Harlan Vaughn's Blog, page 44

December 20, 2016

I Saved $3,000 With Citi Prestige Last Year (and Got a Retention Offer)

Also see:

Citi Prestige by the Numbers

Honest Review: Citi Prestige 40,000 Point Offer

My Citi Prestige card’s $450 annual fee recently posted. I will happily keep it for another year (if only to have Admirals Club access through the end of July 2017).

I’ve dutifully tracked the value I’ve gotten on the Citi Prestige by the Numbers page. But I want to dig into the numbers a little more.

Sorry for the selfie, but I needed a pic for this post

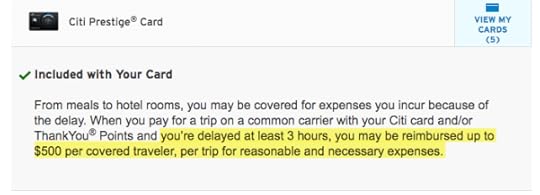

I also got an retention offer to earn 7X Citi ThankYou points on $8,750 in spending on airfare, hotels, and travel agencies – which is fine because I book ALL my airfare on this card to take advantage of its industry-leading trip delay and cancelation insurance that kicks in after only THREE hours (better than Chase Sapphire Reserve and any personal Amex card).

Year One by the numbers

Link: Apply for Card Offers

Here’s a breakdown of the savings I got last year with Citi Prestige (November 2015 to November 2016):

November 15 – $250 airline credit for flights on Norwegian to Martinique

November 18 – $244 saved with 4th night free benefit on a hotel in Martinique

December 10 – $116 saved with 4th night free benefit at the Alexandra DoubleTree in Barcy

December 16 – $450 annual fee charged (amount subtracted from total)

December 17 – $250 airline credit for flights to Dallas

December 18 – $800 from 50,000 Citi ThankYou points (worth 1.6 cents each on American Airlines) for meeting minimum spending requirement and earning sign-up bonus

January 18 – $100 on admission for 2 to Sala VIP Miro lounge @ BCN

January 20- $160 from 10,000 Citi ThankYou points for finding an error on ThankYou.com

February 6 – $70 on admission for 2 to Air France Lounge @ JFK (day passes are $35)

March 6 – $100 on admission to Admirals Club 2X at LGA and DFW (day passes are $50)

May 2 – $490 saved with 4th night free benefit at the Hilton Tokyo

August 7 – $50 on admission to Admirals Club at DCA (day passes are $50)

August 10 – $396 saved with 4th night free benefit at the New York Hilton Midtown

October 12 – $156 saved with 4th night free benefit at Homewood Suites by Hilton Austin-Arboretum/NW

November 9 – $269 saved with 4th night free benefit at Hilton Hawaiian Village in Honolulu

November 9 – $288 saved with 4th night free benefit at Hilton Capital, Washington, DC

Total: $3,289

Let’s analyze

I subtracted the annual fee.

I’m conservative in my estimates.

IMO, all the lounge access shouldn’t be added if I “only” popped in to have a drink. To account for that give and take, I did NOT include every time I accessed a lounge with the card. I included every 3rd or 4th visit, say.

I did stop in to Admirals Club locations during connections, right after landing to grab a drink, or grab a coffee. I figure they all add up.

I used some of the 50,000 point sign-up bonus to book award tickets (like my brother’s trip to Hawaii with Flying Blue and Singapore miles and a Business Class award ticket on Brussels Airlines). I used the base of 1.6 cents per point but definitely got waaay more than that.

And I got $500 in free airfare last year. Between that, the lounge access, and the sign-up bonus, I came out ahead of the $450 annual fee.

Got nearly the whole annual fee rebated from one 4th night free credit

But the biggest value by far was the 4th night free benefit. Wow.

I used it 7 times last year (which also seems conservative). If you only use this perk once or twice a year, the card more than pays for itself, even with the upcoming changes (more on that in a sec).

In fact, I’m about to get another $250 travel credit, which drops my next annual fee to $200.

Note: If you’ve opened or closed another ThankYou card in the past 24 months, you can’t earn a sign-up bonus for this card.

My retention offer

Getting over $3,000 in value (and actually much more) in a year made keeping Citi Prestige for a second year a no-brainer.

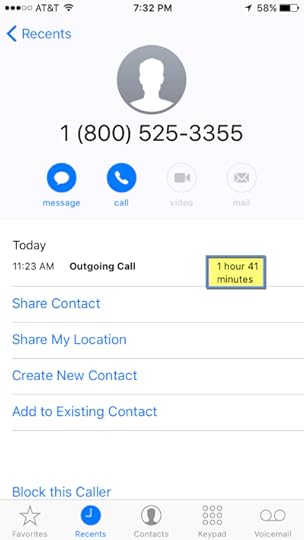

But, I called to check on retention offers. You can find the entire list of data points here.

I got:

4 additional ThankYou points for travel (hotel, air, car rental, travel agency) up to a max of 35,000 over the next 6 months

35,000/4 = 7X Citi ThankYou points on $8,750 in those categories (as they are already 3X categories).

Prolly my fave Citi Prestige bennie

I have a spate of airfare purchases coming up in 2017, so getting 7X and the card’s fantastic trip insurance seemed like a good deal – not that I was going to cancel it, anyway.

I consider this gravy.

Is Citi Prestige worth keeping another year?

Hell yeah. As mentioned, paying $200 for this card ($450 less the $250 travel credit) is an excellent deal. You can easily recoup that with one pointed use of the 4th night free benefit.

Here’s what’s changing on July 23, 2017:

4th night free will turn into a 25% discount (without taxes or fees)

No more free rounds of golf

Points will be worth 1.25 cents each toward travel

NO MORE American Airlines Admirals Club lounge access (this is already gone for new cardmembers)

I’m still going to put on my airfare on this card, and will surely have a 4+-night hotel stay to get more money back. And I’ll use it for Admirals Club access through July.

All of those things are worth $200 to me. At least for another year.

And as for a third year? We’ll have to see how the second goes. But assuming no other major changes or cuts, I don’t see any reason why this card wouldn’t remain a keeper.

