Anndy Lian's Blog, page 97

October 18, 2022

Apples and oranges? How the Ethereum Merge could affect Bitcoin (With additional commnets)

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Apples and oranges? How the Ethereum Merge could affect Bitcoin (With additional commnets)

Additional comments by Anndy Lian on top of what CoinTelegraph has mentioned.

The Merge is the right direction for cleaner crypto mining. The more direct impact I see after the transition is that bitcoin becomes the biggest target for green activists. There were more reports about bitcoin’s energy usage and mostly negative.

And because of the switch, many experts also said miners would forgo POW mining, but I say otherwise. I see the ETH POW Forks projects are working hard. The miner communities are now more united now than ever. For example, Bitmain also brought down the prices of their Antminers to help the miners get back into profits. These various factors helped the miners offset their operating costs in this bear market, keeping them alive.

Additionally, a good point to highlight is bitcoin’s hash rate. The hash rate continues to surge, recording new all-time high daily. The chip shortage has turned around, and the price of GPU is now at a more reasonable value. Taking GeForce RTX 3090 Ti, for example, the MSRP is $2,000, and it came down to $1,030 in September. These are positive signs for bitcoin.

As I have said before the transition, the impact of The Merge will not have too much boost for the crypto industry in the short run. What Vitalik has planned for Ethereum is a long-term vision. As for bitcoin, it is another kind of animal; it is the big brother. If bitcoin drops, the impact on every other cryptocurrency is inevitable.

Apples and oranges? How the Ethereum Merge could affect Bitcoin

While the Ethereum Merge failed to move Bitcoin from a price standpoint, the industry believes we have yet to see the effects of its shift from PoW to PoS.

It’s been a month since Ethereum said goodbye to an essential feature its blockchain shared with Bitcoin. Called the Ethereum Merge, the long-hyped upgrade was widely celebrated, with the blockchain ecosystem. However, for the mainstream audience or even for the average trader, it felt more like a Star Wars Day celebrated by sci-fi geeks than an early Christmas.

As the Ethereum Merge occurred on Sept. 15, the most extensive blockchain ecosystem parted ways with the proof-of-work (PoW), the energy-hungry consensus mechanism that makes Bitcoin tick. The Ethereum blockchain now works on a more eco-friendly proof-of-stake (PoS) mechanism that doesn’t require any mining activities, leaving thousands of miners worldwide scratching their heads.

Price-wise, Bitcoin is yet to take a hit from the fundamental shift of its closest competitor. A whole month has passed since the Ethereum Merge, and the BTC price is still stuck between $18,000 and $20,000.

However, the overarching mainstream narrative of “Bitcoin should contribute to the world, not destroy it by depleting energy resources” is rekindled with Ethereum’s significant switch to a system that keeps blockchain alive with minimal resource consumption.

Ethereum avoided a dead endCointelegraph reached out to industry insiders to get a clearer picture of the Ethereum Merge’s impact on Bitcoin.

“PoW was a dead end for Ethereum,” says Tansel Kaya, a lecturer at Kadir Has University and the CEO of blockchain developer Mindstone, “Because an Ethereum network that doesn’t scale can not live up to its promise.”

However, the Bitcoin community is not happy with the way its biggest price competitor took, according to Kaya. The BTC community often criticizes PoS for being vulnerable to censorship, he remarked, adding:

“If what [Bitcoin maximalists] say is true, Ethereum will either turn into a docile fintech network that is censored by governments, or a centralized structure like EOS, controlled by wealthy investors.”

Speaking to Cointelegraph, Gregory Rogers, CEO and founder of crypto-based gifting platform Graceful.io, noted that the Merge solidified the two distinct blockchains’ positions in the market. “Ethereum remains the transaction chain of choice with its increased speed and reduced fees,” Rogers said, adding, “Bitcoin is now the store of value of choice. They were already headed in this direction, but the Merge simply clarifies it.”

From a price point, though, multichain marketplace UnicusOne founder and CEO Tashish Raisinghani believes that Bitcoin price will take a hit. “The crypto industry had a hard time because of macro-level challenges which resulted in the current bear market,” he said, adding that the Merge would make Ethereum more sustainable compared to Bitcoin, “Which hasn’t yet been able to recover from the Chinese mining crackdown in 2021.”

PoW is unrivaled in network securityAddressing the energy side of the argument, John Belizaire, CEO of eco-focused data center company Soluna Computing, told Cointelegraph that even though Ethereum’s switch to PoS could save energy, “It will also undermine the core decentralization aspect of cryptocurrency.”

Although Bitcoin’s PoW consensus mechanism is energy-intensive, it is also fundamental to the blockchain and “is the best choice for any cryptocurrency that prioritizes network security.”

Co-locating flexible crypto mining centers with renewable energy plants can help stabilize the electric grid, solve renewables’ wasted energy issue, and provide an abundant source of cheap energy to crypto miners, Belizaire added.

The Merge united crypto minersBitmain also brought down the prices of Antminers, its flagship crypto mining units, to help miners get back into profits, he added:

Despite the Merge, Ether miners won’t simply forgo PoW mining just because Ethereum Classic is not minted via mining anymore, according to Anndy Lian, author of the book NFT: From Zero to Hero. Lian told Cointelegraph that the EthereumPoW (ETHW) project — the result of a hard fork after the Merge — is working hard and the miner community is more united than ever.

“These various factors helped the miners offset their operating costs in this bear market, keeping them alive.”

Joseph Bradley, the head of business development for Web3 service provider Heirloom, likened Bitcoin to “a global risk asset that is correlated to TradFi markets.” Bradley told Cointelegraph that, although Ether may be traded similarly, it still has neither the market depth nor the size that Bitcoin has. “Do we expect the world to become more or less chaotic in the coming years?” he asks rhetorically, answering:

Bitcoin and Ethereum: “Apples and oranges”“Most people would lean towards more chaotic. Security will matter during this time. Bitcoin will become even more important. Expensive energy will create innovation with miners — They will most likely move toward positioning Bitcoin mining as an extension of the electrical grid itself.”

Not everyone agrees that the Ethereum Merge will have an impact on Bitcoin, though. Martin Hiesboeck, head of research at crypto exchange Uphold, dismissed a direct comparison between Ethereum and Bitcoin as “apples and oranges.”

Hiesboeck told Cointelegraph that Ethereum is basically a “company controlled by venture capitalists,” that’s why the transition to proof-of-stake aims to improve its economic and environmental credentials:

“Bitcoin doesn’t need to do that. Bitcoin is not a brand. Bitcoin is a computer network. Its output represents money. Nobody owns it. There is no brand. No CEO.”

Khaleelulla Baig, the founder and CEO of crypto investment platform Koinbasket, supported Hiesboeck’s argument, telling Cointelegraph that the Merge won’t have any meaningful impact on Bitcoin as these assets serve different purposes.

Bitcoin’s purpose is “to prove itself as a superior store of value to fiat currencies,” according to Baig. The PoW mechanism goes well with the purpose of Bitcoin, “As it helps the network maintain the scarcity of 21 million BTC via its difficulty adjustment rate,” he added.

Bitcoin as a PoW and Ethereum as a PoS network are making significant contributions to the crypto-asset ecosystem by competing with their best features. Tansel Kaya summarizes: “Having two distinct approaches rather than one is more suitable for the spirit of decentralization.”

Source: https://cointelegraph.com/news/apples-and-oranges-how-the-ethereum-merge-could-affect-bitcoin

The post Apples and oranges? How the Ethereum Merge could affect Bitcoin (With additional commnets) appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 17, 2022

The scourge of NFT wash trading — and how not to get suckered in

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

The scourge of NFT wash trading — and how not to get suckered in

What are the different kinds of NFT wash trading, and what are the red flags that a prospective investor should look for? Anndy Lian explains.

What are the different kinds of NFT wash trading, and what are the red flags that a prospective investor should look for? Anndy Lian explains.Wash trading is not a new word for people in the financial world. You probably have heard from friends that cryptocurrencies are highly “washed” and round-tripping with the same buy and systematically sell price. Since you are familiar with this term, let me tell you the NFT market has similar issues with wash trading.

In a nutshell, wash trading makes it difficult for non-fungible token enthusiasts to gauge genuine market interest in NFT collections. It also inflates and skews the amount of trading in marketplaces, misleading analysts about what’s going on on trading platforms.

All in all, NFT wash trading is one of the biggest impediments to accurately evaluating projects and assets in the NFT industry, which includes NFT collections, NFT tertiary tokens (think $X2Y2 and $LOOKS) and the studios and developers who bring products to market.

Using Footprint Analytics’ data set to detect and filter wash trading, let us take a closer look at how wash traders operate and how on-chain data could be analyzed to detect suspicious activity.

What is wash trading?Wash trading is a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace.

In terms of NFTs, wash trading occurs when the same user is behind both sides of an NFT transaction. It means that both the seller and buyer address is actually owned by the same person. At the moment, wash trading is very common in NFT markets, which are not subject to government regulation or supervision, unlike traditional securities.

Why do people wash trade NFTs?There are two main motives behind wash trading in the NFT space.

Type 1: To earn platform rewards

Some NFT marketplaces, like X2Y2, reward active users by giving them returns (in the form of the protocol’s token) based on their trading volume. Wash traders take advantage of this and maximize their rewards by generating unrealistically large amounts of trading volume. In turn, this can easily deceive users who want to analyze NFT collections or marketplaces in terms of liquidity and volume.Type 2: To create an appearance of value or liquidity

To create a false sense of liquidity and an inflated value of a specific NFT collection or asset, some unscrupulous creators turn to wash trading to deceive buyers. They profit when genuine buyers are tricked into buying an NFT from them at a pumped-up price. This type of wash trader hides their activities with new wallet addresses that are self-funded from central exchange wallets. This type of wash trading generates a relatively small volume, which is not as disruptive to the market as Type 1 wash trading.

How is wash trading done?Due to Type 1 wash trading transactions’ disruptiveness to NFT transaction data, Footprint Analytics aimed to filter them out as much as possible. To understand this type of wash trading, we have to understand the token reward system of X2Y2 and LooksRare. In simple terms, X2Y2 and LooksRare distribute tokens daily to both sellers and buyers based on the address’s trading volume as a portion of the marketplace platform’s daily total volume. Token rewards are fixed daily, so wash traders can wash trade and earn reward tokens repeatedly when the daily distribution resets.

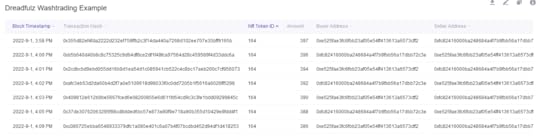

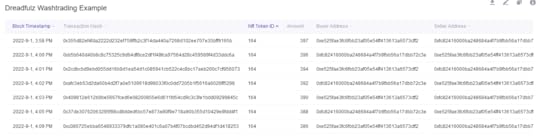

Figure 1 shows an example of wash trading activities on the X2Y2 marketplace— the NFT collection is Dreadfulz.

Figure 1 – Dreadfulz Wash Trading Example (Source: @Hanson520 Footprint Analytics)

Figure 1 – Dreadfulz Wash Trading Example (Source: @Hanson520 Footprint Analytics)As we can see from the figure above, the same NFT (ID 164) was bought back and forth between the same two wallets several times in a day with 300+ ETH sale prices per transaction. On Sept. 1, 2022, these two addresses traded 19 times, generating 7228 ETH in volume and paying 36.14 ETH in X2Y2 platform fees. Keep in mind that the royalty fee rate for Dreadfulz was not set on X2Y2; therefore, no creator fees were paid. Wash traders will choose collections with 0% creator fees to minimize their wash trading costs.

How to detect wash tradingI have looked at how a few analytics platforms, including Footprint Analytics, do their detection and followed their logic. Their methodologies are somewhat similar, to be honest. Along with my own knowledge and analysis, here is a checklist of suspicious data and activity that should trigger any prospective NFT buyer’s alarm bells:

A particular NFT is traded by the same address more than X times a day while the rest of the collection remains untouched.The same address is trading the same NFT in a high-frequency manner.A collection of NFT goes into a self-selling in a high-frequency manner when there is no marketing or promotion backing the sale.The average historical price transacted is X times higher on marketplace A vs. B.The sale price of an NFT is transacted X times higher than the lowest-priced NFT available for sale.The same wallet addresses funding all the suspicious wallets that buy and sell the NFTs.An abnormal high trading volume on a constant basis.The above assumptions are not perfect, and I hope to work with researchers on developing a more comprehensive scorecard to determine NFT trends and behaviors more effectively. The ability to trace multiple wallets over time to identify various levels of relationships would be vital too.

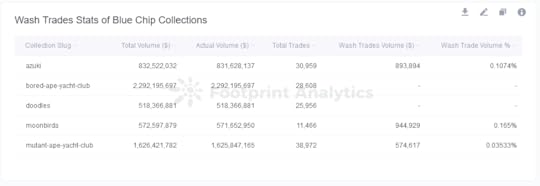

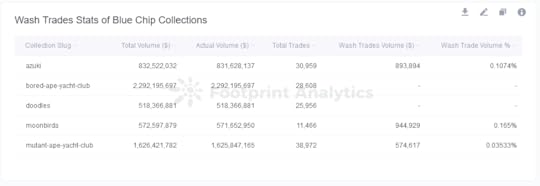

How wash-traded are the top NFT collections?In Figure 2, Footprint Analytics applied their detection rules to the collections with the most trading volume on X2Y2 and LooksRare.

Figure 2 – Wash Trades Stats of Selected Collections (Source: Footprint Analytics)

Figure 2 – Wash Trades Stats of Selected Collections (Source: Footprint Analytics) Based on their rules, they have detected that 95% or more of the trading volume of these collections is wash trading transactions. Wash trading makes up an extremely high percentage of trading volume for these collections, which paints a misleading picture of the collections’ historical volume and sale activities. You can review all the transactions they have filtered at ud_suspicous_txn dataset on their website.

For Footprint Analytics to ensure their rules are working as intended, they have applied them to blue chip collections that are not subjected to wash trading activities in Figure 3. You can view the ud_suspicious_txn_bluechip_collections dataset and review the filtered transactions.

Figure 5 – Unfiltered Trading Stats of Opensea, LooksRare and X2Y2 (Source: Footprint Analytics)

Figure 5 – Unfiltered Trading Stats of Opensea, LooksRare and X2Y2 (Source: Footprint Analytics) Figure 4 indicates that 94.71% and 81.04% of the trading volume on LooksRare and X2Y2 are wash trading transactions, which appears consistent with the marketplace statistics, as shown in Figure 5. We can see from the unfiltered data that the average price per transaction on Looksrare almost reaches US$85,000, which is around 90 times the average price of OpenSea and unrealistically expensive.

You can view the ud_suspicious_txn_x2_looks dataset and review the filtered transactions for X2Y2 and Looksrare marketplaces, as shown in Figure 4.

Final takeaways Figure 6 –

Monthly NFT Volume Stats of OpenSea, LooksRare and X2Y2

(Source: Footprint Analytics)

Figure 6 –

Monthly NFT Volume Stats of OpenSea, LooksRare and X2Y2

(Source: Footprint Analytics) Looking at the monthly trading statistics of the NFT market since January 2022 in Figure 6, we can see that wash trading volume makes up more than 50% of total volume almost every month. Even though total volume is down by a substantial amount from January highs, the percentage of wash trading volume in the NFT market remains similar every month. This underscores how disruptive wash trading is to having accurate NFT transaction data and the importance of filtering out wash trading for any meaningful NFT data analysis.

Source: How to detect NFT wash trading and not get suckered in (forkast.news)

The post The scourge of NFT wash trading — and how not to get suckered in appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

The scourge of NFT wash trading â and how not to get suckered in

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

The scourge of NFT wash trading â and how not to get suckered in

What are the different kinds of NFT wash trading, and what are the red flags that a prospective investor should look for? Anndy Lian explains.

What are the different kinds of NFT wash trading, and what are the red flags that a prospective investor should look for? Anndy Lian explains.Wash trading is not a new word for people in the financial world. You probably have heard from friends that cryptocurrencies are highly âwashedâ and round-tripping with the same buy and systematically sell price. Since you are familiar with this term, let me tell you the NFT market has similar issues with wash trading.

In a nutshell, wash trading makes it difficult for non-fungible token enthusiasts to gauge genuine market interest in NFT collections. It also inflates and skews the amount of trading in marketplaces, misleading analysts about whatâs going on on trading platforms.

All in all, NFT wash trading is one of the biggest impediments to accurately evaluating projects and assets in the NFT industry, which includes NFT collections, NFT tertiary tokens (think $X2Y2 and $LOOKS) and the studios and developers who bring products to market.

Using Footprint Analyticsâ data set to detect and filter wash trading, let us take a closer look at how wash traders operate and how on-chain data could be analyzed to detect suspicious activity.

