Harlan Vaughn's Blog, page 39

July 5, 2017

[DEAL IS DONE] Tomorrow at Exactly 12:00 PM Eastern: $1,300 in Free Credit Card Spending, Plus $25

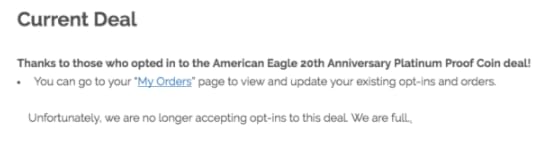

Update: As of 5:32 pm Eastern time, PFS Buyers Club is not letting anyone else opt-in to the offer. DEAL IS DONE.

That went fast

Congrats to those who got in on this! Sign-up for PFS Buyers Club so you don’t miss the next deal when it pops up!

Via my friend Meghan, you can purchase a Platinum coin from the US Mint tomorrow for $1,300 + $4.95 in shipping, then get paid $25 a week later. And yes, you can use a credit card.

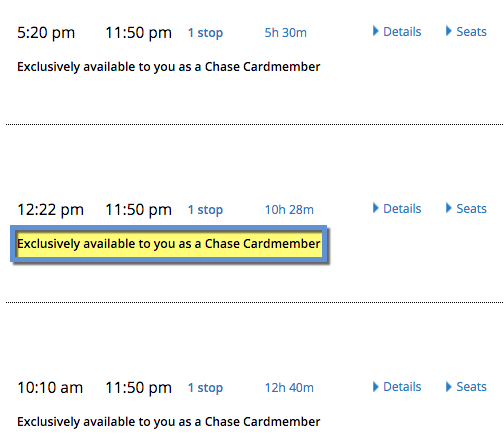

The coins become available at exactly 12:00 pm Eastern time tomorrow, July 6th, 2017. Sometimes these deals go within minutes, so set a reminder for 11:50 am so you can be ready, if you’re interested. And be sure to opt-in (details below).

Buy this coin, get free points and cash

Then, PFS Buyers Club will send you a pre-paid label and pay you $1,330 for your effort – which yields a profit of $25. They send a check or PayPal payment within 7 business days of when you send them the coin.

Here are a couple of tips if you’re interested in this deal.

About PFS Buyers Club

I’d never heard of this company, so had some trepidation about it. But apparently they have a good reputation. My friend Meghan says:

“This could be an option for meeting minimum spend requirements. Tomorrow’s deal is good for $1,300 in spending.

PFS Buyers Club will give you a bonus if you buy particular coins from the mint and send them their way. The process is really simple, they even send you a shipping label. I’ve done a dozen of them and never had any issues.

The only moderately annoying part is registering your card on the US Mint’s website.

The next deal is tomorrow at noon EST, and these things normally sell out within minutes.”

So I’d recommend going ahead and setting up your credit card on the US Mint site today so you’re not futzing with it tomorrow.

What to do if you want this deal

Sign-up for PFS Buyers Club (that’s my referral link, I get $25 if you use it – thank you!)

Opt-in to the deal – you MUST do this if you want to commit (link only works after you sign-up)

Register your card with the US Mint

Tomorrow, July 6th, 2017, be ready to purchase the American Eagle 20th Anniversary Platinum Proof Coin at exactly 12:00 pm Eastern

Get a label from PFS Buyers Club

Send them the coin as soon as you receive it

Get paid, pay off your credit card, and enjoy $25 for your time

Make sure you read through all of the terms and conditions. It sounds pretty straightforward, but make sure you follow their rules exactly.

I wish I could do this deal, but I’m leaving for Montana on Saturday morning, otherwise I would. :/

Bottom line

Link: Sign-up for PFS Buyers Club

This is an easy way to manufacture $1,300 in spending or meet a minimum spending requirement. Knowing someone who’s had several good experiences doing this type of thing put my mind at ease.

My friend Meghan also said sometimes the cash payments are as high as $150 on PFS Buyers Club deals! So if you can’t do the offer tomorrow for whatever reason, sign-up for an account so you’ll get notified of any other deals that pop up in the future.

Hopefully this gives you some ideas. Thank you for signing-up with my link if you decide to opt-in and get some free cash tomorrow!

If you’ve done similar deals in the past, how’d it go? Any other tips for making the transaction as smooth as possible?

So You Wanna Be an Airbnb Host? Part 1: Finding the Right Place

I’ve had Airbnb listings since 2014. In New York, I had 4 listings. And now that I’m in Dallas, I have 2 here.

I get asked a lot about how it all works. Peeps are interested because it’s a fairly low-maintenance source of extra income. I recently wrote I make an extra ~$18,000 a year from my Dallas listings.

While that doesn’t replace the income from full-time work, it sure is a nice boost as it rolls in throughout the year!

Finding an in-demand location is step numero uno

The first step is to find an attractive place in the right location: somewhere tourists want to stay. And as always with me, it comes down to the numbers.

Airbnb Hosting Index:

Part 1: Finding the Right Place

Part 2: Setting It Up

Part 3: Attracting Guests

Part 4: Ongoing Maintenance

Part 5: Taxes, Expenses, and Making It All Work

This series is meant for peeps who want to list an entire home separate from their primary residence on Airbnb.

Can you even do it?

First things first: is Airbnb legal in your town? If it’s not, what about the next town over? You don’t want to be too far from your listings on the off-chance something unexpected happens. And it will.

It doesn’t happen a lot, but I’ve had guests:

Take keys with them

Blow out the electricity

Need to come back because they left something behind

Report leaky pipes

Stop up toilets

Etc, etc, etc

I’d say once every couple of months, I need to access my place for something like this. It’s not a lot, but, like life itself, it happens.

If you can’t be around, perhaps you can find a friend or relative who lives nearby. Or a housekeeper with a fairly flexible schedule. There are a few ways to solve this, but the end point is you or someone needs to be available.

Find a place in a good area

Next, the place you find has to be in a desirable area. Otherwise it won’t work. If it’s in a good area without many chain hotels around, even better! That’s the situation I have in the Oak Lawn neighborhood of Dallas: it’s a cultural hot spot, but there aren’t any big-brand hotels within easy walking distance.

