Farnoosh Torabi's Blog, page 58

October 18, 2012

5 Alternative Investments Fit For Life

If you’re fortunate enough to find yourself with a leftover discretionary fund, you may be stumped on how best to spend it. Stocks? Bonds? Mutual funds? While there are benefits to investing in the stock market, let’s not overlook some other smart, alternative investments that are sure to offer sound returns in life.

Financial Freedom

Investing in your financial freedom – by paying off debt and building personal savings — guarantees a better night’s sleep (not to mention, financial security). Experts agree that paying off debt is one of the smartest investments you can make because once you’re free of financial obligations, you can more easily grow wealth. If you find yourself with a windfall like an inheritance, raise, or bonus — or even if you choose to work a second job for this exact purpose — it makes financial sense to prioritize debt first, then put any extra toward retirement.

Self-Development

While there’s an ongoing debate about the “value” of a college degree, one thing’s for sure – the more talented, educated and skilled you are, the higher your chances of employment and better pay. Now, for those of us already out of college, this doesn’t mean going back for a Masters or PhD, sometimes just learning a second language (hello, Rosetta Stone!) or taking an evening course can enrich our careers and life. In fact, experts say this is one way the rich in this country stay rich. They invest in self-development. It’s a fabulous long-term investment financially and also emotionally.

Travel

While having oodles of money doesn’t necessarily equate to happiness, one type of spending has been proven to lead to bigger smiles. Thomas DeLeire, an associate professor of public affairs, population, health and economics at the University of Wisconsin in Madison, examined nine major categories of consumption and found leisure spending was the only one linked to happiness.

DeLeire’s research shows that a $10,000 increase in spending on leisure goods is associated with a 0.17-point increase in life satisfaction. A $20,000 increase in leisure spending is “roughly equal to the happiness boost one gets from being married,” the report says.

Agriculture

According to Sir Gordon Conway, author of the book, One Billion Hungry, we can expect food prices across the globe to rise steadily for the next 20 years, maybe even by 20%. Try buying shares in a local farm like a CSA (many bloggers have reported saving more than 50% on produce alone), or, start raising more of your own food by planting a backyard vegetable garden. According to MotherEarth News, you can grow $700 worth of food annually in a mere 10×10 patch of yard, an impressive return on a few dollars worth of seeds. Don’t have the time or space to tend to a garden? Planting as few as three strategically placed trees in your yard can reduce your heating and cooling expenses by up to 20% according to the EPA, and can even increase your home’s value. Planting things in the ground may seem like a rather soft investment — but you never know what will grow if your green thumb is nurtured!

Health & Fitness

To ensure a healthy financial future, the single smartest investment you can make is to maintain your physical health. If you don’t, none of your other investments will matter (because you won’t be around to enjoy them). It’s not just about saving money on future healthcare costs: most people generate their lifetime’s wealth, including their retirement funds, predominantly through labor, not investments. And in order to work, you need to be healthy. According to the Center for Bioethics and Human Dignity, of the 10 most common causes of death, including heart disease and cancer, half are related to lifestyle choices. That means for every penny you spend keeping your weight down, quitting smoking, staying fit and reducing stress — even if some of these activities are costly (physical therapy, nutrition classes, or even stress-relieving massage) — they could still pay dividends when they help prolong your life and reduce what you’ll have to spend on hospitalization, medications, doctor’s visits, medical equipment and other health-related expenses in the future.

For example, if you weigh the relatively inexpensive cost of regular check-ups and screenings (my co-pay is around $55 per visit) against the enormous expense of major care such as cancer treatment or long-term home healthcare (researchers from Duke University Medical Center examined the cancer spending of 216 patients with breast cancer, who did have insurance, and found the average out-of-pocket costs averaged $712 a month, most of it going to prescription drugs) you’ll see that the math speaks for itself.

