Why I Product Changed to the Chase Sapphire Reserve

Also see:

The Top Card for Beginners? Yeah, the Chase Sapphire Preferred

I caved. And called Chase. Asked if they’d let me change my Chase Sapphire Preferred to the Chase Sapphire Reserve. And thankfully, they did.

I’m happy to report I’m now the owner of a shiny new Chase Sapphire Reserve card.

Got itttt

Here’s why I did it.

Product Change to Chase Sapphire Reserve

Link: Apply for Card Offers

Link: Honest Review: Chase Sapphire Reserve 100,000 Point Offer

Like most of us, there’s no way in Hades I’ll ever be able to apply for this card with the current prohibitive 5/24 rule. I won’t fall under 5/24 until April 2017. So that means I’d have to wait ~7 months without applying for a single new card offer. Which ain’t gonna happen!

So I popped into a Chase branch and asked if I was pre-approved for, well, anything. NOPE.

OK, that’s cool. I asked if the pre-approvals refreshed at the beginning of each month, as I’d heard in my internet wanderings. The banker told me they refresh every 6 months. But couldn’t tell me where on the 6-month timeline I was. So at worst, that’s another 6 months of waiting. Grrrr.

I thought of that 100,00-point sign-up bonus. Man, it would burn to lose that.

But as I weighed the pros and cons, I decided to change my Sapphire Preferred to a Sapphire Reserve.

Why I did it

The 3X categories

All else being equal, I was losing out on earning 3X Chase Ultimate Rewards points for my travel and dining purchases.

Sure, I can earn 3X Citi ThankYou points on travel with the Citi ThankYou Premier. Between the two, I’d rather earn Ultimate Rewards points.

And I spend a lot on drinks dining, so 3X adds up quickly. I didn’t want to miss that.

$300 travel credit

I knew I could max that baby out and get $300 in essentially free Lyft rides, airfare, and NTTA tolls.

Then, after the close of my December statement, I’ll get another $300 to use. That erases the 1st year’s annual fee completely. And I even come out ahead. So that was also a huge draw.

The 1.5 rate is a comfort

Now, you can redeem each point for 1.5 cents toward travel when you book through Chase. That doesn’t mean you should, as the travel transfer partners are way more valuable. But I like knowing that no matter what, my points will always be worth a certain baseline.

This is admittedly more psychological than anything – I like how Chase is besting Citi, in particular. Hopefully this type of competition nudges Citi and Amex toward improvements in their own cards with $450 annual fees. As I always say, when banks compete – you win.

I’m NOT giving up opportunities

Waiting 6 or 7 months without a new card to fall below 5/24 is something I’m not willing to do. Even for 100,000 Chase Ultimate Rewards points.

At a base level, those points are worth $1,500, which is awesome.

But then I consider the Discover It, a NO annual fee card, made me over $2,200 last year. And I can open a new Bank of America Alaska Airlines Visa every month. Over 6 months, that’s 180,000 Alaska Airlines miles, which I value at $3,600. Not that I will, but I don’t want the option ripped away from me.

Add to that rumors of a new premium Amex card, and the inevitable limited-time offers that will pop up over the next 6 or 7 months and I think: do I really want to miss out on all that?

I routinely get 200,000+ points per app-o-rama. And I just got a new Amex Hilton card for another injection of 75,000 Hilton points.

If I was say, 3 or 4 months away from 5/24, I’d think on it. But 6 or 7? No way.

100,000 Chase Ultimate Rewards points is a lot, and worth a lot, but so are the other cards I apply for and open regularly.

And in the end, I’d rather have access to the 3X categories and annual $300 travel credit than not.

My experience product changing

First, I applied for the Chase Sapphire Reserve online, like a buffoon. When the app when to pending, I wasn’t surprised. I eventually got the rejection letter saying “too many open cards in the past 24 months” – a blatant admission the 5/24 rule exists.

So then I called Chase at the number on the back of my Sapphire Preferred card, and was transferred to a credit analyst.

Before I asked to switch, I asked once more if there was any way to be reconsidered. He said, “Sorry, my hands are tied here. There’s nothing we can do.” (Which I expected.)

Well OK, then. I still want it. Can I change my Preferred to a Reserve and move some credit to the new card, too?

No problemo.

Just like that, it was done

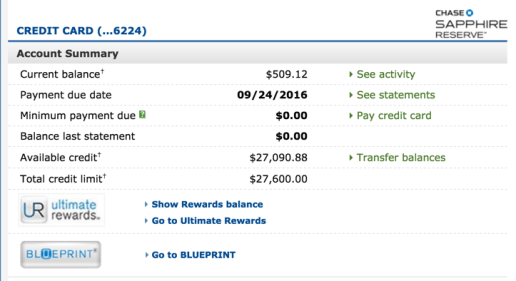

As soon as I logged out and back in again, it was there.

He said I could continue to use my Sapphire Preferred in the meantime – it would earn 3X in the bonus categories and the $300 travel credit was active immediately. That was really cool. I wasn’t sure if it would work that way, but it did.

A few days later, I received a UPS envelope with my shiny new (metal, not plastic!) Chase Sapphire Reserve card inside.

I gotta say, I still felt giddy about getting the card, even though I knew there would be no big sign-up bonus for me.

Oh, I should mention! I recently paid the $95 annual fee on the Preferred. It was pro-rated when I closed the account. And the $450 will appear on my next statement. So I didn’t lose anything by switching.

A small ray of hope

But before I hung up with the Chase analyst, I asked a very explicitly worded question:

“If I were to qualify for a new Chase card, could I product change the Reserve back to the Preferred, then apply for the Reserve, and earn the sign-up bonus on it?”

He knew exactly what I meant. “Yes,” he said. “That would work.”

So if you want to go that route – get the card, max out the travel credits, then change it back again until you can fall below 5/24, it seems that option exists. Sort of like a buy now, pay later dealio.

I’m still on the fence about actually doing this. As mentioned before, 6 or 7 months is just too long to wait for me. But it may be worth it to you.

Bottom line

Link: Apply for Card Offers

The Sapphire Reserve’s $450 annual fee comes to net $150 after the $300 travel credit is considered – only $55 more than Sapphire Preferred’s $95 annual fee.

For the 3X category bonus and access to 1.5 rate for travel booked through Chase alone – it’s worth product changing. And it’s interesting how Chase deliberately cannibalized their own Sapphire Preferred product. Why would anyone keep or go for the Preferred at this point, other than the lower – on paper – annual fee is beyond me.

If you can’t wait to fall under 5/24 and want the card right away, you can product change to it and enjoy the benefits until you do. At which point, you’d product change it to something else (maybe the Chase Freedom Unlimited?) and then apply for a new Sapphire Reserve account. So that could be a nice workaround to access the 3X categories and $300 annual travel credit before 2016 is through.

The process couldn’t have been easier. A 10-minute call with some light begging for reconsideration at the beginning, and it was done.

If you have the Sapphire Preferred, there’s no reason to not product change to the Sapphire Reserve.

Will you change any of your Chase cards to the Sapphire Reserve, or have you already? Did you have a similar reasoning?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!