Jonathan Chait's Blog, page 33

July 6, 2011

&c

--Shutdown Minnesota government fires the people who could tell them how shutdown they are

--Stiff upper lip: David Cameron celebrated Christmas season and went horse-riding with embattled tabloid editor Rebekah Brooks.

--Elizabeth Samet untangles Joseph Heller

--David Leonhardt on the business lobby's faux-roundtable on the deficit

--And Jim Sleeper probably isn't a fan of twitter townhalls

Meek Mice Happier After Exercise, But Still Bullied By Billy Zabka Mice

Interesting study on the physiology of exercise:

For the experiment, researchers at the institute gathered two types of male mice. Some were strong and aggressive; the others were less so. The alpha mice got private cages. Male mice in the wild are territorial loners. So when then the punier mice were later slipped into the same cages as the aggressive rodents, separated only by a clear partition, the big mice acted like thugs. They employed every animal intimidation technique and, during daily, five-minute periods when the partition was removed, had to be restrained from harming the smaller mice, which, in the face of such treatment, became predictably twitchy and submissive.

After two weeks of cohabitation, many of these weaker mice were nervous wrecks. When the researchers tested them in a series of stressful situations away from the cages, the mice responded with, as the scientists call it, “anxiety-like behavior.” They froze or ran for dark corners. Everything upset them. “We don’t use words like ‘depressed’ to describe the animals’ condition,” said Michael L. Lehmann, a postdoctoral fellow at the institute and lead author of the study. But in effect, those mice had responded to the repeated stress by becoming depressed.

But that was not true for a subgroup of mice that had been allowed access to running wheels and nifty, explorable tubes in their cages for several weeks before they were housed with the aggressive mice. These mice, although wisely submissive when confronted by the bullies, rallied nicely when away from them. They didn’t freeze or cling to dark spaces in unfamiliar situations. They explored. They appeared to be, Dr. Lehmann said, “stress-resistant.”

The one downer here is that the weak mice continue to submit to the bully mice even after exercising. I'd like to see them re-run the experiment, but with the weak mice exercise regimen accompanied with a peppy soundtrack:

I bet they'd stand up to the bully mice. If that fails, they could try it with the mice being coached by some kind of wise old man using inscrutable training methods.

(For those unfamiliar with the reference to Billy Zabka, see here.)

Obama Again Does Not Rule Out The Constitutional Option

[Guest post by Matthew Zeitlin]

During President Obama’s Twitter Town Hall event this afternoon, he was asked by Twitter user _RenegadeNerd_ “Mr. President, will you issue an executive order to raise the debt ceiling pursuant to section 4 of the 14th amendment?”

In response, Obama said “I don't think we should even get to the constitutional issue.”

What’s important here is that this is the second time that Obama has been asked about the constitutionality of the debt ceiling and refused to give answer one way or another. In his press conference last week, Chuck Todd asked Obama about the constitutionality of the War Powers Act, the debt limit and whether or not “marriage is a civil right.” Obama then discussed Libya, discrimination against gays and said nothing about the debt ceiling.

In light of Senate Democrats talking about the possible unconstitutionality of the debt limit, Nancy Pelosi inviting Bruce Bartlett to a Democratic Steering and Policy Committee Hearing, Secretary Geithner reading from the constitution, and Obama pointedly refusing to rule out the constitutional option, it seems like the Democratic side of the debate is, at the very least, not preemptively excluding the only negotiating stance they can take that compares in strength to the debt ceiling denial we’re seeing among some House Republicans.

When I talked to Garrett Epps for my piece about the debt ceiling, he described the constitutional option as “like when you go to the poker game and put your gun on the table.” At the very least, Obama is not throwing the gun out the window.

Can Michele Bachmann Win New Hampshire?

Of course she can:

When PPP polled New Hampshire in April Michele Bachmann was stuck at 4%. She's gained 14 points over the last three months and now finds herself within single digits of Mitt Romney. Romney continues to lead the way in the state with 25% to 18% for Bachmann, 11% for Sarah Palin, 9% for Ron Paul, 7% for Rick Perry and Herman Cain, 6% for Jon Huntsman and Tim Pawlenty, and 4% for Newt Gingrich.

Now, another recent poll had Romney leading her by a healthier 35%-12% margin. But the general pattern of Bachmann rising in New Hampshire and holding a clear second place seems unmistakable.

