Marc Goergen's Blog, page 2

May 2, 2022

Governance Through Ownership and Sustainable Corporate Governance

"Sustainable corporate governance is the set of arrangements that ensure that the firm focuses on maximizing long-term shareholder value, which goes hand in hand with the consideration of broader stakeholder interests in the firm’s decision-making. The focus on long-term shareholder value creation not only enhances the survival of the firm in the long run, but it also promotes the preservation of the firm’s ecosystem."

I then review the literature on whether and how different types of shareholders promote sustainable corporate governance in their investee firms. Read more here.

Source: Goergen, M. (2022), ‘Governance through Ownership and Sustainable Corporate Governance’, in Oxford Research Encyclopedia of Business and Management, Oxford University Press, https://doi.org/10.1093/acrefore/9780190224851.013.370.

May 2, 2021

CEO Duality: For Better and for Worse

Separating the roles of the CEO and the chair of the board of directors is considered best practice by many regulators, but should this be? Professor Marc Goergen draws from his research to discuss how combining the two roles can affect a firm’s leadership and shareholder value. Please read more here.

April 18, 2021

As mulheres dão mais sustentabilidade à direção das empresas

Coverage of my research on board diversity and renewable energy consumption by Portuguese newspaper Diário de Noticias can be found here. The article is in Portuguese.

March 20, 2021

Gender Diversity of Boards. IE Researchers: Gender Focus.

Please click the link below to watch my discussion with my colleague, Professor Patricia Gabaldon, on gender diversity on boards, from 18 March 2021. We discussed the benefits that gender diversity can bring to boards and companies, and the barriers that women encounter when trying to get to top leadership positions.

https://www.linkedin.com/video/live/urn:li:ugcPost:6778344373999468544/

January 6, 2021

Corporate Governance. A Global Perspective

Philosophy of the Book

Existing textbooks on corporate governance tend to have a strong focus on UK and/or US corporate governance. This focus is somewhat surprising as the UK and US corporate governance systems have features which clearly set them apart from pretty much the rest of the world. Indeed, the typical British and American stock-market listed firm is widely held (held by many shareholders) and control therefore lies with the management rather than the shareholders. In contrast, most stock-exchange listed firms from the rest of the world have a large shareholder whose control is substantial enough to have a significant influence over the firm’s affairs. Given these marked differences in ownership and control, corporate governance issues emerging in non-UK and non-US firms tend to be very different from those that may affect British and American companies. Hence, it is important for a textbook to bear in mind the diversity of ownership and control across the world in order to provide a holistic overview of corporate governance issues across the world. Indeed, there is no single way of – or system for – ensuring good corporate governance. Further, while national and cross-national regulators over the last two decades have advocated the superiority of the Anglo-American approach to corporate governance, the 2008 financial crisis highlights that there is no perfect system and that each system has shortcomings which may result in spectacular corporate failures.

Importantly, this global perspective is adopted throughout my textbook and is not just limited to a particular part of the book or individual chapters. The adoption of a global perspective is not only important given the nature and diversity of corporate governance, but is also paramount given the increasingly international character of student bodies in most universities (including MBA programmes).

Rather than focusing on corporate governance regulation as some of the established textbooks do, my textbook builds on existing academic research, but without ignoring practice. The adoption of a strong theoretical framework is important as it sets the basis for a critical analysis of existing corporate governance practice and regulation. Frequently, existing textbooks consider corporate governance regulation to be set in stone, failing to question the premises it is built on as well as its effectiveness. For example, successive UK codes of best practice have been based on the premise that independent, non-executive directors are key to good corporate governance despite the lack of academic evidence on the effectiveness of non-executive directors. Even more worryingly as suggested by recent research on director networks, independent directors are often only independent by name.

My book also adopts a multidisciplinary perspective which is important given that corporate governance relates to a range of issues such as economic, financial, accounting, legal, ethical and behavioural issues. Again, existing textbooks frequently have too narrow a focus such as on corporate governance regulation, environmental accounting and corporate social responsibility.

Finally, an effort has been made to convey to the reader the leading edge of knowledge in a given area of corporate governance in an objective and unbiased way. For some areas, the evidence is as yet inconclusive. Rather than proposing unfounded conjectures or taking the approach adopted by regulators as the (only) way forward, this book clearly spells out the lack of knowledge in a particular area. While in some cases this lack of knowledge may be frustrating to the reader, the alternative of lulling the reader into a false sense of security is perceived to be worse.

To summarise, my textbook adopts a global perspective, reflects the multidisciplinary nature of the area and provides a critical review of existing institutional and legal arrangements.

