Harlan Vaughn's Blog, page 46

October 1, 2016

Hurry! ~$500 Moneymaker on Kitchen Appliances at Kohl’s With Discover It or Freedom

Need a little rush this weekend? How about buying $600+ worth of appliances at Kohl’s?

Last year they had a similar appliance deal I didn’t take part in. But this year I did.

Now before you think I’m crazy (although it may be waaay too late for that), let me explain.

This is a moneymaker if you do it right!

Hat tip to Jill Cataldo for blogging about this and my friend Jas for turning me on to this deal!

Build the deal

I feel like I say this every time I write about Kohl’s, but… it’s no secret I freaking love Kohl’s.

Right now, they have a lot of appliances on sale for $17, including:

Toastmaster 2-Slice Toaster

Toastmaster 15-oz. Mini Personal Blender

Toastmaster Mini Electric Chopper

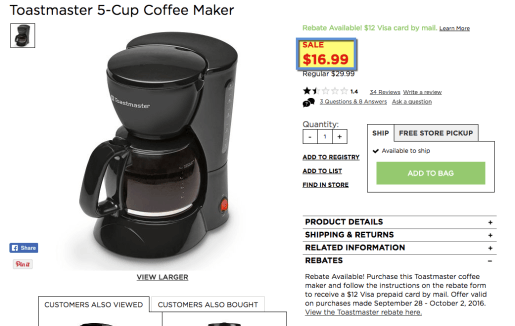

Toastmaster 5-Cup Coffee Maker

Toastmaster Electric Can Opener

Toastmaster Electric Knife

Toastmaster Hand Mixer

Toastmaster 1.5 Quart Slow Cooker

Lots of appliances for $17

In total, there are 8 kitchen appliances at the $17 price.

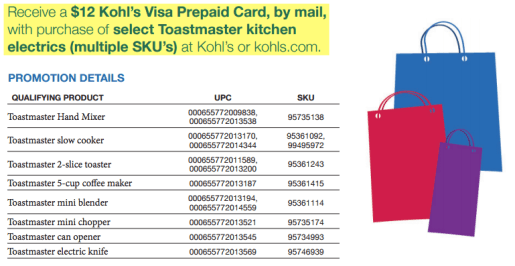

All of the items have a $12 Visa gift card rebate

And, all of the items linked above are eligible for a $12 mail-in rebate. You get a Visa gift card with a limit of 5 per product.

That means if you buy 5 of all 8 items, you can get 40 X $12 back, or $480.

Right now, there’s also a 15% promo code: SMS1871. And it does work for these items.

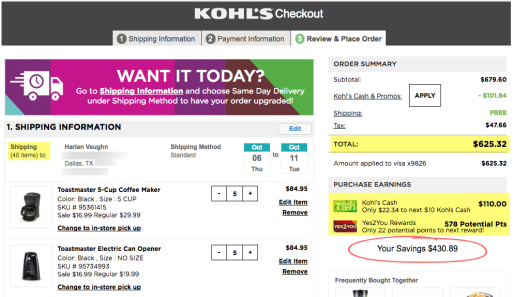

When you add all of them to your cart and add the promotion code, the total is ~$625. You also get $110 in Kohl’s cash to spend next week.

I paid ~$625 for all 40 appliances

Note that taxes in your state might be different than mine! In Texas, the taxes came to ~$48.

And, you must purchase the items by tomorrow, October 2nd, 2016, to qualify for the rebate (here’s the rebate form). Cheers to the weekend!

Stack stack stack

Discover It

Link: Discover It

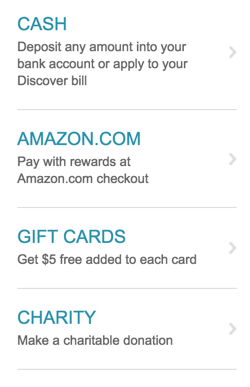

Happy October! You know what that means! Q4 AKA department stores are a 5X category now.

Yay for 5% back

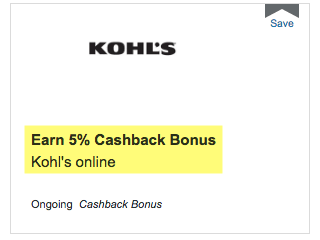

If you have the Discover It card, you can get 5% cashback this quarter at department stores, including Kohl’s, on up to $1,500 in combined spending.

Yay for 5% more back, too!

You can add another 5% cashback when you begin your shopping through the Discover Deals shopping portal.

That adds up to 10% back. Or, you’ll earn 20% back if you’re a new cardmember thanks to Discover’s generous cashback match. It’s deals like these that added up over ~$2,200 back for me last year.

I just got a new Discover It card, so I’ll get ~$125 back from this deal today.

Chase Freedom

Link: Apply for Card Offers

If you have the Chase Freedom, you’ll also earn 5% cashback (5X Chase Ultimate Rewards points) at department stores this quarter, on up to $1,500 in combined spending.

For this deal, you’ll end up with over 3,000 Chase Ultimate Rewards points (~$30 cashback), again depending on your taxes.

Even better, you can still add-in a shopping portal. Cashback Monitor shows these current rates:

That 4X Alaska miles catches my eye

So it’s easy to add an extra 1,000 or 2,000 miles or some cashback to this deal, depending on which one you like.

Add MPX to the mix

I love the MileagePlus X app. Right now, you can earn 3X United miles at Kohl’s. You can purchase a gift card for up to $500 at a time.

I bought a $500 gift card and got an extra 1,875 United miles. Why not.

Easy way to add ~$30 to the stack

I got a 25% bonus because I have the Chase United Explorer card. But even if you don’t, I value 1,500 United miles at ~$30 (2 cents per mile).

And yes, both Discover and Visa cards code correctly through the app – the purchase will show up from Kohl’s and be coded as a department store.

Adding it all up

Link: Kohl’s rebate form (PDF file)

This is all a bit of a mind-bender, so let’s recap all the stacking for purchasing the maximum number of appliances with the $12 rebate.

$480 back as Visa gift cards

~$125 from Discover It and Discover Deals portal OR

~3,000 Chase Ultimate Rewards points (~$30) and ~2,000 Alaska miles from the Alaska Airlines shopping portal (~$40)

15% off with promotion code SMS1871

1,500 United miles from a $500 gift card through MileagePlus X app (~$30)

$110 back as Kohl’s Cash

300 Kohl’s Yes2You points (worth another $30)

Note that I always value airline miles at 2 cents each.

So there’s two ways this can go: the Discover It route or the Chase Freedom route.

With Discover It, you end up with 480+125 + 30 + 140 = $775.

With Chase Freedom, you end up with 480 + 70 + 30 + 140 = $720.

Your appliances are free! And, you even come out ahead by ~$95 to ~$150. That’s a pretty great deal no matter how you slice it. And of course, if you go the Chase Freedom route, the 3,000 Chase Ultimate Rewards points can be worth more if you have another card that lets you transfer to travel partners: Sapphire Reserve, Sapphire Preferred, or Ink Plus.

Update: I already got my Kohl’s Cash via email.

Here’s the $110 in Kohl’s Cash

But wait! There’s more

Free or really cheap kitchen appliances are great and all, but I don’t really need 40 boxes of stuff sitting around.

I might keep 1 or 2 items, and a couple to give away in a few months as Christmas presents, but I plan on reselling these items locally on Craigslist or similar. You may even have a local reselling page on Facebook. Or another site you want to use.

Assuming you can get $10 per appliance, which seems reasonable as they will be new in box, unopened, and retail for ~$30, that’s a profit of $400.

The key here is to sell them as a batch so you only have to deal with one transaction. Or maybe two.

Or, you can donate them to charity for the holiday season. You could even ask them for a donation slip to use as a tax write-off.

Any drawbacks?

Yup, there sure are.

For one, you’ll have to deal with the rebate. And you’ll have to float the ~$625 or so until you get the gift cards in hand.

I plan on using them to pay bills on Plastiq, so I’m essentially running the money through my Discover It card to accomplish that end goal.

And, if you choose to resell these, you will have to list them and arrange payment and pickup. But like I said, if you can do it in one or two transactions locally, it shouldn’t be much of a time suck.

But the pros far outweigh the cons. This isn’t for everyone, but the way I see it is:

I spent 15 minutes buying this stuff. I’ll spend 15 minutes mailing the rebates in. And say 30 minutes for the reselling in hopefully one batch. That’s at least $500 for an hour of work.

That may sound idealistic, as this is my first foray into reselling, but I’m curious to see how it goes. And this is the perfect stackable deal for beginning. Because either way, you won’t lose anything between the rebates and all the stacking.

Bottom line

Free kitchen appliances! And, you get $110 in Kohl’s cash to turn around and use next week. So that’s more free presents, or free household stuff, or clothes, or whatever.

If you sold the items for $10 each, you’d come out ahead by $500, with $400 of that cash in your pocket.

I’ve never resold items like this, but this seems ultra low-risk as they end up being free anyway. So worst case scenario, you end up with a lot of stuff to give away or donate. Which isn’t a bad scenario at all, which is why I gave this a spin today.

The rebate T&Cs say you have to make your purchase by October 2nd, 2016. So if you don’t get around to it today, there’s always tomorrow.

September 23, 2016

Get the Southwest Companion Pass for 2 Years for 90,000 Starwood Points

So it’s done: the Marriott-Starwood merger.

To be honest, they’re handling it a lot better than I thought they would. But I also get the feeling they can’t wait to destroy the program in 2018. But that’s neither here nor there.

Within the opportunity to link your Marriott and Starwood accounts, you’ll get:

An instant status match

The ability to transfer points instantly between both programs (3 Starwood points = 1 Marriott point)

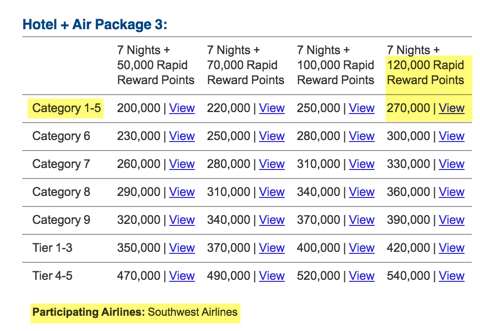

90,000 Starwood points gets you enough Marriott points for a Southwest Hotel + Air package, and thus, the Southwest Companion Pass

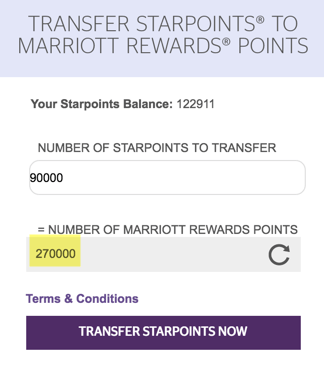

If you transfer 90,000 Starwood points, you’ll wind up with 270,000 Marriott points. Which is enough for a Southwest Hotel + Air package to earn the Southwest Companion Pass.

It could be a fantastic deal if you fly Southwest a lot!

Use Starwood points to unlock the Southwest Companion Pass

Link: Link your Starwood and Marriott accounts

Link: Transfer Starwood points to Marriott

Link: Marriott Hotel + Air Packages

Link: Southwest Companion Pass

Starwood points to NOT transfer to Southwest. But if you like flying on Southwest, you can indirectly use Starwood points to earn the Southwest Companion Pass for 2 full years by transferring 90,000 Starwood points to Marriott for a Southwest Hotel + Air Package.

Use Starwood points to redeem for Marriott’s Southwest Hotel + Air Package in January 2017

When you do, you’ll earn 120,000 Southwest points and 7 nights in a Marriott Category 1 through 5 hotel. Obvi, you’ll get the most bang for your buck at a Category 5 hotel. But you can still do well at some Category 4 hotels.

But the hotel stay is almost moot.

1 Southwest point is worth ~1.43 cents. You’ll get 120,000 Southwest points, which are worth ~$1,716 (120K x 1.43 cents).

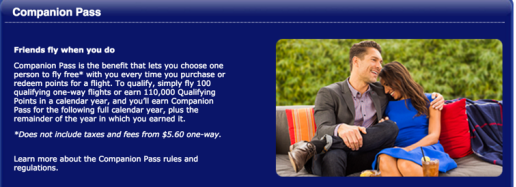

But even better, the points you transfer do count toward earning the Southwest Companion Pass.

Want the Southwest Companion Pass? It’s yours for 90,000 Starwood points

If you transfer the points and redeem for a package in January 2017, you’ll have the Southwest Companion Pass for a full 2 years – which means you can add a companion on ANY paid OR award ticket for only the cost of taxes and fees.

Is it worth it?

If you’re based in a Southwest hub, or a city with good Southwest service, the ability to add a companion for 2 full years is worth as much as you think you’ll use it, especially for expensive tickets like last-minute trips and during the holidays.

Even if you only use it a few times, the hundreds of dollars you’ll save can make this well worth contemplating.

In fact, as a Dallas-based flyer who lives 10 minutes from DAL, I am seriously considering doing this myself. But one huge note – wait until January 2017 to make the transfers. Because Southwest bases the Companion Pass on the year when the points are earned. If you make the transfer in 2016, you’ll only have the pass until the end of 2017.

The numbers

I’d say 7 nights at a Marriott Category 5 hotel are worth ~$800 (at least).

And the 120,000 Southwest points you’ll get will be worth ~$1,716 (at 1.43 cents each).

