Farnoosh Torabi's Blog, page 75

July 4, 2011

MoneyWatch: Extreme Coupon Backlash!

Last month I described five reasons to steer clear of extreme couponing, and now I think I have a sixth: It brings out the worst in both consumers and retailers.

Last month I described five reasons to steer clear of extreme couponing, and now I think I have a sixth: It brings out the worst in both consumers and retailers.

Industry watchers say TLC's popular reality show, Extreme Couponing — which depicts coupon-obsessed men and women spending 30 to 40 hours a week cutting coupons to net pounds and pounds of groceries for pennies on the dollar (exhausted yet?) — may be causing more harm than good in the real world.

On the retail front, some big retailers — wary of couponing copycats — are pushing back on former coupon allowances for ordinary shoppers:

At Rite Aid, shoppers can no longer combine buy-one-get-one-free coupons or promotions — a strategy that, in the past, allowed customers to get two free items. The chain is also limiting the number of coupons a shopper can use per item to four, as long as there is enough stock. Before, the store accepted "multiple identical coupons for multiple qualifying items."

Target now forbids "stacking," the act of combining manufacturer and store buy-one-get-one-free coupons, in order to receive both items for free.

Meanwhile, viewers are trying to take on the TV show's tricks to no avail — and becoming depressed by their inability to replicate the savings achieved by the pros on the show. "Is Extreme Couponing Hurting Self Esteem?" asks Leah Ingram on her blog Suddenly Frugal. Phil Lempert, food industry expert and editor of Supermarketguru.com, told her that "shoppers no longer feel good about saving $10, or 10-to-20 percent. They're becoming depressed that they are not able to buy $1,000 or more groceries for 25 cents."

And, believe it or not, some of the coupon-obsessed across the country have reportedly turned to newspaper theft to take advantage of as many coupon circulars as possible. Some subscribers complain that their papers are missing coupon inserts, while some regional newspaper companies report papers have been stolen from coin-operated racks. Now, that's extreme.

For my Couponing Do's and Don'ts visit the rest of this article at MoneyWatch.com

Photo courtesy: MissMessie's photostream on Flickr

June 27, 2011

Cheap Sunscreen Proves Best

Which sunscreen is best? SPF 60? or SPF 30? Brand-name or store-labels?

Which sunscreen is best? SPF 60? or SPF 30? Brand-name or store-labels?

Check out my latest Financially Fit video on Yahoo!Finance for the truth about sunscreen. An accompanying article is below.

Originally posted on Yahoo!Finance

We know we need to protect ourselves from the sun's harmful rays, but choosing the right kind of sunscreen from the sea of products on the market can be a bit overwhelming. The $5 billion industry holds a spectrum of sun care products at various price points that researchers say isn't always effective. In fact, the Environmental Working Group's 2011 survey of more than 1,700 sunscreens gave only one in five high marks for safety and efficacy.

Determined to find out just how consumers should evaluate sunscreens and which ones offered the most value, we went to the experts at both Consumer Reports and GoodGuide.com. Both publications have recently done extensive research, comparing numerous brands, and it turns out that the higher the price or SPF doesn't necessarily determine a better sunscreen. Here's what they found:

At Consumer Reports, researchers surveyed 22 brands in an external lab, testing them for protection against both UVA and UVB rays and water resistance. Topping the list was the SPF-45 No-Ad sunblock with aloe and vitamin E. It was also the least expensive sunscreen in the test at just 59-cents per ounce. Equate Baby SPF 50 tied for second place at 63 cents per ounce. Also high on the list and low on price was Target's Up and Up spray at 88 cents per ounce.

Interestingly enough, Consumer Reports' most expensive tested brand, La Roche-Posay, which runs more than $18 per ounce, scored well below many cheaper brands.

At GoodGuide.com, scientists ran similar tests but also based their rankings on health and safety. They examined more than 1,300 sun care products and selected the SPF 30 Badger Unscented Natural Sunscreen at $14 per bottle and Burts' Bees Chemical Free Sunscreen SPF 30 for $10 per bottle, as two of their favorites. Some of GoodGuide's picks were more expensive than Consumer Reports' top winners, but that's specifically selected chemical-free brands.

