Harlan Vaughn's Blog, page 32

November 24, 2017

Don’t Forget the Pups: First BarkBox FREE With 6+ Months of Toys & Treats

With all the holiday deals out there, here’s another I wanted to share: BarkBox. I’ve had this monthly subscription since December 2013 for my 7-year-old Corgi/Shepherd mix who is also the love of my life, Fenwick.

I wouldn’t share this if I didn’t truly love it. But it’s worth every last freakin’ cent. Every month, they stuff the boxes with:

2 high-quality chew toys

At least 2 bags of treats

Something to snack on, like a bully stick

I have been continually impressed with the quality of the treats and toys. And Fenwick loves opening his BarkBox every month. It saves me on having to buy treats (I have bags and bags of extras). And if your dog likes to rip up toys or chew the hell out of ’em, they’ll get that moment of bliss every month.

Fenwick can’t decide which BarkBox toy to play with first!

I estimate each box is worth $40+. And I’d have to buy treats anyway.

The 12-month plan is $20 a box. And the 6-month plan is $25 a box. If you wanna try it out, your first box is completely free when you sign-up with my link. This is better than the best publicly available offer to get your first box for $5! To get the free box, you must subscribe to a 6- or 12- month plan.

Get a BarkBox free trial

Link: BarkBox

Even better, you can cancel any time.

I started 4 years ago with a free box and never looked back. Even through bouts of unemployment, changing apartments, and moving from New York to Dallas, Fenwick’s BarkBox has always been a constant in our lives.

Who could say no to that little face?

He loves playing with his toys and looooves his treats. $20 a month is totally worth it for my baby dog.

BarkBox pricing

You get the best deal when you spring for the 12-month subscription. You pay as you go, not upfront. And you can cancel whenever. I’ve always found the customer support to be fast and responsive when I’ve had to change address/missed a box/etc.

If you have a multi-dog household, even better. You’ll wind up with so many extras!

I actually can’t use the treats fast enough! When I travel, I use Rover to book Fenwick’s favorite sitters and always throw in an extra bag to share with other dogs.

If you have more than one pup at home, they can definitely share the surplus of treats and toys!

BarkBox would make an excellent gift for your dog or for someone you know who has a dog. I actually tell people to get Fenwick gifts instead of me – and he’s a very spoiled pup!

Don’t Forget the Pups: First BarkBox FREE With 6+ Months of Toys & Treats

With all the holiday deals out there, here’s another I wanted to share: BarkBox. I’ve had this monthly subscription since December 2013 for my 7-year-old Corgi/Shepherd mix who is also the love of my life, Fenwick.

I wouldn’t share this if I didn’t truly love it. But it’s worth every last freakin’ cent. Every month, they stuff the boxes with:

2 high-quality chew toys

At least 2 bags of treats

Something to snack on, like a bully stick

I have been continually impressed with the quality of the treats and toys. And Fenwick loves opening his BarkBox every month. It saves me on having to buy treats (I have bags and bags of extras). And if your dog likes to rip up toys or chew the hell out of ’em, they’ll get that moment of bliss every month.

Fenwick can’t decide which BarkBox toy to play with first!

I estimate each box is worth $40+. And I’d have to buy treats anyway.

The 12-month plan is $20 a box. And the 6-month plan is $25 a box. If you wanna try it out, your first box is completely free when you sign-up with my link. This is better than the best publicly available offer to get your first box for $5! To get the free box, you must subscribe to a 6- or 12- month plan.

Get a BarkBox free trial

Link: BarkBox

Even better, you can cancel any time.

I started 4 years ago with a free box and never looked back. Even through bouts of unemployment, changing apartments, and moving from New York to Dallas, Fenwick’s BarkBox has always been a constant in our lives.

Who could say no to that little face?

He loves playing with his toys and looooves his treats. $20 a month is totally worth it for my baby dog.

BarkBox pricing

You get the best deal when you spring for the 12-month subscription. You pay as you go, not upfront. And you can cancel whenever. I’ve always found the customer support to be fast and responsive when I’ve had to change address/missed a box/etc.

If you have a multi-dog household, even better. You’ll wind up with so many extras!

I actually can’t use the treats fast enough! When I travel, I use Rover to book Fenwick’s favorite sitters and always throw in an extra bag to share with other dogs.

If you have more than one pup at home, they can definitely share the surplus of treats and toys!

BarkBox would make an excellent gift for your dog or for someone you know who has a dog. I actually tell people to get Fenwick gifts instead of me – and he’s a very spoiled pup!

