Harlan Vaughn's Blog, page 49

July 30, 2016

NYC-BRU J Award Seats on Brussels Open May & June 2017 – Book With Citi ThankYou Points!

I just so happened to be casually looking for JFK-BRU Business Class award space on Brussels Airlines because that’s what Saturday mornings are for, right?

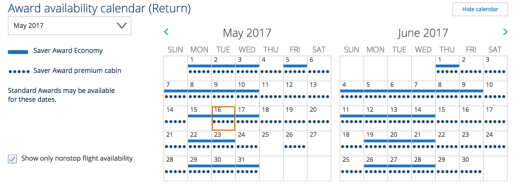

Space is open nearly every day in May and June 2017 in Business Class to AND from Brussels

I was able to find a Business Class award seat on the JFK or EWR to BRU route nearly every day in May and June 2017 (with a few dates in March and April, too).

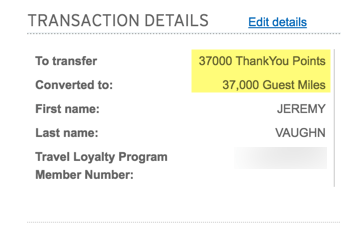

The reason I’ve had my eye on this award is because Citi ThankYou points transfer 1:1 to Etihad Guest miles. And Etihad has a very generous award chart on this particular route.

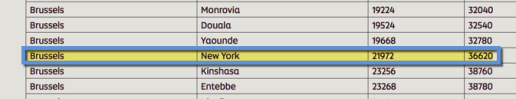

37K round-trip in Business Class? Yes, plz!

A round-trip ticket in Business Class costs just 36,620 Etihad Guest miles. Of course, you have to transfer in increments of 1,000, so realistically this will cost 37,000 Citi ThankYou points. Which is a steal.

Look for SAVER award space

United would charge 70K miles each way, or 140,000 miles, round-trip. So you’ll save a huge number of points by booking through Etihad instead.

How to find the space

Link: Etihad’s Brussels Airlines award table

You find the space by searching on united.com.

Enter “NYC” into the search field to return flights from both EWR and JFK. And then tick “Show only nonstop flight availability” – that isolates the Brussels space nicely.

I do not know if the EWR-BRU route is available at the same price as the JFK-BRU route. They’re both considered “New York” so I don’t see why not. But YMMV.

MileValue also has a nice primer – with plenty of caution added – about how to find and book this space.

Apparently, seats are hard to book with Etihad agents. And there’s a lot of phantom space that appears.

Nonetheless, peeps have had luck booking a seat. You might need some persistence. To save 100K+ miles on a round-trip Business Class seat to Europe is worth it. And here’s a FlyerTalk thread with some experiences.

I’m going all-in

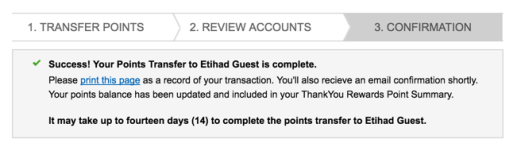

I don’t know how long this space will last. And it can take up to 2 weeks for Citi ThankYou points to transfer to Etihad. In practice, it usually takes about 5 to 6 business days.

BOOM

Brussels, here I come?

I want to take this risk because I have tons of Citi ThankYou points and they are dead easy for me to rack up. So taking a 37K risk isn’t so bad.

I haven’t seen this much award space on these routes in the past, so hopefully some dates will still be available when the transfer completes. I’ll keep you posted if I’m successful.

In the meantime, if you’re feeling froggy, this could be a potentially good opportunity to snag a cheap ticket to Europe. Keep in mind taxes on this route are about ~$94.

Don’t stop at Brussels

If this all works, you can easily use British Airways Avios points, budget airlines, and trains to cobble together an even bigger trip.

Why stop now?

Brussels has a fantastic location near London, Paris, Berlin, Amsterdam, and Prague. I’d love to take the train to Amsterdam. And I’ve been dying to visit Prague.

Oh, the places you’ll go!

Richard Kerr also shared some insights about booking via Etihad for an ANA award.

It seems possible. Again, with some persistence.

Bottom line

I’m not looking forward to the booking process with Etihad. Or waiting for the Citi ThankYou points to transfer. But if this works out, it could be pretty fun.

I’d love to say I snagged a seat on this route – and there are lots of them available in Spring/Summer 2017. Hopefully they’ll still be around when the miles appear. And I can book it without too much hassle.

I’m ready to be flexible with my dates. And you should be too, because there are reports that Etihad doesn’t “see” the same award space that United sees. But there seem to be plenty of seats available, so I’m taking the risk.

So it begins – I’ll be updating about my experience. Fingers crossed.

Please share if you’ve had an experience booking this award. Or booking a partner flight with Etihad!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

July 28, 2016

Should You Use a 0% APR Card to Pay Off Debt?

Also see:

Smart Debt: Is carrying a balance ever a good idea?

Getting FIREd Up

NOTE: The card APRs in this post are current at the time of writing (July 28th, 2016). Be sure to check the offers for more details.

So here’s an idea I’ve been tossing around.

It absolutely burns me up that I’m still dealing with student loan debt. And it should. Mr. Money Mustache said it best:

YOUR DEBT IS NOT SOMETHING YOU “WORK ON”. IT IS A HUGE, FLAMING EMERGENCY!!!

I’ve put off paying down this debt because there have been other opportunities to earn more: I bought a house, maxed out my IRA, started Airbnbs, and now I’m looking at buying a duplex in the DFW area.

All of these things either appreciate or earn more than the interest I pay on my student loans.

But I’ll be damned if carrying that balance doesn’t give me a red rump.

The idea

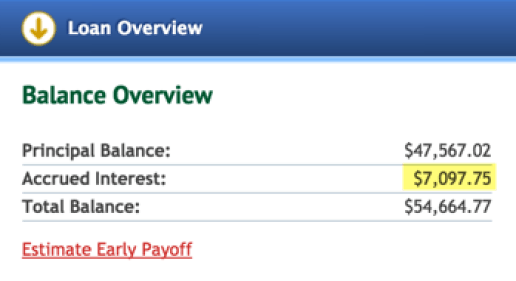

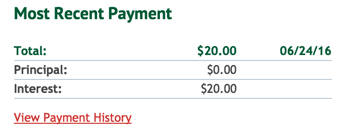

The thing I hate most is 100% of my payments go directly to interest right now.

I’d have to make ~$7,000 in payments before I can touch the principal

I currently owe ~$54K in student loans. The amount is what it is. I was a 17-year-old kid signing a promissory note to go to college. I could bitch about it, but it’s pointless now.

I think of all I could do with that money – travel, put a down payment on an investment property, throw it into my 401(k), or pay down my mortgage. It’s exactly that thought that’s kept me from beginning the repayment journey.

Ughhhh

I recently made a $1,000 payment. Not a cent of it touched the principal.

Fact is, I’d have to make ~$7,000 in payments before I can even begin to touch it.

It feels like saving a grain of sand from the beach. Spitting on a fire. You get the idea.

But, what if I could use a card with a long 0% APR period on purchases to

Pay all the interest

Work on paying down the principal in full

Then pay off the interest that’s been sitting fee-free on a credit card?

Could it give me a boost toward slaying this dragon of dragons?

0% APR cards

Link: View Additional 0% APR offers here

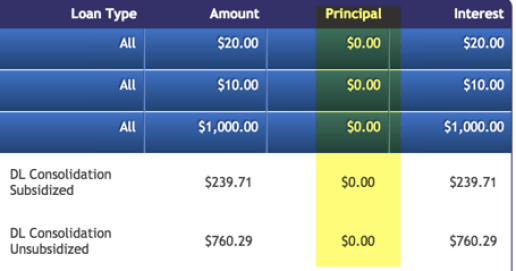

A couple of cards, like the Citi Simplicity and Citi Diamond Preferred, give you a stunning 21-month period with 0% APR on purchases.

