Harlan Vaughn's Blog, page 48

August 23, 2016

Chase OR Costco + Autoslash: Get the Best Price on Car Rentals

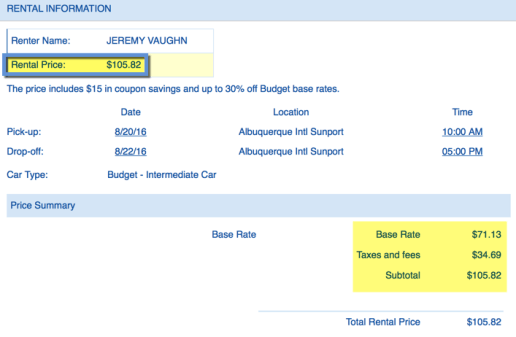

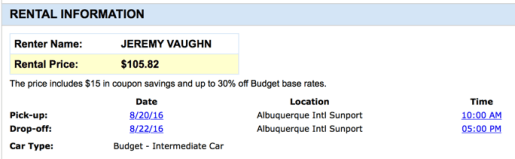

I rented a car this past weekend in Albuquerque.

And I’m renting another one this upcoming weekend for a work trip to Austin.

I’ve rented enough cars by this point to rely solely on 2 places to look: the Chase Ultimate Rewards portal and Costco Travel. One or the other of them has the best deal almost always.

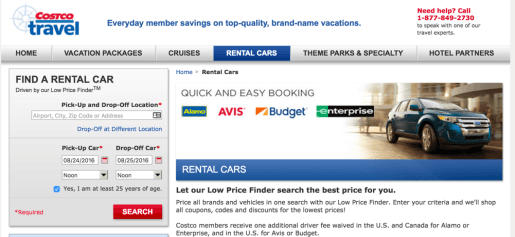

Laaaa! Behold Costco Travel’s car rental search

For good measure, I usually run a search through Kayak, too – just to be sure.

Last week, I booked through Costco. And this week, I booked through Chase. One of them simply always works out for the best.

A quick comparison

Link: Costco Travel

Here are the 3 searches I ran for next week:

Costco – lowest price is ~$232

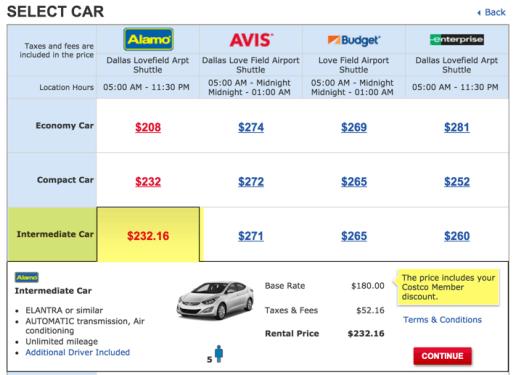

Chase – lowest price is ~$167

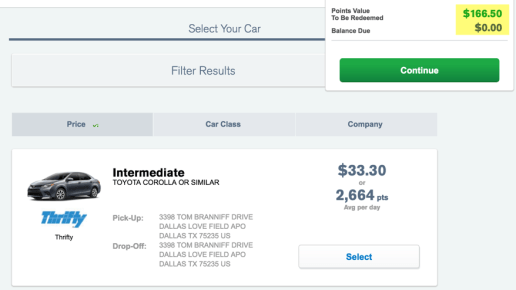

Kayak – lowest price is ~$177

In this case, for an intermediate car, Chase has the best price.

Kayak had some good deals, too. You can rent a “wild card” vehicle for ~$177 and they’ll tell you the company after you complete your purchase via Priceline.

Furthermore, you can also see prices for Sixt and Hertz on Kayak – which you’ll notice are both absent from Costco’s matrix of prices.

So the benefit of running a search through Kayak is the additional information and comparison. Even still, I’ve always found the best price through Chase or Costco. In this example, it happens to be Chase. Keep in mind too, this is just one example.

~$52 a day with taxes and fees isn’t bad

Last week, Costco had the best rates. Look at both and pick the cheapest option for the type of car you want.

All else equal, which is better?

I prefer booking through Chase, actually. Because you prepay for your rental.

So when you arrive to pick up the car, they hand you the keys and you’re off. When you return, they give you a receipt.

But, there’s a huge thing to note about Chase. You can ONLY rent from airports. I have DAL right up the road from me, so it’s only ~5 minutes away. This could definitely affect your decision. But for airport rentals, it’s hard to beat!

With Costco, you pay after the reservation is complete.

So it depends on whether you have a preference for paying upfront or after the fact. I like getting it over with. But if prices are similar, and you have feelings one way or the other, this could be the deciding factor.

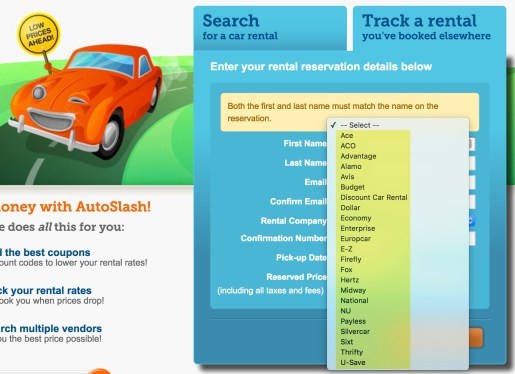

Add Autoslash to the mix for price protection

Link: Autoslash

For added security, I recommend adding your rental information into Autoslash. They’ll track the price of your rental based on your confirmation number, dates, and rental car company. Currently, they cover these companies:

Track most car rental reservations via Autoslash and get an alert if the price drops (Click to enlarge)

This is just good practice.

Because if you book far in advance, prices are nearly certain to fluctuate. And if you book a few days into the future, like I just did, you’ll know if the price suddenly drops the day before.

Depending on the length of your rental and how much you’ve paid, the savings could add up.

I’ve never had to rebook a rental through Chase or Costco, which I suppose is a testimony to their good prices. But I still add everything to Autoslash on that off-chance. I’d gladly cancel and rebook quickly to save some cash!

Bottom line

If you don’t have a Costco membership or a card with Chase Ultimate Rewards, you can still do well simply searching through Kayak. In my example above, you’d only pay ~$10 more to book on Kayak via Priceline.

But if you can, always check Chase and Costco Travel. And to get an even better price, take the ~2 minutes it takes to transfer the information to Autoslash.

This is by far my best tip for getting the best price on car rentals, though I know there are plenty of other tricks. Did you

If you know of a good way to get a deal on a car rental, please let me know about it! I’m genuinely curious, as I tend to rent a car every month or two.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

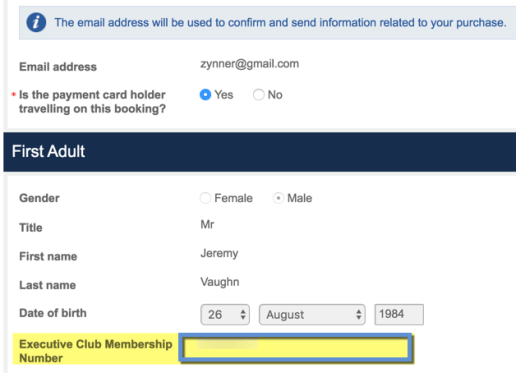

Why & How to Add Your American Airlines Number to British Airways Award Flights

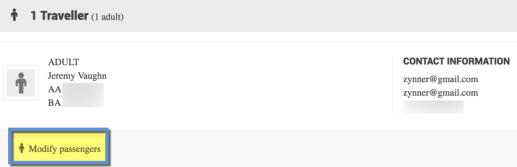

I recently booked American Airlines award flights from Dallas to Albuquerque with British Airways Avios points. I booked it pretty fast and let my British Airways loyalty number auto-populate in the spot for “Membership Number.”

So easy to let this slide

It’s a “blink and you’ll miss it” type thing and easy to overlook.

But, if you have elite status on American Airlines, or certain AAdvantage credit cards with Barclaycard or Citi, you’ll want to change it.

Why to add your American Airlines number

Link: American Airlines elite status benefits

Priority boarding

If you have any type of elite status with American, you’ll get Priority boarding. And if you have certain AAdvantage cards with Barclaycard or Citi, you’ll get Group 1 boarding.

This is essentially meaningless as it’s all a cattle call anyway. But, it does provide one ancillary benefit: overhead bin space. If you board near the end, you’ll be hunting for a place to put your bag. I never check a bag, so I try to board as early as possible.

Adding your American number will get you this – even on an award ticket.

Free checked bag

As mentioned, I don’t check bags unless absolutely necessary. I might actually check a bag for my upcoming trip to Hawaii. Reason being: sunscreen.

I can get it cheap here in the mainland, but they really price gouge certain items in Hawaii. Sunscreen is pretty much a necessity – and believe me, they know it ($$$$).

If you have a co-branded credit card that gives you a free checked bag domestically, be sure to add your American number at least 7 days before your flight to make sure it all links up correctly. Otherwise, you may get stuck paying.

If you have status, it doesn’t matter when you add your number – so long as you do it before you fly.

Flight tracking and boarding pass

I use the American app to alert me to flight delays. I don’t know what’s going on lately, but my past, say, 10 flights have ALL been delayed.

No reason going to the airport to hurry up and wait. You can track flight status through your British Airways number, but it’s a roundabout process. It’s much easier to add your American number and track it on the app.

I like having access to all my flight info on my phone through the American app

Look at that delay! ^^^

I also like having access to my boarding pass. This lets me walk directly to security when I get to the airport. So so easy.

Seat selection

If you have status, you can also select “Main Cabin Extra” seats at no additional cost. The seat isn’t really all that different, other than it’s nearer to the exit. Quick escape once you land!

I always always pick these seats. It’s nothing life-changing, but better than being stuck in the back of the plane if you don’t have to be.

You might accidentally earn miles!

Short story for ya!

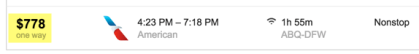

So yesterday, my original flight was at 6:18pm. I got to the airport super early, planning to sit and get some work done for a few hours.

On the departures board, I noticed 2 earlier flights were going out non-stop to DFW from the same gate as mine (B1).

I mean, I wanted that seat but not that price

So I went down to see if I could get bumped. Tickets were selling for $778!

I explained to the gate agent that I was traveling with a carry-on and that Dallas was my final destination – no connections. And that, if it would help operations, I was ready to hop on an earlier flight.

She pulled it up and said, “Your flight is oversold. So I’ll bump you to the next one – there are still open seats.”

Y YES

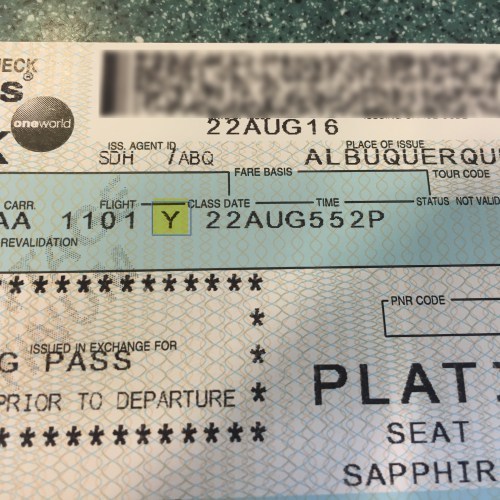

Then she handed me a new boarding pass. I noticed I was now in the “Y” fare class, which is often the fare class they rebook you into at the gate.

I had a stray thought. “Hmm. Maybe I’ll earn miles for it.”

Yes!

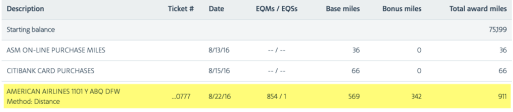

This morning, I noticed my AA balance had gone up a little. I ended up earning 911 miles for the flight. I value that around $18. Nothing crazy, but I’ll take it! I also earned some more EQMs in the process.

Now, I’m not saying to expect this. But it does happen from time to time. And it wouldn’t have happened at all had I not simply switched the number.

How to add your American number

Link: Manage your Oneworld flights on Royal Jordanian

Link: Manage your Oneworld flights on Finnair

I’ve written how to use the Royal Jordanian site to manage Oneworld bookings.

You can manage your bookings with these airlines on the site:

British Airways

Finnair

Qantas

Royal Jordanian (duh)

Cathay Pacific

LAN/TAM

Iberia

And with it, you can:

Change frequent flyer number

Obtain other airline’s record locator

Verify fare buckets

Easily check flight duration and aircraft type

Email yourself a receipt

Get a ticket number

These are all helpful functions with, obviously, a variety of uses. There are many reasons why you’d want to check or alter your reservations. I tend to prefer the Royal Jordanian website for no reason other than old habits die hard. But you can do all of this via Finnair, too.

Open your reservation with your British Airways booking reference.

On the Royal Jordanian site, scroll down to “Traveller details”:

OUT AND OUT - Investing. Positivity. Oh, and travel.

OUT AND OUT - Investing. Positivity. Oh, and travel.

August 22, 2016

How to Get Free Gogo Internet (on American Flights With NO IFE)

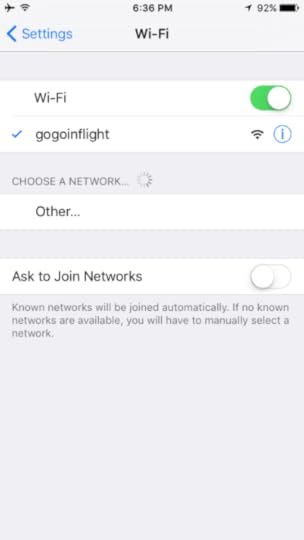

I’ve been flying American a lot lately, and there’s a loophole I sometimes use to get free Gogo internet. I used it today on my flight back from Albuquerque.

There are a couple of catches:

You can only get ~30 minutes of internet

This ONLY works on flights with NO IFE (in-flight entertainment) (as far as I know)

No IFE as in, no screens overhead or in the back of the seat in front of you.

If you’re lucky, you can squeeze out closer to an hour of free internet. But it depends on the flight – there doesn’t seem to be a pattern to it.

Here’s how it works.

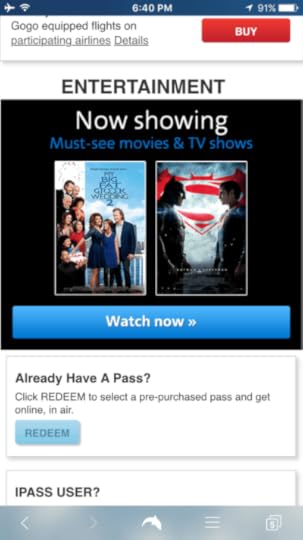

The trick to getting free Gogo internet

First, connect to Gogo wifi.

The connection is made

Then, pull up your browser and type in any web address, like google.com.

Scroll till you see this

Scroll down to the “entertainment” section. You’ll only see this if IFE isn’t on your current flight.

Pick anything

Select any movie and click “Rent” or “Watch.” On a side note, some of them are free to watch, which might appeal to some peeps.

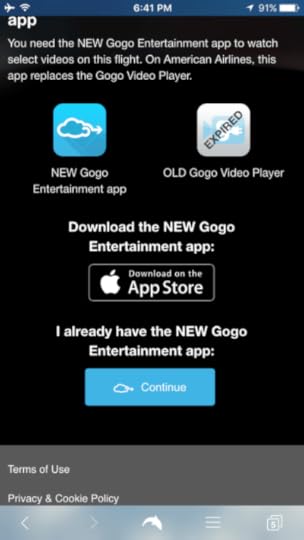

Download on the App Store

Be sure to select “Download on the App Store.” If you pick any of the other ones, you have to go through it all again. I’m not sure what this will say if you have an Android phone, but I suspect something similar.

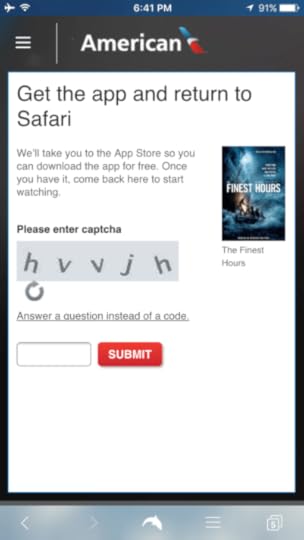

Enter the code

Enter the Captcha code. Note it’s case sensitive. And annoyingly, iPhone automatically capitalizes the first letter. So make sure it’s all lowercase.

Then, you’ll be redirected to download the Gogo app from the App Store.

But – it also opens up the internet and completely connects your device.

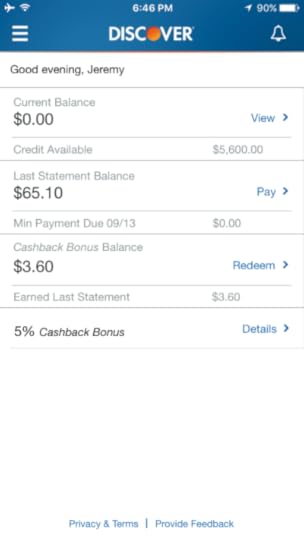

From this point, you can check your email, play on Facebook, read Out and Out :p, or check the Discover app to see if you’ve experienced your own Dublin.

Is my Dublin here yet?

Things to note

Gogo expects you to download the app, then come back and watch the movie you want to rent. So it gives you plenty of time to complete the download. Maybe 20 minutes.

The good thing is you can refresh the download page a few times to reactivate the connection time. So be sure to leave it up on a different browser or tab.

(I use Dolphin as my phone browser and love it, btw).

I’ve also been on some flights that tell you, “You’ve exceeded the number of download opportunities” or similar. But on my flight today, I was able to repeat the process over and over with free internet the entire flight. So there’s no pattern – but Gogo definitely knows about this.

Also, if lots of people on your flight are online, it will be super slow. But on my flight today, I’m pretty sure I was one of the few people connected – and it was actually pretty fast.

And again, it only works on older planes with no IFE. So it’s handy to know about if you often fly into or out of small regional airports, like CMH. :p

Bottom line

I was on the fence about sharing this for whatever reason (a friend told me about it when we flew together). But then I thought, nah, you know – Gogo knows about this. And they have to let people download the app if they don’t have it to watch the movies (theoretically). So I don’t think this will go away any time soon.

I’ve had great luck using this trick and thought I’d share – it’ll hopefully help peeps who fly on American flights.

Would this work on other Gogo airlines besides American?

I don’t know if this would work on all Gogo airlines. I DO I know it doesn’t work on Delta (because they are really good about providing IFE). So if you have a data point with another airline, please share in the comments!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

August 18, 2016

My IHG Q3 Accelerate Offer Is Actually OK! How’s Yours?

I’ve gotten some pretty terrible IHG offers from IHG’s various “Accelerate” promotions (including one that required me to stay at a hotel brand with only 2 locations).

But their new Q3 Accelerate offer is actually… kind of OK (but couldn’t they come up with a different name for it? Even the URL is bland lol).

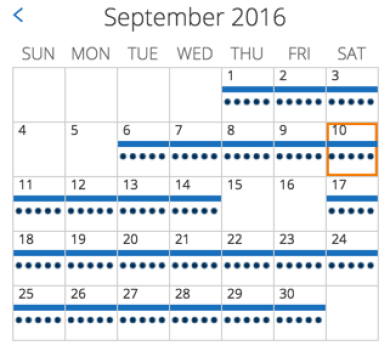

It’s not worth moving a minor mountain for or anything, but it seems I can stay at an IHG for 2 nights in September 2016 and earn an extra 35,000 IHG points.

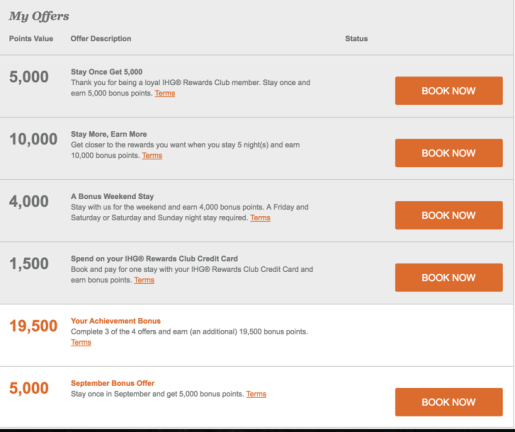

My IHG Accelerate offer

Link: IHG Q3 Accelerate Promo

Here it is:

Not terrible!

So if I can:

Stay once (5,000 points)

In September (5,000 points)

For 2 weekend nights (4,000 points)

And use my Chase IHG to pay for it (1,500 points)

I’ll unlock an achievement bonus (19,500 points)

And earn a bonus of 35,000 IHG points. That’s pretty decent.

I’ll likely have some sort of trip pop up next month. And it might be worth it to switch it over to IHG if it’s during the weekend.

Some analysis

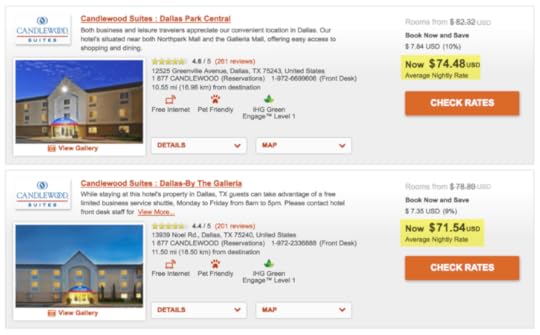

I’m not sure if I’d mattress run for it or not. Although, there are plenty of hotels in the Dallas area with rates around ~$70 a night.

Not bad, not bad

Two nights during a weekend in September, after taxes, costs about ~$165.

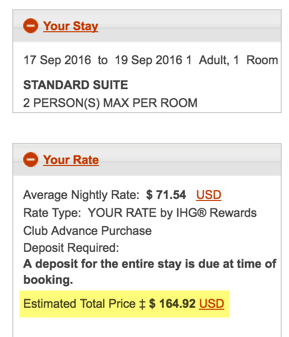

$165 for 2 nights

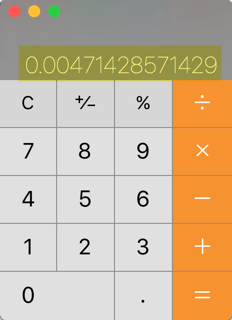

That comes to under half a cent per point for all 35,000 IHG points.

Bout half a cent for each IHG point

Which is good, especially if I can increase their value at hotels that are typically very expensive.

This promotion is worth is if you can double your points value at an expensive hotel, like in San Francisco

Which could be a good deal for a hotel like the Holiday Inn San Francisco-Golden Gateway, which costs ~$405 a night after taxes, or 40,000 IHG points (thus doubling the value of the points earned from the Q3 Accelerate promotion).

Even if I don’t use the points right away, I know I can get good value from them down the road, like I did at the ANA Crowne Plaza in Osaka, Japan. Although I’m not expecting, well, anything extra despite having IHG Spire Elite status (their highest tier).

Bottom line

Your turn!

I’m curious to hear about your offer, as I tend to be geeky about these types of personalized offers. Here’s the link to the promotion to sign-in and check yours. Everyone’s offer may be slightly different.

Keep in mind you should sign up before you stay – IHG doesn’t credit stays after the fact.

Is yours worth mattress running or switching a stay for?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

August 14, 2016

Just Booked a Trip for Next Weekend in 10 Minutes (Instant Transfers Save the Day!)

Also see:

Points and miles as insurance – why it’s good to have a stash

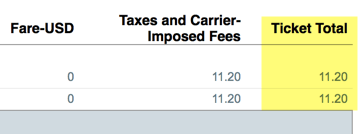

I’ll never forget the thrill and uncertainty of booking my first award ticket. I thought I’d show up to the airport and be turned away for not paying (or something like that). Can a flight really cost ~$11 when you book with… points?

That was a few years ago. But there’s still something so novel about booking award trips. Some of them are planned in advance, like my upcoming trip to Hawaii. And some are aspirational or in the future, like the Brussels Airlines flights I booked with Etihad miles.