Much of the press coverage discounting Bachmann as a candidate, at least beyond Iowa, rests on the assumption that she won't play well outside that state in general, or in New Hampshire specifically. I think this is the same error much of the press corps made during the Democratic primary fight four years before. Throughout 2007, Hillary Clinton held huge national polling leads over Barack Obama. Part of this reflected Clinton's higher name recognition. Another part reflected the fact that many Democrats who hadn't seriously tuned into the race didn't yet take Obama seriously as a candidate. They supported Clinton because Clinton was going to win. But that began to change quickly after Obama won the Iowa Caucus, which provided positive media coverage, and imbued him with the aura of a winner and a plausible nominee. (And to toot my own horn a bit, I was insisting Obama had a strong chance to win for months on end through 2007 when most campaign writers were insisting on describing Clinton as the runaway favorite.)

This dynamic only works if you have the underlying condition of an insurgent candidate who voters who pay close attention are predisposed to like more than the favorite. I think that dynamic probably holds true for Bachmann vis a vis Romney. As Gallup notes, Bachmann's "positive intensity" -- the percentage of voters with strongly positive views of her minus those with strongly negative views -- is ten points higher than Romney's.

Romney benefits from high name recognition and front-runner status. But his vaunted fundraising advantage is far smaller than previously assumed -- he barely made one-third of his first quarter goal. Even before sustaining serious attacks, his favorable ratings in New Hampshire are dropping at rates that ought to terrify his campaign:

Romney's starting to show some signs of weakness in New Hampshire. His support is down 12 points from 37% on the iteration of our April poll that didn't include Mike Huckabee or Donald Trump. His favorability numbers are headed in the wrong direction as well. He's dropped a net 18 points from +49 at 68/19 to +31 at 60/29. He's certainly still the front runner in the state but he's not looking as inevitable as he did a few months ago.

Many reporters have noted that a one-on-one matchup between Romney and Bachmann is Romney's dream scenario. That's true -- it's his best chance to have the establishment rally behind him. I haven't seen them mention that it's also Bachmann's dream scenario -- she gets to face off against an establishment candidate totally unacceptable to large segments of the party base.

Now, the far greater danger to Bachmann is that she faces off against somebody other than Romney -- say, Rick Perry, or possibly even Paul Ryan -- who can appeal to right-wingers and party elites as well. A Perry run seems highly likely and could easily reorder the race. At the same time, he might not run, or he might flop. Meanwhile, the assumption that Bachmann will fizzle out after Iowa seems far, far too pat.

JONATHAN CHAIT >>

An Honest Question For Conservatives On A Confusing Point Of Conservative Doctrine

I disagree with most tenets of conservative thought, but even those I consider demonstrably false or even morally bankrupt I feel I understand. Conservatives oppose subsidizing health insurance because they consider health care a matter of personal responsibility, or just deem covering the uninsured a very low fiscal priority. They think climate change is overblown, or completely fake, or possibly real but not worth the cost of addressing. Etc.

But there's one aspect of conservatism I simply don't understand, which is its approach to many forms of government spending. Conservatives believe, in general, that many forms of government spending are wasteful, a belief shared by large segments of the public. This I understand. the problem is that when conservatives come into contact with actually existing budgets, they wind up implementing some pretty horrific policies -- not merely horrific to liberals, but horrific to (at least my understanding of) most conservative's priorities.

For instance, conservative Republicans in Congress are slashing the transportation budget:

The next flash point in the debate over the nation’s will to live within its means may emerge this week as House Republicans present a long-term transportation bill expected to cut funding for highways and mass transit by almost one third. ...

“According to numerous experts, including the American Society of Civil Engineers, the U.S. needs to invest an additional $1 trillion beyond current levels in the next 10 years just to maintain a state of good repair and meet demand,” the letter said.

Two major studies in the past year have urged increased spending to revitalize the nation’s aging infrastructure. The Urban Land Institute concluded that the United States needed to invest $2 trillion to rebuild roads, bridges, water lines, sewage systems and dams that are reaching the end of their planned life cycles.

Without that investment, the institute warned that the United States would fall dramatically behind much of the world in providing transportation networks needed to remain competitive in the global marketplace.

That report buttressed the findings last fall by a panel of 80 experts led by former transportation secretaries Norman Y. Mineta and Samuel K. Skinner. The panel concluded that as much as $262 billion a year must be spent on U.S. highways, rail networks and air transportation systems.

So all the major experts conclude the transportation infrastructure requires a major funding increase in order to maintain economic competitiveness, but the Republicans instead plan to pass a huge funding cut. Again, that in and of itself does not shock me. There is no shortage of policy areas where the conservative movement takes a position dramatically at odds with the academic/expert consensus. What's confusing to me here is that I don't know what the conservative movement position is. Do they think we're overinvested in infrastructure? That if we reduce government involvement, the private sector will step in? Or that the economic benefits of maintaining our physical infrastructure -- or, more realistically, falling behind at a slower pace -- are simply smaller than the economic benefits of keeping taxes low?

