Harlan Vaughn's Blog, page 33

November 7, 2017

My Free Anniversary Night in Downtown Austin – Thanks to the Chase Hyatt Card!

Say what you will about Chase, but their hotel cards that come with a free anniversary night are worth every penny.

And fortunately, some of them are still accessible even if you’re over 5/24, including:

Chase IHG – more information here

Chase Marriott Premier small business

Chase Hyatt

I wrote how I got $500 in value from the Chase IHG card earlier this year. And I’ve used my Chase Hyatt free night certificate at the Hyatt Centric in New Orleans and the Hyatt at the Bellevue in Philadelphia. I also wrote about 5 worthwhile Category 4 hotels where you can get a lot of bang for your Hyatt free night cert.

A few of Texas hill country – paid for with my Hyatt free night certificate

And this past weekend, I got a stay worth ~$284 at the Hyatt Place Austin Downtown (full review soon!) in exchange for my $75 annual fee.

With values like this, a card with a valuable free night each cardmember year is a no-brainer to keep year after year. Especially when you can get outsized value in popular areas like downtown Austin.

A cute lil weekend trip

Link: Hyatt Place Austin Downtown

Link: Hyatt Category 4 hotels

On a whim, I planned a trip to Austin. And coincidentally realized I had a free night certificate set to expire soonish. I checked to see what hotels, if any, would be in reach with my free night at a Hyatt Category 1 through 4 hotel. And was surprised to see the Hyatt Place Austin Downtown was available (it’s a Category 4).

Location X 3

As I’m always curious about these things, I had to know what the cash rate for the room would be.

~$284 for the night

Wasn’t surprised to see it was touching the $300 mark. Makes sense, as it’s easy walking distance to 6th Street, Rainey Street, the Capitol building, and more bars and restaurants than you could ever possibly explore. I also walked over to the farmers market at Republic Square and admired the selection of produce and handiworks.

After logging into my account, it was easy to book my free night as it was already applied at the checkout screen.

Gotta love that rate

I pondered using the certificate in New Orleans again. Or maybe in Chicago. Both hotels are on this list of high-value options.

In the end, I decided to make a weekend trip out of it. Requested a 2pm late checkout the next day. And had a free breakfast, a small lie-down, brunch out with friends, and then a leisurely afternoon because they held our bags and let us stay parked in the garage.

All in all, a fantastic start to the weekend.

Two problems with free night certificates

As great as these things are, there are a couple of things to watch for.

1. They’re use it or lose it

Link: AwardWallet

I believe there’s a way to cash in your Hyatt free night for Hyatt points. But for the other free nights mentioned above at IHG and Marriott, they are use or lose. And man, it sneaks up on you!

My solution is to use AwardWallet, which alerts you when you have a cert (or points!) about to expire. You could also set a calendar reminder. Or an alert on your phone. Whatever you choose, be sure to keep track of that expiration date. Because nothing is a good deal if you don’t use it.

2. They’re only 1 night

Grrrr. Who wants to stay somewhere for a night? Luckily, I had friends to stay with on Saturday night. Otherwise, I could’ve:

Used Hyatt points for an additional night

Paid cash for another night

Switched hotels and used other hotel points/certs

Option 1 is my go-to because switching hotels is kind of a pain. Although it can be worth it sometimes to see different parts of a city.

You could also use your free cert for the most expensive night of your stay (assuming there is one). And pay cash for the other night(s).

With IHG, there’s a 2-week overlap with the certificate beginning/expiration dates. So if you time it *just right* you can get a free 2-night stay, like I did earlier this year in New York.

Bottom line

Another year, another outsized value from my Chase Hyatt card’s annual free night certificate. This time at the Hyatt Place Austin Downtown for a night that would’ve cost ~$284.

I love love love these free nights. Although you have to track the expiration date. And it can be tough to only have 1 night somewhere. But I got lucky this time and stayed with friends for the next night of the weekend. And it ended up being a perfect setup for a fun night out on the town because of the easy walking distance to 6th Street.

