Michael E. Newton's Blog, page 29

November 16, 2010

The Balance of Power in the Roman Republic, the US Constitution, and Today

November 11, 2010

"Ireland on the brink" with no way out

Ireland on the brink as budget crunch looms

Austerity threatens growth, but markets leave Dublin little choice

After promising a 15 billion euro ($20.7 billion) austerity package of spending cuts and tax hikes, Ireland's government may be facing its last chance to avoid a bailout by persuading markets that the country can repay its debts.

Yields on government bonds have soared in recent days as investors increasingly fear that the only long-term option for Ireland will be a bailout from Europe. But sympathy for Brian Cowen's Fianna Fail–led coalition is almost nonexistent among Dubliners, who see the government as the biggest villain in the collapse of the Irish economy…

Please read the whole article, but I'll summarize it in just a few words: Ireland is damned if they do and damned if they don't. If Ireland does nothing, it will be unable to repay its debts. In other words, it will default if it is not given a bailout. But the EU will not bail out Ireland if it does not reduce its deficit.

If Ireland chooses to reduce its deficit, which it is trying to do, it will require massive tax increases and/or huge cuts in spending. Either will result in massive protests and economic harm.

Western governments have been spending more than it could afford for nearly a century now. In the US, it started in 1913 with the emergence of the Federal Reserve and ratification of the income tax amendment. It got worse with the two world wars, Great Depression, and breaking from the gold standard. Now, countries like Ireland, Greece, Portugal, and Spain have only years, if not months, to get their houses in order. After 100 years of failure, we are now paying the price.

Texas is deep in the red. And it's one of the better states.

I didn't know this until today, but Texas is expecting a $25 billion deficit. FT.com reports:

Rick Perry may have won his third term as Texas governor this month, but the prize is a state budget deficit analysts estimate has grown as high as $25bn.

The projected deficit, to be announced in January, would leave Texas with tough decisions about how to meet spending commitments, as its constitution requires a balanced budget. It faces scaling back already lean budgets for education, healthcare and public safety.

The Dallas Morning News quoted senior legislative staff this month saying the deficit has gone as high as $25bn and could rise if the economy does not pick up.

"It's going to be a really bad couple of years for public schools," said Mark Jones, political scientist at Rice University. Education accounts for 55 per cent of state spending, he said.

Other areas highly dependent on the state are healthcare, accounting for 25 per cent of spending, and public safety, accounting for roughly 10 per cent.

Richard Murray, political scientist at the University of Houston, said the state had not fully recovered from the cuts made in 2003. For example, 26 per cent of Texans are uninsured – a higher percentage than in any other state. The estimated average salary of public school teachers ranks 39th among states, with state and local expenditures per pupil in public schools ranking 44th.

Given an increasingly elderly population, large numbers of uninsured and a rise in those using public education, Mr Murray said drastic cuts would be needed.

What is shocking is that Texas's economy has been better than most. Texas experienced a 1.6 percent increase in jobs over the last year while the U.S. as a whole only saw a 0.2 percent increase. In fact, half of all jobs created were in Texas. Texas has an unemployment rate of just 8.1 percent versus a U.S. average of 9.6 percent.

If fast growing Texas is having trouble balancing its budget, think about all those underperforming states.

Sovereign debt spreads hit records. MSM still unavailable for comment.

Portugal, Ireland, Spain CDS spreads hit records

Fears surrounding sovereign-debt problems on the periphery of the euro zone drove the cost of protecting the debt of Ireland, Portugal and Spain to record highs on Thursday, according to data provider Markit. The spread on five-year Portuguese credit-default swaps widened to 505 basis points from around 491 on Wednesday, topping the 500-level for the first time, Markit reported. That means it would now cost $505,000 a year to insure $10 million of Irish sovereign debt against default for five years. The five-year Irish CDS spread widened 27 basis points to 620, while Spain's spread widened to 294 basis points from 279. Greece's spread was 12 basis points wider at 890.

I am in total shock and disbelief. No, not that these countries are headed down the drain. I've been warning about that for a while. I am shocked that this isn't on the front page of every newspaper and the lead story on the TV and radio news shows. The world is burning while the main stream media fiddles.

November 9, 2010

The Path to Tyranny featured on Conservative Bookstore!

The Conservative Bookstore is featuring my book, The Path to Tyranny: A History of Free Society's Descent into Tyranny, on their site this month.

W.J. Rayment of the Conservative Bookstore posted the full review at Conservative Monitor. Here is the full review for you enjoyment:

Even in the days of ancient Greece, political science was a subject earnestly studied and remarkably well-understood. The multiplicity of city states allowed philosophers to discern patterns in the ebb and flow of historical events. What the Solon's of the age noticed was that when pure democracy was allowed to reign in any state that the inevitable result was a rapid destruction of the economy and a sudden move to tyranny coupled with an almost complete loss of liberty.

Michael E Newton in his seminal work, The Path to Tyranny: A History of Free Society's Descent into Tyranny, we are treated to historical examples of what happens when a society allows rampant, uncontrolled democracy to subvert constitutional balance within a government. Newton begins with ancient Western Civilization where in both Greek and Roman society broke down because the mass of people figured out they could violate property rights through the government. When this happened, productivity was discouraged by ever rising taxation. The declining availability of goods and services caused the frustration of the under-classes (because that an exploited economy could not support their demands). Thus, they would resort to a demagogic dictator who would ring society dry for the support of the masses in the aggrandizement of his own wealth and power.

As The Path to Tyranny so ably illustrates, in example after example, the ultimate result of this process is the loss of freedom, the degradation of the economy, and general misery. This is one of those history books where Santayana's famous quote rings loud and rings true, "Those who do not understand history are doomed to repeat it." There are lessons here for America. Mr. Newton's clear and concise writing style makes them crystal clear.

This is the great thing about this book. It can be understood by both the academic as well as the layman. As a student of history myself (I wrote a textbook on Modern European History), I found myself gesticulating, scribbling in the margins, and generally agreeing with point after point. I kept thinking that this book is irrefutable. I can't imagine an academic or politician arguing intelligently with Newton's assertions or his conclusions. Of course, there are three self-interested groups who would argue that America's present course is a good one. They would be those who believe they will benefit from government largesse in the form of welfare payments, "free" health care, and social security. Then there are those academics who arrogantly think they are smart enough to manage a centralized economy better than Smith's invisible hand. Finally, most ominously, there are those politicians who wish to harness the lazy greed of those who would suck off the system, using it to propel their own political careers in a tyrannical direction…Ironically, in the U.S. most of these politicians are currently called Democrats.

The Path to Tyranny is well-documented – with ample citations, a bibliography, and a comprehensive index. Besides ancient Greece and Rome, it covers ancient Israel, Communist Russia, Fascist Italy, Nazi Germany, and of course the current state of affairs in the United States. In a fascinating section, Newton also nails the dictatorship of Hugo Chavez. After reading this book anyone who subscribes to the democratic agenda, must be stupid, delusional, or a demagogue!

Must Read!

Thank you Mr. Rayment for your great review. I'm glad you enjoyed the book.

ELEFTHERIA I THANATOS!

Baseball analogy for tea party "victory"

To follow up on my post Has the Tea Party accomplished anything yet?

Over the last two years, the Democrats have scored a lot of runs. They hit a grand slam with health care reform. Another home run with stimulus spending. Another with financial reform. They racked up one run after another.

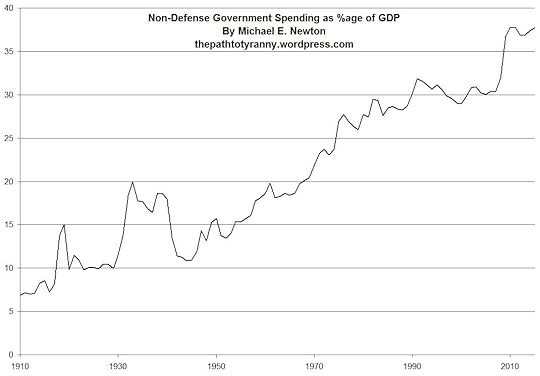

Finally, the tea party movement struck out the Democrats in spectacular fashion (the biggest electoral turnaround in 62 years) and the top half of the inning is over. Now, it is the tea party's turn to try and score some runs. But the limited government side is trailing 37 to zero (government spending excluding defense is 37 percent of GDP).

The GOP now controls the House of Representative, but it does not yet have Senate or Presidency. So the tea party movement has a man on first base. But it's in a deep hole, down by 37 runs, and has to start scoring runs in abundance.

I'm sure you can see why I am not too excited by the tea party "victory" of November 2. Yes, the tea party movement, which didn't even exist two years ago, stopped the Democrats from scoring more runs, but to win you must score runs of your own. In this respect, the tea party has not accomplished anything.

Federal Reserve blames Congress and President for problems

Marketwatch reports in a story titled Fed says Congress needs better growth plan: Central bankers urge tax, regulatory reforms, pro-trade policy:

Top Federal Reserve officials on Monday said the central bank has done everything it can to help a weak U.S. economy. The rest is up to Congress and the White House.

The Fed is correct here. Not only have they "done their part," they've actually done too much. Our current economic problem is not something the Fed can fix. There's no shortage of money. There's no credit freeze. There's nothing the Fed can do. (So why don't they stop their quantitative easing?)

The economic problems come from the fiscal side. High taxes and unpredictable government interference has scared away capital and risk taking. The report continues:

In separate speeches, three senior Fed executives said Washington needs to fashion better tax and regulatory policies that encourage businesses to invest in the U.S. and create jobs.

"It is absolutely imperative that the Congress and the president attack the long-run budget problems the nation faces," St. Louis Federal Reserve President James Bullard said in a speech to Wall Street financial analysts in New York.

"The Federal Reserve cannot and should not do it alone," he said. "Other policymakers must bear their burden and do their part to encourage more-robust economic growth and establish the conditions for stronger employment."

In a speech Monday in San Antonio, [Dallas Federal Reserve President Richard] Fisher warned that the Fed's credibility could be lost if global investors perceive that the U.S. is trying to inflate its way out of debt.

All three said U.S. lawmakers have to figure out ways to boost the nation's competitiveness and develop better long-term growth policies. They urged Washington to streamline regulations, simplify the U.S. tax code and pursue more free-trade deals to open foreign markets to American goods.

Fisher said fewer businesses want to invest in the U.S. because they can get a better return on their investment in other countries.

"The remedy for what ails the economy is, in my view, in the hands of the fiscal and regulatory authorities, not the Fed," Fisher said.

The question remains though: Who is most incompetent? The Federal Reserve? Congress? The President? They are all so totally incompetent that there is only one way out of this mess: the government, that is all three of the above, has to get out of the way. Stop interfering in the economy. Reduce taxes. Reduce spending and return a large portion of the economy back to the free-enterprise system. The economy will not thrive until they do so.

China vs. United States on monetary policy.

China continues its verbal assault on the United States' quantitative easing plan:

China announced new measures Tuesday to curb inflows of foreign speculative capital, as senior government officials stepped up criticism of excessively loose monetary policies abroad, such as those of the Federal Reserve.

Tuesday's announcements were accompanied by fresh criticism from Beijing officials of loose monetary policies abroad and consequent risks in emerging markets.

Chinese Finance Minister Xie Xuren blamed excessively loose monetary policies by issuers of major currencies as compounding fiscal and debt risks.

The comments, made during a meeting with a delegation of British trade representatives, including U.K. Chancellor of the Exchequer George Osborne, appeared to be thinly veiled criticism of the Federal Reserve's latest quantitative easing moves.

Similarly, Chinese Vice Premier Wang Qishan said Tuesday that volatility in global markets was negative for market confidence and that he saw excessively liquidity globally.

Many believe China is an evil communist country that enslaves its people and destroys its environment. While some or all that may be true, China appears to be the good guy when it comes to monetary policy. How is it possible that Communist China understands that creating paper money out of thin air does nothing but create economic distortions while the United States is blind to that reality?

Maybe, instead of having Chinese study economics and business in American universities, we should send some of our student to China to learn economics because they seem to have a better grasp of it.

November 8, 2010

Has the Tea Party accomplished anything yet?

Many people talk about the success of the tea party movement. While we did something remarkable in the 2010 election, we have not really accomplished anything yet.

I recall this chart of total government spending excluding defense over the last 100 years.

In 1910, government at all levels spent about 7% of GDP. Today it is about 37%. Do you see what the tea party has accomplished so far? NOTHING!!!

At best we slowed down the rate of growth or maybe even stopped it. But we have yet to reduce it by a single percentage point after it rose seven percentage points in just two years.

Many in the tea party movement claim that Obama is the worst President ever. Yet, the GOP won just 54.2% of the two-party vote, maybe slightly higher if you add in Murkowski's votes. The Republicans won 240+ seats, but that's less than the 257 seats the Democrats won in 2008. Against the supposed worst President in history, that's all the tea party could accomplish?

I don't mean to minimize the biggest electoral shift since 1948… OK, yes I do. These accomplishments are meaningless unless they are used for something bigger. I will not be satisfied until I see the vast majority of Americans voting for republican government (small 'r' intentional) and that trend line of government moving down instead of up. When that happens, I'll talk about our accomplishments. Until then, I'm too busy working for the cause of liberty to brag about winning a few seats in Congress.

China warns QE2 could create emerging market bubble

China is giving the United States an economics lesson:

Beijing leveled new criticism at the latest round of quantitative easing unveiled by the Federal Reserve, warning the policy could swamp emerging economies with destabilizing inflows of speculative capital.

"For the U.S. to undertake a second round of quantitative easing at this time we feel is not recognizing the responsibility it should take as a reserve currency issuer, and not taking into account the effect of this excessive liquidity on emerging-market economies," Vice Finance Minister Zhu Guangyao told reporters at a press conference in Beijing.

Zhu said the first round of quantitative easing by the Fed was justified to help stabilize markets "at the height of the financial crisis."

However, the second round — dubbed "QE2" in financial circles — comes at a time when economic recovery is beginning to kick in, he said.

"Financial markets are not lacking capital; rather they are lacking confidence in the global economy. Financial institutions have large amounts of cash," he said.

You know how low you've sunk when China, technically the People's Republic of China ruled by the Communist Party of China, makes more economic sense than the Federal Reserve.