Harlan Vaughn's Blog, page 40

May 29, 2017

Last Chance to Get the Hilton Surpass Amex for 100,000 Points (And Why I Got It)

Also see:

7 Hilton Hotels Where 120,000 Hilton Points Are Worth $700+

Through May 31st, 2017 (this Wednesday), the Hilton Surpass Amex has its best-ever sign-up bonus. Yes, it’s offered 100,000 Hilton points before. But this go-around, you also get a free weekend night certificate after your first cardmember year.

I wrote how 120,000 Hilton points can easily be worth over $700. But throw in the free night cert, and you’re approaching $1,000 in value from a single sign-up bonus.

I used Hilton points to stay in colorful Colorado next week

Plus you get Hilton Gold elite status with the card which means… free breakfast! (My fave perk lol.)

I was low on Hilton points and am becoming intensely interested in a trip to Mexico City this year. There are lots of lower-category hotels there – and you get the 5th night free on any award stay.

In general, Hilton points go further at low-tier hotels. But it’s all about how you like to use them.

The Hilton Surpass Amex is worth it if you’ve never had it

Link: Hotel Rewards Credit Cards

I was light on Hilton points after burning them for a trip to Honolulu with my family this past September.

I’m loyal to Hilton lately because I:

Can’t stand IHG

Have absolutely no faith in Starwood beyond 2017 and earning their points is a real chore

Am “meh” about Marriott

Find Hyatt’s new program too weird and limiting

Hilton’s no angel, either. They don’t have an award chart, for one. But they treat their elites well with suite upgrades and free breakfast. And they throw points at you via promotions, stays, and credit cards.

The Hilton Surpass is actually my 3rd Hilton card – I have the no annual fee cards from Amex and Citi. I’ve had consistently good service with Hilton and have no reason not to give them my loyalty.

In the points and miles world, they’re as maligned as Delta once was – but the others have matched them, mostly. So as a free agent, I find Hilton to be the best choice.

Even if you’re not a Hilton fan, you can do well with 100,000 Hilton points.

For example, I’m thinking of spending 5 days in Mexico City. Here’s what I found:

100,000 Hilton points is enough for 5 nights at any of these hotels

Considering you get the 5th night free, you can easily spend 5 free nights with 100,000 Hilton points. And then use the free weekend night certificate somewhere really expensive.

Here are the paid rates:

as

The first hotel, Hampton Inn & Suites Mexico City – Centro Historico, would cost nearly $900.

5 nights cost $887

The kicker, though, is you’d only pay 32,000 Hilton points (8,000 X 4 + 5th night free) for this room. So you’d still have 70,000 points left over. Or you could spring for a different hotel. I regularly find these kinds of deals with Hilton points.

The Hilton Surpass Amex has a $75 annual fee, but you also get:

12X points at Hilton hotels (in addition to what you earn as a Gold elite)

6X points at US supermarkets, US gas stations, and US restaurants

3X points on all other purchases

And of course you get 100,000 Hilton points after spending $3,000 on purchases in the first 3 months of account opening.

The Gold elite status that comes with the card gets you 10X points per $1 spent at Hilton, plus 25% bonus points and welcome points (the amount depends on the hotel brand). So for stays at Hilton, there is no better card.

It has a ~3% forex fee though (can you freaking believe that?!), so don’t use it abroad. But overall, this card is def worth getting if you’ve never had it before (Amex sign-up bonuses are once per lifetime).

Why I Got It

Simply, there are few cards I can get these days. So when a good offer rolls around – and I’m actually eligible – I perk up.

It’s not hyperbole to say this is the best-ever offer there’s been on this card. For me, the free weekend night certificate adds at least $300 in value to the sign-up bonus. And if I can squeeze $1,000 in sweet travel out of a sign-up bonus, you best believe I’ll jump all over it.

Plus, I like to keep a stash of Hilton points – they can be incredibly useful from time to time.

Bottom line

Link: Hotel Rewards Credit Cards

This offer goes poof in 3 days, so get it while you can! Don’t let the naysayers steer you wrong about Hilton points – there are still plenty of ways to wring life out of them, especially if you’re judicious and plan carefully.

FWIW, I was approved instantly online. And this was my 5th Amex card (I also have the Mercedes-Benz Platinum, SPG personal and biz, and no AF Hilton cards – 4 credit and 1 charge).

With the free weekend night certificate thrown in, I couldn’t help myself and dove into this offer because I’d never gotten it before. I have my sights set on Mexico City sometime this year, so I’ll likely use the points there, where 5 nights can easily be $900+.

It’s always good to have a goal in mind. But I like having a stash of Hilton points anyway because they’re now my go-to hotel chain. Especially once the other shoe drops for Starwood in 2018.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

May 28, 2017

Plastiq Rent Payments With US Bank Altitude Code as Travel but Do NOT Earn 3X

On May 1st, I got the US Bank Altitude Reserve card – the first day it was available.

I wrote how payments with Plastiq coded as travel with the Chase Sapphire Reserve card (lots of peeps on Reddit confirm this, too). So I was hoping that would be the case with the US Bank Altitude Reserve. Especially because the minimum spending requirement is $4,500 – that would’ve been a nice points haul at 3X.

The merchant code gave me hope for 3X

And the charges did code as travel. But my statement just closed and I only got 1X point per $1.

