Farnoosh Torabi's Blog, page 41

April 4, 2013

Grow $70 into $600 Worth of Food

More Americans than ever are growing their own food gardens, a trend re-popularized in 2009 when the First Lady first got her hands dirty growing tomatoes, rhubarb, broccoli, and lettuce on the White house lawn (subsequently garden-growing in the US jumped 6% that year).

Or, perhaps gardens are re-appearing because Americans are simply looking for new ways to save on basics like groceries. No matter what the reason, cultivating your own food is proving financially fruitful: the nonprofit National Gardening Association found that the average family with a garden spends $70 a year growing an estimated $600 worth of vegetables: not a bad return on your investment!

If you’re thinking about starting a garden of your own, here are the questions you’re probably already asking yourself, along with some budding insight that might encourage you to grow a green thumb this Spring.

Will It Be Hard?

If you’re having nightmares about start-up landscaping costs, back-breaking watering and weeding sessions, and weekly fertilizing, I’ve got some really great news for you: You might not have to do much at all.

My garden, if you could call it that, was planted and tended to last year with zero experience, absolutely no planning, and even less maintenance after exactly one inspired day of poking seeds into the ground (after barely removing the grass). I assure you that even this ill-advised, completely abandoned plot, by the end of the summer, yielded several salads complete with lettuces, cabbage and chives, a heaping basketful of baby carrots, and a sprinkle of cilantro and coriander seeds, no thanks to any help from me. For something that only cost a couple hours and a few bucks in seeds one Saturday (and a smattering of watering after that; the rain did most of the work), I completely shocked myself with how resilient a little garden like this can be.

But don’t take gardening advice from me. Even pro gardeners will tell you that most of the “effort” of gardening can be eliminated with a bit of planning and the implementation of a few key elements like a soak hose and mulch. (Tune in next week for a list of uber-easy gardening hacks that make the act of gardening a spring breeze.)

What Will it Produce?

A well-maintained food garden can yield an estimated ½ pound of fresh produce per square foot of garden area. And at in-season market prices, that produce is worth $2.00 per pound. In fact, George Ball, chairman and CEO of seed giant Burpee, says seeds like green beans will generate $75 worth of crops for each $1 you spend, and even potatoes will generate $5 of spuds for a $1 in seeds. Still not convinced? One of the simplest vegetables to grow is lettuce — it will grow just about anywhere grass grows, experts say. All you need is about four square feet per person and it will continually renew and feed you salads for six weeks straight!

What Will it Cost Me?

Of course, those kinds of returns do take some upfront capital. Perhaps you need tools to till the soil, or maybe you live in a place with clay dirt and therefore require raised beds. If you live in the country, you might need a bit of fencing around your plot to keep wildlife out. According to experts, at the very least, a basic, 8-by-4-foot raised bed filled with compost and soil will run you about $80, and a few starter plants like tomatoes and peppers will cost another $15 or $20, putting your total start-up costs around $100. But even subtracted from a $600 yield, you’ve still got an extra $500 in your pocket.

A word of warning, however: don’t let too many preparations get in the way of production. In his book, “The $64 Tomato”, William Alexander tells the story of his quest for the perfect garden and how his tools, equipment, fertilizers, pesticides, and water quickly added up until he estimated he’d spent roughly $64 growing each tomato. If you’re just starting out, take a tip from me — no raised beds, no fertilizers, and no fancy tilling. You’d be good just to stick to a watering routine, and see what happens! Gardening takes practice, a bit of instinct — and, it turns out, just a little land and time to turn about $70-100 into garden gold.

Tune in next week with specific tips on how plan, plant and maintain a productive urban food garden.

Photo Courtesy of: http://commons.wikimedia.org/wiki/Fil...

April 3, 2013

Auto Repair Savings Tips

A new study reveals that many Americans don’t trust auto mechanics. Even more think they’ve been ripped off by one, but getting your car serviced doesn’t have to feel like highway robbery.

