Kay Iscah's Blog, page 7

March 30, 2014

One day left to sign up through the Health Insurance Marketplace

Just a quick reminder, that tomorrow March 31st is the deadline to sign up through the healthcare exchange.

If I understand properly, you may be able to still sign up for various reasons throughout the year like job loss or insurance loss, etc. But for most of us March 31st is the general deadline.

https://www.healthcare.gov/

If I understand properly, you may be able to still sign up for various reasons throughout the year like job loss or insurance loss, etc. But for most of us March 31st is the general deadline.

https://www.healthcare.gov/

Published on March 30, 2014 12:53

March 25, 2014

One week left....

My own stress and concerns aside, you probably should check out https://www.healthcare.gov/ if you're currently uninsured. You may discover you qualify for cheap or free health insurance if you're sitting just above the poverty line, and a significant discount if you're comfortably above the poverty line (under $35,000 estimated income), it's worth at least filling out an application to see.

If you already have or had a doctor and you want to keep them, be sure to ask them which insurance plans and networks they accept. While geographically close, my doctor is outside my county, so this was a concern for me. For a particular insurer, she accepted all networks except E. Most of the plans on the marketplace were E, but not all of them, so I did manage to find a plan that let me keep my doctor.

The deadline is March 31, and I don't recommend waiting until the very last day. Best to get it done now.

If you already have or had a doctor and you want to keep them, be sure to ask them which insurance plans and networks they accept. While geographically close, my doctor is outside my county, so this was a concern for me. For a particular insurer, she accepted all networks except E. Most of the plans on the marketplace were E, but not all of them, so I did manage to find a plan that let me keep my doctor.

The deadline is March 31, and I don't recommend waiting until the very last day. Best to get it done now.

Published on March 25, 2014 07:01

March 24, 2014

Dear AFA.... What happens if I...?

I decided to call up the www.healthcare.gov help line to ask a specific question:

"What happens if I estimate my income at $12,000, and I end up making less, say only $11,000 or $10,000?"

The rep sounded more than a little confused by this question, which tells me they didn't really train them to answer it. But...

Her recommendation was that I fill out a change of circumstances form, once I realize my $12,000 estimate will fall short. But she couldn't tell me the result of filling out such a declaration.

But she also assured me that I would not be expected to repay the subsidy if my income dipped below the poverty line.

This is in contrast to the answer I got from an trained agent who said that I would have to pay the subsidy back in this situation.

Why this question is important on a practical level is that business earnings estimates are almost never accurate, at best you can hope to get in the right ball park, and many business are dependent on Nov./Dec. (holiday season) sales at the end of the year. It's fairly predictable that sales will spike, but how much they spike may not be.

Moving away from small businesses, let's say you're a temp work who may change jobs every couple weeks or months due to the needs of your temp agency. Are you supposed to file a change of circumstance form every time your pay rate or hours vary?

"What happens if I estimate my income at $12,000, and I end up making less, say only $11,000 or $10,000?"

The rep sounded more than a little confused by this question, which tells me they didn't really train them to answer it. But...

Her recommendation was that I fill out a change of circumstances form, once I realize my $12,000 estimate will fall short. But she couldn't tell me the result of filling out such a declaration.

But she also assured me that I would not be expected to repay the subsidy if my income dipped below the poverty line.

This is in contrast to the answer I got from an trained agent who said that I would have to pay the subsidy back in this situation.

Why this question is important on a practical level is that business earnings estimates are almost never accurate, at best you can hope to get in the right ball park, and many business are dependent on Nov./Dec. (holiday season) sales at the end of the year. It's fairly predictable that sales will spike, but how much they spike may not be.

Moving away from small businesses, let's say you're a temp work who may change jobs every couple weeks or months due to the needs of your temp agency. Are you supposed to file a change of circumstance form every time your pay rate or hours vary?

Published on March 24, 2014 07:43

March 21, 2014

More articles on this and such...

Basically, I'm sitting and stressing over whether to switch over to some $150/mo insurance which won't be as good as my current plan but will at least let me keep my doctor, or creatively estimate a higher income that would give me a subsidy (zeroing out my premium) and risk being forced to pay it back if I can't raise my income to match it. In TN for me that's a $1848 gamble... in another state with higher subsidies that might be a higher number.

However what doesn't change from state to state is what's considered poverty level, and I can't help thinking that has a little to do with this issue.