Love the high desert!

Long story short, I needed to spend a couple of days in New Mexico to get some work done there. Looking at my upcoming weekends:

Next one was open

After that, Austin for work

Labor Day weekend – nothing available with points

Hawaii

4 weekends = a month of plans. I started poking around and realized, holy crap, I’m gonna book this trip for next weekend!

Finding flights

Always check paid flights first. No use in redeeming points for a cheap flight.

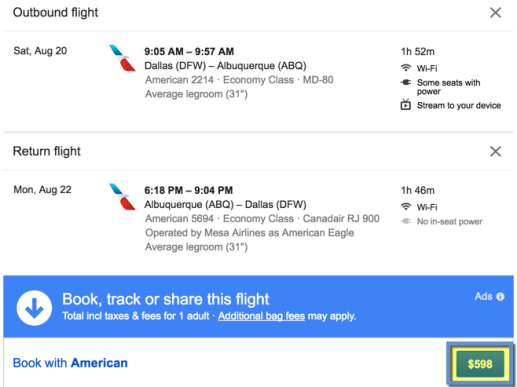

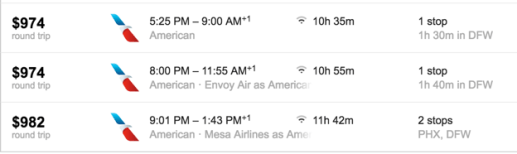

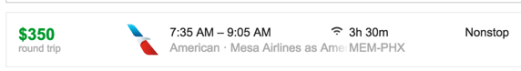

When I checked, I gasped a little.

$600?!

Flights from Dallas to Albuquerque are short – probably 90 minutes of actual time in the air.

Round-trip flights were ~$598!

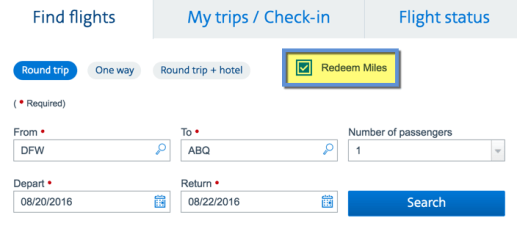

So I checked AA.com to see if award seats were open – knowing I’d book with British Airways Avios points if they were.

So easy

American makes it dead simple to start an award flight search. Just check “Redeem Miles” on the homepage and click “Search.”

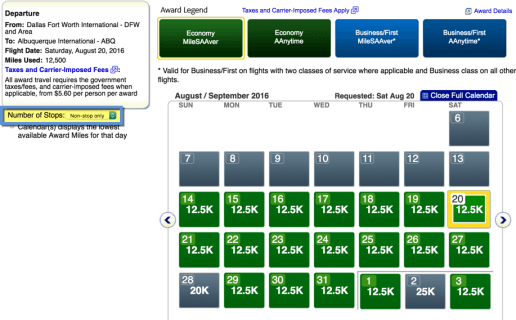

On the next page, check “Non-stop only” to single out flights you wanna book with British Airways Avios points.

No stops, plz

Because American loooves to connect you in some small regional airport (I’m looking at you, CMH) and British Airways charges per flight segment. So obvi the non-stops cost fewer points.

Flights from DFW-ABQ were available nearly every day, including next weekend.

Yes yes yes!

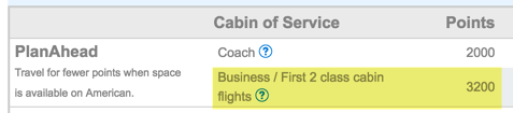

Getting the points

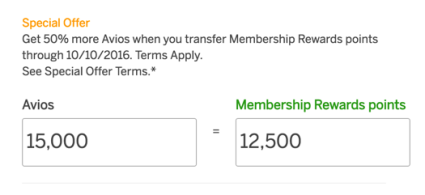

Award flights on American, especially expensive ones like these, are a fantastic deal with British Airways Avios points. You’ll pay 7,500 Avios each way for coach flights up to 1,150 miles. Or 15K for round-trip.

This is the part where keeping up with points and miles news came in handy.

I remembered Amex has a 50% bonus on Membership Rewards points transferred to Avios through October 10th, 2016.

Sweet!

The flights would be even cheaper now. I made the transfer and they appeared instantly in my British Airways account.

That’s the kicker here. The instant transfer. They’re a lifesaver for a:

Spontaneous getaway

Family emergency

Last-minute work assignment

I also think the 2 to 3 day (or longer!) wait times with some transfer partners is a deterrent to even starting with points and miles (mostly the more obscure international programs).

But British Airways is an instant transfer partner of Amex Membership Rewards and Chase Ultimate Rewards. So if you see a flight you want, you can book within minutes.

I chose my flights on AA.com, then replicated the search on BA.com.

Sick

In about 2 minutes, flights were booked. Total cost of ~$11. My 12,500 Amex Membership Rewards points were worth ~$587 ($598 – $11 in taxes). Or about ~5 cents each. That’s a tremendous deal!

This was the crux of the trip. Without the flight availability, it wouldn’t have happened. Period.

But once this was settled, the rest fell easily into place.

Hotel, car rental, pet sitter

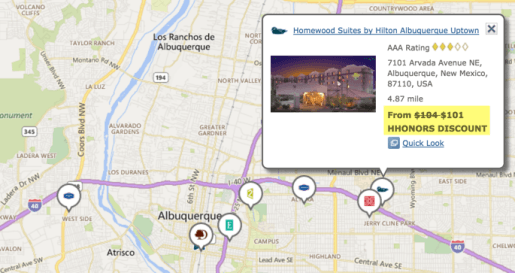

Looks like I’ll be staying at the Homewood Suites by Hilton Albuquerque Uptown. Did a quick search on Hilton.com, clicked “Map View” and picked the hotel most easterly (I need to be close to the East Mountains area).

Boom

$101 a night for 2 nights. Easy. Done (and not worth using points for).

This is where having a hotel chain as a go-to was a time-saver.

I didn’t even check Hyatt, Starwood, or Marriott. Hilton’s done me well since they matched me to Diamond elite status. Having that free breakfast in the morning is what I like the most, all else being equal. And let’s be honest, mid-range hotels are mostly same-ish no matter what brand you’re staying with.

With Hilton, I value the huge amount of bonus points, the room upgrades, and the free breakfast. Having a “set it and forget it” plan with whatever chain you like best cuts out a lot of thought.

For car rental, I checked two places: Costco and the Chase Ultimate Rewards travel portal.

Costco was ~$106, Chase was ~$121. Both not bad ($50 to $60 per day), but I took the cheaper option.

Boom

I’ll pay with my Chase Sapphire Preferred card for primary coverage.

Then I texted my usual sitter and said hey are you available these dates. He was. So the pooch is all set, too.

Becoming Speedy Gonzalez

This may sound like a process, but I’ve refined it over time. I open all the browser tabs and go through them one-by-one.

The flights were booked in about 5 minutes. The hotel and car rental, maybe another 5. And setting up the dog sitter was a quick text message in between.

The first few trips I booked took me hours. I futzed around with it so much. Applied every discount code, checked 4 or 5 sites for each component. The process of learning. So I’m confident I got the best prices possible with the least amount of effort.

In this case, the flights would’ve cost more than all the other parts combined. I still have a child-like wonder about the magic of points and miles to take trips you otherwise couldn’t do.

Love these calm mountains

And to see more of the world – both near and far.

Bottom line

I can’t think of anything I’d rather do more than drive around northern New Mexico for a couple of days.

This trip only fit in either next weekend or in a month. I didn’t want to wait, so I called in my points and miles. Times like this are when it’s helpful to have a stash – preferably in a transferable points program like Chase Ultimate Rewards or Amex Membership Rewards.

Knowing about the current 50% bonus from Membership Rewards to Avios got me better than a 1:1 ratio – and boosted the value of each point.

Having the instant transfer was the biggest benefit of all.

And practice really did make perfect. I’ve run the numbers enough to have my go-to methods in booking quick trips like this. That’s why I think poking around travel sites from time to time is fun (but I’m weird like that).

Having a preferred hotel chain and way to get a cheap car rental was also a huge help. When the need arose, I had a complete trip put together within minutes: flights, hotel, car rental, and even pet sitter.

It’s such a good feeling, too, on so many other levels. To feel free, mobile, and unencumbered. And to know you have options when you need them.

Things are changing in the points and miles space with regard to the banks and their approval guidelines. But times like these, trips like this booked on-the-fly, still makes me feel like it’s all worth it.

In Elephant Butte, New Mexico in 2005. I was 21. It’s been so long – and so much has changed

And man, I can’t wait to be in New Mexico again! Something about the state stirs a part of my soul in a way I can never fully describe. It’s been far too long since I’ve had that feeling. Suffice it to say I can’t wait for next weekend (another plus of booking a quick trip – instant gratification!).

Have you booked a trip in minutes for an event, or just for fun? Feel free to share any quick booking tips you’ve picked up along the way!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

August 3, 2016

Just Booked: A Brussels Airlines Biz Class Award Flight With Etihad Miles

Also see:

NYC-BRU J Award Seats on Brussels Open May & June 2017 – Book With Citi ThankYou Points!

Holy crap, it worked – I’m going to Belgium!

I’m coming for ya, Brussels!

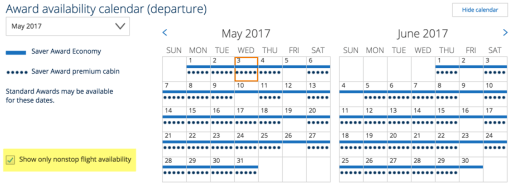

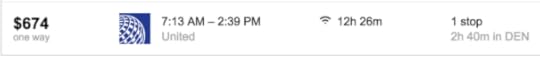

I found a ton of Business Class award seats between NYC and Brussels on Brussels Airlines in May and June 2017 (with a few dates in April and July available, too).

On Saturday, I transferred 37,000 Citi ThankYou points to Etihad Guest in hopes the space would remain. I checked this morning – no miles. But when I checked a few hours later, they were there!

I fired up United.com to hunt for dates:

Nearly every day in May and June 2017 still has availability

Tips: Tick “Show only nonstop flight availability” to isolate Brussels award space. And use “NYC” as the search if you want to see flights from both EWR and JFK.

Once I found the dates I wanted, I called Etihad Guest at 877-690-0767 with a pair of crossed fingers.

About the booking process

The agent I spoke with had no trouble running the search. I did not tell him the flight numbers, just the destinations and dates. Because I wanted him to tell me the flight numbers to make sure we were looking at the same ones.

He confirmed the flights and dates and started booking the award. He was very thorough and must’ve asked me a dozen times to confirm the flight times, numbers, name spelling, etc. No problem there – he was accurate to a “T.”

He confirmed the price would be 36,620 Etihad Guest miles to book the round-trip Business Class seats.

Then he sent me the flight details and asked me to confirm them again via email. I’ve never had an agent do that before.

He asked me to check the spelling of my name, flight dates, times, etc. Because, he said, the name could NOT be changed after it was booked. And he wanted to book it correctly the first time.

I confirmed again all was correct.

He put me on hold to pull up the taxes. When he came back, he said taxes on this ticket would be $92.56. Fine. That matched what I expected to pay. I gave him my card number.

He asked me to log out of my Etihad Guest account while he booked the award (no idea why). Then he put me on hold again to process it.

From Tulsa? OK!

When he came back, he said it was all booked. And that the miles would be taken out in about an hour.

All booked to Brussels next May!

Then he told me I could select my seat directly with Brussels. And went over the baggage allowance. And, he told me to make sure I had the card I used to pay the taxes with me on the day of travel (again, no idea why – I don’t think Brussels Airlines checks that).

He went over the cancellation policy, the rebooking fee if I need to change the dates, and made sure to tell me at least 5 times to make changes 14 days or more in advance.

I was on the phone with the most thorough airline agent I’ve ever spoken with for 35 minutes. Not the shortest call ever, not the longest either.

As soon as I hung up, I made sure I had an actual ticket number with Brussels. It was there. And the rest of the itinerary loaded up perfectly.

The agent knew how to book the award, was familiar with the award charts, quoted the taxes accurately, and found the exact space I saw on United.com.

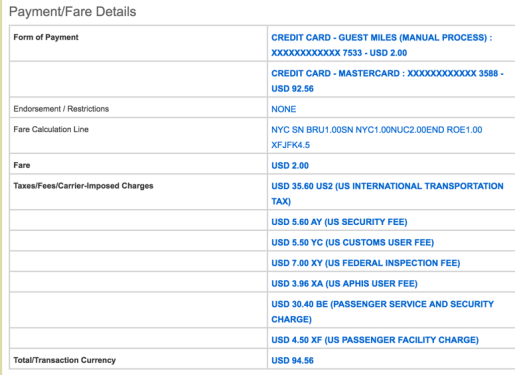

Here is an exact breakdown of the taxes from the receipt:

$2 for fare?

You’ll notice a $2 different in the total and what I was charged. It seems the fare costs $2 – but the charge wasn’t passed along.

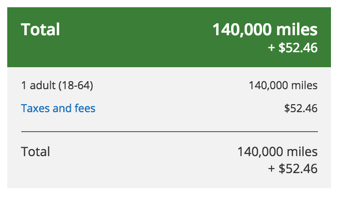

Amazing value

United wants 140,000 United miles for the exact same flights.

No way, man

I paid 36,620 Etihad Guest miles and ~$93 instead. Then I found the retail cost of the flights.

$3,150 – actually a good price for Business Class to Europe

So $3,150 minus the ~$93 I paid in taxes means 36,620 Etihad Guest miles covered a cost of $3,057. So I got a value of 8 cents per mile – not bad!

More importantly, I’m able to fly round-trip to Europe in Business Class for a little under 37,000 miles round-trip – that’s a stunning deal.

Brussels is about that lie-flat (Image is from Bart.la)

Plus, Brussels recently installed new lie-flat Business Class seats on their planes – so I’ll be flying over the pond in style. Good thing because it’s an overnight flight.

You wanna try?

If you want to get in on this spate of award space, I recommend sending some miles to Etihad ASAP. They say it can take up to 14 business days for the transfer to complete, but in my case, it took less than 3 (transferred on Saturday, got them early Wednesday).

You can transfer 1:1 to Etihad Guest from both Amex Membership Rewards and Citi ThankYou. So if you have 37,000 points in either account, you can fly to Europe round-trip in Business Class. That’s a small price to pay for a trip to Europe next spring or summer – awards in economy usually cost more than that.

I probably won’t stay in Brussels the entire trip. Instead, I might stay a couple of days, then hop on the train to Amsterdam or Prague, where I can burn some SPG points on a nice hotel stay.

I have 7 days in Europe, so maybe I could try to squeeze in all 3 cities – a couple of days here and there.

Or maybe I’ll get to Brussels and take a hopper flight somewhere else. I’m not worried at this point with ~11 months to figure it out.

Bottom line

Dates are still wide open for next May and June, so if you’re feeling up to it and don’t mind planning that far in advance, I’d say go for it. It feels good to have a trip planned, even if it is a very long wait.

(Other dates may be available before then – and it’s working checking if you’re interested.)

I can’t stress enough how great of a deal it is to fly round-trip to Europe in a nice Business Class seat for only 37,000 Amex Membership Rewards or Citi ThankYou points and ~$93.

Aside from the 35 minutes spent on the phone, and the 3 business days waiting for the transfer from Citi ThankYou to Etihad Guest to complete, booking this award was simple and straightforward. Much like booking any other award: I gave the agent the cities and dates, miles were deducted, taxes paid, and it was booked.

Overall, this was a great experience. Despite any reservations I had, I wouldn’t hesitate to book another award flight with Etihad miles. Which is good, because in addition to amazing award prices on Brussels Airlines, you can still book American Airlines flights at their pre-devAAluation prices.

Have you had an experience booking a partner award flight with Etihad Guest miles? How did it compare?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

The Top Card for Beginners? Yeah, the Chase Sapphire Preferred

Also see:

New to Points and Miles?

Get a Travel Rewards Credit Card

I’m sure it’s happened to you at some point. A friend asks, “How do you do it?” Take all these trips to places like Hawaii, Tokyo and Osaka, Dublin, Barcelona, and more. How do you get free hotel rooms that cost hundreds of dollars a night?

“I want to travel like you do,” they say. “Where do I start?”

You can stay at the Hyatt at the Bellevue in Philly with Chase Ultimate Rewards points

And you have that moment where you’re thinking inside, “Well for starters, using that debit card for everything you buy isn’t helping anything.” *cough* Kierstin *cough*

You ask about their spending habits. “Do you shop online?” Definitely use a shopping portal – get free miles for clicking a link.

And sign up for dining rewards while you’re at it because you never know when you’ll get some extra miles in your account – especially if you live in a mid-sized to large city.

As far as cards go… where to begin?

Part of me is tempted to say, Discover It ’cause it’s so easy to earn cashback. Or Citi ThankYou Premier because it earns 3X on all travel including gas (but the transfer partners are obscure and points take days to post). Or even Citi Prestige if I know the person books a lot of hotel rooms or buys a lot of flights on American – I can argue why the annual fee is worth it.

Getting Chase Freedom is kind of pointless with the Sapphire Preferred… so I always trace my steps back to the same place.

Going on 5 years with this bad boy

Dammit, the best card to start with really is the Chase Sapphire Preferred.

Why I recommend the Chase Sapphire Preferred

Link: Chase Sapphire Preferred

Here’s what it comes down to:

Easy, daily bonus categories (2X points per $1 spent on travel and dining)

Great sign-up bonus

Easy to rack up points with ongoing spending

Excellent shopping portal (and only one of its kind – Amex, Citi, and Starwood don’t have one)

Useful transfer partners with instant transfers – *this is KEY*

To start, you earn 50,000 Chase Ultimate Rewards points when you spend $4,000 in the first 3 months of opening your account. And the $95 annual fee is waived the 1st year. Stick with me here.

The sign-up bonus is already worth $500 in statement credits. Or $625 on travel. Or even more when you transfer to travel partners.

Chase Airline Transfer Partners

Chase Hotel Transfer Partners

Not only that, but they have useful transfer partners:

50,000 Chase Ultimate Rewards points are worth ~$700 toward Southwest flights

Lots of United award flights are easily bookable on United.com

Booking a Hyatt award night couldn’t be easier – just tick “Hyatt Gold Passport” to see how many points you need for a free night

British Airways is a good level 2

From there, you can learn Flying Blue and Singapore when you have a sec

Basically, this card is good for peeps who know nothing and need to have it easy. AND for those who don’t mind really geeking out and digging around in award charts.

I flew to Dublin in Business Class by transferring my points to British Airways

Southwest, United, and British Airways and more than enough if you want to travel domestically.

Important: Don’t even bother applying for this card if you’ve opened for than 5 other cards in the previous 2 years. But if you’re a beginner, this shouldn’t be an issue – and it’s a good place to start.

That 1st transfer

My friends ask, “So I just transfer the points? And they show up on the other side?”

Ah, I remember my first award booking with points. Still so unsure and skeptical it would actually work.

Then, when I booked the flights, I felt somehow the flights weren’t “real” – that I’d be found out and have them taken away. How could that be possible? Free flights? Yeah right. Where’s the scam?

We stayed in Boston with Hyatt points – then flew back to New York on a free American Airlines flight with British Airways points – all transferred from Chase

It wasn’t until the 3rd or 4th award trip that I started to gain confidence in booking awards.

And having instant transfers is really so nice. You transfer to United, refresh the page, they’re in the account. Same for Hyatt, British Airways, Southwest, and the whole lot.

You can even call to book the award and transfer while you have someone helping you on the other end.

If you want “points training wheels”, this is an excellent place to begin – with a lot of power left over.

Extra points for everyday spending

Most of my friends eat out too much and frequent too many bars. Sound like your friends? For the love of god, earn bonus points on it!

The travel category is very broad and includes airline tickets, hotel stays, tolls, train passes, bus fare, parking, and lots of other incidentals.

Plus you’ll earn 1X point per $1 spent on other stuff. It’s not a lot, but it’s also a lot better than what you’ll earn with a debit card: nothing.

New Orleans is dead cheap with Chase points – getting there and finding a hotel is very easy

The biggest objection I hear is: $4,000?!?! I can’t possibly spend that in 3 months (to meet the minimum spending requirement). So that’s $1,333 per month for 3 months.

How much is your rent? Put it on a card and eat a small fee once or twice.

Use it when you have a big purchase coming up, like a new appliance, upcoming move, or big party to plan. I even bought a car with credit cards.

Or, take your friends out, pocket their cash, and run the bill through your card.

There are plenty of ways to hit the minimum spending requirement.

Bottom line

So I wrote this to share with my friends – I won’t name names lol.

August 2, 2016

Coming Soon: The Doubling (of Discover Cash Rewards Earned This Year)

Also see:

Discover It Is an Amazing Cashback Card (For the 1st Year at Least)!

The 2 Best No Annual Fee Cashback Cards: Fidelity AMEX and Discover It

Get an Easy $600 with the Discover It Card

Or, “The Month Discover Pays My Mortgage“

Or, “The Dublin“

Link: Discover It (with $50 bonus after 1st purchase)

An event so anticipated. It only happens once per year. The month Discover is nice enough to pay my mortgage – THE DUBLIN.

Not this Dublin – but close!

If you don’t have a no annual fee card, or if you staunchly refuse to pay an annual fee on a card for whatever reason, you definitely have a lot of options.

Without making an exhaustive list, I can think of the Citi Hilton Visa, Chase Freedom, Citi Costco, Amex EveryDay, and the Chase Ink Cash and Amex SimplyCash Plus for small businesses.

And, if you want a cashback card with no annual fee, the best ones are:

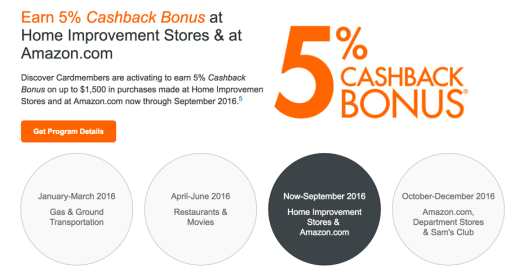

Discover It (5% bonus categories and 1% cash back on other purchases, doubled after the 12th billing cycle for new cardmembers)

Discover It Miles (1.5% cashback on all purchases, ditto for the double cash back)

Fidelity Visa (straight 2% cashback, but you have to have a Fidelity account – all free to have and open)

Citi Double Cash (2% cashback, but you earn 1% when you make a purchase and 1% when you pay it off)

I tend to like bonus categories because I make the most of ’em, but you might prefer straight cashback with no categories to think about.

You can find all the cards that aren’t linked above by clicking through here.

History of The Dublin

In June 2015, Discover announced it would double the cashback earned for new cardmembers with the Discover It and Discover It Miles cards after the 12th billing cycle (or if you were lucky enough to add the promotion to your existing card).

SQUEE!

That means The Dublin has already kicked in for some peeps. But this promotion really started gaining traction around August and September 2015. That’s when I joined (in August).

Since then, I’ve been dutifully following the 5% cashback calendar on the Discover It card. Activating each time.

Restaurants was a good one

I’ve earned 5% on Uber rides, restaurants, my Netflix subscription, and now purchases on Amazon.com.

Of course, they’ve really been 10% categories – which is awesome.

Better yet, Discover will also double anything you’ve earned from the Discover Deals shopping portal.

Some of the portal payouts for stores with a 5% bonus category have been as high as 10%.

For example, when Kohl’s was in the 5% department stores category, the Discover Deals portal added an extra 10% in cashback – which will double to 20%. Add it all together, and it was possible to get a 30% discount at certain stores thanks to The Dublin.

Luckily, this promotion is still running for new cardmembers. So if you want to take part, here’s my referral link with a $50 sign-up bonus (that’ll get doubled too, when you experience your own Dublin).

Is it repeatable?

I wonder if I can close my current Discover It card once The Dublin happens – and then open another one.