Bottom line

It’s pretty incredible that I saved $3,000 with one credit card last year. That being Citi Prestige.

Keep in mind the planned changes won’t kick in until July 23, 2017. So if you pick up the card now, you can get a solid 7 months of the current perks (just not Admirals Club access).

Any way you slice it, you profit the first year with both $250 travel credits

You also get the $250 travel credit twice in the first year (the cycle resets after the close of your December statement). So the first year, you actually profit from the get-go. Not including the 40,000 point sign-up bonus and all the other bennies.

Get your Citi Prestige card here (or below):

Airline and Frequent Flyer Credit Cards

At the moment, I don’t have any paid hotel stays planned (because I am drowning in hotel points and need to burn them). But if/when I do, the charges will go onto this card. And of course, all my upcoming airfare thanks to my retention offer.

Others have gotten even more value from this card their first year. If you have this card, do you think it’s worth keeping despite the upcoming changes? What’s a ballpark range for your savings?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Yes! Hamilton Tickets in Chicago for $120+, Many Dates Still Open

Earlier today, The Points Guy broke the news (which they found via Reddit) of Hamilton tickets in Chicago starting at $85 for peeps with an Amex Platinum (or Centurion) card.

My friend Jas actually got 4 tickets to the January 21st performance for $65 each. January in Chicago didn’t sound so hot (literally), but I was interested when I saw a date in March opened up.

However, when I called, there were actually LOTS of days with plenty of tickets. So I’d encourage you to call Amex concierge and ask!

I had them check:

March 11th (2pm and 8pm show)

March 12th (2pm show)

March 14th (7:30pm show)

March 18th (2pm and 8pm show)

It seemed laborious for my poor phone agent to check all 6 in a row, especially because I kept comparing the seats against the seat map I had open during our call.

Over an hour of lovely hold music before I got a rep

However, every single show had tickets available. So if you’re still looking for – or if you want a crack at – these tickets, I’d say call immediately and have them check the date and time you want.

Some seats were for $120, but others were $180, depending on location and view.

Incredible savings for Hamilton tickets in Chicago

I’m not a theater buff, but sure, I’d like to see this show. Especially if it’s this cheap!

And more importantly, I’ve been looking for a reason to visit Chicago.

I went to college there and haven’t been back in a few years. So I figure I’ll use my Chase IHG free night before it expires, maybe my Chase Hyatt free night cert, or even stay 5 nights (with the 5th night free) at a Hilton, Marriott, or Starwood – some good deals there.

I’ll likely stay the The Loop/River North, which is meh, but I can always hop on the Red Line to Lakeview/Uptown where most of my friends live.

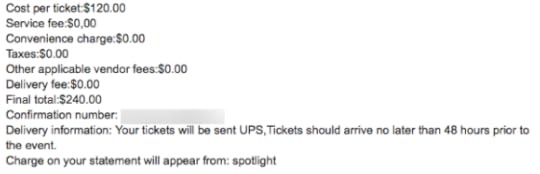

Anyhoooo, I got two mezzanine seats on the left (in the yellow shaded area) for $120 each – with no service fees, taxes, etc.

NO extra charges – love it!

Which is pretty incredible all on its own. Being the value nerd I am, I ran a quick search for comparable seats at the same performance.

I had to pop my eyeballs back into my head

All that was available on Ticketmaster were resale tickets for ~$1,480 – and that includes over $200 in service fees.

What’s worse is someone will probably buy these tickets. But you can buy similar seats through the Amex Concierge for $120 each – with nothing extra added.

If you want to visit Chicago, or live nearby, it doesn’t get much better than this for a very in-demand show at this price.

Bottom line

Holy crap, am I actually doing a post under 700 words? And having a “bottom line” that’s actually a bottom line? #GoMe

No but for real. Don’t be swayed by the reports of “tickets at 4 performances” for Hamilton in Chicago.

I had my pick of several dates and showtimes. And I’m sure other days/months are open as well. Give Amex Concierge a call (the number on the back of your card and press 0#0#0#0# via a tip on Reddit to skip the phone prompts) and check ticket prices.

I f you haven’t tried to snag tickets yet, give it a go. Let me know if you have luck!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

December 1, 2016

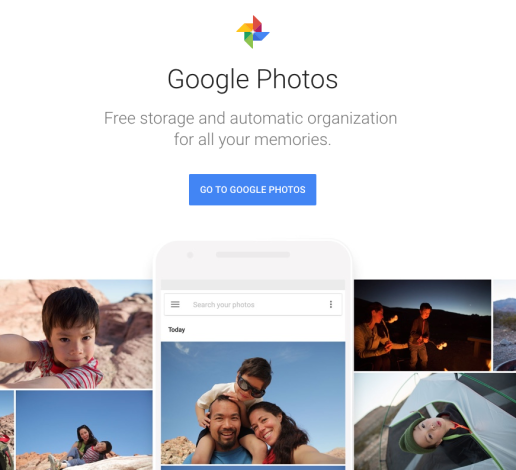

Google Photos App: A Must Download for Unlimited Backup

I read about the Google Photos app from Jeanne at Le Chic Geek back in July and downloaded it based on her write-up.

I was initially wary of:

Another app

Another recurring charge on my card

Another something to keep track of

Gamechanger alert

But I’ll go ahead and say, you can do well with the free version. Especially if you don’t already have a backup.

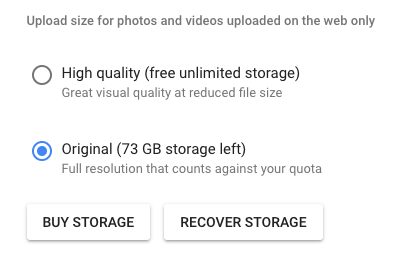

You get free unlimited storage if you go for a reduced file size

In fact, whether you decide to pay the $2 per month or not, this app is a MUST download.

Why the Google Photos app?

Link: Google Photos

Link: Download for iOS

Link: Download for Android

Somebody on the internet is telling you to download yet another app. What else is new, right?

This one’s worth it, though. Because it can actually save space on your phone by creating an online backup of all your photos.

