Matthew Yglesias's Blog, page 2283

June 7, 2011

The Gender Pay Gap Starts Right Out Of College

Ann Daly writes up some new research from the National Association of Colleges and Employers that tries to take a statistically rigorous look at gender-linked disparity in starting salaries for new college graduates:

A woman graduating with a bachelor's degree last year earned a median starting salary of $36,451. For a man, it was $44,159. When you calculate a lifetime of percentage raises and compound interest, that nearly $8,000 difference is staggering.

As demoralizing as the findings of "Gender and College Recruiting" might be for this year's female grads, its implications for future generations of women in the workplace are downright alarming. NACE's analysis, which painstakingly isolates a systematic gender effect by taking into account the differential salary levels among majors and then comparing salaries within the same major, gives lie to the conventional wisdom that paycheck parity will somehow materialize for women with the mere passage of time.

Now obviously some people are going to be very resistant to this conclusion. They'll think that in a competitive labor market with many employers and many workers, employers who discriminate against women in their salary offerings will be at a disadvantage. No firm will want to disadvantage itself in this way, thus the discrimination shouldn't exist. Consequently, this apparently effect is almost certainly due to some other variable that's not accounted for. So it's worth pointing out that by this logic, the gender disparity in employment that existed in 1961 wouldn't exist either. But obviously it did.

Financial Times: Stimulus Needed

The wild-eyed socialists at the Financial Times call for additional currency debasement:

The confluence of stagnation and above-target inflation cuts against the desire of policymakers to start normalising monetary policy after a long period of unusual looseness. In recent months, both the European Central Bank and the US Federal Reserve have become more vocal in their desire to raise rates. This temptation must be resisted. The west's inflation problem stems from the voracious demand from Asia's new industrial powerhouses. This must give hope that a mild dose of stagflation is simply the temporary symptom of an inevitable economic shift. Squeezing domestic inflation to offset it would be counter-productive. In abnormal times, policymakers should also be alive to the balance of risk between inflation and unemployment. Letting the latter rise and become entrenched at a time of weakness would risk hardening the economic arteries further.

If India improves its public policy, then Indian people will get richer. And if Indian people get richer, more people will buy cars and motorbikes. That will increase global demand for oil, without necessarily leading to any technological advances in the oil drilling sector. That, in turn, will lead to an increase in gasoline prices not only in India but also in the United States and Portugal. But strangling economic growth in the United States and Portugal doesn't turn those car-owning Indians back into penniless subsistence farmers.

Fuzzy Math: Blasting Obama, Pawlenty Falsely Claims A Decade Of 5% Growth Has Been 'Done Before'

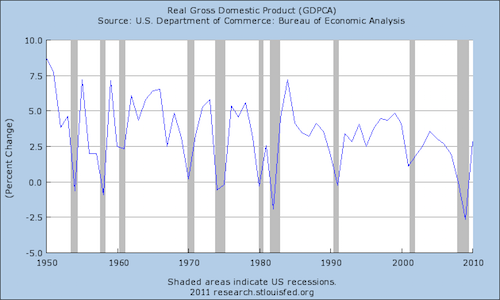

Tim Pawlenty's economic plan calls for a 5 percent growth rate sustained over a ten year period, something he claims has been "done before."

America's economy is not even growing at 2 percent — and that's what many projections say we can expect for the next decade. That's not acceptable.

Let's start with a big, positive goal. Let's grow the economy by 5 percent, instead of an anemic 2 percent.

It's been done before: Between 1983 and 1987, the Reagan recovery grew at 4.9 percent annually. Between 1996 and 1999, under President Bill Clinton and a Republican Congress, the economy grew at around 4.7 percent annually.

The mathematically astute among you may note that neither of these time periods featured five percent growth, nor did either of them last ten years. That's because growth of the sort Pawlenty is promising hasn't ever been done before:

The former governor's observation that current projections are unacceptably low are correct. But counterposing that with unrealistic promises and bogus history doesn't help anyone.

Ron Wyden vs PROTECT IP

Reihan Salam has an excellent column about the latest intellectual property law overreach, Senator Pat Leahy's PROTECT IP bill:

Protect IP claims to be about combating online piracy, hence the bill's clever name (it stands for Preventing Real Online Threats to Economic Creativity and Theft of Intellectual Property). Yet in the name of policing copyright violations, Protect IP effectively makes it a felony to link to a website that is accused — that's right, only accused — of being devoted to copyright infringement. As Google executive chairman Eric Schmidt explained to a press conference in London, Protect IP and laws like it will prove a "disastrous precedent" for free speech. He is absolutely right. Linking is the fundamental building block of the Internet, and hyperlinks are a form of free speech protected under the Constitution. Once the United States government starts messing with hyperlinks, every two-bit dictatorship on the planet will have carte blanche to do the same.

Fortunately, Ron Wyden has put a hold on this bill so we're safe for now.