If there are a lot of hotel options, you’ll want to undercut them all and still make a profit. My other Dallas place is downtown, near many IHG, Starwood, Hilton, etc, hotels.

~$481 to stay at the Sheraton next month

I searched for a 3-night stay at the Sheraton next month. That would run me ~$481.

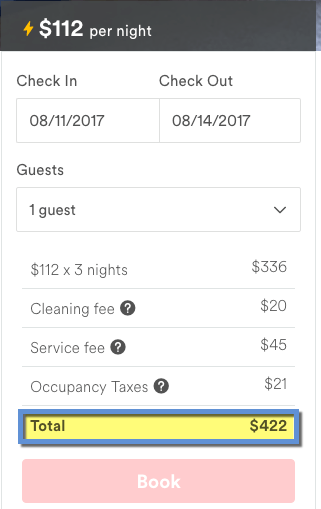

My place is $422 for the same weekend

I have my prices set to where the same stay is $60 cheaper.

For peeps who don’t care about hotel status or perks, or who simply prefer Airbnb places, my listing is a more attractive option.

How I run the numbers for Airbnb hosting

My rule of thumb is to assume the place you want to rent out will be occupied for 20 days each month.

That means if you’re looking to lease/buy a place that costs $1,500 per month, you want those 20 days to more than cover that cost.

$1,500 / 20 = $75 per night. So your breakeven point is $75 per night for 20 nights.

The Sheraton in the example above is $139 a night. My place is $112.

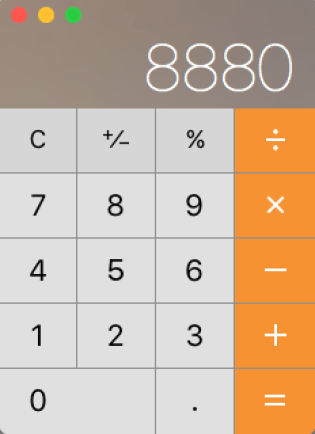

Keep your calculator handy – you’ll be running a LOT of numbers

$112 x 20 = $2,240. After rent is paid, that’s a profit of $740 a month, or $8,880 a year. Not bad!

Of course, 20 nights is an average. I’m closer to 25. But there will be slow months and busy months – based on seasonal things like weather, events, etc.

Once you know $75 per night (in this example) is your absolute base, see how high you can push it while still undercutting everyone else. You want to straddle that line between max profit and max bookings. It’s a delicate balance, but you’ll figure it out after a little trial and error.

Research similar listings on Airbnb to see how much other hosts are charging. How saturated is the area? Can you do better than other hosts? How much profit is enough for you to want to get into this?

What to look for in an Airbnb listing

Once you know how much a place costs and if the numbers even feasible, it’s time to pick a spot.

You’re likely going to be looking at a condo or apartment building unless you’re in a place where single-family homes are in great areas (like Charleston, Myrtle Beach, New Orleans to an extent).

If you have a single-family home, you don’t have to look for anything more. Just make the place look nice and welcoming.

Thou shall not pass more than 2 other doors

If you’re leasing a unit or have a condo, it’s much trickier. You might have to deal with a leasing office, HOA, property management company, or neighbors who don’t like Airbnb. I always look for places where a guest doesn’t have to pass more than 2 other doors, as a minimum.

In an elevator building, that means a place near the elevator. In other buildings, a place directly at the top of the first flight of stairs. As long as guests only pass 1 or 2 other doors, that’s ideal.

Go with your feelings

In your search for a place, you’ll likely be talking with lots of real estate agents, leasing agents, etc. Sometimes I say something like, “I’m not really home a lot. And have a lot of friends over,” to see what they say. If they respond with something like, “We really don’t care what you do,” that’s ideal. Just to feel them out a bit.

What’s the vibe like? Lots of younger people, or does it look like the residents have been there a while? If anything feels “off” or “not quite right,” high-tail it out of there. I’ve gone against my instincts a few times and always regretted it. Only do it if you have peace about it.

Exit plan

Once you find a place, you’ll sign a lease or some kind of agreement. Figure out the worst-case scenario if, for whatever, reason, you can’t have an Airbnb listing there. Will you be kicked out after a warning? Are there fines or early termination fees? Can you sublease? If so, is that feasible in your market?

Before you get into it, think about the end. If it all went down tomorrow, what would you do? Once you figure the worst that can happen isn’t that bad, you’ll feel a lot better about starting.

Most people don’t do things because of fear. Once you take that out of the equation, it’s easier to move forward.

Bottom line

Well that’s my wisdom about getting started with Airbnb. You’ll want to:

Find a place in a good area

Slightly undercut the competition

Run the numbers to make sure it will be profitable

Trust your instincts about choosing “the one”

My guidelines are:

Assume 20 days of occupancy per month

Make sure the unit you like doesn’t require guests to pass more than 2 other doors

If you do well, you’ll hit closer to 25 nights per month – especially in high-demand locations. Again, I can’t stress this enough, if anything doesn’t feel right, don’t do it. Your gut knows what your mind doesn’t. Trust it.

And figure out how much profit is enough for you. In the example above, would $740 per month be worth it to you? Would you do it for more or for less? Factors like distance from your home, your support network, and how much extra time you want to spend will – and should – affect this number.

In the next part of the series, I’ll talk about how to set up a place.

Any questions so far? Leave a reply below and I’ll try my best to help!

July 4, 2017

Must-Haves of Travel: Sesame Oil

Also see:

Must-Haves of Travel: Coconut Oil

Must-Haves of Travel: Apple Cider Vinegar

M ust-Haves of Travel: Activated Charcoal

Must-Haves of Travel: Calcium Bentonite Clay

Must-Haves of Travel: Affordable Razors!

Must Haves of Travel: Rose Petal Water

Must-Haves of Travel: Portable Travel Tubes

When I was in Chicago in March, I wasn’t prepared for how cold it got. And, I’d forgotten my ultra-moisturizing coconut oil. (I also didn’t pack nearly enough layers, but that’s another story.)

In my quest for moisture, I headed to a drugstore for chap stick and… something. I didn’t want to get a huge container because my trip was only 5 days. I thought maybe they’d have a travel pack of coconut oil since it’s gotten so popular recently. No luck there, but they did have… sesame body oil?

Curious little container

Once I got it back to The Drake, I popped open the little container and took a whiff. This stuff smells amazing. And I quickly learned a dab’ll do ya.

A quarter-sized amount in the palm is all you’ll need to cover yourself in the softest, sheerest moisture. Since that trip, I’ve added it to my arsenal as a supplement for coconut oil when I don’t want as much moisture.

Why pack sesame oil?

Link: Neutrogena sesame oil

The 1 ounce travel container I found was more than enough to last 5 full days. Especially when a few drops goes so far. It’s best to use this stuff directly after the shower while you’re still a little damp – it seals in the moisture and makes your skin feel so soft and good.

The smell is extremely light but pleasant. Very neutral.

When you travel, especially on planes, it’s easy to become dehydrated. So I’m mildly obsessed with keeping moisturizing things in my carry-on: lip balm, rose petal water, and now sesame oil.

These tiny spray bottles are easy to toss in a carry-on or keep in the shower – I got the one on the left at Muji

I’ve heard some peeps say they don’t like dealing with the materiality of coconut oil. It’s a liquid above 76 degrees, and a solid if it’s cooler. So in a hotel room, your coconut oil is likely to be solid. That’s never bothered me, because you can warm it up in your hands or under the faucet. But I can see how it’s easier to have a liquid with you that accomplishes a similar goal.

Sesame oil is pretty potent – you really don’t need much. It’s also not as intensely moisturizing as coconut oil and absorbs into your skin much faster. So it’s literally spray and go – as soon as you rub it in, it’s done.

Fenwick loves it too lol

It’s such a nice treat after a long day of travel to have something that feels spa-like and smells so good. After the first time I used it, I looked forward to using it each subsequent day. And because it’s so fast and easy to apply, it didn’t add much time to my overall routine.

Other benefits of sesame oil

It’s great for your body, but you can also use sesame oil as a very light facial moisturizer. I use the tiniest bit on my face and love the little glow it gives

If you have a beard (which I usually do), you can use it as a light beard oil – keeps the skin beneath (close to the follicle) healthy, too

Aromatherapy – this stuff seriously smells so relaxing. And it makes the whole bathroom smell so good

Good for circulation – I always fear the DVT (deep vein thrombosis) from sitting on aircraft. Sesame oil has zinc that promotes healthy circulation throughout the body

Good for inflammation – Have you ever noticed your feet were a little puffy after a long plane ride? Sesame oil reduces joint swelling and helps to get the blood flowing again

Prevents wrinkles – This is another reason I like to put a little on my face: to smooth my skin after being out all day. Or in a dry plane. Gotta stay fresh!

It’s naturally anti-bacterial and anti-viral – Always a plus!

More resources

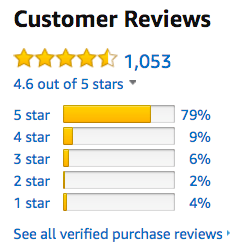

When I went to find a bottle of this stuff on Amazon, I was shocked that it had nearly ALL 4- or 5-star reviews out of 1,000+:

Whaaa?

I’d highly encourage you read the reviews – which are more like testimonials – to see what other peeps have to say.

The Neutrogena brand is meant to use on your skin, as it’s scented, but you can also find unrefined, organic sesame oil that you can cook with.

And here are some other articles:

9 Incredible Benefits Of Sesame Oil (Organic Facts)

20 Huge Health Benefits of Sesame (Care2)

Why Sesame Seed Oil Is Known As The Queen Of Oils (Youthing Strategies)

Bottom line

I’m so glad I discovered this stuff. Also because I love to spray little potions and tinctures everywhere. But it really does smell so good. A big bottle is only $7 on Amazon. And you don’t need to use much at all – a little goes a long way.

I travel with this when it’s warmer. Or when I don’t need the deeply moisturizing experience of coconut oil. In that way, they complement each other nicely. I also love that you can use it on your face (and beard) and how fast it absorbs – just a few seconds and you’re good.

Lots of other reviewers swear by this stuff, and I think I’m one of them now – I’d like to keep a bottle on hand from here on out. Also, it smells SO good.

Have you used sesame oil? Is it something you’d use to replace regular body lotion?

July 1, 2017

Allbirds: The Perfect Travel Shoe?

When I saw an article with the kinda clickbait-y title, “The Most Comfortable Shoes in the World,” I rolled my eyes a bit but definitely clicked on it. Because I like to take one pair of shoes with me when I travel: the ones on my feet. So I was curious what had been singled out as “the one.”

My go-to for the past XX years has been New Balance, which are comfy as heck. But they do have that appearance of “casual athletic” and of course the big reflective “N” logo all over them. I’ve been comfort-over-style, essentially. When I spend hours a day walking, I’d rather be comfortable and dowdy-looking than the alternative.

Enter Allbirds (what a name, eh?).

Hanging in my new Allbirds shoes

The idea of a comfortable and attractive shoe lured me in. They come in a limited range of basic colors, they’re $95 a pop, and the founders are super committed to design, sustainability, and high ethical standards.

“What the heck,” I thought as I placed my first order. If they last 6 months, it’ll be worth it.

They arrived this week. Here’s what I think so far.

My Allbirds research

Link: Allbirds

I didn’t commit based on a single review. But a quick Google search brought up a ton of resources to discover more about Allbirds. Firstly, the tops made of wool. That doesn’t mean they’re hot – it means they’re reactive and durable. If you’ve ever hiked in SmartWool socks, it’s a similar idea. Then I learned the rest is made from all-natural materials.

Refreshing: a simple, comfortable, logo-free shoe

The colors are neutral and practical. There’s nothing flashy about them. You can wear them with pretty much any outfit. And the heel is thick with plenty of cushion.

They even ship in a box that uses less cardboard.

Well how bow dah?

They only come in two styles at the moment: runners and loungers.

Runners are your basic day-to-day shoe, with laces. Loungers are slip-on and def have a more casual vibe. I ordered a pair of gray runners for my Allbirds experiment.

Ready for the world’s most comfortable shoe

Apparently, you can wear them with or without socks. They’re breathable. Water-resistant. And many reviews say they hold up well past the 6-month mark.

Here are a few other resources I consulted before I purchased a pair:

Review: AllBirds Wool Runners (Wired)

There’s a new version of the ‘world’s most comfortable shoes’ that Silicon Valley loves — here’s our verdict (Business Insider)

Allbirds Wool Runners Mini-Review (Pics) (Reddit)

Travel Gear Review: Allbirds – the most comfortable shoes in the world (The Global Couple)

So far

I’ve been wearing them around town for a few days, and so far: wow! They’re like walking on a cushiony cloud.

As soon as I got them, I took the dog around the block and the lily white bottoms instantly got a patina of sidewalk sludge. But it wiped off easily. And the wool tops tend to “repel” most everything.

The bottoms are mostly flat, but have little grooves (you can see in pics above and below). The flatness is good because they don’t track in much dirt from outside.

I wore them during a bout of rain and didn’t notice any water getting down to my socks. I expect it would eventually if you stay out in it for a while but 1.) that sucks and 2.) that’s any shoe. The wool does dry much quicker than what I’m used to, though.

I don’t think I’d wear these to the gym because I don’t want to wear them out prematurely.

The heel gets these little crinkles

Also because, after a few days, the middle part of the heel already shows signs of wear. I mean, it’s a pretty thick heel to begin with, so I was kind of expecting that. Or maybe I just have a heavy tread? It’s not bad or anything, but I wouldn’t want to do say, cardio, in these. Or go on a run.

But for strollin’ around town, they’re pretty dang comfy.

What I’m hoping to get from these shoes

During my recent explorations in Brussels, Amsterdam, and Prague (BAP), I walked a lot in my New Balances.

Did I really walk 4.5 miles around Prague?

Like, a few miles each day.

The eventual fate of all my shoes

I ordered my last pair of New Balance on December 3rd, 2016. And the pic above is July 1st, 2017. So a solid 7 months of wear.

Inevitably, the insole slips around, and the inside back heel (particularly in my right shoes) are ripped to literal shreds. I’m a faster walker, I run a lot, I am NOT kind to my shoes.

But, this pair cost me ~$45 – a full $50 less than the Allbirds.

What I want from this pair is for them to look this good after the 6-month mark:

And I want them to be the one pair I take with me on my travels: comfy enough to wear on a plane, walk around new places, and look good throughout. Considering they’re over double the price I currently pay for a pair of shoes, that seems reasonable. I’ll have to post another update one way or the other.

Bottom line

Comfortable shoes are an essential part of my travel experience. I’ve tried to wear cute shoes before and ended up with blisters, foot pain, and the feeling of not wanting to walk any more. Which sucks when you’re in a new place (this happened to me in Osaka). After some trial and error, I default to New Balance shoes most of the time – especially when I travel.

So when I heard about Allbirds shoes, I dropped $95 on a stylish-looking and comfortable pair of wool runners. I replace my shoes about every 6 months, so if they hold up for at least that long, I’ll consider it a success.

I’m looking forward to traveling and taking these along for the ride slash walk. And so far, so good. They’re extremely comfortable. Perhaps the most comfortable shoe I’ve ever worn (time will tell). They still new to me, so I’m not completely sold just yet. Although reading lots of positive reviews has me hoping for the best.

Have you heard of Allbirds? If you have a pair, what do you think after an extended test run? (Gosh, I’m so punny.)

June 30, 2017

Taking Stock: The 29 Credit Cards I Currently Have – and Why

Time for a credit card inventory. Over the years, my collection of credit cards has grown. I now have 29 credit cards to my name.

(I did have 30, but closed my Citi ThankYou Premier last week. Because the Chase Sapphire Reserve is better for the same 3X categories. And Citi is changing the Prestige and AT&T Access More cards next month – which is causing me to significantly rethink my relationship with them.)

Ah, but a small sample of the 29 cards I currently hold

And, I’m paying annual fees on many of my cards. So I thought I’d put the complete list together to take stock of what I have – and what I’m getting in return. I’ll write a little snippet for each card, but will try to keep it brief. 29 cards is a lot!

Let’s jump right in.

Amex

I’m pretty much tapped on out this bank. I’ve earned most of the sign-up bonuses at least once. There may be a couple here and there I haven’t had. But for the most part, I am done with Amex.

1. Blue Business Plus – $0 – 1 year – Keep

My newest card. I got it last week. This is the one I think I’ll transition to using for Airbnb rent, mortgage, and HOA dues. 2X Amex Membership Rewards points on the first $50,000 each calendar year? Yes, please! AND no annual fee. I also got no hard pull for opening this card.

I love seeing this screen!

But, I’m going to make sure my AT&T Access More card is indeed getting 1X on Plastiq after July 22nd, 2017 – just to be 100% sure. 2X Membership Rewards points isn’t ideal. But I think it’ll still be worth it.

2. No annual fee Hilton – $0 – 1 year – Keep

I love this little card. Not only does it get my access to Amex Offers, but it’s free to keep and helps age my overall credit lines – as do all of my no annual fee cards. That’s the biggest reason why I think everyone should have at least one card without any annual fees. I got it for the sign-up bonus, but will keep it long-term.

3. Hilton Surpass – $75 – 1 year – Cancel

Link: Amex Hilton Surpass

This one’s newish, too. I got it last month for the 100,000 point sign-up bonus. And just completed the minimum spending.

I’m d-d-dying to stay at the Conrad Tokyo. Oh em gee

It comes with a free weekend night certificate on the 1st cardmember anniversary. After I get the cert, I’ll likely cancel this one.