Likewise, state and municipal budgets starved of revenue have slashed funding for extended learning time:

After several years of state and local budget cuts, thousands of school districts across the nation are gutting summer-school programs, cramming classes into four-day weeks or lopping days off the school year, even though virtually everyone involved in education agrees that American students need more instruction time.

Now, this isn't always a direct conservative policy initiative -- many of these cuts are imposed by Democratic-controlled governments. But it is a policy initiative directly created by conservative policies, which have staunchly opposed any federal aid to state and local governments, or any tax increases at the state level, to prevent cuts like this. Again, I'd like to understand the conservative position here. Do they contest the extensive evidence showing that extended learning time is a highly efficient intervention? Do they agree it's highly efficient but think it's simply less efficient than the economic benefits of low taxes?

There are many instances of these cuts going on. The domestic discretionary budget has been constant over the last decade:

Republicans are seeking to implement very large cuts in the domestic discretionary budget category while minimizing defense cuts and fighting tax increases to the death. The House GOP Budget proposes to, over time, virtually zero out all funding for domestic discretionary spending, which obviously even Republicans would never actually implement, but it does signal the movement's disposition toward this category. I'd dismiss it as a simple failure to understand these programs in any detail. But we're already at the point of implementing just the beginning steps of this vision, and it entails things like a one-third cut in the federal transportation budget. I'd really like a conservative to explain the movement's analysis of this. Libertarians, of course, are free to jump in, too.

JONATHAN CHAIT >>

You Wouldn't Like Obama When He's Not Angry

As Brendan Nyhan notes, one of the great journalistic tropes is demanding that public figures use stronger adjectives to describe their position. It's an odd mission. Here's Jake Tapper interviewing Jay Carney:

TAPPER: Can the acting head of the BATF be permitted to go to Capitol Hill to testify? My understanding is that the -- that he's not been allowed by the administration to go there and explain what's going on.

CARNEY: I'll have to refer you to Justice on that. I'm not -- I don't have any information on that.

TAPPER: It's not something that you guys are worried about and incensed about? This is something that ---

CARNEY: Well, Jake, I think it's being investigated for a reason. And obviously, it's a matter of concern, and that's why there's an investigation. But it would be a mistake for me to comment further on -- or to characterize further what happened or -- you know, how -- to rate our unhappiness about it from here. So I think that I have to refer you to the Justice Department for that.

TAPPER: It -- lastly, I mean, we have heard at times, you know, when the president was upset about something -- "plug the damn hole" is one such anecdote that was shared exclusively with every single person in this room by the White House. Did you -- is this president upset about this? I mean, this is a government operation where now weapons -- I mean, the Mexicans are upset that guns are now turning up --

CARNEY: I think you could assume that the president takes this very seriously.

But is he fuming? Infuriated? Enraged? Careening around the Oval Office on a berserk rampage, hurling furniture through windows and pummeling helpless staffers until the secret service wrestles him to the ground and sedates him with a bear tranquilizer?

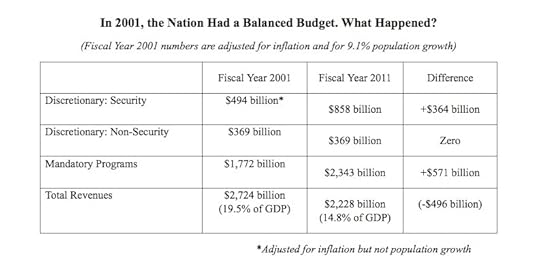

When Conservatives Loved Keynes

While researching an item from earlier this morning -- yes, I do research, I just try to avoid talking to people -- I came across a fascinating exchange about the concept of economic stimulus. In 2001, the economy was undergoing a mild slowdown. Liberals generally argued that the scale of the problem was small enough for the Federal Reserve to handle with monetary policy, and didn't require a Keynesian fiscal stimulus. Conservatives took the opposite position. Here's a great exchange at a 2001 hearing in Congress between Paul Ryan, AEI economist Kevin Hassett, and Bob Greenstein of the Center on Budget and Policy Priorities:

Mr. GREENSTEIN. If I could just comment on it. As I have said before, I think the economic benefits are being overstated. The economy has slowed right now. I don't see how, particularly given the pace of the Senate, the checks are going to go out much before next summer. The CBO forecast you are operating on shows that by 2002 we have a full scale recovery from the recession.

