Harlan Vaughn's Blog, page 43

January 1, 2017

Bahama Breeze: Part 2 – Exploring the Atlantis Resort in Nassau

I referenced the enormity of the Atlantis Bahamas complex in my earlier review. But wow, this place is gigantic!

Walking through it all would be a nigh impossible task. There’s a free shuttle bus to get around the various towers. Most places are a 5- to 30-minute walk, depending on which tower you stay, and how quickly you walk.

View from Dolphin Cay

The Atlantis is a city unto itself. It would take several weeks to experience the dozens of bars and restaurants, swim in all the pools, and walk around the beaches of Paradise Island. So go into it knowing you won’t see everything. But do sketch out a rough idea for what you’d like to see and do.

You won’t get to all 21 restaurants and each of the 19 bars and lounges – not to mention everything else!

I had a Casino Experience Pass included as part of my 4 free nights, and that set us on a course to exploring the Atlantis.

Bahama Breeze Index

Part 1 – Review of My Free Room at Atlantis Beach Tower, Nassau

Part 2 – Exploring the Atlantis Resort in Nassau

Part 3 – Wanderings in Nassau

Using the Casino Experience Pass

The Casino Experience Pass included:

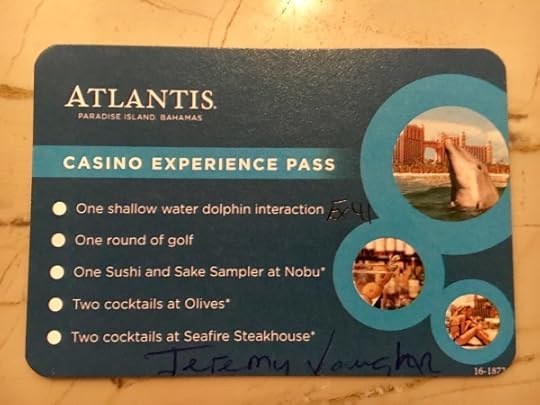

My Casino Experience Pass

And the daily resort fee includes:

What the resort fee covers

I had to pick up the pass inside the casino. I was advised to keep track of it because it is NOT replaceable if you lose it – and you need to present it each time you redeem.

The system is quite low-tech: they simply check the box and cross off each item as it’s used.

When I checked in, the desk agent gave me enough vouchers for 2 free bottles of water each day of my stay. Do NOT drink the water in the room – they are $7 each. Instead, pick up water from around the resort and take it back to your room.

From the Casino Experience Pass, I did everything except the golf.

And from the resort fee, I didn’t go to the fitness center or movie theater. And I didn’t take casino lessons or use the shuttle. I did use the excellent wifi, got all my free water, and drank the coffee in the room.

Olives, Nobu, and Seafire restaurants

Nobu and Olives are near each other inside the casino.

My Sky Juice martini cocktail

We sat down at the bar in Olives, showed them our Casino Experience Pass and ordered 2 Sky Juice martinis. They were delicious and sweet and boozy!

Olives cocktail list

So right off the bat, we saved $30 with the pass.

Then we went directly after to Nobu and got our sushi and sake sampler.

We were pretty hungry by that point so I didn’t get pics. But wow. This might be some of the best sushi I’ve had anywhere. And the sake was wonderful, too.

In fact, it was so good we ordered a couple more rolls and just paid for it. I highly recommend the Bahamian roll!

And at Seafire, located in the marina, we just got a couple of glasses of wine.

I estimate between the 4 drinks, the sushi sampler, and the sake, we got around $75 in free food and drinks from the Casino Experience Pass.

Dolphin interaction

Note this only includes admission for one person. It’s an additional $150 to add another.

Yes, that’s a lot. So I gave it to Jay for his birthday and sat nearby to watch. They are very thorough – and part of the proceeds go toward preserving marine life in the Bahamas.

Jay in his wetsuit

There’s an orientation where they get you fitted in a wetsuit and explain what to expect and how to behave during the interaction. They they tell you a little about dolphins and how some of them ended up in the Bahamas – many were rescued from hurricanes or other natural disasters.

The fitting and orientation took about 30 minutes.

Jay with Electra the dolphin

Then, you get nearly a full hour of being with a dolphin.

You learn their name (our group got Electra), their personality, the tricks they like, and get to pet them quite a lot – and feed them!

They don’t rush you out at all – they were very patient about answering lots of questions. It was a good time, even as an observer. It may be worth paying for if you’re there for a special occasion.

They also limit the size of the groups to about 8 to 10. And you have to schedule your interaction in advance – you can’t just show up.

But the small group size means you get lots of time with your dolphin. They are gorgeous and intelligent animals. This was definitely a highlight for us.

