Michael E. Newton's Blog, page 32

October 21, 2010

Britain to fire 500,000 public sector employees. But not really.

As mentioned earlier, Britain is finally taking action to stave off a credit crisis and possible bankruptcy. Some are reporting that Britain will be firing 500,000 public sector employees.

For example, The Week reports:

David Cameron is laying off 500,000 government employees.

However, that will not be the case. As the Mail reports:

500,000 public sector jobs to go

1 in 10 public sector jobs to go as government gambles on private recovery

According to the story, this 10% reduction will take 4 or 5 years:

But they make clear that the Government has adopted the Office for Budget Responsibility's forecast that 490,000 jobs in the public sector will go by 2014/15.

If the average public sector employee works for 40 years, 10 percent of them would retire within 4 years. In other words, the government will likely lay off very few people. Instead, the British government simply will not fill vacant positions.

This is great news, on the one hand, because the British are working to solve their financial problems and this job reduction it is quite easily achievable because it does not actually require firing many people. However, let us not be under the misapprehension that the British government is making a tough choice here. Do not believe the talk that half a million will be laid off. That is simply untrue.

October 20, 2010

Enumerated Powers Amendment for the Constitution

In addition to repealing the 16th and 17th Amendments and getting rid of the Federal Reserve (all of which began in 1913), I propose this new Amendment:

The federal government shall have no powers beyond those specifically enumerated in the Constitution or absolutely required for the enforcement of those enumerated powers.

The general welfare and commerce clauses do not give the federal government any powers beyond those specifically expressed elsewhere in the Constitution.

All commitments and liabilities of the United States must be honored and paid out either immediately or in their due course. No new commitments or liabilities from unconstitutional programs may be added after the ratification of this amendment.

If anybody has suggestions to improve this amendment, feel free to comment below or email me from the contact page.

Britain takes action to save country from bankruptcy. United States still has its head in the sand.

Britain will stick to its timetable for making the largest cuts in government spending in decades, the chancellor of the exchequer said Wednesday, vowing that the sweeping measures would bring the country "back from the brink" of bankruptcy.

Critics charge that the plan to cut spending by 83 billion pounds ($130.4 billion) between 2011 and 2015 threatens to send the economy back into recession, just as a recovery is losing steam.

Delivering the long-awaited, comprehensive spending review to parliament, Osborne said the austerity plan "is a hard road, but it leads to a better future."

The plan will reduce spending across government departments by an average of 19% over four years and is expected to result in 490,000 public-sector job losses over that period.

There is no doubt about it; these cuts will be painful, but not nearly as painful as doing nothing and going bankrupt. Too many governments, political leaders, and populations have their heads in the sand. Action needs to be taken to stave off a credit crisis. Those countries that do so may feel some short-term pain, but they will be at a competitive advantage five or ten years from now.

Meanwhile, the US has not cut a dime from its budget. Instead, all the talk in the current Congress and the White House has been about more stimulus. Hopefully, this will change on November 2.

October 19, 2010

Sovereign debt crisis spreading to first world countries.

I've written about the sovereign debt crisis numerous times already. See here, here, here, here, and here. But so far, I've only written about those "at-risk" countries such as Portugal, Greece, Spain, and Ireland or individual states such as Illinois. In other words, the sovereign debt crisis has so far been limited to "small" countries or states. Debt defaults among these countries or states certainly would cause problems and a sharp decline in financial markets, but likely wouldn't break the bank. But if this crisis spreads to larger, more financially important countries, it would obviously have a much larger impact, possibly one similar to the stock market crash of 1929.

Marketwatch reports that the sovereign debt crisis may in fact be spreading to a first world nation:

There's no 'B' in PIIGS, but Belgium could eventually cause headaches of its own for the euro zone if a bitter and protracted political fight prevents the country from hitting its deficit-reduction targets.

Belgium, in northern Europe, has seemed an unlikely candidate for sovereign-debt troublemaker. From a fiscal perspective, the country, whose capital Brussels is the home of the vast EU bureaucracy, has been associated more with the so-called core of the euro zone than the troubled "periphery."

But an increasingly bitter political divide along linguistic lines has left Belgium without a government since April and is beginning to raise some concerns.

Belgium, which has enjoyed solid growth, appears on track to reduce its budget deficit to 4.8% of gross domestic product this year from 5.6% in 2009, economists said. The nation's deficit is among the lowest in the euro zone and compares well with other core countries, including Germany at 4.5% of GDP, France at 8% and the Netherlands at 6%.

