Harlan Vaughn's Blog, page 34

November 6, 2017

The Dublin 2017: $2,000+ Cashback This Year From a No Annual Fee Card

Oh my word, I am in love with the Discover it® Cashback Match™ card. I just got my third one and am already busy earning that sweet cashback.

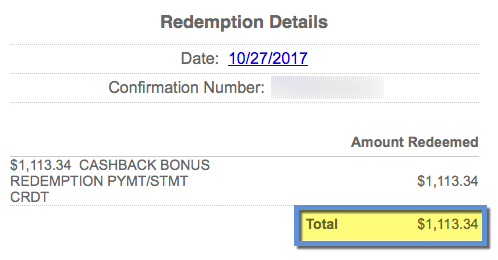

After the first year with my first card, I earned ~$1,184 in matched cashback (~$2,368 in cashback for the year). And after the first year with the second card – this year – I earned ~$1,113 in matched cashback. Or ~$2,226 for the year. All this from a card with no annual fee and no foreign transaction fees.

Incredible – look at that sweet cashback

It’s easy to get $600 in cashback if you make the most of the bonus categories. And you can get a sometimes staggering 30% cashback by stacking the Discover Deals shopping portal with the rotating quarterly bonus categories. When I say “it adds up” I mean it REALLY adds up!

I wasn’t sure if I could get the same card 3 years in a row. But I’m living proof that you can. And even at the low end, $600 back from a no annual fee card is still worth it. I think everyone (especially those over 5/24) should get this card!

Why now is an amazing time to get a Discover it® Cashback Match™ card

Link: Sign-up for Discover it® Cashback Match™ Card

Take a look at the cashback calendar:

#relevant

If you sign-up now, you’ll get the card in time to use it at Amazon and Target through the end of the 2017 and get 5% cashback at those 2 popular Christmas merchants.

Then, a year from now, you’ll have October and some of November to max out the Amazon and wholesale clubs category again before receiving your cashback match after your 12th billing cycle.

In between, there are popular bonus categories, like wholesale clubs (again), grocery stores, and restaurants: most everyone spends in these categories. And they are an easy win for some extra cashback. I’m all about the easy wins!

It grows in the heart

So this is like, weird, but I’ve actually grown to love the Discover brand. I obviously use Chase cards to earn Ultimate Rewards points, and other cards for travel credits, category bonus points, etc.

I do NOT care about Discover’s “Freeze It” feature (where you can freeze your card from spending activity with a click), their credit monitoring, or free FICO score. Those are great features, but what I DO love is their wonderful iPhone app, website interface, and how easy they make it to interact with the card.

I have some sort of animosity for Chase even though I love their points, for Citi because of their “family of brands” rule, and for Amex because of “once per lifetime.”

It’s ruv

But Discover loves me and continues to reward me for putting spend on their cards without restriction – and I love them for that.

I’ve grown to appreciate the reliability and dependability of The Dublin – it’s a yearly event I anticipate for months. And for that moment of joy, I’ve fallen in love with the Discover brand.

I’m not worried about “taking their money” and getting a new card. Because I use my Discover it® Cashback Match™ card constantly – something that surprised me. I thought I’d get the bonus and run or whatever, but I’ve continually found the payouts on Discover Deals to be the best many times over.

And, Discover is making money off the interchange fees. This card is almost always in my wallet despite (or in addition to) category bonuses on other cards. And for card issuers, being top of wallet is all they ever ask for. Discover has that from me. And I really do love this card now. *long dreamy sigh* It’s interesting how you start to having feelings of loyalty for certain brands over time.

Bottom line

This card just doesn’t quit! I got my third Discover it® Cashback Match™ card and couldn’t be more pleased about it. This card has been my trusty companion for the last 2 years. And I already have a healthy start on my Christmas shopping with the fantastic 5% cashback categories.

I’m also riding the high of getting ~$1,113 in pure cash as my cashback match this year. In fact, the $2,200 mark is where I’ve been shooting for the past 2 years now. And with my 3rd card in hand, I expect to get about that much – again! – in the upcoming year.

For a card with no annual fee and no forex fees and few sign-up restrictions, you just can’t beat it with a stick. Most peeps, either new to points or long-timers in “The Hobby” can do well with this seemingly magical card that I’ve fallen in love with over the past couple of years.

If you sign-up with my link, you’ll get $50 after your 1st purchase within 3 months of account opening. And of course that’s matched to become $100 total (after your 12th billing cycle). That should jump-start you toward an easy $600 in the first year.

