Top ten posts of 2024

This was the 14th year since I launched this blog. Over those years, I have posted 1279 times with over 5.7 million viewings and over 2.3m visitors. There are currently 8002 regular followers of the blog.

And there are 14380 followers of the Michael Roberts Facebook site, which I started nine years ago. On that Facebook site, I put short daily items of information or comment on economics and economic events. Of these followers, 79% are men and 21% women (not good!), mostly aged between 25-45 years.

In 2024, my blog viewings were slightly down from last year and from the record COVID year when everybody was stuck at home online. But I did more posts this year, 86 posts up from 83 last year and those that read them stayed on the site for more views with an average 3 views per visitor – a record.

Where do my blog viewers come from? From over 199 countries globally! Led by 116k viewings from the US (or about 25%); 60k from UK (12%). Brazil and Spain are the next largest viewers followed by Canada, Germany, France, India and Australia. Right at the other end of the spectrum, I have had viewings from Fiji, Liberia, Vanuatu, Greenland, Yemen, Mali, Timor, Haiti, New Caledonia and Gabon.

And at the beginning of 2020, I also launched the Michael Roberts You Tube channel. This now has 3300 subscribers, with 73 videos and 55,935 viewings. If you haven’t joined up yet, have a look at the channel, which includes presentations by me on a variety of economic subjects; interviews with other Marxist economists; and some zoom debates in which I participated.

My top three videos of 2024 were: Marx’s law of value and the challenges of the 21st century; What would Marx and Engels says about today’s global capitalist economy?; and Capitalism in the 21st century: a review of the book by G Carchedi and myself that was published in 2023.

In 2023 I also launched a Twitter site. That has only 313 followers. That’s partly because the blog and my Facebook site cover the same things and Twitter requires much more work on a daily basis so there are fewer posts. it seems in general that Twitter is beginning to flag in social media. But watch that Twitter space.

So what was the most popular (in terms of number of viewings) post on my blog in 2024?

Rather surprisingly it was my review of The State of Capitalism, the book written by the NAMe Collective with the lead from Professor Costas Lapavitsas from SOAS University, London. The authors seek to analyse all aspects of capitalism in the 21st century from a Marxist perspective. The book starts with an overview of capitalism in this century. The Collective argues that capitalism is much weaker than in the 20th century. And the roots of this weakness lie in a slower accumulation of capital, particularly since the ‘interregnum’ of the Great Recession of 2007-9. There are several important points in the book that I disagree with. This may be why the post was popular, because the review appears to have sparked a debate on these points from viewers.

https://thenextrecession.wordpress.com/?s=state

Second in the top ten list is another book review of mine – this time of the excellent Unequal Development and Capitalism by Brazilian Marxist economists Adalmir Antonio Marquetti, Alessandro Miebach and Henrique Morrone. They propose a model of economic development based on technical change, profit rate and capital accumulation, on the one hand, and institutional change, on the other. Together these two factors should be combined to explain the dynamics of catching up or falling behind for the countries of the Global South.

The book argues that catching up is not happening. The book’s economic model aligns with Marx’s view that underdeveloped countries should follow the path of technical change set by developed capitalist nations. But as the authors recognize “this trajectory often leads to a decline in the profit rate and, therefore, a decrease in the incentives for investment and capital accumulation. How to circumvent this problem is one of the central issues that a national development plan must face.” Without strong state intervention, the contradiction between a falling rate of profit and increasing the productivity of labour cannot be overcome.

https://thenextrecession.wordpress.com/2024/07/17/catching-up-and-falling-behind/

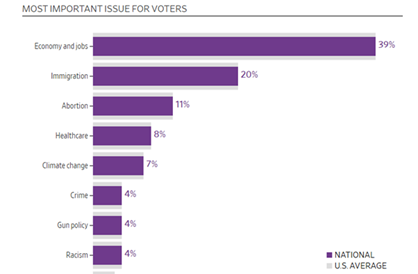

The big political event of 2024 was the US presidential election and the ensuing return of Donald Trump. Two posts on this made the top ten: my post on the challenges within the US economy and then on the underlying causes of Trump’s victory: the cost of living, immigration and the failure of the Democrats to address the class issues of working people. https://thenextrecession.wordpress.com/2024/11/02/the-us-presidential-election-part-one-the-economy/

Biden and Harris crowed about a vibrant, healthy, low unemployment US economy, better than anywhere else. But sufficient American voters were not convinced of this message coming from the so-called ‘liberal elite’, given their own experience. They reckoned they were losing out because of high prices and costs, precarious jobs and uncontrolled immigration that threatened their livelihoods, while the rich and educated in Wall Street and in the mega hi-tech companies made billions. Of course, Trump won’t change any of that – on the contrary, his pals and financial backers are a bunch of rogue billionaires who look to get yet richer from further cuts in taxes and deregulation of their activities.

https://thenextrecession.wordpress.com/2024/11/09/us-election-2024-inflation-immigration-and-identity/

The next three posts in the top ten were on Marxist economic theory. In one post, I engaged in a critique of a weird debate on Marx’s theory of value with an AI model (GZ) developed by a site called Marxism and Collapse (M&C). Their dialogue even involved the current President of Colombia, Gustavo Petro, a former academic. M&C claims that there is a fundamental weakness in Marx’s value theory, namely that it leaves out nature as a source of value. The AI model agreed and reckoned that we need to amend Marx’s value theory into some ‘general’ theory of value that incorporates ‘nature’. In the post, I argued that this change was unnecessary and it weakened Marx’s value theory as a penetrating and compelling critique of capitalism.