Don’t Forget the Pups: First BarkBox FREE With 6+ Months of Toys & Treats

With all the holiday deals out there, here’s another I wanted to share: BarkBox. I’ve had this monthly subscription since December 2013 for my 7-year-old Corgi/Shepherd mix who is also the love of my life, Fenwick.

I wouldn’t share this if I didn’t truly love it. But it’s worth every last freakin’ cent. Every month, they stuff the boxes with:

2 high-quality chew toys

At least 2 bags of treats

Something to snack on, like a bully stick

I have been continually impressed with the quality of the treats and toys. And Fenwick loves opening his BarkBox every month. It saves me on having to buy treats (I have bags and bags of extras). And if your dog likes to rip up toys or chew the hell out of ’em, they’ll get that moment of bliss every month.

Fenwick can’t decide which BarkBox toy to play with first!

I estimate each box is worth $40+. And I’d have to buy treats anyway.

The 12-month plan is $20 a box. And the 6-month plan is $25 a box. If you wanna try it out, your first box is completely free when you sign-up with my link. This is better than the best publicly available offer to get your first box for $5! To get the free box, you must subscribe to a 6- or 12- month plan.

Get a BarkBox free trial

Link: BarkBox

Even better, you can cancel any time.

I started 4 years ago with a free box and never looked back. Even through bouts of unemployment, changing apartments, and moving from New York to Dallas, Fenwick’s BarkBox has always been a constant in our lives.

Who could say no to that little face?

He loves playing with his toys and looooves his treats. $20 a month is totally worth it for my baby dog.

BarkBox pricing

You get the best deal when you spring for the 12-month subscription. You pay as you go, not upfront. And you can cancel whenever. I’ve always found the customer support to be fast and responsive when I’ve had to change address/missed a box/etc.

If you have a multi-dog household, even better. You’ll wind up with so many extras!

I actually can’t use the treats fast enough! When I travel, I use Rover to book Fenwick’s favorite sitters and always throw in an extra bag to share with other dogs.

If you have more than one pup at home, they can definitely share the surplus of treats and toys!

BarkBox would make an excellent gift for your dog or for someone you know who has a dog. I actually tell people to get Fenwick gifts instead of me – and he’s a very spoiled pup!

November 23, 2017

Trim + Paribus: 2 MUSTS for Online Holiday Shopping (Save Money & Time)

If you plan on purchasing gifts online this holiday season, there are two major things to watch for: price drops and missed delivery dates.

Price drops are extremely common with the onslaught of Black Friday/Cyber Monday deals – and often there are even more as “the big day” draws near.

Trim is useful to:

Track price changes on Amazon

Set spending alerts

Monitor your monthly subscriptions

Get the best price on your cable/internet bill

Trim lets you know when a price on Amazon decreases

And I wrote about Paribus waaaay back in May 2015. Not only has their service improved – it’s now completely free.

It’s helpful for tracking price drops at tons of merchants. And helps you get a little something (refund on shipping, store credit, Amazon Prime extension) if there’s a late delivery.

Both of these tools can save you money automatically in the background while you go about your shopping. They’re even better when their powers combine.

Trim aims to help your overall financial life

Link: Trim

Trim is a little worker bee that buzzes around to save you money on your subscriptions, internet bill, and Amazon shopping.

What Trim’s about

When you plug-in your bank accounts, it also tracks your transactions so you can see if anything’s amiss (fraud, overcharging, etc.). And can send you spending alerts for large purchases on upcoming bill due dates. It can text them to you or send them via Facebook Messenger – cool!

1. Subscription services

Trim scans for recurring monthly charges AKA subscription services. I’m spending ~$103 a month on various services.

Most of it is the ~$36 for my dog’s pet insurance and $19 a month for his BarkBox (which is an amazing deal if you have a pup or know someone who does – Fenwick LOVES his BarkBox and I love the high-quality toys and treats).

Not shocked, honestly

So that’s over half of it right there, just on my dog. Which is fine because… I love him. The rest is for MoviePass, Google Photos, Spotify, Netflix, and CrashPlan Pro. All things I use daily or often. And around $100 is right where I want to be for automatic charges.

Anyhoo, you can cancel any pesky subscriptions directly within Trim. (I already got rid of the New York Times subscription.) This is a super cool feature for seeing where you spend money each month – and how much.