But if a government isn't formed soon, the 2011 fiscal target of a reduction to 4.1% could be in jeopardy, said Philippe Ledent, an economist at ING Bank in Brussels. That in turn would make it all the more difficult for Belgium to meet its target of bringing its deficit down to 3% of GDP, the EU limit, in 2012.

In reality, a 4.1%, 4.8%, or 5.6% don't seem too bad, especially considering the 10.6% deficit here in the US for 2010 and 8.3% deficit expected for 2011.

Belgium's deficit figures raise few alarms, but government debt stands at around 100% of GDP, which compares more closely with Greece and Italy.

U.S. debt, by comparison, also stands at about 100% of GDP.

The financial markets are starting to notice Belgium's problem:

Belgium has had no problems selling its government bonds. Borrowing costs have risen, however, with the yield premium demanded by investors to hold 10-year Belgian debt over benchmark German bunds standing at around 0.8 percentage point, up from around 0.4 percentage point around the same time last year.

But borrowing costs are far from problematic, Ledent said. Belgium's premium remains nowhere near comparable to Spain's, for example, which is at around 1.6 percentage points, much less Ireland's at around 4 percentage points.

The cost of insuring Belgian debt against default is up sharply since the April elections, but well off the peak seen in mid-June. The spread on five-year sovereign credit-default swaps was at 119 basis points last Thursday, according to data provider CMA. That means it would cost $119,000 a year to insure $10 million of Belgian government debt against default for five years.

The spread stood at around 60 basis points in mid-April before the latest round of political turmoil and peaked at 149 basis points in late June.

"Up to now, there has been no strong impact [on borrowing costs], but I'm not sure it will continue like that," Ledent said. "If in two, three, four months we still don't have any government, financial markets will consider that we won't reach the [budget] target and then there could be an impact on the spread."

How long can countries like Belgium or the United States continue to borrow at low interest rates? These are countries with deficits exceeding 4% of GDP, in Belgium's case, or 8-10%, in the United States, with debts equal to 100% of GDP. Logic tells us that in these countries, either taxes have to rise significantly or government spending has to fall sharply. Neither Belgium nor the U.S. is doing much to reduce their deficits and even less to cut government spending. Both countries, along with all other nations, are hoping for and relying on an economic recovery to lift their finances. What if we enter another recession? What if the recovery is slower than they expect, as it has been so far? All this talk of deficit reduction will be gone and we'll be looking at even larger deficits and debt levels.

Worse yet, what happens when investors demand higher interest rates? As mentioned above, Belgium is already paying an extra 0.4% interest on its debt. That does not sound like much, but with government debt at 100% of GDP, the deficit increases by 0.4% just from the interest payment. This is an additional cost on government at a time when it needs to reduce its costs. It increases the deficit just as the country is trying to reduce it. Furthermore, this creates a self-fulfilling prophecy: worries of a debt crisis will cause a country's interest payment to rise and deficit to increase, thus increasing the chances of a crisis.

So I will repeat what I've written many times: The sovereign debt crisis is far from over. In fact, it is just beginning.

October 17, 2010

Should we return to the Clinton years? Hell yes!

I often hear from those on the left about how much better the Clinton years were than the Bush years and today. Well, let's compare the size of government during the Clinton years (1993-2000) to the Bush years and today.

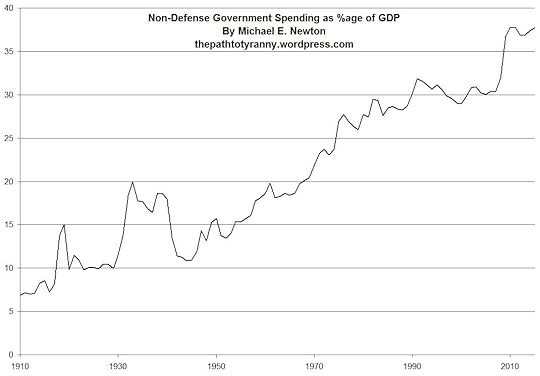

First, my favorite chart again to get a general idea of where we are now versus the Clinton years. Clearly, government spending is much higher now:

Total government spending (federal, state, and local) during the Clinton years averaged 34.3% of GDP. During the Bush years, it averaged 35.0%. During the fiscal year just completed (2010) it was 43.9%. Are those on the left really arguing for a 9.6 percentage point reduction in government spending? And what 21.9% (9.6 divided by 43.9) of government will the cut?

Let's look at the tax side of the equation. Total government revenue (federal, state, and local) averaged 35.2% of GDP during the Clinton years. It was 34.4% during the Bush years. Today (FY 2010), due to the recession, it stands at 30.4%.