I'm not looking to run a political blog. I like the ideals of the AFA, and I'm glad to see more people get covered. I have many issues with this gap, but I can't blame my state for opting out. A couple of maps and articles to explain why:

Article: Characteristics of Poor Uninsured Adults who Fall into the Coverage Gap

& from Wiki, a map showing Median income in the U.S. by county: http://en.wikipedia.org/wiki/File:US_county_household_median_income_2012.png

While the correlation isn't perfect, basically states with more people who fall into this gap are states with lower median incomes. They've opted out in part because in three years when the Federal subsidies for the new Medicare enrollment go away they would have a much heavier burden on a state system which before had been reserved for people who truly couldn't work because of youth or disability... as opposed to waiting tables so they can take a stab at a music career or some other passion, which doesn't pay off immediately.

The idea that childless working adults can't afford any sort of payment towards coverage is a bit grating, since they fall into a variety of situations. You can probably eek by independently in TN on $10,000 a yr. particularly if you're living outside one of the major cities, even though that's technically below the poverty line, with a room mate or two (or out in the country in a small house handed down through the family), you could juggle a decent living situation. Things here are cheaper than in other parts of the country, and there's a very strong barter/DIY/help your neighbor community going.

Refusing subsidies and trying to force these people onto Medicaid limits their options (and kind of wounds the pride). And many of them sort of hover, dipping above and below depending on the particular year. In Nashville we have very strong arts community...not a stable income generally, but people who are smart with their money know to squirrel away extra in the good years to get through the bad.

Which doesn't mean everyone at or near poverty level is in a great financial situation, but many would rather keep a consistent insurance plan and not worry about having to switch companies and doctors just because their income varied by few thousand here or there. (Note: There's a $1 difference between a full subsidy and no subsidy.) And it's very exasperating to know you could get your premium fully covered if you make $12,000, but since you made $11,000 or $9,000 you're just out of luck.

As this is a Federal level Mandate, then I think the Fed ought to cough off and expand the subsidies to cover the gap they left. And/or reconsider expanding the range of subsidies in lower income states, so the Medicaid burden is more evenly distributed. But for healthy, capable adults, I truly believe subsidies are the better option than Medicaid alone.

Before I get overly grim, part of the reason I took a break from this blog is it's focus is supposed to be those just over the poverty line rather than just under... so while there is a concern over what job loss could mean for those at the edge, full time (childless) minimum wage earners probably do qualify for subsidies. The full-timers who don't are most likely small business owners like me who are trying to build something up with sweat equity.

P.S. There are subsidy gaps on the other end too: http://www.npr.org/blogs/health/2014/03/18/291162837/some-young-people-won-t-get-help-for-affordable-care-act-insurance but most of the young adults I know aren't making this upper end income.

However what doesn't change from state to state is what's considered poverty level, and I can't help thinking that has a little to do with this issue.

I'm not looking to run a political blog. I like the ideals of the AFA, and I'm glad to see more people get covered. I have many issues with this gap, but I can't blame my state for opting out. A couple of maps and articles to explain why:

Article: Characteristics of Poor Uninsured Adults who Fall into the Coverage Gap

& from Wiki, a map showing Median income in the U.S. by county: http://en.wikipedia.org/wiki/File:US_county_household_median_income_2012.png

While the correlation isn't perfect, basically states with more people who fall into this gap are states with lower median incomes. They've opted out in part because in three years when the Federal subsidies for the new Medicare enrollment go away they would have a much heavier burden on a state system which before had been reserved for people who truly couldn't work because of youth or disability... as opposed to waiting tables so they can take a stab at a music career or some other passion, which doesn't pay off immediately.

The idea that childless working adults can't afford any sort of payment towards coverage is a bit grating, since they fall into a variety of situations. You can probably eek by independently in TN on $10,000 a yr. particularly if you're living outside one of the major cities, even though that's technically below the poverty line, with a room mate or two (or out in the country in a small house handed down through the family), you could juggle a decent living situation. Things here are cheaper than in other parts of the country, and there's a very strong barter/DIY/help your neighbor community going.

Refusing subsidies and trying to force these people onto Medicaid limits their options (and kind of wounds the pride). And many of them sort of hover, dipping above and below depending on the particular year. In Nashville we have very strong arts community...not a stable income generally, but people who are smart with their money know to squirrel away extra in the good years to get through the bad.

