David Schneider's Blog, page 2

August 27, 2017

Sheep Get Slaughtered – The Death of Retirement

GET YOUR COPY ON AMAZON!

We all know that the broad masses playing Wall Street are not really excelling at it. In fact, they keep on losing money, even though all benchmarks seem to tell a different story. In order to visualize this conundrum, I will make use of animals as it is a long-standing tradition among Stock Market folks to use animals and animal allegories to underline some simple truth. Bears, bulls, sharks and sheep, they all have a story to tell on Wall Street.

Most retail investors following the conventional approach to retirement investing fall into one of two categories. Either they will blindly follow all the advice given to them, not engaging with their investments in any meaningful way, and end up losing a large chunk of money during a bust cycle – at which point they panic, and, under pressure, withdraw from the market. These people I call sheep. The second group reckons they can outwit the market, but don’t have a specific edge. When pitted against the smartest Wall Street has to offer, they inevitably come up short. These I call chipmunks.

The Sheep and Losing Money

The group of sheep is by far the larger group. They are sheep because they blindly follow the lead of their bankers, advisors and TV gurus. They are bamboozled by a slew of jargon. If you ever consulted your banker on the issue of investing for retirement, you might understand what I am talking about. I have seen the process firsthand – I was sitting on the other side of the table wearing a fancy suit, with an expensive pen, and equipped with shiny sales documents featuring lots of graphs and tables. Back in 1999, I was recommending our in-house mutual funds and those funds from investment companies that we had a distribution agreement with. Of course, we bankers received a generous distribution fee as a sales incentive. Tech and internet funds were all the rage, and business was good! Whether our clients could be losing money was not our primary concern.

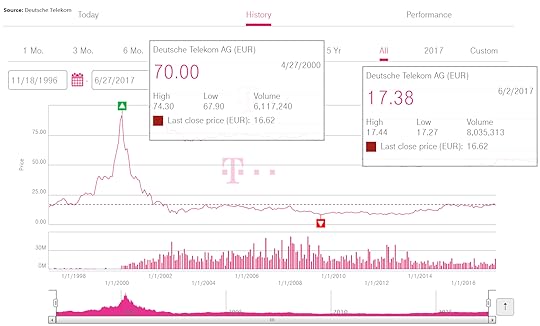

Even when people have the resources to sustain losses, the journey can be harrowing and the results disappointing. My own father is a great example. He got lured into the stock market game in 1996 with the introduction of the widely touted Deutsche Telekom AG IPO (Initial Public Offering). An unprecedented media campaign was launched to promote investing in stocks as the right strategy for the common man and their retirement. And the one stock that would personify this retirement concept would be the stock of Deutsche Telekom AG, which would take care of millions of Germans through stable and secure dividend payments and consistent price increases.

*Source: Deutsche Telekom

German Retail Investors

When it comes to stock markets, Germans usually know they might be in for “losing money”, so like many Japanese, they try to stay clear by being ultra conservative (at least the older generations). Who can blame them after such a traumatic experience? In hindsight, Deutsche Telekom would become a complete disaster, ending with CEO Ron Sommer getting fired, dividend payments cuts, and price volatility that rivaled the Nasdaq’s 70% decline in 2001. But the campaign itself was a huge success. It would suck in millions of Germans to a game that lasted right to the end of the tech bubble.

In this first market correction, my father – along with many other Germans – saw his heavy tech and telecom-weighted investment portfolio cut by more than half. But unlike other Germans, he followed through with the standard advice you hear from financial advisors when they see their clients panic: to stay the course. Many fellow Germans didn’t, and gave up in despair, suffering massive realized losses.

They would soon regret their decision, as an easy monetary policy by Alan Greenspan and other central bankers created a deluge of liquidity that propped up stock markets around the world. Slowly regaining confidence, my father would cautiously buy more stocks at higher prices from 2004 onwards. As markets gained momentum, his initial cautiousness, all of a sudden, turned into open enthusiasm that lasted until 2007.