That would be plenty of time to get ahead

That means you can make a purchase in August 2016 – and not have to repay it until February 2018.

That would give me plenty of time to take a broad swipe at my student loan debt.

Other card on the list may surprise you:

Chase Freedom – 15 months with 0% APR and $150 sign-up bonus (Visa)

Chase Freedom Unlimited– 15 months with 0% APR and $150 sign-up bonus (Visa)

US Bank Platinum – 15 months with 0% APR (Visa)

Amex EveryDay Preferred – 12 months with o% APR and 15,000 Amex Membership Rewards points sign-up bonus (Amex)

Amex Blue Cash EveryDay – 12 months with 0% APR and $100 sign-up bonus (Amex)

Capital One Venture – 12 months with 0% APR and $200 sign-up bonus (MasterCard)

MLB BankAmericard Cash Rewards – 12 months with 0% APR and $100 sign-up bonus (MasterCard)

Discover It – 12 months of 0% APR and $100 sign-up bonus (for new cardmembers) (Discover)

If the card you want to see isn’t linked in the text above, you can find it here:

View Additional 0% APR offers here

And there are many more here, too:

0% on Purchases

Which card to pick? (How to turn a payment into a purchase)

Link: Plastiq

I’ve written about how to make rent, mortgage, and student loan payments with Plastiq. Payments generally show up as a purchase. But be sure to set your cash advance limit to $0 to prevent paying nasty cash advance fees.

You can use Plastiq to pay nearly any bill. You’ll pay a 2% fee with a MasterCard. Or a 2.5% fee with an Amex or Visa card.

Fees with Amex and Visa are 2.5%, and 2% with MasterCard

In my case, I’m thinking of going for the Citi Diamond Preferred card to get a long 21-month 0% APR period. It’s a MasterCard, so I’d pay $140 to make a $7,000 payment (at 2% fee).

Or, it would cost $175 with an Amex or Visa (at 2.5%).

This is the part where you’ll need to run your own numbers to make sure this makes sense.

For example, the Capital One Venture card has a 12-month 0% APR period and a $200 sign-up bonus – totally wiping out the fee and giving me a solid year to pay the cost back.

But, I’d rather have 21 months than 12 months with the Citi Diamond Preferred. And I’m willing to pay a little more to get it.

You might also have better relationships with certain banks. Have a lot of Chase cards (or opened lots of cards in the past couple of years)? Avoid Chase. Never had a US Bank card but have great credit? Try them.

Like the Amex Blue Cash EveryDay bonus categories and think you’ll keep the card long-term? Go for it.

As always, do what’s best for your situation.

The numbers

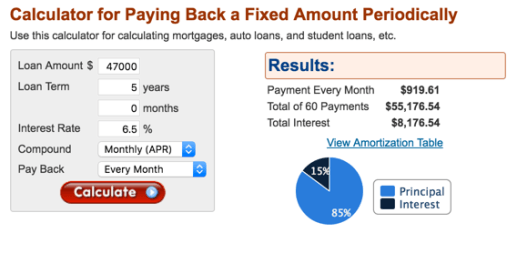

Link: Loan Calculator

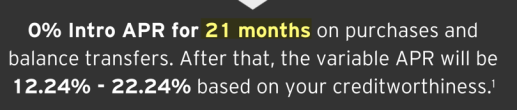

Quite simply, this is the power of compound interest. It’s amazing when it works for you. And can be devastating when it works against you.

~$48K in interest alone over the next 25 years

Now, if I make a payment every month for the next 25 years for the loan as it is now, I’ll end up paying double – the original $47K and $48K more in pure interest. Typing that gave me a full-body shake.

Or, I can pay it back in 5 years with ~$900 a month. And pay much less interest

If I commit to throwing ~$900 a month into the loan – with the current interest erased – it’ll be gone in ~5 years.

Again, that’s $900 a month I can’t use to pay down my mortgage, or to save, or invest. But it does mean I’ll avoid paying ~$40,000 in pure interest. That’s a more palatable way to think of it.

If I committed to putting all of my Airbnb income into it, it could disappear in a year. Somewhere in the middle, which is more realistic, is 2 to 3 years to fully pay this off.

Using a 0% APR card to pay the beginning ~$7K of pure interest would allow me to get right to work knocking this out.

Risk Vs. Reward

You can find cards with pretty long APR periods.

But at the end of the intro APR, you’ll be in a situation where you’ll have to pay off the card to avoid paying even more interest. That could temporarily stagnate the progress you’ve made.

On the other hand, you get a huge leg up into cutting right in to your principal, which will save you serious money down the road.

You are also at the mercy of your credit limit (and even getting approved). If you want to pay a $10,000 payment and your limit is only $2,000, well… you’re out of luck.

You may decide to pay Plastiq’s fee to pay a bill… just make sure your savings and/or sign-up bonus far outweigh that cost. What’s “far outweigh?” That’s hard to answer.

In my case, I’ll save $40,000 long-term by digging into my principal right away (see calculations above). I’d say that far outweighs Plastiq’s $140 fee. Again, run the numbers and make sure it’s worth it for you.

Your debtor might also accept credit cards directly without fees – that would be even better.

Caution, please

Don’t swap one debt for another.

Make no mistake: credit cards are financial tools. So you’ll need the mindset and temperament to handle your credit responsibly and re-pay your debts. Once you’re past the 0% APR period, well, you’re right back where you started – and perhaps even worse off.

Credit card companies are not in business to give you long-term fee-free loans. They’re hoping you’ll slip up and pay them interest. So don’t. Take the free loan. Just be careful.

A hammer is a tool, too. You can use it to build a house. Or you can slip and hit your thumb. With hammers and credit cards, be careful.

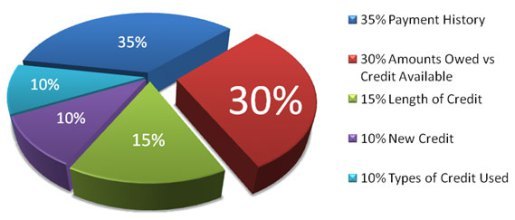

You’ll take a hit… but get a bump. The effect could be net-net

Also, if you get a new card with say, a $10,000 limit and you turn around and make a $10,000 payment, guess what? You’ve just maxed out your card.

Creditors do NOT like to see you using too much available credit on any one card – that sends a warning signal to them and could prevent you from getting more cards.

On the other hand, paying off a big debt (like a student loan) could dramatically improve your credit score. So the effects could cancel one another out.

If you have multiple cards with one bank, see if they’ll let you shift some credit around so you aren’t maxing out a single card.

And consider the risk vs. the reward long-term. Would you max out a card for a year to save a lot of interest on an outstanding debt? (I know I would.)

Again, I must stress how careful you must be here. Play your “cards” right and you could come out way ahead. But mess up, and you could reverse all your progress. Sorry to sound like a nag, but it’s worth repeating.

Bottom line

I think I’m gonna do it. Get a 0% APR card to take off my current student loan interest. Then pay off the loan like a maniac, and circle back around to pay off the card shortly before the APR intro period expires. And save a ton of money in interest payments. It’s all part of my journey toward FIRE.

In my estimation, this will put me right at the core of paying down my principal and shave years off the life of my loan.

I won’t earn a sign-up bonus on the Citi Diamond Preferred card, but saving thousands in interest long-term is worth more to me than any sign-up bonus ever could be.

I’ll use Plastiq to set up the payments and give myself a solid 18 months of consistent payments.

I haven’t considered this route before but it looks to be a quick way to cut right to the heart of the matter by giving myself a fee-free loan and a huge head start. It could work not only for student loans, but for nearly any big debt.