4. Mercedes-Benz Platinum Card – $475 – 2 years – Keep

I just renewed this card, because I was locked into the previous annual fee (it’s currently $550 per year for all personal Platinum Card versions). After that, if the Ameriprise version of the card is still around with a $0 annual fee the first year, I’ll dump this one and get that one instead.

I can’t wait to get some more free crap from the M-B store

I keep this one for Amex Offers, and access to the fantastic Centurion Lounges. My very favorite lounge is the one at DFW – my home airport! So I plan on keeping at least one version of this card at all times.

Oh, and I just got my cert to get $100 in Mercedes-Benz gear. #weekendtrip

5. Starwood personal – $95 – 2 years – Keep

Link: Starwood Amex

Got it for the 35,000 point sign-up bonus. But currently keeping it because I’m getting more than $95 back from Amex Offers. I tend to get really good offers on this card for some reason.

6. Starwood business – $95 – 2 years – Keep

Link: Starwood biz Amex

Ditto here. But I’ll keep it because it gets me access to Sheraton lounges. Saved my whole life in Prague. I still need to write about that, crap. #alwaysbehind

The Out and Out crystal ball predicts a post about the Sheraton lounge in Prague

Bank of America

They’ve tightened lately, but you can still get 30,000 Alaska miles every 45 days. Just be sure to close your old ones or at least reduce your credit lines before you get a new one.

7, 8. Alaska Airlines Visa personal – $75 – 1 year – Cancel

Got them all for the miles. Don’t need them, will cancel.

9. Alaska Airlines Visa business – $75 – 1 year – Cancel

Ditto.

Barclaycard

I’m semi-interested in getting another American Airlines Aviator card (I had it before but canceled it). And I may get a Miles & More or Wyndham card in the future. I try not to mess with them too much, because at their core, they’re a very conservative bank.

10. Arrival – $0 – 2 years – Keep

Downgraded from the “Plus” version of the same card. Keeping primarily to keep $13,000 credit line intact, help age my accounts, and keep a relationship with Barclaycard in case I ever want more of their cards.

Chase

By far my most difficult relationship with any card issuer. I would love to get my hands on a Freedom Unlimited card. But I’ll never slide under 5/24 because… I just won’t. So barring some sort of freak pre-approval, I’ll likely never have it. *wipes tear*

Chase Bank: my lagan love

I could always pick up another Hyatt or IHG or British Airways card… maybe I will. Hmmz.

11. Freedom – $0 – 15 years – Keep

No annual fee. Keeping forever for quarterly 5X categories. Can’t beat that with a stick.

It’s also my oldest card. So it helps tremendously with aging my accounts.

12. Hyatt – $75 – 3 years – Keep

Keeping forever. $75 for a free night at a Category 4 hotel each year is a no-brainer.

I LOVED staying for free at the Hyatt Bellevue in Philly, Penn

13. IHG – $49 – 3 years – Keep

Also a forever keeper. $49 for a free night at ANY IHG hotel in the world? Yes, please.

14. Ink Plus – $95 – 3 years – Keep

Keeping as long as I can to get that sweet 5X at office supply stores. And on my internet and phone bills. I generate thousands of Ultimate Rewards points from this card. As long as it stays as-is, I will keep it.

15. Sapphire Reserve – $450 – 1 year – Keep

Bae

I will totally keep this card thanks to the 3X categories of travel and dining. And the $300 annual travel credit. The Priority Pass Select membership is nice, too. Just a solid card all around.

16. United Explorer – $95 – 1 year – Keep

Link: Chase United Explorer

I like how this card gives me an extra 25% bonus through the MileagePlus X app (which I still use quite a lot).

United finally shows it in black and white

Plus, United finally confirmed in writing what we all knew: Chase United cardholders get more award space. Sometimes the difference is hugely dramatic. I personally love this benefit. The extra miles and award seats justify the annual fee for me.

Citi

17. American Airlines Amex – $75 – 5 years – Keep

I love that this card no longer exists. I use it a lot to sync Amex Offers via Twitter. I also keep it to get 10% of my redeemed miles back (up to 10,000 miles per year). 10,000 American Airlines miles is worth $200 to me, so that along with the Amex Offers makes it a keeper.

18. American Airlines MasterCard – $95 – 1 year – Cancel

Got this one for the sign-up bonus. Redundant card bennies. Will cancel.

19. AT&T Access More – $95 – 2 years – Keep

Current relationship status: TBD

The fate of this one remains to be seen. But, I shop online enough that the 3X for online purchases may be its saving grace. Very much a “wait and see” situation. But on thin ice!

20. Diamond Preferred – $0 – 1 year – Keep

I just got this one to alleviate my student loan debt. But if it’s free to keep, why the heck not?

21. No annual fee Hilton – $0 – 1 year – Keep

I got this one for the 75,000 point bonus. But the card is no longer open for new signups. And might be discontinued later this year. If it were up to me, though, I’d keep it forever.

22. Prestige – $450 – 2 years – Keep

Super super on the fence about this one. I heard a rumor Citi will be adding new benefits to this card next month. And even with the upcoming devaluations, the 4th night free perk is worth its weight in gold – if you use it. I saved over $3,000 with this card the first year.

Prolly gonna keep it

And with the $250 airline credit considered, have already recouped the annual fee this year, too. So I might as well keep it if it’s going to be worth more than its fee. Wait, I think I just convinced myself. Well that’s settled.

Discover

23, 24. Discover It – $0 – 1 year – Keep, Cancel

Link: Discover It

I love these cards because of The Dublin. I got $1,100 the first year as a lump-sum match. And already have ~$800 coming back to me this year – that’s just so far.

Already planning for another good Dublin

For a card with no annual fee, that’s insane! I might cancel the first one and open a new one after I get my second Dublin. And rinse/repeat for as long as the deal is good.

The 5% categories are really 10% categories the first year, with the matched cashback considered. I highly, highly recommend this card.

The only downside is you will get a 1099 for the cashback – so consider that before you jump in.

US Bank

25. Altitude Reserve – $450 – 1 year – Cancel

Another newish card. US Bank is an extremely conservative bank.