A new study reveals that many Americans don’t trust auto mechanics. Even more think they’ve been ripped off by one, but getting your car serviced doesn’t have to feel like highway robbery.

April is recognized as National Car Care Month – a time to invest in your vehicle, keeping it “safe, dependable and on the road longer.” Unfortunately, most of us delay much-needed auto repairs. According to a study by RepairPal, three in four consumers have put off an auto repair for some reason and 11% admit to delaying maintenance, even when their cars’s check engine light comes on. Sound familiar? Well, it turns out that many consumers avoid auto shops because they don’t trust mechanics. Sixty-six percent think they have been ripped off by an auto repair shop and 43% report that just the thought of “being taken advantage of” makes them anxious about taking their car in for a repair.

Estimate It

One of the best things a consumer can do to get a fair repair quote, and ease their mind, is research the cost of common fixes to their vehicle and go in armed with an estimate. Luckily, in the information, that’s easier than ever. Both AutoMD and RepairPal have tools to estimate repair cost with just a few clicks. Consumers can get estimates on over 135 types of repairs for almost every car – based on shops in your area. The RepairPal Price Estimator is also available as a mobile app so you can double check repair estimates right there in the shop. “Getting your car repaired is a little like going to the doctor,” says RepairPal.com CEO Art Shaw. ” You are relying on an expert to provide honest insight based on experience and specialized training that you don’t have…Our mission is to transform this industry by empowering consumers with the tools and information they need and connecting them with the best repair shops that guarantee quality work and fair prices.”

Get it Itemized

Another way to avoid being overcharged for repairs is to know exactly what you’re buying. Estimates should include an itemized list of parts, labor and a summary of the total cost. Before paying, make sure the bill isn’t inflated with questionable charges. Investigate anything categorized as “miscellaneous” to confirm it’s necessary. Often, this is where you’ll have the most wiggle room for negotiation.

Negotiate

Remember: the cost of an auto repair is negotiable like anything else. A great place to start is with “OEM,” or original equipment manufacturer, parts. These are usually more expensive because they’re specifically made with your car in mind. Think of it like a name brand cereal and, like cereal there is a generic alternative for less. “Aftermarket parts” aren’t made by your car’s manufacturer, work in various vehicles and will usually be less expensive. Another option: used or rebuilt parts. Finally, just like with medical care, you want to get a second opinion. Shop around for repair and maintenance quotes instead of settling with the first price you get. There’s no better leverage than a quote from a competitor to negotiate a lower bill with your mechanic.

Photo Courtesy, Marshall Astor.

April 2, 2013

Don’t Get Overcharged For Auto Repairs

A new study reveals that many Americans don’t trust auto mechanics. Even more think they’ve been ripped off by one, but getting your car serviced doesn’t have to feel like highway robbery.

A new study reveals that many Americans don’t trust auto mechanics. Even more think they’ve been ripped off by one, but getting your car serviced doesn’t have to feel like highway robbery.

April is recognized as National Car Care Month – a time to invest in your vehicle, keeping it “safe, dependable and on the road longer.” Unfortunately, most of us delay much-needed auto repairs. According to a study by RepairPal, three in four consumers have put off an auto repair for some reason and 11% admit to delaying maintenance, even when their cars’s check engine light comes on. Sound familiar? Well, it turns out that many consumers avoid auto shops because they don’t trust mechanics. Sixty-six percent think they have been ripped off by an auto repair shop and 43% report that just the thought of “being taken advantage of” makes them anxious about taking their car in for a repair.