Synopsis of the Subject Matter of the Book

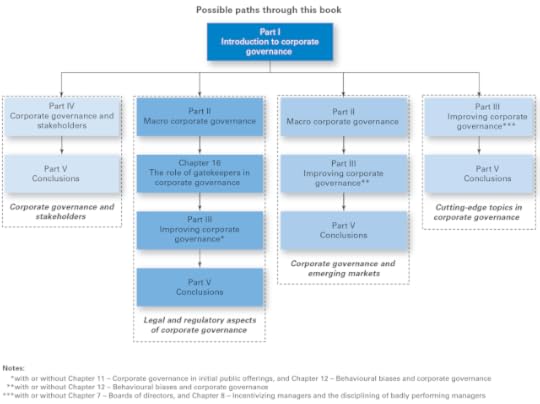

The book is divided into the following five parts:

Part I – Introduction to Corporate Governance Part II – Macro Corporate Governance Part III – Improving Corporate Governance Part IV – Corporate Governance and Stakeholders Part V – Conclusions

Part I introduces corporate governance. Lecturers who wish to cover the basics of corporate governance, without going into too much detail, may concentrate on this part. This part reviews the various definitions of corporate governance and discusses the main theories, including the principal-agent model. It also reviews the patterns of corporate control across the world, highlighting the differences between the UK and USA on one side and the rest of the world on the other side. While in the UK and the USA there is normally no or little difference between control and ownership, in the rest of the world there is often a major difference between the two. It is important to be aware of such deviations between control and ownership as they generate particular conflicts of interests which would not emerge otherwise. Both the differences in corporate control and deviations between ownership and control create conflicts of interests in most corporations which are very different from the conflict of interests at the basis of the principal-agent model. Hence, the principal-agent theory has only limited applicability across the world.

Part II contains an in-depth review of the macro-level aspects of corporate governance. Rather than describing the various systems of corporate governance via a lengthy list of fairly concise sections devoted to individual countries as some texts do, the approach that is adopted here is a comparative one. The focus will be on the characteristics shared across the various systems as well as those characteristics that make them distinct. This part will begin with a review of the various taxonomies of corporate governance systems after discussing the economic and political context in which global capitalism has risen. It will then review the evidence on the link between corporate governance, the development of financial markets and growth. The last chapter of this part will be on corporate governance regulation, with the focus being on the main national regulatory approaches (e.g. prescriptive rules versus codes of best practice) as well as their advantages and shortcomings.

Part III focuses on the ways to enable good corporate governance within countries as well as within individual corporations. This part starts with a chapter on the board of directors. Given the importance that various regulators and codes of best practices – as well as academic research – have attached to this corporate governance mechanism, it deserves its own chapter. The following chapter focuses on the other corporate governance devices that are employed across the world to ensure that managers create shareholder value. The next chapter deals with corporate governance in emerging markets. Emerging economies are often dominated by crony capitalism such as inherited wealth and political interference in corporate affairs, both of which make improvements in corporate governance particularly challenging. This chapter will also discuss the role of stock markets in economic development. The following chapter then reviews the ways and means by which individual companies can deviate from their national corporate governance standards by offering their shareholders and other stakeholders better protection against expropriation by the management and large shareholders. Such means include cross-listing on foreign stock markets, cross-border mergers and (re)incorporations in foreign countries or other federal states of the same country. This part also includes a chapter on corporate governance issues faced by firms that are in the process of going public and or have recently gone public. These firms suffer from issues such as the pronounced asymmetry of information between insiders and outsiders. They also have stakeholders, such as venture capitalists, that are not normally present in more mature firms as well as CEOs that are typically more powerful than their counterparts in more mature firms. The final chapter covers behavioural issues, such as excessive loyalty of the board members to the CEO (or the major shareholder) and managerial overconfidence or hubris.

Part IV covers issues relating to corporate stakeholders other than the shareholders. These issues include corporate social responsibility (CSR) and socially responsible investment (SRI), debtholder related issues (the positive role of debtholders in corporate governance as well as the conflicts of interests that debtholders may be subject to), the rights and the voice of employees across the various corporate governance systems, and the role and responsibilities of gatekeepers (such as auditors, credit-rating agencies and stock-exchange regulators) in corporate governance.

Part V concludes the book by drawing the lessons from the previous chapters, identifying the challenges that those concerned with improving corporate governance face and by proposing ways forward. To be effective, markets need good governance. Recent events have shown that bad market governance – in particular bad corporate governance – has not only negative effects for the markets concerned, but has also much more wide-ranging and devastating effects on wealth distribution and social justice for society as a whole. In other words, corporate governance failures tend to not only result in the expropriation of the shareholders of the immediate corporations concerned, but also affect other economic actors and stakeholders such as debtholders, taxpayers, consumers and job-market participants.

More information about the book can be found here.July 5, 2020

Women on Boards Leads to Greater Sustainability

June 22, 2020

BVCA response to Warwick Business School report

In what follows, I and my co-authors respond to criticism voiced by the British Private Equity and Venture Capital Association (BVCA) about a study we conducted. The original BVCA press release can be found here.

A new paper by Geoffrey Wood of Warwick Business School, Marc Goergen of Cardiff University and Noel O'Sullivan of Loughborough University - 'The Employment Consequences of Private Equity Acquisitions: The Case Of Institutional Buy Outs' - looks at the changes to employment and productivity in companies that have been the subject of institutional buyouts (IBOs) compared to matched companies that did not receive such a buyout.

The paper looks at an initial total of 106 IBOs undertaken over the period 1997 to 2006. This is in the context of 2,200 management buyouts (MBOs) and 500 management buy-ins (MBIs)