What is wash trading?Wash trading is a form of market manipulation where an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace.

In terms of NFTs, wash trading occurs when the same user is behind both sides of an NFT transaction. It means that both the seller and buyer address is actually owned by the same person. At the moment, wash trading is very common in NFT markets, which are not subject to government regulation or supervision, unlike traditional securities.

Why do people wash trade NFTs?ÂThere are two main motives behind wash trading in the NFT space.

Type 1: To earn platform rewardsÂ

Some NFT marketplaces, like X2Y2, reward active users by giving them returns (in the form of the protocolâs token) based on their trading volume. Wash traders take advantage of this and maximize their rewards by generating unrealistically large amounts of trading volume. In turn, this can easily deceive users who want to analyze NFT collections or marketplaces in terms of liquidity and volume.Type 2: To create an appearance of value or liquidityÂ

To create a false sense of liquidity and an inflated value of a specific NFT collection or asset, some unscrupulous creators turn to wash trading to deceive buyers. They profit when genuine buyers are tricked into buying an NFT from them at a pumped-up price. This type of wash trader hides their activities with new wallet addresses that are self-funded from central exchange wallets. This type of wash trading generates a relatively small volume, which is not as disruptive to the market as Type 1 wash trading.

How is wash trading done?Due to Type 1 wash trading transactionsâ disruptiveness to NFT transaction data, Footprint Analytics aimed to filter them out as much as possible. To understand this type of wash trading, we have to understand the token reward system of X2Y2 and LooksRare. In simple terms, X2Y2 and LooksRare distribute tokens daily to both sellers and buyers based on the addressâs trading volume as a portion of the marketplace platformâs daily total volume. Token rewards are fixed daily, so wash traders can wash trade and earn reward tokens repeatedly when the daily distribution resets.

Figure 1 shows an example of wash trading activities on the X2Y2 marketplaceâ the NFT collection is Dreadfulz.

Figure 1 â  Dreadfulz Wash Trading Example (Source: @Hanson520 Footprint Analytics)

Figure 1 â  Dreadfulz Wash Trading Example (Source: @Hanson520 Footprint Analytics)As we can see from the figure above, the same NFT (ID 164) was bought back and forth between the same two wallets several times in a day with 300+ ETH sale prices per transaction. On Sept. 1, 2022, these two addresses traded 19 times, generating 7228 ETH in volume and paying 36.14 ETH in X2Y2 platform fees. Keep in mind that the royalty fee rate for Dreadfulz was not set on X2Y2; therefore, no creator fees were paid. Wash traders will choose collections with 0% creator fees to minimize their wash trading costs.

How to detect wash tradingI have looked at how a few analytics platforms, including Footprint Analytics, do their detection and followed their logic. Their methodologies are somewhat similar, to be honest. Along with my own knowledge and analysis, here is a checklist of suspicious data and activity that should trigger any prospective NFT buyerâs alarm bells:

A particular NFT is traded by the same address more than X times a day while the rest of the collection remains untouched.The same address is trading the same NFT in a high-frequency manner.A collection of NFT goes into a self-selling in a high-frequency manner when there is no marketing or promotion backing the sale.The average historical price transacted is X times higher on marketplace A vs. B.The sale price of an NFT is transacted X times higher than the lowest-priced NFT available for sale.The same wallet addresses funding all the suspicious wallets that buy and sell the NFTs.An abnormal high trading volume on a constant basis.The above assumptions are not perfect, and I hope to work with researchers on developing a more comprehensive scorecard to determine NFT trends and behaviors more effectively. The ability to trace multiple wallets over time to identify various levels of relationships would be vital too.

How wash-traded are the top NFT collections?In Figure 2, Footprint Analytics applied their detection rules to the collections with the most trading volume on X2Y2 and LooksRare.

Figure 2 â Wash Trades Stats of Selected Collections (Source: Footprint Analytics)  Â

Figure 2 â Wash Trades Stats of Selected Collections (Source: Footprint Analytics)   Based on their rules, they have detected that 95% or more of the trading volume of these collections is wash trading transactions. Wash trading makes up an extremely high percentage of trading volume for these collections, which paints a misleading picture of the collectionsâ historical volume and sale activities. You can review all the transactions they have filtered at ud_suspicous_txn dataset on their website.