Other Chase cards with an annual free night include:

Chase IHG – more information here

Chase Marriott Premier small business

Best of all, you can get ALL of these even if you’re over 5/24. Here are a few other hotels to consider for your Hyatt free night.

All this to say… I can’t freaking wait for that new Amex Hilton Aspire card to come out in early 2018. More on that soon, too.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

Hacking Uber: Earn Points, Cashback, and Credits Every Time You Ride

To disclaim up front, I have a difficult relationship with Uber. I don’t like how they treat their drivers, women in particular, and their company culture seems… toxic. For the longest time, you couldn’t even tip your driver, which is why I preferred Lyft.

However, I’ve been riding Uber more lately because they make it so easy to stack multiple offers when you ride.

Oh, Uber. I am “getting there”

And, I’m hopeful they’re slowly but surely turning things around.

With Lyft, you can only earn 3X Delta miles – and 30 JetBlue points on airport trips. Which, meh.

I’d rather earn cashback and Drop points, use travel credits, and get Uber credits for shopping around town. And many times you can stack these deals. You know I love a good stack!

1. Easy win: $1 from Ibotta every time you ride

Link: Download Ibotta

This is an easy, easy win. I like easy wins.

Get $1 from Ibotta every time you take an Uber ride.

A buck back every time

Doesn’t matter how long or short the trip is. Simply open the Ibotta app, click through to Uber, and enter your ride details like usual.

After your trip ends, you’ll get an email from Ibotta saying $1 has been added to your account nearly instantly.

~$146 back to date!

It adds up! You can withdraw the cash to your PayPal or Venmo account (and then to your bank account) when you reach $20 in earned cashback.

Ibotta is also a nifty shopping app where you add offers and scan receipts to earn cashback when you shop. Here’s my review from way back in 2015. I’ve earned ~$146 since I’ve had it! Not bad for a free app – and it’s still going strong.

If you’re new to Ibotta, you can get a $10 bonus when you sign-up with my link and redeem 1 offer. So if you download it and take an Uber ride, you’ll have $11. Keep using it and you’ll have $20 in your bank account in no time.

Also if you take a $10 ride and get $1 back – that’s an easy 10% discount. I live for easy wins like this!

2. 10 Drop points per $1 spent

Link: Download Drop

Another easy win. Another app. This one’s set it and forget it, though.

Raking in the Drop points

You earn 10 drop points per $1 spent on Uber rides. Just download the app (you get $1 if you’re new to Drop), link your cards, and let Drop track the transactions. When you ride with Uber, you’ll see Drop points a couple of days later.

You can redeem Drop points for gift cards to popular merchants like Amazon, Starbucks, iTunes, Groupon… and many more. Beyond download the app and linking your cards, this one is literally effortless. Just make sure to select Uber as one of your 5 ongoing offers. And peek at the app every once in a while to see if you can get a free gift card.

3. Visa Local Offers

This one’s only for select cities, but it’s worth checking in the Uber app to see if you can join.

Uber credits when you link a Visa card

To check, open the app and click “Settings” from the menu in the top left. Scroll down to “Rewards” and see if you can opt-in. If you can, definitely do! Here’s what I see in Dallas:

10% at many merchants

My deals are mostly for restaurants, but Whole Foods caught my eye. There was also a local salon and coffee shop, so it’s not all restaurants. Although it overwhelmingly is.

That doesn’t bother me because I use my Chase Sapphire Reserve for dining anyway. And that’s a Visa.

The way it works is you pay with your Visa card, then the cashback percentage is added to your Uber account as a ride credit. So if you spend $50 on dinner or groceries, you can $5 off your next Uber ride.

And when you stack it with Ibotta and Drop, you get $1 back and 10 Drop points per $1 spent, too. Plus points from using a travel credit card. Pretty easy quadruple dip here. And when you can opt-in, you might find surprise credits in your Uber account for dining out.

And for the love of god, please sign-up for a dining rewards program and earn some extra airline miles, too.