My biggest word of advice is to carefully watch the clock on that APR period. I have no intention of ever paying a dime of interest to any bank. And it’s that mentality that’ll let me use a credit card to avoid paying more of it on my student loan, too. Use it like a tool.

Here’s where to find all of the cards I’ve mentioned in this post:

View Additional 0% APR offers here

0% on Purchases

Run the numbers, pick the right one, and start slicing away debt.

Have you used a credit card to pay down a large debt? Any words of advice you want to add?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

July 21, 2016

New Changes to Citi Prestige, Complete With Typo of Points Worth 2 Cents Each for AA Flights

Also see:

Is Citi Planning Changes to the Prestige Card?

10,000 Citi ThankYou points for catching a site error

Update: The old 50K offer is still available! I’d apply sooner rather than later if you want it. It also says you’ll get AA lounge access still.

Update: Peeps on Reddit are reporting the 2 cent valuation, too. Who knows if Citi will honor this – it does seem like a careless typo after all, which is honestly inexcusable for a bank of their size.

Welp, the dreaded changes to Citi Prestige are in:

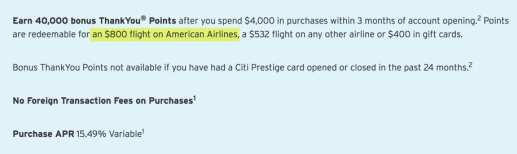

40,000 Citi ThankYou points as a sign-up bonus

Minimum spending increased to $4,000 in 3 months

Dropping American Airlines Admirals Club access (but here’s an easy way to get in anyway)

No changes to 2X dining category (or any other bonus categories)

I’m guessing they had to axe the AA lounge access because of upcoming arrangements between Citi and Barclays with AA cards. That is fine. They could’ve been much worse.

Citi being Citi?

Link: Airline and Frequent Flyer Credit Cards

All-in-all, the changes aren’t worth dumping the card over. And furthermore, it’s still a decent sign-up bonus if you’ll use the other unique benefits, like:

4th night free on any hotel stay (I’ve already saved over $2,000 since I picked up the card in November 2015)

Annual $250 airline credit to use on any airline, even for airfare

Priority Pass Select membership with 2 free guests (like the Sala VIP Miro Lounge @ BCN or Air France Lounge @ JFK)

3X bonus category for airfare and hotel stays

These benefits are completely unique to this card – and they’re a huge reason why it’s perhaps my favorite credit card right now.

Here’s the link to apply for card offers if you wanna pick up this card (or any others).

Changes aren’t so bad, but take a closer look

Here’s where they start to lose me a little bit.

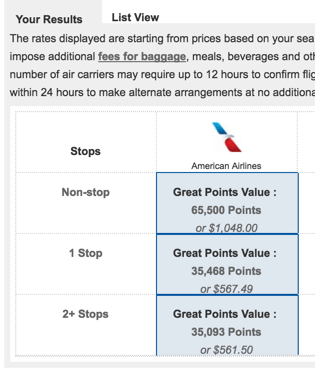

On the application page, they say 40,000 Citi ThankYou points are worth $800 toward flights on American Airlines. Which would mean Citi ThankYou points are worth 2 cents each when redeemed this way.

As of now, each Citi ThankYou point earned as (or combined with) Citi Prestige points are worth 1.6 cents toward AA flights. And in my opinion, a higher rate would not only offset the loss of lounge access, but also be a real game-changer and directly compete with 2% cashback cards, which would be wild.

Still cashing out at 1.6 cents each on ThankYou.com

I did a quick test flight search to see what would come up. And it’s still showing as 1.6 cents each.

And we all know Citi has a propensity for site typos.

But who knows – it’s on the official page. And they’ve added the “$532 flight” language which I haven’t seen before (because each Citi ThankYou point is worth 1.33 cents each on other airlines). So they obviously tweaked it and chose to leave $800 for American Airlines.

It’s worth noting that 50,000 Citi ThankYou points – the previous sign-up bonus – was worth $800 worth American Airlines flights at a 1.6 cent valuation. 40,000 Citi ThankYou points at 1.6 cents each is worth $640 for American Airlines flights.

So, case of bad copy/paste or new benefit/positive change?

My gut tells me the former, but my hopes obviously prefer the latter.

Oooh, pretty

It’s also worth noting the ThankYou.com front page got a refresh – but the back end looks the same. So it’s anyone’s guess if they’re rolling out site changes or what’s going on. With Citi, ya just never know.

Bottom line

Are the changes to Citi Prestige major? Not really. Citi Prestige is still an amazing card, offers a ton of value, and has a respectable sign-up bonus ($640 worth of points is nothing to sniff at).

Is it as good as before? Well, no. But it could’ve also been a lot worse.

Again, here’s an easy way to regain Admirals Club lounge access.

A change I found as a typo (?) is 40,000 Citi ThankYou points are worth $800 – 2 cents each – toward American Airlines flights. I have a feeling that ain’t right, as typos are common for Citi during refreshes – but hot damn if that wouldn’t be amazing.

The ThankYou.com front page got a new look, so who knows. I’m putting my money on another site error – but if it turns out to be real, wouldn’t that be a cool perk to add?

What do you think – typo or real update? If it proves to be real, would that change things in your opinion?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

July 12, 2016

Free Food! Get $20 Toward Your First Meal With UberEATS

Sharing this easy, easy win.

Easy

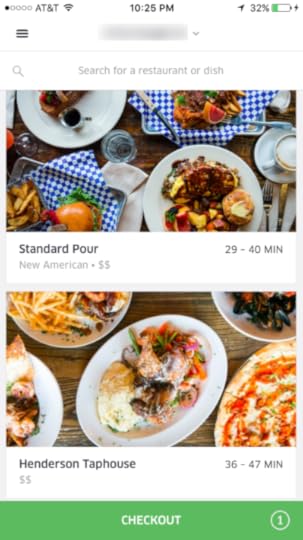

If you’re in a city where UberEATS participates (and there are many – full list below), you can get $20 off your first order when you use an existing user’s promo code after you download the app for iOS or Android.

It only takes a few minutes and you can seriously get a free meal out of it. I’ll show you how easy it is. Rarely are wins this effortless.

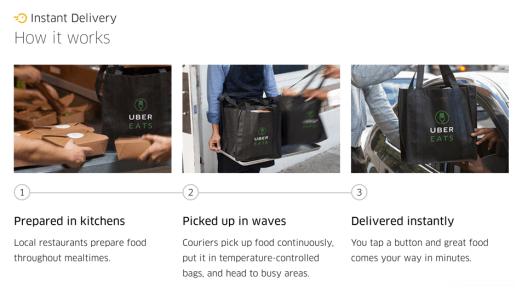

What’s UberEATS?

Link: UberEATS

Uber partners with restaurants in major cities all around the US and Canada (and London and Singapore):

Atlanta

Austin

Brooklyn

Chicago

Dallas

Edmonton

Houston

London

Los Angeles

Melbourne

Miami

New York

Ottawa

Paris

Phoenix

San Diego

San Francisco

San Francisco – East Bay

Seattle

Singapore

Toronto

Washington, D.C.

An Uber driver will deliver the restaurant’s food to you after you order via the app. To make it interesting, they rotate the selection every so often, so there’s always something new to try.

Come to meeee

You can only order through the UberEATS app (not on the website) – so you need a smartphone to access the service (and live in a participating city).

Free food!