Which doesn't mean everyone at or near poverty level is in a great financial situation, but many would rather keep a consistent insurance plan and not worry about having to switch companies and doctors just because their income varied by few thousand here or there. (Note: There's a $1 difference between a full subsidy and no subsidy.) And it's very exasperating to know you could get your premium fully covered if you make $12,000, but since you made $11,000 or $9,000 you're just out of luck.

As this is a Federal level Mandate, then I think the Fed ought to cough off and expand the subsidies to cover the gap they left. And/or reconsider expanding the range of subsidies in lower income states, so the Medicaid burden is more evenly distributed. But for healthy, capable adults, I truly believe subsidies are the better option than Medicaid alone.

Before I get overly grim, part of the reason I took a break from this blog is it's focus is supposed to be those just over the poverty line rather than just under... so while there is a concern over what job loss could mean for those at the edge, full time (childless) minimum wage earners probably do qualify for subsidies. The full-timers who don't are most likely small business owners like me who are trying to build something up with sweat equity.

P.S. There are subsidy gaps on the other end too: http://www.npr.org/blogs/health/2014/03/18/291162837/some-young-people-won-t-get-help-for-affordable-care-act-insurance but most of the young adults I know aren't making this upper end income.

Published on March 21, 2014 12:53

Now to see if I can get rejected by Medicaid on time...

To quickly recap yesterday's post, I'm a small business owner who was already insured. Yesterday, I got a letter saying my High Deductible Health Plan was jumping from $115.90/mo. to $238.14/mo. I'm currently grossing $253.75/mo., so you can see how this is problematic... I'm in a situation where food/shelter are provided, but I do have other expenses. If I was making $30,000 or up, I might be able to shrug off the extra $1466/yr as doing my part to help those less healthy than I, but at my current income level, it's a distressing amount.

State Farm was very gracious about understanding why I could not afford paying double for my plan and gave me the number for an independent agent

who could help me navigate the government site.

I asked her about those of us who make too little to qualify for a subsidy. She said they had been advised to tell people under the poverty level to apply for Medicaid, then use their rejection letters to file an appeal to get a subsidy. (As I said yesterday, this should be automatic, but...government.) Her concern was that I wouldn't get my rejection letter on time.

It was her belief that if I overestimated my income to $12,000 so I could get the subsidy with less hassle, I would be required to repay the entire credit ($154 x 12= $1848) if I didn't manage to actually make enough money to qualify for it, and that's quite a gamble.

The healthcare.gov website however gives a much bleaker answer.

Before anyone starts getting on my case for not having done this sooner. Please remember I got this notice YESTERDAY. Last year my insurance premium actually went down a tad, and $115.90 was doable and I was happy with my insurance/doctor, so I was trying to be a responsible citizen and let it ride.

UDPATE: I called the marketplace help line and they sent me here: https://www.healthcare.gov/can-i-appeal-a-marketplace-decision/ so now I'm filling out a form.

UDPATE 2: Nope, we're just screwed.

State Farm was very gracious about understanding why I could not afford paying double for my plan and gave me the number for an independent agent

who could help me navigate the government site.

I asked her about those of us who make too little to qualify for a subsidy. She said they had been advised to tell people under the poverty level to apply for Medicaid, then use their rejection letters to file an appeal to get a subsidy. (As I said yesterday, this should be automatic, but...government.) Her concern was that I wouldn't get my rejection letter on time.

It was her belief that if I overestimated my income to $12,000 so I could get the subsidy with less hassle, I would be required to repay the entire credit ($154 x 12= $1848) if I didn't manage to actually make enough money to qualify for it, and that's quite a gamble.

The healthcare.gov website however gives a much bleaker answer.

Before anyone starts getting on my case for not having done this sooner. Please remember I got this notice YESTERDAY. Last year my insurance premium actually went down a tad, and $115.90 was doable and I was happy with my insurance/doctor, so I was trying to be a responsible citizen and let it ride.

UDPATE: I called the marketplace help line and they sent me here: https://www.healthcare.gov/can-i-appeal-a-marketplace-decision/ so now I'm filling out a form.

UDPATE 2: Nope, we're just screwed.

Published on March 21, 2014 10:57

March 20, 2014

Seriously?!?.... Or watch as I fall through the income gap!

I already have insurance, so I had not bothered with the https://www.healthcare.gov/ marketplace. But I got a letter today saying my High Deductible Plan was jumping from $115.90 per month to $238.14, so I figured I ought to take a look before the March 31st deadline. At the moment, all I can say is ARGH!