And of course, you can buy a photo afterward for $25. We were chumps and took the bait. The photo (above) did turn out high-quality. And they’re available right after your interaction as you… exit through the gift shop. Ah, consumerism. It’s everywhere here.

The casino

This place is damn crazy. There are peeps coming off docked cruise ships, from the surrounding islands, and from within the Atlantis. It’s huuuuge and has everything you can possibly imagine, from slots to poker to blackjack to you name it.

Casino king

Card tables

Just incredible

If you’ve been to any Vegas casino, you’ll know what to expect: tons of carpet, free drinks everywhere, dim lighting, opulent decor, and tons of flashing lights and urgent music.

Multiply the typical Vegas experience by like, 20, and you can begin to approximate what Atlantis is like.

I’m not much of a gambler, but I stuck a $20 into the penny slot machines and played for a while. I lost it all, of course, but got a drink or two out of it so I figure it was worth it.

December 31, 2016

Out and Out’s Top 9 Posts of 2016

It’s been an incredible year. I’m thankful for readers new and old; for all the comments and emails; and for all the support.

Here are the most-read posts written in 2016.

Out and Out Top Posts of 2016

1. My Experience Getting the $650 Phone Credit With Citi AT&T Access More Card

RIP

Readers were intensely interested in this card. And for good reason: 3X Citi ThankYou points on all online shopping, including payments through Plastiq, and shopping at Amazon and Costco. The card isn’t available any more, sadly. But I still use it regularly to bump up my Citi ThankYou points balance – it’s a wonderful complement to Citi Prestige.

2. My Last Chase Card: Just Applied for Chase Freedom Unlimited

I thought this would be my last Chase card. It wasn’t. I’m still bitter about it.

But at least I product changed to the Chase Sapphire Reserve!

3. [EXPIRED] Hurry! ~$500 Moneymaker on Kitchen Appliances at Kohl’s With Discover It or Freedom

This one by far got the most comments of any Out and Out post ever. Peeps were intensely interested in getting free appliances and a healthy amount of points, miles, and cashback.

This was my life for a day

I still need to post the results of that deal. But suffice it to say: there was one hiccup, but I’d do it all again if there’s ever a deal like this.

4. Honest Review: Chase Sapphire Reserve 100,000 Point Offer

This was my first Honest Review.

I do love this card

And yes, the Chase Sapphire Reserve is incredible.

5. BauBax Ultimate Travel Jacket Review

I still wear my BauBax jacket all the time. It’s a handy garment for the frequent traveler.

Out and Out approved *stamp*

I wore it around Osaka and now pack it regularly to accompany my travels.

6. MileagePlus X App: Earn Bonus United Miles at Amazon, eBay, & More

I have no idea why this app isn’t talked about more. It’s amazing.

It pairs well with the Chase United Explorer card because you earn a 25% bonus with every purchase. Some merchants stopped coding correctly this year, but for the most part, it works.

Such an easy, easy way to earn a ton of miles throughout the year. A must to download.

7. How I Made an Extra $60K from Airbnb in 2015

A lot of peeps know me as the “Airbnb blogger,” which is cool. I’d say I got in on the last wave in New York.

Now I have 2 in Dallas, and one in New York. The Dallas properties perform well, though the numbers aren’t as eye-popping as last year in New York.

I LOVE my Dallas Airbnb properties

Still, it gives me a small business to run a TON of spending through. And it allows me to get business credit cards like the Amex Starwood biz card and Bank of America Alaska biz card.

I also earn a boatload of points paying bills through Plastiq. It requires little effort on my part and still nets me a nice chunk of change. I should do another update on this. Hmmmz…

8. I’m Switching to Alaska and Southwest (With Companion Pass) Next Week

Amazing. I wrote this post last week and people resonated with it very strongly. I think, in general, there’s a lot of unrest with the legacy airlines. And peeps want alternatives.

Yes yes yes

In a few days, I’ll be getting the Southwest Companion Pass and switching all my flying to Alaska and Southwest. I can’t wait for my adventures in 2017.

9. Yup, FoundersCard Still Offers Caesars Total Rewards Diamond Status Through 2017

I love my FoundersCard. I got 4 free nights in the Bahamas and still have a free private jet flight to use.

And I think they’ll keep this extremely valuable benefit again next year, to get Total Rewards Diamond elite status through 2018. I’m hoping so, because I’d like to put it to the test in Vegas this year. On Alaska or Southwest, of course.

My Best Advice: BOOK THE TRIP

Also see:

My Best Advice: Go Go Go

Like most peeps, I am ready to put 2016 in the can. It was a good year. I visited many places for the first time, including:

Barcelona

Martinique

Osaka and Tokyo

The Bahamas

Mmmmagick

December 27, 2016

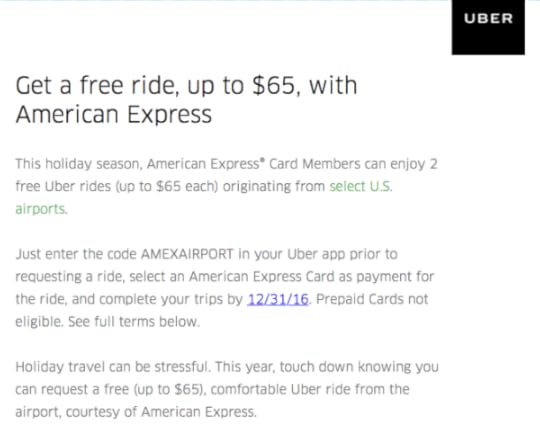

$130 in Free Uber Airport Rides (2 up to $65 each) for Amex Cardholders (Select Cities)!

This is gonna be a fast one so you can add this code ASAP.

Add code “AMEXAIRPORT” to your Uber account

The code is “AMEXAIRPORT” and you can get 2 free rides, up to $65 each, through December 31st, 2016 from these airports:

LaGuardia Airport (LGA)

John F. Kennedy International Airport (JFK)

Newark Liberty International Airport (EWR)

Chicago O’Hare International Airport (ORD)

Chicago Midway International Airport (MDW)

Seattle-Tacoma International Airport (SEA)

Boston Logan International Airport (BOS)

McCarran International Airport (LAS)

George Bush Intercontinental Airport (IAH)

Washington Dulles International Airport (IAD)

Ronald Reagan Washington National Airport (DCA)

You need to set an Amex card as your payment method.

Here are the full terms of this offer.

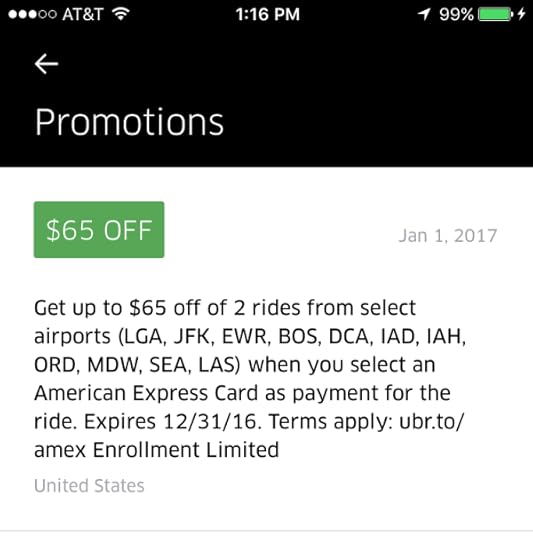

Looks like there are plenty left

I just added this to my account and it went through right away. So hopefully there are plenty left.

This is another great move from Amex, after the 2X small business points promotion, cheap Hamilton tickets, and recent great Amex Offers.

They are doing good things and I’m really pleased to see this!

Get it while you can!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

December 26, 2016

Booked: 3 Free Nights at Hyatt Zilara Cancun With Points!

What I like most about the points and miles hobby is setting a goal, then attaining it.

For a long time, I’ve wanted to stay at the all-inclusive and adults-only Hyatt Zilara Cancun. And in a few weeks, I’ll be there!

Coming for ya, Zilara!

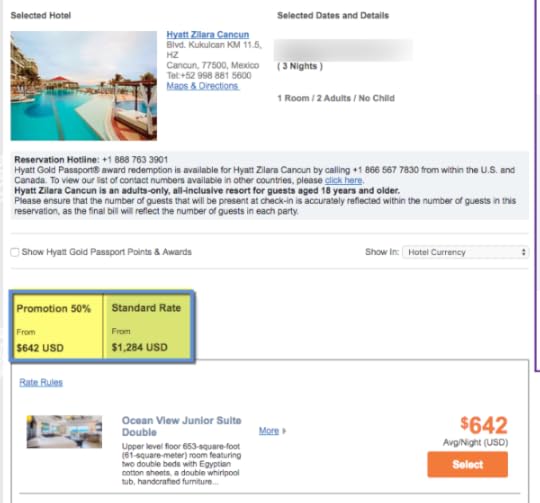

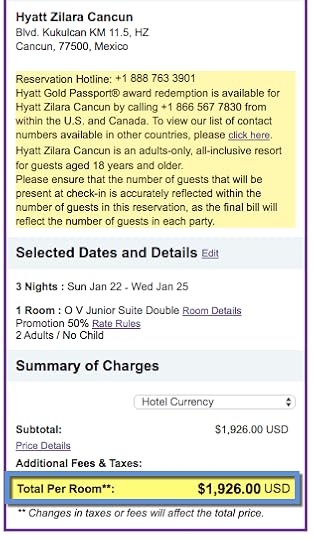

I used 75,000 Hyatt points for a stay that would’ve cost over $1,900 out-of-pocket. Here’s how it came together.

Booking a Hyatt Zilara Cancun Points Award

Link: Hyatt Zilara Cancun

American Airlines had a recent fare sale on non-stop flights from Dallas to Cancun in early 2017.

I instantly thought about the Hyatt Zilara Cancun. First, I made sure the fare didn’t have any minimum stay requirements and that I could find a 3-day chunk of time. I found a few combinations that worked – options!

Ocean View Junior Suites selling for $642 a night + taxes and fees

Then, called Hyatt to check for award space. A rep answered right away and had no problem searching dates. I told her the first set I found – and she confirmed all 3 nights were available in an Ocean View Junior Suite with double beds. I didn’t ask her check the other dates.

I transferred Ultimate Rewards points to Hyatt to top-up my account (I already had some from work-related stays). She held until the transfer went through, which took seconds. And then booked it!

I got the confirmation email before we hung up – it took under 5 minutes to book.

The 3-night stay would’ve cost $1,926

My 75,000 Hyatt points got me a stay worth $1,926, which means each point was worth ~2.5 cents.

Hyatt points can certainly be much more, but there is no way I’d pay the cash rate for that hotel. Plus, I figure I’ll save big on food and drinks, which is another value-add.

Also, I’ve just been really wanting to stay here. Ultimately, your points are there for you to use for experiences you’ll enjoy.

I don’t see myself having paid stays with Hyatt any time soon, so I was eager to zero out my Hyatt points balance. Earn and burn, baby!

AA flights with Citi ThankYou points

Link: I Saved $3,000 With Citi Prestige Last Year (and Got a Retention Offer)

Flights were next. I had them pulled up in another tab on the Citi ThankYou travel portal, and went through the booking process.

~22,000 Citi ThankYou points for TWO round-trip tickets

Thanks to Citi Prestige, each Citi ThankYou point is worth 1.6 cents each toward American Airlines flights (through July 23, 2017). I can earn ThankYou points easily with my Citi AT&T Access More card (no longer available), so I thought nothing of using them for this trip.

Both flights cost 21,634 Citi ThankYou points, or 10,817 points each. That’s an incredible deal!

Of course, once the time comes, I’ll credit them to Alaska.

December 25, 2016

I’m Switching to Alaska and Southwest (With Companion Pass) Next Week

Also see:

Alaska Mileage Plan: The Last Good Loyalty Program? (Alaska Vs. American by the Numbers)

American who? Delta what? Beginning 2017, I’m exclusively flying and crediting everything to Alaska or Southwest.

If I have to fly American, that’ll be credited to Alaska. Thanks to Alaska’s merger with Virgin America, I might not see the inside of DFW much next year. DAL is gonna become my new jam – and it’s only 10 minutes up the street.

I’ll be at DAL a lot more than DFW in 2017

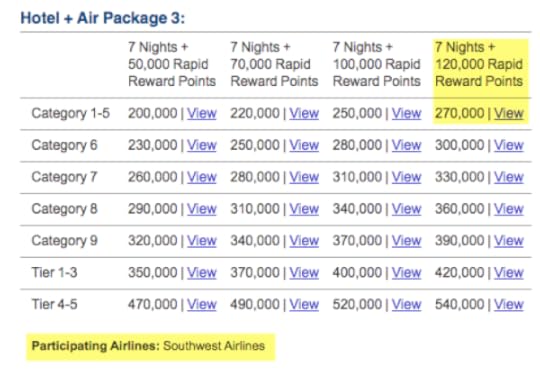

I’m also going to transfer 90,000 Starwood points to Marriott to get:

120,000 Southwest points

Companion Pass for nearly 2 full years

7 nights at a Marriott Category 5 hotel

I easily value that at least $5,000.

Bring on the Alaska and Southwest “Love”

Virgin America

I for one have been looking forward to the Alaska-Virgin America merger for a long time.

Thanks, aviation gods

Because Virgin America has a hub at DAL, which means I can get more places without the help of American or Delta. Which is awesome because Alaska Mileage Plan is the last remaining good mileage-based program.

I currently have 3 companion fares and at $50 flight voucher I need to use. And don’t want those to go to waste.

Southwest

Link: Marriott Hotel + Air package (login required)

I have also been deliberating whether or not to get the Southwest Companion Pass via 90,000 Starwood points.

Package 3 is where it’s at

Because 90,000 Starwood points are worth a lot. But so is the Companion Pass. It’ll be good for the remainder of 2017 and all of 2018 – nearly 2 full years of flying free with a mate. That’s incredible if you put it to frequent use.

120,000 Southwest points are worth at least $1,716 toward Southwest flights. But if I bring someone along, that doubles to $3,432 in paid airfare saved out-of-pocket.

It’s reasonable to value 7 free nights at Marriott Category 5 hotels at $1,000 (at $143 per night). But I’m gonna round right up and call it $5,000 because the Companion Pass is good through the end of 2018.

And 120,000 Southwest points alone are good for nearly 6 free round-trip flights at a cost of $300 each – with a companion for the cost of taxes and fees – which is incredible.

90,000 Starwood points can be worth much more in hotel award stays, or a First Class international flight. It’s going to sting to lose that many in one fell swoop.

But I feel like the lasting value of the Companion Pass, spread out over 2 years, will ultimately be worth much more than a few nights in a hotel, or a couple of flights.

After much back and forth, I’ll pull the trigger on January 3rd and make the required transfers and calls. Plus, I’ll still have some Starwood points left over because I got both credit cards earlier this year. And rocked an awesome Plastiq promotion for 3X Starwood points.

Putting them together

Simply, I’ll still shop based on price and schedule. But I’ll factor in whether or not I want to bring someone along. And decide between Alaska or Southwest case-by-case.

If American is unavoidable because they have the best price or route, I’ll credit the flights to Alaska. And try to avoid Delta altogether.

Airlines hubbed at DAL

Because Alaska and Southwest have plenty of non-stop flights from DAL, so between the two, I should be covered.

I’m thrilled about this arrangement because DAL is so close to me. I’ll think nothing of taking a quick weekend trip. The psychological freedom of having all those points in the mileage bank and earning status with a program I like is invaluable – it’s actually worth a lot more than I anticipated. That feeling alone is worth it.

It also seems good to split the difference between 2 programs so all my eggs aren’t in one (airline) basket. Because Alaska could change their tune (although I oddly trust them). And Southwest could devalue their points or program without warning (which they’ve done before). So this seems like the best hedge, all things considered.

Bottom line

I’m thrilled about the Alaska-Virgin America merger. It really opens Dallas up to the Alaska Mileage Plan program in a way that wasn’t as accessible before.

And I’m finally going to jump on the Southwest bandwagon with two feet first – Companion Pass and all.

Airline loyalty these days is a weird topic that requires many mental leaps and connections. But the arrangement of sticking to Alaska or Southwest for all things flight-related seems to be the simplest solution. And I love the Mileage Plan program! Alaska miles are extremely valuable and versatile. I’m already eyeing a trip South Africa in Cathay Pacific First and Business, with a stopover in Hong Kong for next year.

I’m also just done being on the American/Delta treadmill. It’s tiring keeping up with all the requirements. #goodbyetoallthat

Could you replicate this arrangement? Sure, Alaska and Southwest have prominence in many cities.

Unless you are extremely hub captive (ATL, SLC, or a small regional airport [like CMH]), it might be worth ditching American, Delta, United, and their revenue-based requirements for a year or two. Of course, this isn’t always possible because of price, schedules, connections, etc. But it looks like I’m striking out in Dallas – another reason I’m so glad I moved here!

Are you assessing your loyalty choices this week? Will you make a move to another airline in 2017? I’d love hear about which one and why!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

December 24, 2016

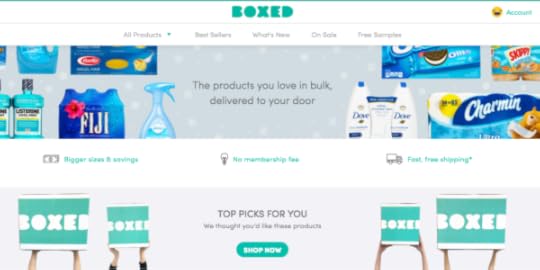

50% Off at Boxed for New Accounts + Amex Offer

Hope you’re having a wonderful holiday. Here’s a good deal alert!

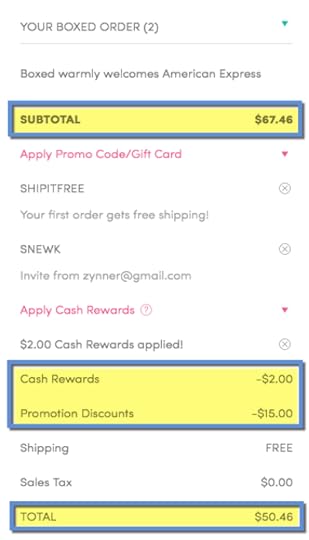

NEW Boxed users can get ~$67 worth of stuff for ~$31 by stacking a new account bonus, cash reward, Amex Offer, and clicking through a shopping portal. The discount works out to be slightly above 50%, assuming you can hit the target right around $67.

Stock up on household basics with over half off

I love a good stack! But keep in mind the math only works for new accounts. So you can either make a new account. Or just use the Amex Offer with a portal bonus and still do well.

Stack to get 50% off at Boxed

Link: Sign up for Boxed

When you use my link to make a new Boxed account, you’ll get $15 to use on your first purchase of $60+ (and I’ll get $15 in Boxed credit, too).

New accounts also start with $2 in cash rewards, which you can also apply to your order. And you’ll get free shipping for any order over $49, which this will be.

Before you start, be sure to add the Boxed Amex Offer for $15 back on a $50+ purchase in your Amex account.

Add the Amex Offer to one of your Amex cards

Then go shopping! Shoot for $67 – or as close as you can get to it for the maximum discount.

Boxed sells household items in bulk, like toilet paper, garbage bags, and cleaning products. And pantry staples like snacks, baking ingredients, and cereal. So it should be pretty easy to find something you want to stock up on.

I have personally used Boxed before and can vouch for their reliability.

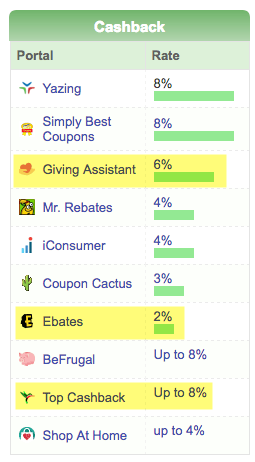

Pick your shopping portal

Afterward, “X” out of the shopping window or tab altogether. Then go to Cashback Monitor so you can drop a cookie for your favorite shopping portal and get some cashback on your purchase.

Pick your shopping portal

You can get 8% back at Yazing, Simply Best, BeFrugal, and Top Cashback. Or 6% back with Giving Assistant.

However, I recommend Giving Assistant. Because they pay out within a couple of business days. The others can take weeks and weeks to see the payout.

Giving Assistant does monthly payouts via PayPal. If you sign-up, you also get $5 back when you make your first purchase.

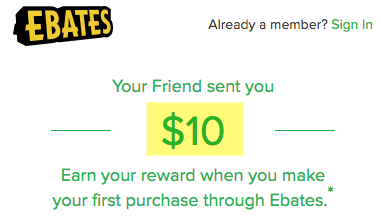

Get $10 more if you’re new to Ebates.

You might also consider Ebates, even though it’s listed at 2% back. New users get $10 back on the first purchase.

That can easily push this discount into the 60+% off terrain – which is pretty incredible. Payouts are slow as molasses, but they’re fortunately automatic. So you might get some surprise cash a few months from now.

If you don’t already have an account with Giving Assistant or Ebates, I’d definitely consider one of those first. The former for payout speed and the latter for the new account bonus.

By the numbers

Here’s how it adds up.

I likey

I added some items and got to $67 (for max discount). So you get:

$67 worth of stuff

$15 off for new account (down to $52)

$2 off from new user cash reward (down to $50)

$15 back from Amex Offer (down to $35)

$3 or $4 back from shopping portal (down to $32 or $31)

The discount works out to be better than 50% off. And if you’re new to Giving Assistant or Ebates, you’ll get $5 or $10 more back, respectively. $10 more off would mean you get $67 worth of stuff for something like $24 – which is an incredible deal.

Plus, you’ll get points or miles for using your Amex card.

Bottom line

You can get ~$67 worth of stuff from Boxed for $31 or $32. And the total drops into the $24 range if you sign-up for a new account with Giving Assistant or Ebates.

This will only work if you make a new account with Boxed and have the $15 off $50+ Boxed Amex Offer in your Amex account. (Although you can still do well even if you don’t.)

Follow these steps:

Make a new Boxed account

Add at least $67 worth of stuff to your cart

CLOSE THE TAB OR WINDOW

Access Boxed again from your shopping portal of choice (I recommend Top Cashback or Giving Assistant. Or Ebates if you don’t already have an account.) Search for “Boxed“

Check out and make sure your discounts are applied and your total is over $50

Get $15 back from Amex and the payout from your shopping portal

The total will come to somewhere between ~$24 and ~$32, depending on which portal you select. But whatever you decide, the discount is greater than 50% off – which is awesome!

I just stacked this all in my mind and had to share lol.

Feel free to ask questions. And let me know if you think of any other angles!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

December 22, 2016

Pick Up 30,000 Alaska Miles Every 45 Days

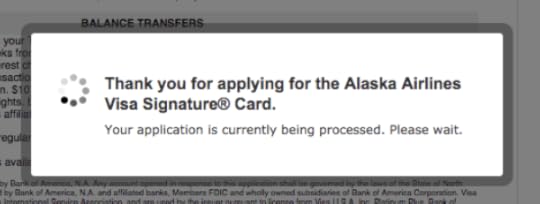

I recently picked up an personal Alaska Visa card, then tried to get another one soon after. It was automatically denied. Like, straight up the answer is no.

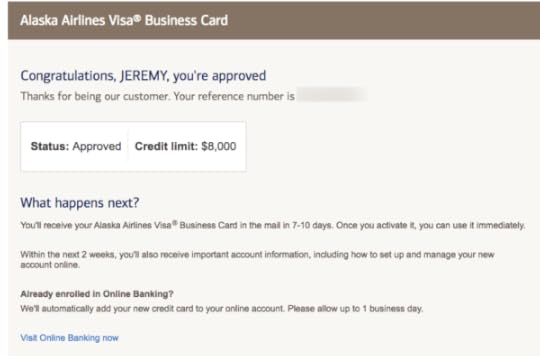

That’s unusual, so I thought it may have been because I didn’t lower the limits on my existing Alaska cards before applying. Not wanting to waste the hard pull on my credit (because multiple inquires on the same day are combined), I applied for the business version of the card and was instantly approved.

Deeee-nied!

But I didn’t want to let it go. I called the next day to speak to a credit analyst (they are open 8am to 7pm and I usually apply for new cards late at night while tipsy) for reconsideration.

I offered to lower my limits on one of the other cards, as they are pretty high (like $20,000 each), but she said the denial had nothing to do with my credit score or account history. And moving credit lines wouldn’t help me, either.

I was denied because I already opened a personal Alaska card within the last 90 days – which was the first time I’d heard that. But apparently it’s been enforced sporadically for a while.

So I figured how to play by the “new” rules and still get my doses of Alaska miles: rotate between the personal and business versions of the card every 90 days.

Get 30,000 Alaska miles every 45 days

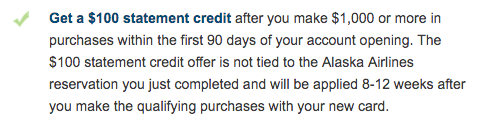

Link: Bank of America Alaska personal card with 30,000 miles and $100 statement credit

Link: Bank of America Alaska business card

Even though I’ve been shut out from getting another personal Alaska card for 90 days, I had no trouble getting the business version of the card. I applied directly after the personal version was denied, and was instantly approved.

Yes!

I’m not sure if the same 90-day rule is enforced for business card applications. But I wouldn’t recommend applying for multiple business cards in a short time period as it might raise red flags.

I applied for the business card as a sole proprietor and used my SSN.

Here’s my plan moving forward. Since I just applied for both versions of the card, I’ll wait 90 days. Then:

Pick up a new personal version of the card

45 days later, get another of the business version

Another 45 days later, get another personal card (which will be 90 days since the last personal card)

Then wait another 45 days for another business card (which will be 90 days since the last business card)

Rinse and repeat

In this way, you can pick up 30,000 Alaska Airlines miles every ~45 days and still play by the rules. Be sure to track your application dates with a spreadsheet, screenshot with a timestamp, calendar alert, or whatever method you like to keep up with the timing.

Are there downsides?

Not really. If you’re denied at any step of the way, you can always try your luck with the other version of the card.

If you’re denied again, you can try for a different Bank of America card so the inquiries will combine. There’s really not much to lose besides a hard pull and a temporary dip in your credit score of 3 to 5 points.

Of course, there’s also a chance Bank of America could tighten their rules further. In that case, you’d have to play by them. But historically, they’ve been an easy bank to work with. And hopefully, that won’t stop as Chase is out of the game and it’s harder to get many Amex and Citi cards.

I’ve gotten this credit more than once

The only other thing I can think of is you may not get that $100 statement credit as the language says:

This one-time promotion is limited to new customers opening an account in response to this offer.

I’ve gotten the $100 statement credit more than once, as it seems to be for new cards and I’m certainly not a new customer. But they could apply that distinction at any time, as it’s included in the T&Cs.

And regarding the business card, you will have to say you have some sort of business. Bank of America didn’t ask me about revenue, and only asked for vague business categories (none of them really fit so I picked the closest approximation). However, it is helpful to actually have sort of side business. As always, do what you’re comfortable with.

Getting 30,000 Alaska miles every 90 days with only the personal version is still a good deal, too, if you don’t have a business.

Bottom line

Link: Bank of America Alaska personal card with 30,000 miles and $100 statement credit

Link: Bank of America Alaska business card

I’m switching my loyalty completely to Alaska and Southwest in 2017. I’m done with American, I’m like Delta who?, and United isn’t remotely ringing any bells for me.

I love how versatile Alaska miles are, and how many partnerships Alaska has for global travel. I already called it the last good loyalty program.

Hawk-eyed readers will notice this post is the first time I’ve mentioned Southwest. Yup, I’m going full hog, Companion Pass with Starwood points, and all that jazz. I’m ready! You’ll hear more about this soon.

And if you’re like me, you can’t earn more American miles through sign-up bonuses. And Chase cards are a thing of the past.

So earning Alaska miles is a good alternative. And now you can get your 30K hit every 45 days by simply switching up which version of the card you apply for.

If you have any of your own data points, please do share!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

December 21, 2016

Bahama Breeze: Part 1 – Review of My Free Room at Atlantis Beach Tower, Nassau

Also see:

4 Free Nights in the Bahamas, Thanks to FoundersCard!

Caesars-Atlantis partnership details

Preview FoundersCard benefits

There are a few things in life that make me say, “Hell, yes!” as fast as 4 free nights in the Bahamas.

Exterior of the Atlantis Beach Tower

I wrote about the details of how I did it, but in a nutshell:

I got free Caesars Diamond elite status from FoundersCard

Caesars has a partnership with Atlantis for Diamond members

The T&Cs say you must book your trip by January 31st, 2017 for travel by February 28th, 2017

I didn’t know if this benefit would return in 2017, so I went all-in

Booking was simple. I requested my dates (December 10th to 14th), booked a non-stop flight there from DFW to NAS with Avios points, and booked a flight back (with a connex at MIA) with American miles.

I was aflutter about the experience, how the benefit would play out, and what the room would be like. I am happy to report it was a wonderful trip.

Bahama Breeze Index

Part 1 – Review of My Free Room at Atlantis Beach Tower, Nassau

Part 2 – Exploring the Atlantis Resort in Nassau

Part 3 – Wanderings in Nassau

Arrival and check-in

Link: Atlantis Beach Tower

The flight over was smooth. No time for the Centurion Lounge, but we did make it to an Admirals Club for coffee, light bits, and a couple of screwdrivers (thanks to my Citi Prestige card).

First glimpses of the Bahamas from above

It was cloudy and drizzly when we landed, but cleared up soon after. As I walked to immigration (which only took about 20 minutes), I noticed adverts for the Atlantis everywhere.

The Atlantis is located on its own island – yeah – and has ton going on. But I’ll save that for Part 2.

December 20, 2016

6 Last-Minute Stocking Stuffer Gift Ideas for the Frequent Traveler

Yeahhhh buddy, ’tis the season (for putting things off to the last minute)!

If you have an Amazon Prime membership, there’s still time to order gifts before Christmas with free 1-day or 2-day shipping.

Here are some cute stocking stuffers for anyone who travels often. And hey, if you get an Amazon gift card, maybe you’ll treat yourself to a couple of these. (Or if you buy one, use your Discover It card for 5% cashback through December 31, 2016. Just remember to activate your bonus before you shop).

6 Gift Ideas for Travelers

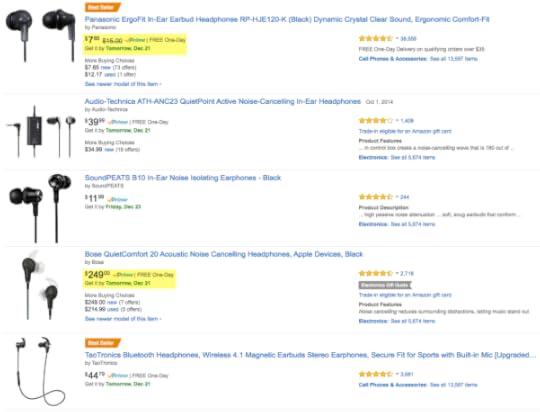

1. Noise-canceling earbuds

Link: Noise-canceling earbuds

For the love of gods, yes yes yes. These little guys are worth their weight in gold if you want to work or read during your flight. And if you get the seat next to a screaming child (we’ve all been there), they can go a long way toward preventing that third Aleve (or is that just me?).

The prices run the gamut

Earbuds are like cars: there are cheap ones, and there are really not cheap ones. What’s funny is how, at all price ranges, you can find a solid pair with nearly all 5-star reviews.

I’d personally go middle-of-the-road, but whatever you decide on will surely be welcomed with open arms. I mean… ears.