I write about this card often because I truly think it’s a great deal. Especially with the holidays coming up and the Amazon/Target bonus categories, now’s a fantastic time to consider this card for Christmas purchases with a cashback match 2 years in a row (November and December of 2017 and October of 2018). You could even use the cashback match to buy Christmas presents for loved ones.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

October 24, 2017

Who’s Going to FinCon This Week? Say Hello!

Well, the day is finally here – tomorrow begins FinCon 2017 in Dallas! I got early bird tickets back in February and it seemed the day would never arrive. I’ve been looking forward to attending my first FinCon expo for a while!

Finally, FinCon 2017 is here!

I know a lot of fellow bloggers and readers will be there – so if you see me around, say hey!

In my natural habitat – drinking and thinking about credit card points lolerz

Tomorrow, October 25th, I’ll actually be at a mini-convention within FinCon called CardCon. Very much looking forward to that as well!

CardCon is a convention-within-a-convention. Cool, right?

What’s it all about?

I’m hoping to learn more about:

Personal finance

The business of blogging

The future of credit card loyalty programs

Financial independence

Latest blog trends, like podcasting and video – just out of pure curiosity

New financial tools and ways to save money

But every conference is really about the networking. And they’re a great way to say hello to people you only know online.

I’m hoping to say hi to Paula from Afford Anything because her writing makes me ridiculously happy, her podcasts are my gym companion, and she’s a kick-ass person I’ve admired from afar for so long. I’ll be in full fanboy mode so will shoot for at least one coherent sentence.

Connect connect

Link: Get the FinCon app

If you have a blog or will be there, feel free to leave a comment with the link and your name – I want to meet as many peeps as possible and have so much fun learning at FinCon this week!

If you’re going, be sure to download the FinCon app that includes the full schedule and lets you make a list of all the sessions you want to attend – super handy for keeping it all in some sort of order.

I’ll post more later – but will be in full conference mode this week. So if you don’t hear from me, I’m learning, taking notes, and hopefully getting brand new crazy ideas to write about.

October 23, 2017

5 Ways to Earn Points for Airbnb Stays (10% Back at Least!)

My friend Meghan asked if I knew of any ways to save on an Airbnb booking. I gave the obvious one – get $40 off a $75+ stay with a new account.

New to Airbnb? Save $40 off your first $75+ stay

Most everyone already has an Airbnb account by now. But if you don’t, here’s my link if you’d like to sign up (and I’ll get a $20 travel credit as well).

That’s honestly the biggest savings. Still, there are other ways to get a return on your Airbnb stay: earn points or miles for it. Depending how you like to redeem them, you can get big value by stacking a few of the methods I’ll tell you about.

Lezz begin, shall ve?

5 ways to earn points and miles for Airbnb stays

These tricks are so easy that you’re literally leaving points on the table if you don’t use them. A couple of them require certain credit cards – but a couple are total freebies.

1. Get 3X Delta miles

Link: Delta + Airbnb

Let’s clear the air here. Do I like Delta miles? Hell no. But I certainly won’t say no to them if it’s as simple as clicking a link.

Get 3X Delta miles with this easy, easy win

All you have to do is start your booking at the link above. The terms say it’s for bookings made by October 31st, 2017 for stays completed by October 31st, 2018. But I have some hope this will be renewed.

Considering Delta miles never expire, there’s literally no reason not to scoop this up. A little here and there can add up over time. And Delta does have some flash sales now and again that are worth a look.

You can transfer Amex Membership Rewards points to Delta instantly at a 1:1 ratio. But it’ll be nice if you already have some miles in there so you can save your points for other award flights.

October 17, 2017

Costco Members: 2 Dozen Kirkland Golf Balls for ~$35! (Limit 2)

Quick!

If you’ve been on the hunt for the Kirkland Signature 4-piece Urethane Cover Golf Ball, here’s your chance because they’re back in stock!

Kirkland Signature Golf Balls are a hot item in the resell community

They’re ~$30 for 2 dozen, shipping is ~$5, some states have taxes – and the limit is 2 per membership. If you’ve been looking for these either to resell or just have as gifts or to use, go go go!

The elusive Kirkland Signature Golf Balls are back

Link: Kirkland Signature Golf Balls

“While supplies last.” But considering Christmas is around the corner, these would make excellent gifts if you have a golfer in the family.

They’re also extremely easy to resell on eBay. I took a quick look and they’re selling for ~$40 per dozen.

You could easily make back more than you spend buying these from Costco

If you got the limit of 2, you’d have 4 dozen golf balls.