In my current situation, I'm effectively self-employed, but because of my business structure (I'm incorporated), I get paid as a part-time employee. I gave myself a little raise this year, so my estimated income based on this one job is going to be a little over $3,000. I'm okay with this. I still have some savings, my family is currently in a place where I can live rent free, and this isn't a burden on anyone... it's actually helpful since I can watch my nephew and pitch in with a few odd household things, etc.

I also have a sub job (which hasn't called me yet this year...curse of healthy teachers), which may turn back into a part time teaching job this summer, but frankly at this point my actual income for the coming year is nearly impossible to predict, since the position isn't certain.

Being in TN, I don't qualify for Tenncare (Medicare) or Medicaid... no kids and I'm not disabled. After playing around with numbers on the healthcare.gov I discovered that if I made $12,000/yr I would qualify for a $154/mo. (this number will vary depending on where you live) tax credit towards my insurance, BUT if I make less than $11,490 (http://apps.npr.org/affordable-care-act-questions/), I qualify for nothing.

The simple federal fix for this would be simply to extend the same tax credit for anyone making $11,490 to those making below, who for some reason did not qualify or did not want to use Medicare, but I guess that sort of logic is too obvious for law makers. Tomorrow I will go chat with my insurance company and make some phone calls to figure this out, but tonight it's raising a lot of prickly questions.

For example what happens if you over estimate your income? Relevant to this blog, say you're working full time minimum wage in March when you sign up, and then in October you lose your job or get cut back to part time, dipping you just under the credit threshold. Apparently you're supposed to notify the system of such changes, but what's the result? Will your insurance suddenly jump up due to a disappearing credit?

The NPR link above says if you fall below the poverty line ($11,490) then "you are exempted from the new mandate to carry health insurance." But that doesn't answer the question about mis-estimating or job loss.

This link: http://www.npr.org/blogs/health/2013/11/11/243987330/self-employed-and-with-lots-of-questions-about-health-care says you won't be punished for overestimating your income, though you may have to pay the difference if you underestimate it... which makes one wonder if those of us in the gap should be creatively optimistic about our income for the coming year. (Don't take that as a recommendation, at least not yet. I hope to have some more concrete information on this tomorrow.)

In my current situation, I'm effectively self-employed, but because of my business structure (I'm incorporated), I get paid as a part-time employee. I gave myself a little raise this year, so my estimated income based on this one job is going to be a little over $3,000. I'm okay with this. I still have some savings, my family is currently in a place where I can live rent free, and this isn't a burden on anyone... it's actually helpful since I can watch my nephew and pitch in with a few odd household things, etc.

I also have a sub job (which hasn't called me yet this year...curse of healthy teachers), which may turn back into a part time teaching job this summer, but frankly at this point my actual income for the coming year is nearly impossible to predict, since the position isn't certain.

Being in TN, I don't qualify for Tenncare (Medicare) or Medicaid... no kids and I'm not disabled. After playing around with numbers on the healthcare.gov I discovered that if I made $12,000/yr I would qualify for a $154/mo. (this number will vary depending on where you live) tax credit towards my insurance, BUT if I make less than $11,490 (http://apps.npr.org/affordable-care-act-questions/), I qualify for nothing.

The simple federal fix for this would be simply to extend the same tax credit for anyone making $11,490 to those making below, who for some reason did not qualify or did not want to use Medicare, but I guess that sort of logic is too obvious for law makers. Tomorrow I will go chat with my insurance company and make some phone calls to figure this out, but tonight it's raising a lot of prickly questions.

For example what happens if you over estimate your income? Relevant to this blog, say you're working full time minimum wage in March when you sign up, and then in October you lose your job or get cut back to part time, dipping you just under the credit threshold. Apparently you're supposed to notify the system of such changes, but what's the result? Will your insurance suddenly jump up due to a disappearing credit?

The NPR link above says if you fall below the poverty line ($11,490) then "you are exempted from the new mandate to carry health insurance." But that doesn't answer the question about mis-estimating or job loss.

This link: http://www.npr.org/blogs/health/2013/11/11/243987330/self-employed-and-with-lots-of-questions-about-health-care says you won't be punished for overestimating your income, though you may have to pay the difference if you underestimate it... which makes one wonder if those of us in the gap should be creatively optimistic about our income for the coming year. (Don't take that as a recommendation, at least not yet. I hope to have some more concrete information on this tomorrow.)