This US Bank card and the Chase Sapphire Reserve are both Visa cards. So while it doesn’t work for the former, I’m hoping it will still earn 3X with the latter for a while longer.

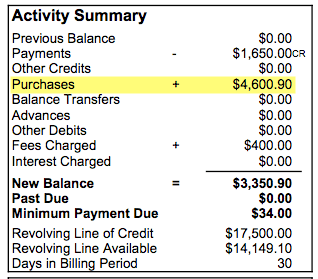

Here’s what I found.

A charge that codes as travel but didn’t earn 3X

Link: Visa merchant codes (PDF file)

Link: Sign up for Plastiq and get $500 fee-free dollars

I made all my rent and mortgage payments last month via Plastiq. And mixed in a couple of regular purchases to meet the minimum spending requirement.

After the Plastiq payments cleared, I noticed the merchant code was listed as 7011 (see pic above).

Lodging? Sweet!

Then I got excited after I looked up the code and saw it was for “Lodging” and that my “itinerary” was for 1 night. All the makings of a 3X travel charge. I was even hoping to trigger the $325 annual travel credit.

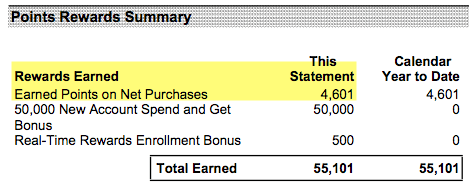

I made ~$4,601 in purchases

I spent a little more than needed to earn the full 50,000 point sign-up bonus. And was hoping to score 13,000+ more points for the Plastiq rent payments.

Sad trombone

However, I earned exactly 4,061 points AKA 1 point per $1. Womp womp.

Why did this happen?

I was kind of expecting to get 3X on these purchases. It worked with my Chase Sapphire Reserve, so I thought surely…

But the fact that it didn’t code as 3X but did code as travel makes me think US Bank knows more than they’re letting on. I have no idea why they’d code these charges as “lodging” and not reward 3X points. It makes me a little nervous for the future of 3X with my other cards with travel as a bonus category, like:

3X with Chase Sapphire Reserve

2X with Chase Sapphire Preferred

3X with Citi Prestige and Citi ThankYou Premier

Pretty bizarre.

I still think the US Bank Altitude Reserve is worth it

Link: US Bank Altitude Reserve card

I have yet to do a full review of this card. But so far, I am loving it, if only for the sign-up bonus, $325 travel credit, and 12 Gogo in-flight passes.

I wrote about how to save on in-flight wifi. I regularly see in-flight internet selling for $20+ for the duration of the flight. So the 12 Gogo passes, at $20 each, are worth $240 on their own. That and the $325 travel credit easily cover the card’s $400 annual fee. And the 3X with mobile pay is certainly nice. Just don’t buy gift cards! And you can’t get the card without at least 35 days as a US bank customer (another credit card, mortgage, checking account, etc.).

Bottom line

So now I know Plastiq rent and mortgage payments do NOT earn 3X with the US Bank Altitude Reserve card even though they code as travel.

Now I wonder what would happen with Citi Prestige and Citi ThankYou Premier… but as long as it still works with the Chase Sapphire Reserve, that’s really all I care about for now. I just hope that whatever US Bank is doing with their purchase data doesn’t make its way to Chase.

The Plastiq payments were worth it to meet the minimum spending this month. And next month I’ll finish getting 2X with my AMEX Starwood biz card. After that, I’ll ride the 3X train with the Chase Sapphire Reserve for as long as I can. If that comes to an end, there’s always my trusty Citi AT&T Access More card. Just another reminder to hop on the good deals while they’re still around.

Have you had a different experience with Plastiq rent payments? I’d love to hear more datapoints!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

May 3, 2017

Why I Got a 0% APR Card to Help Pay Down Debt

Also see:

Should You Use a 0% APR Card to Pay Off Debt?

Welp, I finally did it. Got a new credit card to help pay down my student loans.

It’s an idea I floated before. But I didn’t bite because there have always been other cards I wanted instead. Plus, I like to save or invest money instead of throwing it toward student loans.

I hate their name. I hate how their logo has an apple in it. I hate everything about it pretty much

I’m constantly torn about taking a solid year to get rid of it, then I think… man, I could invest that. Or pay down my mortgage. Or just have it.

Ultimately, I think a hybrid approach is best: break everything down into buckets and work on each one a little at a time. Save a little, invest a little, use the rest for bills.

But I’ve decided to give myself a head start on the student loan bucket. Here’s why.

Lower principal means less interest

That’s the smoking gun right there. My student loan has a 6.75% interest rate (ouch). My investments return a little more than that. But that’s not guaranteed.

Paying down the student loan is guaranteed savings as opposed to non-guaranteed earnings.

My mortgage is 4%. Those are pretty much the only two big loans I have to repay. So it’s obvious to go after the one with the larger interest rate first.

Current state of loans

Right now, if I want the loans gone in 5 years, I’d have to pay ~$993 a month. And pay ~$9,153 in total interest.

Dramatic improvement

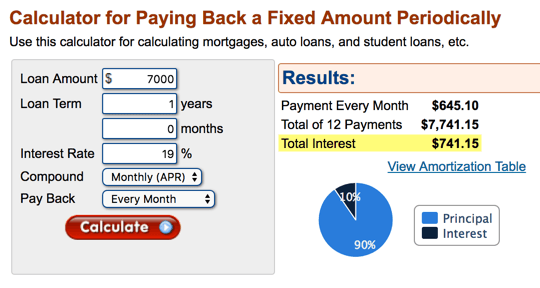

In running the numbers, if I can eat into the principal by even $7,000, my monthly payment drops to ~$855 and the total interest paid goes down to ~$7,882.

That saves me ~$138 a month and reduces the interest by ~$1,271.

$138 x 60 (5 years of payments) is $8,280 saved. Of course, I’d have to pay back the $7,000, so it’s really like saving $1,280 but also still saving the $1,271 in interest payments, for a total of $2,551.

That’s pretty nice! Plus, I can pay back the $7,000 at my own pace if it has 0% APR and isn’t accruing interest of its own for a while.

Where the Citi Diamond Preferred comes in

Link: 0% APR Credit Cards

Citi has two cards with a 21-month o% APR: Citi Diamond Preferred and Citi Simplicity.

Pretty much identical

On the surface the cards are the same. The only major difference is a 1% variation in the regular APR. Both have $0 annual fees.

However, something about the Simplicity card turned me off: “No late fees, no penalty rate.”

To me, that implies it’s intended to be a “training wheels” card, which could mean a lower credit line. I wanted a line of about $7,000 so I could get my loan payments below the $900 a month mark and get them paid in 5 years. For that reason, I applied for the Diamond Preferred card and was approved for a $2,000 limit.

That feeling is so intense

However, with a quick call to Citi, I was able to move $5,000 from my Citi ThankYou Premier (which I never use any more with Chase Sapphire Reserve in the mix) to reach the $7,000 threshold I had in mind.

This is my 7th Citi card (the other 6 are Prestige, ThankYou Premier, AT&T Access More, 2 AA cards, and a Hilton Visa). So I think that was the reason for the initial low limit. But it all worked out.

And now I have a card that won’t gather a dime of interest until February 2019 – that’s awesome!

Effects and consequences

Once I make the initial student loan payment via Plastiq, I can immediately get on my new student loan plan to have them wiped in 5 years. And can invest or save the rest.

It still feels like throwing money into the toilet somehow, but at least I can start to see the end of it… forever. This also reinforces my commitment to finally kick this thing. I’m not thrilled about it. But I will try to stay on schedule as much as possible. And, I’m grateful for this head start.

I’m not worried about the impact on my credit report because my used to available credit ratio will still be very low.

I also found out if my student loans are “paid up” for at least a year it does not have to be included in my DTI (debt-to-income) ratio if I want to get a second mortgage on an investment property (!).

My current loans as-is are $543 per month. Even if the new card shows my monthly payment as $100 a month, that’s still much lower than what I have right now – and will make me a shoo-in for another mortgage approval.

The effect seems minimal

Of course, I’ll still have to pay back that lingering $7,000. I’m fine with leaving it there until 2019 because there is literally nothing else I’d want to use this card for.

Even if I carried the balance beyond February 2019, for a year at a 19% interest rate, I’d still only pay ~$741 in interest – which is still much lower than the ~$1,271 I’d pay on my student loan.

So, in all ways, it seems like a total win. There’s no sign-up bonus on this card, but getting all these good side benefits and savings is worth it for me.

Plus, I can’t really get other cards any more anyway. Amex: nope. Chase: nope. Other Citi cards: nope. What else is left? An Alaska card every 45 days.

April 23, 2017

Airbnb Hosting by the Numbers: 2017 Update

Also see:

Airbnb by the Numbers: An Update for 2016

How I Made an Extra $60K from Airbnb in 2015

Airbnb: Us and Them

Thought it was time to do an update on my Airbnb hosting. And the state of it. Mostly because if the numbers look good, I might get another one.

Long ago, I started my Airbnb operation in New York, which was a smashing success. Until it wasn’t. I no longer have properties in New York, as of last month.

So far it’s going well in Dallas. I have two here. They’re easy to track and manage for what they are because they’re on two separate profiles.

My downtown Dallas Airbnb

In my opinion, a side business is the best way to “manufacture spend” these days. I easily put $6,000+ of expenses on my cards each month – and the bulk of that is in bonus categories.

I recently found out some rent payments code as 3X for “travel” with the Chase Sapphire Reserve. So that’ll keep me with an extra ~20,000 Chase Ultimate Rewards points per month – a handy ransom (if they all code as 3X)!

Airbnb hosting by the numbers

Airbnb makes it dead easy to track your stats these days.

#1

So let’s look at my downtown Dallas Airbnb this year:

~$500 this month from one property

The numbers for January are skewed because I had two places on this profile. I’ll correct below.

The rent for this one is $1515 a month. The electric bill is ~$100. And the internet costs ~$35.

I also pay a house keeper $200 a month to clean it and keep it up. Supplies are cheap, maybe $20 a month? And I replace items here and there as needed.

So, $1515 + $100 + $35 + $200 + $20 = $1,870. That’s the breakeven point for me every month. So far in 2017, I made, in pure profit from this place:

January – $1,442

February – $695

March – $928

April – $523

The numbers are kind of all over the place, so it makes it hard to predict.