I paid ~$76 for 4 dozen balls

With tax (I’m in Texas), I paid ~$19 per dozen ($76 / 4). Assuming I can sell each dozen for $40, I’d make $84 back from these ($160 – $76). If you can time the auctions or find a local buyer and sell them all at once, $80+ for a trip to the post office or to drop off is a pretty great return!

Plus, I used my Citi AT&T Access More card and got ~227 Citi ThankYou points. And $1.20 for being a Costco Executive member. That’s an extra $5 back – not a lot but hey, I’ll take it!

In all, and depending when you sell, there’s no reason you can’t make a cool $100 from these little guys.

A low-stress way to resell

Link: Kohl’s Deal Results: What I Learned & How It Turned Out

I bought some appliances from Kohl’s to resell and found the whole experience arduous with the cutting UPCs, trip to the post office, waiting for the rebates, etc.

But this Costco deal would be a straightforward and rather inexpensive way to dip your toe into reselling. If you did 4 individual auctions on eBay, you could get four 5-star reviews in a row to boost your ratings. Also, ~$76 isn’t a lot to float until you can resell them.

What I might actually do is stick these in the closet until December and see if I can get $50 or more per dozen from last-minute Christmas shoppers, which would make my net return even higher. Plus, I’ll get to see if I like reselling enough to keep doing it when deals like this pop up.

If you can’t tell, I’m still a little new to reselling – but even still, this deal is a no-brainer if you have a Costco membership.

Bottom line

Thought I would share. If you:

Know a golfer or like golfing

Want to do some light reselling

Want to stash away some presents

Have been waiting for this product to return

NOW is the time to buy! I don’t expect these to be available online for long. They’re almost always sold out. And with the holidays coming up, it should be easy to resell these or give as gifts in a few weeks.

Let me know if you snag the deal! Good luck!

October 16, 2017

I Had to Use (My Chase Visa’s) Primary Rental Car Insurance – and Saved $692!

It finally happened – I had to file a claim to use my card’s collision damage waiver benefit. I knew the day would arrive sooner or later.

After I hiked down from Granite Park Chalet, I found my rental car had a little *DING* on the front passenger side door. The parking lot was packed, and it was obvious someone parked too close and opened their door too hard into my rental car. It was nearly imperceptible to the point where I thought about not saying anything about it.

See that little dent? Yeah, I nearly didn’t either… *grumble*

But, I was responsible and filed a proper report when I returned the car. I wasn’t expecting to ever hear anything about it again. Until one day, I got a random call saying they filed a claim against me. In a near-panic, I filed my own claim online through Chase in just a few minutes.

THANK GODS I waived the CDW and put the charge on my Chase Sapphire Reserve card. Taking those small steps saved me nearly $700 – for a little ding on a car door.

Chase Sapphire Reserve Primary Rental Car Insurance

Link: Chase Sapphire Reserve Auto Rental Collision Damage Waiver Benefit

I always ALWAYS use my Chase Sapphire Reserve card when I pay for rental cars. I’ve never been involved in an accident – touch wood – but in case anything ever happens, I want to use the primary car rental insurance so I don’t have to involve my personal insurance company.

Again, nothing major has ever happened. But I noticed a ding on the car door of the Chevy Malibu I rented from Budget in Kalispell, Montana.

Here’s a closeup:

Yasss: Just Got My 3rd Discover it® Cashback Match™ Card (And New Application Rules!)

September 30, 2017

Last Day: Get 5,000 Drop Points ($5) for Out and Out Readers!

Link: Download Drop for iOS

Link: Download Drop for Android

Just a quick reminder. Spencer from Straight to the Points set up a special promotion code for Out and Out readers for downloading the Drop app.

Get early access to Drop!

You get:

Early access to the app

Higher earning rates if you sign-up today

5,000 Drop points with promotion code “outandout” – worth a $5 gift certificate at tons of merchants

There’s also an ongoing offer to earn extra points with Plastiq. If you haven’t already, take a minute this Saturday and get $5 free for downloading!

After you link your banks, the points add up automatically. The only reason you’d want to interact with the app is to activate special offers and redeem your points.

There’s currently a waitlist for the public – but the promotion code above also gets you early access. It’s a pretty cool deal, so definitely take advantage if you haven’t already!

Boom

You can also search “earn with Drop” or “Drop loyalty” in your device’s app store to find the app. Follow the prompts and under the “Account” section under Settings, there’s a box that says, “Have a code?” Click it and enter “outandout” to activate your bonus.