For Footprint Analytics to ensure their rules are working as intended, they have applied them to blue chip collections that are not subjected to wash trading activities in Figure 3. You can view the ud_suspicious_txn_bluechip_collections dataset and review the filtered transactions.

Figure 5 â Unfiltered Trading Stats of Opensea, LooksRare and X2Y2 (Source: Footprint Analytics)Â

Figure 5 â Unfiltered Trading Stats of Opensea, LooksRare and X2Y2 (Source: Footprint Analytics) Figure 4 indicates that 94.71% and 81.04% of the trading volume on LooksRare and X2Y2 are wash trading transactions, which appears consistent with the marketplace statistics, as shown in Figure 5. We can see from the unfiltered data that the average price per transaction on Looksrare almost reaches US$85,000, which is around 90 times the average price of OpenSea and unrealistically expensive.

You can view the ud_suspicious_txn_x2_looks dataset and review the filtered transactions for X2Y2 and Looksrare marketplaces, as shown in Figure 4.

Final takeawaysÂ Figure 6 âÂ

Monthly NFT Volume Stats of OpenSea, LooksRare and X2Y2

(Source: Footprint Analytics)Â

Figure 6 âÂ

Monthly NFT Volume Stats of OpenSea, LooksRare and X2Y2

(Source: Footprint Analytics) Looking at the monthly trading statistics of the NFT market since January 2022 in Figure 6, we can see that wash trading volume makes up more than 50% of total volume almost every month. Even though total volume is down by a substantial amount from January highs, the percentage of wash trading volume in the NFT market remains similar every month. This underscores how disruptive wash trading is to having accurate NFT transaction data and the importance of filtering out wash trading for any meaningful NFT data analysis.

Source: How to detect NFT wash trading and not get suckered in (forkast.news)

The post The scourge of NFT wash trading â and how not to get suckered in appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Magic Eden, largest Solana-based NFT platform, makes royalty fees optional

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Magic Eden, largest Solana-based NFT platform, makes royalty fees optional

The platform said the move was in line with growing market trends, but some are concerned about what it means for the industry.

The platform said the move was in line with growing market trends, but some are concerned about what it means for the industry.Magic Eden, the largest non-fungible token (NFT) marketplace in the Solana ecosystem, has moved to make paying NFT creator royalty fees optional, following in the footsteps of rival marketplaces which have eaten into its market share in recent months.

The platform will also be waiving all platform fees for the foreseeable future, Magic Eden said in a Twitter thread announcing the changes on Saturday.

Anndy Lian, author of the new book âNFT: From Zero to Hero,â told Forkast the attempt to win back users by lowering or removing fees surprised him as he was doubtful of the long-term sustainability of the plan.

âFor [an] NFT platform, where the secondary market is at a really bad situation right now, I am doubtful whether the zero fees are going to work very well,â he said.

Total secondary sales of NFTs have fallen for five consecutive months amid the ongoing crypto winter, forcing creators and marketplaces to re-evaluate how to survive what could be a lengthy bear market.NFT royalties give the original creator a percentage of the sale price each time that NFT creation is sold.

Magic Eden is a giant in the Solana ecosystem, controlling roughly 90% of all sales, and almost nine times the Solana sales of leading NFT marketplace OpenSea, which added support for Solana NFTs in April 2022.

Magic Eden also raised US$130 in series B fundraising in June, bringing its valuation to US$1.6 billion, and cementing its status as a âunicorn,â a privately held start-up with a valuation over US$1 billion.

Smaller marketplaces such as Hadeswap and Solanart have begun eating into that market share recently, according to data aggregator Tiexo, offering more competitive fee structures for users.âThis is not a decision we take lightly,â Magic Eden said in a tweet announcing the move, while also acknowledging the industry has been slowly moving towards optional creator royalties for a while. âWe understand this move has serious implications for the ecosystem. We also hope it is not a permanent decision.â

Royalties for NFTs are typically set to between 5% and 10% and are often encoded into the smart contract of the NFT itself. Marketplaces are able to rework the code around the sales of these NFTs, however, effectively allowing them to set the fees to whatever they like.

In the case of Magic Eden now, that fee now will be left up to the user to decide whether or not to pay. However, if users choose not to pay the fee, they risk being excluded from the full utility or perks of owning the NFT, the platform warned.

Lian told Forkast that marketplaces enforcing this fee structure helps keep NFT prices low. In other words, if a creator knows they will continue to earn royalties over the life of the NFT, they can afford to set a lower initial asking price.Removing this structure incentivizes creators to lift their prices in order to compensate for this loss of income, he said, which could add extra pressure to an already struggling market that is currently extremely sensitive to pricing.

The issue is compounded if smaller marketplaces follow Magic Edenâs lead, which Lian said they will be incentivized to do.

âSo, it goes back to the whole equation: How long is this bear market going to be and how long can you sustain that kind of strategy?â Lian said, âIf Iâm not wrong, maybe [Magic Eden] can for the next two, three, four years, maybe. But Iâm not so sure about the rest.â

Removing the fees from the platform has also already led to a significant increase in the prevalence of wash trading on the platform â the practice of trading assets between wallet addresses owned by the same person or party.Lian explained this was being done to artificially increase an NFTâs trading volume to give the impression it is more highly sought-after than it actually is. This not only discredits the industry but deceives unwitting buyers into potentially paying inflated prices for NFTs.

The issue has become so prevalent on Magic Eden in the few days since fees were removed that OpenSea has since announced it is in the process of temporarily blocking Solana collections from the Top and Trending list on its homepage to avoid âgamingâ those numbers.

Secondary monthly NFT sales in September were only US$550 million, an almost 90% decrease from its high in January 2022. NFT creators, marketplaces and collectors alike have had to make difficult choices about how to respond to the difficult market conditions.

Unfortunately, Lian does not see those conditions improving any time soon.âThereâs a lot of uncertainty. Based on the current charts, we should still be going down or going sideways for the next quarter or so,â he said.

Source: Magic Eden, largest Solana-based NFT platform, makes royalty fees optional (forkast.news)

The post Magic Eden, largest Solana-based NFT platform, makes royalty fees optional appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 13, 2022

熊市依旧在前进,比特币(BTC)能否逆转下行趋势?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

熊市依旧在前进,比特币(BTC)能否逆转下行趋势?

自 2021 年 11 月创下历史新高以来,世界上最大的加密货币比特币( BTC ) 已贬值 70% 以上,与广泛的加密货币市场一致。严酷的加密货币冬天是由通胀飙升、经济衰退担忧中的避险情绪以及 TerraUSD (UST) 稳定币的崩盘引发的。

加密货币先驱会再次出现吗?我们来看看推动 2023 年及以后的 BTC/USD 预测的关键因素。

什么是比特币?

BTC/USD 是比特币兑美元的汇率。BTC to USD衡量购买一个比特币需要多少美元。

比特币创建于 2009 年,是第一个去中心化的数字货币,充当点对点支付系统。它不使用中央机构或银行来管理交易,而是“由网络共同组织”。

加密货币是由化名中本聪的匿名个人或一群人发明的。此后,它已成为最受欢迎的数字资产之一。第一个 BTC 代币,即所谓的创世区块,于 2009 年 1 月开采。

比特币的区块链使用工作量证明 ( PoW ) 共识机制,由矿工验证 BTC 交易以换取 BTC 奖励来保护。这个过程被称为加密挖掘。

这些奖励在每挖出 210,000 个区块或大约每四年一次减半事件后减半,从而减少流通中的整体 BTC 代币数量,并通过减少供应来提高加密货币的价格。

最近的减半事件发生在 2021 年 5 月 11 日,当时比特币的区块奖励减少到 6.25BTC。下一个减半事件估计发生在 2024 年。

除了作为“电子现金的点对点版本”之外,比特币现在还被用作价值存储。比特币的最大供应量为 2100 万个代币。

BTC价格历史

自 2009 年推出以来,BTC 花了大约 8 年时间才飙升至 1,000 美元以上。2017 年,该加密货币表现良好,从 2017 年 1 月初的 1,044.4 美元到 2017 年 12 月 20 日的 17,760.3 美元,在一年内上涨了 1,600% – 创历史新高。

然而,2018 年初的大幅抛售干扰了比特币的价格,到 2018 年 2 月 8 日,比特币的价格跌至 7,637.86 美元。到 2018 年 12 月 10 日,比特币继续下跌至 3,000 美元。

加密货币在 2019 年 7 月初再次达到顶峰,在短时间内超过 12,000 美元,随后损失超过 58% 的价值,到 2020 年 3 月 13 日跌至 5,000 美元。