The baseline issue that legislators ought to ask themselves before they sign on to yet another draconian IP strengthening bill is this: What am I trying to fix? Are constituents writing in to complain that it's harder than ever to find new music recordings to listen to? On the contrary, it's never been easier. Are constituents concerned that Hollywood doesn't crank out capital-intensive movies with stellar special effects these days? Again, no—special effects are getting cheaper and better. And because we now have lots of original programming from cable networks, we're producing more television shows than ever before. It would be very strange to reach the conclusion that Americans in the year 2011 are suffering from a lack of entertainment options. The truth is that the push for these new laws is all about efforts to shore up specific businesses who are hurting precisely because the range of options available to consumers has escalated so dramatically.

Breakfast Links: June 7, 2011

— Peak RIM.

— State parks hammered by budget cuts.

— Mexico's Agustín Carstens lashes out at European domination of the IMF.

— The sun is evil.

— Mitt Romney wants Sarah Palin to run.

— Romney leads Obama among registered voters in a new poll.

— Economy possibly doomed to downward spiral.

— Grover Norquist may not be cutting spending, but he's held down government revenue pretty effectively.

— Austan Goolsbee is leaving the White House so as to not overstep the terms of his leave from The University of Chicago.

June 6, 2011

Jill Abramson As Feminist

Dana Goldstein notes that new New York Times top editor Jill Abramson stands out from a lot of other women pioneers in being much more of an avowed feminist:

All too often, women trailblazers are either outright opponents of feminism, like Sarah Palin and Margaret Thatcher, or hesitant to fully claim the feminist mantle until far too late in the game, like Hillary Clinton and Katie Couric.

Not so for Jill Abramson, the veteran journalist who Thursday was named the first female editor of The New York Times. In an interview with Huffington Post media reporter Mike Calderone, Abramson immediately reflected on the historic nature of her appointment. "I stand on different shoulders," she said, paying tribute to Times CEO Janet Robinson, Maureen Dowd, former columnist Anna Quindlen and deceased journalists Robin Toner and Nan Robertson. "I just kind of called out their names."

On a personal level, I'm excited to see anyone who went to Harvard and didn't work on the Crimson succeed in the media. Especially a fellow Jewish New Yorker! But I'll concede that as far as trailblazing is concerned, the woman thing is probably more important.

Obama Touting Job Training, Not Aggregate Demand, As Key To Boosting Economy

By Matthew Cameron

The Washington Post reports today that President Obama will be making an appearance at Northern Virginia Community College on Wednesday "to discuss the importance of job training to improving the economy." NVCC is one of Obama's favorite stops when on the road, and the fact that Virginia is likely to be a battleground state in 2012 means he is probably looking for any excuse to engage the state's voters. Nevertheless, the message he plans on delivering seems oddly out-of-touch with the nation's current economic situation.

Although we don't yet know the specifics of Obama's speech, its billing as a discussion about "the importance of job training to improving the economy" suggests that the administration remains attached to the idea that the nation's unemployment crisis is structural rather than cyclical in nature. That unemployment spiked for all education levels following the 2008 financial crisis, however, indicates the economy is plagued by more than just structural unemployment caused by a dearth of human capital. Rather, it is coping with severely depressed aggregate demand.

Of course, Obama has little say in whether Congress or the Fed acts appropriately. And it is true that job training is a good policy objective for the long-term strengthening of the U.S. economy. But if Obama hopes to convince voters that he cares about the immediate employment situation, he should address the real issue and not settle for nice-sounding speeches that essentially are irrelevant to the average American's ongoing plight.

The Elderly And The Political Economy Of Deflation

I'm glad to see that my former editor Robert Kuttner's article "Debtor's Prison" (PDF) is sparking increased attention to the political economy of monetary policy. As Mike Konczal and Paul Krugman emphasize we seem to have something a rentier problem in this country, including the fact that the financial services industry benefits from too-low inflation in the wake of a credit bust:

I don't mean to suggest that it's all cynical; my experience is that there are relatively few people who consciously keep a secret set of intellectual books, who preach Neanderthal goldbuggism because it's in their interests while rereading Keynes by dead of night to figure out what's really happening. Instead, people generally manage to believe whatever is in their interests. And maybe not even that: I suspect that there are a fair number of small business owners who faithfully believed in Glenn Becks's warnings of hyperinflation by 2010, quite unaware that the intimidation of the Fed has savaged their own bottom lines.

So let me add to this a constituency that's even more important than the banksters: Old people. People in general overestimate the harm of inflation and old people are insulated from problems in the labor market. And of course old people have emerged as a core conservative constituency in recent terms. Obviously grandpa's not sitting around saying "hahaha I don't care if my son's crushed by mortgage debts and my grandson can't get a job!" But as Krugman says, people generally manage to believe whatever is in their interests. And grandpa's developed a marked tendency to believe that austerity budgeting (with the current elderly exempted!) and disinflationary monetary policy are good for him and his grandchildren alike.