September 28, 2017

Is the Chase British Airways Card Worth It for 50,000 Points? Maybe.

Also see:

Get 6X British Airways Avios Points Everywhere on $20K in Spend – Why I Caved

The tiered sign-up bonus for the Chase British Airways card ends on October 5th, 2017 – in one week! Until then, you can earn:

50,000 British Airways Avios points after you spend $3,000 on purchases within the first 3 months from account opening

An additional 25,000 British Airways Avios points after you spend $10,000 total on purchases within your first year from account opening

A further 25,000 British Airways Avios points after you spend $20,000 total on purchases within your first year from account opening for a total of 100,000 bonus Avios

Committing to spend $20,000 on a single card is a lot to ask. And it’s certainly not for most peeps.

Fly to Amsterdam with British Airways Avios points and ride a bike

But it can be worth it to see this as a 50,000 point sign-up offer to spend $3,000 within the first 3 months – that’s much more reasonable. And forget about the other tiers.

50,000 points for that amount of spending it a respectable sign-up bonus. Especially because this card is NOT subject to the Chase 5/24 rule.

And a thank you to Ben for helping to unravel the numbers of this deal even more!

Pick up 50,000 British Airways Avios points

If you open this card and spend $3,000 within the 3-month timeframe, you’ll earn at least 1 point per $1 spent in addition to 50,000 British Airways Avios points. So you end up with 53,000 points for spending $3,000 – which means you earn ~18 cents per $1 (53,000 / 3,000). That alone is an incredible rate of return.

Remember, you can still book flights outside the US under 651 miles for 4,500 Avios points each way. So 53,000 Avios is enough for nearly 12 short one-way flights, or 6 round-trips (53,000 / 4,500).

I have personally booked Sydney-Melbourne on Qantas and Vienna-Budapest on Air Berlin (RIP). And you can still fly cheaply around Asia on JAL and Cathay Pacific. Or around Europe on Finnair or British Airways.

Viva Oneworld

Or short flights on any of these airlines:

American Airlines

British Airways

Cathay Pacific

Finnair

Iberia

Japan Airlines

LATAM

Malaysia Airlines

Qantas

Qatar Airways

Royal Jordanian

S7 Airlines

SriLankan Airlines

It’s also extremely easy to wring value from these short flights. I always want my points to be worth 2 cents each. So before redeeming 4,500 points, I want to make sure they’re worth at least $90 – which is beyond doable.

SYD-MEL flights are $110 to $294 each way – and all of them meet my 2 cents per point requirement

If your 12 one-way flights are even $100 each, that’s worth $1,200 – which is a very good value from one sign-up bonus. That’s if you just wanted 50,000 Avios.

Why would you stop after earning 50,000 points?

Quite simply, opportunity cost. If you’re not locked out of most sign up offers (unlike me), your $20,000 in spending can unlock many money sign up bonuses. Assuming each one is $3,000, that’s another 5+ offers you could unlock ($17,000 / 3)!

Also, your incremental return does decrease. Though you get ~18 cents per $1 for the first $3,000, that rate plummets afterward. You get:

~5 cents per $1 to earn 32,000 Avios for $7,000 more spending

3.5 cents per $1 to earn 35,000 Avios for $10,000 more spending

Those are still fantastic earning rates for non-bonused spend. But if you can do better in a 5X or even 3X category to earn transferable points, it might be worth skipping the extra spending on the Chase British Airways card.

How to meet 90% of your minimum spending in 15 seconds with Plastiq payments

Need a Checking Account With NO Fees, Minimums, or ATM Charges EVER? Try These.

Also see:

Fidelity Cash Management Account: Why It’s Great

Get Instant Access to Aspiration Summit, the Best Checking Account in America

It’s been over 2 years since I first professed my love for the Fidelity Cash Management account. And about the same amount of time since I wrote about the Aspiration Summit account.

My love ❤️

Both are fantastic checking account options because there are no fees, no minimum balances, and no direct deposit requirements. Essentially they’re free to open and keep forever, even if you never use them. Even better, both accounts reimburse ATM fees from ANY ATM in the world. And neither account incurs a hard credit pull to open.

There are a couple of key differences to them, though. I’ll highlight what they are. But, bottom line, you should have at least one of these accounts – if not both!

1. Fidelity Cash Management Account

Link: Open a Fidelity Cash Management account

I can’t say enough good things about this checking account. You can use it anywhere without ATM fees. When you withdraw from a fee-bearing ATM, the fee is reimbursed the same day the charge clears your account. It’s instant.

