Anndy Lian's Blog, page 99

September 19, 2022

Ethereum Merge hits graphic cards, but GPU-based mining is not dead

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Ethereum Merge hits graphic cards, but GPU-based mining is not dead

Ethereum’s shift of its consensus algorithm from proof-of-work (PoW) to environment-friendly proof-of-stake (PoS) in an event called ‘The Merge’ earlier this week will result in sizeable graphic card (GPUs) dump and hit manufacturers such as Nvidia and AMD.

As The Merge has obviated the need to secure the blockchain network, GPUs are no longer needed on a mass scale and will go for a significant discount, experts said. However, this may not happen immediately as the GPUs can be deployed for a new Ethereum hard fork and mining other stablecoins.

“With the Merge on the cards for a long while now, I would imagine most miners would have planned ahead with alternative money-making schemes. But, once the flooding stops, it would revert to basically as it is now, unless the increased demand for GPUs drop, caused by more than just mining. Things like the extreme influx of using computers for entertainment and work purposes will continue as usual,” Raj Kapoor, Founder and CEO of India Blockchain Alliance, told Moneycontrol.According to experts, there will be increased availability of second-hand GPUs that have been mined to bits.

With The Merge, the energy used to maintain the whole Ethereum network will drop by a huge 99.9 percent, which will result in a 0.2 percent decrease in world electricity use. However, not all ETH miners may want to give up their GPU exploits in favour of the more environmentally friendly PoS variant.

What is GPU-based mining?

The majority of crypto mining in the beginning, especially for Bitcoin and Ethereum, was done on basic CPUs for home computers but as demand increased so did the mining difficulty.

People then discovered that their GPUs were well suited to handle algorithms since these computer parts were actually intended to handle equations for 3D and physics rendering, which are identical to the equations in the blockchain algorithms.

Since GPU mining was far more efficient than using other types of mining gear, it signalled a major shift for the community.

While traditional CPUs were like blunt instruments when it came to mining cryptos, in contrast, GPUs were well-honed Samurai swords. They established a new benchmark since they were much more efficient than the previous technology.

EthereumPOW made for GPU miners

Despite Ethereum Classic already existing as a PoW alternative to the main ETH chain, a new hard fork called EthereumPOW (ETHW) was made for GPU miners.

A hard fork is a significant modification to the network protocol that makes previously invalid blocks and transactions valid, or vice versa. Simply put, a hard fork happens when nodes of the most recent version of a blockchain stop accepting older versions, leading to a permanent separation from the earlier network version.

The ETHW chain’s developers want to replicate the whole original ETH blockchain, including all of its currencies, NFTs, Dapps, and liquidity pools. However, the value of ETHW remains uncertain as there would be few Dapp operators and unlike Ethereum Classic, it is not backed by any stablecoin. Also, emulating the original Ethereum chain would be tricky since ETHW now contains the difficulty bomb, which will render GPU mining obsolete around 2023.

Even so, ETHW was able to secure the backing of BitMEX and Poloniex, two reputable crypto exchanges, as well as the inventor of TRON. Although ETHW has not yet been released as a token, its IOU worth is now trading around $9.09. IOU stands for ‘I owe you,’ which denotes that one party owes another one money.

Since the chain has not yet forked, the ETHW coin would derive from a possible Ethereum hard fork.

Mining for other cryptos

After The Merge, GPU miners will be looking elsewhere for opportunities, like mining some other coin which would still reward firms of graphics cards.

Ethereum is not the only coin that is mined decently on a graphics card. Beam and Ravencoin are actually similarly profitable at this time and though ETH mining has stopped, these will continue. While there will be increased competition to mine these coins, it would balance out eventually.

“Additionally, the companies that produce and distribute GPUs are already selling such items in bundles with other products to drive up their sales and profit margins,” Kapoor adds.

The much-anticipated GPU flood that would curb inflated pricing might be delayed since many GPU miners want to continue supporting Ethereum Classic, ETHW, or whatever PoW currency becomes more profitable.

Interestingly, in anticipation of the debut of the next generation, chip makers like Nvidia and AMD are now selling the majority of current-generation GPUs for less than the manufacturer’s suggested retail price (MSRP).

The impact of PoS can be reduced if PoW chains keep demand high

Anndy Lian, Chief Digital Advisor, Mongolian Productivity Organization, says that the ETH upgrade would be one of the big revenue misses by Nvidia and its stock has fallen nearly 20 percent since the previous quarter due to a slowdown in the gaming business and weakness in the global markets.

“The impact from the change to POS would be reduced if the forked PoW chains can keep their demand high, getting support from the big miners and backed by strong communities who believe that PoW is the core value. If this is executed properly with the support of Nvidia, this market push would surely put the listed company in a much better position,” Lian says.

More certainty for chip manufacturing companies

A Barron’s report quoted analysts led by Stephen Glagola at investment bank Cowen saying that The Merge will affect chip manufacturers whose graphics processing units have been employed in the process because Ethereum’s switch to PoS will eliminate the necessity for mining of Ether.

But a decline in mining is not necessarily negative, rather, it will provide companies manufacturing chips more certainty and eliminate the risk of demand that is blindsided by unstable crypto prices.

“For GPU suppliers Nvidia and to a lesser extent AMD, we view the upcoming Merge as a long-term positive for sentiment as it likely removes the risk of another painful crypto bang/bust cycle in the future,” said the Cowen team.

The post Ethereum Merge hits graphic cards, but GPU-based mining is not dead appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 18, 2022

A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards?

Considered the world’s most actively used blockchain network, Ethereum (CRYPTO: ETH) has successfully transitioned from a mining and energy-intensive proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) model that replaces miners with validators.

Dubbed as The Merge, this move has been touted to help improve Ethereum’s scalability, reduce its energy requirements and make its entire ecosystem more secure.

However, the elimination of the need to mine Ethereum will undoubtedly impact the overall global graphic processing unit (GPU) demand, casting doubt over the future growth potential of chipmakers like NVIDIA Corporation (NASDAQ: NASDAQ:NVDA), Advanced Micro Devices Inc. (NASDAQ: NASDAQ:AMD) and others.

Delving into Nvidia’s quarterly results to understand the revenue share of GPUs in its overall business does paint a less extreme picture than what is being surmised.

ETH upgrade to impact NVIDIA revenue:

Lian Offering a viewpoint on how Ethereum’s transition will impact NVIDIA and other chipmakers, thought leader and best-selling author Anndy Lian says, “The Merge will completely remove the need for miners, who are currently securing the Ethereum network. They will replace them with validators. This upgrade would lead to a big revenue miss for NVIDIA, whose stock was down by nearly 20% compared to the previous quarter, associated to a slowdown in the gaming business and weakness in the global markets.”

The impact of the change to POS would be reduced if the forked POW chains can keep their demand high, getting support from big miners and backed by strong communities who believe that POW is the core value.

“If this is executed properly with the support of companies like NVIDIA, this market push is likely to put these listed chipmakers in a much better position,” Lian adds.

The world leader in the discrete graphics card business, NVIDIA’s graphics business contributes to 58% of the company’s revenues and 62% of its operating income, according to Investopedia.

This includes the GeForce GPUs, GeForce NOW game-streaming service and solutions for gaming platforms provided by NVIDIA.

GPU market to post healthy growth

Despite the fact that sales for the GeForce GPU will be affected by the drop in GPU demand on account of Ethereum’s design change, analysts expect the overall GPU market to post healthy growth rates over the next five years due to strong demand from the gaming industry.

What is worrisome, however, will be the loss of pricing power that companies like NVIDIA enjoyed as long as the semiconductor chip shortage lasted.

With demand pressures and pricing challenges increasing, chipmakers like NVIDIA will need to aggressively focus on other verticals to maintain profit margins.

Echoing this sentiment, Raj Kapoor, Founder and CEO of India Blockchain Alliance says that Ethereum is not the only coin that mines decently on a graphics card and that Beam and Ravencoin are actually similarly profitable at this time, and even when ETH mining stops, those would still continue.

According to experts, post The Merge, crypto miners will be looking elsewhere for mining opportunities as long as there are other coins that will reward them for their effort.

“It is also possible that combined with the great crypto value crash of 2022, some miners decide to get out of the business altogether. Some may even try and make their own forked version of Ethereum, one that requires mining and no rules. We would probably see increased availability of second-hand GPUs that have been mined to bits as a result of the second-largest crypto moving away from mining,” Kapoor says.

He adds that with ETH’s move to PoS being in the cards for a long time, most miners will have planned ahead with alternative money-making endeavors.

Once the flooding of GPUs in the used market stops, GPU demand would revert back to previous levels, unless there is some other factor that reduces the overall demand.

With the increased usage of computers for entertainment and work purposes being a trend that will stay, eventually, all forces will balance out again.

As for companies like NVIDIA that are involved in the manufacturing and distribution of GPUs, they’re already bundling them with other products and exploring other business verticals to supplement their profits, he further says.

While the short-term effect of Ethereum’s shift to a PoS model will dent sales for NVIDIA and other chipmakers, the overall growth story for GPUs and allied services seems intact.

Moreover, as these companies expand their range of products and services into areas such as Artificial Intelligence (AI), their reliance on the crypto world will eventually fade away and will be replaced by Web3-focused consumer products in the near future.

The post A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards?

ZINGER KEY POINTSEthereum blockchain has switched to a Proof-of-stake consensus modelThe complete stoppage of mining Ethereum tokens will have a perceptible but temporary impact on leading chipmakers.

ZINGER KEY POINTSEthereum blockchain has switched to a Proof-of-stake consensus modelThe complete stoppage of mining Ethereum tokens will have a perceptible but temporary impact on leading chipmakers.Considered the world’s most actively used blockchain network, Ethereum has successfully transitioned from a mining and energy-intensive proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) model that replaces miners with validators.

Dubbed as The Merge, this move has been touted to help improve Ethereum’s scalability, reduce its energy requirements and make its entire ecosystem more secure.

However, the elimination of the need to mine Ethereum will undoubtedly impact the overall global graphic processing unit (GPU) demand, casting doubt over the future growth potential of chipmakers like NVIDIA Corporation, Advanced Micro Devices Inc. and others.

Delving into Nvidia’s quarterly results to understand the revenue share of GPUs in its overall business does paint a less extreme picture than what is being surmised.ETH upgrade to impact NVIDIA revenue: LianOffering a viewpoint on how Ethereum’s transition will impact NVIDIA and other chipmakers, thought leader and best-selling author Anndy Lian says, “The Merge will completely remove the need for miners, who are currently securing the Ethereum network. They will replace them with validators. This upgrade would lead to a big revenue miss for NVIDIA, whose stock was down by nearly 20% compared to the previous quarter, associated to a slowdown in the gaming business and weakness in the global markets.”

The impact of the change to POS would be reduced if the forked POW chains can keep their demand high, getting support from big miners and backed by strong communities who believe that POW is the core value.“If this is executed properly with the support of companies like NVIDIA, this market push is likely to put these listed chipmakers in a much better position,” Lian adds.

The world leader in the discrete graphics card business, NVIDIA’s graphics business contributes to 58% of the company’s revenues and 62% of its operating income, according to Investopedia.

This includes the GeForce GPUs, GeForce NOW game-streaming service and solutions for gaming platforms provided by NVIDIA.

GPU market to post healthy growthDespite the fact that sales for the GeForce GPU will be affected by the drop in GPU demand on account of Ethereum’s design change, analysts expect the overall GPU market to post healthy growth rates over the next five years due to strong demand from the gaming industry.

What is worrisome, however, will be the loss of pricing power that companies like NVIDIA enjoyed as long as the semiconductor chip shortage lasted.

With demand pressures and pricing challenges increasing, chipmakers like NVIDIA will need to aggressively focus on other verticals to maintain profit margins.

Echoing this sentiment, Raj Kapoor, Founder and CEO of India Blockchain Alliance says that Ethereum is not the only coin that mines decently on a graphics card and that Beam and Ravencoin are actually similarly profitable at this time, and even when ETH mining stops, those would still continue.

According to experts, post The Merge, crypto miners will be looking elsewhere for mining opportunities as long as there are other coins that will reward them for their effort.

“It is also possible that combined with the great crypto value crash of 2022, some miners decide to get out of the business altogether. Some may even try and make their own forked version of Ethereum, one that requires mining and no rules. We would probably see increased availability of second-hand GPUs that have been mined to bits as a result of the second-largest crypto moving away from mining,” Kapoor says.

He adds that with ETH’s move to PoS being in the cards for a long time, most miners will have planned ahead with alternative money-making endeavors.

Once the flooding of GPUs in the used market stops, GPU demand would revert back to previous levels, unless there is some other factor that reduces the overall demand.

With the increased usage of computers for entertainment and work purposes being a trend that will stay, eventually, all forces will balance out again.

As for companies like NVIDIA that are involved in the manufacturing and distribution of GPUs, they’re already bundling them with other products and exploring other business verticals to supplement their profits, he further says.

While the short-term effect of Ethereum’s shift to a PoS model will dent sales for NVIDIA and other chipmakers, the overall growth story for GPUs and allied services seems intact.

Moreover, as these companies expand their range of products and services into areas such as Artificial Intelligence (AI), their reliance on the crypto world will eventually fade away and will be replaced by Web3-focused consumer products in the near future.

The post A Look At Chipmakers In The Wake Of The Ethereum Merge. Is There Still Demand For Graphics Cards? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 13, 2022

Everything about Ethereum Merge on Blockcast.cc Twitter Spaces

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Everything about Ethereum Merge on Blockcast.cc Twitter Spaces

Ethereum Merge is a hotly anticipated and long-awaited upgrade.

The Merge represents the Ethereum network’s shift to proof-of-stake (PoS), its new system (also called a “consensus mechanism”) for authenticating crypto transactions. The reason the change from PoW to PoS is called “the Merge” is because the already running beacon chain will merge with the existing Ethereum mainnet chain.

On the other hand- The fork, commonly referred to as ETHPoW, will share the same transaction history as the main Ethereum network but start creating its own blocks. What does this mean to the market? Are we looking at more volatility?

Organizer: Blockcast (https://twitter.com/Blockcastcc)

Moderator: Scoot Tripp (https://twitter.com/Cryptobeast32)

Guests:

Jenny Zheng, BD Lead of Bybit NFT

Anndy Lian, Book Author of NFT: From Zero to Hero

Leo, BitCoke Partner

Dr Z, Ethereum Fair Dev

Satoshi_song, Ethereum Fair Dev

Yu Han Wong, Strategy Advisor, Moledao

Pitbull Core Dev

1. The merger of Ethereum is getting closer (expected on the 13th to the 15th). Some uncertainties are reported from time to time, whether there will be a delay, and what will be the impact of the success or failure of the merger?

2. What should we pay attention to when Ethereum hard forks, and what opportunities will there be?

3. The Ethereum Foundation opposes the fork. What measures will they take to organize the fork, such as technical containment, will it have a substantial impact on the fork?

3. The fork is imminent, some exchanges have expressed their support, and many major ones are waiting to see. What advice do you have for the exchange holders?

4. As one of the hard fork chains, what progress has EthereumFair (ETF) made so far? What are the highlights compared to other fork chains?

5. Whether the stability of the mining pool computing power can be stabilized in a relatively short period of time (currently most mining pools fluctuate greatly)

6. What preparations do miners need to do to support POW?

7. After the successful fork of the ETF, what major plans and actions have the community made? Can you share your roadmap?

8. Where will miners move after Ethereum with their miners, what are your thoughts?

9 What risks will the Ethereum Merge pose, specifically in terms of stablecoins and forks?

The post Everything about Ethereum Merge on Blockcast.cc Twitter Spaces appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

What Are The Key Events In September To Look Out For? CPI, The Merge, FOMC & Vasil

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

What Are The Key Events In September To Look Out For? CPI, The Merge, FOMC & Vasil

September 2022 is going to be exciting. Although historically, this is a bad month for the stock markets. But it is not so for the crypto markets. In my humble opinion, there are a couple of key events that investors should be looking at very closely as they are all interlinked.

Consumer Price Index (CPI)

We are starting with September 13. The U.S. Bureau of Labour Statistics will share the Consumer Price Index (CPI) report.

One of those data points is the August Jobs figures that are already out. A close look at the U.S. labor market data showed that non-farm payrolls rose by 315,000 in August, higher than the estimated 298,000 but lower than the previous month’s 526,000. A strong employment sector means a more resilient economic condition, thus propelling Fed to tackle inflation more aggressively. Analysts also dig into the jobs report for signs of what is happening with wage growth.The U.S. CPI figures will ultimately assist the Fed in deciding whether to go for a 50bps or 75bps rate hike, together with the jobs data for August that was provided earlier this month. The U.S. inflation rate increased from 8.6% in May 2022 to 8.5% in July and 9.1% in June. The U.S. inflation rate for August may serve as a benchmark for future Fed rate hikes.

Ethereum Merge

This is a much-anticipated event in the crypto scene for this year. This event has already begun. They have shipped the Bellatrix upgrade, the final update before the Merge itself that is scheduled to happen from September 13-15.This upgrade will reduce Ethereum’s carbon footprint as crypto mining will be removed, moving the network’s consensus mechanism from Proof of Work (PoW) to Proof of Stake (PoS). This move has also affected Nvidia’s stock price, as they have been a key supplier of mining equipment. The miners are still hopeful, and they think that the fork will continue to keep them in the business. On top of these, there was a lot of news and marketing buzz around the new Eth PoW airdrop. Key opinion leaders are telling all that borrowing as many ETH from AAVE or Compound would make sense before the snapshot as they can expect maximum utilization.

The bullish signs are showing on the charts, with the price of Ethereum going up to 4.98% while Bitcoin remains stagnant.