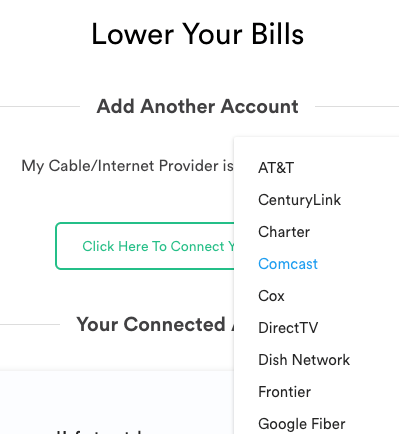

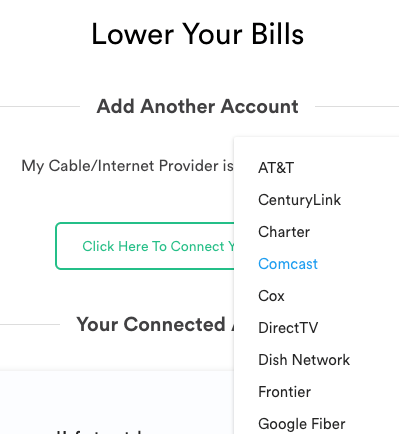

2. Save on cable/internet

This feature has helped me personally.

Select your provider and log in

If your cable or internet bills increase, or if there’s a special offer, Trim goes to work to get you the best price for your area. Spectrum (formerly Time Warner) loooves to give a 12-month “intro” rate then jack it up after a year. Trim proactively caught this on my account and got the intro rate “extended” for me. Pretty cool that I didn’t have to track it or call Spectrum – Trim saved me money (and time!) automatically.

3. Track Amazon price drops

This is a “beta” feature. But if you have a credit card with price protection (most cards have this standard, but especially Amex and Citi cards), they’ll compile a screenshot of the price drop, your invoice, and a document on how to file. But you have to download them and submit the claim. Still, if you have a few of them, or if you see one for a lot of money, that’s extremely helpful.

Amazon has made it harder recently to request price adjustments, so they place the onus on the customer. And Trim makes that easier for you.

You get nothing back if you pay with an Amazon gift card and there’s a price drop. But lots of credit cards let you file for price protection – this could be a big win during a big holiday sale. Especially for larger purchases, like electronics or furniture.

Track price changes with Paribus

Link: Paribus

Paribus tracks a TON of merchants:

If you shop at any of these places, get Paribus!

Here’s how to set it up. Paribus will contact the merchant on your behalf to request a price adjustment. Except for Amazon, as mentioned earlier (which is where Trim comes in).

This one’s already in my favor, but I’m glad Paribus is tracking it!

Most merchants issue the price difference back to your original payment method.

BUT. It’s still gold for Amazon. They either get you an Amazon Prime extension…

My lamps where late, so I got a free month of Prime!

…or store credit.

My vitamins were late, so I got a $10 credit!

I’ve also gotten random credits to my cards when Paribus found lower prices. I’m pretty handy with finding the best deals and using promotion codes, but ~$58 in savings has returned to me thanks to Paribus.

Paribus saved me ~$58 with no intervention on my part

It’s all automatic. And with holiday sales coming up, this is the ace in your hand for saving even more money when you shop.

Bottom line

Link: Trim

Link: Paribus

Trim and Paribus are handy (free!) tools for saving money when you shop online. Between the two of them, they’ll track price changes at lots of popular merchants. And can save you time by filing price adjustment or late delivery claims on your behalf.

Trim takes things a step further by tracking monthly subscriptions and keeping an eye on your cable/internet bill. It can also send you account alerts via text or Facebook.

I have personally benefitted from both of these services. I don’t login a lot – rather, they’re “set it and forget it.” I have seen the emails where I got a free month of Amazon Prime or a credit to one of my cards. With the holidays coming up, save as much money and time as you can. Money is always good to save and time – wow – that’s a huge one when you’re running around every day.

If you’ve used either, do you recommend them? Are there other tools to track price changes I missed?

Trim + Paribus: 2 MUSTS for Online Holiday Shopping (Save Money & Time!)

If you plan on purchasing gifts online this holiday season, there are two major things to watch for: price drops and missed delivery dates.

Price drops are extremely common with the onslaught of Black Friday/Cyber Monday deals – and often there are even more as “the big day” draws near.

