Should You Use a 0% APR Card to Pay Off Debt?

Also see:

Smart Debt: Is carrying a balance ever a good idea?

Getting FIREd Up

NOTE: The card APRs in this post are current at the time of writing (July 28th, 2016). Be sure to check the offers for more details.

So here’s an idea I’ve been tossing around.

It absolutely burns me up that I’m still dealing with student loan debt. And it should. Mr. Money Mustache said it best:

YOUR DEBT IS NOT SOMETHING YOU “WORK ON”. IT IS A HUGE, FLAMING EMERGENCY!!!

I’ve put off paying down this debt because there have been other opportunities to earn more: I bought a house, maxed out my IRA, started Airbnbs, and now I’m looking at buying a duplex in the DFW area.

All of these things either appreciate or earn more than the interest I pay on my student loans.

But I’ll be damned if carrying that balance doesn’t give me a red rump.

The idea

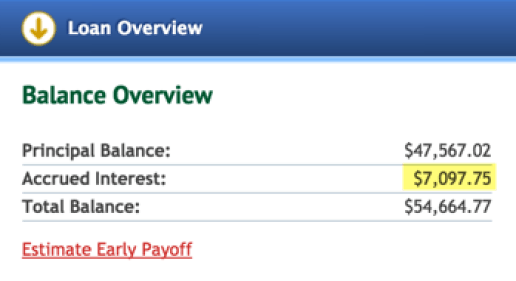

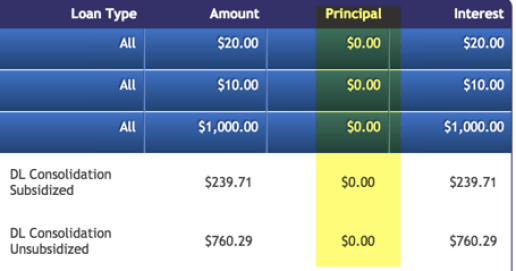

The thing I hate most is 100% of my payments go directly to interest right now.

I’d have to make ~$7,000 in payments before I can touch the principal

I currently owe ~$54K in student loans. The amount is what it is. I was a 17-year-old kid signing a promissory note to go to college. I could bitch about it, but it’s pointless now.

I think of all I could do with that money – travel, put a down payment on an investment property, throw it into my 401(k), or pay down my mortgage. It’s exactly that thought that’s kept me from beginning the repayment journey.

Ughhhh

I recently made a $1,000 payment. Not a cent of it touched the principal.

Fact is, I’d have to make ~$7,000 in payments before I can even begin to touch it.

It feels like saving a grain of sand from the beach. Spitting on a fire. You get the idea.

But, what if I could use a card with a long 0% APR period on purchases to

Pay all the interest

Work on paying down the principal in full

Then pay off the interest that’s been sitting fee-free on a credit card?

Could it give me a boost toward slaying this dragon of dragons?

0% APR cards

Link: View Additional 0% APR offers here

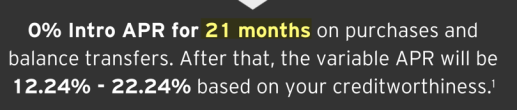

A couple of cards, like the Citi Simplicity and Citi Diamond Preferred, give you a stunning 21-month period with 0% APR on purchases.

That would be plenty of time to get ahead

That means you can make a purchase in August 2016 – and not have to repay it until February 2018.

That would give me plenty of time to take a broad swipe at my student loan debt.

