OECD Forecasts Below-Target Inflation, Calls For Tighter Monetary Policy Anyway

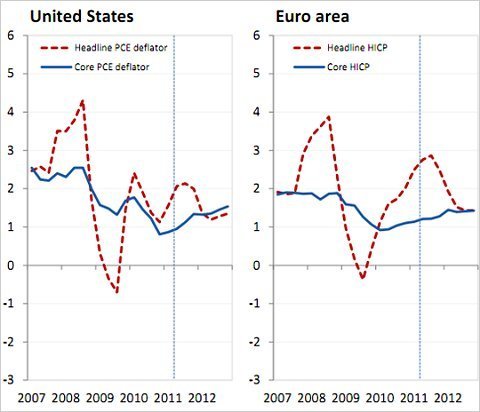

According to the OECD's Economic Outlook, this is what we can expect from inflation:

During the Reagan-era economic expansion inflation averaged 4 percent. During the Clinton and Bush expansions it was more like 2 percent. So what we're seeing here is a forecast of unusually low inflation. What a central bank that doesn't care at all about unemployment should do under those circumstances is push for looser money. And given high unemployment, the case for looser money is even stronger. But the actual OECD recommendation is for higher rates in order to "help to guard against a renewed buildup of financial fragilities and provide a better starting point in event of a need to react to upside inflation surprises."

I have no idea what that means and neither does Paul Krugman who deems it "mumbo-jumbo, a blizzard of words to justify tighter money despite the absence of any rational argument for doing so."

This is an excellent reminder that I'll be moderating a panel on progressives and the Federal Reserve at the upcoming Netroots Nation conference.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers