Jonathan Chait's Blog, page 44

June 15, 2011

&c

-- Jon Cohn on that shaky McKinsey health care report

-- Tim Pawlenty's insane tax proposals, now in chart form

-- Mitt Romney sets new standards in candidate awkwardness

If Obama Can't Get A Tax Cut, He Has An Issue

Brian Beutler reports that Republicans sound opposed to President Obama's plan to temporarily cut payroll taxes:

In a briefing with reporters in the Capitol Tuesday, the House and Senate GOP conference chairs said they're through with short-term stimulus measures, even if they take the form of tax cuts.

"Well they've tried this once, and it hasn't seemed to be working," said Rep. Jeb Hensarling (R-TX).

His Senate counterpart, Lamar Alexander (R-TN) echoed this view.

"We don't need short-term gestures, we need long-term strategies that build into our system simpler taxes, lower taxes, fewer mandates, lower costs, more certainty, any changes in the debt structure of tax reform ought to come out of the Vice President's talks or part of a major tax reform," Alexander said. "If short-term government programs work, we wouldn't have 9% unemployment today because the government has tried it. So we've proved that doesn't work, unforutnately."

The best case scenario for Obama is to pass this tax cut. The next best case scenario is to use it as an issue against Republicans. Selling Keynesian fiscal stimulus is hard. But selling tax cuts, especially when you're a Democrat, is easy. Obama can use the issue to burnish his centrist credentials and paint the Republicans as obstructionist.

Of course, he has to actually do this, which is not exactly assured.

Wall Street Journal Editorial Page Continues Not To Understand Economics

The Wall Street Journal opinion page accuses President Obama of flip-flopping on tax cuts:

This holiday from committing liberal history began in December with the White House-GOP deal that extended the Bush tax rates through the 2012 election and added a payroll tax cut on employees to 4.2% from 6.2%. These proposals came from the same Democrats who only months earlier had increased payroll taxes to finance their health-care bill and routinely claim that tax rates don't matter to the private economy. But then, 9.1% joblessness and 1.8% growth have a way of concentrating the political mind.

The Journal here is conflating two completely different beliefs. One idea is that marginal tax rates are extremely important in determining the incentive of workers, investors and entrepreneurs; raise marginal tax rates too high, and they won't bother to work hard or innovate. The extreme version of this dynamic, called "supply-side economics," deems these incentive dynamics so crucial that they determine the entire course of the economy.

A completely different idea here is Keynesian economics. That idea holds that, when the economy is depressed, it makes sense for the government to encourage people to spend more. The government can do this by cutting taxes temporarily, thus putting more money into the hands of consumers, or by spending the money directly.

The two concepts have nothing to do with each other. The first idea is concerned with the supply of labor, focused on marginal tax rates(the tax rate on your last dollar of income), especially for the rich, and applies to any set of economic circumstances. The second is concerned with the demand for labor, takes no account of marginal tax rates, encourages tax breaks for lower-income workers who are more likely to spend, and applies only to recessions.

The Obama administration, like most economists, has never put much stock in supply-side economics. Most economists believe that marginal tax rates affect supply a bit, but the effect is small, especially at current tax rates. (We might be running into trouble at 50% or higher.) That's what the Journal means when it says Obama thinks "tax rates don't matter to the private economy" -- it's a wild exaggeration, naturally, but an exaggeration of a basic truth. At the same time, Obama has followed orthodox Keynesian response to a severe depression, which is to run high-short term deficits in order to stimulate demand. Obama did include a payroll tax hike in the Affordable Care Act -- on high-income earners, to take effect starting in 2013, by which point the economy was presumed to be in recovery mode.

In the Journal's telling, Obama has flip-flopped -- he opposed the Bush tax cuts, and now he's proposing tax cuts? But of course the 2009 stimulus had tax cuts, too. Obama has favored and continues to favor short-term Keynesian tax cuts, and continues to oppose George W. Bush's permanent supply-side tax cuts. I genuinely couldn't tell you whether the Journal editorial page simply fails to understand the very basic difference in economic doctrines, or is simply pretending not to understand in order to concoct a political narrative to use against Democrats.

What The Norquist Rebellion Means

Kevin Drum thinks the defection of 34 Republican Senators from the Norquist line doesn't matter much:

Kevin Drum thinks the defection of 34 Republican Senators from the Norquist line doesn't matter much:

[M]aybe this is more of a good old sectional fight than a real schism on the proper interpretation of Norquist's anti-tax pledge.

We'll see. The theory here is that having once voted to end a tax expenditure (the ethanol subsidy), Republicans will now be more willing to defy Norquist and vote to end other, bigger tax expenditures (mortgage interest, employer healthcare contributions). I have my doubts about that. Sen. Jon Kyl of Arizona may have voted for the Coburn amendment, but he's also adamant that revenue increases remain off-limits in the debt ceiling talks. This vote has produced a lot of over-the-top rhetoric and frayed tempers, but in the end I suspect it doesn't mean much. Republicans remain just as firmly anti-tax in all its incarnations as they've ever been. Especially with an election coming up.

I think Drum's making a common mistake here. The mistake is his assumption that Senate Republicans just happened to abandon Norquist because they oppose ethanol, and so on this particular issue, they voted their opposition to ethanol over their opposition to taxes.

That isn't what's going on here. Virtually all the media coverage has gotten this vote wrong. Tom Coburn was not going about this in order to eliminate the ethanol subsidy. He made no attempt to work with the House, line up a majority, woo Senate Democrats, arrange for a vote on favorable terms, or do any of the things that Senators do when they're trying to pass a law. His goal was to do one thing: set a trap for Grover Norquist. He's been laying the trap since March.

The point of it is to establish a principle. Republicans working on a bipartisan deficit deal want to define the closing of tax expenditures as not constituting a tax increase. Their problem is that the Taxpayer Protection Pledge, which virtually all Republicans in Congress have signed, specifically defines closing tax expenditures as a tax hike. Coburn's ploy was a way of getting a foot in the door. That's exactly why Norquist is so enraged at Coburn.

Coburn's bill is not going to succeed and never had any chance of succeeding. So the question is, why did 34 Senate Republicans alienate Norquist by voting for it? If they wanted to take a public stand against the ethanol subsidy, they had a Norquist-approved amendment that they could have supported instead. The only reason to support Coburn was to help him undermine the Pledge.

Now, this hardly means the reign of anti-tax absolutism in the GOP is over. It remains the dominant party stance. But for the first time in two decades, there is a crack in the foundation.

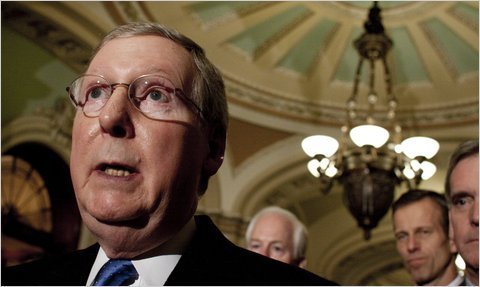

Mitch McConnell's Mixed Message

Mitch McConnell continues to send out confusing signals about a deficit agreement. On the one hand, he invokes the tradition of the grand bipartisan compromise:

"I actually think it would be easier to pass a comprehensive plan," McConnell said. "The American people also want us to tackle the problem. And if we do it together, there will be no political price to be paid for it whatsoever. Let me give you a couple of examples. Ronald Reagan and [former House Speaker] Tip O’Neill fixed Social Security in 1983. It’s lasted for a generation. Reagan carried 49 of 50 states the next year. They did it together. Reagan and O’Neill did tax reform in 1986, Bill Clinton and Republicans did welfare reform in 1996, and Bill Clinton and Republicans actually balanced the budget for a number of years in the late 1990s.

"All of those efforts had significant political problems attached to them, but when you do it together, which one of the great opportunities presented by divided government, serendipitously nobody pays a price for it the next year because neither side can take advantage. So this is the perfect time for a grand, significant package on deficit and debt, and I hope that the president will not miss the opportunity."

That's clear enough. Both sides meet halfway and end up with something that neither regards as perfect but both consider an improvement over the status quo. That would be a deficit deal with a balanced mix of spending cuts and revenue increases. The 1983 Social Security agreement was exactly in that mold. The 1986 tax reform lowered rates, which Republicans liked, and increased progressivity, which Democrats liked.

But McConnell also says the deal must consist entirely of spending cuts:

"I can say pretty confidently, as the speaker has, that we are not going to raise taxes in this agreement," McConnell told National Journal during a lengthy interview in his Capitol office. "And what the president ought to say to his own political left is, ‘Those crazy Republicans won’t let me raise taxes, but we need to do this for the country.’

Well, okay. Maybe he can hold the debt ceiling hostage to making policy changes that McConnell approves of but Obama doesn't. That would means that Obama is free to go to the public and denounce the cuts he was forced to make -- i.e., "take advantage."

McConnell seems not to understand the difference between a hostage negotiation and a normal political compromise. But it's Obama's responsibility to correct this confusion, and it seems increasingly likely that he has failed to do so.

JONATHAN CHAIT >>

Are Homophobic Men Secretly Suppressing Gay Impulses?

Turns out the old stereotype is true:

One study asked heterosexal men how comfortable and anxious they are around gay men. Based on these scores, they then divided these men into two groups: men that are homophobic, and men who are not. These men were then shown three, four-minute videos. One video depicted straight sex, one depicted lesbian sex and one depicted gay male sex. While this was happening, a device was attached to each participant's penis. This device has been found to be triggered by sexual arousal, but not other types of arousal (such as nervousness, or fear - arousal often has a very different meaning in psychology than in popular usage).

When viewing lesbian sex and straight sex, both the homophobic and the non-homophobic men showed increased penis circumference. For gay male sex, however, only the homophobic men showed heightened penis arousal.

Michelle Bachmann's Worldview

Michelle Goldberg has a terrific piece exploring the intellectual roots of Michelle Bachmann:

Bachmann honed her view of the world after college, when she enrolled at Coburn Law School at Oral Roberts University, an "interdenominational, Bible-based, and Holy Spirit-led" school in Oklahoma. "My goal there was to learn the law both from a professional but also from a biblical worldview," she said in an April speech.

At Coburn, Bachmann studied with John Eidsmoe, who she recently described as "one of the professors who had a great influence on me." Bachmann served as his research assistant on the 1987 bookChristianity and the Constitution, which argued that the United States was founded as a Christian theocracy, and that it should become one again. "The church and the state have separate spheres of authority, but both derive authority from God," Eidsmoe wrote. "In that sense America, like [Old Testament] Israel, is a theocracy." ...

In the statehouse, Bachmann made opposition to same-sex marriage her signature issue. Both she and her husband, by all accounts her most trusted political adviser, believe that homosexuality can be cured. Speaking to a Christian radio station about gay teenagers last year, Marcus, who treats gay people in his counseling practice, said, "Barbarians need to be educated. They need to be disciplined, and just because someone feels this or thinks this, doesn't mean that we're supposed to go down that road."

In 2004, Bachmann gave a speech warning that same-sex marriage would lead to schoolchildren being indoctrinated into homosexuality. She wanted everyone to know, though, that she doesn't hate gay people. "Any of you who have members of your family in the lifestyle, we have a member of our family that is," she said. "This is not funny. It's a very sad life. It's part of Satan, I think, to say that this is gay."

The religious right has its origins and deepest roots in social issues, as Goldberg shows. But it has evolved into a more full-fledged worldview with coherent positions on economics and foreign policy that often motivate its believers just as strongly. That is a key development that the many analysts who have been dismissing Bachmann have failed to grasp. Twenty years ago, a figure like Bachmann would represent a sizeable but still minority constituency in the party, speaking to a cadre motivated by social issues but unable to represent the concerns of most Republican voters. (For instance, Pat Robertson, the televangelist who turned in a strong showing in the 1988 Iowa caucus but fizzled afterward.)

But Bachmann is a cutting edge religious right conservative, espousing an apocalyptic free market fundamentalism that's become virtually indistinguishable from the apocalyptic Randian worldview of the party's Randian wing. Bachmann spent months addressing Tea Party rallies where she focused primarily on economics. Meanwhile, the movement's embrace of right-wing Israeli nationalism has merged with mainstream Republican foreign policy thought. (Not just Bachmann but figures like Mitt Romney* and Newt Gingrich will appear at Glenn Beck's nut-fest in Jerusalem this August.)

The skepticism about Bachmann's prospects reflects an antiquated assumption that there's a natural ceiling within the GOP on the support base of a hard-core religious conservative. Yet both the movement and the party have changed in ways that make that less and less true.

*Update: Romney's campaign now says he will not attend.

June 14, 2011

&c

-- John Judis and Walter Shapiro on the GOP debate

-- Humans developed reason to win arguments, scholars argue.

-- How to land your kid in therapy

Senate Republicans Abandon Norquist

A pretty surprising and important thing happened today: Senate Republicans opposed Grover Norquist en masse.

The drama was buried in a minor vote that will go nowhere, but that fact obscures the import of what happened. Norquist runs Americans For Tax Reform, the sponsor of a no-tax pledge signed by virtually all Republicans. Norquist's pledge has held absolute sway over the party for two decades -- Republicans at the national level have opposed on principle any tax hike whatsoever. Any agreement to reduce the deficit is going to require Democratic support, which in turn will require some increase in revenue. Some Republicans negotiating this deal want to get this revenue by closing tax loopholes or credits, which they (accurately) see as a form of spending through the tax code. Norquist opposes any deal as a violation of the party's anti-tax theology.

Sen. Tom Coburn has an odd role in all of this. He was involved with budget negotiations, then bizarrely jacked up his demands and then bolted the negotiations. But before he did that, he started laying a trap for Norquist. Coburn proposed to eliminate the tax subsidy for ethanol, which conservatives have long opposed. Of course, the subsidy is a tax credit, which means that eliminating it would be a tax hike. Norquist has forcefully opposed eliminating the ethanol subsidy, arguing that the ethanol subsidy may be bad, but it can be eliminated only if the revenue is used to reduce revenue. Eliminating even an unjustified tax subsidy in order to reduce the deficit is strictly forbidden. Indeed, according to Norquist's rule, a bill that cut federal spending by 50% and eliminated the ethanol credit would be forbidden if it did not cut other taxes by at least as much as the ethanol credit. Coburn's bill exposed the conceptual absurdity of the anti-tax pledge, which has become the most important impediment to a budget agreement that restrains the size of government.

Even though Coburn remains absent from the budget negotiations, he brought the issue to the Senate floor today. Democrats opposed his bill for unimportant and obscure procedural reasons. Anyway, the point was not to kill the ethanol subsidy. The point was to establish the principle that Republicans can vote to eliminate a tax credit without plowing the money back into other tax reductions. Amazingly, 43 Republicans voted for Coburn's bill. It's a clear signal of at least theoretical willingness to violate anti-tax orthodoxy.

This is not the end of Norquistism in the Republican Party. It's not even the beginning of the end. But it may be the end of the beginning. The House remains a strong bastion of anti-tax absolutism, and I remain skeptical than any balanced deficit deal could pass the lower chamber. And the GOP presidential campaign will reinforce the party's anti-tax absolutism, with candidates pushing the boundaries of supply-side devotion ever farther. Still, the Senate's show of dissent is deeply significant.

Huntsman To Crowd Romney's Turf

Chuck Todd notes that Jon Huntsman's campaign essentially plans to follow Mitt Romney everywhere and compete for the same voters. That sounds like a strange way to win the 2012 nomination, given that he and Romney have such a similar profile and both appeal to a limited slice of the party base. But it's perfectly consistent with my view that Huntsman is playing for 2016. He needs to use this campaign to raise his name recognition and make himself acceptable to the party base without acquiring a reputation as a flip-flopper. Then, if the nominee loses in the general election, the party might be looking to move to the center enough that Huntsman could become the establishment choice.

A key part of this strategy requires Romney losing the primary. If Romney wins the nomination, Huntsman is in trouble -- Republicans won't want to nominate another mainstream Mormon technocrat in 2016 after having lost with one in 2012. (And obviously, if Romney wins, Huntsman can't run in 2016, either.) Thus dividing up the Romney constituency and knocking him out becomes Huntsman's secondary goal of the campaign cycle.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers