What do you think?

Rate this book

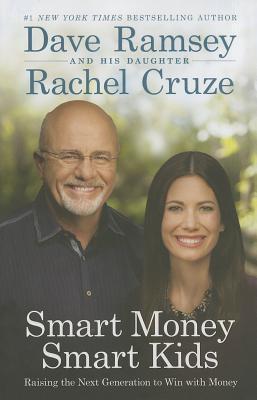

272 pages, Hardcover

First published April 16, 2014

When your child is focused on meeting the real needs of others through giving, it becomes harder and harder for him to focus on his wants. … it's hard for discontentment to take root in a heart full of filled with humility. In the same way, it's almost impossible for selfishness to flourish in the heart of a giver.