The Next Crash

Unfortunately, he saw his portfolio cut in half again in the carnage of the subprime crisis of 2007/2008. Again, thanks to unprecedented monetary policies (by Ben Bernanke) markets recovered. And so he continues to this day, putting more and more money into stocks, mindful of the next crisis, yet not cashing out while he still can.

Doing a rough calculation on the back of an envelope, his average annualized returns for his entire investment portfolio since 1997 including dividends received, though positive, is disappointing at around 4% p.a. before taxes and not inflation adjusted.

My father is not alone. He is just one of millions of retail investors worldwide, mainly middle-class folks, following conventional advice and the tendency to over-trust their financial advisors and bankers. These clients – conned by the industry and fleeced of their savings – are “sheep.” They have no recourse to justice, no sense of how an investment actually works, and they usually end up with scraps, if anything. According to DALBAR, one of the leading industry research firms, “Over a 20-year period, December 31, 1993, through December 31, 2013, the S&P 500 returned an average annual return of 9.28%. However, the average mutual fund investor made just over 2.54%.”

Continue Losing Money

The main issues are that they are being charged horrendous fees for very little value, and the timing of buying and selling has been abysmal. In fact, the statistics prove that clients tend to buy into high-risk assets such as equity funds as they are rising, and then, in market corrections, sell at very inopportune moments. Then, they would pull their money out and wait until markets go up again, before re-entering – the very opposite of the cardinal rule of investing: “Buy low, sell high.” As Charles Ellis, author of The Loser’s Game, observed, “The sad result is that investors time and again buy after a fund’s best results have been recorded and sell out after the worst performance is over.”

The conventional wisdom states that you should just invest at all times, contribute regularly, and above all, do not panic. It seems that the vast majority is ignoring this advice, or are simply not capable of following through. You could compare this to the simple advice to eat less and exercise more in order to lose weight. Most of us just can’t do it, and it’s not always our fault.

Let’s consider a very realistic scenario: An individual investor starts dutifully contributing to a standard benchmark index fund of a reputable firm on a monthly basis – this is already considered the pinnacle of sophistication for retail investors, as index funds are low cost and relatively easy to understand. True to theory and expectations, the price of her funds rises, and all is good. Then, disaster strikes. Stock markets drop. A full selling panic breaks out, and prices drop below her average purchase price. For the first time, she is presented with zero gains for all those years of saving. As panic is as infectious as the common cold during winter, she stops contributing to her savings plan (which could lower her average purchase price considerably), but worse, she is forced to sell out of financial need before she loses everything. And so ends her foray into financial markets for retirement investing. Staying the course did not help one bit.

Naive Investors – Naive Sheep

What is even more unsettling is the sheer unawareness of clients and their blissful ignorance of fees being charged or adverse performance scenarios. If you ever studied the court papers of disgruntled clients who sued mutual funds companies such as BlackRock or Fidelity, you will see a very clear pattern emerge.

Clients regularly underestimate the real fees involved even for index fund investments

Clients are confused by the product variety of today’s mutual fund and ETF universe

Clients have unreasonable return expectations induced by over-optimistic advertising.

And that is the sad truth of how most sheep experience the stock market – they lose, they get bamboozled, and there’s not a damn thing they can do about it. So what could help? Stop Losing Money!

***END***

Stay tuned for more excerpts on retirement investing, passive income and early retirement.

***GET YOUR COPY ON AMAZON***

The post Sheep Get Slaughtered – The Death of Retirement appeared first on 8020 Superinvestors.

August 23, 2017

Protected: Secure Retirement or Chasing a Dream?

This content is password protected. To view it please enter your password below:

Password:

The post Protected: Secure Retirement or Chasing a Dream? appeared first on 8020 Superinvestors.

Protected: Chapter 1: Defined Contribution Plans and New Found Freedom

This content is password protected. To view it please enter your password below:

Password:

The post Protected: Chapter 1: Defined Contribution Plans and New Found Freedom appeared first on 8020 Superinvestors.