4. Travel credits!

I love this one. Lately, I’ve been using my US Bank Altitude Reserve Visa to pay for Uber rides. I have $325 in travel credits to use this year, and by god I’m gonna get my money’s worth.

Luckily, Uber rides count toward the credit. Many cards come with travel credits these daze:

$200 in Uber rides with Amex Platinum Card ($550 annual fee)

$300 in travel credits from Chase Sapphire Reserve ($450 annual fee)

$325 in travel credits from US Bank Altitude Reserve ($400 annual fee)

That’s $825 in reimbursed rides each year.

These cards come with hefty annual fees. But in the case of the US Bank Altitude Reserve card, the $325 back in Uber rides brings the $400 annual fee down to $75. Plus, I get 12 Gogo passes for in-flight wifi, 3X points on mobile payments, and I got a sweet $750 sign-up bonus. All in all, a major score.

When you use travel credits, you can get:

Points for paying with your card

$1 back from Ibotta

10X Drop points

A completely free ride

I have a lot of these travel credits to burn. So getting $1 back from every ride and the credit card/Drop points is gravy. If you’re in the market for a travel rewards card, thank you for using my links. Oh and don’t forget the no annual fee Amex Ameriprise Platinum Card still has $0 annual fee the first year.

How (and Why!) to Use Mint.com to Track Your Credit Card Spending

With over 30 credit cards in my sock drawer wallet now, I have a lot to keep track of. Especially minimum spending requirements and limited-time promotions. I’ve long advocated everyone use Mint.com to track transactions on all their accounts.

Especially because you can see your transactions at a glance – that’s helpful to monitor any unwanted activity if you have several accounts.

Mint.com is the (free!) ace in your hole

But there’s another extremely helpful use: you can track your spending on a particular account based on date or timeframe. Which helps you know how close you are to meeting a spending threshold. Here’s how.

Mint.com – an easy way to track your spending

Link: Mint.com

Recently, I had a promotion on my Chase United Explorer card (which I never use

November 6, 2017

The Dublin 2017: $2,000+ Cashback This Year From a No Annual Fee Card

Oh my word, I am in love with the Discover it® Cashback Match™ card. I just got my third one and am already busy earning that sweet cashback.

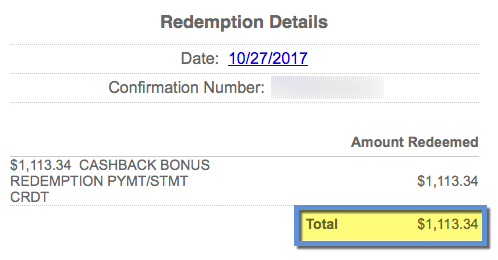

After the first year with my first card, I earned ~$1,184 in matched cashback (~$2,368 in cashback for the year). And after the first year with the second card – this year – I earned ~$1,113 in matched cashback. Or ~$2,226 for the year. All this from a card with no annual fee and no foreign transaction fees.

Incredible – look at that sweet cashback

It’s easy to get $600 in cashback if you make the most of the bonus categories. And you can get a sometimes staggering 30% cashback by stacking the Discover Deals shopping portal with the rotating quarterly bonus categories. When I say “it adds up” I mean it REALLY adds up!

I wasn’t sure if I could get the same card 3 years in a row. But I’m living proof that you can. And even at the low end, $600 back from a no annual fee card is still worth it. I think everyone (especially those over 5/24) should get this card!

Why now is an amazing time to get a Discover it® Cashback Match™ card

Link: Sign-up for Discover it® Cashback Match™ Card

Take a look at the cashback calendar:

#relevant

If you sign-up now, you’ll get the card in time to use it at Amazon and Target through the end of the 2017 and get 5% cashback at those 2 popular Christmas merchants.

Then, a year from now, you’ll have October and some of November to max out the Amazon and wholesale clubs category again before receiving your cashback match after your 12th billing cycle.

In between, there are popular bonus categories, like wholesale clubs (again), grocery stores, and restaurants: most everyone spends in these categories. And they are an easy win for some extra cashback. I’m all about the easy wins!

