FoundersCard Review 2019: Benefits, Updates, Cost – And Is It Worth It?

I’ve been a FoundersCard member for 5 years. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

The upshot is making the most of even ONE perk can outweigh the $395 membership – and the rest is gravy. And when you sign-up with my link, your rate will never go up.

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond elite status (which is back this year through January 2020!) to cover and exceed the membership cost.

And there are new benefits for 2019!

Wow, has it really been 5 years? Just renewed my FoundersCard membership again

Here’s everything to know before you apply for membership.

FoundersCard Review 2019: Overview

Link: Apply for FoundersCard

FoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that.

But many of them, particularly travel and lifestyle benefits, would be useful to most peeps. Especially if you’re a frequent traveler.

FoundersCard breaks down their perks into 4 categories:

Travel

Business

Lifestyle

Hotels

You can still get free nights at Atlantis in the Bahamas

Over the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

1. Travel

Airlines

American – Rotating quarterly benefit. Past quarters included free Platinum elite status challenges, a percentage off fares, and Business Extra points

British Airways – Up to 10% off most fares between the US/Canada and the UK (this is a perk of the Chase British Airways card)

Cathay Pacific – Silver elite status and 5 to 25% off flights

Emirates – 5% off fares from the US

JetBlue – Up to 5% off coach fares

Qantas – 8% to 25% off fares between the US and Australia/NZ, depending on flight direction

Singapore Airlines – Up to 5% off select flights from the US

I’ve made excellent use of the American Airlines benefits. And saved money on paid flights, earned elite status from free challenges, and bonus Business Extra points (which I redeemed for lounge access again this year).

If you pay for flights with partner airlines, these are easy savings

You can also save 5% with Emirates, JetBlue, and Singapore Airlines. And 10% off with British Airways. Not huge discounts, but certainly a nice offer. Especially if you get travel reimbursed or fly those airlines a lot.

Hotels

Caesars – Free Diamond elite status through January 2020 (waived resort fees, VIP lines, $100 Celebration dinner, 20% off select room rates)

Hilton – Free Gold elite status through March 2020 (free breakfast, upgrades when available, late check-out, extra points on paid rates)

Hilton Gold elite status is the best of all chain hotels for free breakfast

I don’t get Hilton elite status through a credit card any more, so this is the only way I get it – which is pretty cool.

I love Hilton Gold status for the free breakfast. And if you stay at Hilton hotels often, you can get:

Bonus points

Free breakfast

Late checkout

Room upgrades

Possible lounge access, if you score a Club floor room

And this year, Caesars Total Rewards Diamond elite status remains, which gets you:

4 free nights at the Atlantis hotel in the Bahamas

$100 celebration dinner

Tier status match with Wyndham

NO resort fees

15% off best available room rates

Occasional free nights at Caesars hotels

If you like Caesars hotels, you can save a lot on resort fees and room rates with Diamond elite status

I actually just redeemed 2 free nights at the Horseshoe Tunica in February 2019 for my little brother.

Got an offer for 2 free nights and booked it!

Granted, these rooms only sell for ~$60 a night, but hey, free is free. They’ll get a kick out of being out of the house for a couple days.

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges.

Rolling up to the Palm Room with my Total Rewards Diamond elite status

It’s not guaranteed to work any more, and you may have to pay. But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two.

Car rentals

Avis – Free Avis Preferred Plus Membership and up to 25% off rentals

Hertz – Free Gold Plus Rewards or FIVE STAR membership and rental discounts up to 20%

Silvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)

Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savings

Couple extra lil bennies.

ZipCar – Waived setup fees for small business owners, $20 toward your first time, and 20% off standard rates Monday through Friday

TripIt Pro – Free year, then $39 annual rate for 3 years

TripIt Pro has become a must for me

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $20 in credit and 20% off during the week.

I’m also gotten hooked on TripIt Pro. It’s becomes part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

There are a few other extras, like a $50 credit with Getaround (for carsharing), 15% off with Carey (a chauffeur service), and $75 off a Sanctifly membership to work out at/near airports. Here’s hoping they keep adding more travel discounts!

2. Business

Shipping, phones, and data backup:

UPS – Big discounts on shipping (up to 47% off)

AT&T – 15% off most voice and data plans $30+, not including unlimited voice and iPad plans

Backblaze – 20% off 1- or 2-year subscriptions (something like this is a MUST for small businesses, or anyone with a computer – I use CrashPlan)

Dell – Up to 50% off select products

If you don’t already back up your computers, you need a service like Backblaze or CrashPlan (which is what I use)

Promotion and documentation:

MOO – 20% off business printing

Constant Contact – 15% off marketing tools and emails

Shopify – 20% off for a year after a 14-day trial, to have your own e-shop

LegalZoom – 20% off (I’ve used this a few times)

BizFilings – 25% off services

Harvest – 15% off

Stripe – $20,000 in fee-free payments (!)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% + 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

These are all geared toward building your small business. In that sense, saving cash definitely helps the bottom line.