Federal Open Market Committee (FOMC)

The FOMC holds eight regularly scheduled meetings during the year and other discussions as needed. September 21 is the next meeting.

The Fed Chairman Powell’s “powerful” speech at Jackson Hole on August 26 is primarily to blame for the recent sharp decline in market prices. Powell’s comments were substantially more hawkish than anticipated and alarmed the market.

The market anticipated the Fed to remain neutral after recent inflation statistics revealed that inflation had peaked and prices were dropping. They expected the Fed to keep to its plans to increase interest rates by another 100-120 basis points (1% -1.2%) by the end of 2022, bringing the Fed funds rate to 3.25%-3.5%. At the last FOMC meeting, Powell had also given the market the assurance that the economy would have a soft landing and that no recession was imminent.

Powell used words like “bring some pain to households and businesses” and “very likely be some softening of labor conditions”. Analysts who looked at the speech were reading that the Fed Chair was suggesting the recent fall in inflation was not good enough. To stop inflation once and for all, the Fed was prepared to increase the unemployment rate, reduce wage growth, and sacrifice short-term growth.

For many Americans, the critical question is whether they can continue to keep their jobs, not the increase in rates of September as the Fed bears down on inflation.

The FOMC has raised interest rates four times in 2022 so far. If you are wondering what has the rate got to do with cryptocurrencies. For your information, Bitcoin’s price dipped as low as $17,500 following the Fed’s two-day meeting on June 14 and 15. The Fed raised interest rates by 0.75%. Generally, traders leave the market when interest rates increase, or other markets are impacted, which leads to a sell-off in cryptocurrencies.

Cardano Vasil Hard Fork

The Cardano Vasil hard fork is currently the second most anticipated upgrade in the crypto space, right behind the Ethereum Merge.

Many of us may not know the term “Vasil”. Cardano, ranked 8th on CoinMarketcap is a proof-of-stake blockchain platform: the first to be founded on peer-reviewed research and developed through evidence-based methods.

Vasil is a major upgrade on Cardano, bringing increased network capacity and lower-cost transactions. The upgrade will also bring improvement to Plutus, Cardano’s smart contract platform, to enable developers to create more efficient blockchain-based applications.

Cardano’s ADA token price rose 2.2% in the past 24 hours and 14% in the last week. This upgrade is confirmed to be on September 22.

Impact on the Financial Market

Because Bitcoin is seen as an investment instrument similar to stocks and bonds, the FOMC and macroeconomic pronouncements can greatly impact its price. Numerous studies show that these announcements also impact the financial market as a whole.

It remains to be seen if history will repeat itself and equities will conclude the month of September lower. As additional evidence comes in over the coming months, the idea of a Fed Pivot that was dismissed after Jackson Hole could start to materialize. Investors in the stock market anticipate that the Fed’s decision will provide them with guidance before the results of the upcoming quarter are released and when macroeconomic conditions change in 2023. Perhaps Ethereum and Cardano are the only shining knights in this financial uncertainty.

We will see.

I will end with a quote. “You will most likely come out on top in this bear market if you stick to your financial strategies and maintain your sense. Keep in mind that the people who sow their seeds today can become the millionaires who will profit from the upcoming bull market.”- Anndy Lian

The post What Are The Key Events In September To Look Out For? CPI, The Merge, FOMC & Vasil appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Fungible after all? Duplicates may disrupt NFT industry after Ethereum Merge

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Fungible after all? Duplicates may disrupt NFT industry after Ethereum Merge

The Merge is the most anticipated event in the crypto industry in years, but could the multibillion dollar non-fungible token industry become an unexpected casualty?

The Merge is the most anticipated event in the crypto industry in years, but could the multibillion dollar non-fungible token industry become an unexpected casualty?The expected “Merge” of the Ethereum blockchain this week could raise the risk of fraud and scams in the market for non-fungible tokens such as Bored Ape Yacht Club as analysts warn original and new versions of the tokens known as NFTs could confuse buyers.

The US$200 billion Ethereum network accounted for 70% of NFT trading activity in August, making it the world’s leading blockchain for such marketplaces run by companies like OpenSea.

However, the Merge of Ethereum to a proof-of-stake (PoS) network from a proof-of-work (PoW) will create duplicates of the NFTs from the original network, something the unscrupulous could take advantage of, Anndy Lian, author of the new book “NFT: From Zero to Hero,” told Forkast in an interview.

Scams are already prevalent in the NFT industry, which lacks oversight or regulatory protection, and any added confusion could generate more. Lian said some exchanges or marketplaces might temporarily stop transactions to address any complications or confusion that arise.

“This will become a big issue for investors who are not careful,” he said.The MergeThe current Ethereum PoW network involves crypto mining companies using energy-gobbling computer farms to solve cryptographic equations that validate transactions on the blockchain, for which they are rewarded with Ether.

The shift to PoS – in which users validate transactions through “staked” ether – is expected to speed up and slash energy use on the network, which may mollify some critics who say the blockchain industry contributes to global warming.

However, Ethereum miners are less than happy as they see a business model evaporate that leaves them with redundant and expensive computer farms that cannot be repurposed. Hence, some have pledged to fork the network and create a concurrent PoW Ethereum network.

“[Miners] are all trying to come out with their own ecosystem,” Lian said, “everyone is trying to grab a [slice of the] pie because of this new consensus mechanism.”This is where the potential NFT confusion comes in. All existing NFTs on the Ethereum blockchain will be duplicated on the new PoS system, but if a PoW fork exists, the original NFTs will continue to exist on that network as well.

And this is not just hypothetical, exchanges have had to explain to users what their policy will be regarding duplicates.

Real dealLeading NFT marketplace OpenSea, which had about four times the sales volume over the last 30 days of its nearest competitor, Magic Eden, announced it was “solely supporting NFTs on the upgraded Ethereum PoS chain.”

Yuga Labs, creators of leading NFT collection Bored Ape Yacht Club, said their licenses only apply to PoS versions of their tokens.Competing marketplace, Rarible, has taken a different approach, saying it recognizes the authenticity of any copies of NFTs created in the same wallet address when they were held on Ethereum.

Rarible noted another potential issue, saying the aggregate number of NFT collectibles may increase, which could depress the value of collections.

“It’s impossible to predict what the actual outcome will be, but it’s highly likely that duplicate NFTs will cause confusion,” said Rarible’s chief strategy officer and co-founder Alex Salnikov in an email to Forkast. “Especially for less experienced NFT collectors.”

Déjà vuThis scenario is not without precedent in the NFT market. One of the most popular NFT collections, CryptoPunks, is actually a re-issue of the original — now known as V1 CryptoPunks — to fix a bug in their programming.

The replacement V2s were airdropped to all holders of the originals and the V1s were left to be forgotten about.However, as V2 CryptoPunks grew to be one of the largest NFT collections, a significant market in V1 versions grew among collectors who were looking to own a piece of NFT history.

CryptoPunks creators, Larva Labs, tried to squash this secondary market using legal means, but ultimately the V1 community won out and both versions can now be traded freely.

Ultimately, Lian believes the market will follow the PoS network as it is recognized as the “official version” of Ethereum.

“Whichever [chain] will gain more traction with the most liquidity will ultimately be the one that everybody will recognize,” Lian said.The upsideThe good news for would-be environmentally conscious NFT investors is that PoS is estimated to be roughly 99.95% more energy efficient than PoW, according to the Ethereum Foundation.

“This may cause a new, environmentally conscious user base to adopt the technology which would in turn help drive greater mass adoption of NFT and Web3 technology,” said Rarible’s Salnikov.

“Increasing activity on Ethereum may also bring about new innovative use cases for NFT technology and drive the development of new tools designed for the growing Web3 creator economy,” he added.

The Merge may help boost Ether’s price as the network introduces new mechanics that will burn, or remove, 1,600 ETH each day, which is expected to have a deflationary impact on the token’s price.That could be good news for buyers whose NFTs denominated in Ether have dropped in value against the U.S. dollar since a peak in November.

But Lian said he is skeptical about the Merge turning the current NFT bear market around.

“I think that’s very wishful thinking.”

Source: https://forkast.news/fungible-duplicates-disrupt-nft-merge/

The post Fungible after all? Duplicates may disrupt NFT industry after Ethereum Merge appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Who owns the most voyager crypto? VGX tokens are also distributed among troubled platform’s customers

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Who owns the most voyager crypto? VGX tokens are also distributed among troubled platform’s customers

Voyager Digital has been making headlines ever since the crypto platform filed for Chapter 11 bankruptcy protection in July 2021. The company is engaged in ongoing court proceedings.

Here we take a look at the voyager (VGX) tokens circulating supply and analyse who owns the most VGX.

Voyager Digital: Origins & token historyVoyager Digital is a US-based cryptocurrency platform that was founded in 2017 by a team of finance and technology industry veterans, including the firm’s CEO Stephen Ehrlich, chairman Philip Eytan and Gaspard de Dreuzy, a serial entrepreneur.

In addition to being a crypto company, Voyager Digital is a publicly traded company listed on the Toronto Stock Exchange (TSX) since 2021 under the ticker VOYG.

As of September 2022, the company hosts over 100 different digital assets through its mobile application and allows clients to earn rewards of up to 12% annually on more than 40 cryptocurrencies.

The Voyager token (VGX) is the platform’s native cryptocurrency. It’s designed to reward customers for their loyalty. It was based on the Ethos Token. In 2019, Voyager acquired Ethos.io and incorporated the team, technology and native token into its ecosystem.

Until 2020, Voyager operated with a multi-token functionality. After 2020, the company integrated its native tokens into a new single token model known as VGX 2.0. Today, VGX maintains a presence on the Ethereum blockchain as an ERC20 cryptocurrency.

According to the project’s whitepaper, Voyager utilises the VGX 2.0 token to boost the platform’s adoption and functionality. Holding VGX allowed users to earn 7% staking rewards and raise their earnings by joining the Voyager Loyalty Program.

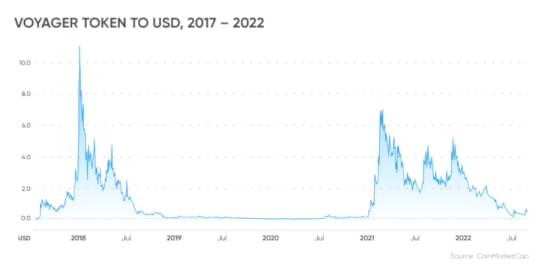

The VGX token was met with enthusiasm. The price rose to an all-time high of $11.02 just six months after the token launched in 2017. The bullish run was short-lived, and the price fell by 96.7% to $0.3678 by August 2018.

The next big jump took place between January and February 2021, when VGX surged 3,267% to $6.9023, from levels as low as $0.2. Around this time, the Uniswap (UNI) token became available on the Voyager platform.

On 22 November 2021, VGX surged to $5 amid a positive general crypto market sentiment, however, this was the token’s last peak as it embarked on a bearish run. But since its November high, the VGX has lost more than 75% of its value, sliding down to $0.9188.

Latest voyager crypto newsIn July 2021 Voyager filed for Chapter 11 bankruptcy protection, as it was heavily affected by the global crypto crash. Since then, the company has been in and out of court proceedings.

As Voyager moves through the Chapter 11 bankruptcy process, latest filings revealed on 8 September that the company will auction off the remainder of its assets on 13 September. The results of the auction will become final during a court hearing approving them on 29 September.

In the latest voyager token news, potential buyers remained unnamed. However, bids previously made by the crypto trading platform FTX were made public. FTX said in a press release on 22 July that it would buy Voyager’s assets and loans at cash value and open accounts for Voyager customers on FTX. This proposal, however, was branded a “low-ball” bid by Voyager’s lawyers.

In a second-day hearing presentation on 4 August, the company stated that it had received “higher and better” buyout offers. As of 12 September, Voyager said that it was contacted by 88 potentially interested buyers and was in “active discussions” with 20.

Who owns the most Voyager crypto?So, who owns the most Voyager crypto and how is the token distributed?

When Voyager decided to integrate its tokens (VGX and LGO (the native token of a company Voyager acquired) into one, VGX was exchanged for VGX 2.0 (now known as VGX) at a 1:1 rate. LGO’s exchange rate to VGX 2.0 was 6.5356340619:1.

The circulating supply of VGX tokens stood at 222 million. The circulating supply of LGO was over 33 million. Following the token swap, Voyager chose to mint a growth pool of tones on an annual basis to power Voyager Loyalty Program rewards, as well as fund promotional campaigns for new and existing customers.

Hence, 40 million new tokens were minted in the first year since the integration, 20 million will be minted in the second year and 10 million between the third and eight years.

According to data provided by CoinMarketCap, the total and circulating supply of VGX, as of 12 September, surpassed 278 million tokens. The maximum supply stood at 297 million.

Voyager also introduced a new initiative called the Voyager Loyalty Program, which Voyager customers can qualify for by maintaining a number of VGX tokens in their accounts. The programme has three tiers:

Adventurer – customers holding over 500 VGXExplorer – customers holding over 5,000 VGXNavigator – customers holding over 20,000 VGXThe more VGX customers stake, the higher they move up these tier categories and the more rewards they earn with each tier.

So, who owns the most Voyager crypto?

Over the last few months, VGX whales have gradually reduced their holdings. However, data revealed by etherscan.io showed that the top 100 VGX token holders, as of 12 September, collectively owned 97.62% of the total supply in circulation.

The website noted that the top account holding the most voyager tokens owned 93.9% of the circulating supply, which amounted to 208 million VGX tokens worth $191m, as of 12 September. According to the website, the account’s address is 0x933bb73de8fcfb74415fbc99561623c593bf3b61.

The second biggest VGX whale owned 1.9% of the total circulating supply, amounting to four million VGX tokens.

The third biggest VGX holder was an account under the address ‘Binance 8’ that held around 0.18% of the total circulating supply, amounting to around 395,757 tokens.

The fourth and fifth biggest voyager coin whales owned around 0.14% of the total circulating supply.

Final thoughtsWhile knowing who owns voyager crypto may be useful for the coin’s enthusiasts, it shouldn’t be used as a sole reason to trade. Nearly all of the maximum VGX supply is in circulation, as of the time of writing (12 September), which could lead to the possibility of greater volatility. Investors are warned to exercise caution.

According to Invezz’s analyst Crisous Nyaga, “uncertainty about the Voyager collapse and low volume trading could lead to market manipulation.

“The coin’s future is uncertain and it will depend on the outcome of the bankruptcy proceedings. If the firm moves completely out of business, there is a possibility that the VGX token will not survive. On the other hand, if it is acquired, there is a possibility that the coin will continue doing well.”Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and the author of NFT: From Zero to Hero, told Capital.com that retail investors are buying VGX based on rumours that the company will be acquired by either Binance or FTX.

“I noted that the current investors are still working very hard promoting in different channels with the hope of making the VGX a more viable choice for new investors and perhaps drawing more attention so that the buyout can complete faster. These are positive signs from the community members who want the token to do well and resume their staking and cashback rewards,” he stressed.Note that analysts’ predictions and opinions can be wrong. Always conduct your own due diligence before trading. And never invest or trade money you cannot afford to lose.

Source: https://capital.com/voyager-who-owns-most-vgx-crypto-tokens

The post Who owns the most voyager crypto? VGX tokens are also distributed among troubled platform’s customers appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

What Are the Major September Events to Keep an Eye On? The CPI, the Merge, the FOMC, & Vasil

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

What Are the Major September Events to Keep an Eye On? The CPI, the Merge, the FOMC, & Vasil

September 2022 will be an eventful month. The stock market has had a terrible month in the past. However, this is may not the case for the cryptocurrency markets. In my humble view, there are a few of major events that investors should pay special attention to since they are all interconnected.

Consumer Price Index (CPI)

We’ll begin on September 13th. The Consumer Price Index (CPI) data will be released by the United States Bureau of Labor Statistics.

One of these data points is the August jobs report, which is already out. A careful examination of US labor market statistics revealed that nonfarm payrolls increased by 315,000 in August, above the projected 298,000 but falling short of the prior month’s 526,000. A healthy labor market means a more resilient economy, prompting the Fed to take on inflation more forcefully. Analysts are also looking for clues in the employment data about what is going on with wage growth.

The CPI numbers for the United States, together with the August jobs data released earlier this month, will eventually help the Fed decide whether to boost rates by 50 basis points or 75 basis points. In the United States, the inflation rate rose from 8.6% in May 2022 to 8.5% in July and 9.1% in June. The August inflation rate in the United States might serve as a guideline for future Fed rate rises.

Ethereum Merge

This is a highly anticipated event in the cryptocurrency world this year. This event has already started. They have released the Bellatrix upgrade, the final update before the Merge, which is set for September 13-15.

This upgrade shift the network’s consensus method from Proof of Work (PoW) to Proof of Stake (PoS). This will lower Ethereum’s carbon footprint by removing crypto mining . This decision has also had an impact on Nvidia’s stock price, given they are a major provider of mining equipment. The miners are nevertheless optimistic, believing that the fork will keep them in business. On top of that, there was a lot of publicity and marketing hype around the new Eth PoW airdrop. Key thought leaders are reminding everyone that borrowing as much ETH as possible from AAVE or Compound before the snapshot is a good idea since they can expect maximum utilization.

The charts are exhibiting strong indicators, with the price of Ethereum increasing by 4.98% while Bitcoin remains unchanged.

Federal Open Market Committee (FOMC)

Throughout the year, the FOMC has eight regularly scheduled meetings and extra talks as appropriate. The next meeting is scheduled on September 21.

The Fed Chairman Powell’s “powerful” speech at Jackson Hole on August 26 is primarily to blame for the recent sharp decline in market prices. Powell’s comments were substantially more hawkish than anticipated and alarmed the market.

The market anticipated the Fed to remain neutral after recent inflation statistics revealed that inflation had peaked and prices were dropping. They expected the Fed to keep to its plans to increase interest rates by another 100-120 basis points (1% -1.2%) by the end of 2022, bringing the Fed funds rate to 3.25%-3.5%. At the last FOMC meeting, Powell had also given the market the assurance that the economy would have a soft landing and that no recession was imminent.

Powell used words like “bring some pain to households and businesses” and “very likely be some softening of labor conditions”. Analysts who looked at the speech were reading that the Fed Chair was suggesting the recent fall in inflation was not good enough. To stop inflation once and for all, the Fed was prepared to increase the unemployment rate, reduce wage growth, and sacrifice short-term growth.

For many Americans, the critical question is whether they can continue to keep their jobs, not the increase in rates of September as the Fed bears down on inflation.

The FOMC has raised interest rates four times in 2022 so far. If you are wondering what has the rate got to do with cryptocurrencies. For your information, Bitcoin’s price dipped as low as $17,500 following the Fed’s two-day meeting on June 14 and 15. The Fed raised interest rates by 0.75%. Generally, traders leave the market when interest rates increase, or other markets are impacted, which leads to a sell-off in cryptocurrencies.

Cardano Vasil Hard Fork

The Cardano Vasil hard fork is the second most anticipated update in the cryptocurrency market, after only the Ethereum Merge.

Many of us may not know the term “Vasil”. Cardano, ranked 8th on CoinMarketcap is a proof-of-stake blockchain platform: the first to be founded on peer-reviewed research and developed through evidence-based methods.

Vasil is a significant improvement to Cardano, delivering enhanced network capacity and decreased transaction costs. Plutus, Cardano’s smart contract platform, will also be improved as part of the upgrade, allowing developers to design more efficient blockchain-based apps.

Cardano’s ADA token price rose 2.2% in the past 24 hours and 14% in the last week. This upgrade is confirmed to be on September 22.

Impact on the Financial Market

Because Bitcoin is viewed as an investment vehicle akin to stocks and bonds, the FOMC and macroeconomic pronouncements can have a significant influence on its price. Numerous studies suggest that these announcements have an influence on the whole financial market.

It remains to be seen whether history repeats itself and stocks end the month of September lower. As additional evidence comes in over the coming months, the idea of a Fed Pivot that was dismissed after Jackson Hole could start to materialize. Investors in the stock market anticipate that the Fed’s decision will provide them with guidance before the results of the upcoming quarter are released and when macroeconomic conditions change in 2023. Perhaps Ethereum and Cardano are the only shining knights in this financial uncertainty.

We will see.

I will end with a quote. “You will most likely come out on top in this bear market if you stick to your financial strategies and maintain your sense. Keep in mind that the people who sow their seeds today can become the millionaires who will profit from the upcoming bull market.”- Anndy Lian.

The post What Are the Major September Events to Keep an Eye On? The CPI, the Merge, the FOMC, & Vasil appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 12, 2022

With Ethereum ‘Merge’ around the corner, what happens to Bitcoin?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

With Ethereum ‘Merge’ around the corner, what happens to Bitcoin?

I shared this with Murtuza over the weekend. The shift to PoS does add pressure to Bitcoin’s energy consumption issue. The amount of energy consumed is one of the key criticism and when Ethereum shifted to PoS completely next week, Bitcoin will become the only top dog left to be on PoW. All eyes will be on Bitcoin. The green experts will find ways to scrutinize Bitcoin. The regulators will find ways to control Bitcoin and targeting PoW seems to be the right move.

The second thing I want to point out is about the perception of Bitcoin. In the longer term, say 30 years down the road when Bitcoin issuance is near zero, another problem we need to face is how the blockchain stays secure. As Ethereum abandons PoW and stating their standpoint, I think this issue will become a spotlight and can indirectly giving the perception that Bitcoin will be unstable and will not be a real asset in the future.

In my humble opinion, we need to solve the issues step by step. Perhaps new protocol innovation can change that.

Another friend of mine also shared this with me on the phone. And I do agree with him too.

“As long as Bitcoin stays in the number 1 position and Satoshi remains a mystery, Ethereum’s shift to PoS will not put a dent in Bitcoin to any image. Regulators can find fault with Ethereum, because their founder is in sight, well not Satoshi.

Ethereum’s price has outperformed Bitcoin in recent weeks because everyone is hopeful that the merge will enhance the blockchain, but its not and also environmentally friendly. But as we all know, the environmental angle will not last long. Ethereum had fallen so badly compared to Bitcoin since the end of last year. This narrative will not stand.”

With Ethereum ‘Merge’ around the corner, what happens to Bitcoin?The Ethereum upgrade may bring more regulatory scrutiny on Bitcoin for its energy consumption. While there could be pressure on Bitcoin, there won’t be much of an overall impact, some experts say.There seems to be no certainty on how Bitcoin, the dominant cryptocurrency, will be affected once Ethereum, the second-largest digital currency, completes its upgrade to a more energy-efficient network.

Ethereum founder Vitalik Buterin has said the upgrade, known as The Merge, is anticipated September 13-15, when it will conclude the shift from the energy-guzzling Proof Of Work (PoW) consensus to the Proof of Stake (PoS) validation method.

Ethereum, with a market capitalisation of $204 billion – half that of Bitcoin – started the first phase of the upgrade last week as it targets building a dependable decentralised ecosystem for the financial future.

In the PoS system, participants known as validators lock in their holdings of cryptocurrency or crypto token (their stake) to the blockchain to validate new transactions and earn rewards. However, they could lose their stake if their validation is inaccurate or fraudulent.

This contrasts with PoW, which uses a lot of energy to mine tokens by using computers to solve mathematical equations. The high energy consumption is a serious drawback for PoW, which continues to be the foundation of Bitcoin mining.

Pressure on Bitcoin

The energy issue is not the only macroeconomic risk for the crypto ecosystem. Other matters such as political unrest, high inflation rates, and hawkish national monetary policies are said to also have led to the present bear market.

Bitcoin reached an all-time high price of $69,000 in November 2021. Since then, the world economy has been struggling and this has caused a sharp decline in the price of Bitcoin (almost 70 percent) and other cryptocurrencies.

The short-term price forecast for the most popular cryptocurrency is still unclear as Bitcoin’s price fluctuates and hovers around $21,000 per coin.

While it is not clear what might aid Bitcoin’s recovery, Ethereum’s network upgrade, which seeks to position its ecosystem as the currency of the future, may put even more pressure on Bitcoin’s usefulness as volatility continues to alarm mainstream investors.

According to Anndy Lian, the author of NFT: From Zero to Hero, the shift to PoS does add pressure to Bitcoin’s energy consumption issue.

“Green experts will find ways to scrutinise Bitcoin. The regulators will find ways to control Bitcoin and targeting PoW seems to be the right move,” Lian said.

He added that over the course of the next three decades, when Bitcoin issuance is near zero, another problem will be how the blockchain stays secure.

“This issue (of Bitcoin’s PoW consensus) will become a spotlight and can indirectly give the perception that Bitcoin will be unstable and will not be a real asset in the future. In my humble opinion, we need to solve the issues step by step. Perhaps new protocol innovation can change that,” Lian said.

“Bitcoin isn’t likely to become more sustainable any time soon,” said Digiconomist, a science and technology publication that tracks Bitcoin energy consumption. The findings gained support after China tightened down on cryptocurrency mining, which sharply reduced the proportion of renewable energy sources used to run the network.

According to Alex de Vries, a researcher and critic of cryptocurrencies, “Bitcoin got dirtier after the Chinese mining crackdown in 2021.”

Hard to change

Ali Merchant, lead developer relations engineer at Akash Network, which works in cloud computing, said that as lucrative as it may sound, changing Bitcoin from PoW to PoS is technically very challenging.

“Even if a group of people decided to implement that change, it would be very difficult to get more than 51 percent of the votes on a network. Pair that up with Bitcoin Maxis who think that PoS could compromise the decentralisation of Bitcoin. To add to that, people who make tons of money out of Bitcoin farming will most likely oppose this kind of proposal,” he said.

This would be true of the Ethereum network, too. Ethereum will also be forked, with one chain continuing to PoW-based validation. Thus, it would be naive to conclude that all PoW chains can be migrated to PoS.

Should Bitcoin too migrate to PoS, it would make some people very upset, although there could be increased adoption of the coin as it would be more eco-friendly.

“Bitcoin migration isn’t coming anytime soon. If it does, it might just see a spike in trading volumes,” Merchant said.

After the Ethereum integration, only 23 percent of the total crypto volumes will be based on PoW, mostly Bitcoin. Regulators will now search for ways to regulate cryptocurrency, with the apparent first step being to target PoW.

Bitcoin’s reputation as a power hog continues to be one of its weaknesses.

In contrast to PoW, which cannot be utilised for the metaverse or non-fungible tokens (NFTs), Ethereum is establishing the framework for PoS. However, other cryptocurrencies may create new protocols and governance models.

With Bitcoin’s future being uncertain, competition, regulation, and energy issues are only a few of the elements at play.

“If we look at investor trends, however, no one holds their bigger capital in Ethereum – people will hold big capital in Bitcoin,” said Raj Kapoor, founder of the India Blockchain Alliance. “Bitcoin will always be like digital gold and Ethereum like fiat money, so while there would be a dip in Bitcoin prices, there would not be much of an impact.”

However, Kapoor said a sharp dip could be expected in the immediate term. The fear that the Bitcoin network may be “regulated away” may also cause the price of Bitcoin to move lower, he said.

The post With Ethereum ‘Merge’ around the corner, what happens to Bitcoin? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Find out more about “NFT: From Zero to Hero” from Anndy Lian on XRdoge TV

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Find out more about “NFT: From Zero to Hero” from Anndy Lian on XRdoge TV

Anndy Lian, book author of NFT: From Zero to Hero shares about his book on XRdoge TV.

Anndy’s book was sold out on 15 August 2022 on Bybit NFT Marketplace. 8000+ copies were sold so far. The book talks about his views on NFT, Web 3.0 and beyond.

The book’s foreword is written by Ben Zhou, CEO and Co Founder of Bybit and also Jay Hao, CEO of OKX. Many other crypto experts have also penned down their words in the book too.

He wants to share the book with people who are both curious about the world and has read many news articles about NFTs. However, I guess these articles were not able to answer all your questions, and you want to know how best to start your NFT journey.

– Why would someone be willing to pay millions of dollars for a PFP (profile picture)? What’s the value behind it?

– Many actors and singers have also released their own NFTs. However, the price quickly dropped by half after their launch. What’s going on?

– Nike, Adidas, Gucci, Hermès— it seems that big companies globally are entering the NFT market but how do we differentiate those seriously deploying from those just trying to take a cut from the hype?

– According to statistics, in the first quarter of 2022, the transaction volume of NFTs reached $26 billion, exceeding the whole of 2021. However, another set of data tells you that the NFT market is down by 92%. Who should we trust? Is NFT the future, or is it just a bubble?

We can see that the NFT market is on fire, but it also comes with a lot of chaos. This is the task I want to accomplish in this book: I will help you to discover the essence of NFTs below the surface of hype and chaos, as well as teach you how to master NFT step by step.

Start from Zero to become an NFT Hero with my book. Let’s dive into the NFT world together!

The book “NFT: From Zero to Hero” is available on Bybit, Amazon Books and Google Books at the current point.

Find out more at the following links too:

Ebook and paperback: https://amazon.com/Anndy-Lian/e/B0BCK7W9BK

Ebook: https://books.google.com.sg/books?id=OSqFEAAAQBAJ&pg

NFT Book: https://bybit.com/en-US/nft/collection/detail?code=1006691081657516032

(You can get more gifts here and surprises here. Sign up at https://partner.bybit.com/b/zerotohero)

Do a review: https://www.goodreads.com/author/show/20740366.Anndy_Lian

The post Find out more about “NFT: From Zero to Hero” from Anndy Lian on XRdoge TV appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.