Trim is useful to:

Track price changes on Amazon

Set spending alerts

Monitor your monthly subscriptions

Get the best price on your cable/internet bill

Trim lets you know when a price on Amazon decreases

And I wrote about Paribus waaaay back in May 2015. Not only has their service improved – it’s now completely free.

It’s helpful for tracking price drops at tons of merchants. And helps you get a little something (refund on shipping, store credit, Amazon Prime extension) if there’s a late delivery.

Both of these tools can save you money automatically in the background while you go about your shopping. They’re even better when their powers combine.

Trim aims to help your overall financial life

Link: Trim

Trim is a little worker bee that buzzes around to save you money on your subscriptions, internet bill, and Amazon shopping.

What Trim’s about

When you plug-in your bank accounts, it also tracks your transactions so you can see if anything’s amiss (fraud, overcharging, etc.). And can send you spending alerts for large purchases on upcoming bill due dates. It can text them to you or send them via Facebook Messenger – cool!

1. Subscription services

Trim scans for recurring monthly charges AKA subscription services. I’m spending ~$103 a month on various services.

Most of it is the ~$36 for my dog’s pet insurance and $19 a month for his BarkBox (which is an amazing deal if you have a pup or know someone who does – Fenwick LOVES his BarkBox and I love the high-quality toys and treats).

Not shocked, honestly

So that’s over half of it right there, just on my dog. Which is fine because… I love him. The rest is for MoviePass, Google Photos, Spotify, Netflix, and CrashPlan Pro. All things I use daily or often. And around $100 is right where I want to be for automatic charges.

Anyhoo, you can cancel any pesky subscriptions directly within Trim. (I already got rid of the New York Times subscription.) This is a super cool feature for seeing where you spend money each month – and how much.

2. Save on cable/internet

This feature has helped me personally.

Select your provider and log in

If your cable or internet bills increase, or if there’s a special offer, Trim goes to work to get you the best price for your area. Spectrum (formerly Time Warner) loooves to give a 12-month “intro” rate then jack it up after a year. Trim proactively caught this on my account and got the intro rate “extended” for me. Pretty cool that I didn’t have to track it or call Spectrum – Trim saved me money (and time!) automatically.

3. Track Amazon price drops

This is a “beta” feature. But if you have a credit card with price protection (most cards have this standard, but especially Amex and Citi cards), they’ll compile a screenshot of the price drop, your invoice, and a document on how to file. But you have to download them and submit the claim. Still, if you have a few of them, or if you see one for a lot of money, that’s extremely helpful.

Amazon has made it harder recently to request price adjustments, so they place the onus on the customer. And Trim makes that easier for you.

You get nothing back if you pay with an Amazon gift card and there’s a price drop. But lots of credit cards let you file for price protection – this could be a big win during a big holiday sale. Especially for larger purchases, like electronics or furniture.

Track price changes with Paribus

Link: Paribus

Paribus tracks a TON of merchants:

If you shop at any of these places, get Paribus!

Here’s how to set it up. Paribus will contact the merchant on your behalf to request a price adjustment. Except for Amazon, as mentioned earlier (which is where Trim comes in).

This one’s already in my favor, but I’m glad Paribus is tracking it!

Most merchants issue the price difference back to your original payment method.

BUT. It’s still gold for Amazon. They either get you an Amazon Prime extension…

My lamps where late, so I got a free month of Prime!

…or store credit.

My vitamins were late, so I got a $10 credit!

I’ve also gotten random credits to my cards when Paribus found lower prices. I’m pretty handy with finding the best deals and using promotion codes, but ~$58 in savings has returned to me thanks to Paribus.

Paribus saved me ~$58 with no intervention on my part

It’s all automatic. And with holiday sales coming up, this is the ace in your hand for saving even more money when you shop.

Bottom line

Link: Trim

Link: Paribus

Trim and Paribus are handy (free!) tools for saving money when you shop online. Between the two of them, they’ll track price changes at lots of popular merchants. And can save you time by filing price adjustment or late delivery claims on your behalf.

Trim takes things a step further by tracking monthly subscriptions and keeping an eye on your cable/internet bill. It can also send you account alerts via text or Facebook.

I have personally benefitted from both of these services. I don’t login a lot – rather, they’re “set it and forget it.” I have seen the emails where I got a free month of Amazon Prime or a credit to one of my cards. With the holidays coming up, save as much money and time as you can. Money is always good to save and time – wow – that’s a huge one when you’re running around every day.

If you’ve used either, do you recommend them? Are there other tools to track price changes I missed?