You’ll find most of the discounts and offers in the business category – and there are lots more. You can poke around with a preview to see them all.

3. Lifestyle

There are lots of discounts in this category:

Trunk Club – $100 credit toward your first shipment

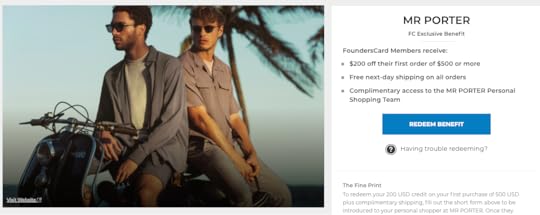

Mr Porter – $200 off your first $500+ order

Entrepreneur magazine – Free 1-year subscription

Inc. magazine – Free 1-year subscription

Dollar Shave Club – $18 in credits toward a razor subscription

Adidas.com – 30% off most items

Rent the Runway – 20% off

Spafinder Wellness 365 – 15% off gift certificates

ShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)

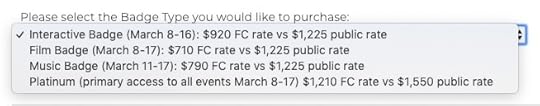

SXSW – Preferred badge pricing

Many gyms, including Crunch, Equinox, and SoulCycle – Preferred rates

Big savings on SXSW passes this year

Most of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, coffee, and lots more (60 lifestyle benefits currently).

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Dollar Shave Club and a gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

4. Hotels

FoundersCard has relationships with hotel chains and independent/boutique hotels around the world. You can get:

Exclusive members-only rates

Upgrades and extra perks

More flexible cancellation policies

No travel agent/booking fees

For example, at certain Marriott hotels, perks include:

Complimentary welcome drinks

More flexible cancellation privileges

Spa discounts

Free breakfast

Discounts off the standard room rate

You get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

21 Marriott hotels participate (8 W hotels, a few St. Regis, and a couple others)

8 Ritz-Carlton hotels participate (also part of Marriott)

6 Park Hyatts participate

But there are many boutique hotels, including NoMad, Standard High Line, Ace, and YOTEL in NYC. And lots all over the world.

It’s aight

While this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Dallas leaves a lot to be desired

I ran a search in Dallas and turned up 2 hotels in the FoundersCard program. New York has 12. Hong Kong has 1.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

What’s it all worth?

As of writing, FoundersCard is $395 a year with waived initiation fees for Out and Out readers.

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

TripIt Pro discount (free for a year, then $10 cheaper for 3 years)

American Airlines lounge membership from FoundersCard promotions for Business Extra points (I go in all the time for snacks and drinks)

LegalZoom 20% discount ($50+ in savings)

Total Rewards Diamond elite status with $100 Celebration dinner and trip to the Bahamas (huge discounts with this perk alone)

Dollar Shave Club credits ($18 to start)

Also, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not saving

It’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1000s ahead, in some cases.

And if you don’t find the discounts useful, then you should skip it.

The goal of FoundersCard is to give small business owners access to discounts typically enjoyed by huge corporations. In that way, it gets you more access, savings, and perks than you’d ordinarily have.

I’ve had my FoundersCard membership for 5 years. And will definitely keep it as long as keep up the value proposition.

Preview the membership here. If you like it, use promotion code “FCHARLAN818” to lock in the special $395 a year rate for life.

Bottom line

Link: Apply for FoundersCard

I hope this is a balanced review of FoundersCard. The upshot is: if you use the benefits, you can do well to recoup the entire annual membership fee – and much more. If there’s nothing that appeals to you, skip it.

I get enough return on my membership with the AT&T discount, which saves me $180 a year (this is irrelevant if you don’t have AT&T, of course). And all the other savings are easy and fun – which is the feeling I get from FoundersCard membership. I love checking the new perks and using the various discounts.

Many of the built-in benefits are ancillary with many credit cards. But here, you can access them without signing up for lots of cards.

As long as the value remains, I’ll keep FoundersCard. The savings are easy, discounts pop up often, and they’re engaged in the end product and user experience. It’s excellent for small business owners looking to access many of the same travel, hotel, lifestyle, and business benefits usually given to large corporations.

Interested? Preview the membership here. And if you want to apply, use promotion code “FCHARLAN818” to lock in the reduced membership rate.

If you have FoundersCard, what do you think of it? Have you gotten outsized value from your membership?