Go In With An Estimate

One of the best things a consumer can do to get a fair repair quote, and ease their mind, is research the cost of common fixes to their vehicle and go in armed with an estimate. Luckily, in the information, that’s easier than ever. Both AutoMD and RepairPal have tools to estimate repair cost with just a few clicks. Consumers can get estimates on over 135 types of repairs for almost every car – based on shops in your area. The RepairPal Price Estimator is also available as a mobile app so you can double check repair estimates right there in the shop. “Getting your car repaired is a little like going to the doctor,” says RepairPal.com CEO Art Shaw. ” You are relying on an expert to provide honest insight based on experience and specialized training that you don’t have…Our mission is to transform this industry by empowering consumers with the tools and information they need and connecting them with the best repair shops that guarantee quality work and fair prices.”

Know What You’re Paying For

Another way to avoid being overcharged for repairs is to know exactly what you’re buying. Estimates should include an itemized list of parts, labor and a summary of the total cost. Before paying, make sure the bill isn’t inflated with questionable charges. Investigate anything categorized as “miscellaneous” to confirm it’s necessary. Often, this is where you’ll have the most wiggle room for negotiation.

Negotiate a Price

Remember: the cost of an auto repair is negotiable like anything else. A great place to start is with ”OEM,” or original equipment manufacturer, parts. These are usually more expensive because they’re specifically made with your car in mind. Think of it like a name brand cereal and, like cereal there is a generic alternative for less. “Aftermarket parts” aren’t made by your car’s manufacturer, work in various vehicles and will usually be less expensive. Another option: used or rebuilt parts. Finally, just like with medical care, you want to get a second opinion. Shop around for repair and maintenance quotes instead of settling with the first price you get. There’s no better leverage than a quote from a competitor to negotiate a lower bill with your mechanic.

Photo Courtesy, Marshall Astor.

Best Days, Months and Hours to Travel

The best selling book “Buy Ketchup in May and Fly at Noon” and its sequel “Buy Shoes on Wednesday and Tweet at 4:00” are chock full of tips highlighting the best times to book a trip, fly an airplane and even get dinner reservations. Check out these highlights.

What are some of your favorite money-saving travel tips? Connect with me on Twitter @Farnooshand use the hashtag #finfit.

April 1, 2013

Top Tax Scams

Just in time for the tax filing deadline, the Internal Revenue Service has released its 2013 “Dirty Dozen” tax scams, ranging from identity theft to online phishing schemes.

Here are three of the most common identified threats and how to protect yourself:

Identity Theft

Identity theft is number one on the IRS’ list of tax frauds this year. It’s a topic that we’ve covered before with 2012 proving a banner year for ID theft. Armed with your personal information, ID thieves can fraudulently file a tax return and claim your refund, as we saw in the case of Jessica Asford. “I called the IRS one afternoon to check the status of my tax refund and they essentially told me that they mailed my refund to someone in California,” she said. “Considering I live in New York, that raised a red flag.”

To combat increased cases of ID theft, the IRS has created a special section of its site to identify issues. If you believe you’re at risk for ID theft tax fraud -maybe you’ve lost identification or have had some suspicious financial activity recently – you can call the IRS Identity Protection Specialized Unit at 800-908-4490. More information can be found on the special identity protection page.

Phishing

Ever get an email from an address you don’t recognize, asking for personal financial information? Well, that could have been a phishing attempt. It’s typically carried out via email and with messages that look legit. Say, for example, you get an email from what seems to be your bank or financial institution. These emails will direct you to a phony site and prompt you to provide valuable information: passwords, Social Security number, date of birth, etc. With that, scammers have all they need to break into your accounts. Around tax season, these phishing attempts coud come in the form of fake messages from the IRS, your bank or popular tax preparers.

You should know the IRS, and most financial institutions, do not initiate contact via email to request personal information. Whatever you do, don’t respond to a message if you’re unsure whether it is legit. If you receive a message on behalf of the IRS that you suspect is a phishing attempt, report it by forwarding it to phishing@irs.gov.

Return Preparer Fraud

Finally, more than half of taxpayers will use tax professionals this year to prepare their returns. Unfortunately some are fraudsters masked as trustworthy tax pros. Some have been caught stealing personal information or inflating returns with fraudulent information. When hiring a professional, seek references from friends and family and verify that the preparer has their IRS Preparer Tax Identification Numbers (PTIN.) That number means they’re authorized to provide the service and they should use it to sign the returns they prepare. Also, watch out for preparers who charge you a percentage of your refund, as most professionals charge a standard fee. To help you find a preparer, the IRS has a guide with tips, a list of red flags and information on how to file a complaint if you run into trouble.

For the full list of the top 2013 tax scams, check out the IRS’ site.

Photo Courtesy, 401(K) 2013.

Tips for Tax Filing Procrastinators

[image error]For many of us April 14th will be a hellish day, as we scramble to complete our taxes before the deadline – and men will procrastinate more than women, incidentally, according to this survey. With the clock ticking, it’s easy to make costly mistakes so here are some last-minute tips.

Don’t Forget Overlooked Tax Breaks

Charitable Deductions. This not only includes the check you wrote to, say, the Red Cross for Hurricane Sandy relief, it’s also the ingredients you used to cook up meals to take to the shelters, the mileage you racked up driving from your home to a non-profit or charity. You can deduct 14 cents per mile plus parking and tolls paid.

Student Loan Interest. For student loan borrowers – this is somewhat of a break. You can deduct up to $2500 of student loan interest. And get this – even if mom and dad are helping you pay off the loan, as long as the student’s name is on the loan (not Mom or Dad’s) the student can claim the deduction. The student must not be a dependent.

Job Search Costs. Even if your job search was unsuccessful in 2012, you are still entitled to deduct some of the related costs from mileage to travel and lodging (if you had to travel far to the interview), staffing agency fees, cost of printing business cards, etc.

Beware of Audit Red Flags

While less than 1% of those earning $200,000 or less gets audited every year, you want to do everything possible to avoid more communication than necessary with the IRS. Some major red flags include:

Underreported Income: The IRS has its eyes on your earnings. Its computers keep track all of our 1099 and W-2 forms.

Massive Charitable Deductions: claiming to give more than what most give in your tax bracket can be a red flag to the IRS, as it compares your donations to national statistics. For example, the average charitable contribution for those earning between $50 and $100,000 a year is a little more than $2,600.

Home Office Deduction: A qualified home office deduction must be a portion of your home that is used exclusively and regularly for your business. The office needs to be in a separate room or if it’s in a section of a room, the division needs to be clear.

Consider Professional Help

If you have really complicated taxes, you’re a business owner, you bought and sold lots of property, lots of stocks in 2012, then I think working with a tax preparer or accountant could be a smart investment – and it’s relatively affordable. (Of course this late in the game they may charge you a premium.) But according to a new survey by the National Society of Accountants, hiring a tax preparer costs an average $246 to complete an itemized Form 1040 with Schedule A, along with a state tax return. If a tax pro can realize just one deduction or credit you overlooked, that, itself help to pay for the fee.

E-File to Save Time, Money and Mistakes

Last year about 81% of taxpayers filed electronically. That number is increasing but that still mean about one in five are using a pen and paper. But get this: electronic filers see an error rate of just 1% versus 20% for those who file on paper and, according to the IRS, “a decreased likelihood” of hearing from them.

No Time? File an Extension

If you run out of time or simply don’t want to file in a frenzy you can always file a 6-month extension with the IRS (to October 15, 2013). Doing so ensures you won’t be subject to late fees and penalties. But don’t think you’re totally off the hook. The extension only means you have more time to file, not to PAY. You need to still estimate your tax liability and make a payment by April 15, 2013.

March 29, 2013

Oliana Refines a Kitchen Staple

[image error]As the country’s biggest food makers come under increased scrutiny for making deceptive health claims about their products, Randy Hernandez has been able to seize upon – and profit from – a growing discontent among consumers.

Two years ago, the 48-year-old actor cum entrepreneur teamed up with his cousin, Dax, and opened the doors of Oliana (8951 Santa Monica Blvd., Suite J), a specialty store that educates and engages customers on the benefits of using fresh extra virgin olive oil. “When you come into the store you will have an experience of tasting a mild, medium and robust olive oil… at its ultimate freshness,” he says. “We’re about the education of what you’re using, where it’s from, and what you are putting into your body.”

Freshly-crushed extra virgin olive oil does not just taste better than the stuff you get from your local grocery store. It is also has significantly higher concentrations of polyphenols, which are known to reduce the risk of cancer, improve cardiovascular health, aid in digestion, and slow down the aging process.

Mainstream manufacturing and distribution processes compromise the integrity of extra virgin olive oil to such an extent that Hernandez flat-out dismisses the majority of his competitors: “We don’t compare ourselves to what’s on the market because we can’t; 75% of the things that are out there are rancid,” he says. “In testing different olive oils we’re finding canola, vegetable, and avocado oils.” Packaging and shelf life can further degrade EVOO’s natural health benefits. (In fact, olive oil is one of the most counterfeited foods in the marketplace, according to this video from Farnoosh).

Oliana is located in the sprawling Pavilions complex at the intersection of Robertson and Santa Monica in West Hollywood, and has benefited greatly from the runoff of foot traffic. In the last nine months, however, Hernandez has seen a shift in his business. “We are getting a lot of people who just want to live and eat healthy,” he says. “We also have our medical clientele who need higher polyphenol counts. Generally anything over 100 is good. But some people – cancer patients, for example – need more. We have oils with polyphenol counts as high as 600.”

Hernandez estimates that new customers spend an average of 20 minutes in the store, learning about the histories, flavor profiles, and health benefits of Oliana’s selection of 48 premium olive oils and balsamic vinegars shipped via a Oliana’s Oakland-based distributor from all around the world. Olive oils from Sicily and California are especially popular among customers, as is their butter-infused EVOO. Among the balsamics, the blueberry, lavender and espresso have loyal followings. The store also hosts $10-a-head private tastings in the evenings for parties of 8 or more, and everyone leaves with a free 16 ml bottle of their choice. “Once we get a customer into the store,” says Hernandez, “they tend to come back.”

Although his costs can vary, Hernandez prefers to keep his pricing strategy simple: $19.95 for 200 ml, $24.95 for 375 ml, and $44.95 for 750 ml, prices that are in line with and even below those of his high-end competitors. The difference is what’s in the bottle versus what’s on the bottle. “You’re paying for fancy packaging [for pricier bottles],” he says of the competition. (EVOO from Oliana comes in a tinted glass bottle that protects it from the sun’s damaging UV rays.)

Oliana is on the cusp of a few different crazes — namely, the buy-local, do-it-yourself, healthy, foodie ones — and Hernandez is optimistic about its growth prospects. “We’re a brick and mortar in West Hollywood, but we’re looking to expand. Our online business is up. We’re getting the word out through social media. We hope to open up 4-5 of these stores within California and beyond over the next 3-5 years,” he says.

Project Curb Appeal: The Look for Less

[image error]It’s been said before that curb appeal, or the first impression of a house’s exterior, is a major selling factor. Whether you’re looking to unload your property soon or just spruce up your home’s exterior for the warmer season, it’s a great time to make improvements.

I spoke recently to Jason Jones, co-founder of Cap Equity Realty, to get a realtor’s perspective on affordable outdoor renovations that will give you the most bang for your buck.

“Spring and early summer are the hottest seasons of the year for home sales,” says Jones. “When spring rolls around, there are more properties on the market and as we near the end of the school year, families are getting ready to move and the activity really ramps up.” Jones says that improving a home’s curb appeal is one of the best ways to ensure it moves quickly on the market. “Aside from adding to the value of a property, with small renovations outside, you see buyers paying closer to the asking price because the property looks more turnkey.”

Create a Welcoming Entrance

Welcoming visiters to your home takes more than a friendly door mat but that’s a good place to start. You can purchase a colorful welcome mat from retailers like Home Depot and Lowe’s from $25-$50. But don’t stop there. Jones says a common, and inexpensive, way of creating an inviting entrance is by changing the color of your front door. His shade of choice: red – and for good reason. According to the Paint Quality Institute, red is the color of passion (hopefully enough to make buyers excited about your home.) On the other hand, blue is seen as “calm, serene, and relaxing, the perfect retreat from an often harsh and demanding world.” Painting your front door is a perfect DIY project with exterior paint costing barely $25 per gallon. And while you’re at it, add a couple coats to the mailbox.

Give Your Structure a Facelift

Why stop at the door? If your home’s siding is looking a little dingy and weatherworn, it’s probably time for a facelift. Repainting you structure can be a big job but’s it’s less expensive than you may think. The cost to paint a home’s exterior ranges from $1.00 – $1.79 per square foot, which includes the cost of materials and labor. Even less expensive is the price tag to brighten up your building with a good ol’ pressure wash. Rent one of these machines to clean off the effects of the cold seasons for about $65-$100 a day from from Home Depot or Lowe’s. Or you could invest in an electric pressure washer for your tool collection at about $200.

Freshen Your Landscape

Finally, you don’t have to have a green thumb to make your yard appealing this spring. The beginning of a beautiful garden can be just a few accent plants that line the path to your door. Plants are relatively cheap and will help remind buyers and neighbors alike that spring has sprung. Also, try framing your entry with a couple of large, decorative potted plants for a big effect with minimal effort. “I did this to a few properties just a few weeks ago,” says Jones. “We went as far as putting new grass in the yard but really just a few flowers can really freshen up a home’s appearance. Another easy improvement: new mulch, which tends to lose it’s color after a while. For materials, the folks at Lowe’s currently are running a “Spring Beautification” promotion that includes deals like 3 for $12 on bags of mulch. Perennials, including pansies, are also on sale for as little as $2 per pack in some areas. Also visit your local plant nursery, where you can often receive inexpensive-to-free seeds, plantable clippings and plants.

Photo Courtesy, RWCOX123.

March 28, 2013

Signs You’re a Shopaholic

There are more than 25 million Americans classified as compulsive shoppers. How do you know if your large appetite for spending makes you a shopping addict? We tapped Dr. April Benson, author of “To Buy or Not to Buy: Why We Overshop and How to Stop” to walk us through the four telltale signs and how to control the urge to splurge. Read more here.

Do you think you show signs of compulsive shopping? Connect with me on Twitter @Farnoosh and use the hashtag #finfit.

How Do You Take Your Credit?

Just like our coffee orders, our credit preferences run the gamut. How many credit cards are in your wallet? Do you carry a balance?

Bank of America recently surveyed 1,500 Americans and asked them about certain credit behaviors.

Here’s what they found:

44% would use $1,000 windfall to pay off debt, with women twice as likely to pay off loans.

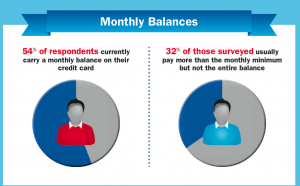

54% carry a monthly balance

32% usually pay more than the monthly minimum, but not the entire balance.

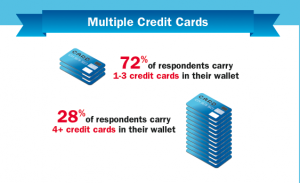

72% carry 1-3 credit cards in their wallet

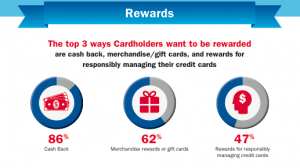

Most cardholders would like to be rewarded with cash.

Almost half would like rewards for managing credit cards responsibly.