I like the $325 travel credit and the 12 Gogo in-flight passes (which I value at $240 alone). So why cancel this card? Simply because I don’t think I’ll make the most of the 3X categories. You can’t buy gift cards – period – and for travel, I’d rather spend on the Chase Sapphire Reserve.

I haven’t used the mobile pay once since I got the card…

I’m a bit on the fence. We’ll see how much I actually use the mobile pay. But my inclination at this moment is that I’ll cancel it next year.

26. Club Carlson Visa – $0 – 4 years – Keep

I used to love Club Carlson. But now they suck. I have a nice $16,000 credit line on this card, so I’ll keep it around to help my debt ratio. And who knows, maybe I’ll want another US Bank card in the future. I haven’t really messed with FlexPerks yet…

Others

27. Fidelity Visa – $0 – 4 years – Keep

I used to love love love this card. But lately, I’ve preferred Starwood points to cashback. Still, there have been a couple of promos lately. And it’s free to have, so why not keep it?

Plus, who knows what will happen with Starwood next year. I might want to rack up a little cashback and sock it away into my IRA.

28. Icelandair MasterCard – $0 – 10 years – Keep

I only keep this one because it’s old as the hills. I charge $5 on it every 6 months or so just to keep it active. This was my first miles card, back when I was a newbie. Awwww.

29. Kohl’s card – $0 – 3 years – Keep

I had some shame about getting this card. But let’s be honest, I freaking love Kohl’s. My limit on this card is only $700. But it gets me some nice discounts and lots of free shipping. I use it to by things for my Airbnbs. So for now, it’s a total keeper.

Bottom line

Link: Apply for Card Offers

Of my current 29 (!) cards:

23 are keepers

6 will be canceled

Of the 23 I plan to keep, I’ll pay $2,124 in annual fees. But I’ll get $750 back in the form of statement credits ($200 from Amex Platinum Card, $300 from Chase Sapphire Reserve, and $250 from Citi Prestige). That brings my net cost to $1,374. I’ll also get:

A free night at ANY IHG hotel (Chase IHG)

A free night at a Hyatt Category 4 hotel (Chase Hyatt)

10,000 American Airlines miles back (Citi AA Amex)

10,000 Citi ThankYou points (Citi AT&T Access More)

10,000 Hilton points (Citi Hilton Visa)

Sheraton lounge access (Starwood biz Amex)

Centurion Lounge access (Amex Platinum Card)

Priority Pass Select (Chase Sapphire Reserve and Citi Prestige)

A free weekend night at nearly any Hilton hotel (Amex Hilton Surpass)

5X Chase Ultimate Rewards points at office supply stores (Chase Ink Plus)

25% more miles through MileagePlus X and more United award space (Chase United Explorer)

4th night free on all my paid hotel stays (Citi Prestige)

Many, many Amex Offers

Not to mention so many bonus categories for nearly every dollar of my spending.

When I add up all I get, it’s definitely worth way more than $1,400 – probably many times more. I love to travel, so I consider these annual fees an upfront cost for all the cash I save by using points & miles. And it seems, to me, a small price of admission.

In writing this, I discovered I’ve actually been pretty judicious about what I keep and cancel throughout the years. And if I cancel 6 of my current 29 cards, that’s a ~20% reduction, which seems about right. Having 23 cards is still a lot. Plus, I’ll likely pick up a couple more to replace them. That’s how the game goes. Cycle in, cycle out.

Now I’m curious – how many cards do you have? Do you think it’s worth paying ~$1,400 in annual fees for all those travel perks? Or is it too much to keep track of?

And if you do decide to get a new card, thanks as always for using my links!

June 16, 2017

Update: My Credit Score Is Recovering After Disputes With All 3 Bureaus

Also see:

How a $6 Charge Made My Credit Score Drop 100 Points

Well, it’s been nearly a year since a $6 charge from Dollar Shave Club on an Amex card plunged my credit score over 100 points.

At the time, my credit score was 803 – the first time I’d ever gone over 800. I know it doesn’t intrinsically “matter,” because a score over 750 is as good as it gets. But I did have some pride at earning an above-800 score.

So I was pretty horrified when one stupid error brought me down to ~700. All the work I’d done to build my credit was instantly erased. And, Amex was totally clueless, unhelpful, and actually prolonged the repair process by saying they’d corrected it on their end when in actuality they hadn’t done anything.

I dragged my feet on filing a dispute with the 3 major credit bureaus because I knew it would be a slog – and it was. No sugar-coating that ish.

Only 13 points to go before I get to 800 again

But, as of last month, my score is now above 780 across the board!

It’s not over 800 yet – I doubt that will happen any time soon – but I am happy my score is recovering. Here’s how it went down.

The long, long dispute process

Link: Equifax dispute process

Link: Experian dispute process

Link: TransUnion dispute process

After I filed my initial disputes, I knew it would take some time for the whole thing to resolve. Because each bureau says something to the effect of, “This is gonna take 30 to 45 days for us to even look at it.”

After that, if resolved in your favor, it could take a couple of more months for that information to appear on your credit report. So, 3, maybe 4 months, from filing the dispute to seeing any update. And the whole time, you’re uncertain and in limbo. Of course.

What I wrote in my dispute file

And also of course, the websites are from the mid-90s, clunky, and hard to navigate. If you ever have to do this, plan to spend at least an hour – most of that clicking through error messages.

On each dispute, I wrote:

Closed account in April 2016. In June 2016, AMEX approved a charge to the closed account and did not notify me – at that point I’d moved to a new address. Paid account in July 2016. AMEX did not update credit.

And I marked that my payment was never late – because the account was closed and therefore had no due date.

I won!

Apparently that was clear enough – because months later, I began getting results of the disputes.

Letter from Experian

I’d nearly forgotten about the whole thing. And in the meantime, learned to live with my kinda lame credit score.

I was still able to get several new credit cards, and even pre-approved for a new mortgage loan. Although I did have to explain a couple of times what happened via reconsideration.

So when I saw my “outcome” was “updated,” I was pretty excited. But I knew it would still take a while for my score to show recovery.

