What do you think?

Rate this book

213 pages, Kindle Edition

Published February 15, 2022

Options trading has a steeper learning curve compared to equities, and options trading also requires a better mathematical knowledge base. Unlike many options trading books that rely heavily on complex math and equations, The Unlucky Investor's Guide to Options Trading takes a more practical approach. Instead of overwhelming readers with formulas like most options trading books, Julia Spina emphasizes understanding the principles behind options trading, such as managing risk, thinking in probabilities, and understanding the strategies. This approach makes the book ideal for readers who want to learn how to trade effectively without getting bogged down by unnecessary technical details.

At the end of each chapter in this book is a very nice Key Takeaways page that does a great job of summarizing the chapter. This is useful for future references when you want to skim through the book but not read everything again.

“Options are effectively financial insurance, and they are priced according to similar principles as other forms of insurance. Premiums increase or decrease according to the perceived risk of a given underlying (a result of supply and demand for those contracts) ... To quantify the perceived risk in the market, traders use implied volatility (IV) … When options prices increase (i.e., there is more demand for insurance), IV increases accordingly, and when options prices decrease, IV decreases. IV is, thus, a proxy for the sentiment of market risk as it relates to supply and demand for financial insurance. IV gives the perceived magnitude of expected price movements; it is not directional.”

“Trading when credits are higher also means common losses tend to be larger (as a dollar amount), but the exposure to outlier risk actually tends to be lower when IV is elevated compared to when it's closer to equilibrium. This may seem counterintuitive: If market uncertainty is elevated and there is higher perceived risk, wouldn't short premium strategies carry more outlier risk? Although moves in the underlying tend to be more dramatic when IV is high, the expected range adjusts to account for the new volatility almost immediately, which in many cases reduces the risk of an outlier loss.”~ The Unlucky Investor's Guide to Options Trading, by Julia Spina

“Buying options for profit is like playing the slot machines. Gamblers who play enough times may hit the jackpot and receive a huge payout. However, despite the potential payouts, most players average a loss in the long run because they are taking small losses the majority of the time. Investors who buy options are betting on large, often directional moves in the underlying asset. Those assumptions may be correct and yield significant profits occasionally, but underlying prices ultimately stay within their expected ranges most of the time. This results in small, frequent losses on unused contracts and an average loss over time.”

“Selling Options for profit is like owning the slot machines. Casino owners have the long-run statistical advantage for every game, an edge particularly high for slots. Owners may occasionally pay out large jackpots, but as long as people play enough and the payouts are manageable, they are compensated for taking on this risk with nearly guaranteed profit in the long term. Similarly, because short options carry tail risk but provide small, consistent profits from implied volatility (IV) overstatement, then they should average a profit in the long run if risk is managed appropriately.”~ The Unlucky Investor's Guide to Options Trading, by Julia Spina

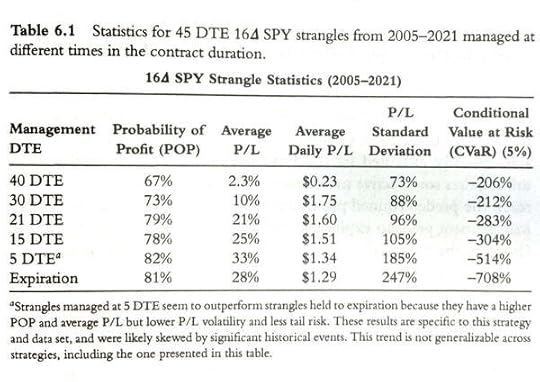

When it comes to strategy, this book typically focuses on directionally neutral strategies, such as a short strangle. Based on what I’ve learned from this book, the ideal options trade would be:

Selling a 45 Days To Expiration (DTE) Strangle, at 16 Delta, on a highly liquid index while the Implied Volatility is elevated. Then manage the trade at 21 DTE.

“As volatility reverts back to a long-term value following significant deviations, it is more valid to make directional assumptions on IV once it’s inflated rather than directional assumptions around equity prices. This book, therefore, typically focuses on directionally neutral strategies, such as the short strangle, because these types of positions profit from changes in volatility and time, and are relatively insensitive to price changes. However, that is a personal choice.”~ The Unlucky Investor's Guide to Options Trading, by Julia Spina

I think this is my new favorite Options trading book. It’s a quick read, not overly reliant on complex equations, and it gives some really useful trading strategies that every options trader should understand. In my personal options account, I dedicate 20% of my BPR to this strategy that I call the TastyTrade strategy, which is the 18-delta, 45DTE Strangle. I do this trade on a few different underlyings when they have a high IV Rank.