Economic Overview for Start-Ups in Ireland

Exuberance in public and private spending during the early years of the new millennium was fuelled by confidence gained during the boom years of 1995-2000. Economic growth of an average 9.4% lead to commentators calling the economy a “Celtic Tiger”. Slower average growth of 5.9% until 2008 did little to slow spending. Economic growth came to a sudden halt after the collapse of the property market and its associated tax revenue, the governments guarantee over bank deposits and interest payments on sovereign debt of 9% threatened to bankrupt the country.

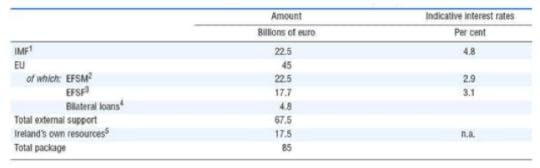

An economic adjustment package of €85 billion from the European Union, the International Monetary Fund and Ireland’s own reserves was made available in November 2010 to allow a softer transition into financial austerity.

Components of the EU/IMF/Irish assistance package

Source: European Commission, 2012. Ireland’s Economic Crisis.

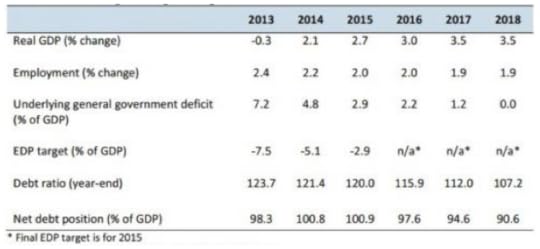

The country was able to exit the economic assistance program in late 2013, however it still reports on economic stability to the European Commission. These reports also incorporate forecasts made the Department of Finance. Evidence shows that positive results from of the economic strategy are visible. The labour market has seen reduced unemployment and domestic demand – that further stimulates the job market – has stabilised. The approach taken by the government has three dimensions. Structural reforms are necessary to strengthen competitiveness. This takes the form of changes in tax rates and the establishment of the Action Plan for Jobs and Pathways to Work. These government initiatives aim to create more jobs and assist the unemployed in returning to work. The second dimension is the provision of sufficient funding in the longer term to support the return to health of the economy. The final part of the strategy is to return to sustainable levels of public finance. A significant step towards this goal will be the eradication of the overly large deficit by the conclusion of the next fiscal year.

Economic growth, general government balance and debt ratio.

Source :Central Statistics Office, 2013, 2014. Department of Finance, 2014-2018, 2014.

External support for Ireland’s return to economic health is available from numerous sources. The main credit rating agencies have endorsed Ireland’s improved prospects by adjusting their ratings, all now rate Ireland’s sovereign debt as investment grade (Department of Finance, 2014). Standard and Poor rate sovereign debt as BBB+, Moody’s gave an improved rating in January 2014 as Baa3 – with a positive outlook – and Fitch confirmed their position in February 2014 as BBB+, with a stable outlook.

The Washington based think-tank – Heritage – rank Ireland as 8th globally and 2nd regionally on their 2014 index of economic freedom across 186 countries.

Economically speaking Ireland is well positioned to benefit from a financial renaissance.

Please contact us to discuss your Start-Up idea or arrange economic analysis of your region.

The post Economic Overview for Start-Ups in Ireland appeared first on Black Dog Consulting.