Google Photos proactively saves precious MB (or GB!) on your phone

Once they’re uploaded, you can delete the dozens of selfie attempts, carefully arranged food photos, and endless shots of the same thing in various degrees of zoom. (I hope to god that’s not just me.)

Go ahead, take a few more selfies with your brother

Even better, you can upload every. single. photo. currently on your phone. Yes, it will take a while to upload. But once it’s done, you can erase the pictures of a Mai Thai you drank in Hawaii in 2013 without guilt. And free up a ton of space on your phone.

Pro tip: Set it to only back up when connected to wifi to save your cellular data!

About that $2 charge

Google Photos will back up all your photos free and without limits, “up to 16MP and 1080p HD.”

Or, you can pay $2 a month for your photos to be uploaded at their full size and quality. Now, the free version is actually more than enough – the quality will still be fantastic. And any changes will likely be imperceptible to the naked eye. Especially if all you’re doing is uploading them to Facebook, or a blog post, or sharing with friends.

Still, I opted to pay the $2 monthly charge to preserve the file size. I have that thought in the back of my mind that says, “You never know.”

What if I want to make a photo book one day? Or blow up one of the pictures? Or just have the photos of my loved ones to look at years and years from now – what will I want to do with these photos in the future?

I can’t know the answer of course, but I want the option to have the original size. And for that (probably ridiculous) reason, I am willing to pay the very nominal amount each month.

What it does

The search function is where is gets really cool. And there are some built-in features that are really handy and fun.

Easy, simple menu

For one, it’s dead simple to search. You can search for people (through face recognition), places (based on geo-tag), or things (like monuments, wine bottles, or dogs).

Find any person, place, or thing in your photo files

And, you can create albums to share, collages, even animation and videos. Google will make some of these for you automatically – and it’s super fun when they pop up.

That time I went to Santiago, Chile

There’s also a news feed like you see above – “Rediscover this day” – that is totally charming. It flashes me back to a particular day. The day I met a friend for the first time. Or visited a new place. Or simply had a good one.

How to search

I always talk about my dog. And of course I have dozens of photos of him on my phone. But now I type “dog” into the Google Photos app and BAM:

You wanted pics? Nicely arranged photos of my handsome mutt

It works well for places, too. This is perhaps the easiest search to perform.

From the “duh” files

For example, my search for “Munich” returned lots of images of beer steins from Oktoberfest. Perrrrfect.

November 20, 2016

Ameriprise Amex Platinum Card Has No Fee the First Year, Plus $400 in Travel Credit (and Free Lounge Access!)

My friend Angie passed this tip along today, and I must say I was very tempted.

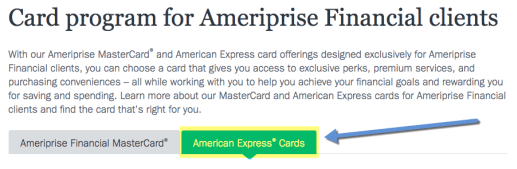

You can pick up the Ameriprise Amex Platinum Card with no annual fee the first year.

Good deal alert!

For those of you who can’t earn the sign-up bonus on an Amex card, the good news here is there isn’t one – so you’re not missing out on anything.

Plus, now is a good time to apply because the $200 annual travel credit will reset in January 2017.

So you essentially get the card free for a year, plus $400 in statement credits ($200 in 2016 and $200 in 2017).

Why the Ameriprise Amex Platinum Card?

Link: Ameriprise Amex Platinum Card

The typical benefits of other Amex cards are all here, too. Including access to the Centurion lounges, Priority Pass Select, and Delta SkyClubs.

And you’ll get 5X Amex Membership Rewards points for airfare.

Click this tab to find the card

Angie confirmed she is NOT an Ameriprise client and was instantly approved online today. In fact, she doesn’t have any accounts there.

This is a nice workaround to the once per lifetime rule. You might consider trying for this card if you want to keep lounge access but don’t want to pay another annual fee.

Also, you get $400 to have the card the first year.

There’s also evidence that you can reapply for this card shortly after closing it – just to put that out there.

…in theory

Finally, I can personally confirm it’s possible to have two Amex Platinum Cards at the same time – in case you don’t want to cancel your existing card before opening this one.

Any drawbacks?

Just the minor ding to your credit score, but that’s temporary.

No one needs two Platinum Cards. But if you’re in limbo, or nearing the annual fee on your existing one, you can get an easy double dip for the $200 travel credit.

To my current knowledge, you can still set United as your preferred airline and purchase gift cards through the MileagePlus X app to trigger the credit.

Mostly, this is an easy way to get free lounge access and an extra $400 worth of stuff in exchange for a hard pull. Just keep an eye on the renewal date, because the $450 annual fee will kick in the 2nd year.

Bottom line

I’m all about easy wins. And this is one if I ever saw it.

Consider the Ameriprise Amex Platinum Card to replace your current Platinum Card when you near renewal. Or if you just want to get the $200 annual travel credit twice in the first year- and free lounge access.

If you’re on the fence like me, you have about a month (I’d apply by mid-December at the latest) to decide.

And, as of today anyway, you don’t need any sort of relationship with Ameriprise to be approved.

Just thought I’d pass along. Feel free to share any data points about recent approvals, your experience with the card, or anything related to the annual travel credit.

I’m also happy to help with questions!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Honest Review: Chase Ink Preferred 80,000 Point Offer

RIP: Chase Ink Plus was one of the best cards for 5X categories. Yes, you earned 5X Chase Ultimate Rewards points at office supply stores, and on phone, cable, and internet service. And 2X on hotels and gas.

Um, what business is he in? Cuz I’d be all up in it

Chase Ink Plus is gone and in its place… the Chase Ink Preferred. But they nerfed the 5X categories! (And kept them on the Chase Ink Cash, thank gods.)

If you’ve opened more than 5 new cards in the last 24 months from ANY bank, go ahead and stop here. And read some of my other posts. Cuz its unlikely you’ll be approved for this one.

Or get one of these cards, which aren’t subject to the 5/24 “guideline”:

Chase British Airways

Chase Hyatt

Chase IHG

Chase Fairmont

Chase Marriott Business

Chase Ritz-Carlton

If you’re on the prowl for a card to use for your small business, the Chase Ink Preferred is still extremely worthwhile.

The short

Not as good as Ink Plus. Redundant if you have other Chase cards. Most of us can’t get it, anyway. But worth it if you spend even small amounts in the bonus categories.

The long

Link: Apply for a Business Credit Card

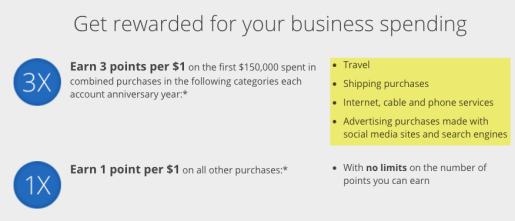

With the Chase Ink Preferred, you’ll earn 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months after account opening. And you’ll get 3 points per $1 in these categories:

Travel

Shipping purchases

Internet, cable, and phone services

Advertising purchases made with social media sites and search engines

On the first $150,000 spent in combined purchases each account anniversary year. Mmmkay?

The Ink Preferred is a nice way to access these 3X bonus categories

This is an excellent card to have if you spend a lot on travel. And “travel” here is extremely broad. Think airfare, hotels, tolls, parking garages, subway passes…

Internet, phone, AND cable is another huge category for most people AND offices. So, another win there.

And if you ship a lot of items (perhaps for eBay or Amazon sales), or advertise your business, you’ll get 3X points for your efforts there, too.

If you spent the maximum of $150,000 in the bonus categories, you’d earn a staggering 450,000 Chase Ultimate Rewards points ($150,000 X 3). Which is enough to do… A LOT. Even if you don’t spend that much, 3X is still a strong earning rate.

However, if you have other Chase cards, like the Sapphire Reserve, you already get 3X on travel. And if you have the Ink Plus (no longer offered), you can still earn 5X on internet and phone. Which is pretty awesome. But if you don’t have either, the Ink Preferred is a nice way to access a lot of strong bonus categories.

Cell phone coverage

Another benefit of the Ink Preferred is your cell phone is covered for theft and damage, up to $600 per claim (max of 3 in a 12-month period). There’s a $100 deductible, so more like $500 per claim.

Wait what?

You have to pay your bill with the card to access the coverage. Which is great because hey, 3X bonus category.

I haven’t seen this feature on a lot of cards, so it’s nice to have. Especially if you’re accident prone. Or just clumsy.

I Imagined a New Premium Chase Card… How’d I Do?

Also see:

Imagining a New Premium Chase Card

Honest Review: Chase Sapphire Reserve 100,000 Point Offer

Back in March, I imagined what a new premium Chase card would look like. By August, we had a new bundle of joy: the Chase Sapphire Reserve.

Are you the premium Chase card of my dreamz?

I had high hopes for such an offering. So I thought it’d be fun to look back and compare what I wanted at the time to what actually came about.

And because my points & miles predictions for 2016 aren’t doing so hot. Oops.

Chase Sapphire Reserve: What it is

Link: Honest Review: Chase Sapphire Reserve 100,000 Point Offer

Here’s what I predicted way back when about a premium Chase card:

It would have a $450 annual fee

And United Club lounge access

$200 or $250 in travel credits

3X, 4X, or 5X bonus categories

At least 1 seriously amazing perk

Primary car rental insurance worldwide

Several ancillary bennies

Airline and/or hotel elite status

Premium Ultimate Rewards points (make them worth 1.5 cents each)

A great sign-up bonus

Priority Pass, Global Entry, no forex fees, great phone service

So how’d I do?

What I got right

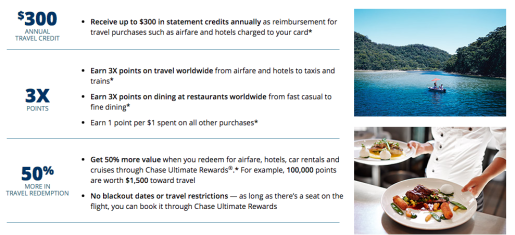

The Chase Sapphire Reserve does indeed have a $450 annual fee.

And they bested my desire: you actually get $300 annually to use toward any type of travel

The 3X category for travel and dining (but not gas) is seriously welcome.

Yes! Just what I wanted!

Yes to primary car rental insurance.

The points ARE worth 1.5 cents each, when you book travel through Chase. That one was spot on!

So was a great sign-up bonus. I’d even call it huge.

And yes to Priority Pass, Global Entry, no forex fees, and great phone service.

Out of the list of 11, I got 7 things correct. A pretty good run!

What I got wrong

Lounge access

There is no United Club lounge access. For lounge access, I must say, the Platinum Amex leads the pack. Because they have an excellent private lounge network. And you can get into Delta SkyClubs, in addition to Priority Pass and Airspace lounges.

Hahaha! You are NOT getting in here!

Citi Prestige nixed Admirals Club access. So I guess Chase didn’t feel compelled to add United Club access.

American, Delta, and United all have $450-annual-fee co-branded cards with lounge membership included. So it’s not surprising for them to siphon it off other cards.

One seriously amazing perk

I was thinking something in the vein of Citi Prestige’s 4th night free perk, which I’ve used over and over this year. While that perk will remain (for now), it’s changing to a 25% discount on July 23, 2017. Still pretty great, though.

Chase didn’t add anything too mind-blowing to the CSR.

Several ancillary bennies

Again, to compare with Citi Prestige, I was thinking something along the lines of 3 free rounds of golf per year. And Citi Price Rewind.

But also again, the golf perk is going away next year. And I don’t count the addition of The Luxury Hotel & Resort Collection as an an ancillary bennie. Cuz I’ll never use it (I think most of us have our chains we’re loyal to).

Strike!

Airline and/or hotel elite status

A la Platinum Amex, which gets you Gold elite status with Hilton and Starwood.

For now, AMEX Platinum is still a back door to Marriott Gold elite status

Chase could’ve added elite status with Hyatt and/or Marriott. Or even IHG. But it didn’t happen.

Or maybe a fast track with United, because they are so intertwined? It would’ve put the card over the edge, IMO.

But Citi Prestige never had this, either. Still, it would’ve been a nice play against Amex, especially for Marriott status, given the Marriott-Starwood merger.

Bottom line

Can’t win ’em all. Chase did a fantastic job putting together the Sapphire Reserve card. I got 7/11 right. And 4 wrong.

But upon reflection now, the Sapphire Reserve does have enough perks. Because too many would be unsustainable long-term. And only lead to cuts and changes, as we’ve seen with Citi Prestige.

I got my chance to imagine. And saw the end result.

Is it worth the $450 annual fee? I think so, if only for the 3X categories and $300 travel credit alone.

What would you like to’ve seen added to the Chase Sapphire Reserve? Do the current perks make it worth keeping it year after year?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

November 13, 2016

Honest Review: Chase Freedom (With Any Sign-Up Offer)

Also see:

The 4 Best Credit Cards for Holiday Season 2016

Let (Chase) Freedom ring!

I love this card. 5X Chase Ultimate Rewards points on up to $1,5000 in spending per quarter – 7,500 bonus points – in rotating categories? And useful ones to boot? OK!

That’s why I called it the best card for shopping this holiday season.

2016 was another strong year for Chase Freedom quarterly bonus categories

This card has been a bastion in my arsenal for years by now.

And why not? It’s free to keep forever. In fact, it’s my oldest card – I’ve had this account since 2002. So it’s been almost 15 years!

Chase Freedom provides an easy way to rack up an extra 30,000 Chase Ultimate Rewards points per year. That’s worth $300 on its own, which is awesome for a card with no annual fee.

Its power lies in pairing though, so be aware. However, 5% cash back – on its own – is nothing to sniff at, either.

The short

If you spend a lot in the rotating bonus categories, this card is an ace in hand.

The long

Link: Apply for Card Offers

Link: Honest Reviews

You can earn up to $75 cash back per quarter AKA $300 cash back per year. There’s no annual fee.

For a card that’s free to keep, an extra $300 per year from everyday purchases is kinda great. Hold on to it – that’ll also help to age your overall credit accounts and help to boost your credit score. Again, for free.

In fact, there’s little reason to ever cancel a card with no annual fee. I mean, just keep it forever, right?

Chase’s short but powerful list of airline transfer partners. But you’ll need to pair the Freedom with another card to access them

If you have the:

Chase Sapphire Reserve OR

Chase Sapphire Preferred OR

Chase Ink Plus

Then you gain superpowers with the Chase Freedom. That’s because you can combine all your points in one place and then transfer them to valuable travel transfer partners, like United, Hyatt, or British Airways.

Yup, Chase Freedom can get a gateway for a free night at the Park Hyatt Sydney

30,000 Chase Ultimate Rewards points a year can get you:

A round-trip coach award flight anywhere in the US – 25K points– transfer to United

A round-trip coach award flight to Hawaii – 30K points – transfer to Flying Blue

One-way coach award flight from New York to Frankfurt – 17K points – transfer to Singapore

2 round-trip coach award flights from Dallas to Cancun (this works on MANY other routes) – 30K points – transfer to British Airways

A night at a top-tier Category 7 Hyatt – 30K points – transfer to Hyatt

Any of these options is easily worth much more than $300.

Grade: A

The ability to earn 5X United miles or 5X Hyatt points at the grocery store, for dining, or on Amazon (all previous bonus categories) is pretty dang great.

I max the categories out every quarter. Instead of $300 cash back, I get 30,000 extra Chase Ultimate Rewards points per year.

At my base rate of 2 cents per point, that means $600 to me (or 10% back). Again, for a card that’s free to keep.

A word of caution: don’t even bother if you’ve had more than 5 cards opened in the previous 2 years. You have little hope of being approved.

This card is also a good “gateway card” for beginners (slash did I just compare earning points to drugs? It really is addictive!).

Because once you see the points starting to rack up, you’ll finally feel like hey, I really can earn these things! And use them! It’s a nice boost to your balance.

Also, earning 5X or 5% cash back on routine purchases is as good as it gets. No other bonus category tops this earning rate. For that reason alone, this card is worth it.

Keep or DTMFA: Keep.

Link: Apply for Points Reward Cards

Never dump a card with no annual fee. ‘Nuff said.

While I wouldn’t make this my first card to apply for if you’re starting out, it should definitely be in your first 5. Definitely have a look at the current cashback calendar and decide if it’s right for you.

You can apply for points cards here – thank you for using my links!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

November 12, 2016

Hotel Review: Aloft Winchester, Virginia

During my drive from Brooklyn to Dallas, I planned to stay 2 nights at hotels along the way. Long story short, my freaking car broke down. And I was plunged into a land of endless Plan Bs.

I prefer Hilton hotels. So during a fuel stop around dusk, I searched for a room on the Hilton app. Nothing was available within 100 miles. And I was tired from driving since 4am.

I didn’t have 100 miles left in me. I was ready for anything – even a roadside motel, “Psycho”-style.

So I checked Hyatt and Starwood. No Hyatt hotels in rural Virginia (not a surprise, but worth a looky-loo).

But there was a random Aloft hotel 45 miles away. I booked a room at the Aloft Winchester, nestled near the West Virginia border in extreme northern Virginia. It was ~$120 with taxes for the night.

As an added bonus, there were no pet fees! Hilton likes to charge $30 to $75 as a non-refundable pet deposit. So that was a silver lining.

Location of the Aloft Winchester

I booked on my phone and sped down the highway. I was so tired, my eyes were literally crossing. And I was getting bad road hypnosis.

Obviously, I made it because I’m writing this now. That day is etched into my memory as one of the longest of my life…

Arrival and check-in

Link: Aloft Winchester

Google Maps guided me into the parking lot. I turned off my car’s engine, and it quickly unwound, spent. I felt similar.

I ran in to the desk. The agent told me there was a baseball tournament in town, and I’d booked the last available room for the evening because of a cancellation. Lucky!

From the corner of my eye, I noticed an entire teenage baseball team in the “common area” as these millennial-focused hotels are so fond of having. *full-body shudder*

Hallways of the Aloft Winchester

The agent noted my SPG Gold status (from my Platinum Amex). She invited me to grab a drink and a food item from the Re:Fuel snack display, which was a nice gesture.

I told her I was bringing a dog and she assured me it was totally fine. I grabbed the room key and went to gather my things and critter.

The room

I threw everything down in a heap, got the dog settled, and immediately took a LONG, HOT shower. I’d been sitting in a hot car for… hours, stewing.

The room was cozy, but I was here for one purpose only: to PTFO (pass the bleep out).

View upon walking in

The room had a modern, kinda retro-y vibe. It was very clean. And quiet. And the king-sized bed looked like heaven.

It had that whole “no dresser, room divider, compact yet spacious” thing going on. So when you walk in, you’re pretty much in the bathroom, which was directly to the right of the door.

Sink

Shower and toilet

Bliss lotion and soap

Bliss products in the shower

Coffee, tea, ice bucket, bottled water, and safe

Around the divider, the rest of the room.

Bench and TV

Desk

Fenwick taking in the view from the window

The bed, with record player art above

Cute retro clock

I sat down at the desk and uploaded photos from the day. Then suddenly wanted a nightcap, despite my exhaustion. But probably because of it.

The photos uploaded quickly via the hotel’s wifi. All-in-all, the room was clean and comfortable and the wifi quick. I say this all the time, but it’s all I ever want in a hotel room.

I was pleased and surprised by how welcoming the staff and other guests were toward my pup. He’s such a sweetheart, but sometimes people are surprised to see dogs in dog-friendly hotels. He was exhausted too, poor guy.

He curled up at the foot of the bed, as he does each night. And I went to grab a beer.

The hotel

I took a few snaps of the lobby and social spaces as I sipped a local brew from the hotel bar.

The Aloft Winchester bar

Bar. Check-in desk and Re:Fuel snack counter behind

Main entrance

Couches and social area

Each space flowed into the next. There was a pool table and a few other seats and couches. But they filled up fast.

The service at the bar was perfect. I sat at a table in the middle of the room, and pondered little dilemmas as I finished my drink.

Gym

There was a gym with a few weights and a couple of basic machines on the first floor. Nothing extraordinary, but nice to have. There was also a decent-sized pool. But I didn’t have time to experience the hotel’s features.

I headed back up to the room and fell asleep in under 2 seconds (PTFO’d).

Bottom line

My stay at the Aloft Winchester in Virginia was excellent. The staff was awesome. And the way they welcomed me and Fenwick made us both feel at home. Cheap and cheerful best describes this place – it’s a combination I personally love.

I wasn’t “into” the open layout, some of the loud colors, and the trying-too-hard modernness of the hotel’s concept. That’s to be expected with the Aloft brand.

But the bed was comfy, and the room was clean and quiet. So the basics were well-covered. I would recommend this hotel, especially if you’re into Marriott/Starwood.

*eyeroll*

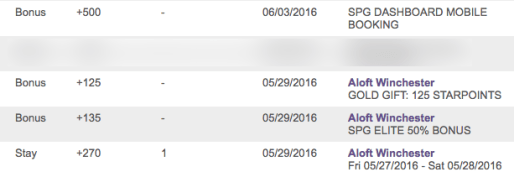

Quickly need to get this off my chest. I’m eternally miffed by the small amount of points SPG loyalists earn for paid stays.

I earned 530 Starwood points in total: 270 for the room, 135 as a Gold elite bonus, and 125 bonus as a “gift.” Gee, thanks!

There was a promotion at the time for booking through the app, so I earned 500 more Starwood points on top of that. It blows my mind the promotion gave me nearly as many points as the actual stay. And that the base amount of points was only… 270. K. What’s the allure?

The low earning rate slash difficulty in earning Starwood points has always been my #1 concern about the program. I guess it’s a moot point now, with the merger and all.

The next day, we woke up and sped away to Tennessee. And stayed at a Hilton. But that’s another story altogether…

The 4 Best Credit Cards for Holiday Season 2016

It’s nearly mid-November, how’d that happen?

I’m gearing up for Black Friday/Cyber Monday, as I’m sure many of you are, too.

Dear everyone I know, you might get a kitchen appliance. Love, H.

Here are my top picks for cards to use for gift shopping and travel this holiday season.

Holiday 2016 best credit cards

1. Chase Freedom

Link: Apply for Points Rewards Cards

Link: Activate Chase Freedom bonus

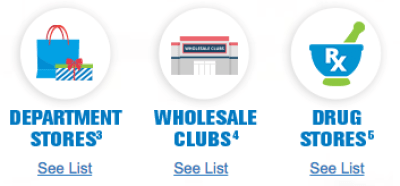

Hands-down my fave. Earn an easy 5X Chase Ultimate Rewards points, on up to $1,500 in combined spending at:

Department stores (Macy’s, Kohl’s, Sears, Nordstrom – complete list here)

Wholesale clubs (BJ’s, Costco, Sam’s Club)

Drugstores

Through December 31st, 2016.

Excellent selection for the holiday season

I’ll likely spend a lot at Kohl’s, cuz that’s just how I roll. And I’ll definitely use this card at Costco, too.

Be sure to activate the bonus. This is an easy way to rack up 7,500 Chase Ultimate Rewards points per quarter ($1,500 x 5).

Those will transfer 1:1 to travel partners when combined with other Chase cards, including Sapphire Reserve, Sapphire Preferred, Ink Plus, or Ink Bold.

I always get 2 cents of value from each of my Chase points (and usually much more), so I peg this as an easy $150 back toward travel.

Essentially, I make sure Chase Freedom is a 10% cashback card when I shop in the 5X quarterly bonus categories. And so should you, if you have one of the other cards listed above.

And if not, 5% back is better than nothing AKA using a debit a card. Chase Freedom is also a great “intro” card if you’re new – but I’d compare it to the Freedom Unlimited, especially if you don’t like the 5x categories.

But for holiday shopping – this is #1.

Note you can NOT get approved from this card if you opened more than 5 cards from ANY bank in the past 24 months. Sigh.

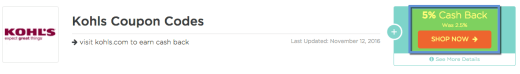

Giving Assistant has some nice payouts

Pro tip: If you shop online, always start through a shopping portal. I check Cashback Monitor constantly. And saw Giving Assistant has some good payouts for department stores (like 5% cashback at Kohl’s). Get $5 free if you sign up using my link (and I’ll get $5 too). TopCashback is another good one!

2. Discover It

Link: Discover It with $50 bonus after first purchase

Link: Yes! Just Got My $1,100+ Discover It Cashback Match (The Dublin)!

Link: Amazon

Dear light of heaven, I love this card. I got $2,200+ back last year from Discover It, gratis.

Can’t shake a stick at 10% back on Amazon

Through December 31st, 2016, you can earn 5% cashback on up to $1,500 in combined spending at:

Amazon

Department stores (like Chase Freedom)

Sam’s Club

Just remember to activate the bonus before you start shopping.

This is an excellent complement to the Chase Freedom for when you max out the department stores category. Or instead of Chase Freedom thanks to the Amazon category.

You could even purchase $1,500 in Amazon gift cards to use any time (guilty as charged). You’d earn 5% cashback for the current billing cycle ($75). And if you’re a new cardmember, another $75 after the 12th billing cycle during an event I’ve lovingly named “The Dublin.”

For a total of $150, or 10% cashback. Not bad for a card with no annual fee!

Can’t wait for The Dublin 2!

And now, Discover tells you exactly when your next Dublin will be. So I’m waiting patiently for October 27th, 2017. And am on track for another $1,000+ haul!

I’m on my 2nd Discover It card because you can have 2 max. But have to wait a year after the 1st one to open a 2nd.

This card is another excellent choice for holiday shopping.

3. Chase Sapphire Reserve

Link: Apply for Points Rewards Cards

Link: Honest Review: Chase Sapphire Reserve 100,000 Point Offer

I product changed to the Chase Sapphire Reserve. Because you can’t get approved if you’ve had more than 5 open cards in the previous 24 months. Which… I will never not have.

But I recommend this card for its:

Huge 100,000 point sign-up bonus after spending $4,000 in the first 3 months

$300 annual travel credit which you can use for travel in 2016 AND AGAIN in 2017

3X bonus categories for travel and dining

This one isn’t so much for shopping. But for easing the sting of higher fares during the holidays. You can literally straight-up buy a plane ticket and get $300 back.

I do love this card

And because 2016 is winding down, the credit will reset in January 2017. The annual fee is $450, but you can recoup $600 of it very quickly.

If you plan to shop a lot, you can more easily meet the minimum spending. And then you’ll have a crap ton of points to use for travel.

Basically, turn holiday shopping into “meeting minimum spend” time.

The 3X you’ll earn on travel and dining is nice, too. I am in love with this card, even though I didn’t get a sign-up bonus *grumble grumble*

4. Citi Prestige

Link: Apply for Hotel Rewards Cards

Link: Honest Review: Citi Prestige 40,000 Point Offer

Link: Citi Prestige by the Numbers

Yes, Citi has made massive changes to this card. But the good news is they don’t kick in until July 23, 2017. So you have a good 9 months to get your money’s worth.

Aye verily, I’ve recouped nearly $3,000 during the first year I’ve had the card. That’s insane.

The card continues to be worth it for:

$250 travel credit

4th night free on paid hotel stays

Industry BEST trip delay and cancellation insurance

I book ALL my airfare with this card. Because trip delay kicks in after only 3 hours, which is industry best. Even Chase Sapphire Reserve makes you wait 6 hours. And most other cards make you wait 12!

Plus, you get $250 in travel credits, which reset after the close on your December statement. So it’s possible to recoup the $450 annual fee with $250 back in 2016 and $250 back in 2017. Again, easing the sting of higher holiday fares.

I used the 4th night free benefit to save in Japan

If you plan on spending any time in a hotel, you get the 4th night free on paid stays. It’s a perk I use like crazy!

It’s true this card is a little less shiny than it was when it was launched. But the fact is, the changes are still pretty far away. And you can do well to assuage holiday travel if you maximize the very generous benefits that remain.

Bottom line

Those are my picks. But really, you can do well to simply get a new card and meet the minimum spending. Like the Starwood Amex card. Or whatever else strikes your fancy.

I highly recommend keeping Chase Freedom and Discover It top of mind and wallet, though (especially the latter for Amazon). And filling in around those.

If you get one of these cards in the next few days, it should arrive in time for Black Friday. But LBH, I’m in it for Cyber Monday.

November 11, 2016

4 Free Nights in the Bahamas, Thanks to FoundersCard!

Also see:

Free Caesars Total Rewards Diamond Status with FoundersCard

Yup, FoundersCard Still Offers Caesars Total Rewards Diamond Status Through 2017

The (good) hits just keep on coming! (I wrote about a free private jet flight from FoundersCard yesterday).

I got free Caesars Diamond elite status this year from FoundersCard, which comes with a ton of benefits, including:

Diamond lounge access

No resort fees at Caesars properties

$100 celebration dinner

Priority lines everywhere

Because of this, I’ve been thinking about a weekend trip to Las Vegas.

Up next: 4 free nights in the Bahamas!

Another benefit of Caesars Diamond status is 4 free nights at the Atlantis Resort in the Bahamas (part of the Marriott Autograph Collection).

Well, I just called to book it – and it went off without a hitch!

I used British Airways Avios points for flights there. And American miles for flights back. Total cost of ~$214 for round-trip coach flights for 2 from Dallas to Nassau. But the whole experience is worth nearly $2,600.

That includes 4 free nights from Caesars Diamond status – courtesy of FoundersCard. I’m so stoked!

About the 4 free nights

Link: Total Rewards Diamond elite status

Link: Caesars-Atlantis partnership details

Link: Preview FoundersCard benefits

I feel naked without a trip booked, which is the precarious place I found myself in upon returning from Washington, DC, earlier this week. But I lasted a solid 3 days without booking another trip!

(I don’t count the trip in May 2017 as it’s over 6 months away.)

While poking around the Caesar’s website to see the full benefits, I noticed a mention of “Aspirations eligibility” and fell down the rabbit hole.

Which brought me to this page with details of the Atlantis benefit.