If I take the 4 months, add them up, and divide by four, I get $897 a month, on average from this place. Assuming it performs at that level all year, $897 X 12 is $10,764. Or about $11,000 a year in pure profit, after expenses.

Electricity is all over the place, too

Some months electricity is only $60ish. Other months (the summer obviously), it’s $100ish. So there’s plenty of give and take going on. Despite the weather, this place tends to stay booked.

#2

Here’s the second one, in Oak Lawn near where I live.

Nearly $700 in pocket!

Everything about this place is smaller in scale. It’s physically smaller, for one. Also cheaper. The stays tend to be longer, so it gets fewer cleanings. And overall, it’s much easier to manage – less of my time.

The rent is $950, the electricity is billed through management and so far has been only $25ish a month, the internet is $35, and the cleanings are also $50 a pop. Same cost for supplies, too ($20 a month).

$950 + $25 + $35 + $150 + $20 = $1,180. I give this one 3 cleanings a month on average (that’s where the $150 came from).

In April 2017, I made $693 in pure profit. But, I’ve only had this February (technically, for a few days in January, but I’m subtracting those). So far, I’ve made:

February – -$59

March – $607

April – $693

I’ll chop off February (the “getting started” month), and go with March and April. My Virgo-ness doesn’t like such a small sample size, but it’s all I have right now. Based on it, I get $650 a month or an extra $7,800 a year from this place. Not bad!

Risks and changes

I’m still newish to the overall Dallas market – but I like the results so far. Of course, they’re nowhere near New York-level returns. But I knew that going into it.

I risk, every month, losing money on these places if they don’t book up. It has only happened a single month so far while the places have been fully operational (see above) – and I don’t really count that.

This Q1 in Dallas is actually better than the Q1s I had in New York – I got really close to losing a lot of money those months in New York.

Airbnb will collect taxes for the City of Dallas starting next month (May 2017). So that will be new. And remains to be seen how or if that will affect business.

There’s also the possibility of being kicked out of these places. But it’s so low-risk in Dallas – all you face is eviction. It’s a chance I’m willing to take. And so far – touch wood – it’s been smooth sailing. So much so that I dare say I’m even… enjoying it!

Bottom line

This is, ashamedly, my first time taking a look at my raw numbers for 2017.

But when I look at them as an average, I like them: $10,764 + $7,800 = $18,564.

$18,000+ a year for a low-stress side hustle that nets me plenty of bonus points is worth it to me.

Again, it’s nowhere near the $60,000 I made in New York in 2015. But those days are long gone with all the new regulations there.

So, I’m making less but also doing less and don’t have as much going on overall.

If I were to get another place in Dallas, I’d probably take the average of the two I already have – and assume about another $9,000 a year in profit. That would bring me closer to $30,000 a year, which is still damn good.

Huh. I think I just convinced myself to get another one.

Thanks to the readers who love geeking out on numbers and data as much as I do!

April 14, 2017

Booking BAP: A $5,000 Trip to Europe for $238 & Points!

Also see:

Just Booked: A Brussels Airlines Biz Class Award Flight With Etihad Miles

My Best Advice: BOOK THE TRIP

In a few weeks, I’ll be in Brussels, Amsterdam, and Prague for the first time. I am calling this trip “BAP” (after the 3 cities).

This is the trip I booked waaay back in August 2016 for biz class seats with Etihad miles. At the time, I paid ~37,000 miles for round-trip seats from New York to Brussels on Brussels Airlines. Etihad has since raised the price to 88,000 miles – which can still be a good deal to Europe in Business.

That was about 9 months ago – the furthest out I’ve ever planned a trip. At the time, I figured I’d fill it in when the time came. Which is now.

I’m coming for ya, Brussy

Here’s how I put together a $5,00+ week-long trip to Europe for $238 out of pocket.

Booking BAP (Brussels, Amsterdam, Prague)

1. To New York and back

First things first, I had to get myself to New York for the flight.

I booked the way there with 6,637 Citi ThankYou points and nothing out of pocket:

One ticket

This will be my first big solo trip as a single guy. Still feeling a bit strange about it…

Then I booked my way back to Dallas with 5,810 Southwest points:

Total bargain

The reason for the different airlines simple came down to schedules.

For this flight, I charged the $5.60 in taxes to my Citi Prestige card. I hadn’t used my $250 annual airfare credit yet, so again, nothing out of pocket.

2. New York to Brussels

I wrote about the gory details of booking these flights with Etihad miles.

I paid 36,620 Etihad Guest miles and ~$93 back in August 2016.

So this gets me to Brussels!

I’ll spend 2 days exploring the city.

Cuuute

I’m staying at this cute Airbnb duplex near Grand Place for 2 nights.

$18 a night

I had a $100 Airbnb gift card from a promotion a long time ago. And an $80 credit for referring a new Airbnb host. So $180 skimmed right off the top.

In the end, I charged $39 to my Chase Sapphire Reserve to earn 3X Chase Ultimate Rewards points. That’s $18 a night out of pocket.

3. Brussels to Amsterdam

Then I’ll take the Thalys train from Brussels to Amsterdam.

Cheep!

A First Class “Premier” seat was a little more than the regular seat. Considering this was my biggest expense of the entire trip, I decided to splurge. And paid $106 for the train ticket to Amsterdam.