PSA: Get Your FREE Kindle Book Via the IHG App

Also see:

Everyone Can Get Free Kindle eBooks From IHG App

Just a little reminder to go grab your free Kindle single from the IHG app! I wrote about how to do this in February this year. And thought it might be a nice happy during the busy holiday travel season.

I already got mine!

Check the IHG app to see how many books you can get

As a reminder, you can get:

2 free books per year if you make an IHG account (1 every 6 months)

4 free books per year if you’re Gold elite (1 per quarter)

8 free books per year if you’re Platinum elite (2 per quarter)

12 free books per year if you’re Spite Elite (3 per quarter)

The app lets you know when you can come back for another

If you have the Chase IHG card, you get 2 free Kindle singles each quarter. They only cost a few bucks at most, but hey, free is free!

There’s a nice array of genres to choose from

Most everyone will find something of interest. If you hate it, nothing lost. And you might discover a new author.

Get you a good deal on a Fire tablet tmrw, boo

If you don’t have a Kindle, you can use the Kindle app to read on your phone or computer. Or if you want a Kindle, keep an eye out for a good deal tomorrow during Amazon’s Black Friday sale!

Free Kindle IHG App

Link: IHG app for iOS

Link: IHG app for Android

Link: Kindle app for iOS

Link: Kindle for Android

Happy holidays everyone!

PSA: Get Your FREE Kindle Book Via the IHG App!

Also see:

Everyone Can Get Free Kindle eBooks From IHG App

Just a little reminder to go grab your free Kindle single from the IHG app! I wrote about how to do this in February this year. And thought it might be a nice happy during the busy holiday travel season.

I already got mine!

Check the IHG app to see how many books you can get

As a reminder, you can get:

2 free books per year if you make an IHG account (1 every 6 months)

4 free books per year if you’re Gold elite (1 per quarter)

8 free books per year if you’re Platinum elite (2 per quarter)

12 free books per year if you’re Spite Elite (3 per quarter)

The app lets you know when you can come back for another

If you have the Chase IHG card, you get 2 free Kindle singles each quarter. They only cost a few bucks at most, but hey, free is free!

There’s a nice array of genres to choose from

Most everyone will find something of interest. If you hate it, nothing lost. And you might discover a new author.

Get you a good deal on a Fire tablet tmrw, boo

If you don’t have a Kindle, you can use the Kindle app to read on your phone or computer. Or if you want a Kindle, keep an eye out for a good deal tomorrow during Amazon’s Black Friday sale!

Free Kindle IHG App

Link: IHG app for iOS

Link: IHG app for Android

Link: Kindle app for iOS

Link: Kindle for Android

Happy holidays everyone!

Need a Drink? Get a Free Cocktail Every Day for $10 a Month (in AZ, CA, FL, NJ, NY, TX, HKG)

How I did not discover by now is beyond me. If you need a nice stiff drink this holiday season, here’s an extremely good deal.

With the Hooch app, you get 1 drink per day (in select cities) for ~$10 a month. The list of bars is pretty solid – and more importantly, the drinks are good!

I am loving Hooch so far. A drink a day for $10 a month!

And if you use my link to sign-up, your first month is only $1 when you enter code “02803c“! Plus, they have a great deal on gift memberships until November 26th, 2017 (Sunday)!

I tried the app myself. Here’s what I think so far.

Out and Out’s Hooch app review

Link: Sign-up for Hooch (use code “02803c” to get your first month for $1)

To start, the reason I downloaded the app is because I live in Dallas (one of the featured cities). And my first month was only $1. I saw I could cancel any time, so I set a reminder in Todoist to do just that if I didn’t like it.

Plus, I noticed one of the participating bars was literally across the street from my downtown Dallas Airbnb. And I was going there that night!

Free hooch at The Mitchell in downtown Dallas!

I put it to use right away.

For one, you can NOT go in and order any cocktail. Instead, you have 3 options to choose from. Mine were:

Miss Mitchell (a bubbly cocktail)

Pony + Shot (Miller High Life and Legacy whiskey)

Classic gin and tonic (duh)

You can see what’s in a drink before you select it

On the menu, these drinks were all ~$12+. So I got my money’s worth right away!

Once you tap “Select Drink,” you have 3 minutes to show a bartender – because at this point you’ve redeemed your drink for the day.

I showed the bartender the app and he knew what it was right away and confirmed the gin and tonic. Easy as that. No codes to scan or anything.

A few minutes later…

Ahhh… Cheers to free drinks!