Some sunscreen tips from all experts we spoke to, including Dr. David Colbert, founder of the New York Dermatology Group, include:

Choose sunscreen with at least SPF 30, but don't splurge for anything that's much higher. New FDA regulations are, in fact, limiting the maximum SPF to 50 since there's not enough proof SPFs beyond that number provide greater protection.

Application is key. Reapply at least every two hours and always after swimming or sweating.

The proper application amount for exposed skin is about one ounce, or one shot glass full of liquid sunscreen.

Consider using a sunscreen spray for hard-to-reach parts of your body like your back.

June 22, 2011

Money 911 on Today Show

This morning on the NBC Today Show, I joined personal finance experts Jean Chatzky and David Bach to answer some of your questions about money and credit.

This morning on the NBC Today Show, I joined personal finance experts Jean Chatzky and David Bach to answer some of your questions about money and credit.

My question came from a viewer in Texas. Here's what she had to ask:

I am wanting to improve my credit score and I have several items on my credit that are from several years back that need to be paid on. I heard that if you pay on old debts that it could actually hurt your score. Is that true and if so what is the best way to improve my credit?

My answer:

Paying off old debts that date several years back does not hurt your credit score, but it doesn't really help either. Once a bill becomes 180 days past due that negative information gets recorded on your credit report and stays there for 7 years, regardless of any improvements you make. As a result, your credit score stays the same. You can try to plead with the lender AND the credit bureaus to have the information removed from your credit report after you pay it off completely, which can help your score, but it's extremely rare.

That said, if you can afford it, I would recommend still paying off those old debts. At the very least, you can have those items reported as "paid in full" on your credit report, and when a lender looks at your credit history, that'll improve your chances of getting approved for a future loan. The best way to boost your score is to tackle your most recent debt, pay it down as soon as possible and never miss a payment deadline going forward.

Visit msnbc.com for breaking news, world news, and news about the economy

June 7, 2011

Back in AM New York!

After a three-year hiatus, I'm so excited to rejoin the team at Manhattan's largest daily newspaper – AM New York. Starting today I am the paper's personal finance columnist, bringing money advice to New Yorkers each Tuesday. Today's topic: Getting on the right financial track in your 20s, 30s, 40s and beyond. Here's a peek at the launching issue!

After a three-year hiatus, I'm so excited to rejoin the team at Manhattan's largest daily newspaper – AM New York. Starting today I am the paper's personal finance columnist, bringing money advice to New Yorkers each Tuesday. Today's topic: Getting on the right financial track in your 20s, 30s, 40s and beyond. Here's a peek at the launching issue!

May 26, 2011

ABC 7: Cash Discounts!

This afternoon at the nail salon I had to pay with my credit card because I was totally cash dry. The salon owner was none-too-thrilled with my form of payment…Had I offered to pay in cash I have a feeling he would have given me a discount.

This afternoon at the nail salon I had to pay with my credit card because I was totally cash dry. The salon owner was none-too-thrilled with my form of payment…Had I offered to pay in cash I have a feeling he would have given me a discount.

This week the fabulous Nine Pineda of ABC's 7 On Your Side in New York interviewed me about how we can bank on using cash in today's marketplace. It's a fact that merchants hate paying the interchange or "swipe" fee to banks each time we use our cards in stores. As a result, some shopkeepers will give you a discount for paying in cash. Not to mention – they get paid right away, as opposed to days later.

May 22, 2011

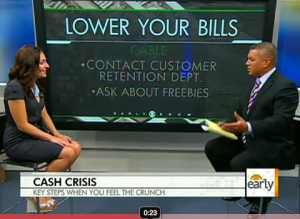

CBS: Combat the Cash Crisis

WIth rising gas and good prices Americans face a cash crisis. I joined Russ Mitchell on the CBS Early Show this weekend to offer some practical and simple solutions for finding more cash in your monthly budget. Check out the video here.

WIth rising gas and good prices Americans face a cash crisis. I joined Russ Mitchell on the CBS Early Show this weekend to offer some practical and simple solutions for finding more cash in your monthly budget. Check out the video here.