What is remarkable is the similarity between the Clinton years and the Bush years, on average. The Bush years saw total government spending 0.7 percentage points higher than during the Clinton years, but total government revenue 0.8 percentage points lower. However, not all this credit and/or blame can be assigned to these Presidents or even to the Congresses because these figures include state and local government, as well. On the balance though, these periods were remarkably similar.

Another interesting factor is that government spending fell 4.5 percentage points during the Clinton years, yet rose 4.4 percentage during the Bush years. Government revenue saw the reverse, up 3.9 percentage points under Clinton but down 4.2 percentage points under Bush. Much of this is simply the result of economic cycles. Clinton started after a recession and ended with a bubble. Bush started with that bubble and ended with a recession.

But the most notable thing is what is occurring today. Under President Obama, government spending as a percentage of GDP has risen 6.9 points while revenue has fallen 2.6 point. Again, President Obama and Congress cannot take all the credit/blame because most of this change has been due to the recession. However, government spending has risen more under Barack Obama in just two years than it did under Bush in eight. In fact, government spending as a percentage of GDP in 2009 alone rose more than it had in the previous 36 years. During the previous recession (2000-2003), total government spending rose 2.7 percentage points and we recovered from that recession just fine. In this recession (2007-2010 so far), government spending as a percentage of GDP has risen 8.9 points and the recession continues.

All this raises a few questions:

What have we to show for this 8.9 percentage point increase in the size of government?

Do the liberals really want to return to the Clinton day? Are the liberals willing to reduce government spending by 21.9% (9.6% of GDP)?

Will conservatives trade a tax increase equal to 4.8% of GDP in exchange for cuts to government equal to 9.6%?

As for me, I'd gladly trade the tax increase for smaller government because we are already paying for the tax increase. To fund our budget deficit, government is issuing debt and printing money. Instead of charging us taxes, they are devaluing the Dollar. Instead of paying for our large government through taxation, we are paying for it with reduced value of our wealth and increasing foreign ownership of our country. Therefore, taxes are much less important than government spending. So yes, I'd certainly support an increase in taxes equivalent to 4.8% of GDP IF AND ONLY IF we reduce government spending by 9.6%, returning us to those much hallowed days of the Clinton Presidency and Contract With America Congress.

* This does not reflect my opinion of Clinton as a person or his policies. Likewise, much of the above talk of "Clinton years" was the result of general economic trends and the Republican Congress. As always, I am a firm believer that history moves in trends and our leaders reflect those trends. (See my book, The Path to Tyranny. Additionally, I plan to write an entire book on this subject in the future.)

October 14, 2010

Biggest increase in dependence on government in 2009 since 1976

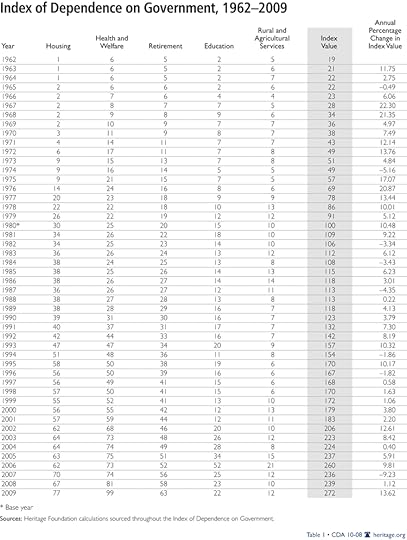

According to The Heritage Foundation's 2010 Index of Dependence on Government, dependence on government rose 13.62 percent in 2009. That is the largest single year increase since 1976.

Heritage included a lot of detail in its reports and many cool graphs. I suggest you go to the full report. I would like to comment on one more chart of theirs.

Many conservatives lament the fact that so many Americans pay no taxes. As you can see below, the percentage of Americans who paid not income tax rose from 12.0 percent in 1969 to 43.6 percent in 2008. I actually wish that many more Americans were exempt from paying taxes. However, we cannot have a situation where nearly half of Americans pay no income tax while the size of government grows. The wealthy are seeing their burden doubly rise from the growing cost of funding government and their increased share in paying for it. While this will satisfy the "soak the rich" crowd, it only pushes the wealth to hide their income and wealth from the government or move overseas entirely.

October 12, 2010

Democrats think US corporations should pay US income taxes on foreign income. Are they crazy?

Democratic candidate for US Senate Richard Blumenthal attacked Republican candidate and former WWE CEO Linda McMahon on Twitter:

STAFF: 2009: WWE Didn't Pay U.S. Income Taxes On $4.1 Million In Earnings From It's International Subsidiaries.

Why should US corporations pay US income taxes on foreign income? They already paid taxes on that income in the country in which it was earned. Foreign corporations don't pay US income taxes on foreign income, so why should US corporations? Charging US income taxes on earnings in foreign countries makes US corporations less competitive.

The US already has the second highest corporate income taxes among industrialized countries. The United States should be lowering corporate tax rates, not making it more expensive to be a US corporation.

Richard Blumenthal is encouraging US corporations to close up shop, move overseas, and save million of dollars in taxes.

Federal Reserve says: Damn the torpedoes, full speed ahead!

Fed vice chairman Janet Yellen acknowledges that the Fed's low interest rate policy is creating a moral hazard and may cause companies to take too much risk but that the Fed will pursue this policy any way. AP reports:

Record-low interest rates may give companies an incentive to take excessive risks that could be bad for the economy, the Federal Reserve's new vice chairwoman warned on Monday.

Janet Yellen has supported the Fed's policy of ultra-low interest rates to bolster the economy and to help drive down unemployment. Her remarks, which don't change that stance, may be aimed at tempering critics. They worry she'll want to hold rates at record low levels for too long, which could inflate new bubbles in the prices of commodities, bonds or other assets.

Yellen, who was sworn in as the Fed's second-highest official last week, made clear she is aware of the risks.

"It is conceivable that accomodative monetary policy could provide tinder for a buildup of leverage and excessive risk-taking," Yellen said in remarks to economists meeting in Denver. It marked her first speech since becoming vice chairwoman.

Yellen has a long history with the Fed. Before taking her current job, she served as president of the Federal Reserve Bank of San Francisco since 2004. She also was a member of the Fed's Board of Governors from 1994 to 1997, when Alan Greenspan was chairman.

As vice chairwoman, Yellen will help build support for policies staked out by Ben Bernanke, the current chairman.

The Fed at its November meeting is expected to take new steps to energize the economy. It's likely to announce a new program to buy government bonds. Doing so would lower rates on mortgages, corporate loans and other debt. The Fed hopes that would get people and companies to buy more, which would strengthen the economy.

The new effort is expected to be smaller than the $1.7 trillion launched during the recession. Under that program, the Fed bought mostly mortgage securities and debt, although it did buy some government bonds, too.

The Fed has held its key interest rate at a record low near zero since December 2008. Because it can't lower that rate any more, it has turned to other unconventional ways to pump up the economy.

By now, we all know that low interest rates created the housing bubble. And before that, the tech bubble. Almost all bubbles are created by the Fed lowering interest below the market rate and encouraging companies and individuals to take on excess risk. They are at it again.

So where is/will be the next bubble? Treasuries? Gold and silver? Equities? All of the above?

October 7, 2010

TARP was a waste of money, despite what the Treasury Department tells you.

The Treasury announced that the total cost of TARP would be just $50 billion. In their perverse logic, the Administration and media played this up as a government success story. But we really should look at TARP as an investment. Congress approved spending $700 billion for TARP, of which only $296 billion was spent. Looking at TARP as an investment, the government lost 16.9% over a two year period. And they call that a success!

What else could the government have done with the $296 billion? Since TARP was signed into law on October 3, 2008, the following instruments have produced these returns:

TARP

Troubled Asset Relief Program

-16.9%

SPY

S&P 500

9.1%

TLT

iShares Barclays 20+ Year Treas Bond

15.7%

IEF

iShares Barclays 7-10 Year Treasury

19.3%

SHV

iShares Barclays Short Treasury Bond

0.7%

GLD

SPDR Gold Shares

57.8%

XLF

Financial Select Sector SPDR

-18.8%

All major markets (stocks, long-term bonds, intermediate-term bonds, short-term bonds, and gold) posted positive returns. In some cases, very good returns. As you can see, I added the Financial sector into that table, which declined slightly more than TARP. Most of TARP's investment were in the financial sector. The small difference is largely a rounding error because I am looking at XLF's return up to today whereas the Treasury is using expected returns as of some future date. And that is assuming you trust their accounting…

But this raises the question of why they invested in the worst performing market sector? Those of us who argued that they were throwing good money after bad were correct. Maybe Treasury lost less money than we expected, but we were still correct in predicting negative returns on this investment.

Of course, the government claims that TARP saved the financial system from utter destruction. Oh, to live in a world where you can make outrageous claims without any proof. Next thing you know, the government will claim that the American Recovery and Reinvestment Act of 2009, also known as the stimulus bill, "created or saved" millions of jobs, even though the unemployment rate has remained steady near the 10% level.