I Saved $3,000 With Citi Prestige Last Year (and Got a Retention Offer)

Also see:

Citi Prestige by the Numbers

Honest Review: Citi Prestige 40,000 Point Offer

My Citi Prestige card’s $450 annual fee recently posted. I will happily keep it for another year (if only to have Admirals Club access through the end of July 2017).

I’ve dutifully tracked the value I’ve gotten on the Citi Prestige by the Numbers page. But I want to dig into the numbers a little more.

Sorry for the selfie, but I needed a pic for this post

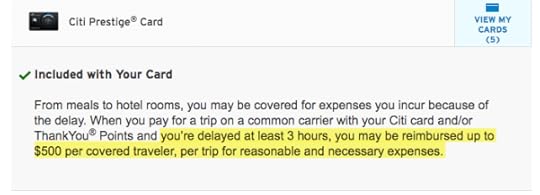

I also got an retention offer to earn 7X Citi ThankYou points on $8,750 in spending on airfare, hotels, and travel agencies – which is fine because I book ALL my airfare on this card to take advantage of its industry-leading trip delay and cancelation insurance that kicks in after only THREE hours (better than Chase Sapphire Reserve and any personal Amex card).

Year One by the numbers

Link: Apply for Card Offers

Here’s a breakdown of the savings I got last year with Citi Prestige (November 2015 to November 2016):

November 15 – $250 airline credit for flights on Norwegian to Martinique

November 18 – $244 saved with 4th night free benefit on a hotel in Martinique

December 10 – $116 saved with 4th night free benefit at the Alexandra DoubleTree in Barcy

December 16 – $450 annual fee charged (amount subtracted from total)

December 17 – $250 airline credit for flights to Dallas

December 18 – $800 from 50,000 Citi ThankYou points (worth 1.6 cents each on American Airlines) for meeting minimum spending requirement and earning sign-up bonus

January 18 – $100 on admission for 2 to Sala VIP Miro lounge @ BCN

January 20- $160 from 10,000 Citi ThankYou points for finding an error on ThankYou.com

February 6 – $70 on admission for 2 to Air France Lounge @ JFK (day passes are $35)

March 6 – $100 on admission to Admirals Club 2X at LGA and DFW (day passes are $50)

May 2 – $490 saved with 4th night free benefit at the Hilton Tokyo

August 7 – $50 on admission to Admirals Club at DCA (day passes are $50)

August 10 – $396 saved with 4th night free benefit at the New York Hilton Midtown

October 12 – $156 saved with 4th night free benefit at Homewood Suites by Hilton Austin-Arboretum/NW

November 9 – $269 saved with 4th night free benefit at Hilton Hawaiian Village in Honolulu

November 9 – $288 saved with 4th night free benefit at Hilton Capital, Washington, DC

Total: $3,289

Let’s analyze

I subtracted the annual fee.

I’m conservative in my estimates.

IMO, all the lounge access shouldn’t be added if I “only” popped in to have a drink. To account for that give and take, I did NOT include every time I accessed a lounge with the card. I included every 3rd or 4th visit, say.

I did stop in to Admirals Club locations during connections, right after landing to grab a drink, or grab a coffee. I figure they all add up.

I used some of the 50,000 point sign-up bonus to book award tickets (like my brother’s trip to Hawaii with Flying Blue and Singapore miles and a Business Class award ticket on Brussels Airlines). I used the base of 1.6 cents per point but definitely got waaay more than that.

And I got $500 in free airfare last year. Between that, the lounge access, and the sign-up bonus, I came out ahead of the $450 annual fee.

Got nearly the whole annual fee rebated from one 4th night free credit

But the biggest value by far was the 4th night free benefit. Wow.

I used it 7 times last year (which also seems conservative). If you only use this perk once or twice a year, the card more than pays for itself, even with the upcoming changes (more on that in a sec).

In fact, I’m about to get another $250 travel credit, which drops my next annual fee to $200.

Note: If you’ve opened or closed another ThankYou card in the past 24 months, you can’t earn a sign-up bonus for this card.

My retention offer

Getting over $3,000 in value (and actually much more) in a year made keeping Citi Prestige for a second year a no-brainer.

But, I called to check on retention offers. You can find the entire list of data points here.

I got:

4 additional ThankYou points for travel (hotel, air, car rental, travel agency) up to a max of 35,000 over the next 6 months

35,000/4 = 7X Citi ThankYou points on $8,750 in those categories (as they are already 3X categories).

Prolly my fave Citi Prestige bennie

I have a spate of airfare purchases coming up in 2017, so getting 7X and the card’s fantastic trip insurance seemed like a good deal – not that I was going to cancel it, anyway.

I consider this gravy.

Is Citi Prestige worth keeping another year?

Hell yeah. As mentioned, paying $200 for this card ($450 less the $250 travel credit) is an excellent deal. You can easily recoup that with one pointed use of the 4th night free benefit.

Here’s what’s changing on July 23, 2017:

4th night free will turn into a 25% discount (without taxes or fees)

No more free rounds of golf

Points will be worth 1.25 cents each toward travel

NO MORE American Airlines Admirals Club lounge access (this is already gone for new cardmembers)

I’m still going to put on my airfare on this card, and will surely have a 4+-night hotel stay to get more money back. And I’ll use it for Admirals Club access through July.

All of those things are worth $200 to me. At least for another year.

And as for a third year? We’ll have to see how the second goes. But assuming no other major changes or cuts, I don’t see any reason why this card wouldn’t remain a keeper.

Bottom line

It’s pretty incredible that I saved $3,000 with one credit card last year. That being Citi Prestige.

Keep in mind the planned changes won’t kick in until July 23, 2017. So if you pick up the card now, you can get a solid 7 months of the current perks (just not Admirals Club access).

Any way you slice it, you profit the first year with both $250 travel credits

You also get the $250 travel credit twice in the first year (the cycle resets after the close of your December statement). So the first year, you actually profit from the get-go. Not including the 40,000 point sign-up bonus and all the other bennies.

Get your Citi Prestige card here (or below):

Airline and Frequent Flyer Credit Cards

At the moment, I don’t have any paid hotel stays planned (because I am drowning in hotel points and need to burn them). But if/when I do, the charges will go onto this card. And of course, all my upcoming airfare thanks to my retention offer.

Others have gotten even more value from this card their first year. If you have this card, do you think it’s worth keeping despite the upcoming changes? What’s a ballpark range for your savings?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!