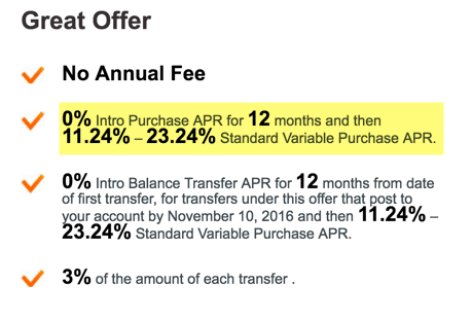

Largely because this caught my eye:

I want that 0% APR

I wrote about getting a card with a 0% APR period to kick-start my student loan payoff. Could this be my ticket to accomplishing that goal and resetting a new Dublin?

I’ve also written about why a no annual fee card is necessary for healthy personal finances. The goal is to keep them open as long as they’re free. But maybe this one deserves to be closed and reopened.

My Own Dublin

I know some peeps have run a LOT of cash through this card, especially with the Apple Pay 23% cashback promo. And I wrote how it was possible for even the casual Discover It cardholder to earn an easy $600 in cashback.

Now, I’ve participated in every bonus category. Shopped through the Discover Deals portal to furnish my Airbnb locations. And pretty much had this card in my back pocket for the better part of a year.

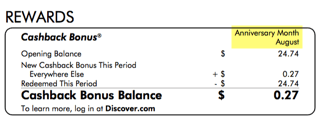

Here’s what I’ve earned in the past 11 months:

MonthBonus earnedTotal

1. September 2015$13.77

2. October 2015$526.34

3. November 2015$116.42

4. December 2015$6.13

5. January 2016$85.03

6. February 2016$107.29

7. March 2016$200.00

8. April 2016$28.17

9. May 2016$187.52

10. June 2016$24.74

11. July 2016$0.27

Total$1295.68

I’ve already earned $1,295.68. And after the 12th billing cycle closes, I should get another $1,295.68.

That means I’ve earned close to $2,600 in cashback this year – NOT BAD for a card with no annual fee.

Discover reminds me my anniversary is in August

My birthday is also this month, so that’ll be a nice present. It also means my September mortgage payment will be more than covered. Thanks, Discover!

Bottom line

While it may seem like Discover is giving away the farm – they’re not. I’ve gotten back far more from Citi this year.

Discover is growing their membership base, brand recognition, and word-of-mouth. Which leads to more sales, more merchant acceptance, and more loyal customers.

It’s all a part of the product sales cycle. I know this promotion lured me in – I’d never even considered getting a Discover card before I heard about it.

I do think Discover It is a fantastic introductory card for people who like category bonuses and/or cashback. And, it’s a great way to get to know shopping portals. Free money for clicking a link – couldn’t be simpler.

Discover It Miles is also worthy for its 3% cashback the 1st year. Both are fantastic cards for the 1st year, which is why I’m thinking of closing my current card and getting a new one to reset The Dublin.

This time of year, late summer, I know lots of peeps are getting ready for their own version of The Dublin. It certainly is an event to behold.

Did this promotion lead you to your first Discover card, too? Will you rinse and repeat to have another Dublin next year?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Booking Hawaii: Part 2 – Using Citi ThankYou Points for Award Flights on Delta and United

Also see:

Trip Report: Hawaii 2013

Booking Hawaii: Part 1 – Flights for 4 to Honolulu

When last we parted, all was happy and good. Flights for 4 people were booked to Honolulu. Then life, as it does, got in the way.

Jay went back to New York for a too-good-to-pass-up film job. That’s right – I am now in Dallas alone. *cue torrential tears*

That was a whole other wrenching experience, but it also had consequences for this planned trip.

“So no Hawaii trip?” “I can’t.” Crap.

No Honolulu for you?

I called Connexions Loyalty (the travel agency Citi uses to book flights with ThankYou points) to ask if I could transfer the ticket to my little brother. I knew it would be a long shot, but worth trying.

The best they could do was cancel the ticket and give Jay the credit – no transferring, no name-changing. Oh, and there would be a $200 fee to redeem the credit. That stung, but at least part of the ticket will be put toward eventual travel.

By the time this all shook out, I accumulated more Citi ThankYou points. And continue to earn 30,000 to 40,000 ThankYou points per month.

Then I thought, why not take my little brother anyway?

How to add another person to the trip?

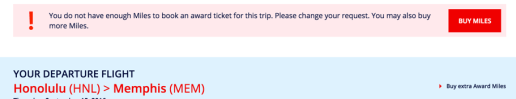

By this point, coach flights from Memphis to Honolulu were nearly $1,000.

Too many pernts

That would cost about 60,000 Citi ThankYou points and… no way! I can do better.

No cigar, either

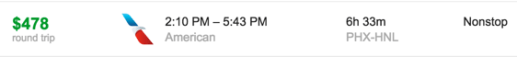

The original PHX-HNL trip the rest of us bought, was still available for ~$478 round-trip, or about 30,000 Citi ThankYou points.

While that was helpful to disregard award availability for 4 people, I’d still have to deal with the Memphis to Phoenix segments. Which would of course cost more points.

So I crossed out using Citi ThankYou points for paid American Airlines flights @ 1.6 cents each, and considered the other options:

United flights with Singapore miles (35K round-trip in coach)

Delta flights with Flying Blue miles (30K round-trip in coach)

American Airlines flights with Etihad miles (45K round-trip in coach)

For all of these awards, you can fly one-way for half the price

Now, I was able to find a one-way there on the dates we needed (including a sweet set of flights landing within 15 minutes of ours!). And a one-way to get my little brother home. But not on the same airline. And American had nothing for award space (seriously, WTF, American?!).

That meant booking two one-way award flights.

I was so happy to share my points to include my little bro on the family trip!

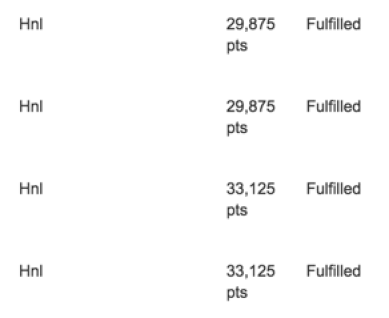

I booked a one-way from Memphis to Honolulu on United, with a connection in Denver, for 17,500 Singapore miles.

And another one-way from Honolulu back to Memphis on Delta, with a connection in Minneapolis, for only 15,000 Flying Blue miles – that’s a fantastic deal!

Here’s how I did it.

Back with Delta

Citi ThankYou points transfer instantly to Flying Blue, which is awesome. So I booked the return flight first.

You can easily search for Delta flights on the Air France website. And you can travel from anywhere in Hawaii to anywhere in the continental US for only 15,000 Flying Blue miles each way.

I found several open flights within a couple of minutes

I quickly found the flights I wanted, and clicked through to book ’em. But got an error message.

Noooo! Phantom award space? Site glitch?

Then I called Air France at their New York office: 800-375-8723.

The agent quickly understood what I was trying to do. And explained Delta was pricing the award as two one-ways on their end because of the connection in MSP. He said it had been happening a lot lately and they are working to correct Delta’s busted-ass booking engine (yeah, good luck with that).

So if you hit the same snag, be sure to call. I gave the agent the flights I wanted, and gave him my card over the phone.

Within minutes, I got the itinerary, and saw my card had been charged $5.60.

The retail cost of the flight was ~$630 – which means each point was worth 4 cents apiece. Niiiice.

I advocate using points and miles because you won’t pay revenue prices.

There with United

At the same time, I transferred 18,000 Citi ThankYou points to Singapore Airlines. The transfer took less than a day. I transferred them on July 22nd in the morning. That same evening, they were in the account.

That was…

…fast!

The next morning, I verified the flights were still available by checking on United.com – make sure you are NOT logged in when you search because United shows additional award flights for folks with elite status and/or the Chase United Explorer card.

Then, I called Singapore Airlines at 800-742-3333 to book. Again, within minutes, it was done.

I was charged in Singapore dollars, but it came out to $5.59 for the award. So be sure to use a card with no foreign transaction fees when you book these awards.

Another 4 cents per mile!