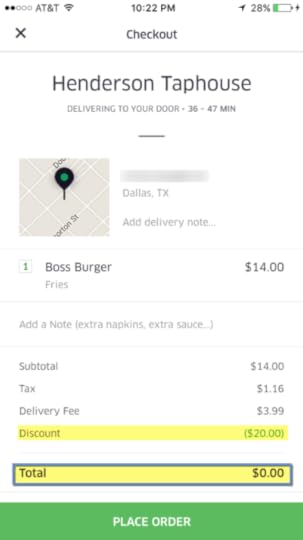

Now for the fun part. You can get $20 off your first order with no minimum – and you can use it toward the $3.99 delivery fee.

After downloading the app, click the “Promotions” tab and enter an existing user’s promo code. Mine is “eats-rfufr” if you want to use it. This will give you $20 to use toward your first order. You should see a confirmation message pop up.

(Full disclosure: I get $20 when you make your first order, if you use my code.)

Enter in the promo code under the “Promotions” tab

Now you’re ready to start browsing the food options.

OM NOM NOM

Select whatever you want. Remember, you have $20 to spend.

I added a burger and fries to my cart. Mmmm, burger and friiiies.

That’s a nice price

You can use the $20 toward the food price, tax, and $3.99 delivery fee. So in my case, the $14 burger and fries ends up being completely free.

Once you find something you wanna gobble, hit “Place Order” and get ready to chow down.

You can share your own promo code with others, too. Then they can get free food and so can you.

Bottom line

This should make for some nice lunch breaks this week.

I do not know if this promotion is in limited quantities, or if it has an expiration date.

So if you’re interested, I’d go ahead and download the UberEATS app and apply a promotion code sooner rather than later. As a reminder, my code is “eats-rfufr” – that’ll give you $20 to spend on food if you wanna use it. And you can apply it toward taxes and the delivery fee, too.

I’m also not sure how an actual purchase from UberEATS will code (as travel or as a restaurant, but I’m assuming travel). Best bet is to use a card that has both as a bonus category (Chase Sapphire Preferred or Citi ThankYou Premier).

Share with your inner circle to keep the free food coming in.

Remember to tip though!

Have you had an experience with UberEATS?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Citi AT&T Access More Card Earns 3X for Student Loan Payments on Plastiq

Also see:

Earn Points for Rent and Mortgage Payments With Plastiq (2% Fee With MasterCards)

Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

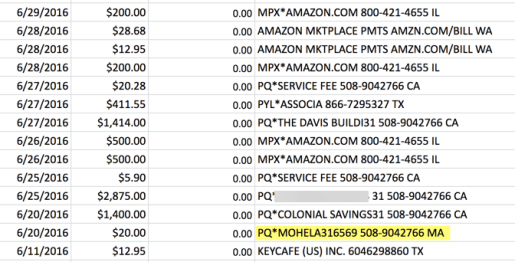

I made a test payment to my student loan company through Plastiq and earned 3X Citi ThankYou points with the Citi AT&T Access More card.

I’ve written how easy it is to boost your ThankYou points balance by paying rent and mortgages via Plastiq with that card.

Literally the devil

And now, there’s another way to earn Citi ThankYou points if you need to make student loan payments.

About Plastiq + Citi AT&T Access More

Link: Plastiq

Link: Citi AT&T Access More card

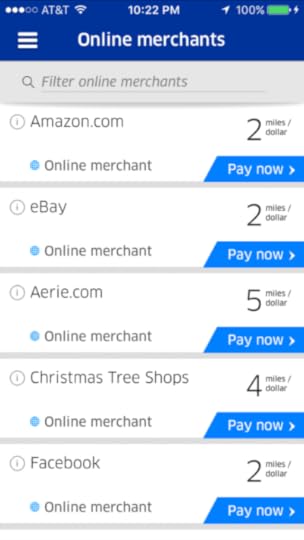

The Citi AT&T Access More card earns 3X Citi ThankYou points on AT&T purchases, travel, and online purchases. And 1X everywhere else. The card has a $95 annual fee.

The “online purchases” category is broad and includes:

Amazon

Some eBay purchases

Department stores

Clothing stores

Costco

Pretty much any other online merchant

The 3X category also includes Plastiq, a service that lets you pay bills with a credit card for a 2% fee (with a MasterCard, which the Citi AT&T Access More card is).

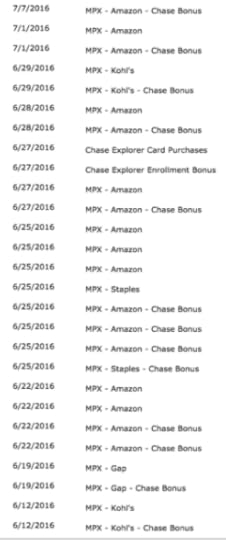

I used an Excel Solver formula thanks to the writers at ‘Dem Flyers to check the earning on my student loan payments.

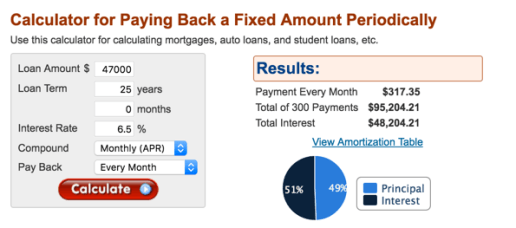

ALL my Plastiq payments code as 3X, including to Mohela, my government student loan servicer

I wasn’t sure if my student loan payment would qualify for 3X because Citi says:

“You won’t earn 3X Points for purchases of and payments for medical services, insurance, taxes and government services, education, charities and utilities.” (Bolding mine.)

Coded as “Tuition and Education Services”

And Plastiq definitely codes student loan payments as “education services.”

Regardless, I still earned 3X Citi ThankYou points on my student loan payments.

My Plastiq payment posted in 4 days

Moreover, I haven’t had any issues with my payments through Plastiq. My test student loan payment of $20 posted within 4 days.

By the numbers

Link: View Additional Hotel Credit Card offers here!

If you owe a lot of student loans, I know, it sucks. I’m in the same boat.

But. If you love to travel and run all your student loan payments through Plastiq and the Citi AT&T Access More card, you could do well with the 3X earnings.

Citi Prestige is perhaps my favorite card available on the market right now (and you can apply for one here).

It gets a lot of help from its trusty sidekick, the Citi AT&T Access More card. When you combine the points, they’re worth 1.6 cents each toward American Airlines flights. Or you can transfer the points to travel partners including:

Etihad

Flying Blue

Singapore Airlines

Virgin America (soon to merge with Alaska Airlines!)

Hilton

Let’s say you paid $20,000 of student loan debt this way. You’d:

Pay $400 with Plastiq’s 2% fee

Earn 61,000 Citi ThankYou points (including on the fees)

61,000 Citi ThankYou points are worth ~$979 toward American Airlines flights if you also have Citi Prestige. So you come out ahead by ~$579, even with the 2% fee considered.

Seattle summers are actually splendid – go visit!

61,000 Citi ThankYou points is also easily enough for 2 round-trip domestic flights on United via Singapore Airlines (at 25,000 Singapore miles for each).

Yep, those are my feet on a beach in Hawaii

You also earn 10,000 Citi ThankYou points when you spend $10,000 on the card within a cardmember year. 71,000 Citi ThankYou points is enough for 2 peeps to fly from anywhere in the mainland US to Hawaii round-trip in coach on United (at 35,000 Singapore miles for each).

Or you could fly one-way in Singapore Suites (First Class) from New York to Frankfurt for ~57,000 Singapore miles. That’s definitely worth more than the $400 you’ll pay in fees. Not to mention you’ll take a chunk out of your student loans!

Even if you cash out the points for a cent each (but please don’t), they’d be worth ~$610. At the lowest points value rate possible, you’d still come out ahead.

There’s no reason to leave money on the table while making bill payments with Plastiq and the Citi AT&T Access More card.

Bottom line

I’m loving this. I pay all my rent payments, my mortgage, and now my student loans through Plastiq and charge it all to my Citi AT&T Access More card. And here’s my experience getting $650 toward an iPhone through AT&T with the card.