Boom #donewiththose

It’s also an amazing tool for overseas travel. I transfer some cash into this account a few days before a trip. In the past, I’ve paid nasty interchange charges each time I’ve needed to access my cash. With this card, there is a 1% fee built-in but there are no additional fees. I don’t mind the 1% because it’s $1 per $100 – which is a small price, in my opinion, for all the convenience I get from this account. I love it.

I also use this account for my Airbnb business as a de facto business checking account. I let the balance build every month. Then I pay the rents and bills. And transfer the rest to pay down my student loans. Rinse and repeat each month.

It’s an incredibly easy way to keep all that separate from my (other) main Chase checking account – which I wouldn’t recommend these days. I got it forever ago and don’t pay fees to have it. If I did though, I’d have zero issue dumping it for this account. Now, I like how it keeps things apart per the envelope method.

What to know before you get a Schwab checking account

The inevitable question is, “How does it compare to the Schwab Bank High Yield Investor Checking Account?”

They’re essentially the same. BUT:

Schwab uses a hard pull when you open their account

Fidelity uses a soft pull

Schwab requires you to open an investment account, although you do NOT have to use it – ever – if you don’t want to

Fidelity doesn’t require any other accounts

AND:

Both have no fees

Both reimburse all ATM fees (yes, worldwide)

Both have free bill pay

Both are great if you invest with the respective firms

I didn’t want the hard pull or an account I’d never use. Between them, the Fidelity account was better for me. And I’ve just stuck with it.

2. Aspiration Summit

Link: Open an Aspiration Summit account

So this account has several of the same features as the Fidelity account. And, it has a savings component.

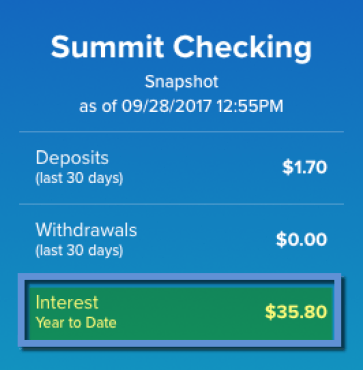

I’ve gotten ~$36 bucks in interest this year. Not a lot but not nothin’

Once you hit $2,500 in the account, you’ll earn 1% interest on the balance, which compounds monthly. So if you’re interested in saving too, this is a great account for an emergency fund.

Get $25 to donate to charity – and I’ll get $25 to donate, too

You’ll also get $25 to donate to charity when you sign up.

There are no fees, no minimums, and no requirements to keep the account free. But there’s one important difference in how ATM fees are reimbursed: it happens when your monthly statement closes instead of when the charge clears, like with Fidelity’s account.

This isn’t a huge issue, but it’s something to be aware of so you can set your expectations.

If you’re interested in a no-fee checking account with global ATM access, this one is another contender.

Which one is best for you?

I give a slight edge to Fidelity for being able to link my IRA accounts. And an edge to Aspiration Summit for its versatility as a savings account. Net-net, both are excellent options.

I’d go with the Fidelity account if you:

Already have other Fidelity accounts

Want your ATM rebates back instantly

Have a Fidelity Visa

I’ve donated $225 to human rights so far because of Out and Out readers!

And recommend the Aspiration Summit account if you:

Don’t mind waiting for the ATM fee reimbursement

Also want a high-yield savings account

Like the charitable giving option

Both accounts a stellar choice for completely free banking. I’ve used both extensively and never had an issue. So I recommend either one wholeheartedly.

And if you are paying fees to have a checking account, to keep a minimum balance, or to access your money… stop that immediately! There’s no need to pay anything.

Bottom line

Link: Open a Fidelity Cash Management account

Link: Open an Aspiration Summit account

I know we get caught up on credit cards in this hobby of ours. But we all need checking accounts to make our payments. There’s simply no need to pay fees to have your money in an account or to access it – no matter where you are in the world.

I’ve withdrawn cash from my Fidelity account in Ireland, Japan, Germany, Chile… and occasionally withdrawn money when I couldn’t use a credit card.

I can personally vouch for either account. It mainly comes down to how quickly you want your ATM fees reimbursed. And if you want a hybrid savings option.

Even if you already have a checking account you like, consider the envelope method – both are great free options for this.

It’s been a while since I’ve mentioned these checking accounts – and I like each for different reasons. Even if you only use them for international ATM withdrawals, that’s reason enough.

So now I’m curious – what’s your favorite checking account? Are there any better than these 2?