https://thenextrecession.wordpress.com/2024/10/03/marxs-theory-of-value-collapse-ai-and-petro/

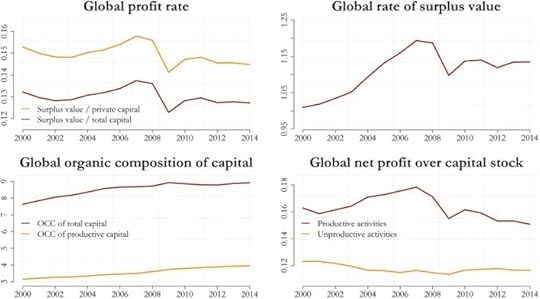

A post on Marx’s law of profitability was next. In this, I discuss new evidence supporting the law produced by Tomas Rotta and Rishabh Kumar. They generate a new panel dataset of the key Marxist variables (labour values) from 2000 to 2014 using the World Input Output Database (WIOD).

They find that the average profit rate declined at the world level from 2000 to 2014. The big advantage of their analysis was that they could produce a rate of profit based on the productive sectors of economies. The rate of profit in these productive sectors best indicates the health and direction of the capitalist economy.

https://thenextrecession.wordpress.com/2024/01/23/marxs-law-of-profitability-yet-more-evidence/

The next post went right to the heart of Marx’s labour theory of value. It covered a debate between American Marxist economist, Fred Moseley and German Marxist scholar, Michael Heinrich on the interpretation of Marx’s theory, which took place at November 2023’s Historical Materialism conference in London. Heinrich criticises the traditional interpretation of the labour theory of value, according to which the value of commodities is determined solely in production, and argues instead that value is created only when it is converted into money through the sale of commodities on the market.

In a short book, Moseley argued for the labour theory of value interpretation. In the post , I explained why this apparently obtuse debate matters. If the theory of surplus value coming from the expenditure of human labour power disappears from any analysis of capitalism to be replaced by money, then we no longer have a theory of exploitation or any theory of crisis at all.

https://thenextrecession.wordpress.com/2023/12/23/marxs-value-theory-and-the-value-form-interpretation/

Perhaps the most important trend in 2024 has been the very fast decline of European capital since the end of the pandemic. That’s particularly the case for Europe’s manufacturing powerhouse, Germany. My post on this came in at No 7 on the list. The largest economy in Europe is in a slump. Indeed, German real GDP has shown no growth for five consecutive quarters and has really stagnated for the last four years.

This has led to the collapse of the SPD-led coalition government and an early general election has been called for February, with the so-called ‘populist’ hard right set to poll strongly.

https://thenextrecession.wordpress.com/2024/09/01/germany-the-end-of-eu-hegemony/

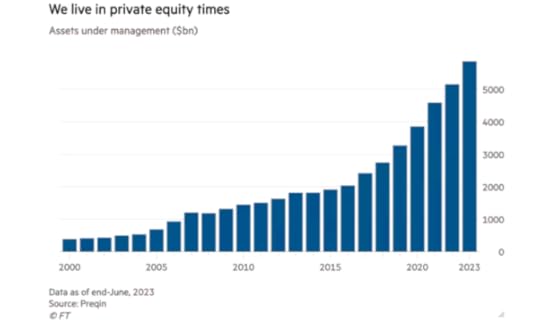

My post on the rise of private equity companies in 21st century capitalism was next in the top ten.

Over the last two decades, the vampires of private equity have gorged themselves on the profits of labour in the companies they have sweated, while avoiding sharing those profits with their investors or with governments through taxation. They engage in various forms of ‘financial engineering’ to increase their gains. And in doing so, they have leveraged key sectors of the economy into huge debts at the expense of productive investment. Now rising debt servicing costs are adding to the risk of a major financial crash, acting as a stake through the heart of many of these vampires.

https://thenextrecession.wordpress.com/2024/11/19/private-equity-vampire-capital/

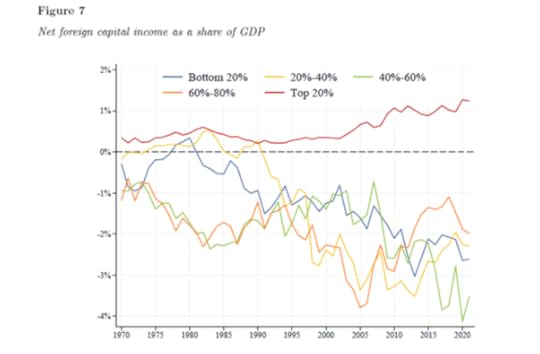

Last but not least (at least for me) was my post on imperialism. In this post, I referred to some new measures made by the World Inequality Lab on the flows of income from the so-called Global South to the imperialist core. They found that net income transfers from the poorest to the richest is now equivalent to 1% of the GDP of top 20% countries (and 2% of GDP for top 10% countries), while reducing that of the bottom 80% by about 2-3% of their GDP.

I also looked at how to measure the level of so-called ‘super exploitation’ (ie where workers’ wages fall below the value of their labour power) in the Global South. Using World Bank poverty wage level measures, I calculated that roughly 5-10% of G7 countries’ workers are being ‘super-exploited’, while in the BRICS (the major Global South countries) it’s about 25-30%. But that still means that 70% of workers in the BRICS, while earning way less per day than G7 workers, are not earning below the value of their labour power on a national basis. Exploitation of workers in the Global South is huge, but super-exploitation, as such, is not the main cause.

https://thenextrecession.wordpress.com/2024/04/23/further-thoughts-on-the-economics-of-imperialism/

Michael Roberts's Blog

- Michael Roberts's profile

- 35 followers