Farnoosh Torabi's Blog, page 66

March 29, 2012

Turn Your Shopping Habit Into Cash

Consignment is one way to turn your shopping addiction into some much-needed cash. Check out this week's Financially Fit video, where we follow one stay-at-home mom and showcase her consignment savvy.

Consignment is one way to turn your shopping addiction into some much-needed cash. Check out this week's Financially Fit video, where we follow one stay-at-home mom and showcase her consignment savvy.

KLG & Hoda: Gender Pricing

Did you know women pay $1 billion more for health insurance than men? And that's not all we pay extra for. From cars to mortgage to deodorant and dry cleaning, women pay more for everyday goods and services. Marie Claire's latest issue talks all about "gender pricing"

Did you know women pay $1 billion more for health insurance than men? And that's not all we pay extra for. From cars to mortgage to deodorant and dry cleaning, women pay more for everyday goods and services. Marie Claire's latest issue talks all about "gender pricing"

I joined Lea Goldman, MC features editor, along with Kathie Lee and Hoda, to discuss this strange-but-true trend.

Visit msnbc.com for breaking news, world news, and news about the economy

March 27, 2012

5 Countries Where the Dollar Goes Farther

There are a number of exciting destinations beyond our borders where the greenback is as good as gold. Check out these top 5 countries in my latest Financially Fit video on Yahoo!Finance.

March 26, 2012

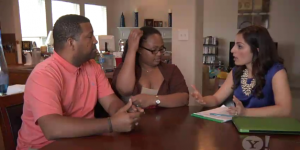

Remake America: Couples & Money

In this week's Remake America: How will Kirk respond when family finances strain his marriage? Like many couples, Kirk and LaTosha aren't just having trouble with money — they're having trouble talking about it. Join the conversation.

In this week's Remake America: How will Kirk respond when family finances strain his marriage? Like many couples, Kirk and LaTosha aren't just having trouble with money — they're having trouble talking about it. Join the conversation.

March 24, 2012

Impulse Shopping: Resist the Urge

It's hard to control our impulse to spend, especially when we're tired, sad, hungry or happy.

It's hard to control our impulse to spend, especially when we're tired, sad, hungry or happy.

A survey by Harris Interactive and the National Endowment for Financial Education says a whopping 80% of American adults admit to making impulse purchases in the past year, either for themselves or for their home. Not surprisingly, two-thirds say they later regretted the purchase.

The fact is, the pressure is on when we shop. There are numerous factors at play – from loud, fast music to the beautifully packaged products to attractive smelling fragrances in the store. All excite the dopamine (aka "happiness") levels in the brain and entice us to buy that very chic, but unnecessary leather jacket. We also tend to shop at the last minute, particularly around the holidays, which leaves us with little time to debate whether a purchase is really worth it.

Here are five tips to help you gain control during your next shopping trip.

1. Shop With a Frugal Friend

Sometimes you just need a super rational friend or relative – the one who never pays retail – to knock some sense into you when contemplating a $200 pair of shoes. The fact is, the salesperson isn't going to tell you they're not worth it. An honest friend who knows you're saving up for a home or a new car will be there to remind you that you don't "need" the shoes.

2. Don't Shop Thirsty

Age-old studies show that we tend to spend more on grocery purchases when hungry. It makes total sense. Always keep a piece of fruit or granola bar in your bag. A bottle of water won't hurt, either. A separate study out of the University of Twente in the Netherlands found that needing "to go" gave us more willpower while shopping. In fact, those who drank water – and waited 45 minutes – were better able to delay gratification.

3. Take the Back Roads

One of the best ways to avoid retail temptation is to reroute your day-to-day habits. For example, if you normally pass the shopping mall on your way home from work – and you always stop in – take a different road that has fewer temptations. Or, if the fancy coffee shop where you fall prey to their $5 moccachinos, is next to your office, try a different entrance tomorrow.

4. Take a Breather

Adrenaline often kicks in while shopping. We see the cashmere sweater we've had our eye on for months finally go on sale and the sales lady says it's a final sale. What to do? My advice: step away from the sweater…at least for 10 minutes. Leave it at the register, where you can usually place items for up to 24 hours, and take a lap around the mall or anywhere you will not be tempted to make a pressured decision. Think about the trade-offs of buying this sweater. What might you need to give up to buy it? Do you really need it? Allow yourself some time to think things through in a calmer atmosphere. Chances are you may decide you don't need or want it after all.

5. Shop With Cash

If you're on a budget and need some help curbing frivolous buys, leave your credit cards at home. Cash physically limits our ability to overspend. Psychologically it also hurts more to part with cash than credit because we are forced to examine how we're spending the money….and whether it's really worth it.