Published on March 20, 2014 23:00

March 11, 2014

Affordable Healthcare Reminder

Open Enrollment ends March 31, so less than three weeks left.

https://www.healthcare.gov/

The theory is that the site should help you find free or affordable health insurance. If you're already enrolled, you don't have to use the site, but those in the lower income bracket may qualify for assistance or even free insurance coverage.

In reality you may fall through a gap. One of my friends is currently experiencing this in TN. The site assumes she qualifies for free health insurance, so it offers her no payment assistance, but she makes too much to qualify for Medicaid. An article about the gap:

http://www.tennessean.com/viewart/20140101/BUSINESS05/301010098/5-million-people-fall-into-health-care-coverage-gap-2014

If you don't sign up for insurance, you may face a penalty...maybe. Here's some links for helping to figure that out:

http://www.npr.org/2013/10/11/230851737/faq-understanding-the-health-insurance-mandate-and-penalties-for-going-uninsured

https://www.ehealthinsurance.com/affordable-care-act/faqs/how-much-are-the-tax-penalties-for-not-having-health-insurance-and-when-do-they-apply

http://www.forbes.com/sites/mikepatton/2013/10/28/obamacare-penalties-and-exemptions/

Have you signed up? Did you find yourself in a gap? If so please leave a comment to tell us about your experience.

https://www.healthcare.gov/

The theory is that the site should help you find free or affordable health insurance. If you're already enrolled, you don't have to use the site, but those in the lower income bracket may qualify for assistance or even free insurance coverage.

In reality you may fall through a gap. One of my friends is currently experiencing this in TN. The site assumes she qualifies for free health insurance, so it offers her no payment assistance, but she makes too much to qualify for Medicaid. An article about the gap:

http://www.tennessean.com/viewart/20140101/BUSINESS05/301010098/5-million-people-fall-into-health-care-coverage-gap-2014

If you don't sign up for insurance, you may face a penalty...maybe. Here's some links for helping to figure that out:

http://www.npr.org/2013/10/11/230851737/faq-understanding-the-health-insurance-mandate-and-penalties-for-going-uninsured

https://www.ehealthinsurance.com/affordable-care-act/faqs/how-much-are-the-tax-penalties-for-not-having-health-insurance-and-when-do-they-apply

http://www.forbes.com/sites/mikepatton/2013/10/28/obamacare-penalties-and-exemptions/

Have you signed up? Did you find yourself in a gap? If so please leave a comment to tell us about your experience.

Published on March 11, 2014 05:14

February 26, 2014

Minimumwager on Facebook

Not using it very actively yet, but this book/blog does have a facebook page: https://www.facebook.com/LivingMinimumWage

I'm trying to wrap up a writing project that I thought was going to wrap up back in October, but that didn't happen like planned. And the launch stuff for my novel which should of happened back in November is instead happening now.

Lots of little life things keeping me busy now. Trying to sleep more, read more, exercise more, eat better, spend more time with the nephew, as well as reinvigorate the design side of my business (mainly my Cafepress shop), and somewhere in there I need to get my taxes done. I've also started tutoring a 5 year old.

However if all goes well, I'll be paying more attention to this blog come late spring/summer, and will be working on a second edition of Living Single on Minimum Wage. A big part of that process will be reader feedback, which is the main reason for the facebook page.

While we're on the subject, Amoeba Ink has a Facebook page too: https://www.facebook.com/AmoebaInk

Any support is appreciated.

I'm trying to wrap up a writing project that I thought was going to wrap up back in October, but that didn't happen like planned. And the launch stuff for my novel which should of happened back in November is instead happening now.

Lots of little life things keeping me busy now. Trying to sleep more, read more, exercise more, eat better, spend more time with the nephew, as well as reinvigorate the design side of my business (mainly my Cafepress shop), and somewhere in there I need to get my taxes done. I've also started tutoring a 5 year old.

However if all goes well, I'll be paying more attention to this blog come late spring/summer, and will be working on a second edition of Living Single on Minimum Wage. A big part of that process will be reader feedback, which is the main reason for the facebook page.

While we're on the subject, Amoeba Ink has a Facebook page too: https://www.facebook.com/AmoebaInk

Any support is appreciated.