Remember Club Carlson? A few years ago I Club Carlson-ed my way through Europe. And stayed at several of their hotels in Ireland. Of course, they are now dead to me, but I had 117,000 Club Carlson points literally just chillin’. And I wanted to burn them on this trip.

My free digs in Amsterdam

Lucky for me, I found 2 nights at the Park Plaza Victoria Amsterdam for 100,000 Club Carlson points.

I love seeing a $0 subtotal

Of course me being me, I wanted to see how much it would’ve cost with cash:

Nearly $600, or $300 per night

In this case, my 100,000 Club Carlson points were worth ~$595 – not bad at all.

4. Amsterdam to Prague

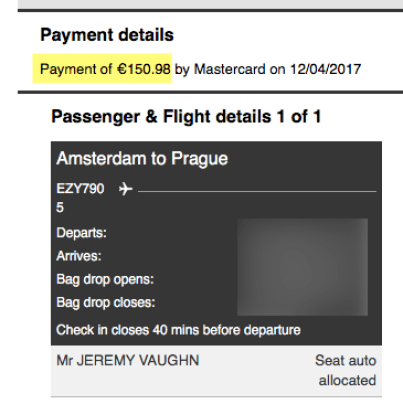

Next, to Prague.

Just paid for it

I found an EasyJet flight for ~$160. I bought it outright with my Citi Prestige card, which covered the entire cost thanks to the remainder of the $250 annual airfare credit.

3 nights in Prague for 21,000 Starwood points

I found 3 nights open at the Sheraton Prague Charles Square Hotel for 7,000 Starwood points per night. So I booked it on the spot.

Or, ~$719

The 3 nights would’ve cost ~$719, so in this case, my Starwood points were worth over 3 cents each. That’s not stellar for Starwood points, but I really didn’t want to pay over $700. Plus, I just signed-up for a promotion to earn 20,000 Starwood points in the next couple of months, so I figured I could easily replace them.

Value added tax indeed

Because this is a Sheraton, I have access to the Executive lounge thanks to my SPG biz Amex (yessss!). This includes breakfast, snacks all day, and drinks in the evening – I expect I’ll be here a lot, if only for the drinks.

April 13, 2017

[False Alarm] Citi Card Apps No Longer Have 24 Month Language?

Update: Not sure what’s going on but I see the 24-month language on some application pages. I’m wrong and nothing has changed. I got excited and jumped. Going to close this for now. Sorry for the false alarm!

Just a quick post.

Citi has been limiting card sign-up bonuses per family of “brands” to every 24 months – with a clock that resets if you open OR close an account within that family. The 3 brands are:

American Airlines

Hilton

ThankYou points

So for example, if you opened or closed the Citi Hilton Reserve within the previous 24 months, you could NOT get the sign-up offer on the Citi Hilton no annual fee card. Period.

But it looks like that restriction has shifted:

“New accounts only”

Now it says, “This offer valid for new accounts only.”

What does that mean?

So… “new accounts” could mean:

If you’ve ever had that card, you can’t get it again OR

Each card is considered a new account, regardless of how many times you’ve earned the sign-up bonus

I checked an AA card, a Hilton card, and a ThankYou card (the Prestige, above), and they all have this new line in the T&Cs.

If it’s the latter, that’s obviously awesome.

Cuz then you could get another bonus

I actually don’t know of any card with that disclaimer that forbids you from earning the bonus again. A few say that, but it’s not enforced for future cards. The Discover It comes to mind – but I got a second card to get another Dublin anyway.

Discover It has similar “new account” language

My inkling is that you can now earn the sign-up bonuses again. Of course, there aren’t any data points yet.

But if that’s what it means – exciting! I hope Chase and Amex will reconsider their positions, too. And god knows Citi needs to do something to catch up to the Sapphire Reserve. Come on, Citi. Fight for market share! Even US Bank is catching up.

Bottom line

Link: Apply for Card Offers

If Citi is indeed letting peeps earn sign-up bonuses again without the 24-month restriction they’ve had for a while now, this is great news!

But Citi being Citi, it could also mean a new account as in brand new (haha, get it? I’m feeling punny). AKA once per lifetime, like Amex. But it seems one card in the brand doesn’t affect the others any more, so that seems to’ve definitely changed. So if you have one Hilton card, you can get the other one now – and earn the sign-up bonus on it.

Thought this was interesting and wanted to share. What’s your take on it? Is Citi finally loosening?

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

April 11, 2017

Cool! Some Plastiq Payments Coding as 3X for Travel With Chase Sapphire Reserve

It looks like some payments with Plastiq are triggering 3X points per $1 with the Chase Sapphire Reserve card. Apparently, rent or mortgage payments are coding as “lodging/travel” and appear as “travel” – which is a 3X category.

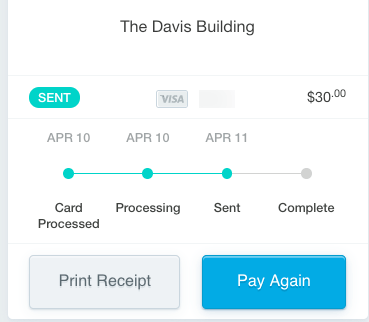

I made a $30 payment toward one of my Airbnbs and didn’t change the category in Plastiq – I left it marked as a rent payment.