Other card on the list may surprise you:

Chase Freedom – 15 months with 0% APR and $150 sign-up bonus (Visa)

Chase Freedom Unlimited– 15 months with 0% APR and $150 sign-up bonus (Visa)

US Bank Platinum – 15 months with 0% APR (Visa)

Amex EveryDay Preferred – 12 months with o% APR and 15,000 Amex Membership Rewards points sign-up bonus (Amex)

Amex Blue Cash EveryDay – 12 months with 0% APR and $100 sign-up bonus (Amex)

Capital One Venture – 12 months with 0% APR and $200 sign-up bonus (MasterCard)

MLB BankAmericard Cash Rewards – 12 months with 0% APR and $100 sign-up bonus (MasterCard)

Discover It – 12 months of 0% APR and $100 sign-up bonus (for new cardmembers) (Discover)

If the card you want to see isn’t linked in the text above, you can find it here:

View Additional 0% APR offers here

And there are many more here, too:

0% on Purchases

Which card to pick? (How to turn a payment into a purchase)

Link: Plastiq

I’ve written about how to make rent, mortgage, and student loan payments with Plastiq. Payments generally show up as a purchase. But be sure to set your cash advance limit to $0 to prevent paying nasty cash advance fees.

You can use Plastiq to pay nearly any bill. You’ll pay a 2% fee with a MasterCard. Or a 2.5% fee with an Amex or Visa card.

Fees with Amex and Visa are 2.5%, and 2% with MasterCard

In my case, I’m thinking of going for the Citi Diamond Preferred card to get a long 21-month 0% APR period. It’s a MasterCard, so I’d pay $140 to make a $7,000 payment (at 2% fee).

Or, it would cost $175 with an Amex or Visa (at 2.5%).

This is the part where you’ll need to run your own numbers to make sure this makes sense.

For example, the Capital One Venture card has a 12-month 0% APR period and a $200 sign-up bonus – totally wiping out the fee and giving me a solid year to pay the cost back.

But, I’d rather have 21 months than 12 months with the Citi Diamond Preferred. And I’m willing to pay a little more to get it.

You might also have better relationships with certain banks. Have a lot of Chase cards (or opened lots of cards in the past couple of years)? Avoid Chase. Never had a US Bank card but have great credit? Try them.

Like the Amex Blue Cash EveryDay bonus categories and think you’ll keep the card long-term? Go for it.

As always, do what’s best for your situation.

The numbers

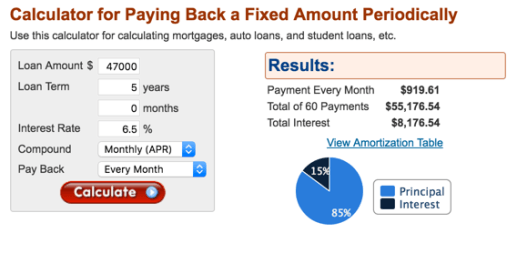

Link: Loan Calculator

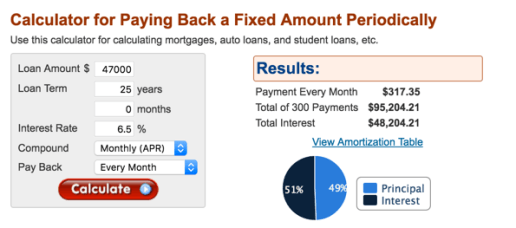

Quite simply, this is the power of compound interest. It’s amazing when it works for you. And can be devastating when it works against you.

~$48K in interest alone over the next 25 years

Now, if I make a payment every month for the next 25 years for the loan as it is now, I’ll end up paying double – the original $47K and $48K more in pure interest. Typing that gave me a full-body shake.

Or, I can pay it back in 5 years with ~$900 a month. And pay much less interest

If I commit to throwing ~$900 a month into the loan – with the current interest erased – it’ll be gone in ~5 years.

Again, that’s $900 a month I can’t use to pay down my mortgage, or to save, or invest. But it does mean I’ll avoid paying ~$40,000 in pure interest. That’s a more palatable way to think of it.

If I committed to putting all of my Airbnb income into it, it could disappear in a year. Somewhere in the middle, which is more realistic, is 2 to 3 years to fully pay this off.

Using a 0% APR card to pay the beginning ~$7K of pure interest would allow me to get right to work knocking this out.