May 18, 2011

Yahoo: Maximize Groupon

Do you Groupon? Daily deal sites are all the rage these days. The massive success of Groupon and LivingSocial has inspired a wave of similar web sites all offering deep discounts on everything from fashion to travel, dining, entertainment and beauty. Even Facebook couldn't resist. The social network recently launched its own service called Deals.

Do you Groupon? Daily deal sites are all the rage these days. The massive success of Groupon and LivingSocial has inspired a wave of similar web sites all offering deep discounts on everything from fashion to travel, dining, entertainment and beauty. Even Facebook couldn't resist. The social network recently launched its own service called Deals.

But buyers need to beware. About 20% of daily deal consumers end up wasting their vouchers and never redeeming the deal. The problem is that daily deal sites encourage consumers to buy on impulse. We see the time clock ticking on the site, telling us we only have two hours left to buy a deal for 80% off teeth whitening or 50% off acupuncture, and our adrenaline starts to flow. We click the "buy" button without really thinking rationally. It happens to the best of us.

Experts say one way to maximize the daily deal market is to buy with your friends. If you work it out the right way, you'll all get a discount, or at least one of you will. Another tip: Choose offers that don't require you to go too far out of your way. Take the path of least resistance. "You want something that's right in your path going to work, right on your path going home, right on your path going to school so that you know you will use that service. If you have to go out of your way you're not going to use it," says Beth Pinsker, Editorial Director at DealNews.com.

Deals from national vendors are another safe way to go, since they allow consumers the most opportunity to redeem their vouchers. Groupon, for example, recently offered a very popular $8 deal for a large pizza at Domino's worth $20, valid at nearly all U.S. locations. And it may sound obvious, but you're best to stay away from deals that you wouldn't normally desire. Is it a "need" or a whimsical "want?" "If you pick a balloon ride two hours away and have all the great intentions in the world of going, you're not going to get there," says Pinsker.

And if you still end up with buyer's remorse, there's hope yet. Consumers can resell their unwanted deal vouchers on a number of Web sites, including Lifesta.com, DealsGoRound.com and CoupRecoup.com. "It's like an eBay or stub hub for daily deals basically," says Yael Gavish, CEO of Lifesta.com. "If you happen to buy something that you know you're not going to use, just upload it as quickly as possible. "

View the accompanying video below. This article is part of a series on Yahoo!Finance related to being Financially Fit.

May 16, 2011

CBS: Groupon Remorse

Ever bought a Groupon or other daily deal voucher and days later go, "what was I thinking?" Yeah. Those acrobat lessons don't seem like such a need, after all…even if they were 80% off. As it turns out 20% of buyers on daily deal sites end up wasting their deal vouchers. This morning on the CBS Early Show I offered some examples of good deals and bad deals, and how to make the best choice on any of these deal sites.

Ever bought a Groupon or other daily deal voucher and days later go, "what was I thinking?" Yeah. Those acrobat lessons don't seem like such a need, after all…even if they were 80% off. As it turns out 20% of buyers on daily deal sites end up wasting their deal vouchers. This morning on the CBS Early Show I offered some examples of good deals and bad deals, and how to make the best choice on any of these deal sites.

Check out the video below. If for some reason the video doesn't work, click on this link.

May 10, 2011

Yahoo: Retail Mark-Ups

As consumers, we face mark-ups on all products and services. If we didn't, businesses wouldn't be profitable. But some mark-ups are much higher than others. In our latest Financially Fit video on Yahoo!Finance we rounded up some of the highest retail mark-ups and how to pay less.

As consumers, we face mark-ups on all products and services. If we didn't, businesses wouldn't be profitable. But some mark-ups are much higher than others. In our latest Financially Fit video on Yahoo!Finance we rounded up some of the highest retail mark-ups and how to pay less.

That's me holding a pair of designer jeans…watch the video to find out their outrageous mark-ups!

May 8, 2011

CBS: Sneaky Pricing Tricks

Retailers work hard to manipulate us, tweaking price tags and offering "special" promotions to get us to spend more than we normally would. I stopped by the CBS Early Show on Saturday to go over five common tricks to avoid and how to stay in control of our spending and protect ourselves against these retailer tricks. The segment stems from a piece I wrote for CBSMoneyWatch.com on pricing psychology.