What do you think?

Rate this book

320 pages, ebook

First published June 10, 2025

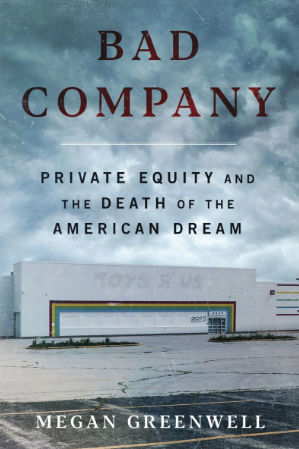

This book follows four workers: Liz, Roger, Natalia, and Loren. Each of them saw a private equity firm upend one of four businesses—a retail chain, a small-town hospital, a newspaper company, and an apartment complex—and with it, his or her life. Taken together, their individual experiences also pull back the curtain on a much larger project: how private equity reshaped the American economy to serve its own interests, creating a new class of billionaires while stripping ordinary people of their livelihoods, their health care, their homes, and their sense of security. At heart, this is a story about the hollowing out of the American Dream, and the people trying to do something about it.By the time the book's narrative has given the back story of these four individuals, they seem as close acquaintances to readers of this book, and soon readers will be cheering them on as they read about the struggles of these four individuals as they do battle with the heartless financial behemoths.

When the only worth of a local grocery store, a newspaper, or a hospital is the short-term profits it can generate, the company becomes little more than a mine awaiting extraction. Businesses that were once pillars of a society founder and crumble. In the best-case scenario, money that used to flow continuously through town is redirected to a gleaming office tower in Manhattan. In the worst case, grocery stores and newspapers and hospitals disappear altogether. Workers lose their jobs. Customers lose the services they rely on. Little League teams lose their sponsors. Communities lose their institutions.

Only private equity wins.