Harlan Vaughn's Blog, page 45

November 10, 2016

Cool! FoundersCard Members Get a Free Private Jet Flight With JetSmarter

Also see:

18 FoundersCard Travel Benefits (Status, Discounts, and Freebies)

Assessing the Benefits of FoundersCard

Yup, FoundersCard Still Offers Caesars Total Rewards Diamond Status Through 2017

My FoundersCard Membership Just Paid for Itself This Year

It’s no secret I love my FoundersCard membership. It’s not for everyone, but I’ve gotten outsized value from it. And continue to be impressed by their offerings, like free Diamond elite status with Caesar’s among a ton of other travel benefits.

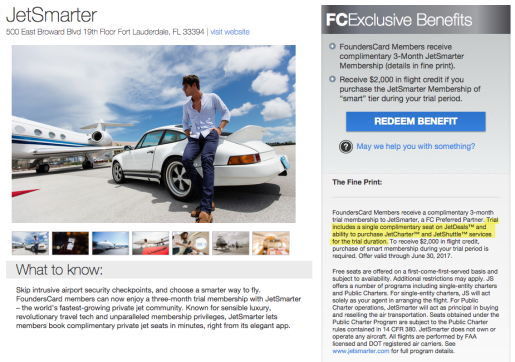

There’s a fun new promotion for a free seat on a private jet through JetSmarter.

I was a smidge jealous when I saw fellow blogger Angelina scored a free seat. But now I may be joining her ranks!

The deets are buried in the fine print. But it works!

Now FoundersCard has a deal where members can get a free 3-month JetSmarter membership. And as part of that, a free JetDeals flight. It’s only a one-way flight, so you’ll have to find another way home.

But considering these tickets can be pricey, not to mention an awesome and unique experience, this is yet another innovative FoundersCard perk.

And depending on where you depart, this benefit alone can totally cover the $395 a year membership cost.

The JetSmarter benefit

Link: JetSmarter

I log into the FoundersCard site every so often just to see what the hell they’ve cooked up next. When I saw a partnership with JetSmarter, I wasn’t sure what to expect.

But buried in the fine print was an offer for a free seat:

FoundersCard Members receive a complimentary 3-month trial membership to JetSmarter, a FC Preferred Partner. Trial includes a single complimentary seat on JetDeals™ and ability to purchase JetCharter™ and JetShuttle™ services for the trial duration.

JetDeals seems to be where they list discounted seats for flights that are going out anyway.

Dallas to Houston can be expensive

Typically, seats can cost in the neighborhood of $1,000.

But I found a seat from New Orleans to Miami for a touch over $400.

Smooth $400 to fly from New Orleans to Miami

And FoundersCard members can have the seat for free. Notice the $0 purchase cost.

That would make a fun day trip because – why not, it costs nothing (except a way back, but Avios…).

Don’t you dare cancel

However, you’ll need to be damn sure of your itinerary. Because canceling can result in penalties up to $1,000. Read as: Don’t cancel. Just go – it’s cheaper lol.

There are flights available all over the world. And some are pricey!

I’m brand spankin’ new to JetSmarter. And I doubt I will ever pay to charter a private flight. But scrolling through the list, I found flights the world over. And some of them touch or exceed the $1,000 mark.

So this could be a good replacement for a train if you were to say, book an open-jaw ticket in Europe. If the dates work out, this would be a fantastically opulent way to travel to the next city.

So far, I found a free flight to Houston

JetSmarter let me know I could fly for free to Houston tomorrow from Dallas. I have nothing against Houston, I’m just not ready to hop on a plane like that. Or am I?

Mostly, I’m just curious to see if other cities will make their way to the list.

Anyhoo, if you’re a FoundersCard member, this is something well worth looking into!

Join FoundersCard?

Link: Preview FoundersCard benefits

FoundersCard comes with a slew of bennies. So many that most peeps will find something that will more than cover the yearly cost.

Here’s a list of 18 of them to give you an idea.

You can join here and use my promotion code “FCHARLAN818“ to lock-in the $395 a year price for life – that’s my referral code. I get FoundersCard points if you join using my link. And you get a lower rate for joining.

I’ve had it since 2014 and have no plans to stop now – not when they have cool promotions like free private jet flights!

I’ve had nothing but positive experiences with FoundersCard. Take a look around the site and feel free to contact me for help or to ask specific questions!

Bottom line

FoundersCard members can get one free seat on a one-way private jet flight with JetSmarter.

Really freaking cool. I’m tempted to do it just to say I did it. :p

Keep in mind, the cancellation penalties are pretty strict. But you can book a seat on a private jet for literally $0. And some of the routes can be pretty pricey.

I’m gonna hold out and see if any other routes pop-up on JetDeals, like to Las Vegas, or maybe Austin. So I’ll be keeping an eye on it. I’m thinking Vegas because I have free Caesars Diamond elite membership (also through FoundersCard). But I’m open. I’d love to have this experience!

Thought this was fun and unique, so wanted to share.

Have you ever taken a private jet flight? How was it – all it’s cracked up to be?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Pro Tip: Purchase In-Flight Wifi Before You Fly

Just a little reminder and tip.

I rarely pay for in-flight wifi. It’s kinda nice to be uncontactable for a little while. Most domestic flights are ~5 hours max anyhow, and usually shorter.

But I found myself needing to get some work done on a plane this week and made the decision to rely on American’s in-flight wifi from Gogo.

(Typing on a computer in a cramped economy seat is another issue altogether. And I highly recommend one of these for seatmates who can’t stop staring at your screen.)

Yes, I like saving big

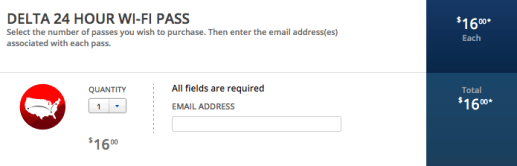

The all-day pass I bought 5 minutes before boarding my American Airlines flight was $16. But on the plane, they wanted $24. So I saved a tidy $8, a ~33% discount, just for paying in advance.

Note that prices can vary based on the flight. But in general, if you need or want it, it’s better to purchase an all-day pass ahead of time.

And WHERE you buy the pass makes a difference for American or Delta all-day passes.

Why buy an in-flight wifi pass

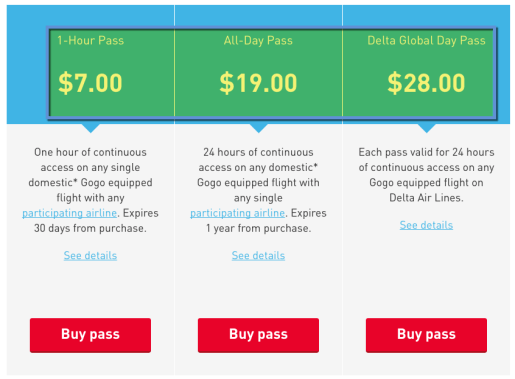

Link: Buy a Gogo internet pass

Quite simply, you can’t go wrong.

I’d recommend the all-day pass, especially if you have connecting flights

You can get an all-day pass to use on ANY single airline with Gogo in-flight internet for $19. That’s one of these guys:

Gogo’s lineup

This is an better deal than what you’ll pay at 30,000 feet. Because you can use the internet for 24 continuous hours. Hopefully you won’t need all 24 hours!

How it works

When you purchase a pass, it’s added to your Gogo account. So you’ll need to make one or have one.

Then, when you connect in-flight and log into your account, there will be a pop-up that asks, “Do you want to use your pass?” So it’s stored in your account until you want to use it. And they’re good for a year after purchase.

You also don’t have to use it. For example, if by some miracle the in-flight option is cheaper. In that case, just click “No, I don’t want to use my pass,” and save it for a longer or more expensive (for wifi) flight at any point within the next year.

Do NOT do this for American or Delta

Link: American Gogo all-day passes for $16

Link: Delta Gogo all-day passes for $16

When you click American or Delta’s dedicated wifi links, you’ll see both airlines sell day passes for only $16, as opposed to Gogo’s $19.

It’s cheaper to buy direct from American or Delta

Why it’s like this, I don’t know. Because Air Canada, Alaska, United, and Virgin America leave all the wifi selling to Gogo. But with American and Delta, you can save a few extra bucks. You just have to click the right link.

The pass works the same way as what Gogo sells. Except you’re obviously only limited to American or Delta flights. But if you’re flying either airline, it’s a no-brainer to save even more.

Bottom line

I didn’t get a screenshot from the in-flight wifi this week, but American wanted $24 for in-flight wifi from Washington, DC, to Dallas. Ridiculous! (It’s a 2.5 hour flight.)

I wanted to get some work done and was able to squeeze in nearly 2 hours of pure, unadulterated typing bliss on my laptop (ahhhh typing).

Also, I’m happy to report, the wifi was very fast up there! Much faster than expected.

I wouldn’t get it in my head to actually rely on quick speeds, though. Part of me was always prepared for it to drop out at any second. But I’m happy with the product I got. And buying a day pass in advance is definitely the way to go.

The exception is American or Delta. Because they sell passes for $16, instead of Gogo’s $19.

This would be a big saver if you have connections and want to stay online for 2 or more flights. Or if you have a longer flight, like JFK-SFO or similar.

You can literally buy these 5 minutes before departure and save yourself a little cash.

Oh and for those who are curious… these links don’t work once you’re up in the air. I tried them – they redirect. Pretty clever, eh?

With a little planning, it’s extremely easy to get a nice discount (I saved 33%) on the ground. Cuz once you’re airborne, the price rises, too.

Do you use in-flight wifi? What’s your experience been (speed, reliability, pricing, etc.)?

Do you buy the passes in advance?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

November 9, 2016

One Month Left: 3X SPG Points on Plastiq Payments With Starwood Amex Biz Card

Y’all know I love a good opportunity to stack!

Well shiver me timbers and ’tis the season, but I’ve been putting most of my spending these days on… Amex cards?! Yup, even though I recently product changed to the precious Chase Sapphire Reserve.

For regular spending, I’m meeting the minimum requirement on the Hilton Amex (no fee version). And for everything else, I’ve been using my Starwood Amex business card to run payments through Plastiq. It’s just too good of a deal right now.

Here’s why.

Get 3X SPG points on Plastiq payments

There are two promotions at play here.

1. The 10K for $10K deal

Link: Sign up for spend $10K get 10,000 SPG points promotion

The first is a targeted offer. It’s only for the business version of the SPG Amex.

Get 2X points on up to $10,000 in spending

You can earn 5,000 Starwood points when you spend $5,000 on your SPG Amex business card. And another 5,000 Starwood points when you spend $5,000 more.

Basically, you get 2X Starwood points per $1 on all spending, up to $10,000.

To enroll, click here and sign into your Amex account.

Oh but wait. You weren’t targeted? Neither was I. But I called Amex and was able to enroll in the offer anyway. I called the number on the back of the card – the phone agent knew the offer I was referencing and was able to apply it to my account.

So if you can’t enroll online, I recommend to call and ask if they can help you.

To get the deal, you must enroll and spend either $5,000 or $10,000 by December 15th, 2016. The good news is you have over a month to do that!

2. The small business promotion

Link: Sign up for Amex Shop Small promotion

Link: Plastiq

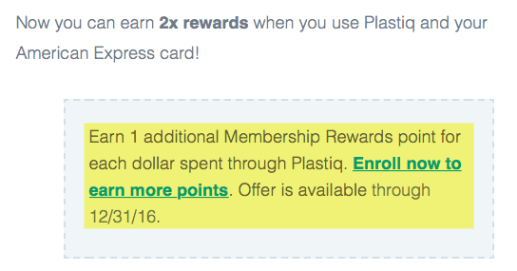

You can also get an extra point per $1 spent at “small businesses” through the end of 2016.

And again, you need to enroll online. This offer is available for all Amex cards (not just the SPG cards). But the beauty is in the stacking.

It combines with the previous offer. And, Plastiq is considered a “small business.”

They even sent an email about it

You can use Plastiq to pay your:

Mortgage or rent (Click for more details)

Student loan (Ditto)

Car payment

Utilities

So, pretty much any bill. You can even pay an individual.

I’ve been paying (and pre-paying) everything through Plastiq. Because you get:

1 SPG point per $1 for regular spending

1 SPG point per $1 from the 10K for $10K offer

1 SPG point from the Shop Small promotion

That translates to 9 Marriott points per $1, too. Because you can transfer from Starwood to Marriott at a 1:3 ratio. And earning 3X SPG points is pretty sweet in and of itself.

If you max out this offer, you can earn a total of 30,000 Starwood points.

Drawbacks?

Yeppers. Plastiq charges a pesky 2.5% fee on credit card payments. So if you send $10,000 in payments, you’ll actually be spending $10,250, or $250 alone in fees.

Granted, 30,000 Starwood points are worth much, much more than that.

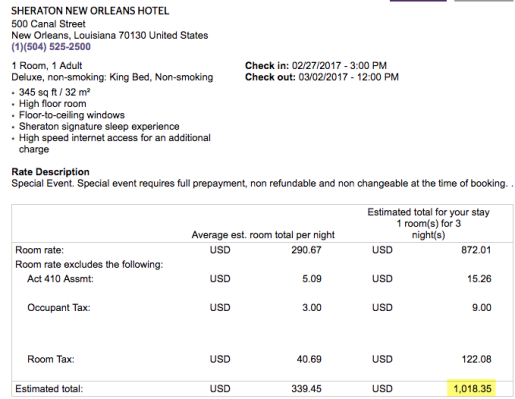

New Orleans for Mardi Gras?

I actually just found an incredible deal. You can stay 3 nights at the Sheraton New Orleans for 10,000 Starwood points per night because it’s . And you’ll be right on Canal Street for the parade. Plus, you’d get access to the lounge because that’s a perk of the SPG Amex biz card. (Mardis Gras is on February 28th in 2017.)

The retail price is currently over $1,000.

So yes, depending on how you use the points, it could be well worth it to pay Plastiq’s fee. If you parlay the points into a much more lucrative opportunity. In this example, you essentially get 3 nights in New Orleans during Mardi Gras for $250.

New Orleans, here I come?

But it’s also only a good deal if you can afford to pay off your balance quickly. Because if you accrue interest, it’s not worth it. So assess and decide if it’s worth it for you.

I’m always paying business expenses, so it’s just cycling money through for me. If you’re in a similar situation, I’d say go for it.

If you don’t have the card, but need to spend $5K…

Link: Apply for Card Offers

Why not sign up for the Amex SPG biz card?

You’ll earn 25,000 Starwood points when you use the card to make $5,000 in purchases within the first 3 months.

So for the first $5,000 in spend, you’d earn:

25,000 Starwood points for meeting the minimum spending

15,000 more points with the 3X in play

For a total of 40,000 Starwood points.

Of course, you’d earn 15,000 more points if you go for all $10,000, for a total of 55,000 Starwood points (165,000 Marriott points). And you’d need to apply very soon to take part.

But what if you aren’t targeted for the 10K for $10K offer? In that case, you could still get 2X with the Shop Small promotion. Or 35,000 Starwood points for spending $5K. And 45,000 points for $10K. Still worthwhile, but yeah, it wouldn’t be *as* awesome.

Find the offer

If you want to apply, you can click “Card Type” then “American Express” to find the offer (after you click the banner). You may need to scroll down. And be sure to select the business version of the card.

Worth a shot if you’re keen! (And I endlessly appreciate your support for using my links. It goes a LONG way toward supporting the site!)

Bottom line

I’m in the process of earning my 30,000 SPG points. By stacking the spend $10K get 10,000 SPG points promotion and Amex Shop Small promotion, you can get 3X SPG points on bill payments with Plastiq.

Be aware Plastiq charges a flat 2.5% fee on credit card payments. But it can still be worth it, because SPG points can go a long way.

Also, kudos to Amex for getting me to switch spend away from Chase (who made me switch spend away from Citi).

The current state of the game is fascinating right now. Curious to see what 2017 will bring. If it’s more promotions of this caliber from Amex and others, it will be a great year for earning points and miles. Because when banks compete, you win.

Did you get in on this 3X offer already? Also curious: are you using your Amex cards more this quarter?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Hotel Review: Capital Hilton, Washington, DC

I’m back in Dallas and still reeling from an incredible trip this past weekend to Washington, DC, for BAcon 3 (BoardingArea’s conference for the blogger crew).

The more I stay in hotels, the more I feel it’s the staff that makes a good stay above all else. Location is probably second. Yep. Followed by breakfast. All I ever want is breakfast.

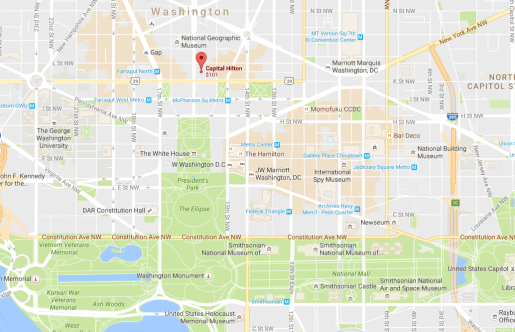

I took a Lyft for the short ~4-mile ride from DCA to downtown DC for my stay at the Capital Hilton. It was nice to see the foliage, and feel the fall chill: two things I’ve been missing in Texas.

Back like a heart attack

I was in DC this August for FTU Advanced. So it was nice to be back, twice in a year.

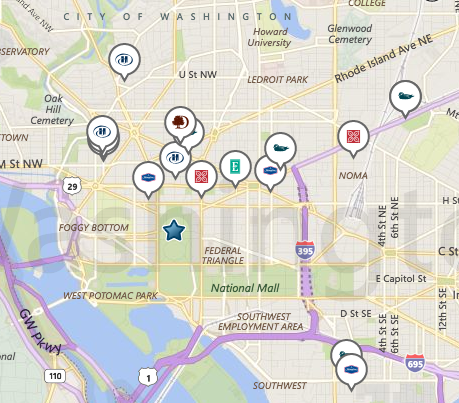

The location of the hotel is incredible.

Easy walking distance to so much good stuff (Click to enlarge)

You can easily walk to the White House, and Logan Circle or 14th Street for bars and restaurants. And anywhere downtown. Or take a quick Lyft to the Smithsonian museums, Washington Monument, and Lincoln memorial (or just walk it – it’s a beautiful part of the city).

It’s also 2 blocks from the subway, for those who like to ride the train. The location is the biggest reason I chose to stay here – it was the closest Hilton hotel to my conference location.

Arrival and check-in

Link: Capital Hilton

The ride in took about 20 minutes. The employees at the door opened the car door, greeted me, and asked if I needed help right away. I only travel with a carry-on, so I was good. But it was an extremely nice gesture.

The lobby

There was a separate check-in line for HHonors members. It was empty, so I swooped in.

The desk agent acknowledged my Hilton Diamond elite status.

Now, mobile check-in AND digital key were available here, but I did not use either. Why?

By selecting a room in advance, you give up your chance for an upgrade. They’re hoping you’ll pick a room so they won’t have to upgrade you. Tricksy, isn’t it?

So I asked if any upgrades were available (I booked a “King Pure Allergy” room). And got a King room on the Executive Floor. She said that was my upgrade. I never plan to spend much time in my room, so ultimately, it never matters. It’s just, ya know, the little things.

I got info about the Executive Lounge, a wifi password, and was welcomed to use the MINT health club attached to the hotel, which looked fully-stocked with equipment, had yoga classes, the whole nine yards.

Hallways of the Capital Hilton

As I headed to the elevator, I was at least hoping for a nice view.

My room, 1441

Especially because it was on the top (14th) floor.

The room

When I walked in, I thought, “meh.” It was fine.

View upon walking in

The decor was stodgy, and it was a little compact, but that’s to be expected in a major city.

There was a comfy couch, a desk, TV, and a bed with two nightstands.

Closet with ironing board, safe, hangers, extra bedding

Desk

Couch

TV and dresser

The bed

And yes, I did make sure to unpack my shirts as part of getting settled in. I love and encourage this habit!

Then I made my way over to the windows…

View from the window

…and was met with a particularly uninspiring view:

Oh, OK. Wow.

Basically a gigantic hole in the ground.

Then to the bathroom. It was big enough for me. And I loved having the magnifying mirror. I also liked having the shower behind another door within the same room.

Bathroom (and harro!)

Peter Thomas Roth toiletries

There were high-quality bath products. And of course, I packed some coconut oil in a travel tube.

Shower and toilet

Overall, the room was clean and quiet. And the premium wifi was super fast. I only had to reconnect every other day to the hotel’s internet.

The A/C in the room was a unit under the window, next to the bed. It made a gentle clacking sound as it blew air. I was fine with the white noise. And mostly grateful I couldn’t hear any of that god-awful construction outside.

While I would’ve loved an upgrade to a suite, this room was fine. And the staff were all very gracious and welcoming.

And, I wasn’t really in there but to sleep, anyway.

Breakfast and Executive Lounge

Breakfast was served in the Executive Lounge. There was a selection of fruit and yogurt, pastries, bacon, and eggs. There were also a few juices, coffee, and boxes of cereal.

That’s about it. I was rushing each morning, so I barely had time to grab a banana and go.

I’ve honestly had better breakfast at Hyatt Place hotels than here. I don’t eat pork, so… and the eggs were that mass-produced kinda globby tasteless variety – you know the kind.

So I loaded up on fruit and had a croissant or tart. I’m glad it was included, but if this was intended for top-tier elites, it was lackluster.

At other times, there was always fruit, cereal, and coffee and available. And plenty of bottled water. I took a couple of bottles up to the room each time I visited. And filled up on coffee. So those were incredibly nice perks to have.

Fruit and cereal in the Executive Lounge

And they had cheese cubes, crackers, olives, and one small hot item each evening for “cocktail hour”.

Evening snacks

But to my chagrin, there were no cocktails – just beer and wine. And you had to pay.

$6 for beer and $8 for wine. *side eye* So I skipped that completely.

Seating in the Executive Lounge

On another note, I notice these “big city” Hiltons give you less and want you to pay for more. I got better food and free drinks at the DoubleTree in Murfreesboro, Tenneesee. But similar service at the New York Hilton Midtown.

Free bottled water and 24-hour coffee – lifesaver

Bottom line

I enjoyed my time at the Capital Hilton. But I’m finding I like Hilton’s sub-brands more. Particularly DoubleTree. And I’ve heard good things about Hilton Garden Inn.

DC is a Hilton haven

Washington, DC, is flush with Hilton in its many iterations, and many other hotel chains, too.

I wouldn’t rush back to the Capital Hilton. Instead, I’d try another location or sub-brand.

The Executive Lounge and breakfast was just OK, the room was nice enough, but I feel like they skimped on the details. Like the upgrade, and those other “little something extras.” A few more hot items at breakfast and actual cocktails for cocktail hour, how bout?

But the staff were wonderful. And the location is incredible. I had a great time here, but wasn’t blown away. I’d say… 3 stars?

If you’ve stayed here, or elsewhere in DC, how does your experience compare? I’d love to hear if there’s a better hotel, or if this is the norm in that part of town.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

October 10, 2016

Honest Review: Citi Hilton Visa 75,000 Point Offer

Also see:

It’s Back! 75,000 Hilton Points for Citi Hilton Visa With No Annual Fee

My Top 5 Hilton Category 2 Hotels for Award Stays

It’s no secret I’m a Hilton fanboy. I lurve them because they make earning points a breeze. And they actually give you a healthy amount of points for staying at their hotels, unlike Hyatt and Starwood (!).

Are Hilton points inflated? Hell yeah. But so are the earning rates.

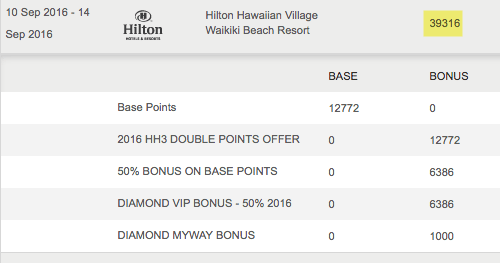

I loved using my Hilton points at the Hilton Hawaiian Village in Honolulu last month

I’ve found good deals with Hilton points, and not because I looked a long time. They’re out there – as with any type of hotel points.

I love the 5th night free perk on award stays when you have any type of status.

And 75,000 Hilton points can be worth over $1,000, as we’ve seen before.

At a bare minimum, there’s no reason why you can’t get $400+ of value from 75,000 Hilton points. Considering the card has no annual fee (and is therefore free to keep), that’s a great deal – and a decent sign-up bonus.

The short

A handy little card with a decent sign-up bonus, if you have a Hilton stay in mind.

The long

Link: Apply for Card Offers

Link: Honest Reviews

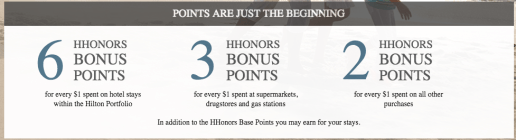

With this card, you’ll get

6X Hilton points on stays with Hilton

3X Hilton points at grocery stores, drugstores, and gas stations

2X Hilton points everywhere else

Automatic Hilton Silver elite status (meaningless, but gets you the 5th night free on award stays)

Decent earning rate

Watch out, though

So here’s the scoop.

Womp womp

Citi is now only handing out bonuses per “family” of cards. That means if you get this Hilton card, you can’t earn the sign-up bonus on the other Citi Hilton card.

Which is the Citi Hilton Reserve – that comes with 2 free weekend nights at most Hilton hotels (even the super luxurious ones), and Hilton Gold elite status. There’s a $75 annual fee on that card, but it can be worth it for the Gold status alone (free breakfast and a decent shot for upgrades). And if you opened OR closed the Citi Hilton Reserve in the past 24 months, you can’t get this new offer.

Arguably, the 2 free weekend nights can be worth… easily over $1,000 if you stay at a hotel where rooms are $500+ a night (they’re out there).

Which one is better for you?

So the road forks in the woods. Which one will you choose? The 75,000 points and no annual fee OR the 2 free weekend nights, Gold status, and $75 annual fee?

Dun dun dunnnnn!

If you like Hilton, the Citi Hilton Reserve is better.

If you already have Hilton elite status and a lot of Hilton points (the boat I’m in), well heck, wouldn’t you like to have 75,000 more points than you already have?

There’s also the issue of how you plan to redeem. Are you thinking special trip (honeymoon, romance, etc.)?

Or do you want some points on hand to fill in gaps here and there? Consider the 5th night free can really boost the value here. That will help guide your decision, too.

A shower of Hilton points

Me, I have enough Hilton points for 2 weekend nights at a super nice Hilton. Would it pain me to redeem 200,000 Hilton points all at once for only 2 award nights? Not really, actually.

Hilton throws points at me left and right by staying regularly and signing up for their promos. Every time I turn around, I have another 100K Hilton points.

To my mind, I’d rather have the 75,000 points free and clear and keep the card forever. Your situation may be different, so give it a think-through before you dive in.

That said, it’s worth it because it’s one of the few cards that earns bonus points at drugstores. If you spend a lot at CVS, Rite Aid, or Walgreens… this card is your friend.

Grade: B

Yeah, it’s “Bitchin’.” Free Hilton points, free to keep, Silver status to get you started, it’ll age your credit, and get you in nicely with Citi.

I wouldn’t touch this card at its usual 40,000 point offer, but at 75,000 Hilton points, it’s worth a look. And, there’s no reason why you can’t squeeze $400 to $1,000+ out of value with this card.

I also wouldn’t apply for this card over others in Citi’s portfolio, but like I said, if you’re looking to score some relatively easy Hilton points, I’d throw it on the pile.

Keep or DTMFA: Keep.

Link: Apply for Card Offers

Keep it forever. You never know when you’ll want the 5th night free on award stays. Citi is good about applying promotional offers to the card. And retention offers. And it could improve your credit score if you keep it long-term. It’s free to keep and have, so there’s never a reason to cancel.

Also, if this is your only Hilton card, obviously use it for your Hilton stays.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

October 9, 2016

Did You Do the Kohl’s Appliance Deal? Get Back $2 per Item!

Out and Out reader Claudia let me know all the of the items included in last week’s awesome Kohl’s appliance deal are now on sale for $14.99 (at the time, they were all $16.99).

So if you’re crazy like I was/am, and bought 40 items in total, making a quick 15-minute call to Kohl’s can get you $80 back!

That obviously sweetens the previous deal – and saves you more.

Here are a couple of things to note.

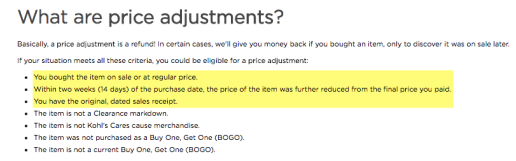

Some tips for Kohl’s, and shopping in general

1. Call soon to get a Kohl’s price adjustment

Link: Kohl’s price adjustment guidelines

First of all, the Kohl’s customer service number is 855-564-5705 (I had to peck around the site a bit to find it).

Claudia emailed me about this today so I thought I’d share. I just got off the phone with Kohl’s and they told me I was eligible for an $80 price adjustment.

The deal qualifies

The official price adjustment policy is you can get one if it’s been less than 14 days. The deal ended October 2nd, so depending if you bought on the 1st or 2nd, you still have a few more days to get your adjustment.

2. Ask if they can give you a new gift card, or refund your original gift card, IF…

The silver lining of using the MPX app means you can “hide” the refund from Chase/Discover if you bought a gift card. Even though it didn’t earn the 5X like I hoped. :/

Because if Kohl’s refunds your card, you’ll lose the 1X you did earn – Chase will take back the points; Discover will reverse the cashback.

Obviously only do this if you think you’ll shop at Kohl’s again. Otherwise, take the statement credit to your card!

And, you can only ask for this if you had mixed tenders like I did ($500 as a gift card, the rest on Discover It).

3. Always save your MPX cards, don’t mark as redeemed

Once you mark a gift card as redeemed in MPX, *poof!*, it’s gone. And apparently, it’s a nightmare to get the gift card number after the fact. Luckily, I’ve never been in this situation.

Let it be

But never ever click “Mark as Redeemed” unless you’re 1,000% sure you’ll never need that gift card number again.

4. You can do the rebate on ONE form

I got a lot of questions about this. I’m planning to fill out ONE form and include the 40 UPCs in ONE envelope.

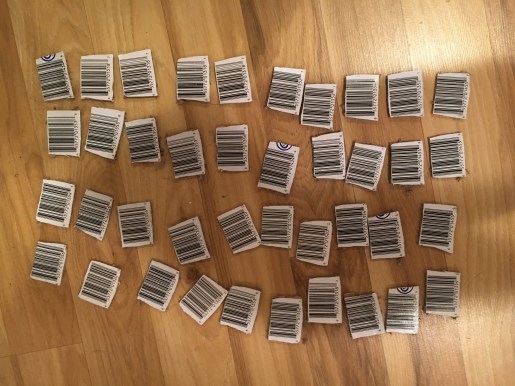

This is what 40 UPCs looks like

All in the same pot.

I believe all they do is confirm the date on the receipt and count the number of UPCs. I had a fun weekend carving out 40 UPCs with an Exacto knife lol. I have yet to list them for sale. And obviously have not mailed them yet. I will next week.

(Bonus.) Be sure to make copies of everything! Just in case there’s an issue, you want to have some recourse. Especially if you send it all your originals!

Bottom line

Getting $80 back makes this deal even MORE worthwhile. And I’m glad I did it, even though there are a LOT of steps involved. I find it fun and kind of thrilling. To hunt the deal, and piece it together and all that.

Next week will see me:

Get $80 back from Kohl’s

List the items for sale

Mail-in the rebate form and UPCs

I’ll be sure to post an update once it’s all said and done.

If you’re eligible for a price adjustment, call Kohl’s at 855-564-5705 and see what they can do for you. And feel free to leave any other tips in the comments.

Thanks as always for reading, commenting, and reaching out. Thank you thank you! Have a great week!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

October 3, 2016

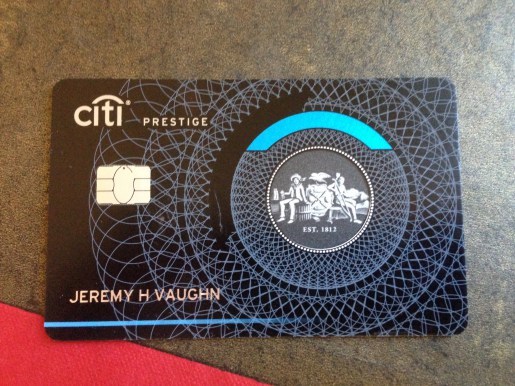

Honest Review: Citi Prestige 40,000 Point Offer

Oh, Citi Prestige. How prestigious you once made me feel. You’re probably still my favorite card overall, but your shine has tarnished since I fell for you in November 2015.

Since then, you’ve returned well over $2,000 in value for me. And you’re still giving.

My lagan love, Citi Prestige

But, cruel winter awaits. As of July 23rd, 2017, you can’t have my heart any more. I’ll have to take it back. You’re going to change.

Like a trojan horse, Chase unleashed the Chase Sapphire Reserve which now blows you out of the water.

Citi, you were competing so well. What happened? (My guess is they were losing too much dinero.)

The short

A once-great card that’s now only worth it if you have a lot of paid hotel stays of 4+ nights.

The long

Link: Apply for Card Offers

Link: Honest Reviews

You will earn 40,000 bonus ThankYou points after you spend $4,000 in purchases within 3 months of account opening. That’s easily worth $532, as Citi ThankYou points points are worth 1.33 cents each toward travel booked through Citi. And $640 toward American Airlines flights booked through Citi at the rate of 1.6 cents each. So, a decent sign-up bonus.

But beginning July 23rd, 2017, Citi will take away:

The 1.6 rate toward redeeming points on American Airlines flights AND the 1.33 rate on other airlines (down to 1.25 like Citi ThankYou Premier – oops!)

The 3 free rounds of golf

American Airlines Admirals Club lounge access (this is already gone for new cardmembers)

Taxes and fees from the 4th night free, and move to a 25% discount (an average of all the nightly room rates)

So basically… it’s the Citi ThankYou Premier card with a hotel perk.

Citi’s favorite tool lately. Little snip here, little snip there… OMG we butchered it!

Note that if apply for the card now, you will NOT get Admirals Club access. But you’ll still get the Priority Pass Select card, which could be worth it for some peeps.

This card will still have 3X on airfare and hotel stays, and 2X on dining and entertainment.

But! Citi ThankYou Premier has a broader 3X category for ALL travel purchases including gas. And a much lower $95 annual fee.

And now Chase has said hoo-hah by adding a 3X category for travel (not for gas) and dining to the new Sapphire Reserve. So the piddly categories on Citi Prestige seem… not so great.

However, if you have a lot of paid hotel stays, you can easily recoup the card’s $450 annual fee with two or three bookings – that’s worth something.

But if you like racking up Citi ThankYou points, there are better cards (Citi ThankYou Premier and Citi AT&T Access More).

Nasty move, Citi

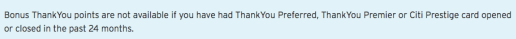

Also remember, Citi now limits the sign-up bonus per family of cards. So if you’ve opened OR closed another ThankYou points-earning card in the past 24 months, you can’t earn the sign-up bonus.

Grade: C

Yep, just “Cool.”

The bonus categories no longer feel “bonus-y” and that they’re going to cut their flagship perks is a huge blow to the value of this card.

Again, if you pay for a lot of hotel stays, it IS worth it to keep this card for the 25% perk.

And if you don’t have the Chase Sapphire Reserve *cough*, it’s nice to earn 3X on airfare and your hotel stays. So basically just book hotels with this card. I’d say that’s cool, wouldn’t you?

Keep or DTMFA: Keep.

Link: Apply for Card Offers

Quite simply, if it’s giving you value, then there ya go.

If you want to earn 3X Citi ThankYou points for travel, get the Citi ThankYou Premier. Because you can also book travel at a value of 1.25 cents per point (note that Prestige is still superior until July 23, 2017 with 1.6 for American Airlines and 1.33 for other airlines).

Or if you’ve found ways to maximize Citi ThankYou points, well hey: that’s awesome. I certainly have my preferred uses for them.

Also keep if it’s easy for you to rack up Citi ThankYou points across multiple cards, because that DOES add up and adds value to each card (the idea of synergy).

The best reason to keep it though

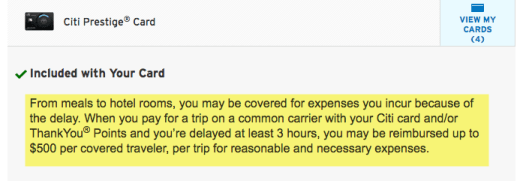

I have to sing the Citi Prestige card’s unsung song: they have the BEST trip and baggage delay coverage of ANY card – only 3 hours!

Citi Prestige: After 3 hours, you can spend $500

A 3-hour delay and I can start feeding myself? Well hell, I’ve been delayed 3 hours a time or two.

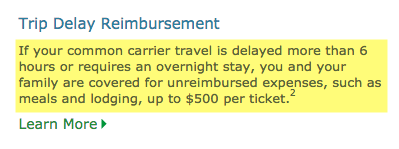

Chase Sapphire Reserve: After 6 hours, you can spend $500

Other premium cards, including the precious Chase Sapphire Reserve make you wait 6 hours. And oddly enough, the Chase Sapphire Preferred AND Citi ThankYou Premier have it as 12 hours (!).

For that reason alone, I consciously book my airfare on this card exclusively.

But when and if I ever get the Chase Sapphire Reserve (Update: I got it!), I’ll still charge airfare to Citi Prestige because of this benefit and 3X Citi ThankYou points. Plus, I can easily get award flights with Citi ThankYou points – they still have value.

Citi Prestige leads for trip and baggage delay. If you live in a hub where weather is prone to cause delays (Atlanta, Chicago, Dallas, even New York), I’d give a second thought to this card. Especially if you have a lot of paid hotel stays (did I just type that for the like fifth time? Geez!). There, I sang my song.

I will personally keep this card for as long as I can recoup the annual fee easily. After that, sayonara, I’ll pay for my own food if I’m delayed.

So what do you make of this assessment of Citi Prestige? Still a good card… or nah?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Gauging Interest: Dallas Points & Miles Meetup & an Out and Out Slack Channel

Back when I lived in New York, I grew fond of the Reach for the Miles Meetup group organized by Mike from Upgrd and Stefan from Rapid Travel Chai. And I miss that now that I’m based in Dallas.

Wanna meet IRL in Dallas?

There currently isn’t a Dallas points & miles meetup, but I’m interested in putting one together if there’s enough interest. It costs time and money to organize, but I’m willing to put in the work if peeps want to show up to network and talk about all things points & miles.

I’m also currently engaged in a Slack channel organized by Dan from Points With a Crew. And I had a thought to start a new one.

Calling anyone who might be interested in either!

The Meetup

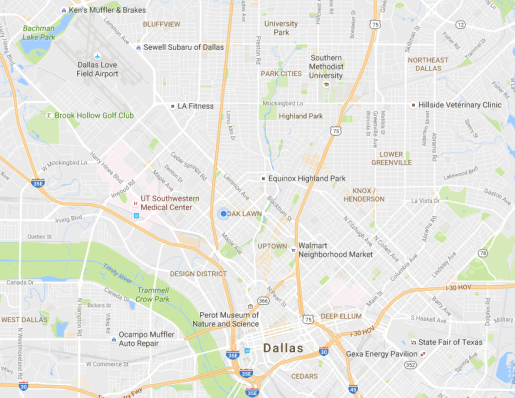

First things first, the Dallas metro area is obviously huge. I’m based in Oak Lawn, Dallas – near Uptown, Downtown, Deep Ellum, Knox/Henderson, and Highland Park. So any meetups organized will likely be in those neighborhoods.

The target area

I realize lots of folks live in the surrounding cities of the Metroplex, but… if I were to start a Dallas miles & points meetup, would those neighborhoods work for you guys?

Ideally, I’d like to find one to three regular joints, arrange a happy hour, and reserve a room or other area for us to meet in every 6 weeks or so.

The timing here is a bit funky because of the holidays coming up all in a row (Thanksgiving, Christmas, New Year), but if there’s interest, I’d like to organize a meetup before the end of 2016. And resume a fairly regular schedule going into 2017.

The idea is to find a place to host us, and whoever wants to join can RSVP through a Meetup group I will create. We’re all travelers of course, so you might not be able to make them all, but that’s fine. Right now, I’m just wondering how many of you guys are in the Dallas area and interested in an idea like this.

The Slack channel

Link: Slack

Slack is pretty dang nifty. They have an app for pretty much every device. And it’s a great way to interact with a team of people.

As mentioned, I’m currently in the Points With a Crew Slack channel, with ~700 other people.

I’m grateful to Dan for organizing it. But I find the sheer volume of material to be overwhelming. Every time I log in, I’ve missed 1,000+ messages. It requires constant monitoring, and I simply cannot keep up. Although I will try better, Dan, if you read this!

Slack off with 100 other miles junkies

I had another idea to create an Out an Out Slack channel – but strictly limited to 100 members.

That way we can have deeper discussions that move at a slower pace. And because I want it to be limited, I was thinking of having a very quick and easy questionnaire for membership. Because I’d like to get peeps who are interested in manufactured spending, reselling, award travel, credit cards, and of course points & miles.

Ideally, we’d form a little group and give one another tips and tricks, share ideas, and take some of the heftier content to a safe space online where it won’t get out or be leaked.

Are you interested?

If you’re game for either (or both!), please leave a quick comment here with something brief and be sure to leave your email (only I can see it).

Let me know which idea you’d like to see happen. And anything helpful you want to add (a venue you know of, a topic to focus on).

Depending on the demand, I’d like to start one or both pretty soon.

This will require my time and energy, so I just want to be sure it’s worth pursuing. If they work out, I’ll update with more details and sign-up links in a future post and keep the emails to reach out that way, too.

Bottom line

This is my first big step in potentially moving Out and Out to different venues, so I’m excited. And I wonder if I should give it a go.

Please leave a comment – it can be very brief – with which idea, the Meetup in Dallas or the Slack channel – you’re interested in. And be sure to leave your email. Again, only I can see your email.

Thank you guys so much – I’m continuously blown away by the amazing people I’ve met so far. Hopefully this leads to new ways to meet and interact. And if not, I’m grateful to have this little slice of online space to keep up with you.

October 2, 2016

Why I Product Changed to the Chase Sapphire Reserve

Also see:

The Top Card for Beginners? Yeah, the Chase Sapphire Preferred

I caved. And called Chase. Asked if they’d let me change my Chase Sapphire Preferred to the Chase Sapphire Reserve. And thankfully, they did.

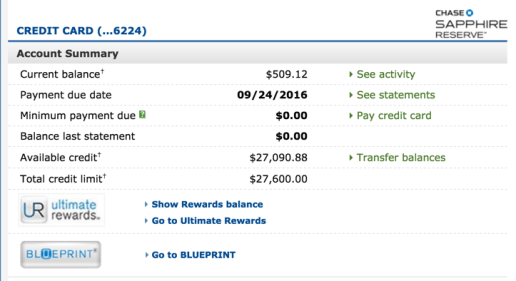

I’m happy to report I’m now the owner of a shiny new Chase Sapphire Reserve card.

Got itttt

Here’s why I did it.

Product Change to Chase Sapphire Reserve

Link: Apply for Card Offers

Link: Honest Review: Chase Sapphire Reserve 100,000 Point Offer

Like most of us, there’s no way in Hades I’ll ever be able to apply for this card with the current prohibitive 5/24 rule. I won’t fall under 5/24 until April 2017. So that means I’d have to wait ~7 months without applying for a single new card offer. Which ain’t gonna happen!

So I popped into a Chase branch and asked if I was pre-approved for, well, anything. NOPE.

OK, that’s cool. I asked if the pre-approvals refreshed at the beginning of each month, as I’d heard in my internet wanderings. The banker told me they refresh every 6 months. But couldn’t tell me where on the 6-month timeline I was. So at worst, that’s another 6 months of waiting. Grrrr.

I thought of that 100,00-point sign-up bonus. Man, it would burn to lose that.

But as I weighed the pros and cons, I decided to change my Sapphire Preferred to a Sapphire Reserve.

Why I did it

The 3X categories

All else being equal, I was losing out on earning 3X Chase Ultimate Rewards points for my travel and dining purchases.

Sure, I can earn 3X Citi ThankYou points on travel with the Citi ThankYou Premier. Between the two, I’d rather earn Ultimate Rewards points.

And I spend a lot on drinks dining, so 3X adds up quickly. I didn’t want to miss that.

$300 travel credit

I knew I could max that baby out and get $300 in essentially free Lyft rides, airfare, and NTTA tolls.

Then, after the close of my December statement, I’ll get another $300 to use. That erases the 1st year’s annual fee completely. And I even come out ahead. So that was also a huge draw.

The 1.5 rate is a comfort

Now, you can redeem each point for 1.5 cents toward travel when you book through Chase. That doesn’t mean you should, as the travel transfer partners are way more valuable. But I like knowing that no matter what, my points will always be worth a certain baseline.

This is admittedly more psychological than anything – I like how Chase is besting Citi, in particular. Hopefully this type of competition nudges Citi and Amex toward improvements in their own cards with $450 annual fees. As I always say, when banks compete – you win.

I’m NOT giving up opportunities

Waiting 6 or 7 months without a new card to fall below 5/24 is something I’m not willing to do. Even for 100,000 Chase Ultimate Rewards points.

At a base level, those points are worth $1,500, which is awesome.

But then I consider the Discover It, a NO annual fee card, made me over $2,200 last year. And I can open a new Bank of America Alaska Airlines Visa every month. Over 6 months, that’s 180,000 Alaska Airlines miles, which I value at $3,600. Not that I will, but I don’t want the option ripped away from me.

Add to that rumors of a new premium Amex card, and the inevitable limited-time offers that will pop up over the next 6 or 7 months and I think: do I really want to miss out on all that?

I routinely get 200,000+ points per app-o-rama. And I just got a new Amex Hilton card for another injection of 75,000 Hilton points.

If I was say, 3 or 4 months away from 5/24, I’d think on it. But 6 or 7? No way.

100,000 Chase Ultimate Rewards points is a lot, and worth a lot, but so are the other cards I apply for and open regularly.

And in the end, I’d rather have access to the 3X categories and annual $300 travel credit than not.

My experience product changing

First, I applied for the Chase Sapphire Reserve online, like a buffoon. When the app when to pending, I wasn’t surprised. I eventually got the rejection letter saying “too many open cards in the past 24 months” – a blatant admission the 5/24 rule exists.

So then I called Chase at the number on the back of my Sapphire Preferred card, and was transferred to a credit analyst.

Before I asked to switch, I asked once more if there was any way to be reconsidered. He said, “Sorry, my hands are tied here. There’s nothing we can do.” (Which I expected.)

Well OK, then. I still want it. Can I change my Preferred to a Reserve and move some credit to the new card, too?

No problemo.

Just like that, it was done

As soon as I logged out and back in again, it was there.

He said I could continue to use my Sapphire Preferred in the meantime – it would earn 3X in the bonus categories and the $300 travel credit was active immediately. That was really cool. I wasn’t sure if it would work that way, but it did.

A few days later, I received a UPS envelope with my shiny new (metal, not plastic!) Chase Sapphire Reserve card inside.

I gotta say, I still felt giddy about getting the card, even though I knew there would be no big sign-up bonus for me.

Oh, I should mention! I recently paid the $95 annual fee on the Preferred. It was pro-rated when I closed the account. And the $450 will appear on my next statement. So I didn’t lose anything by switching.

A small ray of hope

But before I hung up with the Chase analyst, I asked a very explicitly worded question:

“If I were to qualify for a new Chase card, could I product change the Reserve back to the Preferred, then apply for the Reserve, and earn the sign-up bonus on it?”

He knew exactly what I meant. “Yes,” he said. “That would work.”

So if you want to go that route – get the card, max out the travel credits, then change it back again until you can fall below 5/24, it seems that option exists. Sort of like a buy now, pay later dealio.

I’m still on the fence about actually doing this. As mentioned before, 6 or 7 months is just too long to wait for me. But it may be worth it to you.

Bottom line

Link: Apply for Card Offers

The Sapphire Reserve’s $450 annual fee comes to net $150 after the $300 travel credit is considered – only $55 more than Sapphire Preferred’s $95 annual fee.

For the 3X category bonus and access to 1.5 rate for travel booked through Chase alone – it’s worth product changing. And it’s interesting how Chase deliberately cannibalized their own Sapphire Preferred product. Why would anyone keep or go for the Preferred at this point, other than the lower – on paper – annual fee is beyond me.

If you can’t wait to fall under 5/24 and want the card right away, you can product change to it and enjoy the benefits until you do. At which point, you’d product change it to something else (maybe the Chase Freedom Unlimited?) and then apply for a new Sapphire Reserve account. So that could be a nice workaround to access the 3X categories and $300 annual travel credit before 2016 is through.

The process couldn’t have been easier. A 10-minute call with some light begging for reconsideration at the beginning, and it was done.

If you have the Sapphire Preferred, there’s no reason to not product change to the Sapphire Reserve.

Will you change any of your Chase cards to the Sapphire Reserve, or have you already? Did you have a similar reasoning?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

October 1, 2016

[EXPIRED] Hurry! ~$500 Moneymaker on Kitchen Appliances at Kohl’s With Discover It or Freedom

Update 10/3/16: This deal has expired. I plan on writing about my experience with it – here’s how to keep up with the blog so you’ll get the updates!

Need a little rush this weekend? How about buying $600+ worth of appliances at Kohl’s?

Last year they had a similar appliance deal I didn’t take part in. But this year I did.

Now before you think I’m crazy (although it may be waaay too late for that), let me explain.

This is a moneymaker if you do it right!

Hat tip to Jill Cataldo for blogging about this and my friend Jas for turning me on to this deal!

Build the deal

I feel like I say this every time I write about Kohl’s, but… it’s no secret I freaking love Kohl’s.

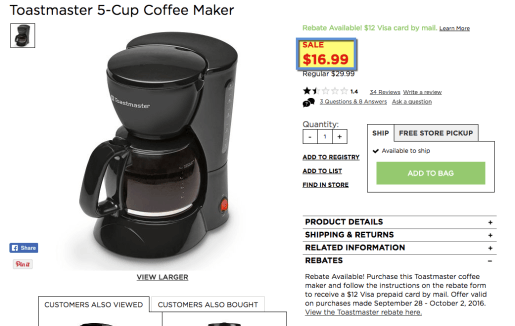

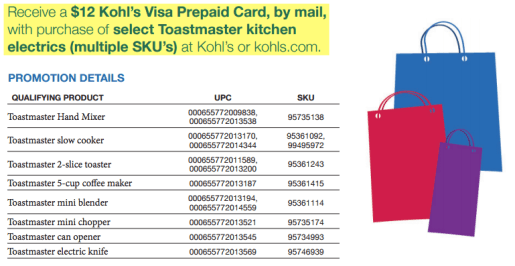

Right now, they have a lot of appliances on sale for $17, including:

Toastmaster 2-Slice Toaster

Toastmaster 15-oz. Mini Personal Blender

Toastmaster Mini Electric Chopper

Toastmaster 5-Cup Coffee Maker

Toastmaster Electric Can Opener

Toastmaster Electric Knife

Toastmaster Hand Mixer

Toastmaster 1.5 Quart Slow Cooker

Lots of appliances for $17

In total, there are 8 kitchen appliances at the $17 price.

All of the items have a $12 Visa gift card rebate

And, all of the items linked above are eligible for a $12 mail-in rebate. You get a Visa gift card with a limit of 5 per product.

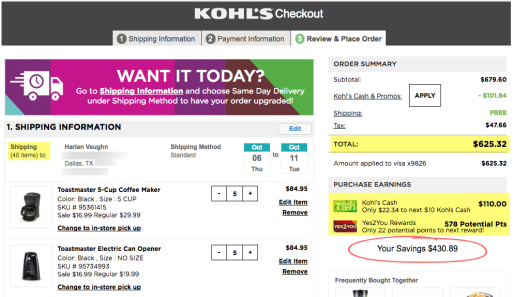

That means if you buy 5 of all 8 items, you can get 40 X $12 back, or $480.

Right now, there’s also a 15% promo code: SMS1871. And it does work for these items.

When you add all of them to your cart and add the promotion code, the total is ~$625. You also get $110 in Kohl’s cash to spend next week.

I paid ~$625 for all 40 appliances

Note that taxes in your state might be different than mine! In Texas, the taxes came to ~$48.

And, you must purchase the items by tomorrow, October 2nd, 2016, to qualify for the rebate (here’s the rebate form). Cheers to the weekend!

Stack stack stack

Discover It

Link: Discover It

Happy October! You know what that means! Q4 AKA department stores are a 5X category now.

Yay for 5% back

If you have the Discover It card, you can get 5% cashback this quarter at department stores, including Kohl’s, on up to $1,500 in combined spending.

Yay for 5% more back, too!

You can add another 5% cashback when you begin your shopping through the Discover Deals shopping portal.

That adds up to 10% back. Or, you’ll earn 20% back if you’re a new cardmember thanks to Discover’s generous cashback match. It’s deals like these that added up over ~$2,200 back for me last year.

I just got a new Discover It card, so I’ll get ~$125 back from this deal today.

Chase Freedom

Link: Apply for Card Offers

If you have the Chase Freedom, you’ll also earn 5% cashback (5X Chase Ultimate Rewards points) at department stores this quarter, on up to $1,500 in combined spending.

For this deal, you’ll end up with over 3,000 Chase Ultimate Rewards points (~$30 cashback), again depending on your taxes.

Even better, you can still add-in a shopping portal. Cashback Monitor shows these current rates:

That 4X Alaska miles catches my eye

So it’s easy to add an extra 1,000 or 2,000 miles or some cashback to this deal, depending on which one you like.

Add MPX to the mix

I love the MileagePlus X app. Right now, you can earn 3X United miles at Kohl’s. You can purchase a gift card for up to $500 at a time.

I bought a $500 gift card and got an extra 1,875 United miles. Why not.

Easy way to add ~$30 to the stack

I got a 25% bonus because I have the Chase United Explorer card. But even if you don’t, I value 1,500 United miles at ~$30 (2 cents per mile).

And yes, both Discover and Visa cards code correctly through the app – the purchase will show up from Kohl’s and be coded as a department store.

Adding it all up

Link: Kohl’s rebate form (PDF file)

This is all a bit of a mind-bender, so let’s recap all the stacking for purchasing the maximum number of appliances with the $12 rebate.

$480 back as Visa gift cards

~$125 from Discover It and Discover Deals portal OR

~3,000 Chase Ultimate Rewards points (~$30) and ~2,000 Alaska miles from the Alaska Airlines shopping portal (~$40)

15% off with promotion code SMS1871

1,500 United miles from a $500 gift card through MileagePlus X app (~$30)

$110 back as Kohl’s Cash

300 Kohl’s Yes2You points (worth another $30)

Note that I always value airline miles at 2 cents each.

So there’s two ways this can go: the Discover It route or the Chase Freedom route.

With Discover It, you end up with 480+125 + 30 + 140 = $775.

With Chase Freedom, you end up with 480 + 70 + 30 + 140 = $720.

Your appliances are free! And, you even come out ahead by ~$95 to ~$150. That’s a pretty great deal no matter how you slice it. And of course, if you go the Chase Freedom route, the 3,000 Chase Ultimate Rewards points can be worth more if you have another card that lets you transfer to travel partners: Sapphire Reserve, Sapphire Preferred, or Ink Plus.

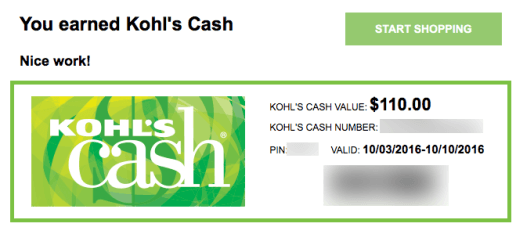

Update: I already got my Kohl’s Cash via email.

Here’s the $110 in Kohl’s Cash

But wait! There’s more

Free or really cheap kitchen appliances are great and all, but I don’t really need 40 boxes of stuff sitting around.

I might keep 1 or 2 items, and a couple to give away in a few months as Christmas presents, but I plan on reselling these items locally on Craigslist or similar. You may even have a local reselling page on Facebook. Or another site you want to use.

Assuming you can get $10 per appliance, which seems reasonable as they will be new in box, unopened, and retail for ~$30, that’s a profit of $400.

The key here is to sell them as a batch so you only have to deal with one transaction. Or maybe two.

Or, you can donate them to charity for the holiday season. You could even ask them for a donation slip to use as a tax write-off.

Any drawbacks?

Yup, there sure are.

For one, you’ll have to deal with the rebate. And you’ll have to float the ~$625 or so until you get the gift cards in hand.

I plan on using them to pay bills on Plastiq, so I’m essentially running the money through my Discover It card to accomplish that end goal.

And, if you choose to resell these, you will have to list them and arrange payment and pickup. But like I said, if you can do it in one or two transactions locally, it shouldn’t be much of a time suck.

But the pros far outweigh the cons. This isn’t for everyone, but the way I see it is:

I spent 15 minutes buying this stuff. I’ll spend 15 minutes mailing the rebates in. And say 30 minutes for the reselling in hopefully one batch. That’s at least $500 for an hour of work.

That may sound idealistic, as this is my first foray into reselling, but I’m curious to see how it goes. And this is the perfect stackable deal for beginning. Because either way, you won’t lose anything between the rebates and all the stacking.

Bottom line

Free kitchen appliances! And, you get $110 in Kohl’s cash to turn around and use next week. So that’s more free presents, or free household stuff, or clothes, or whatever.

If you sold the items for $10 each, you’d come out ahead by $500, with $400 of that cash in your pocket.

I’ve never resold items like this, but this seems ultra low-risk as they end up being free anyway. So worst case scenario, you end up with a lot of stuff to give away or donate. Which isn’t a bad scenario at all, which is why I gave this a spin today.

The rebate T&Cs say you have to make your purchase by October 2nd, 2016. So if you don’t get around to it today, there’s always tomorrow.