But you can go ahead and double that because you’ll immediately earn the Southwest Companion Pass.

Plus any other flights you buy over the course of 2 years (I’ll peg this at $1,000).

So your 90,000 Starwood points get you:

$800 on the Marriott stay

$3,432 on Southwest award flights with the Companion Pass

$1,000 more for your Companion on paid Southwest flights over 2 years

Which comes to $5,232. So, in essence, your 90,000 Starwood points can be worth over $5,000 depending on how much you use your Companion Pass – and which Marriott hotel your choose for your 5-night stay.

Each Starwood point, then, is worth ~6 cents each – which is a stellar deal any way you slice it – especially if you already like to fly with Southwest.

Get Starwood points

Link: Amex SPG personal card (25,000 Starwood points)

Link: Amex SPG business card (25,000 Starwood points)

Link: Apply for Card Offers

If you need or want Starwood points, sign-up for one of the cards above for an injection of 25,000 points after meeting the minimum spending requirements.

Or, apply for any number of cards that earn Chase Ultimate Rewards points which transfer to travel partners, including Marriott:

Chase Sapphire Reserve

Chase Sapphire Preferred

Chase Ink Plus

You won’t get approved for any of the Chase cards if you’ve had more than 5 open cards in the previous 24 months. But if you get one (or both, like I did) of the Amex cards and top yourself off with Chase Ultimate Rewards points transferred to Marriott, that could be another way to get all the points you’ll need. Remember:

Chase Ultimate Rewards transfer to Marriott at a 1:1 ratio

Starwood points transfer to Marriott at 1:3 ratio (and vice versa)

So run the numbers to see if it makes sense. If you fly Southwest a lot, and have a lot of Chase Ultimate Rewards, Marriott, or Starwood points, it could add up to be a very worthwhile deal.

Bottom line

I’m mulling over the possibilities this merger has created as of today, so be on the lookout for more ways to make your points worth more.

I do think this one is perhaps the best, though. In fact, I am strongly considering it myself.

But remember to wait until January 2017 before you redeem your points this way – because of how the timing on the Southwest Companion Pass works.

If you wait until 2017, you’ll get a Companion Pass good for all of 2017 and all of 2018 – and 5 free nights at a Marriott Category 1 through 5 hotel.

Starwood points don’t transfer to Southwest directly, so this is an indirect workaround that can be pretty valuable if you time it and use it right.

What do you think? Is this a good deal or nah? Will you consider doing it?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

September 22, 2016

Honest Review: Amex Starwood Business Card 2 Free Nights Offer

Note: The offer for 2 free nights expires October 19th, 2016, but is valid at the time of publication.

Well color me surprised. I wasn’t expecting to see any type of limited-time offer on the Amex Starwood cards again. But now we have one, although it’s only on the business version of the card.

And, it’s dumb. Geez, Amex, it’s like you’re on the Titanic, and about halfway across the Atlantic right now…

The short

The most restrictive offer ever on an otherwise so-so card. Either Amex is desperate or thinks we’re stupid… or both. Not worth it for most.

The long

Link: Amex Starwood Business Card (2 free nights offer)

Link: Amex Starwood Business Card (25,000 point offer)

Link: Honest Reviews

Wowww, let me peel this out a little.

With this offer, you’ll earn 2 free nights at:

Participating Category 1-5 hotels & resorts worldwide after you use your new Card to make $5,000 in purchases within the first 3 months.

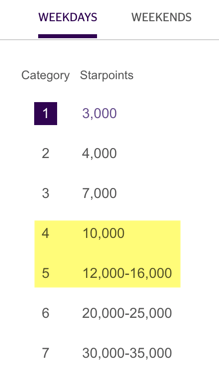

Here’s SPG’s weekday award chart (you get a 1,000-point discount on weekends at Category 1 and 2 hotels):

Starwood’s award chart

Obviously, you want to target the Category 4 and 5 hotels to make the most of the offer.

So at best, this deal is worth:

20,000 Starwood points for 2 nights at a Category 4 hotel

24,000 Starwood points for 2 nights at a Category 5 hotel @ 12K per night

32,000 Starwood points for 2 nights at a Category 5 hotel @ 16K per night

Considering the usual sign-up bonus on this card is 25,000 Starwood points after completing the minimum spending requirements, you actually come out worse with the first two options.

There are a few instances where this deal might be worth it, like 2 nights at the new Westin Nashville, but you’ll have to be selective

The only way you can do well is IF you find a Category 5 hotel at the 16K per night rate. Even then, this doesn’t beat the previous limited time offer of 35,000 Starwood points.

Restrictions!

The beauty of Starwood points lies in their variety of uses, like:

The ability to transfer to airline partners

Cash + Points bookings

SPG Moments

Nights & Flights

With this offer, you actually lose the ability to do these things with your points.

I’m really failing to see how this offer is better…

To boot, if you used the free nights at a Category 1 hotel during the weekend, for example, this offer would be worth only 4,000 Starwood points (!!!).

Really, Amex? I actually prefer the basic 25K offer which is also still available.

Can it be a good deal?

In limited settings. For example, Philadelphia, Portland, Seattle, and Nashville are all cities with surprisingly high hotel rates.

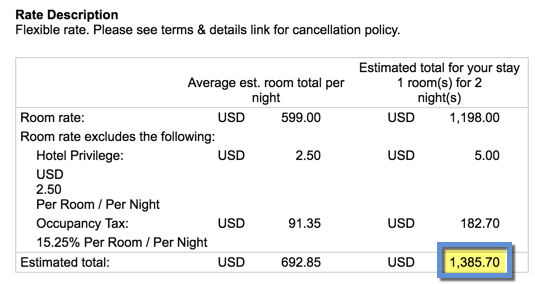

The base rate at the new Westin Nashville is well over $600 per night (and it will be a Category 5 hotel)!

Here’s one instance where this offer is stellar

With this 2 free nights offer, you’d save well over $1,300:

Worth it

Many cities in Canada, like Vancouver and Toronto, can also be expensive. Or London. Or Paris. Hawaii sometimes (there’s a Category 5 hotel in both Honolulu and Kauai).

If you can find a Category 5 hotel that’s typically expensive, and that’s how you intend to use this offer, you’ll save yourself 32,000 Starwood points in the process.

And, as shown above, it can be a good deal – easily over $1,000.

It’s just… in comparison to the normal offer, or previous limited time offers, I wouldn’t trip over myself to pick it up, unless you have a specific use in mind.

Grade: D

Sorry, Amex. Your desperation is showing.

Why the low grade? For one, you can’t earn this sign-up bonus if you’ve ever had this card… in your entire lifetime.

Had this card 10 years ago and canceled it to explore other hotel chains? Well, Amex is saying you can’t have the bonus. No bonus for you! Which is damn stupid.

And, Amex likely knows they are sounding the death knell with their SPG card portfolio and are trying an offer to attract new customers. On the surface, it looks good: 2 free nights. But when you analyze it, you realize quickly it’s nothing special.

You know what would’ve been, though? THREE free nights. Now that would’ve earned a “B” for “Bitchin'”!

OR – the ability to use the 2 free nights at ANY category of hotel, including the super high-end ones.

But as it stands, Amex, ya blew it!

Keep or DTMFA : Keep.

Link: Amex Starwood Business Card (2 free nights offer)

Link: Amex Starwood Business Card (25,000 point offer)

Why am I rating this with a “D” but saying to keep it?

Because either:

Amex will keep the portfolio and try to make the card better

Chase will get the portfolio and try to make the card better

This comes marked with a big “hopefully” of course. But personally, I want to stick around to see what happens with the card.

I’m also curious to see how Marriott will treat Starwood now that the deal is done. Will they keep it semi-separate a la Ritz-Carlton? Or go ahead and make it Marriott?

Either way, one thing is for certain: SPG will be dead come 2018, and your Starwood points will be worth much less. Marriott is going to neuter SPG because they have literally no incentive to keep the program intact.

What, you think the largest hotel chain in the world is going to care about cannibalizing a once-great loyalty program after they join operations?

A final thought is this card gets you access to the lounges at Sheraton hotels, and that’s worth having if you stay there often.

But mostly, I’d keep this card in hope of some Chase – Amex competition, depending on how they divvy up the existing customer base.

That, to me, makes the card worth keeping (but curiosity killed the cat, right?).

So what’s your take? Do you agree with my Honest Review? Is the 2 free nights offer compelling enough to sign up for, or do you prefer the normal 25,000 point offer?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

September 20, 2016

My Best Advice: Unpack When You Get to Your Hotel Room

Also see:

More posts containing my best advice

Something fast and simple I’ve been practicing lately has gone a long way to change my mindset when I stay in hotels: unpacking.

It sounds so small – it is! – but I’ve found the effect is well worth the extremely minimal effort it takes. And, you end up saving yourself time in the end.

It beats living out of a suitcase, especially for stays of more than a few nights (and curiously, I’ve had a lot of 4-night stays recently thanks to Citi Prestige). Unpacking has made the difference between feeling transient or temporary and like I’m home for a little while. And that mindset carries over to how I interact with the place I’m in, albeit in a very small way. But, hey, it all adds up.

Why unpack?

Do you unpack your suitcase when you get to your hotel room? Why or why not?

If you’d asked me that last month, I would’ve had an answer (which would’ve been I don’t), but no explanation, really.

I hung my shirts. In a closet. In a hotel room

On a recent trip to Washington, DC, I had some shirts I didn’t want to get wrinkled, so I hung them up.

And then, I folded and put away my pants. And my unmentionables (I’ve always loved that term as a reference).

Emptied my backpack and put out my cords and chargers. That was all I brought – I unpacked in about 2 minutes for a quick weekend trip.

I spent the next few days marveling at how everything was in reach. No sorting through a heap after the shower because everything was already in its place. No wondering, “Oh, bloody hell now where is that…?” (I’m a stodgy old British man in my mind.)

What a feeling! After all my years of traveling, something felt new and novel again: simply unpacking.

But then…

Humans have rituals. New environments break them. Unpacking helps put them back. And lets us ritualize the way our evolutionarily formed brains intended.

I noticed having my morning ritual intact directly before leaving put me in more of a homey mindset. Like I wasn’t far from normality. And everything was right where it should be.

Now, I’m not saying there was some dramatic effect. But it did give me a little boost.

Even hung my pool shirts in Hawaii

And it was comforting to come back and know where everything would be.

The 2 minutes I spent unpacking probably saved me dozens of minutes in fumbling and sorting and walking back and forth. Now I wonder why I tried to live out of suitcases for so long. Especially after considering the payoff of saving several minutes with a small investment of only a couple of them.

Bottom line

Now I’ll ask you the question I couldn’t answer: Do you unpack your suitcase when you get to your hotel room? Why or why not?

If you’ve never done it, I recommend you give it a try!

And if you already unpack, do you find there’s a benefit, however small it may be?

Would love to hear your thoughts on this, as someone who’s recently found out the joy of unpacking.

Definitely one of those “why haven’t I been doing this all along?” moments!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

September 19, 2016

Yes! Just Got My $1,100+ Discover It Cashback Match (The Dublin)!

Also see:

Coming Soon: The Doubling (of Discover Cash Rewards Earned This Year)

Discover It Is an Amazing Cashback Card (For the 1st Year at Least)!

Get an Easy $600 with the Discover It Card

Well, I woke up this morning to find a smooth $1,100+ in raw cash in my Discover It account. Talk about something nice to wake up to!

And just last week, I got a second Discover It card – so I can have another Dublin around this time next year!

Um, what’s The Dublin?

Link: Discover It (with $50 bonus after 1st purchase)

“The Dublin” is a derivative of “The Doubling,” countrified to match my sometimes-twangy Southern accent (though much worse for wear after a decade up North).

The term refers to Discover’s promotion to match all your cashback earned the first year with the Discover It card, including:

The 5% cashback categories (effectively making them 10% cashback)

1% on regular purchases (meaning it’s a 2% cashback card the first year)

Shopping portal bonuses (routinely 10% to 20% back)

The $50 you get after making a purchase (so, $100 back in the end)

For 12 months, you get to watch your cashback accumulate. Then, after your 12th billing cycle, Discover matches it all in one lump sum – that matching is the event I call The Dublin.

And mine happened today!

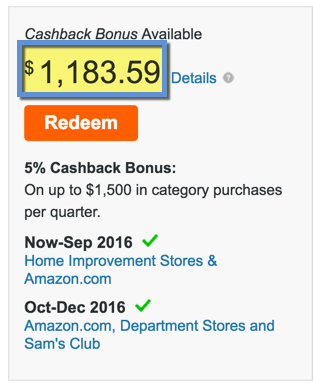

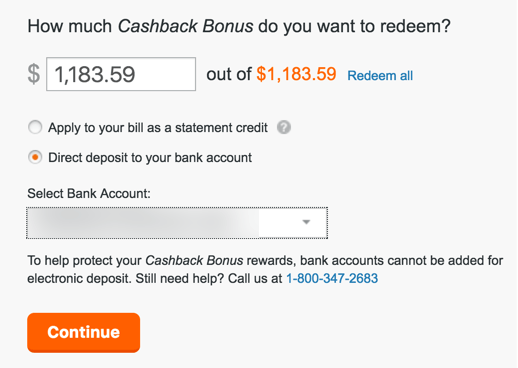

Gee thanks, Discover!

Here are all the ways you can redeem the cash:

Cash sounds good

I redeemed it all for an electronic deposit in my bank account.

Yes!

I’ll likely funnel all of this money directly into my student loans. I’ve also been thinking about getting a rowing machine lately (yay, fitness!). This bonus would more than cover it.

You can rinse and repeat

You can have 2 Discover cards at a time. I left my 1st card open and applied for a 2nd card – it arrived last week.

Today, after I deposited the match from the 1st card, I went ahead and set my 2nd card into motion in anticipation of another $1,000+ from Discover next year.

But remember, The Dublin is a match.

So that means I’ve already earned $1,100 over the course of the past year. And today, got another $1,100. That means I was able to earn well over $2,000 in pure cash this year – which is an incredible return for a card with no annual fee that’s free to keep forever!

A great card for beginners AND old-timers

I’ve met some people who simply don’t trust how points work. The process of accumulating, and searching to redeem, is “too much of a hassle.”

(I, for the record, love searching airline sites and plucking out good deals. Is it time-consuming? Yes. But the ends more than justifies the means.)

But everyone understands cash in hand. Because Discover It gives you access to the fantastic Discover Deals shopping portal, it’s a great card to have to get in the habit of clicking through each time you shop online.

A great intro to rotating bonus categories

It’s also a great introduction to quarterly category bonuses (and bonus categories in general) – a feature of many other points and miles cards.

And, it’s pure fun to watch the cashback pile up.

Some people like to watch it build, like a savings account. But others, including yours truly, ferret it away as soon as it’s earned.

Either way, you still get the thrill of The Dublin after the 12th billing cycle.

And for peeps who are dyed-in-the-wool rewards card junkies, you can’t deny the incredible earning potential and the value of the (effectively) 10% cashback in the bonus categories.

Plus, it’s not a Chase, Citi, or Amex card, so your chances of approval are quite good.

I’ve written about how it’s easy to get at LEAST $600 back with this card. And, based on my own experience, much more!

Bottom line

Link: Discover It (with $50 bonus after 1st purchase)

I love the Discover It card. Between the bonus categories, excellent shopping portal, and tremendous ease of use, I was able to score well over $2,000 in cashback this past year. Not bad for a card that’s free to keep forever. Literally, free money.

This card is also a great option if:

You’re building your credit

You want or need a 0% APR intro period (it’s 12 months with this card)

You want to get into earning rewards

You want a new card in the mix that’s not Chase, Citi, or Amex

All the cash you earn will get matched after the 12th billing cycle. And, I must say, it feels pretty dang good when that moment happens (The Dublin).

So good, I got a second card to start all over with.

I’m curious – if you have this card, have you received your Dublin yet? How’d you make out?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Honest Review: Barclaycard Arrival Plus 50,000 Mile Offer

Also see:

DTMFA: Barclaycard Arrival Plus. Still a good card?

Interesting offer from Barclaycard.

They’ve had a so-so year with their cards, with a limited-time increase to 50,000 miles on the Miles & More card, the release of 2 decent JetBlue cards, and now this.

The typical sign-up bonus on the Barclaycard Arrival Plus is 40,000 Arrival miles, so this offer adds an extra $100+ of incentive.

Perhaps Barclaycard is rethinking their strategy with this card, as they should. It used to have a lot more features and benefits – but those have been cut, leaving behind a product that’s unremarkably ordinary.

The new limited-time 50,000 mile offer on the Barclaycard Arrival Plus

With a ~$500+ sign-up bonus, it might be worth a look.

The short

A typically lackluster card worth getting when you’re full up with the other banks and want to get an easy injection of travel credit. This is the highest offer there’s ever been for this card.

The long

Link: Barclaycard Arrival Plus

Link: View Additional Limited Time Offers here!

Absolutely.

BUT – Barclaycard will often waive the annual fee if you call and speak with a supervisor. So that’s something to keep in mind once the second year begins, should you decide to try. (They waived it for me the second year.)

This is a great card to get for the sign-up bonus alone.

All cards have 3 main things to look for: sign-up bonus, regular spending bonus, and ongoing benefits.

This card has the first, but not the last two. So grab the sign-up bonus while this offer is around, especially if you’re locked out of Chase, Citi, and Amex. Evaluate it for around ~10 months and decide if you want to ask for a fee waiver the 2nd year.

If you can’t get it, DTMFA.

OR, downgrade it to its no annual fee counterpart to keep the credit line intact to help boost your credit score, like I did. And let’s hope Barclaycard rethinks this card and adjusts the perks and fee accordingly in the near future.

Do you agree with my assessment of this card’s offer? Will you add this one to your wallet?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Hotel Review: Hilton Hawaiian Village, Honolulu

Also see:

Booking Hawaii: Part 1 – Flights for 4 to Honolulu

Booking Hawaii: Part 2 – Using Citi ThankYou Points for Award Flights on Delta and United

Booking Hawaii: Part 3 – Hilton Hawaiian Village and Tending Reservations

After months of anticipation, the day finally came to travel to Hawaii. I was a Nervous Nelly because of a line of thunderstorms moving through Dallas (where I was) and onward to Memphis (where the fam was).

Thoughts of missed connections, rebookings, and sitting in an airport instead of in Hawaii came to mind. But thankfully, it all came together without a hitch.

I flew over with my Mom, stepdad, and Jay. And my little brother met us at HNL.

Entrance to the Hilton Hawaiian Village in Honolulu

We took an Uber to the Hilton Hawaiian Village, about ~20 minutes away. Really, couldn’t have gone more smoothly.

Arrival and check-in

Whoa. Prepare thyself. The Hilton Hawaiian Village is no ordinary hotel. It’s a compound.

With 3,000+ rooms, thousands of employees, dozens of shops, restaurants, and bars, and 5 towers spread across 22 acres, it’s legit a village.

Hilton must looove this property, because the occupancy rates here are extremely low.

The check-in area has multiple lines, and is set next to the main service road going through the village.

There are lines for:

Regular check-in

Hilton HHonors members

Digital check-in

The regular check-in line was around 50 deep (!), but the Hilton desk only had about 10 people. I’d already checked-in via the Hilton app and was given a room in Diamond Head Tower, but wanted to see if we could get an upgrade to the Ali’i Tower or Rainbow Tower. After a few minutes, I was up.

The desk agent was very friendly and thorough – impressive given the volume here.

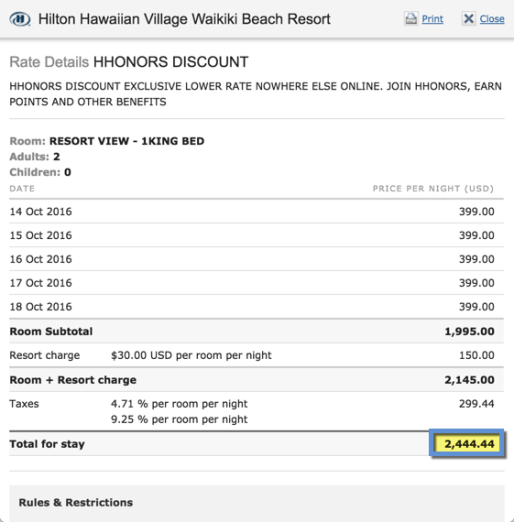

I’d originally booked the cheapest resort view room. But both me and my mom were upgraded to an Ocean View room in Rainbow Tower. I paid for my mom’s 4 nights with Citi Prestige. And my 5 nights were booked with Hilton points (with the 5th night free).

My 200,000 Hilton points got me a room worth well over $2,000

Considering the upgraded rooms often go for ~$400 a night, that’s a great deal. And it means my Hilton points were worth a cent each, which is a good rate.

They also gave us 2 dining credits because I booked as a Hilton Diamond elite member. Both rooms got $20 a day to spend at certain restaurants on-site. You can use them all in one go or spread them across a few days.

My mom got $80 to spend and I got $100. This was instead of getting free breakfast (which I would’ve preferred), but definitely better than nothing. This was also a value-add to the Hilton points booking.

All-in-all, an excellent check-in experience. Hilton really took care of us with the upgrade to Ocean View rooms, dining credit, and quick service.

The room

Link: Rainbow Tower

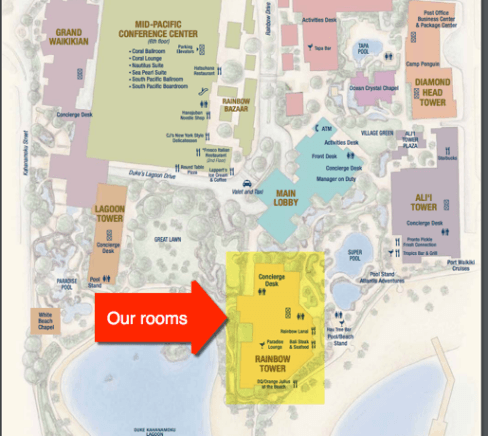

I liked being in Rainbow Tower. It’s the one nearest the ocean, and most rooms have spectacular views.

Rainbow Tower

We were on the West-facing side

I got room 1524, and my mom got room 2010. Both rooms faced west – with excellent views of the sunset in the evening.

Hallways of the Rainbow Tower

My room, 1524

View upon walking in

TV, bench, desk

Coffee, tea, ice bucket, cups

Double beds

Closet with safe, extra pillows, iron, hangers

Desk

View from the balcony

View from the window

Boys in my bed(s)!

The room was bright, clean, and cozy. Not too big, but not tiny either.

The double beds were a bit on the small side, but nothing unmanageable.

The closet was nicely sized, and there was a fridge to store our drinks and keep them cool.

And the view from the balcony…

Day view

Evening/sunset view

Incredible. I spent many moments out there, absorbing the views and feeling the ocean.

I asked my bro what he thought of the view. This was his reaction:

About sums it up :)

The bathroom was also well-stocked with plenty of towels and bath products.

Bathroom

Shower

Peter Thomas Roth toiletries

Each day, the cleaning staff came ’round and stocked us up on everything, replaced the towels, and refreshed the beds.

Like any popular resort, the room had its battle scars: chipped paint, scuffs on the door frames, stains beat into the carpet. That’s not a criticism, so much as a fact of life at places like these. I do think they did a good job of keeping the rooms updated.

Pool-ready in Oahu

Last time, I stayed at the Ali’i Tower. I honestly don’t have a preference between Rainbow or Ali’i. I liked being close to the beach and loved the view from Rainbow Tower.

I suppose the major plus with Ali’i is the rooms are a bit more modern (think more dark wood and white and not beachy-themed colors) and there’s a private pool only accessible to peeps staying there.

But all else being equal, I loved the room and Rainbow Tower this time: clean, quiet, fast wifi, comfy beds, and very close to everything that makes the resort a destination.

What HHV is and what it isn’t

When you stay at a place like Hilton Hawaiian Village, you have to know going into it to expect:

Lots of crowds

Long lines

People everywhere

Kids everywhere

Noisy in the common areas

Long wait for elevators at times

In short, it can be a circus. This isn’t some quaint hotel with a lazy hammock tied around two palm trees with an ocean breeze.

It’s is a full-on resort, and you should expect people to be crawling through every square inch of the place at all times. That’s at its peak during the sunny midday.

Landon in the Super Pool

All that to say, we had no trouble getting 5 beach chairs IN A ROW, dipping in the pool, getting sat at the restaurants, or getting around in general. In fact, we found ourselves with patches of complete peacefulness around the lagoon and occasionally around the pools.

We also had the screaming babies, pushy people in the elevators, and general tourist malaise – you know what I’m talkin’ about. But taken for what it is, there’s no reason you can’t have a perfectly lovely time here – relaxing, even!

My mom and bro at The Tropics restaurant

After my last visit there in 2013, I went back again. And after a second go-round, you know what?, I’d go back again… in a few more years.

View of the lagoon

It’s set up to where you don’t have to leave the premises.

If you want to fly to Honolulu, take a cab in, and plant yourself next to a pool for a few days, it’s totally possible to have that experience. And, if you want to see more of Honolulu, it’s so centrally located that you won’t have trouble doing that, either.

Waikiki Beach

A bit more on the property

We ate at The Tropics and Bali restaurants with our dining credits. And took advantage of the various happy hours throughout the resort.

Grabbed pizza and bought a few trinkets.

Sampled the Super Pool, Tapa Pool, Paradise pool, the lagoon, and of course the beautiful Pacific Ocean.

Even attended the Waikiki Starlight Luau. I could’ve skipped it, but mama wanted to do it, so… can’t say no to mama!

We ate breakfast off-site every day at these places:

Wailana Coffee House

Eggs ‘n Things

Goofy Cafe

All were great in their own way. We took Lyft everywhere because Uber had surge pricing ALL THE TIME. But each time, we were picked up at the check-in area. And the fares were reasonable – about $8 or $9 to most places in town.

And after the first $12 Mai Thai at the Super Pool, we wised up, headed to the ABC Store on-site, bought rum, mixer, and some plastic cups and loaded up with ice from the ice machines and called it a day. Much more economical than paying for each drink.

This is, of course, discouraged, but no one checked and we didn’t hear anything about it. We weren’t exactly flashing it around, either.

There is plenty to do within the resort itself. Try each pool, visit the happy hours, and believe it or not, some of the souvenirs were well-priced. I also love the stretch of Waikiki Beach in front of the property.

Bottom line

I gotta say, Hilton has treated me very well this year as a Diamond elite member.

And even though it’s a little schmaltzy, I think the Hilton Hawaiian Village is a special resort – there’s just nothing else quite like it.

I’ve been to other beach resorts, but none are as well-rounded, affordable, and easy to reach as this one.

My goal was to get to the pool, sip a drink, and unwind for 5 whole days. During that time, I thought of nothing. Nothing! And it was perfect.

Of course, we spent a little time dealing with the crowds and the physical experience of getting around the huge grounds. But all-in-all, it was exactly what I had in mind – but you should be aware of what you’re getting into here.

I’d say if you can find a cheap room (~$200 a night or less), cheap flights, or if you have points (see Part 1 and Part 2 of my Booking Hawaii series) – and you want a dead cheap vacation to Hawaii – it’s hard to top this.

Honolulu is also a great base for island-hopping to see more of Hawaii – and you can get to other parts of Polynesia and even Asia from here.

It’s an easy jaunt from the West Coast, a longer one from other locales, but after visiting the Caribbean for the first time this year, I gotta say: I like Hawaii better.

Yes, I’ll go again in a few more years. And next time I want to revisit Maui and see Kauai for the first time.

Have you stayed at the Hilton Hawaiian Village or another hotel in Honolulu? How does your experience compare?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

September 16, 2016

Honest Review: Chase Sapphire Reserve 100,000 Point Offer

For my first Honest Review, I’ll come to a card I haven’t written about yet: the Chase Sapphire Reserve. Make that THE Chase Sapphire Reserve.

I’ve avoided mentioning it because, well, most of us can’t get it because of Chase’s prohibitive 5/24 rule. But, if you’re new to the points & miles world, wow. What a great place to start.

Or, if you can manage to get yourself a pre-approval in-branch (no dice here, eff you Chase!), definitely pick it up.

You can tell if you’re really pre-approved is if Chase gives you a definite APR. If they give you a range, you’re pre-qualified, not pre-approved. You want that definite number.

The Chase Sapphire Reserve is in here, or at least you’d think judging from the publicity

Another strategy would be to say screw it and apply anyway. If you’re denied, have another Chase card waiting in the wings that isn’t covered by 5/24, which are at the time of writing:

Chase British Airways

Chase Hyatt

Chase IHG

Chase Fairmont

Chase Marriott Business

Chase Ritz-Carlton

That way the inquiries will hopefully combine and hey, at least you’ll have something.

The short

An all-around stellar travel credit card with huge rewards, an eye-popping annual fee, and a long list of perks that make it more than worth its weight in proprietary metal.

The long

Link: Apply for Card Offers

Link: Honest Reviews

In exchange for the $450 annual fee, you’ll get 4 or 5 times that amount back (or more!), depending on how you redeem your points.

This card is a game-changer because right off the bat, your points are worth 1.5 cents each when you book travel through Chase.

Good job cooking this one up in those headquarters of yours, Chase

So you’re already up to $1,500 with the sign-up bonus of 100,000 Chase Ultimate Rewards points after spending $4,000 on purchases within the first 3 months of account opening.

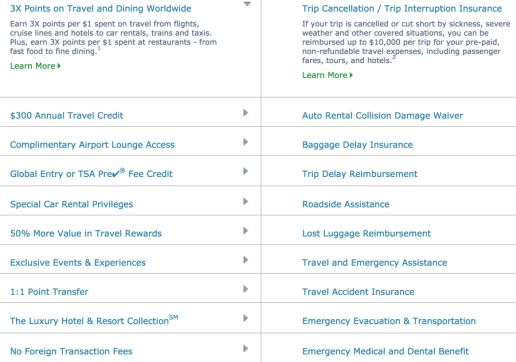

On top of that, you’ll get:

$300 annual travel credit that resets after the close of your December statement

3X Chase Ultimate rewards points on travel and dining

Priority Pass Select access with guest privileges

And lots of other bennies that might come in handy one day, like roadside assistance, emergency medical evacuation, trip delay and cancellation coverage, and 90-day price protection – for starters

Chase Sapphire Reserve travel bennies

There’s been much spilled digital ink over this card. If you want it, check your pre-approval status in branch, or perhaps throw a random application out and see what happens – if you have backup or can absorb the credit inquiry within an overall app-o-rama.

That $300 statement credit tho

If you get the card in 2016, you’ll get $300 in travel purchases credited back to your account this year. And that’ll reset after the close of your December statement.

So in early 2017, you can hit it up for another $300 in credits.

In my mind, that erases the annual fee completely the first year. And you still have that 100K sign-up bonus. With $600 in credits added in, the total value rises to $2,100 – at least.

Grade: A

Kudos, Chase. You knocked it out of the park. Everyone wants with card and you claim you didn’t even market it!

You messin’, Chase?

This card is bold, now industry-leading. 3X is a new standard for travel and dining.

And 1.5 is the new base valuation of your points. And the $300 statement credit is the highest there is (I’m looking at you Amex with $200 on the Amex Platinum Card and you Citi with $250 on the Citi Prestige).

Normally, A stands for “Are you freaking serious? Why haven’t you applied already?!”

But for Chase cards, be sure to assess your situation carefully if you’ve had a lot of cards in the recent past.

Keep or DTMFA : Keep.

Is it worth paying $450 after the sign-up bonus is used up and the $300 statement credit’s been had? I think so, if only for the 3X category.

If you spend a lot in those categories, you’ll rack up a mega amount of points throughout the year. And considering each point is worth 1.5 cents, that’s 4.5% back toward travel on those purchases.

You need to spend $10,000 in the categories to make the annual fee worth it, though.

Because 10,000 X 3 = 30,000 X 1.5 = $450 back toward toward travel booked through Chase.

$10,000 is a low figure for lots of peeps in the travel and dining categories, especially if you have a lot of paid airfare, tolls, bus and subway passes, hotel or Airbnb stays, or if you eat out a lot. In that case, you’ll earn a huge amount of points of the course a year, which makes this card a firm keep, annual fee and all.

Do you agree with my assessment? The Honest Reviews series is new, so I’d love to hear your thoughts to shape the column moving forward!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

September 15, 2016

Introducing Honest Reviews

Hidey ho from gorgeous and sunny Honolulu, Hawaii, where I’ve spent the last week doing absolutely nothing!

Well, not entirely nothing. I worked on a new column for Out and Out and wanted to introduce it.

I like applying for new credit cards to boost my points and miles balances (as I’m sure most of us do). And I already write about various offers from time to time.

So I thought it would be a fun exercise to make a format out of it that’s easier to read and follow – and one that’s standardized. So here’s Honest Reviews – my honest take on credit card offers.

How Honest Reviews will work

Link: Honest Reviews (Work in progress)

Each card will get a grade from A through D – I don’t bother with Fs – and a recommendation to Keep the card if you already have it or DTMFA.

Yay for Honest Reviews!

There will also be a short intro, an extremely brief (one or two sentence) summary called “The short” and a longer analysis called “The long.”

That way you get the long and short of it, a grade, and short-term advice on whether you should snag an offer for the sign-up bonus or keep it long-term (or both).

The grading scale is:

A – Are you freakin’ kidding me, why haven’t you applied already AKA Apply now!

B – Bitchin’

C – Cool

D – DIAF

I’ve already added an Honest Reviews tab under “Credit Cards” at the top of the page – and you can see some offers I have in the pipeline to review (and a preview of the grade/rating the card might get – subject to change based on analysis, of course).

Why now?

I have links from CreditCards.com and this is way to put them front and center with my usual candor and incredible wit.

August 30, 2016

Uber Alternatives in Austin: Ride Austin and Fasten

For my next trick, I will put up a post from the city I’m currently visiting lol.

I got to Austin on Sunday, and decided to meet up with a friend for drinks downtown.

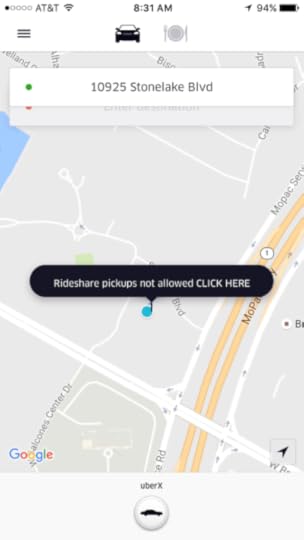

No problem, I’ll Uber down, a 15-minute ride.

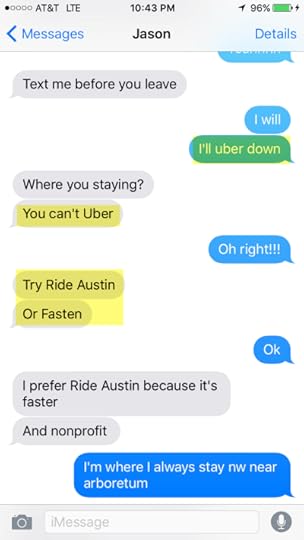

Tips from my friend Jason

He gave me two tips: Ride Austin and Fasten.

Ride Austin

Link: About Ride Austin

Link: Download Ride Austin (iOS)

Ride Austin is a non-profit rideshare company.

They have an iPhone and Android app. The interface looks remarkably like Uber – in fact, you might not even realize it’s not Uber after you get it installed.

Ride Austin’s Uber-like interface

Getting it set up is simple. You must enter a payment method to begin using the app. And you can connect it to your Facebook (if you wish) for one-button set-up.

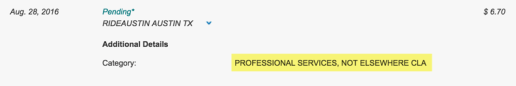

I used my Citi ThankYou Premier, hoping to get 3X Citi ThankYou points per $1 spent, but I’m not sure yet how it will ultimately code. In a pending state, it looks like this:

“Professional services”

To begin my first ride, I simply entered my hotel address and where I wanted to go – but you already knew that.

My driver, Tina, came within 5 minutes, and whisked me away downtown. 15 minutes later, I was there – and it was as easy as I wanted it to be: cashless, quick, simple.

Too bad for Uber

While we drove, I asked Tina about her thoughts on Uber.

And she said something to the effect of how it’s too bad they refused to go through with fingerprinting. And that now, there are other companies filling the void.

Should Uber ever try to return to Austin, they’ll have to battle home-grown companies and will likely lose.

Uber created a market, then a vacuum. And now Austinites are doin’ it for themselves. #highfive

I couldn’t agree more. People get attached to brands, especially local brands – just ask Alaska Airlines.

I enjoyed the experience from app download to arrival.

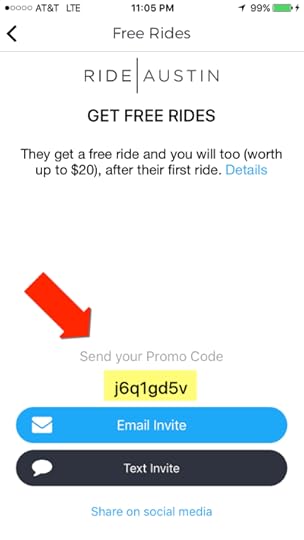

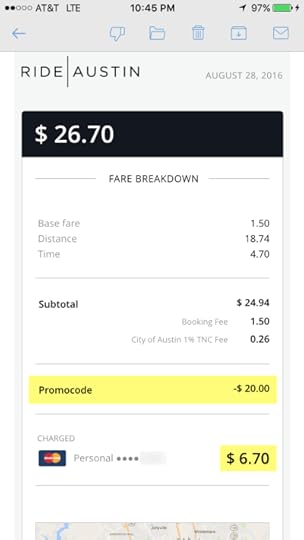

If you’re planning on visiting Austin, I highly recommend Ride Austin. You can get $20 off your first ride if you use my promo code. I get a $20 credit too – I might have to come back to Austin to use it!

Get $20 off your first ride with Ride Austin

My code is “j6q1gd5v” – enter it after you download in the “Promotions” section of the app to get $20 off.

Can confirm it works

Very proud for Austin. And Uber, good luck ever getting back into this market. Why any company would let Austin go is beyond me. But it’s so good to see citizens creating solutions – and quickly!

Fasten

Link: Fasten

Fasten is available in Austin and Boston so far.

Again, it’s free – and you need to have a payment method to use it. I recommend it for shorter rides.

One, because it’s for-profit (Ride Austin is not-for-profit). And two, there’s a $5 promo code – “OC2992 “- and it’s best to save Ride Austin’s $20 code for a longer ride.

I won’t get into too much detail other than it works in a very similar way.

But I have to give the edge to Ride Austin for being a non-profit – and for filling the void so quickly. They are only 75 days old as of the time of this writing!

I took a short ride on Fasten too, and it was as expected. So if you need a rideshare backup, give this one a download, too.

Bottom line

Bon voyage, Uber AND Lyft – in Austin, anway.

Girl, bye

If you’re coming to Austin, be sure to download Ride Austin and Fasten.

My Ride Austin promo code gets you $20 off your first ride: “j6q1gd5v“

And my Fasten promo code gets you $5 off: “OC2992″

I’m happy to see small, local companies filling the void of startups that couldn’t – or wouldn’t – survive the local legislation.

If you want to explore Austin, try the fantastic restaurants, or get sloppy on 6th St or Rainey St – definitely download these.

Both were tips from a friend of mine who lives here – so I thought I’d pass it on to you guys.

Thanks as always for reading, commenting, and supporting.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!