I sent the payment as “rent, mortgage, and real estate”

And when I checked today, it had cleared and earned 90 Chase Ultimate Rewards points (3X).

SWEET – 3X

If you have rent or mortgage payments, it would be worth it to use your Chase Sapphire Reserve card, even considering Plastiq’s 2.5% fee.

By the numbers

Link: Sign-up for Plastiq

If you have a payment of $1,000, you’d end up paying $1,025 ($1,000 X Plastiq’s 2.5% fee). And you’d earn 3,075 Chase Ultimate Rewards points.

Despite the $25 fee, those points are worth at least ~$46 toward travel booked through Chase (3,075 X 1.5 cents per point). So you come out ahead by $20+ per $1,000 sent.

Even if you have the Chase Sapphire Preferred, you’d pay the same $1,025. And earn 2,050 Chase Ultimate Rewards points (2X for travel). If you value these points at 1 cent each, that’s a ~$5 loss. But if you value then at 2 cents each (which I do), you can come out ahead by ~$16 (2,050 X .02 = $41. And $41 – the $25 fee is $16).

Either way, that’s an extremely decent return for those payments.

Sayonara, AT&T Access More

Link: Earn Points for Rent and Mortgage Payments With Plastiq (2% Fee With MasterCards)

Y’all. I have been jammin’ on my Citi AT&T Access More card for rent and mortgage payments through Plastiq for the longest (it’s no longer available to new applicants).

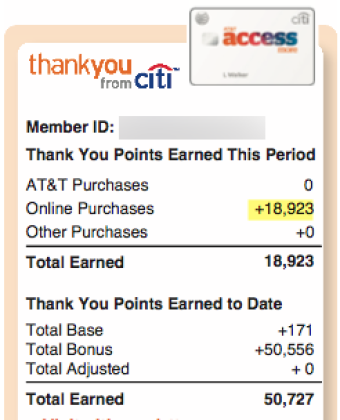

My statement closed today, actually. And I got my usual ~19,000 Citi ThankYou points this month:

PERNTS!

BUT. I’d rather have an extra 19,000 Chase Ultimate Rewards points by far.

So after I spend $10,000 on my SPG biz Amex this month to get 2X Starwood points (Doctor of Credit has the deets on the promotion I signed-up for), I will switch my Plastiq payments to my Chase Sapphire Reserve instead.

New bae

I’ll do this for as long as the gettin’ is good. However, I’ll still put $10,000 in payments on my Citi AT&T Access More card to score 10,000 bonus points each calendar year – which amounts to 4X on that first $10,000 spent (which I’ve already more than met).

I’ve been using that card because of the broad 3X categories and still use it heavily. But rent and mortgage payments are the lion’s share of my spend on that card. And now that’ll go on my Chase Sapphire Reserve for as long as this lasts.

What else triggers 3X?

This is the biggest question. I’m not sure how “rent” translates to “travel” for Chase but I won’t question it. Rather, my only curiosity is “What else works?”

I will make a couple of payments to my utility company and student loan company to see how those code. Unless anyone has any data points already. If not, I will share mine in a couple of days when they post.

If all payments through Plastiq trigger 3X that would be a huge deal. I just hope this gravy train lasts for a while. I certainly plan to earn as many extra Chase Ultimate Rewards points as I can while this is available. And honestly, rent and mortgage is my biggest category anyway so I’m beyond pleased with this.

Is Plastiq reliable?

In its infancy, Plastiq had its growing pains. Customer service was dismal, some payments were late (or worse, never showed up), and it left a bad taste with lots of peeps – for good reason.

The payment I made yesterday was sent today

However, they’ve improved hugely since then. I’ve personally made dozens and dozens of payments through their service and have never had a missed or late payment. *knocks on wood*

That said, they give you an estimate of how long payments will take. If it’s electronic, they’ll say 3 to 5 business days.

For a paper check through the mail, it’s 5 to 7 business days. Add a few extra to that.

I like to send my payments 10 or even 12 business days in advance. They’ve always gotten to my recipient when they said to expect them. But if a payment is delayed or gets lost, I want to give myself a few days to send the payment another way so I’m not scrambling.

So, I’ve had a very positive experience – no delays or mishaps. Be smart about it and you’ll be fine.

Bottom line

For whatever reason, rent and mortgage payments via Plastiq are coding as travel with the Chase Sapphire Reserve.

I’m not sure (yet) what else works for this 3X. But I’ll know more in a couple of days.

Before you schedule several payments, I’d send a small amount or just one – then check if you earned 3X. If you do, go wild while you can. This may last a while, or it may not.

I’ll update here with more data points regarding those other payments. If you already have any, please share below.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

April 2, 2017

2017: The Year of Solo Travel (Ch-ch-changes)

I occasionally post personal updates here. Because I expect they’ll influence the way I travel and how I plan trips.

I wrote about getting a job at a PR firm in Manhattan, paying off my credit cards and starting FIRE, and leaving New York for Dallas: all personal things that influenced the scope of my thinking, and subtleties about how I travel.

So here’s another update: I’m newly single. The past couple of months have been pretty rough. Although I still managed to visit New York and Chicago to see Hamilton.

“Sho,” by Jaume Plensa, at SMU in Dallas

Now it’s table for one, breakfast for one.