The benefit of booking this way

It’s quite easy to find award space for one or two on most routes – including to Hawaii.

Both Flying Blue and Singapore charge much less than Delta and United charge for their own flights.

With Flying Blue, you’ll pay 30,000 miles round-trip for coach seats on Delta – from any starting point in the continental US.

Delta charges 45,000 miles round-trip to Hawaii on their own planes.

And with Singapore, you’ll pay 35,000 miles round-trip for coach seats on United – from any starting point in North America. Or you can fly in Business for 60,000 miles round-trip (which is also a great deal if you want Business seats – I am fine with coach for flights 6 hours or under).

United charges 45,000 miles round-trip in coach and 80,000 miles round-trip in Business.

So the discounts are worth it, especially if you’re booking for more than one person.

More money for Mai Thais! Another one, please and thank you :)

As a rule of thumb, if the seat you want costs over $600, it’s better to use 30,000 miles (or even 35,000 miles).

Because you’ll get at least 2 cents worth of value from each one. Otherwise, use your Citi ThankYou points to find a paid flight on American Airlines (where they’re worth 1.6 cents each through July 23rd, 2017). Or just pay and know you got a deal on cheap flights.

August 1, 2016

Booking Hawaii: Part 1 – Flights for 4 to Honolulu

Also see:

Trip Report: Hawaii 2013

Next month, I’m headed to Honolulu with my Mom, stepdad, and little brother. I’d been throwing around the idea of a family vacation for a while.

I haven’t been back to Hawaii since 2013.

I enjoyed my time at the Hilton Hawaiian Village so much, I swore I’d go back someday. And now that I’m all Hilton-y and have Diamond elite status, I thought my Mom would absolutely love staying here with me. So I wanted to treat her to a trip.

Nothing quite like a Hawaiian sunset

But first, to get there.

Sussing out flights to Honolulu

So rich was I with Citi ThankYou points that I looked into all the booking options:

United flights with Singapore miles (35K round-trip in coach)

Delta flights with Flying Blue miles (30K round-trip in coach)

American Airlines flights with Etihad miles (45K round-trip in coach)

Citi ThankYou points for paid American Airlines flights @ 1.6 cents each thanks to Citi Prestige

For added fun, I also looked at flights from the West Coast. Because you can pay 12.5K Avios each way for flights on American or Alaska – and I had plenty of Chase Ultimate Rewards points. I even checked into award flights on United thanks to increased award availability for having the Chase United Explorer card.

The first snag was that me and Jay (who ended up not being able to go – more on that in a later episode) wanted to fly from Dallas. And my Mom and stepdad had to leave from Memphis.

I wanted to line up the flights to:

Arrive at similar times in Honolulu OR

Connect in the same place so we could fly together

Have specific travel dates

This was gonna be tough.

I thought we could all meet in Denver to fly on United. Or LAX to fly on Delta. Or Phoenix, maybe, to fly on American. I tried every combination I could think of.

Here’s the award space for ONE person

Finding one seat was a piece of cake. Finding two, sure.

Finding four to arrive on the same day… not so much.

I searched for a couple of hours to make several dates work. We were all flexible.

On a lark, I checked paid fares and noticed they were pretty cheap right after Labor Day from Phoenix to Honolulu non-stop on American.

To fly from Dallas to Phoenix is cake (both are American hubs). And lo and behold, 2 award seats were available from Memphis to Phoenix to catch the flight – but only in First Class.

So turned the little gears.

Putting it all together

In the end, using Citi ThankYou points for paid flights was the best deal. We got the exact dates and flights we wanted without having to worry about award availability.

~30K Citi ThankYou points for each round-trip flight from Phoenix to Honolulu

All of these are from Phoenix to Honolulu. I am staying 5 nights and my Mom and stepdad are staying 4 because they had to keep an eye on their vacation days.

Fares for Jay and me were ~$478. And fares for my Mom and stepdad were ~$530.

Had I booked award flights, I would’ve paid a very similar amount of points. Again, I can’t overstate how simple of a solution this was.

Find the flights, pay with Citi ThankYou points – done. No more searching. Booked.

I’m coming for you, Honolulu

It was especially convenient given the way we wanted to structure our dates and flights. This would’ve been much harder to book as a regular award. Not for one or two, but for four… yes.

Booking this trip has made me love Citi ThankYou points even more. So I’m disappointed they’re reducing the value toward American Airlines flight for Citi Prestige cardholders from 1.6 cents each to 1.25 cents each next year.

Put in perspective, these flights will cost ~38,000 and ~42,000 Citi ThankYou points, respectively, next year.

That increase adds up fast. I’ve done well with this particular perk, so I hate to see it go. Ah well, another year to enjoy it.

But wait, what about getting to Phoenix?

Oh yeah, that detail. After I booked the main flights with Citi ThankYou points, I wiped out my balance. Earn and burn, I always say.

So here’s what we did. Jay and I bought a cheap positioning flight. They were ~$150 each. Not worth redeeming miles or points for.

My Mom and stepdad’s flights were tougher.

For serial?

Non-stop flights were expensive (and only available on American – I didn’t want to make her connect again). To make it harder, American was only releasing First Class award seats.

But then I thought…

I have a lot of these points too.

You can book American award flights with BusinessExtra points

I usually let them accumulate, and then treat myself to a free Admirals Club lounge membership whenever my current one runs out.

I had about 10,000 of these points, so I figured why not put them to use to fly my Mom in First on her way to join me in Hawaii?

As soon as I redeemed, I got an email with the award code. I called the number in the email, fed the agent the flights, and had it booked in 5 minutes. Seriously so easy.

~$11 for First Class tickets? BOOM

The agent charged me $5.60 each way, so it came to about $22 for both tickets.

Ode to Citi Prestige

Link: Apply for Card Offers

You beautiful thing. Why must you change?

Why yes, I CAN work an Exorcist reference into a “Booking Hawaii” post

On July 23rd, 2017, my favorite card, the Citi Prestige, will get a little less shiny. Specifically:

No more Admirals Club access

The 4th night free will be an average cost of the 4 nights, taxes excluded

Points will be worth 1.25 cents each toward flights, instead of 1.6 for American Airlines and 1.33 for others

No more free rounds of golf

You’ll still get:

$250 annual airline credit

3X on airfare and hotels booked directly

2X on dining and entertainment

Priority Pass Select membership

I booked this trip with the 1.6 redemption perk. And, you’ll soon find out, I paid for 4 nights but will get the 4th one free. And even topped off my Hilton balance to get another free night. So this card had a huge hand in planning this trip (hence my ode).

The good news is, you still have close to a year to take advantage of all this.

Apply before September 1st, 2016, and you’ll get Admirals Club access through July 23rd, 2017. Apply after September 1st, you won’t get in.

It’s got a $450 annual fee, but considering it’s August, you can get $250 in airline credits for 2016 and $250 in 2017. By the time the changes kick in, you can reassess whether or not you want to pay again.

Yep, Citi Prestige is still worth a small pile of cash

Either way, you come out ahead financially and still get all the other perks. You’ll also get 40,000 Citi ThankYou points when you spend $4,000 in the first 3 months of account opening – that’s worth $640 toward American Airlines flights (including partner codeshare flights).

So yes, you can very much come out ahead with this card. I say right now’s the best time to get it if you’re ever going to.

To apply, click here, select Citi, and you’ll see it right on top.

Bottom line

This was first time planning a trip for 4. And to all you families out there, mad respect. I don’t know how you do it.

In total, I paid:

Exactly 126,000 Citi ThankYou points for 4 round-trip coach tickets from Phoenix to Honolulu

6,400 BusinessExtra points and ~$22 for 2 round-trip First Class award tickets from Memphis to Phoenix for my Mom and stepdad

~$300 to position Jay and myself in Phoenix from Dallas

It always hurts a little to redeem that many points at once.

But the beauty of redeeming points this way was being able to throw out ALL of the award charts. I found the flights I wanted and had them within minutes.

That allowed me to work through the snags and select my own dates, meet my Mom in Phoenix, and take the family on a trip to Hawaii.

I’m so excited for this trip. Next up, adding my little brother into the equation and booking the hotel stay.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!