It grows in the heart

So this is like, weird, but I’ve actually grown to love the Discover brand. I obviously use Chase cards to earn Ultimate Rewards points, and other cards for travel credits, category bonus points, etc.

I do NOT care about Discover’s “Freeze It” feature (where you can freeze your card from spending activity with a click), their credit monitoring, or free FICO score. Those are great features, but what I DO love is their wonderful iPhone app, website interface, and how easy they make it to interact with the card.

I have some sort of animosity for Chase even though I love their points, for Citi because of their “family of brands” rule, and for Amex because of “once per lifetime.”

It’s ruv

But Discover loves me and continues to reward me for putting spend on their cards without restriction – and I love them for that.

I’ve grown to appreciate the reliability and dependability of The Dublin – it’s a yearly event I anticipate for months. And for that moment of joy, I’ve fallen in love with the Discover brand.

I’m not worried about “taking their money” and getting a new card. Because I use my Discover it® Cashback Match™ card constantly – something that surprised me. I thought I’d get the bonus and run or whatever, but I’ve continually found the payouts on Discover Deals to be the best many times over.

And, Discover is making money off the interchange fees. This card is almost always in my wallet despite (or in addition to) category bonuses on other cards. And for card issuers, being top of wallet is all they ever ask for. Discover has that from me. And I really do love this card now. *long dreamy sigh* It’s interesting how you start to having feelings of loyalty for certain brands over time.

Bottom line

This card just doesn’t quit! I got my third Discover it® Cashback Match™ card and couldn’t be more pleased about it. This card has been my trusty companion for the last 2 years. And I already have a healthy start on my Christmas shopping with the fantastic 5% cashback categories.

I’m also riding the high of getting ~$1,113 in pure cash as my cashback match this year. In fact, the $2,200 mark is where I’ve been shooting for the past 2 years now. And with my 3rd card in hand, I expect to get about that much – again! – in the upcoming year.

For a card with no annual fee and no forex fees and few sign-up restrictions, you just can’t beat it with a stick. Most peeps, either new to points or long-timers in “The Hobby” can do well with this seemingly magical card that I’ve fallen in love with over the past couple of years.

If you sign-up with my link, you’ll get $50 after your 1st purchase within 3 months of account opening. And of course that’s matched to become $100 total (after your 12th billing cycle). That should jump-start you toward an easy $600 in the first year.

I write about this card often because I truly think it’s a great deal. Especially with the holidays coming up and the Amazon/Target bonus categories, now’s a fantastic time to consider this card for Christmas purchases with a cashback match 2 years in a row (November and December of 2017 and October of 2018). You could even use the cashback match to buy Christmas presents for loved ones.

The Dublin 2017: $2,000+ Cashback This Year From a No Annual Fee Card

Oh my word, I am in love with the Discover it® Cashback Match™ card. I just got my third one and am already busy earning that sweet cashback.

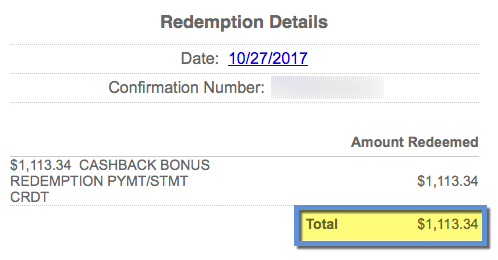

After the first year with my first card, I earned ~$1,184 in matched cashback (~$2,368 in cashback for the year). And after the first year with the second card – this year – I earned ~$1,113 in matched cashback. Or ~$2,226 for the year. All this from a card with no annual fee and no foreign transaction fees.

Incredible – look at that sweet cashback

It’s easy to get $600 in cashback if you make the most of the bonus categories. And you can get a sometimes staggering 30% cashback by stacking the Discover Deals shopping portal with the rotating quarterly bonus categories. When I say “it adds up” I mean it REALLY adds up!

I wasn’t sure if I could get the same card 3 years in a row. But I’m living proof that you can. And even at the low end, $600 back from a no annual fee card is still worth it. I think everyone (especially those over 5/24) should get this card!