Medicare and the Philosophy of Language

Paul Krugman on whether or not House Republicans voted to end Medicare:

I'll just quote the blogger Duncan Black, who summarizes this as saying that "when we replace the Marines with a pizza, we'll call the pizza the Marines." The point is that you can name the new program Medicare, but it's an entirely different program — call it Vouchercare — that would offer nothing like the coverage that the elderly now receive.

To be persnickety about it, the line should be that when we replace the Marines with a pizza, we'll call the pizza "the Marines." The point is that simply taking the name for something (i.e., "the Marines") and applying it to a pizza doesn't change the fact that the Marines are not a pizza. Jon Chait explaining that when you change a program's characteristics "you have a gray area where you can legitimately debate whether a change constitutes ending Medicare."

This idea, particularly Chait's version of it, reflects the traditional outlined by Gottlob Frege and Bertrand Russell. On the other side is Saul Kripke's causal theory of reference, which I always thought was bogus. But on Kripke's account, the Social Security Act of 1965 created a program named "Medicare" and as a result of that dubbing event any program descended from the original creation continues to be Medicare. To try to make this plausible, consider that the just-announced Lion version of Mac OS doesn't actually have more characteristics in common with System 5 than it has with Windows Vista or any number of contemporary Linux releases. Nonetheless, we think it makes sense to say that both Lion and System 5 represent evolutionary steps in the story of Mac OS. In that light, the GOP's proposed health care program doesn't need to actually have any common attributes with Medicare to qualify as a kind of Medicare.

Now if you ask me, this Kripke/GOP view is nonsense and all the Mac OS story shows is that Apple owns the intellectual property and can call things what they want. But it also highlights a lot of the folly of political "fact checking." There's simply isn't a rigorous boundary between a factual question and a political one. Now that said, I don't think this is a difficult political question. Normally the risk when a politician proposes a brand new kind of program is that he'll exaggerate its originality. Thus when George W Bush signed a bunch of amendments to the Elementary and Secondary Education Act he called it "No Child Left Behind" because he liked the slogan and wanted the branding. But Paul Ryan is doing the reverse. He's replacing a popular program with a program that would be totally different—and much worse—and trying to use linguistic bullying to obscure the extent of the change from people.

Reducing The Incidence Of Suicide By Reducing Human Misery

Ross Douthat dances on the grave of Dr Jack Kevorkian arguing that though the idea of allowing the terminally ill to get help killing themselves may sound appealing, it'll put us on a slippery slope to all manner of suiciding:

Writing in The Atlantic three years ago, Bruce Falconer profiled one such clinic: Dignitas, founded by a former journalist named Ludwig Minelli, which charges around $6,000 for its ministrations. Like Kevorkian, Minelli sees himself as a crusader for what he calls "the last human right." And like Kevorkian, he sees no reason why this right — "a marvelous possibility given to a human being," as he describes it — should be confined to the dying. (A study in The Journal of Medical Ethics suggested that 21 percent of the people whom Dignitas helps to commit suicide are not terminally ill.)

But unlike Kevorkian, Minelli has been free to help kill the suicidal without fear of prosecution. In the last 15 years, more than 1,000 people have made their final exit under his supervision, eased into eternity by a glass of sodium pentobarbital. Were Minelli operating in the United States, he might well have as many apologists and admirers as the late Dr. Death. But it should make us proud of our country that he would likely find himself in prison, where murderers belong.

I found this whole column to be a kind of telling tale about the difference in conservative and liberal worldviews. After all, in the grand scheme of things physician assisted suicide is not a major source of suicides. And what's more, though I generally think of suicide as a bad thing, it's not like continuing to live in the mind frame that leads a person to want to kill himself is so fantastic either. Maybe rather than trying to get fewer people to kill themselves by getting jazzed up about incarcerating Jack Kevorkian we should be worrying more about the incidence of human misery.

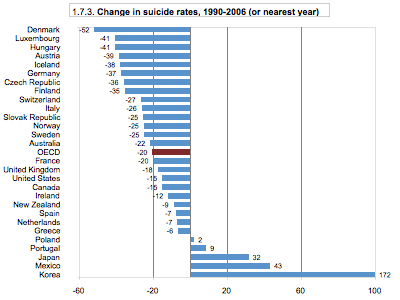

The good news, according to this data Matthew Cameron found, is that suicide rates are declining across Europe and North America:

If there's something to be alarmed about, suicide-wise, it doesn't seem to me to be Ludwig Minelli but rather the countries bucking this trend. Off the top of my head, the fact that Korean workers are outliers in lack of leisure time as well as suffering from a skyrocketing suicide rate suggests that maybe they should relax. Research also seems to indicate that economic downturns boost suicide rates among working age people, though not the under-25 or over-65 cohort. So maybe we should be pushing for more robust fiscal and monetary stabilizers! I don't think making the evil eye at Ludwig Minelli is going to end the global recession.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers