Harlan Vaughn's Blog, page 41

March 18, 2017

I’m Over Cashback Cards and Into Starwood Points

Also see:

Why I Don’t Care About SPG Starpoints

It’s Back: 35,000 Points With Both Amex Starwood Cards

There, I said it.

In 2013, I famously said (typed), “I don’t care about Starpoints.” At the time, my grievances were:

1 point per $1 spent was too low of an earn rate

You have to spend so much to earn a meaningful reward

The earn rate with other hotel programs is better, so why bother with Starwood?

I like you now and I’ll be sad when you leave

But a lot has changed since then. The merger with Marriott opened a few cool new opportunities, like:

The ability to earn the Southwest Companion Pass with 90,000 Starwood points (through March 31st, 2017)

Instant transfers to Marriott at a 1:3 ratio – and some hotels are a total steal with points!

1:1 transfers from Amex Membership Rewards to Marriott (by way of Starwood)

If you have Starwood Platinum status, you can match to Marriott, then get United Silver status

Amex desperately scrambling to get new cardmembers and throwing out Starwood points like candy

Nothing’s fine I’m torn

And, I’ve been putting a non-bonused spend on my Amex Starwood card, to the chagrin of my previously beloved Fidelity Visa. (Although I still use the mess out of my Discover it card cuz I want that sweet Dublin!)

In fact, I think I’m…. over cashback cards. For now, at least.

Drinking the Starpoints Kool-Aid

Link: Personal Starwood Amex 35,000 point offer

Link: Small business Starwood Amex 35,000 point offer

Link: USAA Limitless 2.5% cashback card

When I saw the USAA Limitless card with its allure of 2.5% cashback I thought holy moly, this is it – this is better than the Fidelity Visa!

Note: You can only get the card if you’re a USAA member.

But then I thought, 2.5%? I can do better with Starwood points. That was new for me – a real “a ha” moment.

Because I calculated the Companion Pass deal made each Starwood point worth at least 6 cents each. Or 6% back.

Plus, if I transfer the points to airlines with a 1:1 transfer ratio, I’ll get 5,000 bonus miles for every 20,000 points transferred. Which means the earning rate is 1.25 miles per $1 spent.

BUT. I only use miles if they’re worth at least 2 cents each. By that standard, 1.25 X 2 = 2.5% back – the same as the USAA Limitless card. And I often get even more value than that.

You can also do well using the points at Starwood hotels, obvi.

Cashed ’em out, no lookin’ back

I also realized the Fidelity Visa puts you on a bit of a treadmill. Cuz you have to spend $2,500 to earn 5,000 rewards points – the minimum needed to get a $50 cashback redemption.

That’s not a lot in general, but it’s a lot for non-bonused spending. And at this point, I think I’d rather put it on the Starwood Amex and have 2,500 Starwood points instead.

Not to say that doesn’t also put you on a spending treadmill to reach another redemption threshold. But 2,500 Starwood points is enough for a weekend night at a . Or swap it for 7,500 Marriott points, which can also be meaningful. Or just save them for bigger award.

The good and the bad

If I go ahead and open that USAA card, it would incur a new hard pull on my credit report. And appear on my personal credit report.

That’s fine, as it’s no fee, and everyone should have at least one no annual fee card.

But the business Starwood Amex doesn’t appear on my personal credit report and doesn’t count for the Chase 5/24 rule. And I don’t wanna open a card I may never even use…

Also, USAA could pull this card at any moment (it’s still in “pilot”). If I don’t get it soon, my opportunity might pass. And who knows if I’d ever like to have it down the road. The Starwood cards may have a time limit, too. So might as well use them while you still can.

The USAA card doesn’t have a sign-up bonus. Then again, if you’ve ever had either version of the Starwood Amex you can’t earn the bonus again on the version you had. So that’s a net-net.

All told, I can’t find a single compelling reason to get the USAA card. For ongoing non-bonused spending, I think I’ve finally gone to the dark side. Of Starwood points.

It took a while, and I may be riding the last wave here. But if it weren’t for Starwood points, I wouldn’t have had the chutzpah to dump American and Delta and switch to Southwest and Alaska this year. So there’s always that.

If you’ve never had either Starwood card, I highly recommend opening it before April 5th, 2017 to earn 35,000 Starwood points as a sign-up bonus.

Bottom line

Link: Personal Starwood Amex 35,000 point offer

Link: Small business Starwood Amex 35,000 point offer

I loved taking a contrarian stance re: Starwood points for a long time. The airline and hotel industry, loyalty programs, opportunities, the way we spend – it’s all shifted these past few years.

I debated getting the new USAA Limitless card. But I can’t convince myself it’s worthwhile. And I’ve been putting most of my non-bonused spending on the business Starwood Amex.

In a broader scope, I also put a heavy amount of spending on my Chase Sapphire Reserve and Citi AT&T Access More cards – probably my top 2 heavy hitters. And the rest on the Chase Freedom and Discover it for the 5% categories. And the rest on the Starwood card.

That means Chase and Citi have the bulk of my business. That’s a big shift from a few years ago when I was still trying to use the Amex EveryDay Preferred card all the time. And of course my Fidelity Visa (then an Amex, too) with the Serve card. Ah, remember that? Ch-ch-changes.

Are cashback cards worthwhile when you can do so much better earning and redeeming points? Is there a sweet spot here I’m totally missing?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

March 17, 2017

Hotel Review: The Drake (Hilton), Chicago

This past week, I ventured up to Chicago to see Hamilton and hang out with some old college buddies.

I booked 5 nights at The Drake hotel Chicago, located on the Magnificent Mile/Michigan Avenue, with Hilton points. The 5th night was free on this award booking, so I paid 200,000 Hilton points (50,000 X 4) for the entire stay.

My eventual room would’ve cost $1,400+ out of pocket

Because I’m Diamond with Hilton, I got an upgrade to a King Bed on the Executive Floor. Similar room rates to when I stayed say this would’ve been ~$1,404 in cash. But I didn’t have to pay taxes on the award booking, which are over 17% per night (!!!).

That means my Hilton points were worth .07 cents each – and more when you count the free breakfast and free food in the evenings. That’s a good rate for Hilton points!

I took a Lyft from Midway after flying on Southwest from Dallas-Love Field. Traffic was backed up, but I made it to The Drake in about 30 minutes.

Arrival and check-in

The first thing to note is the location. It’s at the top of the “Magnificent Mile,” which runs down Michigan Avenue from Oak Street down to the river. It’s a solid 10-minute walk from the nearest subway stop (the Red line @ Chicago Ave), but easy to catch a bus on Michigan Avenue. And it’s super touristy.

Looking back, I wish I’d stayed in The Loop instead so I could be closer to Red and Blue line trains because I have a couple of friends in Logan Square.

Very elegant lobby with detailed trim, ceilings, chandeliers, and fresh flowers

But upon walking in, I could feel the “Old Chicago” vibe peeps on TripAdvisor talk about so much.

Check-in area

There was no line at the desks, and they’d already prepared an envelope stuffed with coupons, a welcome letter, and a premium wifi code, for my stay.

My Diamond status was acknowledged, and they gave me an upgrade to the Executive (10th/top) floor.

But, a huge reason I picked this hotel was because of the Executive lounge. I’ve done well in the past with breakfast, drinks, and canapes at other Hiltons and was really looking forward to it. But it was closed for renovation until – get this – the following week. Arggh!

In lieu of losing that, they had these coupons for a free pastry, juice, and coffee at the Lavazza. And a free appetizer at Coq d’Or each evening. I would’ve preferred the Executive lounge. But I took the coupons, which were a nice gesture.

Breakfast and appetizer coupons instead of Executive lounge access

I had a feeling these coupons would be kind of a PITA to redeem, though – more on that later.

T&Cs of each coupon

Though the lounge situation was a letdown, the rest of the check-in was quick. And I always love getting an upgrade!

The room at the Drake Hotel Chicago

Hallways of The Drake hotel Chicago

My room, 1007

View upon walking in

The door opened into a small entry room. The bathroom was to the left. And the main room was to the right.

Entering the bedroom

The bed and nightstands

Sitting area with a real, live plant!

TV, ice bucket, coffee machine

Desk and chair

Closet, iron, hangers, luggage rack

I promptly hung up all my shirts.

February 16, 2017

It’s Back: 35,000 Points With Both Amex Starwood Cards

Also see:

I Got the SPG AMEX with 35,000 SPG Points – Here’s Why

Last Chance for AMEX SPG 35,000 Point Offers (and Why I Got Both Cards)

My Experience Getting the Southwest Companion Pass With Starwood Points

Well would ya lookit that. I wasn’t expecting to *ever* see a limited-time offer on the Amex Starwood cards again. But now, you can earn 35,000 Starwood points on the personal and small business cards after meeting tiered minimum spending requirements through April 5th, 2017.

It’s back, like a heart attack

Marriott has agreed to leave SPG alone until 2018, but then get ready for a butchering. Realistically, Marriott has no incentive to keep the program as it currently is. But, I’m pleased Amex is giving peeps one more stab at this terrific offer.

I broke the seal with the business version of the card last time this offer came ’round in March 2016. Before it ended, I had both versions.

Little did I know I’d hoard the points like a squirrel or ferret until such a time as I’d use them for a Southwest Companion Pass. The hammer drops on that method on March 31st, 2017. But if you applied like *now* and met the minimum spending in short order before the statement closes, you could probably squeak by.

The huge caveat is the bonus on both cards is once per person, per lifetime (AKA 7 years). But if you’ve never had it… I highly doubt this offer will ever come back.

The short

Highest-ever offer returns. If you’ve never had the card, this is probably your last chance to get it.

The long

Link: Personal Starwood Amex 35,000 point offer

Link: Small business Starwood Amex 35,000 point offer

Link: Honest Reviews

If you’re in the lucky position to pick either, I’d go with the small business version of the card. Because you get everything that comes with the personal version for the same price, plus:

Sheraton Club Room access

AMEX OPEN discounts

Doesn’t appear on personal credit report, so won’t count for Chase 5/24

However, it has a higher minimum spending requirement. You’ll earn 25,000 Starwood points after you make $5,000 in purchases within the first 3 months. And an extra 10,000 Starwood points after you make an additional $3,000 in purchases within the first 6 months. For a total of $8,000 in spending.

You can use the card to pay bills like mortgages, rent, and student loans with Plastiq. Or, pay your tax bill (’tis the season), ugh.

The personal version requires $3,000 in purchases within the first 3 months to earn 25,000 Starwood points. And $2,000 more within the first 6 months to earn 10,000 more Starwood points. For a total of $5,000 in spending.

With both cards, the $95 annual fee is waived the 1st year.

How to use the points

35,000 Starwood points plus the minimum spending is 40,00 points (or more, if you get the business card). Considering you get 5,000 bonus miles when you transfer to airlines with a 1:1 transfer ratio, that’s easily 50,000 Alaska, American, Asiana (and many other airlines’) miles.

Or you could use them for:

Cash + Points bookings

SPG Moments

Nights & Flights

Of course, you can also use them to stay at Starwood (or Marriott!) hotels, too.

February 12, 2017

This Card Got Me a $500+ Hotel Stay for $49

So, I’m shutting down my last New York Airbnb at the end of this month. This will effectively cut my final tie to that city – finally. I wanted to go for a night or two to turn in the cable box, return the keys, and officially wrap it up.

Of course, I thought about using hotel points because I really didn’t want to pay for it (although I could theoretically write off the expense). Then it occurred to me I had a free night from my Chase IHG card set to expire. Even better, I just earned another one for paying the second year’s $49 annual fee.

[image error]

Right where I need to be in town and 100% free

I used them for a ~$539 two-night stay at the Hotel Indigo Lower East Side New York for $0. Because the annual fee is waived the first year, I basically paid $49 – and got back a stay worth over $500.

Here’s why you might consider picking up the Chase IHG card. Even if you already have lots of other cards.

The Chase IHG card gives easy value year after year

Link: Apply for Card Offers

Right now, the current offer on the Chase IHG card is 60,000 IHG points after you spend $1,000 on purchases in the first 3 months from account opening.

The points are great, but the real value is in the perks. You get:

A free night at ANY IHG hotel every year on your cardmember anniversary

10% of your redeemed points back (up to 100,000 per year)

IHG Platinum elite status, which is completely worthless but gets you a few extra points on paid stays

There’s also the “soft” benefit of using the card for a stay that’s been part of all my previous Accelerate offers.

Paying with the Chase IHG card has been an easy way to tick one off the list

But the real value is with the annual free night. You can use it at literally ANY IHG hotel that has an award night open.

I saved myself a tidy ~$539

This 2-night stay that would’ve otherwise cost ~$539. The location is perfect – only 3 short blocks from where I need to be. Plus, I booked non-stop round-trip flights with Southwest points. So the entire trip will be completely free (except for food and cabs).

The reason I booked this hotel and not a more expensive one is because it was going to expire next week. For me, it was use it or lose it. I’m glad I did, and saved some cash.

But you can push it to the limit and get some serious value if you don’t procrastinate like I did.

It’s ~$696 after taxes

You could stay at the InterContinental Le Moana Bora Bora in a double bungalow and save yourself ~$696 on a night. Or double up like I did and get nearly $1,400 in value. I plugged in random dates in April 2017 and found lots of open rooms.

as

Or, something a bit easier… a night at the InterContinental Paris – Le Grand, where rooms are ~$321 in May 2017.

With a little planning, you could add a fun stop somewhere along your travels. Or burn it at the last minute on something you were going to pay for anyway.

This card is NOT under 5/24

If you’re scraping the bottom of the barrel like me, consider picking up this card. It’s one of the few NOT under 5/24 (the Hyatt card is too, incidentally).

I’m actually considering closing my Chase Hyatt card and getting it again for the sign-up bonus. Like the Chase IHG card, you get a free night every year on your cardmember anniversary, but you can only use it at Category 1 through 4 hotels – here’s my list of Hyatt Category 4 hotels where you can get outsized value.

For ongoing value, the Chase IHG card is better. The annual fee is lower ($49 vs. $75) and the free night doesn’t have restrictions. Basically, there’s no way in Hades I’m ever giving up this card.

Are there drawbacks?

You can use the free night anywhere. BUT. It’s just one night.

If you want multiple nights, you have to either pony up more points or pay out-of-pocket. To get around this, you can do what I did and save them up 2 years in a row – and then redeem them for 2 consecutive nights.

Or, there are plenty of situations where you could use 1 night, like:

Fly into one city, stay the night, take the train to another city (Fly to Brussels, stay at the InterContinental Amstel Amsterdam for free, take the train to Paris)

Use it for a special event, like watching the New Year’s Eve fireworks in Sydney like I did

A romantic evening slash staycation

An unexpected business trip where you’re in and out – or for an airport hotel when they cost a lot

On a road trip, where you pop into an expensive city for the night (it always blows my mind how much Nashville hotels cost, for example)

[image error]

The Hotel Indigo in Nashville costs more per night than the one in New York. What?!

Also, the free night is use it or lose it. So if you let it expire, it’s gone. There’s also no way to extend it. But you have a whole year to use it, so surely you can stay somewhere for an evening.

Bottom line

Link: Apply for Card Offers

I hate on IHG a lot. Their elite status is useless, they don’t give free breakfast if it’s not included with every room already, and their points proposition pales in comparison to Starwood, Hyatt, or even Hilton.

But I have a soft spot for IHG. The PointBreaks list is a quarterly endearment, they keep chugging along with the Accelerate offers, and my gosh, the Chase IHG card is totally worth having for that 1 free night per year.

Plus, if you do use PointBreaks, you’ll get 10% of your points back. That’s only 500 points, but you often get 500 points as a Platinum elite perk (status that comes with the card). So you can effectively book a PointBreaks hotel for 4,000 IHG points. That’s a fantastic deal if you can find a hotel that works.

The card isn’t under 5/24. And you’ll definitely get your $49 worth – and often much, much more.

From my one $49 annual fee, I got 2 free nights at the Hotel Indigo Lower East Side New York (which I’ll be sure to review). That was possible because the card is $0 the first year, and $49 the second year – so 2 nights in total for $49. Really, an amazing deal.

Just wanted to share my excitement – the thrill of chasing a deal is real, y’all.

Have you gotten outsized value from the Chase IHG card’s free night? How much did you save?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

February 10, 2017

Join Me at FinCon 2017 in Dallas with Limited-Time $249 Passes

I read a lot of personal finance blogs. Increasingly, they mention “travel hacking” AKA what we do on the daily as a way to travel cheap.

And it’s true – I see the parallels between the 2 niches. Especially if you’re using the money you save on traveling and put it in a retirement account. WHICH YOU ALREADY DO, RIGHT?

February 9, 2017

Bahama Breeze: Part 3 – Wanderings in Nassau

During my time in Nassau, I managed to make it into town twice. The first time was in the middle of the day on a Saturday. And the second was a Monday night, which we quickly found out was not the best time to visit.

If you stay in Nassau (maybe because of the 4 free nights at the Atlantis from FoundersCard/Total Rewards Diamond status), you will probably end up on Bay Street at some point. Wait, I made a little map:

Lay of the Nassau land (click to enlarge)

So that’s kinda what to expect.

And here’s what I did during my explorations beyond the Atlantis!

Bahama Breeze Index

Part 1 – Review of My Free Room at Atlantis Beach Tower, Nassau

Part 2 – Exploring the Atlantis Resort in Nassau

Part 3 – Wanderings in Nassau

Beach bummin’ in Nassau

1. Downtown/Bay Street

Link: Things to do on Bay Street

This would be “The Action.” Here, you’ll find Senor Frogs, where you can get a stiff margarita with a bunch of bros and retirees. We saw the bartenders pouring tequila down people’s throats… it’s that kinda place!

And the Straw Market, where you can buy cheap handmade trinkets. Be prepared to be very, very in a mood to haggle.

A restaurant called The Poop Deck came recommended, but I didn’t make it there. However, if the quality of the other restaurants is any indication, it should be quite good. Try the conch anywhere you go – it’s all locally caught and fresh. As is all the seafood, really. You can’t go wrong with the seafood, even in the touristy places.

I am 100% drunk in this photo

I did hit up Lukka Kairi for dinner, which was fantastic. And grabbed beers at the Pirate Republic. They had some excellent local brews on draft. And the outdoor balcony overlooking the ocean was bliss!

There’s not much happening on a Monday in Nassau – Lukka Kairi was literally the only place open. We also popped into the British Colonial Hilton Nassau downtown for a quick beer before heading home, just to check out the property and enjoy a brewski.

Smoking a Cuban in Nassau

We also got some Cuban cigars. I didn’t truly realize how close the Bahamas were to Cuba until I got there. Nor did I realize how good a Cuban can be. I’ve tried a few others since I’ve been back in Dallas, and can’t the Cubans off my mind!

Cuba is a short boat ride away

A nice cigar is about $10. And we walked around the harbor, enjoying them.

There are 700+ islands in the Bahamas

In fact, I didn’t know the Bahamas had so many little islands. If you want to see one nearby, Harbor Island would make a good day trip. I might do that next time I’m there.

Sneaky bitches

We popped into a couple of different bars and restaurants for snacks. I don’t remember the name, but there’s a Greek restaurant you can access via stairs from Bay Street. They had a drink called a “Sneaky Bitch,” which I thought sounded perrrrfect for me lol.

If you want something fun and innocuous to do during the day, check out the Pirates of Nassau museum. It’s $13 to get in. There’s lots of interesting stuff in there. And awesome photos and stories.

I also recommend simply wandering. Those are usually the best adventures.

February 8, 2017

How a $6 Charge Made My Credit Score Drop 100 Points

Considering all the things I’m juggling all the time, my accuracy rate is pretty high. But more to keep track of means more things fall through the cracks.

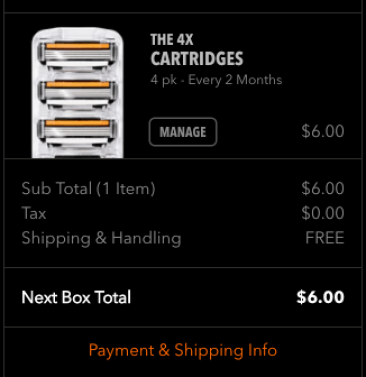

Before I moved to Dallas ~7 months ago, I changed all my addresses to my new address. During this, I paused the shipping on my Dollar Shave Club account.

And somewhere along the line, I canceled my Amex EveryDay Preferred card because I wasn’t making 30 transactions on it per month. To help with the transactions, and because it was so low, I made it my primary card for Dollar Shave Club’s recurring $6 monthly charge.

You can guess what happened. Somewhere in the middle of everything, the shipping resumed.

$6 messed up my credit score

And somehow, the charge cleared. Usually, when a card is closed, you’ll get an email from the merchant saying the payment failed. Not so with this one.

Amex cleared the charge. And I never got an email from or letter from them. Until one day, I saw my credit score dropped from 803 to 702 – because of non-payment of the $6 charge.

Amex has no idea what’s going on

Of course, I immediately called them and asked WTF? How could a charge clear on a closed account? And even still, why no notice – no statement, no “uh hey you owe us money,” nothing?

Every rep I spoke with said, yeah that’s definitely not supposed to happen. They admitted fault more than once.

This is the only blemish on my credit report. I’ve been so vigilant about protecting it for years. To say I was livid is an understatement.

So, so ugly

What was alarming is no one I spoke with seemed to have any idea how to fix it. Or why it happened. They were clueless and didn’t have answers, which was frustrating.

What Amex did about it

Their solution was to “re-age” my account. I of course made the $6 payment over the phone. And they said they could extend the closing date of the account so it would appear as closed with a $0 balance (as shown in the image above).

Fine, I said. Do it. They said it would take a month to show up on my credit report. A month!

Well, a month later, my score was still in the low 700s. So I called again, and this time spoke with a supervisor. She could see the notes on my account. But it was never properly “re-aged,” whatever the hell that means. So she said she’d do it for real this time.

Another month passed. The mark is still on my credit.

To recap: I made the payment. It wasn’t my fault. How it slipped through their system is a mystery. IT WAS ONLY FOR 6 FREAKING DOLLARS.

My next steps

Link: Equifax dispute process

Link: Experian dispute process

Link: TransUnion dispute process

So, Amex was and is useless to remove this strike from my credit report. I’m to the point where I just want this dumb thing removed.

So I’ve initiated disputes with the 3 major bureaus. And I WILL make sure it happens.

My biggest concern was I couldn’t get premium rewards cards any more. But so far, I’ve been auto-approved for several new cards (not that I get many of them anyway because of bank rules).

And the one time my account went to pending, the agent didn’t even mention it. Plus, a friend reminded me, 700 is still a good score.

Yes, but it’s not the 800 it once was before this happened. Over something so small.

So now I must wait 8+ weeks to hear back about my disputes. I have proof I paid the charge, the date the account was closed, and the date of the transaction. So it should be fairly obvious what happened.

What’s still most surprising is how utterly useless Amex was to remediate their mistake. And how much my score fell. I knew it was sensitive, but wow. 100 points for a $6 charge seems extreme.

Bottom line

So I’m going through the process of disputing my credit report with the 3 major bureaus. It’s a total PITA. And it seems like such an exercise in futility. Like, why can’t Amex just fix it?

I don’t want to go through it, but it seems I have no choice if I want the mark removed.

Just be careful with those recurring charges. Similar slip-ups have happened to me in the past, but I’ve always resolved payment directly with the merchant by simply using a different card. How and why this happened continues to elude me.

It just goes to show, you can never be too careful. And to double- and triple-check everything.

Have you ever had to dispute an item on your credit report? How did the process go? I’m hoping this is a quick and easy fix!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Confirmed: FoundersCard Gets You Total Rewards Diamond Status Through 2018

Also see:

Free Caesars Total Rewards Diamond Status with FoundersCard

Yup, FoundersCard Still Offers Caesars Total Rewards Diamond Status Through 2017

Assessing the Benefits of FoundersCard

18 FoundersCard Travel Benefits (Status, Discounts, and Freebies)

I’ve written a lot about FoundersCard over the years.

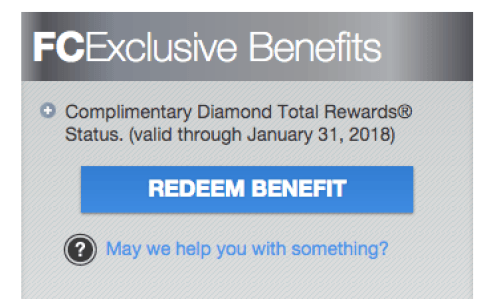

One of their cornerstone benefits since 2014 has been free Caesars Total Rewards Diamond elite status.

Thankfully, it’s made a comeback every year. Including this one!

Yes! FoundersCard’s best benefit returns for another year

You can get Total Rewards Diamond status through January 31st, 2018 – nearly a full year.

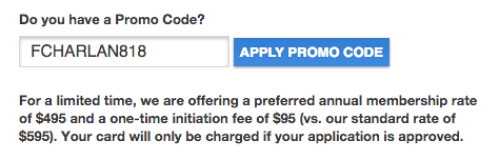

The bad news is FoundersCard currently costs $495, plus a one-time $95 fee, if you’re new.

Been better, been worse

However, if you have a trip to Vegas in the near future, it could be worth it anyway.

What you get with Total Rewards Diamond status

Link: Caesars Total Rewards status benefits

With Total Rewards Diamond status, you’ll get:

Access to Diamond Lounges

No resort fees

Guaranteed Room with 72 hours notice in Atlantic City and Las Vegas

Access to Priority lines at hotel check-in, restaurants, casino cages and the Total Rewards Center

Use of VIP Reservations Hotline

Diamond Aspirations eligibility

Receive 20% discounts at casino gift shops

The Diamond Lounge access and lack of resort fees in Vegas is easily enough to cover the FoundersCard membership fee.

But what I’m most interested in is the “Diamond Aspirations eligibility.”

In December 2016, I got 4 free nights at the Atlantis in the Bahamas, which was easily worth over $1,100. Update: Out and Out reader Dan let me know this benefit has returned for 2017! So, 4 more free nights in the Bahamas is on my radar again for this year. This is open to all Total Rewards Diamond members – just call to book!

I reached out to Caesar’s to check if I was eligible to book a package this year. But they told me I had to wait for my Diamond status to hit again.

So then, I called FoundersCard. They said I was in the first batch to renew Diamond status and that it should hit next week. (So new and existing FoundersCard members get the perk.)

Not so sure about this one

However, I don’t have much hope. Because it looks like packages this year are based on Tier Score instead of just status. Either way, I will definitely be following up on this. And will report if it’s possible.

And the other benefits are still extremely valuable if you use them a lot. Apparently, they also give you comped rooms and free show tickets as bonus benefits when you visit Vegas a time or two. Plus, you get a $100 Celebration dinner credit again this year.

Wanna sign up?

Link: Sign up for FoundersCard

Right now, you can sign up and lock in a rate of $495 per year. It usually hovers around $395 these days, although I have no information on when or if that will return. But you can basically buy status for a set price.

If you use my promo code “FCHARLAN818” you can get the $495 rate ($100 off the normal rate).

You also get tons of other benefits, so take a look and see if it’s worth it for you.

Most peeps seem to only want the Total Rewards Diamond status, so if that’s you, the question is whether to sign up now or wait for the $395 rate to come back. If it does, I’ll be sure to have a post on it!

Bottom line

I’m pleased FoundersCard brought back Total Rewards Diamond status this year. It’s valid through January 31st, 2018. And comes with a slew of valuable bennies.

Now that this is a for sure thing, I think I need to plan a trip to Vegas and take full advantage of the Diamond Lounge, lack of resort fees, VIP access, free $100 dinner, and whatever else they wanna throw my way.

I’ll keep an eye on other potential rewards. And will be sure to let you know if I find a lower rate.

Check out my previous posts to read more about everything you get with FoundersCard. And do let me know if you have questions, want a referral, or plan to use the heck out of this perk in Vegas or elsewhere this year!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

February 7, 2017

Kohl’s Deal Results: What I Learned & How It Turned Out

Also see:

[EXPIRED] Hurry! ~$500 Moneymaker on Kitchen Appliances at Kohl’s With Discover It or Freedom

Did You Do the Kohl’s Appliance Deal? Get Back $2 per Item!

A few times per year, Kohl’s sells small kitchen appliances at a steep discount. With card category bonuses, shopping portals, promo codes, and rebates, it works out to better than free – especially if you can resell them. It’s the ultimate in deal stacking.

I ordered 40 appliances. (Do I sound crazy yet?)

“What have I gotten myself into now?”

While I’d love to say the whole thing went off without a hitch, that’s not exactly true. Here’s what I learned about stacking. And how it all turned out.

Stacking is like jenga

If the blocks aren’t exactly perfect, it starts to fall down.

I wanted to stack the following. Here’s what I expected and if it worked out:

$480 back as Visa gift cards – GOT IT

~$125 from Discover It and Discover Deals portal – KINDA SORTA

OR ~3,000 Chase Ultimate Rewards points (~$30) and ~2,000 Alaska miles from the Alaska Airlines shopping portal (~$40) – DID NOT DO THIS ONE

15% off with promotion code SMS1871 – GOT IT

1,500 United miles from a $500 gift card through MileagePlus X app (~$30) – GOT IT

$110 back as Kohl’s Cash – GOT IT

600 Kohl’s Yes2You points (worth another $60) – GOT IT

The cash payment was for ~$625 – but how much did I get back?

So, it all worked out except for the entry marked “Kinda Sorta” – that’s because of the Discover gift card I bought through the MileagePlus X app.

It usually codes reliably for its respective category bonus – but NOT with Kohl’s. So I didn’t earn the 5% cashback (which would’ve been doubled because I got a new Discover It card). Instead, I just got 1% cashback (really 2% after The Dublin).

But, the ~$125 I put directly onto the Discover It card did earn 5% back (really 10% back because the card is new).

So 2% on $500 plus 10% on $125 = ~$23. And I got ~$58 ($29 x 2 because it’ll get doubled) by shopping through the Discover Deals shopping portal.

~$29 for shopping through Discover Deals, which will be doubled

For a total of ~$81 cashback with the Discover It card. Not the $125 I was hoping for, but still respectable.

When you add up all the stacking, it comes out to $761. Considering I paid $625 for all 40 appliances, I came out ahead by ~$136. So not only were the appliances free, but I made a little by:

Finding a promotion code

Using the right card with a category bonus

Clicking through a shopping portal

Mailing in the rebates

About that last one…

Cutting out UPCs can be extremely zen

I fired up my X-acto knife and got to work cutting out 40 UPCS from cardboard boxes – highly, highly recommended if you ever do this.

MVP

I carefully sliced the 4 sides around the UPC, then pried away the rectangle like a beating Visa rebate heart. Over and over.

This is what 40 UPCS looks like

I had to do it segments of about 10 each. If you’re in a weird mood, it won’t work. You have to zone and let it flow – even then, your hand will still hurt from gripping the blade and slicing through the cardboard.

I don’t know of a better way to extract a single piece of cardboard from a box. But it left clean lines. I figured if I wanted to resell the appliances, it would be worth it to keep them relatively spotless.

Removing all the UPCs probably took me an hour.

Then, I had to mail the rebate form and UPCs. I bought a cheap padded envelope at Walgreens for about a buck and mailed it for about $5. But that still took my time and a few extra dollars.

And somehow, I loved the sport of it. The thrill of the deal. Seeking it out and getting it.

Some peeps despise managing a project like this, but me? I was happy to spend part of a Saturday cutting out UPCs and mailing them away blindly. (If I didn’t sound crazy before, what about now?) :p

This was by far the most tedious part of the whole process.

When they say 8 weeks, they mean 8 weeks

I was on pins and needles about getting that Visa gift card in the mail.

So relieved when this came

I placed the original Kohl’s order on October 1st. And got the gift card in the mail on December 3rd – nearly 8 weeks to the day.

Sending in that form with all the UPCs felt like sending a package into a black hole. Part of me expected it to get lost (even though I added tracking and delivery confirmation).

I was most nervous about this because the $480 was by far the biggest piece of my “reimbursement” puzzle.

So if you get in a Kohl’s deal with a rebate, patience is key. They received it and will take their sweet time processing it. But it will eventually arrive.

I particularly loved that they sent one gift card for $480 instead of – god forbid – individual gift cards.

Check for more discounts in the meantime!

About a week after I placed the original order, I noticed the prices had fallen $2 per item – well within the Kohl’s price adjustment window.

$2 doesn’t sound like much, but when you buy 40 items, that’s $80!

Got my $80 back

I immediately rang them up and got my $80 back.

That brought my overall earnings for this deal to $216 (the previous $136 + $80 more). Which is obviously sweet.

I freaking love Kohl’s

Link: Holy crap I love Kohl’s

It takes a certain personality type to love online shopping at this particular department store. They’ve engineered it to give you that thrill when you think you’re getting a good deal.

And in a lot of cases, you really are. You just have to be judicious and keep your impulsiveness in check.

I used my Kohl’s Cash, baby

To get the most from a Kohl’s deal, you have to be ready to purchase other items with your Kohl’s Cash. Because it’s use it or lose it.

My modus operandi the whole time was getting a new duvet cover (so hint: have an ulterior motive of something you really want to buy).

With my Kohl’s Cash and Yes2You Rewards points, it was free. So I added a comforter and a hand towel (the latter to trigger free shipping), and called it a day. Kohl’s ultimately got me to spend more money with them because of the Kohl’s Cash.

But in terms of the deal, I still came out ahead despite this purchase. And it made me love Kohl’s all over again. Also, I love my new comforter. It’s on my bed right now.

I also got 20% cashback by using my Discover It card and clicking through the Discover Deals shopping portal. Suh-weeet!

Reselling is a PITA

My original post wrongly assumed it would be a pinch to resell these appliances.

I posted a couple of Craigslist ads for a bulk purchase:

My ever-so-enticing write-up

Guess how many responses I got? Not a single one.

In the end, I:

Sold a couple to friends for $10 each

Took a couple to my Airbnbs

Gave some to my little brother when he moved into a new apartment

Gave some away as Xmas gifts

Donated the rest to charity

All that to say, they were on my hands for longer than I would’ve liked. I offloaded most of them and even sold a few.

I gave my little brother and his friends some of them. And gave the rest to charity.

Even still, I profited.

Would I do it again?

Yes. When I have the energy.

If I had it to do over again, I’d earn points & miles instead of cashback because I think ultimately, they’re worth more with how I redeem them.

I’d also be sure to have a sharper X-acto knife and schedule a solid hour to cut out the UPCs and send them away all in one shot so it’s not some lingering project for several days. Because your time is valuable. I also enjoyed managing the details of this project (typical Virgo) – but not everyone will. So consider if you’d even enjoy this before you begin.

If the answer is no, skip it. There are plenty of deals out there.

Bottom line

I made a couple of hundred bucks with the Kohl’s small appliance deal.

Yes, it was tedious. No, it wasn’t perfect. Yes, it takes a certain personality type. No, I wouldn’t do it every time.

When you can find a perfect storm of category bonuses, promo codes, shopping portals, and rebates, it’s definitely worth it. You just need a couple of hours to cut out the UPCs and send them on their way. And to distribute your bounty to friends or wherever you want them to ultimately go.

I mostly wanted to test the deal-stacking waters and this seemed like a low-risk way to begin. I’m still not sure if I’d move up in risk level beyond this.

If there’s another super easy deal, yeah, I’d do it. But I’d focus on points instead of cashback. And I’d have a better plan for unloading the merchandise.

All-in-all, it was super smooth. Most things did work. And now I know what to look out for and expect if I ever do it again.

I know a lot of peeps got in on this deal. Now that the dust has settled, did your experience go as easily as mine?

What did you do to unload your purchase once it arrived? I’m curious to know if there’s a better way to go about this – when and if this deal returns!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

A Scary Moment at the Hyatt Zilara Cancun

I wrote my review of the Hyatt Zilara Cancun and how I’m an honorary Roman for how much I feasted there.

But there was a moment that was terrifying.

The beaches have markers every 100 feet or so, color-coded green, yellow, or red. They swap them out throughout the day and are intended to let you know how dangerous it is to swim in the water.

Jay and I got into the Gulf of Mexico in a yellow zone, next to a red zone. We were laughing and talking and suddenly heard a whistle that we’d gone too far. Jay swam away. But I had trouble moving – every time I made progress, I was pulled deeper into the water. And it was over my head before I knew it.

There was another guy next to me (and lots of peeps a few feet away) so I didn’t think any of us were in any real danger. I asked him if he was having trouble, too. He nodded. “We need help.”

“Yeah. We need help.” So we both started waving to the lifeguards on the shore.

Hyatt Zilara Cancun Index

Review of My Free Stay at the Hyatt Zilara Cancun

Mexico and Bust: Eating at All the Hyatt Zilara Cancun Restaurants

A Scary Moment at the Hyatt Zilara Cancun

Travel safety above all

I’m a pretty cautious person. But it’s mind-boggling how you can be fine one moment. And totally not the next. It happens fast.

Seeing the water after the trip gave me chills – the Zilara is out on a narrow strip of land

The lifeguard swam out and reached us within seconds. That’s the thing – we weren’t that far out.

He tossed a floatation device, we grabbed it, and he pulled us back. It was over as quickly as it began – just like that.

I wasn’t in panic mode. I had already begun swimming back and was making progress. But being in over my head was the scariest part. And I thought, I’d rather have help than not. Even though I resolved to stay calm and make it back.

Afterward, the lifeguards asked us tons of questions – our names, where we were from, room number, and lots of other things. I thanked them all for the help, but they said they do this all the time and they’ve seen much worse. Which is truly scary.

I was all beached out after that experience. As we walked back to the room, I noticed them speaking with police – I guess they’re required to put it on file every time they jump in and help.

These guys and other safety professionals really do risk it all to help you

The experience was over within a few moments. But it made me think for days afterward what might’ve happened if I couldn’t have made it back to shore on my own. Or if I’d been swimming at night and couldn’t see. Or…

What I took away from it is to know and observe your limits, even if you think you’ll be OK. To stay close to help. And to really be grateful for the professionals who do this every day.

Bottom line

I had a wonderful time at the Hyatt Zilara Cancun. Except for this brief moment.

When it got scary and too close to danger. It’s incredible how you can get so far out so fast.

I’m grateful I walked away from the experience with nothing more than a racing heart. I don’t want to think about what might’ve happened. It made me consider my limits and safety.

I felt especially vulnerable because I was in unfamiliar surroundings. As we always are when we travel.

If anything, take this as a reminder to remain very careful, keep near help, and observe all the signs.

Stay scrappy. And stay safe, too – especially when you travel!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!