Jake Desyllas's Blog, page 25

October 5, 2015

223 A Guide To Passive Investment Portfolios: Interview With Tyler From Portfolio Charts

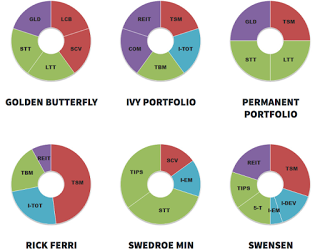

Portfoliocharts.com is a brilliant, free resource for passive investors. It provides a comparison of all the main passive investment portfolios using funky charts to visually explain the data. The site was created by Tyler, an early retiree with a background in mechanical engineering. Tyler created the site for fun as a personal project, but I think it is the best guide to passive investing portfolios on the web.

In this episode, Tyler gives his own take on passive investing and talks about how to use the portfolio charts site. He explains some interesting results from his analysis and shows how they challenge common myths about portfolios.

Show Notes:

Portfolio Charts Website@portfoliochartsI'm not a financial advisor and your money is your responsibility.

Listen To Episode 223

Published on October 05, 2015 14:44

September 27, 2015

222 Early Retirement Lifestyle Part 2 (Interview with Justin From Root Of Good)

This episode is part 2 of the interview with Justin from Root of Good. Justin talks about how the goal of early retirement differs from mainstream ideas of "success". He provides suggestions for those interested in pursing early retirement.

Show Notes:

Root of Good

Jack Ma Interview

Listen to Episode 222

Published on September 27, 2015 20:02

September 24, 2015

221 Early Retirement Lifestyle Part 1 (Interview with Justin From Root Of Good)

There are many practical steps required to reach financial independence, which we've discussed a lot on the podcast. However, there are also some interesting psychological challenges to early retirement. Who would you be without your job? What would you do all day if you never had to work? Justin retired at the age of 33. He writes about financial independence at the Root of Good blog. In this interview, he gives his take on the psychological side of financial independence and describes his early-retirement lifestyle.

Show Notes:

Root of Good BlogThe Early Retiree's Weekly Schedule

Listen To Episode 221

Show Notes:

Root of Good BlogThe Early Retiree's Weekly Schedule

Listen To Episode 221

Published on September 24, 2015 09:10

September 15, 2015

220 What To Expect From Investing

Many people find getting started as an individual investor daunting. This podcast episode is about how little I knew about investing when I got started. I describe what I came to expect from investing as I learned more about it. If you are starting out in investing, I think hearing my experience will be relevant for you.

Show Notes

Fail-Safe Investing: Lifelong Financial Security in 30 Minutes by Harry BrowneWhere Are the Customers' Yachts by Fred SchwedThe Little Book of Common Sense Investing by John BoglePrevious TVL Episodes on InvestingPrevious TVL Episodes on the Permanent PortfolioI'm not a financial advisor and your money is your responsibility.

Listen To Episode 220 (10 mins)

Published on September 15, 2015 20:22

September 4, 2015

219 How To Do A Monthly Financial Review

It took me a long time to work out how to stay on top of my finances. After a lot of trial and error, I developed the habit of doing a monthly financial review. This is what enables me to confidently manage my finances without having to think about money all the time. In this episode, I explain how you can implement your own monthly financial review. Topics covered include:

Habits to set up when implementing a monthly review, including dedicating adequate time (about 4 hours per month) and making a detailed checklist or task list to use.Key questions to consider when designing your monthly financial review system, such as whether to use an online finance app or one that runs on your own computer.Stages of the monthly financial review to implement: downloading finance data, cleaning data, inputting data, reconciling, and analysis (budget, investments, and net worth calculation)

Show Notes

Some software options for your checklist: Evernote and Omnifocus Some finance apps: iBank, Mint, Personal CapitalSoftware for automating renaming and moving of files: HazelTVL Episode 181 on budgeting and net worth calculation

Listen to Episode 219

Published on September 04, 2015 08:02

August 25, 2015

218 Choosing A Job-Free Lifestyle

In many previous episodes of this podcast, I've explored different ways to live a job-free lifestyle. I've interviewed extreme savers, unjobbers, lifestyle entrepreneurs, and startup entrepreneurs. Many listeners have raised an important question about these lifestyles: how do you choose between these different strategies for quitting the rat race? How do you decide which job-free lifestyle you want to pursue for yourself? This week's episode discusses this question and provides suggestions for how to choose a job-free lifestyle.