And with my trip to Brussels coming up in a few weeks, I realized I’ll be traveling alone for the foreseeable future. I started researching a RTW trip with stops in Hong Kong and South Africa (my first time in both places!) on brand new (to me) airlines.

I was also thinking of visiting Vermont in the fall to see the changing colors. And it hit me so hard that I’ll be doing all of this alone. So I’ve been gathering my personal power. It’s been good getting to know me more.

I’ve also never felt so alive. And I’ve never felt so alone. Solo travel.

Seven years

I was with Jay for seven years. We traveled the world together.

Always looking for two award seats, double occupancy, two tickets – everything came in pairs for so long.

The last time I was single, I was a (literally) poor and (literally) starving art student in Chicago. Each year, things changed. No year since has not had staggering change.

We moved to New York, started working, got Fenwick (our dog), moved all around the city, and of course I got deeply involved with points and miles somewhere in there, too.

My first award trip was to Hawaii

In 2013, we went to Hawaii (I started Out and Out in March of that year). And saw Maui, the Big Island, and Oahu. From there, it’s been a journey to so many new places (and returns to some places I hold in my heart). We went to Australia, Japan, Ireland, Alaska, and most recently Cancun. And so many other places.

On a bit of a petty note, I also recently got the Southwest Companion Pass. And now I don’t have a companion to share it with.

February and March were rough for me. We were together a long time. I don’t have anything bad to say about any of it. I just want to make sure I honor the time we had. And move forward in a way that gives me care for myself.

Other schtuff

While we’re at it, I should also say I got rid of my Airbnb business partner.

Now I have one in Dallas all on my own and another I co-manage. The other guy, I think, had some sort of nervous breakdown. And the reason I had to go to New York at the end of February was to completely and utterly scrub him out of my life.

With that trip, I cut my final tie to New York – that was the last thing I had there. It was also a bit of a sad trip – nostalgic, say – to see the places I used to love and close some doors for the last time.

What do you do when you know you’ll never go back? Just shut the door and sigh as you walk down the stairs. Try not to cry while you walk back with so many people all around you.

I got to see two dear old friends while I was there. We sat and talked for hours and walked around the city. Got drunk and laughed. Lots of hugs. Definitely needed that. Anyway…

Clearing out the energy

Everything you do taxes your energy.

What if I’m not sure just yet?

Holding things in your mind requires energy.

I was holding on to all this mental sludge for so long I could barely think straight. Things I had been putting up with for years finally caught up with me. I suspected they would at some point.

When I moved to Dallas, it was because I didn’t want to give New York my 30s. I gave that city my 20s, but I thought – I’ll be damned if it takes my 30s.

Now I don’t have to deal with those things any more. Just like that, they’re gone.

That’s the hardest part, too. All the emptiness. Empty drawers, empty closet. Empty empty empty. I’m not trying to fill it up just yet. But it’s still there – pictures of empty.

Bottom line

I’d been avoiding writing this because putting it up here, on my blog baby, makes everything so real. And I didn’t want it to be truly real. Until now, I guess.

But yup – I’ve already visited New York and Chicago on my own. And I’ll be in Brussels in just a few weeks. And I’m very much looking forward to that.

Solo travel is bringing new philosophies into my little world: being the travel companion you want to meet, taking myself out because I want to, the freedom and scariness of exploring alone, and finding the open-heartedness to go through with it all. I hope those are topics I can think and write about later, as they’ve newly become very real to me.

On another note, thanks for the continued support as I took some time to sort of work through this. Back to regularly scheduled Out and Out goodness – and hopefully a lot more of it. Just wanted to post an update – still here and thankful.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

March 19, 2017

Easy Win: Do the Dollar Shave Club Amex Offer and Get Some Free Stuff

So there’s a semi-complicated new Dollar Shave Club Amex Offer that you can approach in a couple of different ways.

Whichever way you wanna slice it, it’s extremely worthwhile because you end up with free stuff. If you have this Amex Offer in your account, there’s absolutely no reason why you shouldn’t get in on this.

Shave wit me

I’ll break it down and help you decide which route you should go, should you be a human who removes hair with a razor or bathes, and have this Amex Offer. Even if you don’t, read on.

Dollar Shave Club Amex Offer

Step 1. Load the Amex Offer

There are 2 versions of the offer:

Spend $10 at DSC and get a $10 statement credit

Spend $10 at DSC and get 1,000 Amex Membership Rewards points

Add the Amex Offer

I was targeted for the second version, which I find preferable. Why? Because I value those points at 2 cents each. So to me, that’s $20 for spending $10 – I get a free $10 right off the bat.

If you got the first version of the offer, that’s cool too. Because you spend $10 and get $10 – literally free.

Step 2. Buy a DSC gift card

Link: TopCashback

Link: DSC gift cards

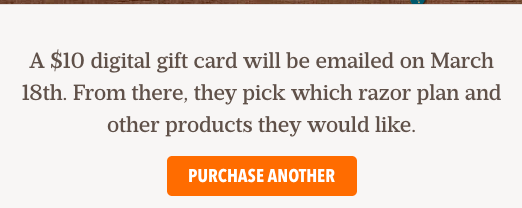

Make sure you buy a $10 gift card. But click through TopCashback to get 12% back, or $1.20, for your efforts.