780+, baby (Credit score recovery phase)

The image at the top showing a 787 score is from Credit Karma, which pulls from Equifax and TransUnion.

781 with Equifax

I also checked Citi for my FICO (not FAKO) score with Equifax, where it’s currently 781.

Just super excited to see NO accounts with “negative marks”

And Credit Sesame shows similar results. The “C” grade is for new credit inquiries – I’ve learned to live with that, too, because there will always be new credit inquires.

June 13, 2017

Gasp! Citi AT&T Access More Will No Longer Earn 3X for Rent & Mortgage Payments

I am in a slough of despond. Following this morning’s depressing news that you can no longer use Visa cards for Plastiq rent and mortgage payments, I received the following email from Citi:

Crying

As of July 22nd, 2017, “rental and real estate” payments will only earn 1 point per $1 spent instead of the current 3X points. This was definitely going to be my backup for Visa cards.

And, given that Citi Prestige is getting poopier on July 23rd, 2017, I am suddenly rethinking my entire relationship with Citi cards.

If only 1X, which 1X?

I reported some rental payments were earning 3X with the Chase Sapphire Reserve. And then noticed the same payments only earned 1X with the US Bank Altitude Reserve.

Well, as of today, you can’t use any Visa credit cards for these payments. Which was fine, as I had my trusty Citi AT&T Access More card for 3X.

I was a bit on the fence anyway because I combine the points with my Citi Prestige where they’re worth 1.6 each toward American Airlines flights – that’s going down to 1.25 cents (for all airlines) on July 23rd, 2017.

My other Citi ThankYou card, the ThankYou Premier, hasn’t seen much any use since the Chase Sapphire Reserve came out.

With Visa cards – and now the Citi AT&T Access More card – gone as rent & mortgage payment options, it looks like these payments are going to get 1X from now on from any card you use.

So now I’m wondering which 1X I’d like. There’s always Starwood points, though that will also likely come to a screeching halt early next year.

And even at 1X, I could always use an American Airlines card to rack up some miles (I have a MasterCard and Amex version of their cards).

The bigger issue, though, is if it’s worth paying Plastiq’s 2.5% fee to earn 1X. I’ve been hitting 3 to 4 cents per point with a few of my award bookings lately. But paying the fee would make me have to hit that benchmark for it to be worth it. Now I’m wondering if it’s worth it at all. Even a 2% cashback card wouldn’t cut it.

I know deals come and go, but this one is hitting me a lot more than the usual loophole closures.

Bottom line

It’s been a phenomenal ride with the Citi AT&T Access More card – I’m sad to see this one go. And a bit surprised, considering it’s no longer available for new sign-ups.

How Plastiq currently codes with Citi AT&T Access More

Next month, this card and Citi Prestige will both become a lot less valuable than they currently are. I’ll do one more round of payments. And then maybe make a test payment to make sure it is indeed coding as 1X. Because, who knows, maybe it’ll slide under the radar.

I’m seriously rethinking my relationship with Citi, too. Maybe I’ll transfer all my ThankYou points to Etihad and make a clean break. Because it looks like we are definitely breaking up next month. :/

Is Chase winning the flexible bank points game now by default? Or is it time to take another look at Amex Membership Rewards? That new 2X card is looking mighty attractive right about now…

May 31, 2017

Still Available: Ameriprise Amex Platinum Card, $0 the 1st Year and 1.25 Points per $20K Spent

Also see:

Ameriprise Amex Platinum Card Has No Fee the First Year, Plus $400 in Travel Credit (and Free Lounge Access!)

I wrote back in November how you can get an Ameriprise Amex Platinum Card with a $0 annual fee the first year. The fee on all personal Amex Platinum Cards has since gone up to $550 – but this deal is surprisingly still kicking.

$0 the first year and 1.25 points on purchases

Even better, you get 5,000 bonus Amex Membership Rewards points for every $20,000 you spend on the card. You can earn 30,000 extra points this way – so it’s good for up to $120,000 in spending each calendar year. You also still get 5X points on airfare and travel booked through Amex.

Get the Ameriprise Amex Platinum Card while you can

Link: Ameriprise Amex Platinum Card

I sorta can’t believe this is still available after the annual fee recently went up to $550 a year. Like all other flavors of the Amex Platinum card, you also get:

5X Membership Rewards points on airfare booked with airlines and travel booked through Amex

$200 in Uber credits annually

$200 airline fee credit per calendar year

$100 fee credit for Global Entry

All the other Platinum Card bennies

The T&Cs say every calendar year for the bonus points

But it does earn 1.25 points per $1 if you meet the $20,000 threshold (25,000 points / $20,000 spent). Incidentally, that’s the best earning rate for regular purchases – all the others earn 1X on normal spend. The extra points aren’t earth-shattering, because have to spend a LOT to get them.

Overall, this card is still worth considering as it’s free the first year and you get all the other perks, too.

In fact, if you got it now, you could get the $200 airline fee credit now and $200 more in January – plus all the Uber credits and the Global Entry credit – and easily come out ahead by $600+.

You also get lounge access to:

Centurion lounges

Delta SkyClubs

AirSpace lounges

Priority Pass Select lounges

Depending on how often you visit, that can be a huge value-add, too.

So if your annual fee is coming up on another Amex Platinum Card, you could apply for this one and cancel the other.

I can also confirm it’s possible to have 2 Amex Platinum Cards simultaneously. And my friend Angie was able to get this card with no previous relationship with Ameriprise.

There’s no sign-up bonus on this card, but it costs nothing the first year. And if you make the most of the fee credits and lounge access, you can do quite nicely for yourself – especially if you visit lounges a lot.

Bottom line

Link: Ameriprise Amex Platinum Card

Mostly, this is an easy way to get free lounge access and an extra $600+ worth of stuff in exchange for a hard pull. Just keep an eye on the renewal date, because the $550 annual fee will kick in the 2nd year. Although there’s evidence that you can reapply for this card shortly after closing it – just to put that out there.

