Joseph Hogue's Blog, page 86

August 14, 2022

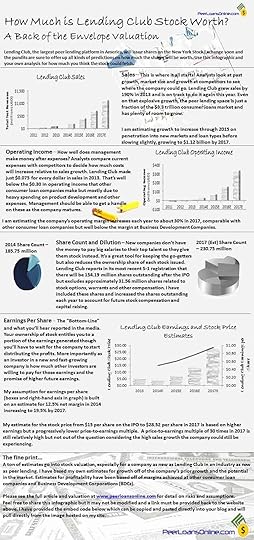

How Much is Lending Club Stock Worth?

Lending Club, the largest peer lending platform in America, will issue shares on the New York Stock Exchange soon and the pundits are sure to offer up all kinds of predictions on how much the shares will be worth. Use this infographic and your own analysis for how much you think the stock could fetch. I’ve included more detail on my own analysis below the infographic.

How Much is Lending Club Stock Worth

How Much is Lending Club Stock WorthInsert this Infographic into your blog or website! Copy and paste the following code directl...

The Future of Peer to Peer Lending with Ron Suber, President of Prosper

Today’s post is the first part of an interview with Ron Suber, President of Prosper Marketplace. Ron joined Prosper in 2013 to develop and execute on the company’s business development strategy. He previously served as a Managing Director at Wells Fargo Securities and as a senior partner at Merlin Securities.

The interview provided a ton of insight, more than eight pages worth, so I decided to split it into two...

August 13, 2022

Investment Diversification is a Double-edged Sword

Look through any peer lending site for five minutes and you’ll probably see the word, “diversification,” at least ten times. As an investment analyst, the idea of investment diversification has been a fundamental part of my consultations with clients and portfolio managers.

The bird’s eye view of diversification is this, putting all...

Building Wealth through Peer Lending, an Interview with David Shipman

I’m pleased to present our very first of many interviews on this site. I am interviewing both online loan investors and peer lending borrowers for their story on how the online loans revolution has changed their lives. You will never find a more insightful and honest discussion of peer loans than you will going right to the source and the people in the community.

Our first interview is with David Shi...

Home Improvement Loans: Get the Funds You Need to Make Your Dream Home a Reality

Is your home in need of repairs or renovations? You might be inspired to create your dream home, but covering the costs can be tricky. If you need funds to make these improvements, a home improvement loan may be the answer.

This post will discuss everything you need to know about home improvement loans: what they are, how they work, and who is eligible. We'll also provide tips on getting the best rate on your loan. The information here is valuable to all home improvers, no matter which phase of...

Cracking the How to Get Free Money Code: 15 Ways You Must Know

Does “free money” really exist? If it does, you know you want some. While there is no such thing as a free lunch in this world, there are some clever ways to get paid for minimal effort. You just have to know where to look.

Many companies promote their brands and look for talents online, opening up many opportunities to earn. You don't even have to get out of the house for most.

A gadget, an internet connection, and a little effort are all it takes to increase your income at home.

Let's look ...

August 10, 2022

The Psychology of Money: 8 Ways to Improve Your Money Mindset

As the old saying goes, personal finance is ‘mostly personal and a little bit financial.' Long-term growth and success rely more on our habits and behaviors than on complex knowledge and advanced strategies. Learning a few key points on the psychology of money can go a long way to building the right mindset for prosperity.

Let's look at a few far-reaching psychological concepts that play an outsized role in our financial lives, including some of the biases and fallacies that can point us in the ...

July 20, 2022

21 Cheap Foods to Buy When You’re On a Budget

Groceries can take up a significant portion of your budget each month. However, if you carefully choose what you buy, it doesn't have to be that way. Purchase affordable yet nutritious foods that help you stay healthy and save every time you head to the checkout. Let's look at some here.

Wholesome Food For Budget-Conscious Shoppers1. BananasBananas should always be on your shopping list because they're a great bargain. They usually cost around 58 cents per pound and are packed with essential n...

May 10, 2022

How to Buy NFTs: Five Steps for the New Investor

If you’re thinking about how to buy NFTs or investing considerably in the non-fungible token market, you’re certainly not alone. Even celebrities are cashing in on the NFT marketplace by purchasing and creating their own NFTs.

Inside Bitcoins reports that celebrities like Mark Cuban, Paris Hilton, and Lindsay Lohan have invested in the NFT sector by creating one-of-a-kind NFTs for fans and collectors alike to purchase. And that’s one unique aspect of non-fungible tokens; they are a one-of-a-kind...

May 2, 2022

4 Dividend Stocks to Fight Inflation

Inflation is affecting all aspects of your life. First, your weekly trip to the grocery store is more expensive because the price of meats, dairy, fruits, and almost everything else costs more. Next, the gas you use in your car is way up in price from last year. In addition, rents are rising too. So inflation is probably impacting stocks in your portfolio too. However, some companies can raise prices and maintain margins and profitability in a high inflation environment. In this article, we talk...