…I had G&T in hand.

November 14, 2017

New Credit Card Checklist: What to Do When You Receive Your New Card

Getting a new credit card is a big step for lots of peeps. It’s a new account, new financial history, and something else to track.

Did you know your new credit card came with a checklist? It does. Sorry

Some of you might be like “Ugh,” but I’m like “Yay!” Even though I have 33 credit cards right now (yep!).

Here are the steps I take with each new card. And you should, too. It’ll help maximize your benefits, earn more rewards, and keep track of what’s what!

So ya got a new card, eh?

Cool! Activate that sucker. And then to these things.

1. Keep track of your minimum spending

Chances are you have to spend $X,XXX amount in X timeframe to earn some awesome sign-up bonus. #kewlz

But, did ya know the clock is already ticking? It began the second you were approved for the card, NOT when you received or activated it. So you’re probably already a week or so behind by the time you first hold it in your hot little hand.

Make a note of your approval date. Or set a reminder on your calendar or phone. This date is so important. Because if you miss your timeframe, the banks will likely not have sympathy for you. So that’s the ultra first step.

Remember, you can always use Plastiq to meet your minimum spending in just a few minutes. Note that any annual fees do NOT count toward minimum spending.

2. Record that sucker

Link: Evernote

Link: 7 Awesome Uses of Evernote for Travelers

Snap a picture of that bad boy into your Evernote account. I find it’s helpful because:

You always have the card number available even if you’re not at home

It’s time-stamped, so you can see when you got it

You can look it up on your computer when you’re too lazy to get up (#me

Acorns: A Simple Way for Beginners to Invest (And You Should!)

Lately, I’m concerned with helping my 24-year-old brother develop healthy financial habits. I didn’t take control of my financial life until I was nearly 30. And god I wish I could get back those early years. Why?

Compound interest is the most powerful force in the universe.

The earlier you start, the longer your money grows. It’s a simple concept. But so many peeps put off investing.

It’s perceived as complicated, overwhelming, and something to fear. The financial industry made sure you feel that way so you’ll overpay some bozo to manage your finances. Don’t get tricked. Get smart – and fast. Your financial future is an out-of-control emergency you can’t afford to sleep on.

It doesn’t matter where you start. Just as long as you do start.

Am I crazy about Acorns? No. But it’s a great place to begin

Acorns is a micro-investing app that will fit the bill nicely. Here’s my review.

Why Acorns?

Link: Sign-up for Acorns

To start investing with Acorns, you need at least $5 in your account. And when you sign-up with my link, you’ll get $5 to start investing!

After you sign-up, you’ll get a recommendation based on your goals. These are directly tied to your risk tolerance – and you can change them any time.

In general, your risk tolerance should be higher the longer you plan to invest. So if your timeline is 10+ years – which it is you’re young and saving for retirement – you should go for the “Aggressive” option.

Acorns is pretty good at suggesting a portfolio

This mix is your portfolio. For example, the Aggressive mix (for the most growth) has:

Vanguard REIT ETF (VNQ)

Vanguard FTSE Emerging Markets (VWO)

Vanguard S&P 500 ETF (VOO)

Vanguard Small-Cap ETF (VB)

Vanguard VEA ETF (VEA)

Vanguard index funds are widely regarded to be the best in the industry (though I prefer Fidelity). But that’s for another time. For now, you’re beginning. That’s the most important thing.

And that’s also the answer to “Why Acorns?”.

REALLY cool extras

As I dug deeper, I found a lot that made me really like Acorns. For one, they have a fantastic app. It looks great, it works, and it’s easy to use.

I love this

You can set one-time or recurring investments. I think most peeps can handle $5 a week. And I love the “Round-Ups” feature.

That means when you link a card and a bank account, Acorns will round up every transaction to the next whole dollar – and transfer the difference into your investments.

So if your coffee is $2.15, Acorns will put $0.85 into your investment account. That doesn’t sound like much, but that’s the point. It all adds up, it’s easy, and you’re adding small amounts over time instead of huge lump sums. This is a lot more approachable and less daunting.

Invest while you shop

They also have what they call “Found Money.” It’s basically a shopping portal – but the cash back you earned is invested for you.

Now, I recommend checking Cashback Monitor to make sure you’re getting the best deal. But it’s hard to argue with the fact that you’ll earn compound interest for years on the money you earn. So I do like this option. In many cases, the payouts are quite good. But still, check other portals to be sure you’re getting a great deal, OK?