Even insurance companies are recognizing the cost-benefits of preventative health measures; many are offering discounts on wellness services so check with your insurance provider to find out what’s covered under your plan. What’s more, investing in your health doesn’t necessarily have to be expensive: some of the healthiest foods happen to cost the least — often less than a $1 a pound – and you can skip the expensive health club, too (walking, jogging and neighborhood meet-ups can take the place of a pricey gym membership).

It’s all about a mindset: putting your savings, safety and health above competing priorities — and viewing them as legitimate investments in your financial well-being.

Photo courtesy of Flicker/ USFS Region 5.

October 17, 2012

Save More Through Peer Pressure

Having inadequate savings is a big concern for many Americans. In fact, nearly 20% will cite not saving enough as their biggest financial regret. There are endless reasons why we fail to save, but a new study suggests an unconventional strategy to succeed in setting a little something aside: save with friends.

Researchers from the National Bureau of Economic Research recently issued a working paper titled, “Under-Savers Anonymous: Evidence on Self-Help Groups and Peer Pressure as a Savings Commitment Device.” In it they examine saving practices through a series of experiments involving 2,687 low-income micro-entrepreneurs in Chile.

The entrepreneurs were divided into three groups; one with high-interest savings accounts of 5%, another with accounts that yielded 0.3% and a treatment group that would save and announce their progress regularly within the group. The most successful group? “Participants assigned to the Peer Group Treatment deposited 3.5 times more often into the savings account,” the paper reported. In addition, their average savings balance was nearly twice that of those with accounts with minimal yield, the same for those with higher yields. Why? As shown in other studies, regular accountability and follow-up played an important role in sticking to good habits. If you want to see this effect in your own financial life, there are steps you can take.

Join the Club

Before the days of big banks, savings clubs were a popular means of building a nest egg. Called susu, tontine, or stokvel in different cultures and periods, people have been successful at pooling money historically. Establishing a savings club among a small group of trusted friends can be productive, especially if the savings is attached to a goal like a group trip. Get your family in on it. Goals like saving for a young relative’s education is something everyone can get behind and contribute to through the establishment of a fund, for example. Following the National Bureau of Economic Research’s model, the club would work best with regular meetings among members, goals and transparency to hold everyone accountable.

Go Digital

Online programs stickK, 43 Things, Lifetick, and Mint all have features that encourage individual accountability if groups aren’t your thing. With stickK, for example, you can take your saving social by listing your goals, then assigning a team member to track your progress. StickK gives you the option to share your progress through Facebook and Twitter where your team members can cheer you on. It also allows you to kick it up a notch with penalties. Let’s say you plan to save 10% of your monthly earnings. Once team members and deadlines are set, you can assign a referee to monitor your progress. Finally, connect the commitment to your bank account and every time you miss a goal, there’s a payday for your team. How’s that for incentive?

Photo Courtesy, 401(K) 2012.

October 16, 2012

Easy Ways to Lower Your Internet Bill

Being without Internet access can be more than a little inconvenient. It can mean a harder time staying up on the news, doing research for work and school and, of course, applying for jobs. If you’re paying through the nose for Internet, or avoiding it altogether because of the cost, here are some basic strategies to get broadband for less — maybe even for free. Read more here.

What are some ways you’ve lowered your Internet bill? Connect with me Twitter @Farnoosh, using the hashtag #FinFit.

Quick Fixes For Tech Disasters

Murphy’s law, that anything that can go wrong will go wrong, is especially potent in my relationship with technology. It would seem that at the very moment I need my laptop, cell phone and email accounts to work in harmony – when a deadline depends on it – everything goes kaput. I’ve had my oft-used email account mysteriously become suspended, misplaced my laptop’s power chord and broken several cell phones.

Murphy’s law, that anything that can go wrong will go wrong, is especially potent in my relationship with technology. It would seem that at the very moment I need my laptop, cell phone and email accounts to work in harmony – when a deadline depends on it – everything goes kaput. I’ve had my oft-used email account mysteriously become suspended, misplaced my laptop’s power chord and broken several cell phones.

Been there? Nowadays we do everything digitally, especially work. As convenient as it all is, what happens in the event that one of your devices malfunctions or is otherwise unusable? It could mean catastrophe, if not just a delay in your work day.

Personally, I was able to survive these tech challenges with a little quick thinking and these tools.

Get on the Cloud

Google, Apple, and Dropbox all have “cloud” services that, in essence, save your documents and other files remotely. Let’s say, for example, you’re working on a presentation when suddenly your laptop dies (or like me you lose the charger on vacation,) with cloud computing, you have access to your files on all of you devices no matter what.. It’s also great for anyone that works on multiple computers to prevent duplicating and subsequently misplacing files. Best yet: Dropbox offers up to 2gb for free, while Google and Apple both offer 5gb at no cost.

Get a Handheld Backup

In the event that your computer is inoperable, you’ll probably still need to work, but let’s say you don’t have access to a second computer. If you’re one of many Americans with a smartphone and/or tablet, then you’re in luck. Apps like Evernote or Google Drive are great for word processing – and free. Drive also has tools for spreadsheet, presentation and form creation that will allow you to create and edit documents from your handheld device.

Sync the Essentials

A few years ago, the unthinkable happened. I was carefully curating labels for my email when the whole system crashed. If you’re like me and use the same product for your contacts, email and calendar, then you understand my horror. Within seconds, I’d gone from well-organized — with my next two weeks plotted out in front of me — to helpless. You could go the old-fashioned route and carry a physical organizer or take the time now to sync your schedule, calendar and email. Most cell phones give you the option to auto sync. That means whenever you add an event or friend to your phone, it goes straight to you computer – and vice versa. So should you lose your phone, you don’t have to say goodbye to your contacts. And if your email server and calendar go on the fritz, you can still operate without missing a beat.

Connect Without Wi-Fi

It can be hard to find internet access in a pinch if you’re somewhere remote, or simply away from home. But did you know that as long as your phone still has a signal, you can attach it to your laptop and use it as a hotstop? It’s called “tethering” and sounds like you’d have to be a technician to pull it off but new apps like FoxFi for Android and Tether for iPhone make it as simple as installing Angry Birds. In my own experience of filing a story on the road, a tethered connection is a bit slower than my broadband at home, but nonetheless a lifesaver in the eleventh hour.

October 15, 2012

3 Ways to Save on Your Heating Bill

The cold-weather season’s finally upon us, which means it’s time to reassess our utility expenses.

The cold-weather season’s finally upon us, which means it’s time to reassess our utility expenses.

The U.S. Energy Information Administration released a short-term outlook last Wednesday on the expected price of fuel this winter. It shows the cost of heating your home is going to increase across the board. The EIA projects households will pay 19% more for heating oil and 15% more for natural gas than last winter. Expenditures for electricity and propane will also be 5% and 13% higher, respectively.

Heating your home could be expensive this year but with careful planning and a few small investments, you can cut costs. The Department of Energy has tips to help you stay warm this winter and protect your pursestrings.

Perform an Energy Check-Up

It may be worthwhile to invest in an energy audit that can help identify potential energy waste. It’ll uncover simple fixes, like replacing ventilation filters, that will improve your home’s performance. They can potentially cost a few hundred dollars, but can save you 15-30% on your heating bill, according to New York utility company Con Edison. Some utility companies do offer free or discounted audits to certain customers, so call your service provider first. Otherwise, you can seek from quotes from third-party auditors. The Residential Energy Services Network provides a directory of certified energy auditors in your area.

Seal the Cracks

Or, consider performing a DIY audit, by first inspecting leaks and cracks around windows. A $5 tube of caulk can go a long way in sealing off a whistling pane. Well-sealed heating and cooling ducts can improve your home’s efficiency by 20%, according to the Department of Energy. The agency has DIY instructions on where and how to seal air ducts. “Use duct sealant (mastic) or metal-backed (foil) tape to seal the seams and connections of ducts. After sealing the ducts in those spaces, wrap them in insulation to keep them from getting hot in the summer or cold in the winter,” the instructions say. You can also use “sweeps,” sealing strips for the bottoms of your doors, to block a draft from creeping in.