Get yer 12% back

There’s also an option to earn 15% on “razors,” but I don’t know what that means. And I’d rather do ahead and trigger the Amex Offer than have to worry about it. Also, for a $10 transaction the difference is only .30 cents and I’d rather have peace of mind.

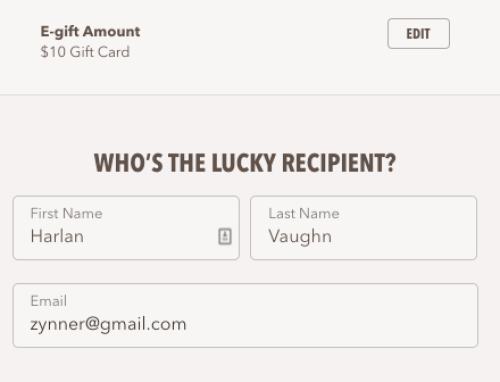

Then go buy yerself a gift card.

I bought one for myself. Thanks, me!

You can purchase them for anyone, including yourself. Be sure to use the email you’ll eventually use to open a DSC account. Or the email you currently have on file with them.

Boom

Step 3. Load the gift card to your account

Here is where roads diverge in a wood.

New user via referral

Link: Join DSC and get your first box for $1

If you don’t already have an account, you can get your first DSC box for $1 when you join via my link, regardless of which box you want.

There are 3 options:

The Executive: 6 blades, $9 for 4 cartridges each month

The 4X: 4 blades, $6 for 4 cartridges each month

The Humble Twin: 2 blades, $3 for 5 cartridges each month

But they’re all $1 the first month. After you join, you can apply the gift card you bought in Step 2.

It’s easy to load the gift card to your account

New user via Swagbucks

Link: Join DSC and get Swagbucks

OK, or. You can join via Swagbucks and get a $5 starter box.

For doing that, you’ll get 475 Swagbucks (“SB”), and another 1,500 SB for your 2nd month. Doctor of Credit, as usual, has the most succinct and pertinent details.

Meh

However, you are locked into The Executive option. And you must say subscribed to that plan to earn the full amount. It adds up to $19.75 worth of SB, and you can still use your gift card from Step 2.

I personally don’t like this option because I like The 4X box. And I don’t like that SB are only redeemable for gift cards. That said, you could easily get a $20 Amazon gift card out of this whole dealio, which is definitely useful. I just prefer cashback is all. And I don’t need 6 blades.

As always, do what’s best for you, though.

Note: If you have FoundersCard, you get another $18 in DSC credit for a new account, which stacks with all this.

Existing user

If you already had a DSC account like I did, you can still do well here. Just add the credits to your account, pocket your $10 or 1,000 Amex Membership Rewards points, your $1.20 from TopCashback, and let the $10 credit play itself out.

Either way, you’re still coming out ahead and should take advantage of this opportunity.

Why I’m recommending this deal

Link: DSC products

Simply, DSC did me a solid.

After all, it was a $6 DSC charge that dropped my credit score 100 points (for The 4X box).

While it was absolutely an Amex issue, they proactively reached out and offered to send me a box of goodies.

From the Out and Out bathroom, thank you DSC!

I never expected anything nor did I blame them for what happened. But over the course of the exchange, I learned the people behind DSC are relatable, empathetic, and kind.

To me, that counts for a lot. I’ve also been trying and using the products for a while now – and they sell more than just razors. You can get:

Body wash

Chap stick

Face wash

Hair gel

Buttwipes lol

Etc.

The point is, you could use your $10 gift card for any of those – not just razors. The products smell yummy and most of them are under 3 ounces which means… TSA-friendly for travel.

That good people are behind the products is a big deal in my eyes – and I have to give them 2 thumbs up for being engaged with their community.

Plus, the stuff is free so get it while you can!

Bottom line

The Dollar Shave Club Amex Offer has a few facets – and all of them are worth exploring. No matter which route you decide, or if you’re a new or existing user, you can do well with this deal.

Not targeted at all? No matter, you can still get the 1st month of a subscription for only $1. Just please, for the love of god, remember to switch your payment method if you use an Amex card and cancel it later.

I hope everyone gets in on this deal. Remember to get the $10 gift card via TopCashback. I recently found out the peeps behind DSC are really kind people. So I had to share this easy win!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

March 18, 2017

Get $25 With New Accounts at Giving Assistant, Ebates, and BeFrugal Shopping Portals

When you shop online, always always click through a shopping portal to earn extra points, miles, or cashback.

I personally use Cashback Monitor to find the best payouts before I shop anywhere.

Da best

I usually like to earn Alaska miles or Chase Ultimate Rewards points for online shopping. But occasionally, cashback offers are simply too good to pass up.

And competition is fierce. So much that they’ll sometimes give you free money to sign up and use their portals.

BeFrugal is a new one for me

I thought I’d round up 3 cashback portals where the initial bonus might be worthwhile for a little shopping. And tell you what’s required to get the bonus AKA the cash in your hot little hand.

Note: I get cashback when you sign up for these portals, too. Thank you for using my links!

Get a shopping portal bonus

These bonuses are for NEW sign ups. If you’re an old-timer to points and miles, you likely already have accounts with all of these portals. In that case, check out my backlog of Every Single Out and Out post!