The Game is Rigged Against You.

If you weren’t born wealthy. If you weren’t born white. If you weren’t born with a penis. Your sister or brother (as poor as you) can rant that they aren’t wealthy because they made mistakes. They should have worked harder, saved more, not bought that stereo system on credit in 1996. And, to some degree, they are right. If you can stay healthy, be both clever and smart, not make unplanned babies, not buy on credit, not get divorced . . . you will fare better than others. If you can do all those things, many of which you don’t have control over, you may float to financial security. But many, many people who are smart and work hard, do not.

It’s easy enough to blame the individual, because you can usually identify the mistake or mistakes that has them living on the edge now. But when you look at the big picture, the trends, you see the truth. If you were born poor, odds are, you’ll stay poor. You might wobble between lower middle and poor, but you’ll probably never sit on a pile of actual financial security — assets, capital gains, a solid retirement.

The over-simplified explanation is this: We are all playing a game of Monopoly, trying to accumulate some assets without getting kicked back to Go, or worse, into bankruptcy. Unlike the Monopoly game you play at home, though, not everyone starts out with the same amount of money. Some people start with that $1500. A few start with $15,000. And a millions of us start out with a pale pink $5 bill. A disproportionate number of single mothers, LGBT people, and people of color are in the $5 category.

Even if we land on unpurchased Boardwalk, we would never be able to buy it. One wrong move, like landing on a high rent property or the tax square, and we’re done — penniless, no way to dig out, trying to live on that $5 bill you get every time you manage to pass Go. That’s called “Living on the public dole,” or “being a Welfare Queen.”

Imagine where you’d be if you’d started out with $15,000. You could buy Park Place and Boardwalk and accumulate even more. Mistakes — and you would make mistakes because we all do — would be no big deal. You could pay a fine or the $50 to get out of jail with barely a shrug.

Of course, in the board game, everyone starts out with the same $1500 and everyone gets the same $200 when they pass go. Those are the rules. But in real life, the people who start the game with $15,000 get to make the rules, and changes them as often as necessary to make sure they continue to win and get farther and farther ahead.

This is the truth. Lawmakers are elected officials. They are elected because wealthy people donate money to their campaign funds and causes. In other words, lawmakers work for the wealthy people. The wealthy people make the rules that you are playing by every day.

This is why poor people end up in jail for not paying a $35 parking ticket. This is why poor students pay 9 times the interest rate than banks do. This is why the gap between wealthy people and poor people is widening every day.

CAN THE GAME BE CHANGED?

When I paint it that way, it looks pretty hopeless. It’s not hopeless. We do have some advocates in powerful places.

We also have a HUGE untapped collective power. In 2014, only 36.4 of US citizens voted. The wealthy few own congress because their money buys votes, but it doesn’t have to. You don’t have to believe or even watch the ads. Push past the slogans and lies and do your research. Push past the scare tactics and check the facts. Check multiple sources. When a fact makes you uncomfortable, check it, and, if it’s true, change your thinking instead of changing the fact (“Oh, they can manipulate anything . . .” ) Think critically.

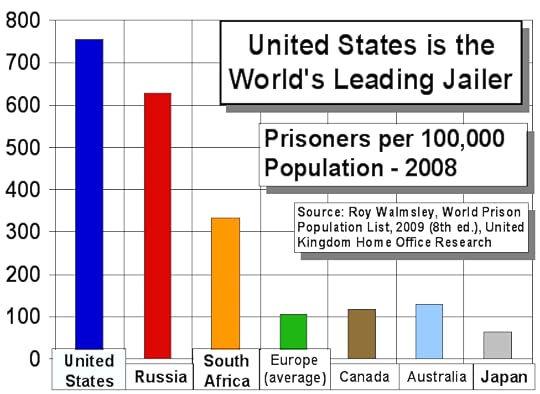

Stop hating your own kind. People keep telling you that this is the Land of the Free and that we have Equal Rights. It’s not true. We’re not the Land of the Free — the opposite, in fact:

https://upload.wikimedia.org/wikipedia/commons/f/fa/Incarceration_rates_worldwide.gif

Once you’ve been committed of a felony, your odds of attaining any kind of financial security go down even more, since finding a job is almost impossible. You have become one of the Untouchables.

We love to sing and talk about Equal Rights, but it has always been an ideal, not a fact. Even when it was possible for some of us to work hard at the same job and retire with security, it wasn’t true for all of us.

It’s easy to identify mistakes that poor people make that keep them poor, but there are reasons for those mistakes. Even if they aren’t your particular mistakes, show compassion. Be an advocate for both better choices and better opportunities. It’s staggering how many poor people hate and blame poor people.

CAN YOU BEAT THE ODDS AND WIN THE GAME?

That, of course, depends on how you define “win.”

Do you need to own a private jet and a home in the Hamptons? If so, I have no words of wisdom. We all dream, but unless you win the mega-millions lottery (you are more likely to be killed by a vending machine), there’s not a clear path that I know of.

Let’s define win as “having financial security.” Having money in the bank for emergencies. The ability to pay monthly bills. A realistic plan for retirement. And some extra for quality of life — the occasional vacation, etc.

I still don’t know the answer for you. There was a time when the answer for me was NO. I was caring for my dying husband, doing piece work writing at his bedside. Had I found a way to make more money, I couldn’t have done it — we would have lost his Medicaid. I tried, with everything left in me, to follow Dave Ramsey’s plan, but we just kept going deeper. How do you follow a budget when literally every month a new crisis consumes more than you have left?

So if you’re in dire circumstances like those, my advice to you is accept every bit of help you can. Be sweet, be openly brave, and if you have a crisis of faith, don’t share it on Facebook. I’m sorry if this sounds cynical, but it is literally the only thing you can do right now to take care of your family and protect what’s left of your future. People who have resources should share, and if you’re in dire circumstances, they should share with you.

If you have any flexibility, there’s a lot you can do to help yourself, in spite of the rigged game.

Get out of debt. Dave Ramsey doesn’t understand true poverty, but he is right about one thing — get out of debt as fast and as hard as you can. If you’re in too deep through no fault of your own, you might need to hit reset — declare bankruptcy.

Learn the mistakes that poor people make (“Might as well buy it now because I’ll never be able to afford it”) and avoid as many as you can — checks for cash, rental furniture, lack of car insurance, driving suspended… These are called Poverty Traps — businesses and systems targeting poor people, making them poorer for a profit.

Find allies. Other people are fighting the same battle. Help each other out with rides, emergency babysitting, tutoring each others’ kids, and $20 till payday.

Know your enemies. No matter how bad things are, they can always get worse. Divorce, alcoholism, health crises — these can derail all of your good efforts. You can’t control them, but take whatever action you can to avoid them if possible. Be gentle with your spouse, try not to comfort yourself with drugs or food, eat as healthy as you can (beans are cheap and healthy). If something starts to get ahead of you, try to get help while it can still be fixed — marriage counseling (income based at some agencies), rehab, check ups, bariatric surgery — whatever you need to do. Again, I’m not suggesting you can prevent all of this. But if you try, you may be able to prevent some of it, which is good for the budget, but more importantly, It’s your life. And, in the case of marriage, sometime you should just get the heck out of there.

Protect your interests. If you start to gain ground, others may tug you back. If you manage to sock away $563 for your emergency fund, that number is going to burn in your brain while your addict brother talks about his eviction. It’s good to help others, but decide how much of your budget you can afford to give every month and stick to it. If you want to help others in your boat, take them groceries and model good choices.

Everything is on the table. In all the time I took care of my husband, I never once considered selling the house and moving our family to an apartment. The rent would have been the same, but the maintenance would have been dramatically less (and more accessible for him). The idea of living in an apartment just wasn’t in my repertoire of solutions. This is where the internet is your friend. Your own circle of friends may have the same ideas as you, but an online forum will draw ideas you never even considered (and, inevitably, a few people blaming you for ur stupidty smdh, but ignore them). Many ideas will not be viable, but chew them around a little before discarding them.

Do cost benefit analysis. Following the advice of a book on frugality, I listed every grocery I bought with the prices per unit. Anytime I considered a purchase, I consulted my notebook, measuring whether this was the best possible price I could get on this 6 ounce container of generic yogurt. I could have spend that same time calling around and getting a better price on my car insurance and saved myself hundreds of dollars a year. I’m not saying don’t be frugal. I’m saying, if you can spend an hour saving a hundred dollars or 14 cents, pay the extra 14 cents and focus on the big bucks.

Take smart chances. Lottery tickets aren’t smart chances. Multi-level marketing jobs are rarely smart chances (and they are targeted toward people in your exact situation). Going back to school may be a smart chance (do your research!). For profit online colleges are never a good chance. Fighting for your kids’ education is always a good chance (and I know it’s not easy, when you work this many hours).

The game is rigged. I can’t give you a pathway to wealth. But, for now, there are still pathways to financial security for many of us, and to at least less financial insecurity for all of us. Keep fighting for equality, and keep fighting for your future.

If you’re driving ten miles to save 4 cents on gas, you’re losing.

If you’re driving ten miles to save 4 cents on gas, you’re losing.