caroline Lucas, Green https://twitter.com/IanD...

Ian Dunt: "Caroline Lucas, Green https://twitter.com/IanDunt/status/1186680346408042498: 'I want to speak out on behalf of those who do not share this govt's vision of a mean-minded little Britain, with our borders closed and our horizons narrowed. For those like me who are proud to stand up for the precious right to be able to work and study and live and love in 27 other countries, who celebrate the contribution made by the 3 million EU citizens in our country. For those who recognise that imperfect thought it undoubtedly is, the EU remains the greatest international venture for peace, prosperity and freedom in history.' Thank f--- for Caroline Lucas, man. Really...

#noted #2019-10-22

Ian Dunt: "Rory Stewart. Let's find out where he's at htt...

Ian Dunt: "Rory Stewart. Let's find out where he's at https://twitter.com/IanDunt/status/1186677364878663680: Ah, maybe a good place. 'My big beg to the House, and here I am speaking to colleagues who voted for Brexit, is let's please in these very very final stages, do it properly. This is your great founding moment. This is your opportunity to create an enormous constitutional change that can last for 40 years. So do it properly.' Stewart valiantly pointing out that he has backed Brexit deals over and over again. 'I'm not a member of this party anymore. I don't get any bonus points. But in return, people deserve scrutiny. This is a hell of a big document. I know they'll be many voices in the Chamber who say we've been talking about this long enough. We cannot think like this. This is our parliament. We cannot do down our parliament. This was an exercise in regaining the sovereignty of parliament. And if it's about regaining the sovereignty of parliament, then treat parliament with respect. If you are taking back control, then show that you are worthy to exercise that control...

#noted #2019-10-22

October 21, 2019

Comment of the Day: Dilbert Dogbert https://www.bradford-...

Comment of the Day: Dilbert Dogbert https://www.bradford-delong.com/2019/10/raymond-chandler-1938-_the-red-wind_-there-was-a-desert-wind-blowing-that-night-it-was-one-of-those-hot-dry-santa.html?cid=6a00e551f0800388340240a48fd8d2200c#comment-6a00e551f0800388340240a48fd8d2200c in Santa Ana Winds: "Back in the mid 50's I spent time with my older brother in San Bernadino. His house was near the El Cajon Pass. I remember a night spent listening to the winds roaring down the pass. Next day I wandered around the area. Near his house was a new cheap development of houses without garages. Just car ports. Most of them were blown over. Another memory was going to a near by airport to check the condition of the small plane he built. As we drove in I notice a ball of aluminum in a tree. A plane came loose and ended up there. My bros plane suffered a broken spar. He was an aircraft mech so he fixed it....

#commentoftheday #2019-10-21

Comment of the Day: Nils https://www.bradford-delong.com/...

Comment of the Day: Nils https://www.bradford-delong.com/2019/10/raymond-chandler-1938-_the-red-wind_-there-was-a-desert-wind-blowing-that-night-it-was-one-of-those-hot-dry-santa.html?cid=6a00e551f0800388340240a4dc99d2200b#comment-6a00e551f0800388340240a4dc99d2200bin Santa Ana Winds: "I can reliably tell you that there was a Diablo wind on October 19 and 20, 1991, which led to the severity of the Oakland Hills fire. I was out at Mt. Tamalpais that day, and when we had hiked to the north end of the mountain near the Mountain Theater we could see a long streak of smoke trailing out to sea through the Golden Gate, at 11 am. I knew a serious fire had broken out, but of course could not tell where. I feared that my car at the East Gate parking lot was being consumed by wildfire and we were all going to die (or something like that). But when we got to East Peak and looked over the bay, about 1pm, we could see flames leaping in the Oakland Hills. I stopped worrying about me and worried about my aunt and uncle who lived in the hills above Tunnel Road (they got out OK but their house was gone, foundations calcined to a pile of sand, a few blobs of melted metal all that was left of my Grandmother's silver, although the gladiolus my aunt was planting that morning mostly survived). I take this sort of weather very seriously. PG&E is right to cut power no matter how inconvenient it is. We also, though, need more independent power, especially for critical installations like hospitals, nursing homes, schools. Off-grid living is becoming more and more a matter of survival and community resilience, less a fringe movement....

#commentoftheday #2019-10-21

Bret Devereaux: Battle Pachyderms https://acoup.blog/2019...

Bret Devereaux: Battle Pachyderms https://acoup.blog/2019/07/26/collections-war-elephants-part-i-battle-pachyderms/: "One reading of the (admittedly somewhat poor) evidence suggests that this is how Pyrrhus of Epirus used his elephants���to great effect���against the Romans. It is sometimes argued that Pyrrhus essentially created an ���articulated phalanx��� using lighter infantry and elephants to cover gaps���effectively joints���in his main heavy pike phalanx line. This allowed his phalanx���normally a relatively inflexible formation���to pivot...

#noted #2019-10-21

Bret Devereaux Elephants Against Wolves https://acoup.blo...

Bret Devereaux Elephants Against Wolves https://acoup.blog/2019/08/02/collections-war-elephants-part-ii-elephants-against-wolves/: "The playbook for dealing with elephants was actually fairly simple in concept���Vegetius, a later Roman military writer, manages to sum up the ���best practices��� in less than a paragraph (Vegetius 3.24). Ideally, the elephants should be met by light infantry screening troops, whose freedom of movement allows them to avoid the elephant���s charge. Those light troops ��� armed with missile weapons (especially javelins, but also slings) should especially target the mahouts, in an effort to panic the elephants. Ideally, a space is left open for the elephants to flee too, although ancient sources are full of examples where they were simply driven back through the enemy formation. The goal isn���t to kill the elephant, but instead to panic the animal and drive it off or���better yet���drive it through the enemy. This latter point is notable: ancient military writer after ancient military writer notes how elephants were often as much a danger to their own troops as to the enemy, especially when wounded or frightened...

#noted #2019-10-21

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers