Anndy Lian's Blog, page 98

October 6, 2022

What is CC0 NFT? Are they any good? What are good?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

What is CC0 NFT? Are they any good? What are good?

Melos Studio is launching their music NFT + CC0 month. CC0, also known as the Creative Commons, means âno rights reservedâ on intellectual property. It’s a type of copyright that allows creators to waive legal interest in their work and take it into the public domain almost instantly.

They have invited the following guests to discuss it.

Yalu – Lin Melos Co-Founder

TP – X2Y2 Co-Founder

Daley – Community Lead of BSC Daily

Anndy Lian – KOL/ Best Selling NFT Book Author âNFT: From Zero to Heroâ

A CC0 NFT can be owned by others. Anyone can use the NFT for commercial purposes without attributing it to the original artist or creator. In summary, CC0 NFTs can be seen as open-source IPs.

The sound of NFT on CC0 might sound like it is worthless, and everyone is copying everyone. But it may not be. If more people use the art, CC0 NFTs often become more valuable. If more people pay attention to it, it becomes more valuable. And CC0 incentivizes sharing the projectâs art, creating derivatives or monetizing it. This is the point shared by Daley from BSC Daily.

However, Anndy Lian states two critical issues. NFT is still growing, and transforming from a 2D NFT to 3D for another batch of sales looks like a money grab. If the community generally accepts this, we will see more people selling new collections by adding some curly hair to the image. This changed the value totally. Anndy also cautioned that we need to trace back to the original CC0 image to ensure it is copyright-free.

The full discussion can be found at https://twitter.com/i/spaces/1ynJOagNbMlKR.

CC0- Are they any good? What are good? We just got to remind ourselves that NFTs are more than just owning a piece of art, or pure speculations; they are part of a community, where a culture has been created, and culture creates a following.

NFTs have opened a whole new set of opportunities for businesses and creators. You can read more about this topic in Anndy’s new book- NFT: From Zero to Hero at https://books.google.com.sg/books/about/NFT_From_Zero_to_Hero.html?id=OSqFEAAAQBAJ&source=kp_book_description&redir_esc=y

The post What is CC0 NFT? Are they any good? What are good? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 4, 2022

Can Play-to-Earn gaming replace traditional jobs?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Can Play-to-Earn gaming replace traditional jobs?

Web3, the latest iteration of the Internet, has radically changed the gaming business by integrating unique features involving blockchain, cryptos and non-fungible tokens (NFTs).

The question that arises now is whether Play-to-Earn, or P2E, games can offer an alternative to traditional wage employment for people looking to move out of their jobs, whatever be the reason.

Gaming in the Web2 era was controlled by tech enterprises and involved players shelling out money to the developers. The advent of P2E gaming, completely decentralized, has put power in the hands of the players, who can tokenize in-game assets in the form of unique NFTs, a form of digital assets, for ownership rights.According to a study by market researcher Absolute Reports, the global P2E NFT gaming market size was estimated to be worth $776.9 million in 2021, having received a fillip from the COVID-19 pandemic.The market is forecast to reach a readjusted size of $2.8 billion by 2028, expanding at a Compound Annual Growth Rate of 20.4 percent during 2022-2028.

Moneycontrol spoke to experts to ascertain if people can indeed earn a stable income from P2E games so that they can leave traditional jobs.P2E cannot replace regular jobs

Ishank Gupta, advisor to IndiGG, the largest gaming DAO (decentralised autonomous organisation) in India, says P2E games can be a potential second source of income, but cannot replace earnings through traditional jobs.

Gupta believes that emerging markets like India will drive the Web3 gaming adoption.

When asked to elucidate, he said mobile data was most affordable in India with the average cost of 1GB of 4G data at Rs 20. The country is also a “mobile first” nation with over 700 million smartphones.

India is expected to be home to 500 million players by 2024, creating a sizable (mobile-first) market for game creators, he said, adding that app install statistics show 17% of all game downloads come from India.

âIn the world of Web3, where everyone is still at the starting line, we may acquire a head start and become first movers in the business by taking steps to establish an indisputable community that interacts with Web3 games and goods. When it comes to gaming, India is regarded as an important market,â Gupta says.

Experts point out that the future of work is being redefined by new technologies, with blockchain — Â a database that stores information in a digital format — being the most important development that happened in the past 10 years.

Back in 2021 in emerging economies, the first generation of games like Axie Infinity was able to replace ordinary jobs.

Driving a taxi or being a delivery driver made less money than a middle-level P2E Axie player.

However, the first generation of P2E has a lot of holes in terms of game depth, tokenomics, overall dynamics and aesthetics.

Corruption, inflation driving users toward Web3

Asked about the fascination with P2E games in emerging economies, Martin Repetto, CEO and co-founder of Mokens League, says rampant corruption, high inflation and depreciation of local currencies have created the perfect ecosystem for crypto to be the king.

âThe combination of trying to escape high taxes with badly rendered services, inflation, and economic freedom, makes it perfect for Blockchain games and DApps (decentralised applications) to triumph. There is no coincidence that the most successful Play-To-Earn games came from emerging markets/economies/countries,â Repetto says.

P2E growth depends on per capita GDP

P2E is one of the ways to earn an additional income, but it may not work for all countries.

In Singapore, for example, Gross Domestic Product (GDP) per capita reached a record high of US $66,176.39 in 2021. Even so, the cost of living is high and the P2E concept is harder to attract the 9-5 working class because it may not be able to pay even for their monthly groceries.

In Kenya, where GDP per capita is expected to reach US $1,550.00 by the end of 2022, P2E is viable.

In fact, in Kenya play-to-earn, when positioned well, can reduce the unemployment rate and increase overall GDP.

India will be the outsourcing factory for Web3

Anndy Lian, Chief Digital Advisor to the Mongolian Productivity Organization, says the revenue from Web2 gaming goes to the gaming companies, but Web3 gaming is better distributed.

âUsers get rewarded for their efforts and their assets can be further monetized. NFTs are in-game assets, not in-game expenses, anymore because you can resell your NFTs in the secondary market; if you promote harder, you can command a higher price. The value of your assets is in your own hands,â he says.

He adds that India is very developed in Web2 and many users are transiting to Web3 and a big pool of developers will make India the biggest outsourcing factory for Web3.

Future of Web3 gaming

The platform’s development and level of user interaction will determine how well it does.

The platform will gradually attract additional developers, users, and practical outcomes as it goes through its motions.

Over time, the platform’s market valuation will increase as more users and developers join it.

P2E is an idea that is gradually gaining hold among gamers. However, it still has a long way to go before it can take the place of traditional jobs.

The platform doesn’t currently have the gamers and developers it needs to grow and succeed and will become more reliable and popular as it evolves further.

This will encourage other developers to produce their own games for the system, accelerating the growth of the metaverse crypto.

Saurabh Tiwari, a Pune-based Web3 enthusiast, and an avid gamer, told Moneycontrol that NFT-based games were previously a grey area, just like TikTok was initially.

Earlier, making reels was dismissed as a temporary fad that would wane with time; the very same influencers are now being invited to mainstream channels as guests and are earning lakhs of rupees every month, he said.“Playing games definitely can be a long-term career option if planned properly because the loyalty amounts, once a gamer creates his own community and followers, are huge.

Multinational companies are investing big in the space which only goes on to show they see huge potential here in the long run,” Tiwari said.

The post Can Play-to-Earn gaming replace traditional jobs? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

ADA/BTC prediction: Will Vasil hardfork turn around Cardano’s downward trend?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

ADA/BTC prediction: Will Vasil hardfork turn around Cardano’s downward trend?

Bitcoin (BTC), the first cryptocurrency and the most valuable coin, is losing steam in 2022 amid a wider shift in market sentiment. Meanwhile, Cardanoâs (ADA) long-awaited Vasil hard fork failed to trigger bullishness.

What does it mean for the ADA/BTC forecast? Here we take a look at the Cardano (ADA) to Bitcoin (BTC) cryptocurrency pair and factors shaping the ADA/BTC exchange rate.

What is ADA/BTC?

ADA/BTC represents the exchange rate between ADA, the native cryptocurrency of the Cardano blockchain, and BTC, the native coin on the Bitcoin Network.

Maxim Shilo, digital assets analyst at CoinLoan, explained that to determine the ADA/BTC rate, the coinsâ prices are calculated separately, then added together, noting:

âIf BTC rises 4.5%, and ADA rises 2.5% at the same time, then ADA/BTC price is down 2% respectivelyâ¦There might be some differences, which are for market makers to spread on.âBitcoin was created in 2009 as a digital alternative to cash. Since its launch, the cryptocurrency has started to act as a store of value. It’s been compared to gold as a hedge against inflation.

Bitcoinâs key feature is mining. This is done through a blockchain that connects all public BTC transactions together. The blockchain uses a Proof-of-Work (PoW) consensus mechanism through which miners compete to solve mathematical equations and confirm the legitimacy of transactions. Miners are rewarded in BTC.

BTC tokens also undergo halving events roughly every four years. This is when the number of the BTC coins in circulation is reduced by half, making the token scarcer and raising its price.

Cardano was launched in 2017 as a third-generation crypto platform that uses the Proof-of-Stake (PoS) consensus mechanism. The blockchain prides itself in being the first ever crypto platform âto be founded on peer-reviewed research and developed through evidence-based methodsâ.

Cardanoâs key focus is on being sustainable. In September 2021 the platform introduced smart contract capability, which means that the blockchain can now also support the creation of decentralised apps (dApps), new tokens, decentralised finance (DeFi) games, non-fungible tokens (NFTs) and more â one of the key factors that makes it stand out compared to BTC.

The platform was developed in âerasâ, each named after a prominent historical figure in the fields of literature and computer science, such as Byron, Shelley, Goguen, Basho and Voltaire.

As of 30 September, the blockchainâs era is Basho, which introduced more scaling and optimisation to Cardano. Voltaire will be the last era in the blockchainâs development, which will bring governance to the system.

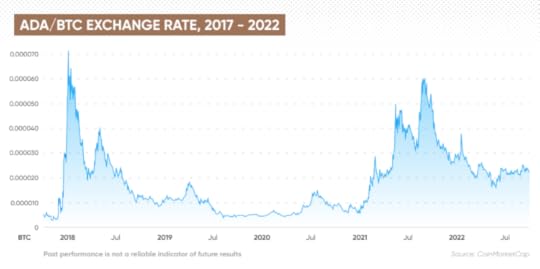

ADA/BTC historical rate chartThe ADA/BTC exchange rate surged 1,373.4% in the four months after the launch of the ADA token, trading at 0.00007103BTC in January 2018. At the same time the ADA price in USD jumped more than 4,800% to $1.0797. This was when ADA reached its all-time high against BTC.

Between 2018 and 2020 the exchange rate moved sideways, peaking at 0.00001811BTC and 0.00001495BTC in April 2019 and July 2020, respectively. In 2021, ADA regained its momentum against bitcoin.

Between January and September 2021, the ADA/USD rate surged over 800%, with ADA enjoying the peak of 0.00006008BTC. The jump was mostly driven by bullish sentiment for Cardano, with ADA trading at a record high of $2.9682 in September 2021.

But, wider sentiment in the cryptocurrency markets shifted. ADA/USD swinged lower, losing over 20% year-to-date. Separately, ADA and BTC have lost 68% and 58% of their value in 2022, respectively (as of 30Â September).

Is the Vasil fork driving ADA/BTC?Cardanoâs long-awaited Vasil mainnet upgrade, which aims to improve the blockchainâs scalability and increase the networkâs capacity, was launched on 22 September after several delays. The Cardano Foundation said on Twitter.

Full Vasil capability became available on 27 September. In addition to that, the Cardano blockchain activated the Plutus V2 cost model, which delivered lower transaction costs for smart contracts.

This update was expected to boost ADAâs value, but failed to do so. According to Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of NFT: From Zero to Hero, âthis is mainly due to the financial uncertainty globally.â

âMarco risks led by a very hawkish US Fed have also weighed down ADA’s price movement after Vasil’s launch,â he told Capital.com.

The ADA/BTC exchange rate dropped by 5.5 % between 22 and 29 September, during the hype in the run-up to the forkâs launch.

Shilo agreed that this phenomenon was linked to wider macro-economic factors stemming from a troubled global economy and a wider bear market. âMacro doesnât really care about the updates or future promises,â he said.

Shilo added that Cardano was not the only token affected by macroeconomics on the brink of a big upgrade, using Ethereumâs Merge as an example.

Lian noted that although ADA failed to jump after the Vasil fork, their voting power has increased by 53%, noting:

âThis means that more ADA was being used across proposals in Project Catalyst with 11% of all the circulating ADA being used in Catalyst Fund9, which is a community-driven initiative that allows users to vote and determines the future direction of the ecosystem.â

According to Lian âmore utility and support from the community means better potential for the development of the tokenâ.

In other news, the Cardano Foundation is preparing for an events season, which will kick off in October 2022. The Foundation is due to participate in a number of key crypto events that could affect an ADA/BTC forecast.

In November, Cardano will hold the Cardano Summit 2022 in Switzerland, which will focus on presentations and updates from developers of Cardanoâs decentralised applications (dApps).

ADA/BTC forecast for 2022 and beyondBased on the analysis of ADAâs past price performance, as of 30 September, the algorithm-based forecasting service WalletInvestor predicted that ADA/USD could fall to $0.0423 in 2023. The platform did not provide a price prediction for 2027.

In terms of its bitcoin prediction, the site saw BTC/USD trade at $30,274.06 in 2023 and reach $74,480.14 by 2027.

While WalletInvestor did not provide a direct Cardano/Bitcoin forecast, data suggested that the exchange rate could be 0.000000567BTC in 2023.

DigitalCoinPrice predicted that ADA/USD could rise to $0.46 by the end of 2022, $0.99 in 2023 and $1.76 in 2025. Its long-term prediction saw the coin reaching $6.04 in 2030.

The site also gave an upbeat BTC/USD forecast, expecting the coin to average at $20,403 in 2022, $44,579 in 2023, $79,430 in 2025 and surpass $273,000 in 2030.

DigitalCoinPriceâs ADA/BTC forecast for 2022 expected the pair to reach 0.00002255BTC. In 2023, the ADA/BTC prediction saw the exchange rate falling to 0.00002221BTC. The siteâs ADA/BTC forecast for 2025 stood at 0.00002216BTC. Its long-term ADA/BTC forecast for 2030 was 0.00002212BTC.

Shilo stressed that bitcoin has relative strength to altcoins and added that in his opinion the ADA/BTC forecast is pointing downwards:

âIt’s unlikely that [ADA] will outperform BTC. I can’t see it happening in the near term. Only very few selected coins have done so in the long term, and historically the chances are very slim. Given that the price is trading in the range and is in no man’s land against BTC, it’s clearly pointing toward a downward trend.âNote that analystsâ and algorithm-based forecasts can be wrong and shouldnât be used as a substitute for your own research. Always conduct your own due diligence before trading, and never trade money you cannot afford to lose.

Source: https://capital.com/ada-btc-prediction-cardano-bitcoin-vasil-hardfork

The post ADA/BTC prediction: Will Vasil hardfork turn around Cardano’s downward trend? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 29, 2022

XRP, ADA, Meme Coins Become Object of Interest for Author of Bestselling NFT Book, Anndy Lian

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

XRP, ADA, Meme Coins Become Object of Interest for Author of Bestselling NFT Book, Anndy Lian

Anndy Lian, international blockchain expert who positions himself as a thought leader on social media platforms and is the author of a book called “NFT: from Zero to Hero,” has taken to Twitter to pick its followers’ brains about whether he should invest in altcoins such as XRP, ADA and IOTA. Judging from his tweet, Lian is already a holder of meme cryptocurrencies.

Judging from his tweet, Lian is already a holder of meme cryptocurrencies.

Which coin should I buy now? #XRP #ADA #NEAR #IOTA #CRO or should I stay with #meme?

— Anndy Lian (@anndylian) September 29, 2022

“XRP, ADA, IOTA or should I stay with #meme?”

From his tweet, Anndy Lian is considering making a purchase of some leading altcoins, including top 10 XRP and ADA, as well as IOTA, CRO and NEAR.

He also says that he could stay with the meme; however, he does not specify exactly which meme coins he holds – DOGE, SHIB, FLOKI, BabyDoge or some canine coins with smaller capitalizations.

From his earlier tweets posted in September, it is clear that Lian has been following the main events in the crypto industry, such as Cardano’s Vasil and Ethereum’s Merge hard forks.

He has not disclosed which cryptocurrencies he holds.

“NFT: from Zero to Hero” is Lian’s second book, according to his LinkedIn page. In 2019, he also co-authored a book titled “Blockchain Revolution 2030.” By now, 8,000 copies of the former have been sold.

This crypto influencer considers buying SHIB

Crypto influencer David Gokhshtein, former U.S. congressional candidate who founded Gokhshtein Media, has tweeted that yesterday he nearly purchased meme token Shiba Inu.

Gokhshtein has been bullish on the second largest meme token throughout the year, praising its model and its metaverse. He holds both Dogecoin and SHIB. Recently, he tweeted that it is okay to hold both, while some in the armies of both tokens find it hard to find a mutual understanding.

On Wednesday, Gokhshtein also shared that he had been considering buying more XRP tokens to expand his XRP bag. He believes that if Ripple wins the current legal battle against the SEC that has been going on since 2020, it will become a major driver not only for Ripple and XRP but for the entire crypto industry too.

As part of his challenge, he also considers buying some LUNC.

I was close to buying more $SHIB tonight.

I’m also back and forth still on $LUNC. (Strictly for that challenge)

— David Gokhshtein (@davidgokhshtein) September 29, 2022

Read more on U.Today https://u.today/xrp-ada-meme-coins-become-object-of-interest-for-author-of-bestselling-nft-book-anndy-lian

The post XRP, ADA, Meme Coins Become Object of Interest for Author of Bestselling NFT Book, Anndy Lian appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 28, 2022

NFTs: The Bridge Between Web2 and Web3

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

NFTs: The Bridge Between Web2 and Web3

Mention the word NFT and the first thing that comes to mind are “PFPs” (Profile Pics) and “trading”. It certainly comes as no surprise, considering the fact that a majority of NFT markets function on these premises.

Yet, to simply relegate NFTs to these two areas would be scratching the surface — NFTs represent so much more, with vast potential waiting to be unlocked. This was the topic of the panel discussion at the FIL-Summit ’22 as part of Asia Crypto Week. Hosted on Sep 26, 2022 at Marina Bay Sands, our NFT Marketplace Business Development Lead, Jenny Zheng, took the stage with four other panelists as they engaged in a fireside chat about NFTs as the bridge between Web2 and Web3.

NFT Utility

The utility of NFTs is one of the biggest debates between NFT proponents and skeptics — the latter arguing that NFTs are mere digital assets used for speculation, with limited real-world functionality. Many, if not most NFTs, started out that way. But just as beauty is in the eye of the beholder, “NFT utility depends on how it’s being used and positioned from the creator’s perspective”.

“Many of us would look at NFTs from an art perspective, but there are so many other possibilities for them to evolve into.”

“In the near future, NFTs and the underlying blockchain technology can be used as identification in passports or even for event ticketing,” said Anndy Lian, Zero to Hero Creator and Chief Digital Advisor.

Guangmian Kung, Integrations and Partnerships Lead at Kleros echoed his sentiments.

“We often look at NFTs as items to sell, but what about non-transferable NFTs like Soulbound Tokens — a new identity verification system that represents who you are and what you’ve achieved. This opens up a whole new system of reputation authentication that can build trust in society.”

NFTs in the Bear Market

NFT Summer catapulted NFTs into mainstream consciousness, with the likes of celebrities and influencers driving mass adoption. In 2021, NFT trading volume reached an all-time high of $23 billion. Unfortunately, that all changed in 2022, when crypto winter hit. FUD was abound, causing a sharp dip in floor prices and NFT sales. Yet, through it all, the adoption rate still remained healthy.

Zheng explained how the bear market is the best time to build products.

“Even though Bybit NFT Marketplace started later compared to other players, we’re still growing very fast with a community of more than 600,000 users,” said Zheng.

“Our key to success was reducing technical barriers, making it simple for users to buy and sell NFTs. For those who are adventurous and bold, there’s still a lot of room for growth.”

Adding on to Zheng’s statement, Lian talked about another important value of NFTs — community building.

“The value of NFTs is in its community,” explained Lian. “That social aspect is something that’s so much more valuable than the price. Prices may be sensitive in a bear market, but it’s a good time to build a community.”

NFTs and Security

Security was also a major topic, as NFT thefts and hacks continue to make headlines. Naturally, this begs the question of the safety standards in the industry and what regulations can be implemented to prevent fraud.

“Changes and improvements need to be applied to the underlying infrastructure to prevent secondary market sales of unethically acquired NFTs,” said Kung.

“I hope that the market will start to take these into consideration and come to a universal solution.”

Adding to that, Zheng pointed out a possible solution that centralized exchanges can provide:

“There are many debates between centralized versus decentralized exchanges, but for certain, centralized NFT exchanges provide a higher degree of security”.

“For Bybit NFT Marketplace, we carefully curate and evaluate all our projects to prevent any intellectual property issues,” explained Zheng. “We also audit contracts to ensure that they are safe and reliable for our users.”

The Road Ahead for NFTsMore and more brands are adopting NFTs as part of their marketing strategy. From Nike’s Cryptokicks NFT Sneakers to Oracle Red Bull Racing’s Full Charge: Factory Pass, these serve to build rapport with their community by giving them exclusive perks and/or access to events.

As promising as it sounds, there’s a caveat — the technical challenges mainstream marketers face when trying to enter the NFT space.

“It’s difficult for these project owners if they lack the know-how and the expertise,” explained Zheng. “As a centralized exchange, we provide the tools — merging, airdrops, and whitelisting — to reduce the barriers to entry, making it easier for brands to kick-start their Web3 journey.”

Lian concurred, adding that “centralized exchanges do have a role to play.”

“Currently, everyone has a wait and see attitude. Brands need to dive deeper into the Web3 environment as it’s currently very scattered,” he said. “I hope that institutions and brands can find a common ground where they can learn, understand and educate, so that everyone can grow together.”

Source: https://blog.bybit.com/en-us/post/nfts-the-bridge-between-web2-and-web3-bltbe72f3340cd9342d/

The post NFTs: The Bridge Between Web2 and Web3 appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

NFT: From Zero to Hero > Interview with Anndy Lian

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

NFT: From Zero to Hero > Interview with Anndy Lian

Question: Anndy, many people know you, but for those who don’t, can you tell us a little about yourself? Who are you? What did you do in the past and what are you doing now?

Answer: Thanks for reaching out to me. My name is Anndy Lian. My first Bitcoin was in 2013 and then diving deep into the blockchain technology side of things in 2017. I invested in some of the earliest blockchain projects all the way back to the Initial Coin Offering (ICO) era. Also, as a partner of an investment company granted Capital Market Services (CMS) license from Singapore regulator MAS, I have been approached by many early NFT projects. All these have given me an early start in the NFT space. I was the Blockchain Advisor for the Asian Productivity Organization (APO), an intergovernmental organization committed to improving productivity in the Asia-Pacific region. Concurrently, I was appointed by the Governor of Gyeongsangbuk-do, South Korea, to help the province to grow using blockchain technologies. I was also an Advisory Board Member for Hyundai DAC, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group. At one point, I was the Chairman (Singapore) of the Korea eSports Industry Association too.

Throughout my blockchain journey, I worked alongside policymakers, private sector decision-makers, and experts to create business value propositions for different industries. I continue to advise governments and companies as I speak now.

Currently, I serve as the Chief Digital Advisor at Mongolia Productivity Organization, championing national digitization. I was recently awarded an honorary doctoral degree by the Academic Council of Ulaanbaatar Erdem University in recognition of my contribution to the development of productivity science in Mongolia.

I was the immediate past Chairman of a ranked top 30 crypto exchange. My curriculum activities give me a 360-degree perspective on what NFTs will be like in the future. After all these years, I have decided to compile what I see in the NFT market into a book. This is how my new book “NFT: From Zero to Hero” is born.

Question: NFT: From Zero to Hero! An interesting title! Reviews of your book are really good. Why did you publish such a book? What is your purpose?

Answer: The book was supposed to be published one year ago, but I did not do it due to my other commitments. I also want to take my time to review and use the different tools and platforms that I have mentioned in my book. Frankly, that took me some time. I do not want to write anything about it if I have not tired it myself.

Back in 2018 where I published my first book, titled “Blockchain Revolution 2030” and published by Kyobo, the largest bookstore chain in South Korea, NFTs were one of the core topics I talked about. Back then, NFTs were not something everyone was sharing. Most thought that it was purely a fad. I think otherwise. Most people are looking at the money-making side of things, and they forget the true meaning behind NFTs. That is why I drafted my book, and I want to share the knowledge behind NFT with everyone.

Another purpose of my book is to share it with the traditional guys, not in the crypto space. There is a lack of good information in the market; scammers are trying to be consultants and want to render their expertise to traditional business owners. Most times, they waste money and precious time. They were also giving a bad name to crypto. My book is simple to read and would be a good guide for them to start from zero and become a hero in the NFT space.

As for the crypto natives who think they know it all, they should read and look at some of the recommendations that I have put forth. I am very sure most of them have not tried the NFT tools and are still buying NFTs based on rumors and news, most times buying NFT with a gambling mindset. This doesn’t seem right, and if there are statistics to back thing up, they should use it as a reference. This gives them a higher chance to become an NFT Hero.

Question: In fact, you are looking for answers to many curious questions in your book. Frankly, I was not very interested in the NFT field and therefore I am interested in his book, I want to learn something in depth. One of the fundamental questions is, really, why would people pay millions of dollars just for a profile picture?

Answer: Your question is good; why would people pay millions of dollars for just a profile picture. Most people would think that holding on to a Bored Ape is about social status, and you can show off to the crypto community to show you have the money and power. This is wrong. People holding on to the NFT are looking at business networking and giving them access to by-invitation events only where they can meet influential people.

Question: We see NFT investments of big brands, what do you think awaits us in the future?

Answer: NFT is the bridge to Web3, it has big potential. If you have read my book, chapter 8 on NFT Trends Shaping the Future of NFTs, you will get the answers. The potential applications of NFTs are nearly endless. Some claim ten years from now, and all purchases will be accompanied by NFTs. Others think smart contracts will replace legal documents. And while many think NFTs are a fad or too niche to become widely used, big players from Meta (formerly Facebook) to Twitter to Reddit and Visa are taking notice and are working to ensure they don’t miss out on the NFT boom.

Gaming industry will change. Healthcare will take NFT to a more personal level. Art will be better tracked and authenticated. The list goes on.

Question: How can we measure the value of an NFT? Sometimes I just see a photo sell for thousands of dollars, and sometimes we see an NFT bought for millions of dollars turned into a worthless piece. What advice would you give people at this point?

Answer: You got to understand what is value. It seems that value = millions of dollars. This is a wrong way to look at NFT. If you like the NFT, you can buy it. If you expect what you like to go from $1 to $1,000,000, then this becomes speculation. Then the question is when to sell it? Most experts will ask you to “HODL”, but how long can you hold it for? Therefore, my advice to new users is to look at NFT in a more fun manner. Like that NFT and the price is low, grab it. If the price went up, and you want to part with it, then sell it.

The actual value in NFT is the utility and community. Without these elemensts, NFT is value-less.

Question: What would you like to say to people who plan to read your book? What will you gain them?

Answer: They will gain insights to my thoughts on NFTs and which vertical would excel better in the future. This will allow them to watch out for the right things.

The future these NFT trends depict is an interesting one. While many people are concerned about the implications of the metaverse and the rise of AI, it’s a future full of possibilities.

It’s a future that bridges the gap between consumers and creators, gives value and security to digital assets, and one which, for better or for worse, will shake up the world.

The future is bright, but the road is tortuous. The NFT market will eventually mature and deliver on its promise.

Your new asset is in the digital world.

Question: I want to talk a little bit about the markets. The world is going through a bad time. War, inflation, food crisis, etc. Crypto markets are affected like other markets. What days do you think await us?

Answer: The market will be stagnant because of global uncertainties. We are going through a cycle, and this cycle would last a few years. But does this mean we stop building and working? No.

We got to work harder and be ready when the bull market awaits us.

Question: What advice would you give to investors? What path should they follow in this process?

Answer: Always be patient and do your research well before committing to any investment in general.

As for NFTs, you should read Chapter 4 on How to spot a good NFT project. Let’s grow together- from zero to hero.

Source: https://cryptoprofessorr.com/nft-from...

The post NFT: From Zero to Hero > Interview with Anndy Lian appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 27, 2022

FIL-Singapore Summit 2022: NFTs, The Bridge between Web 2.0 and Web 3.0

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

FIL-Singapore Summit 2022: NFTs, The Bridge between Web 2.0 and Web 3.0

Filecoin is making the web more secure and efficient with a decentralized data storage marketplace, protocol, and cryptocurrency. They are here in Singapore during the Token 2049 week to bring more Web 3.0 people together at their flagship event FIL-Singapore Summit.

It’s the perfect opportunity to connect with developers, storage providers, ecosystem partners, investors, and clients across the entire Filecoin ecosystem.

At one of the panel discussions, experts discussed the topic- NFTs, The Bridge between Web 2.0 and Web 3.0. The panellists lineup includes YC (Business Development Manager, Moledao), Anndy Lian (Author, NFT: from Zero to Hero), Jenny Zheng (BD Lead, BYBIT NFT), Guangmian (Integrations and Partnerships Lead, Kleros and Faye (Founder, Unschul).

They looked into topics such:

The fundamentals of NFTs

– As the interest in NFTs drops significantly with the bear market, how do you think we move forward from here?

– What are the existing utility of NFTs and how are they valuable?

“For corporations who are entering into the NFT space. They do not have the right tools and people. There are a lot of things that need to be done. If you are going to a decentralised marketplace, no one can also help you. If you come to a centralized marketplace like Bybit, we have tools that can help you make your NFTs happen.” Jenny Zheng commented.

Brands and Corporations Entering the NFT space

– Why do you think large brands such as Marvel, Disney, Adidas, Pepsi, LV and celebrities such as Snoop Dogg, Eminem and Jimmy Fallon are getting involved with NFTs?

– How does the use of NFTs as a technology disrupt existing institutional systems and applications?

“Brands can use NFT to build their relationship with their users.” YC mentioned.

Future outlook of NFTs as we move from Web 2.0 to Web 3.0

– NFTs have received a lot of resistance in terms of acceptance. Why do you think that is happening, and what will it take for mass adoption of NFTs?

– What do you think about some of the ways that liquidity can be added to NFTs, whether in terms of NFT collateralised loans, AMMs, or derivatives like futures on NFTs?

– What do you think will be the next big trend in NFTs?

“I really hope to see more AAA games entering the NFT market. I think the driving force for the next wave will be led by NFT.” Anndy Lian added too.

FIL-Singapore is a collaborative four-day event hosted by the Filecoin community in Asia. There will be a Filecoin Summit and many independently hosted events including meetups, workshops, a hackathon and happy hours throughout the week.

The post FIL-Singapore Summit 2022: NFTs, The Bridge between Web 2.0 and Web 3.0 appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 22, 2022

NFTs Finally Infiltrated AAA Gaming

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

NFTs Finally Infiltrated AAA Gaming

The NFT market seems to be heading towards another month of consecutive dip. Based on the figures obtained from Crypto Slam, the dip started in April 2022 with a sales volume of $3,806,346,613.84 in total. Followed by May- $3,184,422,599.20, June- $879,080,400.63, July- $682,104,319.50 and August- $633,988,424.51. The number of unique buyers has dropped by 42% since April. While many of the NFT holders were expecting “The Merge” will lift the markets up, it did not happen that way. In fact, Ethereum’s price has dropped around $1,347.98 at the point of writing.

“The NFT market is flushing out bad assets and keeping the good ones. This might prompt a revaluation of the true value of the NFTs, and alter how they are used. As mentioned previously, NFT is the new asset in the digital world, and NFT marketplaces should start to strategize and embrace traditional AAA games into this space. The bearish market allows all of us time to build, and we create new opportunities. We have to do it the right way.’ Anndy Lian, thought leader and best-selling book author “NFT: From Zero to Hero” added.

Anndy is correct. We are at a point where the crypto industry is all very cautious. The NFT sector is at its all-time low. Web2 and AAA gaming are finding their way to us. We have to take this opportunity.

Here are some AAA games that I have been keeping an eye on.

Epic Games Store Launches First NFT GameAccording to a press release, Epic Games’ game marketplace has included Mythical Games’ Blankos Block Party as its first non-fungible token (NFT)-powered Web3 title. The announcement comes less than a year after Mythical Games received $150 million in a Series C fundraising round valued at $1.25 billion.

Blankos Block Party is a free-to-play multiplayer party game based around unique collectible digital vinyl toys known as Blankos, which may be purchased, updated, and sold inside the game. Mythical Games and Third Kind Games collaborated on the game’s development.

Epic Games are open and has left the door open for developers who want to build around NFTs. This is a positive sign.

NFT Games on MinecraftDespite Mojang Studios’ opposition to the incorporation of NFTs, MyMetaverse was able to incorporate NFTs into multiple games, including its own Minecraft server.

“We wanted to show Mojang that it could be done in a way that benefited them and benefited their player base,” said MyMetaverse CEO Simon Kertonegoro.

According to Simon, multiple servers have violated the Minecraft NFT restrictions, which were designed to protect players from unwanted interactions. The CEO did point out that they are able to implement NFTs on their own servers without violating the game’s regulations. They accomplish this by removing all pay-to-win NFTs and making their best NFTs fully free to play.

Ubisoft is working on integrating NFTsUbisoft is a French video game company headquartered in Saint-Mandé with development studios across the world. Its video game franchises include Assassin’s Creed, Far Cry, For Honor, Just Dance, Prince of Persia, Rabbids, Rayman, Tom Clancy’s, and Watch Dogs.

In an interview with Axios, as far as NFTs are concerned, the CEO still believes there is a possibility in the company’s future work on it. He says: “If we find something that will be very interesting and will please players, we’ll work on it.”

More to comeImmutable co-founder Robbie Ferguson stated on September 13, 2022, that two AAA studios had begun developing on the Immutable X platform. Ferguson said the first game would be shown within a month. This implies that before the middle of October, we should know which triple-A developer is joining the NFT movement. This is less than a month from now.

Last but not least, Kakao Games and XL Games are already preparing a new game, ArcheWorld, integrating NFT and Play-to-Earn game mechanics. Representing Bybit NFT Marketplace, I will be on the same panel with XL Games at Blockchain Gaming 2022 organized by ABGA on September 27 on “What Blockchain Technology Can Bring to Traditional Gaming Giants.” I will let you know more about the discussion after the conference.

Source: https://hackernoon.com/nfts-finally-infiltrated-aaa-gaming

The post NFTs Finally Infiltrated AAA Gaming appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

ETH to BTC prediction: Will post-Merge Ethereum rise to challenge Bitcoin domination?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

ETH to BTC prediction: Will post-Merge Ethereum rise to challenge Bitcoin domination?

Bitcoin (BTC), the crypto market pioneer, is, by market capitalisation, twice the size of ethereum (ETH), the second largest coin. Will ETH eclipse BTH following successful completion of The Merge that saw it switch to the proof-of-stake (PoS) consensus mechanism?

Here we take a look at the ETH to BTC exchange rate, and what factors are shaping ETH/BTC in 2022 and beyond.

What is ETH/BTC?ETH/BTC represents the exchange rate between ether, the Ethereum blockchain’s native coin, and bitcoin, the native coin on the Bitcoin Network.

ETH/BTC represents how many bitcoins can be bought for one ether, with the rise in ETH/BTC signifying either a rise in ETH or fall in BTC, and vice-versa.

BTC was meant to be “a purely peer-to-peer version of electronic cash”. However, over the years the cryptocurrency has also become a store of value and a comparison to gold as a hedge against rising inflation.

Bitcoin mining relies on a blockchain that connects all public transactions. Using a proof-of-work (PoW) consensus, BTC miners compete against one another to solve mathematical equations and confirm the legitimacy of transactions. They are rewarded in BTC tokens.

In order to reduce the rate at which new BTCs are given as rewards, the cryptocurrency was designed to undergo halving events roughly every four years. A halving reduces the number of bitcoins released into circulation by half, limiting supply.

Ethereum, a programmable network for building decentralised applications (dApps), was launched in 2015, and was inspired by bitcoin’s limitations.

“While Bitcoin is only a payment network, Ethereum is more like a marketplace of financial services, games, social networks and other apps that respect your privacy and cannot censor you,” Ethereum’s website says.

Another key element of Ethereum is the blockchain’s ability to run smart contracts – computer programmes on the blockchain that allow for the creation and smooth running of dApps.

Just like BTC, ETH initially used a PoW mechanism, but since 15 September 2022 relies on PoS. The change became known as ‘The Merge’, and was designed to reduce Ethereum’s energy consumption by around 99.95%.

The Merge is one of a series of upgrades. In a July presentation, the platform’s co-founder, Vitalik Bouterin, named the following development stages, but did not specify when they will happen:

The Surge – the addition of Ethereum sharding, which will lower the cost of bundle transactions and make operating easier.The Verge – users will be able to become validators without having to store large amounts of data.The Purge – will simplify the Ethereum protocol and cut down on the amount of space the blockchain uses.The Splurge – this upgrade includes “all of the other fun stuff”.These updates also have potential to affect the ETH price shaping the ETH to BTC exchange rate.

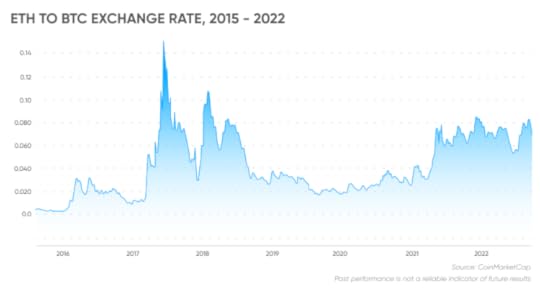

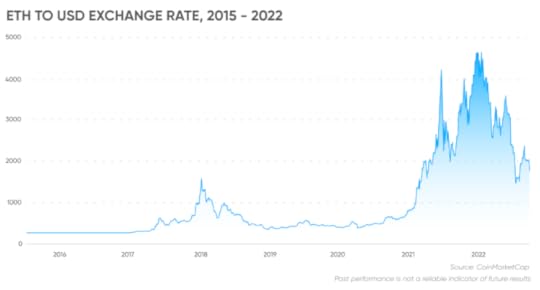

ETH to BTC historical rate chartThe ETH to BTC exchange rate surged by 2,518% in the first two years after the pair started trading, from 0.005767BTC in August 2015 to the all-time high of 0.151BTC in June 2017, signifying the quicker rise in ether’s price.

However, this peak in the ETH to BTC price chart did not last long. The exchange rate fell to 0.02427BTC in December 2017 – down 83.9% since the June peak.

The ETH value reached $1,396.42 in January 2018, and the ETH to BTC rate jumped to 0.09724 BTC.

ETH managed to uphold its positive trend against BTC for the next three weeks as the price chart gained 16% more, peaking at 0.1131BTC on 1 February 2018.

ETH to BTC performed fairly well for the duration of 2021, peaking in mid-May at 0.08178BTC, when the ETH price reached $4,168.7 and BTC was trading at $50,000.

The ETH/BTC pairing was not hugely affected when the BTC value reached its all-time high of $66,971.83 in November 2021, It did peak in December 2021 at 0.0879BTC after briefly falling to 0.06034BTC on 19 October 2021.

Following the collapse of the TerraUSD (UST) stablecoin and its sister token LUNA and the wider crypto crash that followed, the ETH to BTC exchange rate fell by nearly 30% from 0.07554BTC in May 2022 to 0.05373BTC in July, indicating a faster decline of ETH price.

ETH’s price dipped to as low as $993 in June, with BTC slumping to $19,017 amid the bearish sentiment in the cryptocurrency world sparked by LUNA collapse and tightening monetary policy.

Ether rose to 0.0846BTC in September 2022 in anticipation of The Merge. The current exchange rate stood at 0.07088 BTC, as of 20 September.

Is The Merge driving ETH/BTC?On 15 September Ethereum successfully upgraded its system from PoW to PoS after a six-year build-up. However, the ETH price did not rally as much as investors were anticipating.

Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of NFT: From Zero to Hero. noted that right after The Merge, the price swung above $1,640 and fell shortly after:

“This is very much expected. There was much influx of ETH into various exchanges since the 12th and then building up to around 1.8 million ETH before the completion. In this case, I see that investors could be planning to sell off before the price fell.”Lars Seier Christensen, chairman of the Concordium Foundation and founder of Saxo Bank, said that the Ethereum community anticipated a “much more positive reaction to the successful Merge”. He added that the recent rally was what in TradFi we call “buy the rumour, sell the fact” and that whoever saw The Merge as upbeat news had already bought ETH.

“Merge is really a non-event. It changes nothing in terms of scalability or fees, and actually antagonises a number of long-term Ethereum supporters – the miners,” he added.Eugene Zomchak, CoinLoan’s head of product, told Capital.com that the value of ETH to BTC is likely affected by other microeconomic factors such as the cryptowinter and the Fed’s policy tightening than The Merge, noting:

“There are some positive forecasts coming in from enthusiasts who note that the Merge was a landmark event and the price of ether could surge by two, three and even five times.”Since The Merge, the BTC price has been fluctuating between $19,000 and $20,000. ETH reached $1,469.74 on 17 September before falling to around $1,300, as of 20 September.

Lian stressed that it is important investors remind themselves that the effects of The Merge, possibly including the ETH to BTC price, will only be felt in the long-term:

“The gas fees will remain the same, and other scalability issues are still unsolved. The community at large must wait for Surge, Verge, Purge, and Splurge improvements to see a reduction in transaction costs and boost scalability significantly.”Concordium Foundation’s Christensen also noted that the current market environment is challenging:

“The correlation to broader asset markets is very clear, and if stocks don’t recover, this will add to negative sentiment. If Ethereum goes decisively below 1,400, I think we could see a significant sell-off.”Christensen added that the next Ethereum upgrades will be in focus:

“The most important thing is increased scalability, which will reduce fees. Until that happens, Ethereum is in effect not much use, and entirely reliant on Layer 2 solutions that provide much less security than Ethereum itself.“Considering how difficult the Merge has been to execute, with years of delay, my personal belief that Ethereum can deliver the next stages in a speedy fashion is limited. Ethereum has one advantage and one advantage only: a very loyal ecosystem that will go through the most extraordinary and irrational hurdles, just to stay loyal. I wonder how long that will last.”ETH/BTC exchange rate forecastsBased on its analysis of past price performance as of 20 September, algorithm-based forecasting service Wallet Investor predicted that ETH/USD could trade at $2,391.383 in 2023 and reach $7,135.056 by 2027.

In terms of bitcoin prediction, the site saw BTC/USD trade at $33,668.92 in 2023 and reach $79,969.28 by 2027.

While Wallet Investor did not provide a direct ETH/BTC exchange rate forecast, the data suggests that they expected the rate to be 0.335BTC in 2023 and 0.421BTC in 2027.

DigitalCoinPrice supported a positive ETH/USD forecast, as of 20 September, and expected the coin to grow to $1,832.85 by the end of 2022, $3,032.72 in 2023 and $5,417.40 in 2025. Its long-term prediction saw the token surge past $18,000 in 2030.

The site also gave an upbeat BTC/USD forecast, expecting the coin to grow to $27,580.79 by the end of 2022, $41,874.03 in 2023 and $76,453.11 by 2025, passing $264,000 in 2030.

DigitalCoinPrice expected the rate to be 0.0665BTC by the end of 2022, 0.0724BTC in 2023, 0.708BTC by 2025 and 0.068BTC by 2030.

Note that forecasts and analysts’ expectations shouldn’t be used as a substitute for your own research. Always conduct your own due diligence and rely on your own projections. And never trade money you cannot afford to lose.

Source: https://capital.com/eth-btc-prediction-ethereum-bitcoin-merge-domination

The post ETH to BTC prediction: Will post-Merge Ethereum rise to challenge Bitcoin domination? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

September 19, 2022

Will NFT Sales Surge because of Ethereum Merge?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Will NFT Sales Surge because of Ethereum Merge?

Ethereum got its long-awaited upgrade. After years of planning, development, and delays, the world’s second-largest coin by market capitalization has moved to proof-of-stake. The Merge is up and running, yet the price is still down but NFT sales went up after months of downtimes.

Sales volume and prices of NFTs have surged, according to crypto Footprint Analytics, a crypto big data company. Before the merge, Bored Ape’s sales were up by more than 45% from a week before. They have transacted one of the NFTs at 130 ETH, which was around $230,911.25 at the time. After Merge, they made around $7 million in sales. While CryptoPunks had 25% more than its previous week. Doodles, an NFT collection had more than a 1,200% jump in sales after it secured a $54 million funding round led by Reddit founder Alexis Ohanian’s venture capital firm, Seven Seven Six.

Four seconds after the Ethereum Merge, the first transaction of an NFT created using the proof-of-stake (PoS) consensus was approved. Block 15537393’s timestamp for the Merge was 6:42 AM UTC on Thursday. A user promptly purchased an NFT at block 15537394 with 36.8 ether (ETH), or $53,403 at the time.

For now, the increase in demand for NFTs is a bright spot for the industry. The communities who are watching the NFT market closely also pointed out that there is a chance for the 5th month of continuous dive in the overall NFT market. Others who do not know what will the merge bring to the table were hoping that the transaction fees would be lower and will bring in more sales and liquidity.Anndy Lian, best-selling book author “NFT: From Zero to Hero” commented: “Users will need to wait for the Surge, Verge, Purge, and Splurge improvements to see a reduction in transaction costs and boost scalability significantly. Low transaction costs are crucial because large costs make many NFT use cases unfeasible, particularly in the gaming and metaverse industries. Numerous NFT gaming weapons, avatars, and skins will probably trade for relatively little money, therefore for them to be profitable, transaction times must be quick and costs must be cheap.”

Lian added that the current cycle looks speculative as the spike effects only happened to a few projects and not all. Whether the prices of existing NFTs would come back is still unclear.

The other talking point on the ground is about intellectual property rights after the merge. Much is also unknown regarding how or whether intellectual property rights would be transferred to NFT copies on forked versions of Ethereum. Most NFT developers will almost certainly only transfer rights to holders of NFTs on the most popularly adopted post-fork chain, which will almost certainly be EthereumPoS.Suppose the legitimacy of both the PoS and PoW chains is recognized by major players in the NFT ecosystem. In that case, the split EthereumPoW chain may dilute the value of existing NFT collections owing to increased supply. This would also create a tangled scenario in terms of intellectual property and commercial rights, perhaps leading to huge disputes amongst NFT owners.

Eventually, the market will determine which NFT assets are valued based on liquidity and community acceptability. Investors and traders may want to wait till the dust settles before making any decisions about their Ether and NFT holdings.

Source: https://www.benzinga.com/22/09/28917641/will-nft-sales-surge-because-of-ethereum-merge

The post Will NFT Sales Surge because of Ethereum Merge? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.