The fee on my Mercedes-Benz Amex Platinum card is due next month. I might get $100 worth of M-B stuff like I did last year, cancel it, and hop over to the Ameriprise version to stay in supply of lounge access (I looove the Centurion lounge @ DFW). It’s a good strategy because the $0 annual fee the first year might not stick around – so get it while you can, if you’re interested.

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

Don’t Miss Out: Free Museums, One Month for 5X, Hilton Surpass 100K

Happy Wednesday!

Here are some deals still on the go – snag ’em while you can!

Through May 31st (today!)

Hilton Surpass Amex 100K offer

Link: Hilton Surpass Amex

Last call to earn 100,000 Hilton points with the Amex Hilton Surpass. Here’s why I took the bait with this truly best-ever offer. Not into Hilton points? Think again. I estimate this bonus is worth at least $1,000 if you plan carefully.

June 3rd and 4th

Free museums

Link: Museums on Us

Free museums if you have a Bank of America debit or credit card. Only good for the cardholder and doesn’t include special exhibits. That said, there’s a participating museum in nearly every state, so check it out if you want some free culture this weekend.

Check out the Denver Zoo this weekend for F-R-E-E

Through June 30th

Get your 5X!

Link: Apply for Card Offers

If you have Chase Freedom, get 5X Chase Ultimate Rewards points and drugstores and supermarkets on up to $1,500 in spend. Can activate retroactively and still get bonus points. Easy categories here.

Activate your 5X – you have a month to max it out

With Discover It, get 5% back at home improvement stores and wholesale clubs on up to $1,500 in spend. Must activate BEFORE you shop. New cardmembers get their cashback matched after the 12th billing cycle, so it’s like getting 10% back. Discover is not accepted at Costco, but you can purchase cash cards online and use them in-store for a nice discount. Boom.

The Boxed deal is back

Link: Sign up for Boxed and get $15

The Boxed deal might be in your Amex account

I wrote about how to save 50% on merchandise at Boxed with an Amex Offer. Instead of $15 back on $50+, it’s now $25 back on $65+. Still a dang good deal. Even better, you can tweet #AmexBoxed to add it to your synced card even if you weren’t targeted.

2X SPG points

Doctor of Credit has the details. You get 10,000 bonus SPG points for spending $10,000 on your Starwood business Amex through the end of June. So, 20,000 SPG points on $10,000 in spend = 2 SPG points per $1 spent. Great deal if you’re targeted – worth checking.

Bottom line

Get ’em while they’re around. Any other good ones to share? Let me know and I’ll add ’em!

* If you liked this post, consider signing up to receive free blog posts via email (only 1 per day!) or in an RSS reader and you’ll never miss an update! And thanks for using my links to apply for new card offers!

May 30, 2017

Added My Brother as an Authorized User – His Score Went up 100+ Points in a Month!

Also see:

How a $6 Charge Made My Credit Score Drop 100 Points

When my little brother (he’s 24) told me he wanted to get a place with his girlfriend – their own place – the first thing I asked was, “How’s your credit?” because I knew they’d check.

Last month, his score was 586

He didn’t know. When we checked, his score was a dismal 586. It wasn’t because he had bad credit. But because he had no credit at all. Literally, zero accounts ever in his life.

I think I have 30 credit cards by now (?), a paid-off auto loan, and about to have two mortgages. With regard to my brother, hopefully I’ve helped create a path to his own points and miles journey.

But first things first.

Address matters when you add an authorized user

We don’t live together. He’s in Memphis, and I’m in Dallas. So I wanted to get him a card with a bank that DOES ask for a Social Security Number for authorized users.

Citi and Chase do NOT ask for this information. Without an SSN, the account can still appear on the authorized user’s credit report provided the addresses match – which ours obviously wouldn’t (unless I said he lived with me). Even still, I didn’t want to wait for the pairing to happen on the back end.

Amex, Bank of America, Barclays, and US Bank DO ask for an SSN for an authorized user account – perrrfect. I added him to my Amex Hilton account because the card was new and the statement was set to close the soonest.

Plus, the address thing didn’t matter because I tied his SSN, and therefore his personal credit report, to the card.

Amex has the best authorized user controls

With most banks, you can’t adjust the spending limit on an authorized user’s card. Meaning they have access to your entire credit line.

Bank of America and Chase let you set spending limits on employee cards if you have a small business card with them. But Amex is the only bank that lets you set controls on personal cards.

This is your key to custom limits on Amex authorized user cards

You can also set an alert if the user approaches their limit. This is helpful to know when there’s a lot of activity on the card.

When the card arrives, the authorized user can create their own login, and get access to Amex Offers. You can NOT link the new card to your existing Amex account. You have to create a new one if they want access. Although you can still make payments and see the charges in your own account.

What happened after a month

After the statement closed, I wondered if everything had “plugged in” correctly. And asked my brother to pull his updated score from Credit Karma.

Whoa – up 104 points a month later!

Between April 13th and May 18th, his score went up over 100 points – to nearly 700! I wasn’t expecting it to rise so high that quickly.

As of now, the authorized user card is his only account. And even though I set a spending limit on the card, the credit report shows the entire credit line – which is a nice side effect.

He probably can’t open his own credit cards with only one account on his report. And I thought it may not be enough to get an apartment. But the landlord said they only look at the score – and as long as it was “good,” that’s all they wanted to see.

He got the place and they’re moving in this weekend. Now I’m wondering how long before I can sign him up for a few Chase cards (of course). Although I’m thinking a secured card might be the way to go for now?

Should you do this?

If you have kids, or someone you really trust, it’s nice to get them started early with a good credit score and well-aged accounts. Looking back, I wish I’d added him to one of my cards years ago.

Just remember, whatever charges they make on their card, YOU are ultimately responsible for paying. Yup. Even though they can make their own payments, if they don’t, it’s your credit that’s ultimately on the line.

Giving someone a boost to their credit score is awesome if you can do it. Go for it, just be responsible.

Bottom line

I wanted to boost my brother’s credit score by adding him as an authorized user to one of my cards. Well, it worked – his score shot up over 100 points within a few weeks.

I’m hoping this is the beginning of a journey to responsibly use credit and eventually get him on the points and miles train.