Risk Vs. Reward

You can find cards with pretty long APR periods.

But at the end of the intro APR, you’ll be in a situation where you’ll have to pay off the card to avoid paying even more interest. That could temporarily stagnate the progress you’ve made.

On the other hand, you get a huge leg up into cutting right in to your principal, which will save you serious money down the road.

You are also at the mercy of your credit limit (and even getting approved). If you want to pay a $10,000 payment and your limit is only $2,000, well… you’re out of luck.

You may decide to pay Plastiq’s fee to pay a bill… just make sure your savings and/or sign-up bonus far outweigh that cost. What’s “far outweigh?” That’s hard to answer.

In my case, I’ll save $40,000 long-term by digging into my principal right away (see calculations above). I’d say that far outweighs Plastiq’s $140 fee. Again, run the numbers and make sure it’s worth it for you.

Your debtor might also accept credit cards directly without fees – that would be even better.

Caution, please

Don’t swap one debt for another.

Make no mistake: credit cards are financial tools. So you’ll need the mindset and temperament to handle your credit responsibly and re-pay your debts. Once you’re past the 0% APR period, well, you’re right back where you started – and perhaps even worse off.

Credit card companies are not in business to give you long-term fee-free loans. They’re hoping you’ll slip up and pay them interest. So don’t. Take the free loan. Just be careful.

A hammer is a tool, too. You can use it to build a house. Or you can slip and hit your thumb. With hammers and credit cards, be careful.

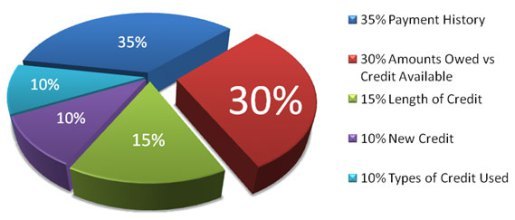

You’ll take a hit… but get a bump. The effect could be net-net

Also, if you get a new card with say, a $10,000 limit and you turn around and make a $10,000 payment, guess what? You’ve just maxed out your card.

Creditors do NOT like to see you using too much available credit on any one card – that sends a warning signal to them and could prevent you from getting more cards.

On the other hand, paying off a big debt (like a student loan) could dramatically improve your credit score. So the effects could cancel one another out.

If you have multiple cards with one bank, see if they’ll let you shift some credit around so you aren’t maxing out a single card.

And consider the risk vs. the reward long-term. Would you max out a card for a year to save a lot of interest on an outstanding debt? (I know I would.)

Again, I must stress how careful you must be here. Play your “cards” right and you could come out way ahead. But mess up, and you could reverse all your progress. Sorry to sound like a nag, but it’s worth repeating.

Bottom line

I think I’m gonna do it. Get a 0% APR card to take off my current student loan interest. Then pay off the loan like a maniac, and circle back around to pay off the card shortly before the APR intro period expires. And save a ton of money in interest payments. It’s all part of my journey toward FIRE.

In my estimation, this will put me right at the core of paying down my principal and shave years off the life of my loan.

I won’t earn a sign-up bonus on the Citi Diamond Preferred card, but saving thousands in interest long-term is worth more to me than any sign-up bonus ever could be.

I’ll use Plastiq to set up the payments and give myself a solid 18 months of consistent payments.

I haven’t considered this route before but it looks to be a quick way to cut right to the heart of the matter by giving myself a fee-free loan and a huge head start. It could work not only for student loans, but for nearly any big debt.

My biggest word of advice is to carefully watch the clock on that APR period. I have no intention of ever paying a dime of interest to any bank. And it’s that mentality that’ll let me use a credit card to avoid paying more of it on my student loan, too. Use it like a tool.

Here’s where to find all of the cards I’ve mentioned in this post:

View Additional 0% APR offers here

0% on Purchases

Run the numbers, pick the right one, and start slicing away debt.

Have you used a credit card to pay down a large debt? Any words of advice you want to add?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!