How to Calculate and Communicate Your Desired Total Compensation

Negotiating how much you make at your jobs is one of the most important things you’ll do in life.

This structure applies to many salaried positions but usually not jobs that pay hourly.

Unfortunately, many are quite unprepared for the process, and that starts with not realizing there are multiple layers to a complete compensation package, with salary being only one of them. I decided to go ahead and write this piece after seeing a number of Twitter threads where there were vast ranges of compensation for similar jobs, and realized that I could possibly help with awareness.

The key thing I want you to take away from this piece is that you need to be negotiating Total Compensation—not just salary—for your next role.

The technical term for compensation is actually remuneration (re-MOON-eration), which people invariably pronounce as renumeration (re-NOOM-eration).

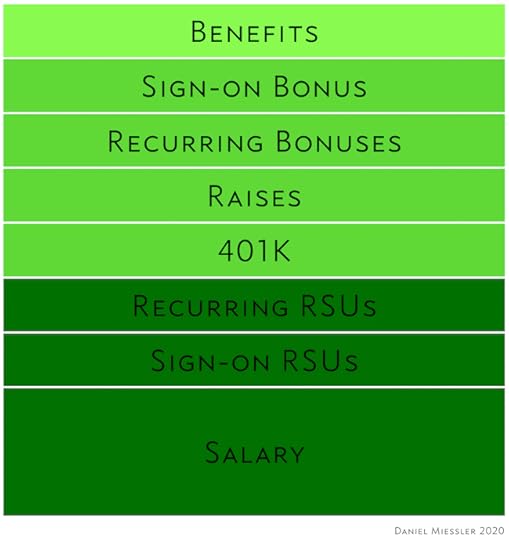

Ok, now that you know that Total Comp (as they call it in the biz), is about a lot more than just salary, let’s look at the individual pieces. You can think of Total Comp as having the following 8 components. Yes. 8.

Sign-on Bonus: Your sign-on bonus is a cash amount you receive immediately after starting, but it’s often broken into two or more pieces. For example, one half after 6 months or a year. A decent sign-on bonus would be something like 1/4 of your first year’s salary, and a great one would be half or more. Keep in mind that bonuses are taxed like gifts, which means you only get a bit more than half.

Sign-on RSUs: Sign-on RSUs are an extremely important component of your compensation package. This is often the most important chunk of equity you’re getting in the company, and could even drive how much you get in the future. Use your research to determine how much it should be, but the range should be somewhere between 2-4X what you make in salary.

Salary: While the whole point of this article is to stress how salary is just one component of overall compensation, it’s still a crucial one. Salaries pay bills, while RSUs, raises, bonuses, and other types of compensation are a lot less tangible. Salaries are often the most regulated and restricted within companies as well, so you can’t easily ask for something 1.5 or 2 times higher than is being offered. The only exception to that is if you happen to know that those numbers are possible but simply aren’t being offered to you. The best advice is to 1) find the bands for your position if possible, 2) do your research on what others are making in similar roles, 3) ask for the top of the band, and 4) if they’re still not getting close, tell them that you just need to be slotted as a higher position to get you into the salary range desired. Finally, if they’re unable or unwilling to budge, either get that extra amount through another part of the overall package, or tell them you’re not interested.

401K: Many companies in non-growth industries don’t have RSUs as part of their compensation plan. For those industries, one of the most important aspects of your compensation is your 401K, which is basically a way to stash away money without it being taxed when it gets withdrawn. What you want to look for here are 1) does the company have one at all?, 2) do they do matching?, and 3) how much matching do they do?, and 4) do they allow matching beyond the no-tax limit?. In general the more matching they do, up to higher percentages of your salary, is better. And if they do so above the no-tax limit of around 18K/year, that’s even better.

Some companies adjust compensation quarterly rather than annually, and this is especially popular in sales-oriented jobs.

Raises: Raises are usually given anually, and they tend to be fairly locked down as well. They’re usually based on some combination of your performance (merit), the performance of your local team, and the performance of the company overall. Again, try to find out as much as possible about what’s normal for the company, and shoot for the high-end of that. But this is one of the values that’s likely to be fairly static.

Different industries weight compensation to different parts of this stack.

Bonuses: Bonuses are similar to raises in that they’re usually defined by HR for a set period of time for set types of positions, and they tend to not get negotiated much. Just make sure you’re not being offered some bonus amount that’s lower than other people, based on any data you have.

Stock/RSUs: RSUs are where you can make up a lot of ground on salary and bonuses if those aren’t as pliable as you’d like. Companies often have far more freedom sweeten deals with stock than any other component. If you feel like you’re significantly low on salary, see if you can get where you want with more stock. Also keep in mind that there are different types of stock-based compensation, and that RSUs are generally preferred. Finally, do keep in mind that stock is only as valuable as the company is, and that depends on many factors. The leadership, the product, the economy, etc. Factor that all in when you’re thinking about how much value a company’s stock has relative to salary.

Pay inequality is a big problem in tech, especially for underrepresented groups like women and minorities. The best way you can help is by sharing yours. I’ll go first.

Daniel Miessler's Blog

- Daniel Miessler's profile

- 18 followers