How Tax Systems Evolve in the Collaborative Age

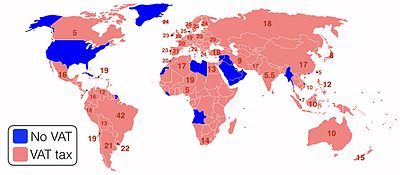

As I was looking at a EU document about VAT in all European countries, the historical tables have caught my attention (pages 18 sqq). They show invariably a substantial increase in VAT rates in the last decades. In most countries, this tax has become the main income stream of governments. In South East Asia, Singapore and Malaysia have just introduced the equivalent GST, and it will soon in introduced in India at a substantial rate.

GST or VAT is becoming increasingly important. This tax is non progressive, it applies to poor and rich at the same time; actually percentage-wise rich people will generally pay less if they consume less than their income. At the same time, income tax importance has generally stagnated or touch less people (in France, less than 40% of taxpayers pay income tax). Similarly, corporate tax shows a strong tendency to diminish in all countries nowadays. VAT/GST increasingly becomes the main income stream of governments.

GST or VAT is becoming increasingly important. This tax is non progressive, it applies to poor and rich at the same time; actually percentage-wise rich people will generally pay less if they consume less than their income. At the same time, income tax importance has generally stagnated or touch less people (in France, less than 40% of taxpayers pay income tax). Similarly, corporate tax shows a strong tendency to diminish in all countries nowadays. VAT/GST increasingly becomes the main income stream of governments.

I believe that this evolution reflect deep transformations related to the Fourth Revolution, without being quite sure about the cause. In a way, it is a problem because tax systems become generally less progressive (increasing tax with revenue) and this increases inequalities. At the same time it follows the fact that income might not reflect value and that final consumption might be a better indicator and taxable source nowadays.