Why now is an amazing time to get a Discover it® Cashback Match™ card

Link: Sign-up for Discover it® Cashback Match™ Card

Take a look at the cashback calendar:

#relevant

If you sign-up now, you’ll get the card in time to use it at Amazon and Target through the end of the 2017 and get 5% cashback at those 2 popular Christmas merchants.

Then, a year from now, you’ll have October and some of November to max out the Amazon and wholesale clubs category again before receiving your cashback match after your 12th billing cycle.

In between, there are popular bonus categories, like wholesale clubs (again), grocery stores, and restaurants: most everyone spends in these categories. And they are an easy win for some extra cashback. I’m all about the easy wins!

It grows in the heart

So this is like, weird, but I’ve actually grown to love the Discover brand. I obviously use Chase cards to earn Ultimate Rewards points, and other cards for travel credits, category bonus points, etc.

I do NOT care about Discover’s “Freeze It” feature (where you can freeze your card from spending activity with a click), their credit monitoring, or free FICO score. Those are great features, but what I DO love is their wonderful iPhone app, website interface, and how easy they make it to interact with the card.

I have some sort of animosity for Chase even though I love their points, for Citi because of their “family of brands” rule, and for Amex because of “once per lifetime.”

It’s ruv

But Discover loves me and continues to reward me for putting spend on their cards without restriction – and I love them for that.

I’ve grown to appreciate the reliability and dependability of The Dublin – it’s a yearly event I anticipate for months. And for that moment of joy, I’ve fallen in love with the Discover brand.

I’m not worried about “taking their money” and getting a new card. Because I use my Discover it® Cashback Match™ card constantly – something that surprised me. I thought I’d get the bonus and run or whatever, but I’ve continually found the payouts on Discover Deals to be the best many times over.

And, Discover is making money off the interchange fees. This card is almost always in my wallet despite (or in addition to) category bonuses on other cards. And for card issuers, being top of wallet is all they ever ask for. Discover has that from me. And I really do love this card now. *long dreamy sigh* It’s interesting how you start to having feelings of loyalty for certain brands over time.

Bottom line

This card just doesn’t quit! I got my third Discover it® Cashback Match™ card and couldn’t be more pleased about it. This card has been my trusty companion for the last 2 years. And I already have a healthy start on my Christmas shopping with the fantastic 5% cashback categories.

I’m also riding the high of getting ~$1,113 in pure cash as my cashback match this year. In fact, the $2,200 mark is where I’ve been shooting for the past 2 years now. And with my 3rd card in hand, I expect to get about that much – again! – in the upcoming year.

For a card with no annual fee and no forex fees and few sign-up restrictions, you just can’t beat it with a stick. Most peeps, either new to points or long-timers in “The Hobby” can do well with this seemingly magical card that I’ve fallen in love with over the past couple of years.

If you sign-up with my link, you’ll get $50 after your 1st purchase within 3 months of account opening. And of course that’s matched to become $100 total (after your 12th billing cycle). That should jump-start you toward an easy $600 in the first year.

I write about this card often because I truly think it’s a great deal. Especially with the holidays coming up and the Amazon/Target bonus categories, now’s a fantastic time to consider this card for Christmas purchases with a cashback match 2 years in a row (November and December of 2017 and October of 2018). You could even use the cashback match to buy Christmas presents for loved ones.

The Dublin 2017: $2,000+ Cashback This Year From a No Annual Fee Card

Oh my word, I am in love with the Discover it® Cashback Match™ card. I just got my third one and am already busy earning that sweet cashback.

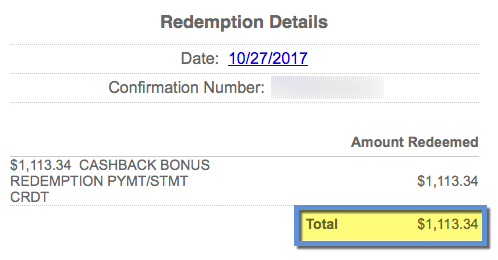

After the first year with my first card, I earned ~$1,184 in matched cashback (~$2,368 in cashback for the year). And after the first year with the second card – this year – I earned ~$1,113 in matched cashback. Or ~$2,226 for the year. All this from a card with no annual fee and no foreign transaction fees.

Incredible – look at that sweet cashback

It’s easy to get $600 in cashback if you make the most of the bonus categories. And you can get a sometimes staggering 30% cashback by stacking the Discover Deals shopping portal with the rotating quarterly bonus categories. When I say “it adds up” I mean it REALLY adds up!

I wasn’t sure if I could get the same card 3 years in a row. But I’m living proof that you can. And even at the low end, $600 back from a no annual fee card is still worth it. I think everyone (especially those over 5/24) should get this card!

Why now is an amazing time to get a Discover it® Cashback Match™ card

Link: Sign-up for Discover it® Cashback Match™ Card

Take a look at the cashback calendar:

#relevant

If you sign-up now, you’ll get the card in time to use it at Amazon and Target through the end of the 2017 and get 5% cashback at those 2 popular Christmas merchants.

Then, a year from now, you’ll have October and some of November to max out the Amazon and wholesale clubs category again before receiving your cashback match after your 12th billing cycle.

In between, there are popular bonus categories, like wholesale clubs (again), grocery stores, and restaurants: most everyone spends in these categories. And they are an easy win for some extra cashback. I’m all about the easy wins!

It grows in the heart

So this is like, weird, but I’ve actually grown to love the Discover brand. I obviously use Chase cards to earn Ultimate Rewards points, and other cards for travel credits, category bonus points, etc.

I do NOT care about Discover’s “Freeze It” feature (where you can freeze your card from spending activity with a click), their credit monitoring, or free FICO score. Those are great features, but what I DO love is their wonderful iPhone app, website interface, and how easy they make it to interact with the card.

I have some sort of animosity for Chase even though I love their points, for Citi because of their “family of brands” rule, and for Amex because of “once per lifetime.”

It’s ruv

But Discover loves me and continues to reward me for putting spend on their cards without restriction – and I love them for that.

I’ve grown to appreciate the reliability and dependability of The Dublin – it’s a yearly event I anticipate for months. And for that moment of joy, I’ve fallen in love with the Discover brand.

I’m not worried about “taking their money” and getting a new card. Because I use my Discover it® Cashback Match™ card constantly – something that surprised me. I thought I’d get the bonus and run or whatever, but I’ve continually found the payouts on Discover Deals to be the best many times over.

And, Discover is making money off the interchange fees. This card is almost always in my wallet despite (or in addition to) category bonuses on other cards. And for card issuers, being top of wallet is all they ever ask for. Discover has that from me. And I really do love this card now. *long dreamy sigh* It’s interesting how you start to having feelings of loyalty for certain brands over time.

Bottom line

This card just doesn’t quit! I got my third Discover it® Cashback Match™ card and couldn’t be more pleased about it. This card has been my trusty companion for the last 2 years. And I already have a healthy start on my Christmas shopping with the fantastic 5% cashback categories.

I’m also riding the high of getting ~$1,113 in pure cash as my cashback match this year. In fact, the $2,200 mark is where I’ve been shooting for the past 2 years now. And with my 3rd card in hand, I expect to get about that much – again! – in the upcoming year.

For a card with no annual fee and no forex fees and few sign-up restrictions, you just can’t beat it with a stick. Most peeps, either new to points or long-timers in “The Hobby” can do well with this seemingly magical card that I’ve fallen in love with over the past couple of years.

If you sign-up with my link, you’ll get $50 after your 1st purchase within 3 months of account opening. And of course that’s matched to become $100 total (after your 12th billing cycle). That should jump-start you toward an easy $600 in the first year.

I write about this card often because I truly think it’s a great deal. Especially with the holidays coming up and the Amazon/Target bonus categories, now’s a fantastic time to consider this card for Christmas purchases with a cashback match 2 years in a row (November and December of 2017 and October of 2018). You could even use the cashback match to buy Christmas presents for loved ones.