Show Notes

TVL Episode 124: Four Ways To Quit The Rat Race Video of Four Ways To Quit The Rat Race Presentation Becoming an Entrepreneur: How to Find Freedom and Fulfillment as a Business Owner

Listen to Episode 218

Published on August 25, 2015 20:47

August 18, 2015

217 Panama: Our Adventure Begins

This episode is a discussion with a special guest— my wife Hannah Braime, who is the host of Becoming Who You Are. We've just moved to Panama and we love it here already. In this episode we talk about all the preparations involved in our move, the start of our travel lifestyle, and our first impressions of life in Panama.

Show Notes

Hannah BraimePrevious TVL episodes on perpetual travelTVL episode 130: Interview with Pete SiscoListen to Episode 217

Show Notes

Hannah BraimePrevious TVL episodes on perpetual travelTVL episode 130: Interview with Pete SiscoListen to Episode 217

Published on August 18, 2015 19:58

August 3, 2015

216 Financial Independence Strengthens Your Moral Backbone

A listener shared these reflections with me:

"I like to think I'm a moral person but many times in my career (and in the careers of friends), I've been forced to choose between unethical behavior and possibly losing my job. I handled this on a case by case manner, where I had to weight the importance of the unethical behavior, the likelihood of me being punished, the odds of me successfully elevating the issue to a superior, how much the unethical behavior would actually hurt the injured party, etc. In other words, my response was ambiguous and led to a lot of sleepless nights."

The listener went on to explain that achieving financial independence strengthened his or her moral backbone and make it easier to say no to bad people at work. This is a brilliant insight and highlights one of the great benefits of financial independence. In this week's podcast episode I share some suggestions about how you can use entrepreneurship, extreme saving and unjobbing to make it easier for you to do the right thing.

Listen to Episode 216 (10 mins)

Published on August 03, 2015 03:49

July 28, 2015

215 Extreme Decluttering

“Simplicity is making the journey of this life with just baggage enough.” Charles Warner

Over the last three years, I've reduced my possessions to only those things that will fit inside one suitcase and one hand luggage bag. My wife and I decided to pursue extreme decluttering, in order to make a lifestyle of long-term travel more practical.

Decluttering was easy at first, but got harder the more extreme I took it. My possessions were not just serving practical needs, but emotional ones too. I had to work out how to address those needs before I could get rid of my stuff. Decluttering also forced me to acknowledge mistakes I had made in the past— mistakes I preferred to avoid thinking about.

Overall, extreme decluttering has been a fantastic learning process. I feel much freer because of it. I think that you can benefit in a similar way by decluttering, even if you don't want to reduce your stuff in such an extreme way as I did.

Show Notes:

Previous episodes on MinimalismGoing Paperless part 1 and part 2Episode on InventoryHome Inventory appGoodReadsIf This Then ThatEvernoteApple Photos

Listen to Episode 215 (19 mins)

Published on July 28, 2015 08:53

July 21, 2015

214 From Drama To Empowerment: Discussion With Hannah Braime

In this week's podcast episode, special guest Hannah Braime talks about how to free yourself from a life of drama and move to a life of empowerment. Hannah is a coach, author, and host of Becoming Who You Are.

We discuss some powerful concepts from the field of psychology that Hannah uses in her coaching. She explains how easy it is to get stuck playing a series of roles in your life— acting out a script written by someone else. These roles are all too familiar: "the victim", "the persecutor" and "the rescuer". Hannah explains how to empower yourself to leave such roles behind and live life according to your own plans. I really enjoyed the discussion and I think you will find it both interesting and helpful.

Show Notes:

Becoming Who You AreVideos about The Drama TriangleJoseph CampbellTransactional AnalysisGames People Play by Eric BerneKarpman Drama TriangleThe Power of TED by David EmeraldListen to Episode 214 (25m)

Published on July 21, 2015 05:45