Cool! Some Plastiq Payments Coding as 3X for Travel With Chase Sapphire Reserve

It looks like some payments with Plastiq are triggering 3X points per $1 with the Chase Sapphire Reserve card. Apparently, rent or mortgage payments are coding as “lodging/travel” and appear as “travel” – which is a 3X category.

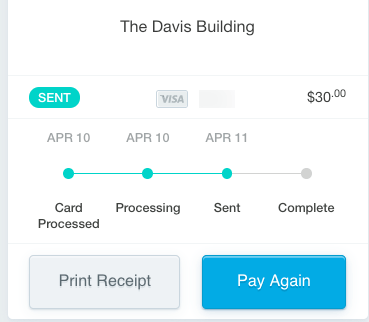

I made a $30 payment toward one of my Airbnbs and didn’t change the category in Plastiq – I left it marked as a rent payment.

I sent the payment as “rent, mortgage, and real estate”

And when I checked today, it had cleared and earned 90 Chase Ultimate Rewards points (3X).

SWEET – 3X

If you have rent or mortgage payments, it would be worth it to use your Chase Sapphire Reserve card, even considering Plastiq’s 2.5% fee.

By the numbers

Link: Sign-up for Plastiq

If you have a payment of $1,000, you’d end up paying $1,025 ($1,000 X Plastiq’s 2.5% fee). And you’d earn 3,075 Chase Ultimate Rewards points.

Despite the $25 fee, those points are worth at least ~$46 toward travel booked through Chase (3,075 X 1.5 cents per point). So you come out ahead by $20+ per $1,000 sent.

Even if you have the Chase Sapphire Preferred, you’d pay the same $1,025. And earn 2,050 Chase Ultimate Rewards points (2X for travel). If you value these points at 1 cent each, that’s a ~$5 loss. But if you value then at 2 cents each (which I do), you can come out ahead by ~$16 (2,050 X .02 = $41. And $41 – the $25 fee is $16).

Either way, that’s an extremely decent return for those payments.

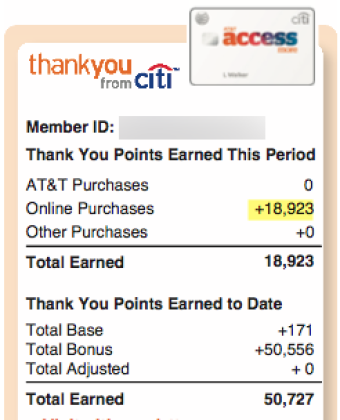

Sayonara, AT&T Access More

Link: Earn Points for Rent and Mortgage Payments With Plastiq (2% Fee With MasterCards)

Y’all. I have been jammin’ on my Citi AT&T Access More card for rent and mortgage payments through Plastiq for the longest (it’s no longer available to new applicants).

My statement closed today, actually. And I got my usual ~19,000 Citi ThankYou points this month:

PERNTS!

BUT. I’d rather have an extra 19,000 Chase Ultimate Rewards points by far.

So after I spend $10,000 on my SPG biz Amex this month to get 2X Starwood points (Doctor of Credit has the deets on the promotion I signed-up for), I will switch my Plastiq payments to my Chase Sapphire Reserve instead.

New bae

I’ll do this for as long as the gettin’ is good. However, I’ll still put $10,000 in payments on my Citi AT&T Access More card to score 10,000 bonus points each calendar year – which amounts to 4X on that first $10,000 spent (which I’ve already more than met).

I’ve been using that card because of the broad 3X categories and still use it heavily. But rent and mortgage payments are the lion’s share of my spend on that card. And now that’ll go on my Chase Sapphire Reserve for as long as this lasts.

What else triggers 3X?

This is the biggest question. I’m not sure how “rent” translates to “travel” for Chase but I won’t question it. Rather, my only curiosity is “What else works?”

I will make a couple of payments to my utility company and student loan company to see how those code. Unless anyone has any data points already. If not, I will share mine in a couple of days when they post.

If all payments through Plastiq trigger 3X that would be a huge deal. I just hope this gravy train lasts for a while. I certainly plan to earn as many extra Chase Ultimate Rewards points as I can while this is available. And honestly, rent and mortgage is my biggest category anyway so I’m beyond pleased with this.

Is Plastiq reliable?

In its infancy, Plastiq had its growing pains. Customer service was dismal, some payments were late (or worse, never showed up), and it left a bad taste with lots of peeps – for good reason.

The payment I made yesterday was sent today

However, they’ve improved hugely since then. I’ve personally made dozens and dozens of payments through their service and have never had a missed or late payment. *knocks on wood*

That said, they give you an estimate of how long payments will take. If it’s electronic, they’ll say 3 to 5 business days.

For a paper check through the mail, it’s 5 to 7 business days. Add a few extra to that.

I like to send my payments 10 or even 12 business days in advance. They’ve always gotten to my recipient when they said to expect them. But if a payment is delayed or gets lost, I want to give myself a few days to send the payment another way so I’m not scrambling.

So, I’ve had a very positive experience – no delays or mishaps. Be smart about it and you’ll be fine.

Bottom line

For whatever reason, rent and mortgage payments via Plastiq are coding as travel with the Chase Sapphire Reserve.

I’m not sure (yet) what else works for this 3X. But I’ll know more in a couple of days.

Before you schedule several payments, I’d send a small amount or just one – then check if you earned 3X. If you do, go wild while you can. This may last a while, or it may not.

I’ll update here with more data points regarding those other payments. If you already have any, please share below.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!