I think we do have a problem right now, and our best mechanism right now is interest rates. I hope the Federal Reserve lowers them further. I think that is going to have a much bigger effect than anything you do on taxes because I don't think -- it is not that tax policy can't have a stimulative effect. It is very unlikely even this year to occur in time to make much difference.

Dr. HASSETT. I would just like to add, Mr. Ryan, that the economists who studied this were quite surprised to find that fiscal policy in recessions was reasonably effective. It is just that folks tried a first punch that was too light and that generally we didn't get big measures until well into the recession. So the reason that in the past fiscal policy hasn't pushed us out of recession is that we delayed.

So I think that Mr. Greenstein agrees, and he is saying it is not likely that we would pass it soon but I would argue this is why we should.

Mr. RYAN. That is precisely my point. That is why I like my porridge hot. I think we ought to have this income tax cut fast, deeper, retroactive to January 1st, to make sure we get a good punch into the economy, juice the economy to make sure that we can avoid a hard landing.

The concern I have around here is that everybody is talking about let's wait and see, let's see if they materialize. Well, $1.5 trillion have already materialized in the surplus since then-Governor Bush proposed this tax cut in the first place. The economy has soured. The growth of the projections of the surpluses are higher. So we have waited and we do see, and it is my concern that if we keep waiting and seeing we won't give the economy the boost it needs right now.

Greenstein is taking the sensible position that the 2001 recession seems mild enough that Keynesian tax cuts will not be needed -- by the time their stimulative effect kicks in, the economy should be growing again. Hassett, the conservative, replies that Keynesian fiscal policy during recessions works, and the only problem is that it's usually too small. And Ryan agrees!

Ryan and Hassett, of course, fiercely opposed the concept of fiscal stimulus in 2009. I don't see how you can explain progressing from that position to opposing Keynesian stimulus during a severe liquidity trap, the worst economic crisis since the depression, except as a function of pure partisanship.

What Does John Boehner Really Want?

Katrina vanden Heuvel argues that President Obama should immediately commit, in public, to invoking the 14th Amendment prohibition against defaulting on the debt in the case of any failure to lift the debt ceiling. Matthew Yglesias seconds her, on the grounds that Obama needs leverage to force Republicans to accept a deal:

Ultimately, to get a bargain there has to be some reason to prefer a bargain to not having a bargain. The White House would clearly prefer a deal on the long-term deficit to trying to invoke a novel constitutional doctrine. But it seems like House Republicans might also plausibly prefer a deal to watching the president invoke said doctrine. In that case, you get a deal. But absent some kind of viable White House “Plan B,” then it’s difficult for the House GOP to agree to anything.

Hmm, I'm not so sure about that. For the hard core default denialists among the House GOP caucus, there's no reason at all to want a deal. The baseline is that we don't lift the debt ceiling and therefore immediately have a balanced budget entirely through spending cuts. Any deal simply increases the size of government from that baseline.

Obviously, the House leadership does not agree with that analysis. The leadership understands that failing to lift the debt ceiling would have horrific consequences. But they also don't want to cross the base, and they don't want to have to round up a lot of their members and force them to cast a vote that could end their career via right-wing primary challenge.

If you're John Boehner, it's going to be very hard to navigate this issue without infuriating either your voting base or your financial base. You want this issue to go away. In that sense, the 14th Amendment solution might be your best outcome. Indeed, Boehner's ideal scenario may be if Obama came out for the 14th Amendment solution and it passes legal muster, allowing him to avoid any ideological compromise while assuring business leaders that Obama will prevent any of the consequences of his position.

Granted, the Constitutional Option would deny Boehner the chance to wring concessions on spending from Obama. But are those concessions worth risking his own job and the jobs of many of his members? I doubt it. Besides, Boehner could always cut a budget deal with Obama outside the debt ceiling context.

JONATHAN CHAIT >>

Counting Jobs

The Weekly Standard calculated that the 2009 economic stimulus cost $278,000 per job, a talking point picked up by Republicans in Congress. The figure relies upon some pretty poor math, reports Jake Tapper:

The Weekly Standard arrived at its figure by dividing the cost to date of the stimulus bill, $666 billion, by the low end of the estimate of how many jobs the Council of Economic Advisers reported had been created by the legislation, 2.4 million.

The Council of Economic Advisers report, issued last Friday, states that in the first quarter of 2011, the stimulus bill “has raised employment relative to what it otherwise would have been by between 2.4 and 3.6 million.”

