Coo Coo for Cocoa

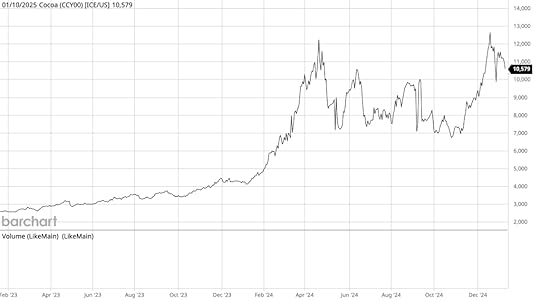

Cocoa has been on a wild ride for the past year.

So wild that Bloomberg has a separate category for “The Cocoa Crisis.” Contributing to the recent hysteria is news that Hershey has requested “special permission to buy over 90,000 tons of cocoa.” Evidently the chocolate manufacturer has requested a position limit exemption from the CFTC. (Links to the “Cocoa Crisis” coverage are in the article).

Note that exemptions, specifically for hedging, are explicitly recognized in the relevant regulations, and are granted routinely, so this is not really exceptional. Not knowing the exemptions granted to Hershey in the past it is difficult to know whether the magnitude of the exemption is extraordinary.

The article is confusingly written. In commodities subject to limits, there are different kinds of limits. These include single month and all month limits outside the “spot month” and “spot month” limits. Spot month limits kick in sometime prior to expiration. In cocoa, it is my understanding that the spot month limit kicks in on First Notice Day, which for the next ICE Cocoa contract (“CC”), March 2025 (“CCH5”) is 24 February, 2025.

The article implies that the exemption requested is for the spot month:

The maker of Reese’s Peanut Butter Cups wants to take a position that will allow it to purchase more than 90,000 metric tons of cocoa on ICE Futures US, said the people, who asked not to be identified because the information is private. The request to the Commodity Futures Trading Commission equates to about 5,000 20-foot containers and is more than nine times the amount the exchange currently allows.

The spot month limit is 1,000 lots, so 9,000 contracts would be 9x the spot limit. The single month/all month limit is 4,900 contracts, so the requested exemption would be less than 2x the single/all month limit.

I am somewhat skeptical that the exemption request is related to the spot month given that spot exemption requests can occur closer to FND, and the magnitude is so large relative to ICE cocoa certified stocks (currently only 1,604 lots) that granting such an exemption would be problematic. Particularly problematic would be “purchas[ing] more than 90,000 metric tons of cocoa on ICE Futures US” if that means acquiring that much physical cocoa via the delivery process.

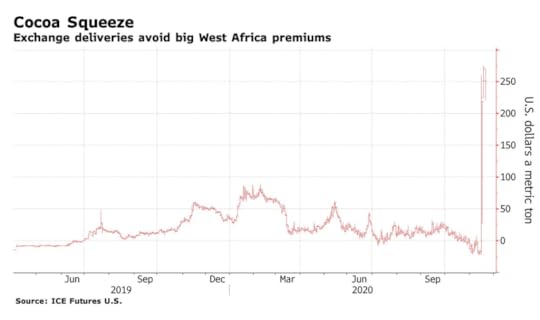

But Hershey did that in 2020, and exchange cocoa is supposedly at a discount to the cash market. The cash market discount begs the question: why? Are apples being compared to apples in terms of quality, location, etc.?

Acquiring 90,000 tons–or 25 percent of that amount– would require bringing in large amounts of cocoa to exchange warehouses. That in turn would require acquiring cocoa on the cash market (at a supposed premium), getting it to ICE warehouses, grading it, etc. So it’s hard to believe that cert cocoa is an economical source of supply for Hershey in the quantities mentioned in the Bloomberg article.

The price movement in 2020 sure as hell looks like a squeeze, but neither ICE nor the CFTC took action, so maybe Hershey figures it can do it again.

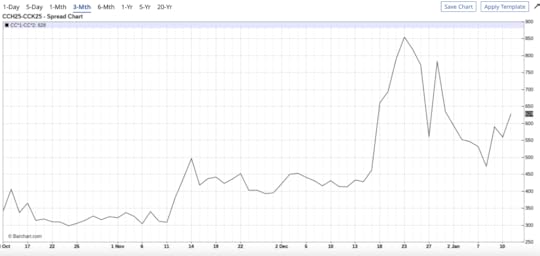

Unlike 2020, this time the spread didn’t take off:

The March-May 2025 spread did spike in mid-December, but only narrowed slightly after the publication of the Bloomberg article on 8 January. (Perhaps somewhat confusingly, an increase in the spread is referred to as “narrowing”. “Wider” means a bigger carry: “narrower” means less carry or more backwardation).

Here’s 2020 for comparison:

I certainly believe that big commercials can sometimes bamboozle ICE and the CFTC, especially when it comes to telling just so stories about how its economical to take delivery. So it’s not inconceivable that Hershey is trying to do that here, and that they will succeed.

The are other curious things in the article. For example: “A spokesperson for the Pennsylvania-based company said Hershey has a ‘rigorous’ procurement process and that it is ‘well covered’ on its cocoa needs for 2025.” If “well covered” means that Hershey has supply contracts sufficient to meet its anticipated physical needs, why would it need to take delivery? If “well covered” means that they supply contracts are fixed price, Hershey wouldn’t need to hedge using futures. So the company’s statement obfuscates rather than informs if it is intended to ease fears that the company could be hammered by a high and rising cocoa price in 2025.

As I noted before, the epic price rally has put cocoa in the news frequently. Another example is this Reuters article from last month. In brief, the high and volatile cocoa prices have driven speculators from the market, leading to thinner, less liquid markets.

A couple of comments.

First, the exit of hedgies has not caused prices to decline, which implies that they were not the ones that caused the high prices in the first place as has been frequently claimed (as is usually the case when prices move a lot–“round up the usual suspects”).

Second, the reduction in speculative capital makes the price more sensitive to bigfooting by commercials. Like Hershey. Just sayin’.

Third, this demonstrates clearly the effects of clearing and margining. Volatility and high flat prices increase margins and thereby the cash needed to maintain positions. Since cash liquidity can be costly, this raises the cost of providing both long term and short term market liquidity, which leads to the exit of speculative capital that has occurred in cocoa. This in turn increases volatility all things equal. That is, the margining mechanism creates a positive feedback loop that can be detrimental to market performance.

Not to say that the credit risk mitigation benefits of margining don’t outweigh these market liquidity costs. Just pointing out that mitigating credit risk is not cost free.

Given the decline of liquidity and the possibility that a large commercial may lean on the delivery process, the cocoa market is worth keeping an eye on.

As an aside, some years back there were squeezes in cocoa in March. I used to teach my commodity trading course in Geneva in March, and I joked to my students that I should buy CC calendar spreads before heading to Geneva. (I now teach there in April). This March might be particularly interesting.

And of course there was the big Armajaro corner in cocoa in July 2011.

All in all, cocoa can be a source of material for those interested in how er “technical factors” affect pricing. Including me. So I guess you could say I’m coo coo for cocoa:

(A flashback to my youth).

Craig Pirrong's Blog

- Craig Pirrong's profile

- 2 followers