March 22, 2012

Wedding Costs: Asking Family For Help

[image error]

When it comes to weddings, who writes the check? Is it solely up to the bride and groom to pay, or are family members expected to pitch in? And how do you ask your family for financial assistance? In this week's Financially Fit, I break down the Do's and Don'ts.

March 21, 2012

Best Ways to Avoid ATM Fees

[image error]To avoid trips to the ATM – and incurring fees – I used to just pay directly with my debit/ATM card in stores and restaurants. But now, some banks – including mine – are charging a fee for that. So, how else to avoid those pesky ATM fees that seem to be getting more and more expensive? ATM fees, in fact, reached record highs in 2011 for the seventh year in a row, according to Bankrate.com. The average fee banks charge non-customers to use their ATM (aka "out-of-network fees") jumped 3% to $2.40 this year. Add to that the ATM's own $2 surcharge, and you're looking at a more than $4 fee just for withdrawing money from your own bank account.

As someone who doesn't believe in spending money to access my money, here are some ways to minimize your ATM fees.

Stick to Your Bank's ATM

It's sometimes easier said than done, I know. But if you have a smart phone you can more than likely download your bank's free mobile application, which can guide you to its closest ATMs no matter where you are.

Locate Surcharge-Free ATMs

The My Mobile Allpoint App is free to download and can locate surcharge-free ATMs close to where you are. Your bank may still charge you an out-of-network ATM fee, but if you're not near your bank's ATM, this is your next best bet.

Sign Up For Fee-Free Checking Accounts

While scarcer, fee-free checking accounts do still exist. You can start your search by checking out online banks such as Ally, USAA and ING Direct, which charge no ATM fees (or offer a capped number of free withdrawals per month). Credit unions and local, community banks tend to have better fee terms, as well.

Opt For "Cash Back"

Retailers like Whole Foods, Walgreens, CVS and Trader Joe's are known to offer shoppers a free cash-back service any time they pay with their debit or ATM card. Just make sure your bank isn't going to charge you a fee for using your debit card in the first place. And keep in mind that cash back withdrawals are usually capped at $40 or $60, much less than traditional ATMs.

Photo courtesy: Redspotted's photostream on Flickr

March 20, 2012

The Revolution: Feed Your Family For Less

[image error]My debut guest appearance on ABC's The Revolution was such a blast! Our focus was how to reduce waste and save money. Here's my clip with health and fitness guru and co-host Harley Pasternak discussing how to eat healthy on a budget. Check out the clip!

[image error]

What's Your Tax Personality?

Are you an early filer? A procrastinator? Envelope pusher? A year ago I explored our various tax personalities for The Daily Beast and thought it was worth a repost. (There are 7 to be, exact).

Are you an early filer? A procrastinator? Envelope pusher? A year ago I explored our various tax personalities for The Daily Beast and thought it was worth a repost. (There are 7 to be, exact).

Here's a snippet…For the rest, check out TheDailyBeast.com

From anxiety to confusion to downright hysteria, tax season is fraught with emotion. "Taxes make us feel sick to our stomach," says Tim Pychyl, professor of psychology at Carleton University in Ottawa. "It requires us to pull together a bunch of things… and most of us don't even understand the tax system," he says. True that.

The fact is some of us are better at handling stress than others and our tax strategies (or lack thereof) reflect our personalities. If you've yet to file–and you know who you are–there are probably deeper reasons behind your last-minute approach besides the argument that you just ran out of time. Similarly, if you filed in February (and we hate you) your diligence speaks volumes about your overall responsible nature.

What does our tax-filing behavior say about us? With the April deadline looming, I tapped a few experts to weigh in on what our 1040 tendencies suggest about our overall temperaments. In all, I discovered seven tax personalities. Which one are you?

1. The Conscientious Early Bird (Who's Also a Bit Scared). You love getting that worm. And if you're also expecting a refund, that's motivation enough. But why you file as soon as possible may not just be for efficiency; there are underlying emotional reasons why you feel compelled to file early, as well. You're a "defensive pessimist," says Pychyl. "You have a fear of failure and work proactively to get your taxes done." The same goes for other deadline-driven aspects of your life. You finish work presentations weeks in advance and buy Christmas gifts in July. For you, fear is a motivator. Imagining the worst-case scenario–like failing to file and facing the wrath of Uncle Sam–pushes you do everything in your power to make sure that scenario doesn't happen. Bottom line, says Pychyl: You're extremely conscientious and have high emotional intelligence. (Whatever.)

[Photo courtesy of 401k's Photostream on Flickr]

March 19, 2012

Remake America: Walking Away

[image error]It's an absolute heart-breaking and stressful decision, but one with which millions of Americans are grappling: Should I walk away from home and mortgage? In this week's episode of Remake America I offer some advice that some may consider controversial.