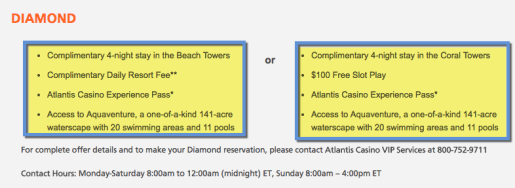

Choose A or B (Click to enlarge)

Caesar’s Diamond members get 4 free nights at the Atlantis Resort. And you can choose between:

4 free nights in the Beach Towers (slightly smaller)

No resort fees

-OR-

4 free nights in the Coral Towers (slightly bigger)

$100 in free slot plays

I chose the Beach Towers

Both options include:

Atlantis Casino Experience Pass

Access to Aquaventure, a crazy big water park

The Casino Experience Pass includes:

Shallow Water Dolphin Interaction for One, Round of Golf for One, Sushi and Sake Sampler Platter at Nobu, Two Cocktails at Olives, Two Cocktails at Seafire Steakhouse.

And the daily resort fee includes:

WiFi in Rooms and Hotel Lobby’s (up to 4 devices), Access to Fitness Center (2 guests per day), Two Bottled Waters Per Day, Per Room, Movie Theater Unlimited Access, Coffee and Tea In Room, Casino Lessons Daily, Shuttle between Towers.

I’m not big on gambling, so I opted for the Beach Towers with no resort fees (Option A). And you bet I’ll be getting my 4 free cocktails and sushi & sake platter!

How to book it

You must call 800-752-9711 to book this. And provide your Caesars Diamond number. Part of me was expecting them to say, “Nope, you can’t get it!”

But the phone representative had no trouble finding available dates for me. She went over all the options. Told me the differences in the rooms. And went over the cancellation policy (flexible until 7 days prior).

I confirmed my dates, she took my email, gave me a confirmation number, and said it was all set!

I also gave her my credit card to add to the room. The total call time was 9 minutes to book this. Could NOT have been simpler.

Also, you must book your trip by January 31st, 2017 for travel by February 28th, 2017. So you have ~4 months left.

I don’t know if this benefit will return next year. Or if they’ll replace it with something else. But I’m looking forward to seeing what happens – go if you can!

By the numbers

I love geeking out on this stuff.

So of course I wanted to find the retail cost if I paid for this out-of-pocket.

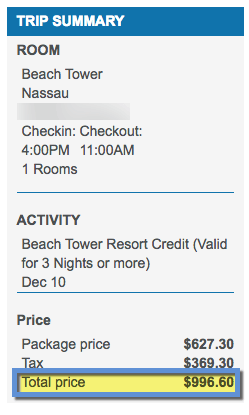

4 free nights is worth nearly $1,000

I selected the cheapest room in the Beach Tower, the Terrace View room, because let’s be honest, that’s what they’ll stick me in although you know – I’m Marriott Gold now so maybe they’ll have mercy on my soul and upgrade me!

Either way, the base rate with taxes would be ~$997 for my dates.

One-way flights for 2 are ~$814

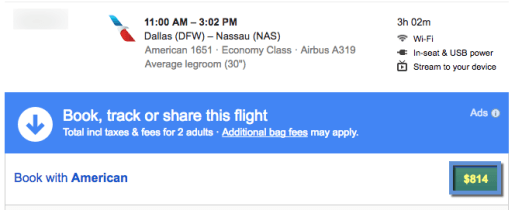

I used 20,000 British Airways Avios points to book the nonstop flights from Dallas to Nassau, and paid ~$11 in taxes. That’s a value of 4 cents per point – an awesome rate!

Wowza

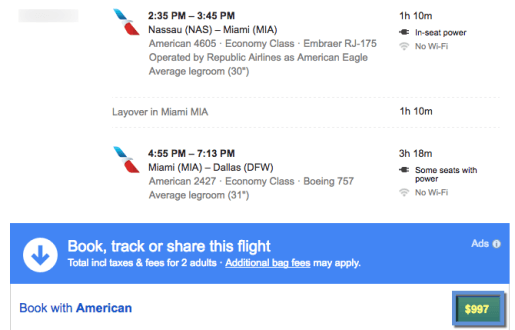

The flights back would’ve cost ~$997 themselves. Jeez.

But I paid:

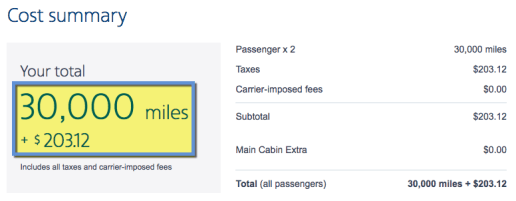

Muuuch better

For a value of nearly 3 cents per mile ($997 – $203 / 30,000 = 2.6). I’m fine with this, as long as I get 2 cents or more from each point or mile.

In all, I paid $203 + $11, or $214.

But saved:

$997 on the hotel – totally free, and no resort fees

$803 on flights there ($814 – $11 in taxes)

$794 on flights back ($997 – $203 in taxes)

For a total of $2,594 saved out-of-pocket

The points and miles I used were:

20,000 British Airways Avios points

30,000 American miles

So a ~$2,600 Bahamas vacation for a little over $200 – I’d call that a staggeringly great deal.

Also, the flight times are extremely humane. Nothing too early or late. And only an hour layover on the way back.

I feel like I really lucked out with this trip. It probably took, all told, 20 minutes to throw it all together.

Bottom line

Suh-weet! I can’t wait to visit the Bahamas for the first time in a little under a month.

I’m hoping for upgrades with both the room and the flights – which would make the points and miles worth even more.

Along with the free private jet flight, FoundersCard has returned outsized value for its $395 annual membership fee.

If you want to join, you can use my promotion code “FCHARLAN818“ to lock-in the $395 a year price for life – that’s my referral code. You can preview the benefits here. I’ve also written about many of them.

Can’t wait to stay at the the Atlantis Resort in the Beach Towers. There are lots of mixed reviews on TripAdvisor, but I’m hoping for the best.

Has anyone else used this rather hidden FoundersCard benefit? Or stayed at the Atlantis?

If so, how was it? Would love to hear how it went!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!