Invest In Efficiency

Lastly, the DOE suggests if your HVAC system is more than 10 years old that you replace it with a new ENERGY STAR system, which can save you up to $200 annually, according to the agency’s estimates. But before heading out to the nearest hardware store, DOE has a check-list to determine whether you should, in fact, purchase a new water heater of furnace. The least expensive investment you can make: A programmable thermostat. Set it to lower the temperature just after you leave for work and return just before you get home. A device around $50 can save you $180 every year in energy costs.

Photo Courtesy, BryanAlexander.

October 12, 2012

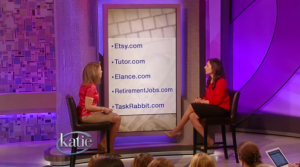

Katie: Make Easy Money Online

Yesterday, I stopped by the Katie show to offer viewers a few strategies for making extra money – many you can do from the comfort of your home. Check out the clip and share with us an cool side gigs you’re working on.

Yesterday, I stopped by the Katie show to offer viewers a few strategies for making extra money – many you can do from the comfort of your home. Check out the clip and share with us an cool side gigs you’re working on.

Today Show: Outlet Shopping Savvy

Our outlet coverage for Yahoo Finance caught the attention of Today Show producers, so I stopped by this morning to reveal the secrets to outlet shopping.

Our outlet coverage for Yahoo Finance caught the attention of Today Show producers, so I stopped by this morning to reveal the secrets to outlet shopping.

Visit NBCNews.com for breaking news, world news, and news about the economy

#AskFarnoosh: Buying a Car. Help!

[image error]This week, I tackled a question from Rich, a Facebook fan, regarding how to buy a car. He asks:

When is the best time to buy a new car, Farnoosh? Used & new? I just can’t seem to get the right advice!

Also, what are the pros and cons of getting your own financing first, i.e. credit union, bank-or going through the dealerships and the car companies?

Dear Rich,

Truth be told, I’ve only purchased a car once in my life: a 2006 pre-pre-owned sports car from my brother (a gift to myself after finishing book #2). I paid the Blue Book value and did so in cash. The plan is to keep it for a long time…or at least until it’s time to make room for car seats. That said, in all my ten years of reporting on personal finance and interviewing industry experts, I have picked up a thing or two. I also – just for you and everyone else curious about this topic – tapped Ron Montoya, consumer advice editor for Edmunds.com for additional insight.

First, with regards to timing, I’ve heard – and reported – on everything from “best to buy during Labor Day weekend” to “wait until the end of year” when dealerships have to clear inventory for new year models to “buy at the end of the month – any month,” with the thought that dealers will need to meet their month-end sales quota and be more open to negotiating. And while these statements have been proven true in some instances, every dealership is different so it’s difficult to speak in absolutes. It really just depends. (sorry, lame answer, I know. But it’s the truth.)

Ron has some additional advice regarding timing. While he doesn’t believe in tips like “best to buy on a rainy day,” for new cars, he does think it’s best to wait to buy until a few months after a model’s been released. “This allows the inventory to build up. Having waited, the selection may not be everything, but you’ll get a deal,” he says. ”The downside, though, is if the maker is planning to redesign the next model, the resale value of your recent purchase will drop tremendously. It won’t matter, however, if you’re planning on keeping your vehicle for the long haul.” As for used cars? “There’s never really a good or bad time to buy a used car,” he says. “It’s a matter of where you look, so shop around. To get the best deal, buy through a private party, an owner selling on their own – of course to do so you’ll need cash or to secure financing through you bank.”

Which brings us to the second part of your question – how to best finance a car? Ultimately you want to obtain the loan with the most competitive interest rate, which tends to be offered by auto companies. You can find deals for as low as 1%, says Montoya, but you’ll need stellar credit to qualify. [According to myFico that means a credit score of about 720 for a 48-month new or used auto loan] “To secure it, you could also lose incentives like a lower sticker price,” he adds.