I charge about $10K a month and therefore earn about 30,000 Citi ThankYou points AKA 360,000 Citi ThankYou points a year. I also earn points with Citi Prestige and my new Citi ThankYou Premier card. Safe to say I’m rolling in Citi ThankYou points (and therefore Etihad and Singapore Airlines miles).

I dare venture the Citi Prestige/Citi AT&T Access More combo is as good as Chase Ink Plus/Chase Sapphire Preferred.

At any rate, they’re both valuable combos in different ways. And so far, I’m loving the Citi ThankYou program – more on that coming up!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

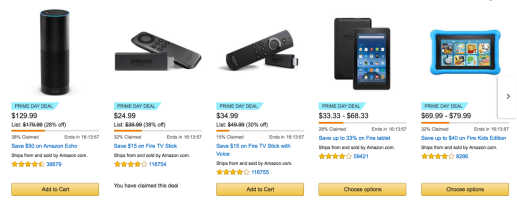

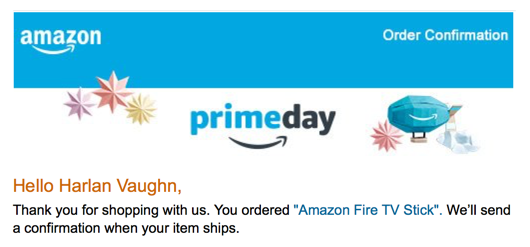

Best Cards to Use for Amazon Prime Day

It’s here – Amazon Prime Day. I was excited to see what Amazon would do today (July 12th, 2016) after the disappointing selection last year.

Prime Day is here, and it’s worth it this year

It looks good – there are many worthwhile deals for items like TVs, tablets, portable readers, clothes, even cleaning supplies.

Discounts are around 25%, with some items even more reduced. So it might be worth it to stock up – or at least see if something catches your eye today.

What’s Prime Day?

Link: Prime Day deals

Link: 30-day free trial of Amazon Prime

For the second year, Amazon has many big-ticket items on sale exclusively for Prime members. It’s something of a mid-year perk/annual sale that props up the summer shopping lull.

This being Amazon, a huge number of items – pretty much anything you can think of – are available with double-digit markdowns for one day only (today, July 12th, 2016).

Plenty of shopping opportunities = Christmas in July

Prime Day last year had much hype but was a bust – so I think Amazon felt compelled to up the ante this year and maybe even overcompensate, which means better deals for buyers.

You can get electronics, books, shirts, toys, cleaning supplies, even toothpaste, at steep discounts.

If you don’t have Amazon Prime, you can get a 30-day free trial. If you’ve already had a free trial, you can sign-up for $10.99 per month – which might be worth it if you want to buy a big-ticket item, like a TV.

Best cards for Amazon shopping

Shopping at Amazon is a topic that is near and dear to my heart because, well, I shop there a lot. So I’ve experimented with all kinds of ways to pay for items in the past.

Here’s my shortlist of the best cards.

1. Chase Ink cards

Link: View Additional Business Credit Cards Here

Absolutely the best because of the 5X category at office supply stores.

There’s an Office Depot right around the corner that sells gift cards, including Amazon in any value between $25 and $500.

A $500 purchase at any office supply store will net you 2,500 Ultimate Rewards points – a nice chunk of points for a quick jaunt. It adds up fast.

Shopping at Amazon as a means to a Mexico vacation? You betcha

I’ve had my eye on the Hyatt Zilara Cancun for a while now.

Rooms can easily be $1,000 per night for 2 at the standard rate – a rate I don’t plan on paying. Instead, you can book it for 25,000 Hyatt points per night – and Chase Ultimate Rewards point transfer to Hyatt at a 1:1 ratio.

Because of the ability to transfer not only to Hyatt, but also to United, British Airways, and several other travel partners, I’d rank the Chase Ink cards as the best ones for Amazon shopping.

Here’s my comparison of the two available Chase Ink cards.

2. Citi AT&T Access More

Link: Citi AT&T Access More card

I’ve written extensively about this card. It’s fantastic for paying your rent or mortgage, and for online shopping in general. That’s because you earn 3X Citi ThankYou points for online shopping purchases.

That category is thankfully very broad – and includes Amazon. Better yet, you get 10,000 bonus Citi ThankYou points if you spend $10,000 or more during your cardmember year (which more than makes up for the $95 annual fee).

Combined with another Citi card, like the Citi ThankYou Premier, or especially the Citi Prestige, the card’s earning power and points value get quite the boost – including the ability to transfer to Citi’s travel partners. in the case of the Citi Prestige card, each point is worth 1.6 cents toward American Airlines flights.

Links to this card are elusive, but I’ll do my best to keep mine updated.

Easy win for extra miles for Amazon shopping

When you use this card for Amazon shopping, be sure to buy a gift card through the MileagePlus X app to earn an extra 2X United miles per $1.

Combine that with the 3X category on the Citi AT&T Access More card, and you’re up to 5X (3X Citi ThankYou points + 2X United miles). An excellent 5X option for the lazy (or if you don’t feel like going to an office supply store).

3. Chase United Explorer

Link: Chase United Explorer card

Hmmm, why is this one on the list?

Chase Bonus!

Two words: “Chase Bonus.” I’ve been using the MileagePlus X app a lot lately – and you get 25% more miles if you have the Chase United Explorer card. So far, I’ve gotten a few thousand extra miles for having it.

The sign-up bonus isn’t stellar, but you can sometimes find better targeted offers by logging in on United.com.

You also get access to more award seats on United metal – but I like using United miles for partner award flights.

In any regard, depending on how much you spend on the MileagePlus X app, you can rack up some serious miles if you have this card. A 25% bonus is nothing to sniff at, and might make it worthwhile to add to your wallet. Added bonus: you don’t have to pay with the card and the $95 annual fee is waived the 1st year.

Are there downsides?

Yes, absolutely. When you pay with a gift card, you effectively lose any purchase protection that would be offered by your credit card.

In that case, I’d still recommend using the Citi AT&T Access More card to earn a straight 3X Citi ThankYou points. You’ll also have access to Citi Price Rewind and the card’s purchase protection. This would be a good option if you want to buy something expensive, like a TV or big electronics purchase.

But, if you just want to buy a few new shirts, or stock up on cleaning products, I’d still go the gift card route and leave it up to Amazon to replace any defective items. They have a solid return policy and anything under $50 should be pretty low-risk (and therefore safe to buy with a gift card).

Bottom line

I already bought an Amazon Fire TV stick today (with method #1 above).

So cool

Have you heard of it? You plug it into your TV’s HDMI port and it allows you to access Netflix, Hulu, and obvi stream from Prime Video. You can also add games and apps to it. Really cool, and adds a lot of options to your TV (and it’s only $25 today!). A friend showed it to me and I had to get one for myself.

Have fun finding the deals on Amazon today.

Did I miss any good ways to earn extra miles and points for Amazon purchases?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

June 19, 2016

Hilton Auctions: Another Way to Use Your Hilton Points

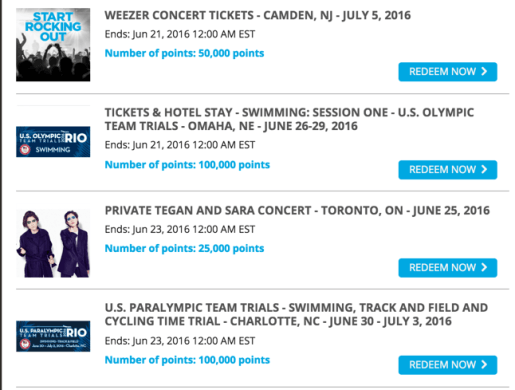

Peeps on Reddit posted about using Hilton points for “experiences” like:

Concerts

Sporting events

Food events

Culture events

It’s very similar to SPG Moments both in theory and application.

Use your Hilton points for lots of experiences via their online auction platform

There are lots of events on there. They’re not extremely overpriced and might be appealing to some.

I wouldn’t say like, sign-up for a Hilton card to bid on these. But if you are flush with Hilton points, it could be worth a look to see if anything strikes your fancy.

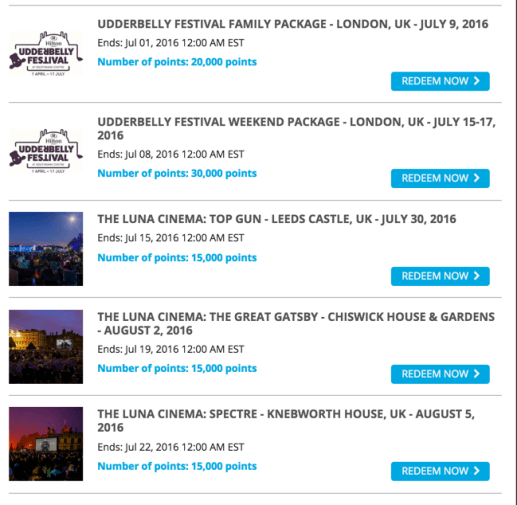

What’s on Hilton Auctions?

Link: Hilton Auctions

You can view all of the auctions here. Or you can sort based on your preference for concerts, food events, etc.

Some events on Hilton Auctions

I must say, not all of them are bad deals.

For example, there are Coldplay, Dixie Chicks, Demi Lovato, and Gwen Stefani tickets on there right now starting at 50,000 Hilton points for a pair and going up to 100,000 Hilton points. Depending on demand and ticket price, you could do well if you have a lot of Hilton points at your disposal.

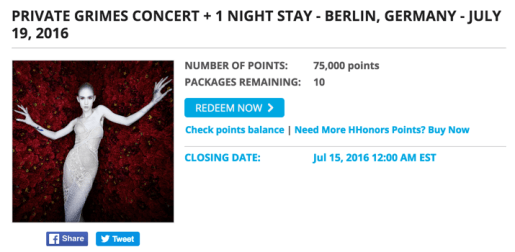

Grimes concert + 1 night at Hilton Berlin for 75,000 Hilton points

There’s an experience for a “private” Grimes concert and a night at the Hilton Berlin in Mitte for 75,000 Hilton points.

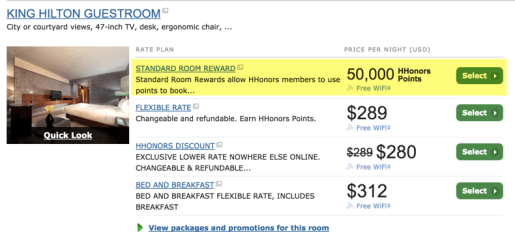

A night at Hilton Berlin is 50K Hilton points

It would cost ~$280 to stay there that night, or 50,000 Hilton points. If you want to visit Berlin, and you’re a fan of the artist, that could be a pretty cool experience!

Culture events

The culture, food, and sports events are all over the map – literally. They have events in the United Kingdom, Indianapolis, and Omaha – and lots of places in between.

Redeem now or spin the wheel

Like SPG Moments, you can redeem your points instantly for a set number of packages. Or you can bid with your points, auction-style.

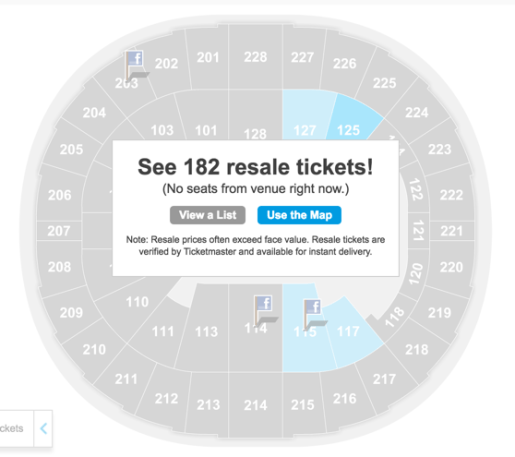

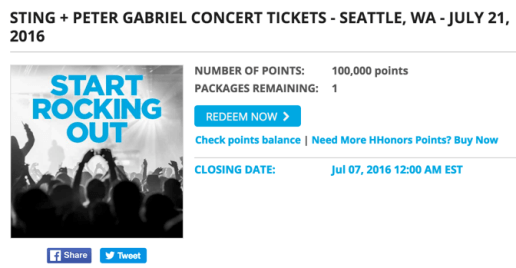

I noticed some of the listed events were already sold out, like the Sting and Peter Gabriel concert in Seattle.

No mas

Resale tickets in section 1 start at ~$250 and go up to ~$500 each, or you can still redeem 100,000 Hilton points.

Hilton points to the rescue?

The value here is based on how much you personally want each experience – and whether you’re willing to part with your Hilton points to pay for them.

In my opinion, Hilton points are extremely easy to earn, especially if they’re your preferred hotel chain. So while this won’t be useful for everyone, maybe someone can extract some value from it.

Bottom line

I didn’t know Hilton Auctions was even a thing. But it does make Hilton points a little more versatile.

If you have a lot of them, and you find something you’d really enjoy, the valuation is up to you.

Lots of the “experiences” are in the 100,000 point range, which is 2 award nights at a decent Hilton hotel. Worth maybe $500 to $600 (in the example of the Hilton Berlin above).

Some of the experiences are limited, sold out, or priced reasonably – so it’s worth a look anyway.

Let me know if you’ve redeemed your Hilton points this way! I’d be curious to hear about the user experience on the other end, post-auction.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Delta Beats American If You Credit Premium Flights to Alaska Mileage Plan

Or, “Why I’m Flying Delta Again”

In my quest to credit partner flights to earn elite status on Alaska Airlines, I’ve been focused on flying coach with American. That’s because ALL AA economy flights get 100% credit with Mileage Plan.

Welcome indeed

If economy is your preference, American is by far better than Delta – if your end goal is to earn status or redeemable miles with Alaska.

But, if you fly Business or First, Delta wins hands-down. And, it might even be worth it to fly Delta anyway.

Let’s take a look.

Why Delta as a means to Alaska Airlines status?

Quite simply, Delta First Class flights aren’t that much more expensive than American coach.

And, the extra cost is worth it in certain situations. Like if you need to arrive and depart at certain times. Or have a preferred airport (LGA over JFK, maybe).

Here’s an example.

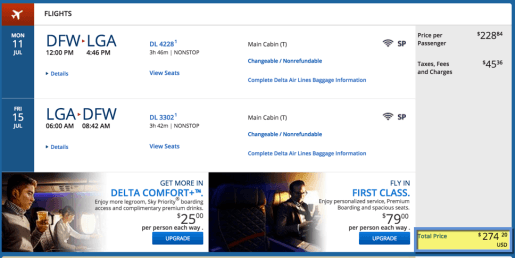

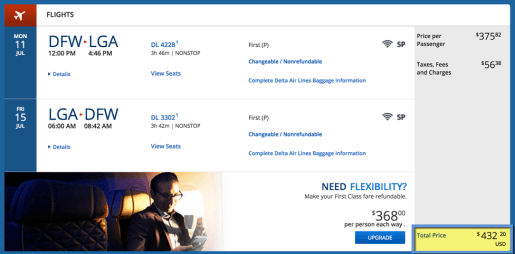

~$274 to fly Delta in coach from Dallas to New York

I found coach flights on Delta departing around noon on Monday and leaving early on Friday in mid-July for ~$274.

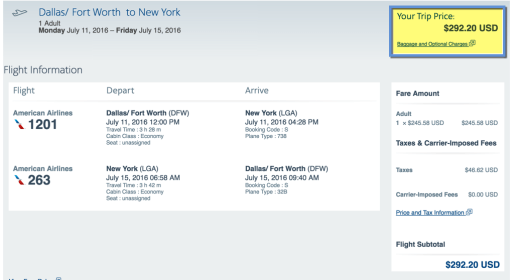

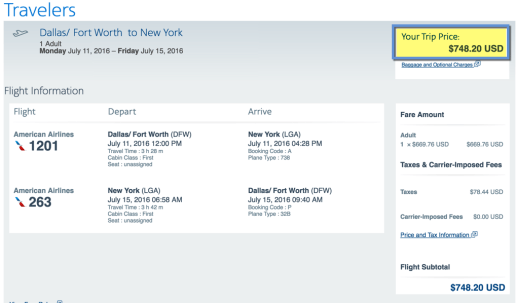

American costs more

For similar flight times, American wants ~$292. And, for the record, the cheapest AA flights were ~$248 round-trip: not that much different from Delta.

If you credit these flights to Alaska Airlines, you’d earn a different amount of miles. You’d earn:

2,778 Alaska miles from flying American (100% credit for all coach fare classes)

1,389 Alaska miles from flying Delta (50% credit for T fare class)

If each Alaska miles is worth 2 cents each when you redeem for an award flight, 2,778 Alaska miles are worth ~$56. 1,389 Alaska miles are worth ~$28.

Bump to First?

Link: Earn Alaska credit for AA flights

Link: Earn Alaska credit for Delta flights

Here’s where it gets interesting.

First Class on the same Delta flights isn’t that much more expensive than coach. It’s ~$158 more to fly First.

The same Delta flights are ~$432 for First Class

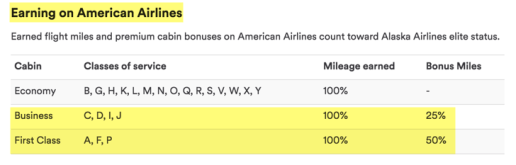

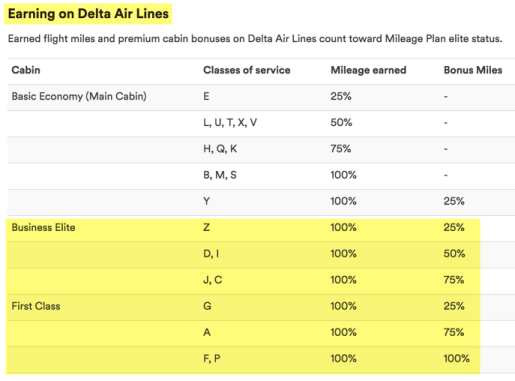

And, you earn many more miles with Delta in premium seats than with American – if you credit the flights to Alaska.

100% + up to 50% bonus on American Business or First Class flights with Alaska

You’ll only earn a 25% bonus flying Business on AA. And a 50% bonus flying First Class.

100% + up to 100% bonus on Delta Business or First Class flights with Alaska

With Delta, most Business Class fares earn a 50% or 75% bonus. And, you can earn up to 100% bonus miles on First Class flights.

If you credited the same flights above to Alaska, but in First, you’d earn:

4,167 Alaska miles from flying American (100% + 50% credit)

5,556 Alaska miles from flying Delta (100% + 100% credit)

Again, if each Alaska miles is worth 2 cents each when you redeem for an award flight, 4,167 Alaska miles are worth ~$83. 5,556 Alaska miles are worth ~$111.

The kicker

If you fly in premium cabins and pick flights based on schedule, the biggest upside is how much more the same First Class flights would cost if you flew American (~$748 vs ~$432).

~$748 on American vs Delta’s ~$432

To bump from Delta coach to First, you’ll pay ~$158 more.

But to bump from American’s coach to First, you’ll pay ~$456 more.

And because Alaska’s Mileage Plan is distance-based (for now), you’d earn ~1,400 fewer miles than if you paid less and flew Delta for the same cabin and similar flight times.

Worth it go to from American coach to Delta First?

Another thing to think of is cost vs number of miles you’ll earn.

You’ll earn more Alaska miles for American coach than Delta coach, and more for Delta First than American First.

Is it worth it to pay more?

In these examples, you’ll pay ~$292 for American coach and earn 2,778 Alaska miles (worth ~$56).

And you’ll pay ~$432 for Delta First and earn 5,556 Alaska miles (worth ~$111 and these count toward elite status!).

So you pay ~$140 more but earn miles worth ~$56 more. The net/net ends up being ~$84 more to fly Delta First as opposed to American coach for similar flight times.

That could be worth it if:

You prefer to fly First

You’re checking bags (Delta First Class includes 2 free checked bags each way. That could save you $200 to check bags round-trip, and make this a no-brainer)

You’re nearing an award threshold with Alaska and want more miles

You’re nearing an elite status threshold with Alaska and want more miles

Also, this is just one example.

This is obviously NOT worth it if:

You find a cheap coach fare on American

Delta First prices are exorbitant

But if you find a great deal on First with Delta, and it’s not that much more than flying coach, why not?

Delta’s operations can’t be understated. They are so good. If you’re flying for business or for meetings, it could be worth flying Delta to have more assurance you’ll make it on-time.

Finally, if you’re in the First Class cabin, you stand a better chance of getting rebooked in case of irregular operations or inclement weather than if you’re flying coach.

Bottom line

There are a few mental hoops to jump through with regard to the value of your miles, your elite status, and comparing/finding the various fare classes with American and Delta.

But, if your end game is elite status and miles with Alaska Airlines, it could be well worth it to fly Delta First. What surprised me is how comparatively cheap Delta First is compared to coach flights on American.

I’m looking at Delta again, in a way I didn’t expect.

I was also surprised that earning rates with American were 50% lower for First than with Delta, considering all the catfighting and mud-slinging that’s gone on between Alaska and Delta the past few years.

If you’re gunning for elite status with Alaska, will these earning rates convince you to take another look at fares in Delta First?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

June 18, 2016

Driving NYC to Dallas: 4 Days of Ups and Downs (and Fire!)

Also see:

Come in Houston, er, Dallas: Buying a House and a Move Toward FIRE

Goodbye to All That: In a Month, Dallas Here I Come!

I set the date, said my goodbyes, and cut the ties.

The move to Dallas has been a long time coming. I picked Memorial Day weekend to drive from Brooklyn to my new place in Dallas.

Now I’m here and it’s been about 4 weeks. Everyone kept talking about “getting settled.” Pssh, I don’t need to get settled. I’ll just pick right up.

It’s been a crazy few weeks:

2 new Airbnbs

Buying investment property #2

Unpacking boxes

Werkin’

Getting acquainted with a new city

Visits from friends (already!)

In short, I guess, yeah, I did need time to “settle.”

The drive down took 4 days. I thought it would take 3. Here’s how it went down and why it took longer.

Day 1 – Brooklyn, NY to Winchester, VA

By far the longest day.

I swept the apartment and wiped everything down one last time.

The movers took everything 2 days before. I slept on a pallet of comforters and quilts that last night.

At 3am, I woke up, packed the last items in the already packed-to-the-gills car, and set the keys on the counter. Took one last look and shut the door.

That moment, that feeling – I won’t soon forget how it felt to leave New York.

Closing the New York chapter with the close of a door.

Loaded up the dog and drove in the dark across Staten Island with a plan to fuel up at the first gas station in New Jersey where gas prices are much cheaper than in the city.

They’re all full-service, so I told the attendant to fill ‘er up. It was before 4am and I wanted to get as much driving done as I could before the city traffic roared to life.

But then, the car wouldn’t start.

I swear my heart skipped a beat. The car full of everything important to me and with the dog inside.

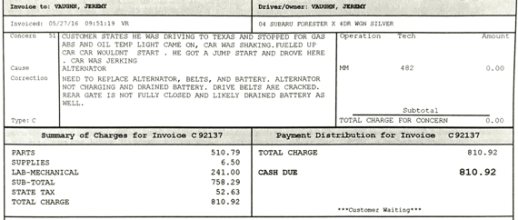

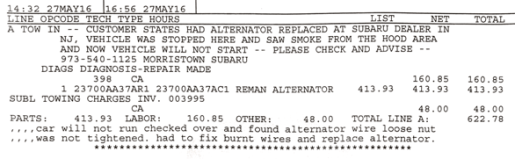

The attendant jumped the car and we drove to the nearest Subaru dealership in Morristown, NJ. We got there around 5am and they opened at 7am. For 2 hours, we sat there, waiting. I tried to sleep sitting up while I could.

Ughhh

Fast forward 4 hours and ~$800. I have a new alternator. And they tell me the car is good to go – all the way to Texas. I’m grateful for the quick turnaround and ready to get back on the road.

It’s afternoon by this time and all I’ve eaten is a gas station breakfast sandwich. So when we saw some restaurants off the highway in Hamburg, PA, we pull over to grab a bite.

As we headed inside, I turned around and noticed smoke coming out of the hood of the car.

So I pop the hood, and not only is the car smoking – the engine is ON FIRE.

Yes. Actual fire.

My burned-up, white-hot, still-smoking engine

Not like a roaring, out-of-control blaze, but lit up like a freaking birthday cake.

At this point, I feel so physically ill from the car trouble I think I’m going to collapse. So I call USAA (my car insurance company) and get a tow to the nearest Subaru dealership in Allentown, PA.

Getting towed in Pennsylvania

I’ve never had trouble with the car since I bought it in February. I even drove it to Philadelphia and back the weekend before with no problems whatsoever. And had it looked at ~2 weeks before setting out and was given the all-clear.

Fixing the damage

At the next Subaru dealership, they said the alternator wasn’t correctly attached and the cables had burned out – literally.

Another few hours of waiting.

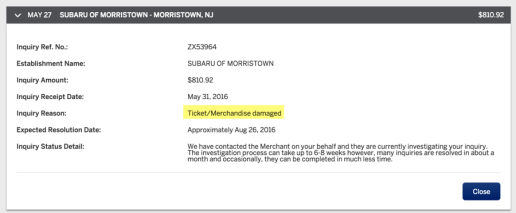

Luckily, they agreed to bill the first dealership for the repair. And I called Amex (I used my Amex SPG card to pay for the previous repair) to dispute the alternator charge. That’s still pending.

EFF YEW

After all of this, I’ve been up since 3am and it’s about 5pm. I make up my mind to drive as far as I can without breaking down. At this point, I just want to be as physically far away from New York City as possible.

I drive until dark and make it to Virginia. It’s so dark I can barely see the road and I’ve been up for hours dealing with car repairs. At this point, there are no more problems and the car drives perfectly.

I pull over and see what my options are. All the Hiltons are booked up. There are no Hyatts. But there’s an Aloft hotel ~30 miles south in Winchester, VA. I book it on the mobile app and head there. It’s so cheap I just pay for it. So ready to sleep.

Fenwick at the Aloft hotel in Winchester, VA – he loves to look out the window!

At this point, there isn’t a lot left of me.

Earning SPG points for Uber now

On the plus side, this was my first paid SPG stay this year, so I can earn SPG points with Uber (even though I prefer Lyft now). And I got 500 SPG points for booking via the app.

We check-in and sleep so hard.

Day 2 – Winchester, VA to Murfreesboro, TN

Thank gods this is a fairly uneventful day. Great weather, hot. Car drives great. We scoot into Nashville shortly before sunset.

My mom lives in the Memphis area, which is about ~3 hours from Nashville. I decide I can’t go another 3 hours – the day before still has me exhausted.

Days of this

But, we avoid Nashville Memorial Day traffic by staying at the DoubleTree by Hilton Hotel Murfreesboro, which turned out to be fantastic (review soon).

We have a few drinks in the hotel restaurant, shoot the shit with the server (she was excellent), and enjoyed a big, free breakfast the next morning. Just what the doctor ordered.

Day 3 –

Murfreesboro, TN to Horn Lake, MS

I toyed with the idea of driving the ~10 hours straight through to Dallas and stopping to grab lunch with my mom.

But when I got there, she convinced me to stay. I ended up spending the afternoon with my grandmother in Memphis and then spending the night at my Mom’s house.

Lots of elite status perks, including:

Southern cooking that only moms can do

Free freshly cooked breakfast

Check in and out any time

Unlimited free shuttle rides to anywhere in town

Did You Get Free Tickets From Ticketmaster?

A bit of a quick PSA.

If you’ve paid Ticketmaster’s exorbitant “service fees” for event tickets since 1999, check your account.

They’ve settled a $400 million dollar lawsuit and have returned the money in the form of free concert tickets and discount codes for future events.

Long story short, if you’ve purchased a ticket through Ticketmaster in the past ~17 years, you may have free tickets sitting in your account – most of their emails about this have been going to spam folders.

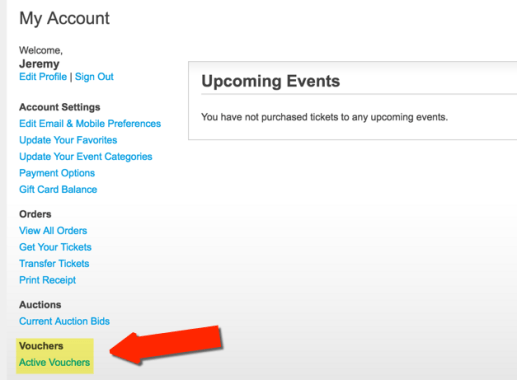

Check your account

Link: Ticketmaster lawsuit info

To check if you have any free tickets or discounts, log into your account at Ticketmaster.

See if you have any vouchers

Look to the left. You’ll see an “Active Vouchers” link on the left. Click it.

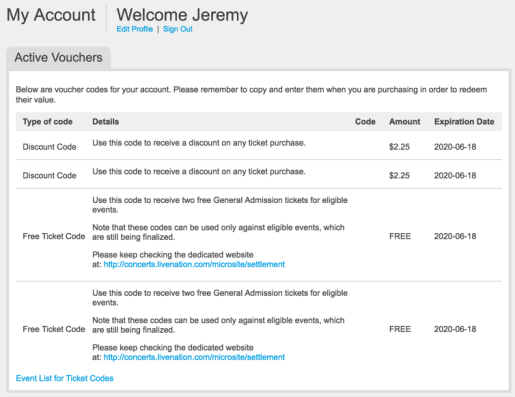

My free tickets

I’ve gone to a few concerts in the past ~17 years or so. I had 4 free tickets to 2 separate events and ~$5 to use toward any ticket purchase.

The list of “eligible events” is still being finalized. But it’s worth it to see what’s there. Who knows, maybe you’ll be able to use the tickets for something worthwhile. They have an expiration date 4 years into the future.

If you’re like me, you never received an email about this. Many of you might have free tickets or discount codes sitting in your account, too.

Bottom line

This is an easy win if you’ve purchased tickets via Ticketmaster since 1999. Here’s the lawsuit page.

You may have free tickets or discount codes in your account, but most email providers are flagging the notifications as spam.

We don’t know which events will be eligible for the free tickets yet. But hey, you might’ve already paid for them over the years with Ticketmaster’s crazy “service fees.” Worth a look, anyway.

I’m also interested in data points – let me know what you find in your account!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my link to apply for new card offers!