Published on February 26, 2014 08:05

February 5, 2014

Goodreads Giveaways Equals Free Books

I have an absurd number of books on my to-read pile as it is, so I've refrained from signing up for any of Goodreads' many, many giveaways. However, if you would like to have some more free books, you should be aware of this:

https://www.goodreads.com/giveaway

Obviously you can't win every giveaway, but given the number, you've got a fair chance of winning something. However, in the interest of being thrifty and not greedy, you should only sign up for giveaways on books that you think you would actually like to read. I've seen some people win fantasy giveaways when they don't like fantasy and then post reviews griping about how don't like fantasy books. This seems unfair both to other readers who might enjoy that genre and to writers and publishers who do these giveaways in hopes of generating some buzz and reviews.

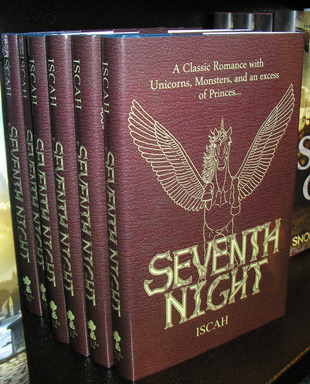

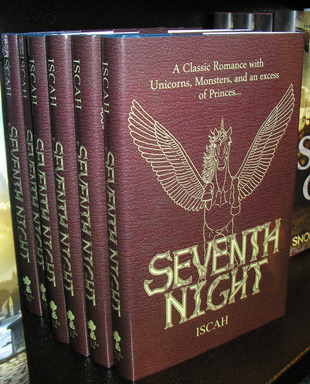

And yes, I have a vested interest in this little announcement. My own novel Seventh Night is available as a giveaway during the month of February:

And yes, I have a vested interest in this little announcement. My own novel Seventh Night is available as a giveaway during the month of February:

https://www.goodreads.com/book/show/18777181-seventh-night

However, I think this applies to most any contest. Don't sign up if the prize doesn't appeal to you.

Currently Goodreads doesn't allow for ebook giveaways, but there are plenty of other places for those. Amazon offers free Kindle books regularly, and many review blogs like to offer giveaways.

Tome Tender is doing a giveaway for three ebook copies of Seventh Night (ends February 20th).

https://www.goodreads.com/giveaway

Obviously you can't win every giveaway, but given the number, you've got a fair chance of winning something. However, in the interest of being thrifty and not greedy, you should only sign up for giveaways on books that you think you would actually like to read. I've seen some people win fantasy giveaways when they don't like fantasy and then post reviews griping about how don't like fantasy books. This seems unfair both to other readers who might enjoy that genre and to writers and publishers who do these giveaways in hopes of generating some buzz and reviews.

And yes, I have a vested interest in this little announcement. My own novel Seventh Night is available as a giveaway during the month of February:

And yes, I have a vested interest in this little announcement. My own novel Seventh Night is available as a giveaway during the month of February:https://www.goodreads.com/book/show/18777181-seventh-night

However, I think this applies to most any contest. Don't sign up if the prize doesn't appeal to you.

Currently Goodreads doesn't allow for ebook giveaways, but there are plenty of other places for those. Amazon offers free Kindle books regularly, and many review blogs like to offer giveaways.

Tome Tender is doing a giveaway for three ebook copies of Seventh Night (ends February 20th).

Published on February 05, 2014 11:52

February 1, 2014

Have you consider going Toilet Paper free?

Toilet paper is cheap and convenient, and while I try to minimize my use, it's not something I'm eager to give up. But for most of history and still in many countries today, toilet paper is not the norm. Frugal Living NW has explored replacing paper toilet paper with reusable cloth wipes.

Reusable Cloth Toilet Paper (landing page)

Reusable cloth toilet paper FAQs (+ how to make homemade wipes)

I'm not specifically endorsing this idea or nay-saying it. And I do think this is a proper place to wash separately and apply bleach. But if you're very interested in the green movement and ways to save the odd penny, this may be worth some consideration. (If you're not, it may arm you with some ideas for egads the TP is gone emergencies.)

But what do you think? Responsible and thrifty or too extreme for you?

Reusable Cloth Toilet Paper (landing page)

Reusable cloth toilet paper FAQs (+ how to make homemade wipes)

I'm not specifically endorsing this idea or nay-saying it. And I do think this is a proper place to wash separately and apply bleach. But if you're very interested in the green movement and ways to save the odd penny, this may be worth some consideration. (If you're not, it may arm you with some ideas for egads the TP is gone emergencies.)

But what do you think? Responsible and thrifty or too extreme for you?

Published on February 01, 2014 14:21