But, do still consider banks when shopping for a car. It’s smart to come to the dealership with a pre-approved loan offer in hand from a local bank or credit union. It’ll give you a sense of what you can afford – and also some real negotiating power with the dealer’s bank when you’re ready to close.

Happy driving!

Photo courtesy: DHilowitz on Flickr

October 11, 2012

5 Secrets to Outlet Shopping

Outlet malls create an adrenaline rush. You’ve got all your favorite stores in one place at big discounts. But don’t be fooled! This $25 billion-a-year industry is masterful at getting you to part with your money. Here are five secrets to outlet shopping, all to help you be a smarter shopper once you get there. Read more here.

And, as always, we want to hear from you. What’s the best outlet deal you ever purchased? Connect with me on Twitter @Farnoosh and use the hashtag #finfit

October 10, 2012

When Going Green Costs You

[image error]

All costs being equal, my guess is most people today would choose an environmentally-friendly option over its counterpart. However, when “green” products carry a higher price tag, the choice isn’t always so obvious.

Perhaps you’ve already made some budget-friendly — and environmentally-friendly – swaps around your household (dish rags instead of sponges, a Nalgene instead of disposable water bottles and re-useable grocery bags instead of plastic) and for those eco-responsible upgrades, Mother Earth thanks you.

However, as reported by EatingWell Magazine, when researchers tested each of these common “green” improvements they found some surprising results. In the case of re-useable grocery bags, for example, they,”had more ecoli than underwear” claims a microbiologist at the University of Arizona in Tucson — most of it coming from meat juices soaking into the fabric of the bags and festering there. Seventy-five percent of re-useable dishrags were found to be infected with coliform bacteria, claims the health org NSF International, and if your water bottle has a spout, be aware your hands often corrupt it with germs when you go to pull it open (the solution? Sanitize cloth grocery bags and dishrags by washing them often in hot water with bleach, and always make sure to wash water bottle caps thoroughly). And those are just some of the costs to your health.

Watch Hybrid Price Hikes

The price of maintaining, repairing and even acquiring insurance for green products is consistently higher than for regular items. For example, insurance rates for hybrid cars are expected to rise now that there are more on the road (and therefor more hybrid accidents). And while you might pay less in gas with these vehicles, some hybrid-owners aren’t factoring in a higher electricity bill at home when they plug in their car (based on national averages on electricity costs, if you drive your EV 50 miles every day, you can expect your electricity bill to increase by half), nor are they considering whether that electricity comes from a coal or oil burning plant that also pollutes the air.

Beware Solar Price Flares

Take solar panels: though you’ll start selling power back to the grid almost immediately (typical installation costs about $24,000 offset by subsidies and leasing in some states; most users claim the system pays for itself in less than a decade) there are incidentals you may not be expecting to pay, further delaying the break-even point. For example, MSN Real Estate reported that off-the-griders in Woodstock, NY were being hit with a service charge by their utility company for staying connected to the grid, a charge of roughly $240 annually.

Saving with Green Improvements

What eco-friendly changes around the home do consistently save families money? Strategies like adopting a vegetarian diet at least a few times a week (food’s cheaper when you lessen your meat intake); walking, bicycling or taking public transit to work instead of driving; and avoiding buying “new” all the time (cars, computers, furniture, baby gear, etc), can have a considerable impact on your budget AND on the environment.

For example, buying used helps in three ways: it keeps perfectly good stuff out of landfills, you save a ton of money (experts suggest a savings of 20-70% from cars to clothes) and you also lessen the need for the mass-manufacturing of new stuff, thus conserving natural resources. If shopping at flea markets isn’t your style, why not start with a simpler change? According to the Environmental Protection Agency website, just by switching light bulbs from incandescent to Energy Star-rated CFL bulbs you can lower your electricity bill immediately, offsetting the cost of the slightly higher-priced bulb in just six months.

Environmental improvements needn’t be difficult or expensive, but understanding and calculating their full cost and — even health impact — can save you in the long run.

Photo Courtesy of Imagination Box Co.