How a $6 Charge Made My Credit Score Drop 100 Points

Considering all the things I’m juggling all the time, my accuracy rate is pretty high. But more to keep track of means more things fall through the cracks.

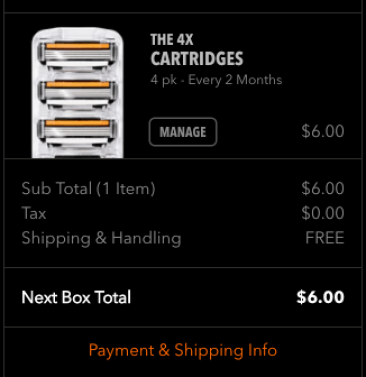

Before I moved to Dallas ~7 months ago, I changed all my addresses to my new address. During this, I paused the shipping on my Dollar Shave Club account.

And somewhere along the line, I canceled my Amex EveryDay Preferred card because I wasn’t making 30 transactions on it per month. To help with the transactions, and because it was so low, I made it my primary card for Dollar Shave Club’s recurring $6 monthly charge.

You can guess what happened. Somewhere in the middle of everything, the shipping resumed.

$6 messed up my credit score

And somehow, the charge cleared. Usually, when a card is closed, you’ll get an email from the merchant saying the payment failed. Not so with this one.

Amex cleared the charge. And I never got an email from or letter from them. Until one day, I saw my credit score dropped from 803 to 702 – because of non-payment of the $6 charge.

Amex has no idea what’s going on

Of course, I immediately called them and asked WTF? How could a charge clear on a closed account? And even still, why no notice – no statement, no “uh hey you owe us money,” nothing?

Every rep I spoke with said, yeah that’s definitely not supposed to happen. They admitted fault more than once.

This is the only blemish on my credit report. I’ve been so vigilant about protecting it for years. To say I was livid is an understatement.

So, so ugly

What was alarming is no one I spoke with seemed to have any idea how to fix it. Or why it happened. They were clueless and didn’t have answers, which was frustrating.

What Amex did about it

Their solution was to “re-age” my account. I of course made the $6 payment over the phone. And they said they could extend the closing date of the account so it would appear as closed with a $0 balance (as shown in the image above).

Fine, I said. Do it. They said it would take a month to show up on my credit report. A month!

Well, a month later, my score was still in the low 700s. So I called again, and this time spoke with a supervisor. She could see the notes on my account. But it was never properly “re-aged,” whatever the hell that means. So she said she’d do it for real this time.

Another month passed. The mark is still on my credit.

To recap: I made the payment. It wasn’t my fault. How it slipped through their system is a mystery. IT WAS ONLY FOR 6 FREAKING DOLLARS.

My next steps

Link: Equifax dispute process

Link: Experian dispute process

Link: TransUnion dispute process

So, Amex was and is useless to remove this strike from my credit report. I’m to the point where I just want this dumb thing removed.

So I’ve initiated disputes with the 3 major bureaus. And I WILL make sure it happens.

My biggest concern was I couldn’t get premium rewards cards any more. But so far, I’ve been auto-approved for several new cards (not that I get many of them anyway because of bank rules).

And the one time my account went to pending, the agent didn’t even mention it. Plus, a friend reminded me, 700 is still a good score.

Yes, but it’s not the 800 it once was before this happened. Over something so small.

So now I must wait 8+ weeks to hear back about my disputes. I have proof I paid the charge, the date the account was closed, and the date of the transaction. So it should be fairly obvious what happened.

What’s still most surprising is how utterly useless Amex was to remediate their mistake. And how much my score fell. I knew it was sensitive, but wow. 100 points for a $6 charge seems extreme.

Bottom line

So I’m going through the process of disputing my credit report with the 3 major bureaus. It’s a total PITA. And it seems like such an exercise in futility. Like, why can’t Amex just fix it?

I don’t want to go through it, but it seems I have no choice if I want the mark removed.

Just be careful with those recurring charges. Similar slip-ups have happened to me in the past, but I’ve always resolved payment directly with the merchant by simply using a different card. How and why this happened continues to elude me.

It just goes to show, you can never be too careful. And to double- and triple-check everything.

Have you ever had to dispute an item on your credit report? How did the process go? I’m hoping this is a quick and easy fix!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!