The White House has long disputed the math of dividing the cost of the stimulus by the number of jobs created – we asked a similar question back in October 2009, when that computation resulted in the comparable bargain of $72,408 per stimulus job, as you can read at this blog post.

Then, as now, White House officials note that the spending didn't just fund salaries, it also went to the actual costs of building things -- construction materials, new factories, and such. So the math is flawed, White House officials say, since reporters are not including the permanent infrastructure in the computation, thus producing an inflated figure. White House officials also questioned why the Weekly Standard would use the lower figure from the projection of the number of jobs created, and noted that the temporary nature of the stimulus bill meant that its impact would diminish over time, when the private sector began hiring again. In other words, the number of jobs created at its peak – as many as 3.6 million, according to the Congressional Budget Office’s May 2011 report – would be more appropriate, White House officials say.

Fourth Branch takes the Standard approach and applies it to the Bush tax cuts:

[T]he Bush tax cuts passed in 2001 were estimated by the Joint Committee on Taxation to cost about $864.2 billion from 2001-2008 (the first year of the Bush tax cuts through the last year of his presidency). During that period, according to the Wall Street Journal, 2,625,000 jobs were created. That comes out to a total cost of $329,220 per job under the Bush tax cuts. And that’s if we assume that every single job which was created during Bush’s presidency was attributable to the Bush tax cuts (pretty unlikely) AND if we exclude the costs of the 2003 tax cut (estimated to cost another $350 billion over 10 years). We could have written a check for $100,000 to each person who “allegedly” had their job created by the Bush tax cuts and saved $600 billion, but they wouldn’t have received it because the check was instead delivered to really wealthy people.

My point isn’t that the Obama stimulus was good because the Bush tax cuts were bad. Instead, my point is that the math employed by The Weekly Standard is absurd. This example highlights the absurdity.

That calculation seems far too friendly to the Bush tax cuts. The Bush tax cuts were enacted at the beginning of an economic expansion, so crediting them with every job created -- i.e., to assume that in their absence zero jobs would have been created -- lacks any credence. Still, it does show that even by the standard's silly the math, the Bush tax cuts were a massive failure.

Paul Ryan's Gibberish

[image error]Paul Ryan appeared on the Laura Ingraham show, and for my sins I listened. Obviously, the whole interview was pitched at a rock-bottom intellectual level, but this bit of doggerel especially stood out:

We're not gonna go down this path of taxing people. Look, if we thought tax increases would have worked, which we don't, then we'd be growing our economy already. Raising taxes on anybody in a weak economy like this number one, it doesn't work. But more importantly it takes the pressure off the real problem which is overspending.

Leave aside the fanatical assertions that any budget solution must be 100% on Republican terms, and the completely nonsensical embrace of Keynesianism as applied to tax policy as opposed to spending. (Any theory that asserts that it's especially bad to raise taxes during a weak economy also says it's bad to cut spending during a weak economy; likewise, any theory that focuses on the importance of long-term marginal makes no account of the state of the business cycle. Ryan mashes together two different theories incoherently.)

Let's focus on the boldfaced sentence. Ryan asserts that if tax increases worked, we'd be in a recovery already. I'm trying to figure out how many ways in which this is wrong. It's a lot of ways. First, we are in a recovery. It's a slow recovery from a deep financial crisis.

Second, we haven't imposed any tax hikes. The Bush tax cuts are fully in effect. If it were fair to conclude that any policy currently in effect must have failed because the economy is growing too slowly -- and it's not fair -- then that logic would be an indictment of Ryan's tax policy, not President Obama's.

Third, of course, it's not really fair to indict a set of policies by pointing to the after-effects of a financial crisis for which the policies have no relation. So if Obama had raised taxes in 2009, holding them responsible for slow growth since then would still be at best a wild exaggeration. (At least, though, it would make sense on its own terms, unlike Ryan's claim that something Obama has not done is responsible for the economy.)

And fourth, we do have an actual experiment with raising tax rates on the highest income. President Clinton did it in 1993. Paul Ryan wasn't in Congress yet, but he was working for his mentor, Jack Kemp, who predicted that raising taxes on the rich would reduce tax revenue, reduce the wealthy's share of the tax burden, and decrease growth. He was proven spectacularly wrong. In 2001, Ryan predicted the Bush tax cuts would increase economic growth and allow the government to pay off the entire national debt, and was again proven spectacularly wrong. Ryan can cling to his supply-side faith, but he certainly shouldn't be arguing on the basis of what recent events have proven.

Jonathan Chait's Blog

- Jonathan Chait's profile

- 35 followers