2021 年,加密货币再次迎来了历史上最大的牛市。到 2021 年 1 月 8 日,该代币的价值约为 39,000 美元。2021 年 4 月 16 日,比特币达到了 63,258.51 美元的第一个峰值——飙升了约 62%。BTC 的价格继续上涨,在 2021 年 11 月 9 日达到 67,549.74 美元的历史新高。

2022 年,该代币经历了迄今为止最严酷的加密冬天之一,自 2021 年 11 月的高点以来下跌了近 72%,目前(10 月 12 日)徘徊在 19,000 美元。是什么塑造了 BTC/USD 的预测?

加密货币市场在 2022 年受到多种因素的影响,例如乌克兰战争、TerraUSD (UST) 稳定币崩盘和通胀上升。Castle Funds 总裁兼首席投资官 Peter Eberle 告诉 Capital.com:

“2022 年上半年对股票、债券和加密市场来说是可怕的。俄罗斯入侵乌克兰、美国政策制定者缓慢意识到通胀是真实的、然后积极转向加息、中国新冠政策导致的供应链问题等宏观因素的汇合,都导致整个市场出现大幅抛售。 ”

Eberle 补充说,Terra 的“崩盘”导致其姊妹加密货币 LUNA 随后下跌,“造成跨多个平台的级联清算”,不仅影响了 BTC/USD 价格,还影响了包括三箭资本和摄氏度在内的多家对冲基金网络。

6 月 9 日,比特币一度突破 31,000 美元,但很快就变成了抛售,导致比特币损失了 90% 以上的小幅收益,10 天后跌至 19,000 美元。从那时起,BTC 一直在波动,交易价格在 23,000 美元至 19,000 美元之间。

“在第二季度末,业内许多人都在等待众所周知的‘下一只鞋要掉’,但幸运的是事情平静了下来,”Eberle 指出。

蒙古生产力组织首席数字顾问、《NFT:从零到英雄》的作者 Anndy Lian 表示,比特币的价格取决于美联储 ( Fed ) 会议的结果和货币政策收紧的决定,以及最新的通胀数据如生产者物价指数(PPI)和消费者物价指数(CPI)。

“不过,我并不悲观。矿业公司经历了艰难时期。尽管哈希率很高,但比特币的价格并没有显着上涨。这表明矿工们并没有通过堆积网络来获得比特币的巨大收益,他们相信,由于网络已被证明具有持久力,挖矿业务将会做得很好。”

Capital.com 的季节性研究显示,从历史上看,10 月一直是加密货币的好月份,自 2011 年以来,10 月比特币的价格变化平均上涨了 14.6% 。然而,事实证明今年有所不同。Castle Fund 的 Eberle 指出:

“2022 年第三季度,加密市场出现整合,而股票和债券继续下滑。道琼斯工业平均指数下跌 6.2%,比特币下跌 2%,但波动性显着降低,更广泛的加密货币市值增长 8.5%。”

Eberle 补充说,比特币兑美元的预测目前主要关注宏观事件,特别是美联储的利益决定、俄罗斯-乌克兰冲突的未来结果以及定于 11 月 8 日举行的美国中期选举。此外,Eberle 还添加了一些关于比特币过去减半事件的历史展望:

“2015 年 BTC 在减半前 547 天触底,而 2018 年则在 517 天前触底。下一个减半估计发生在 2024 年 4 月或 5 月,因此如果历史重演,我们应该接近下一个牛市的开始。”

BTC预测 2022 年及以后

尽管最新的价格走势下跌,但基于算法的预测服务Wallet Investor在撰写本文时(10 月 12 日)给出了看涨的 BTC/USD 预测。该网站指出,BTC 是“一项非常好的长期投资”。

根据对过去价格表现的分析,WalletInvestor 预测 BTC/USD 可能在 2023 年交易价格为 25,373.90 美元,并在 2027 年飙升至 47,496.74 美元。

DigitalCoinPrice支持积极的 BTC / USD 预测,但在接下来的几年中增长速度更快,预计到 2022 年底该加密货币将达到 24,206.47 美元,到 2023 年底达到 43,340.43 美元。

其对 2025 年的 BTC/USD 预测显示,该加密货币平均达到 77,238.07 美元,2027 年达到 94,929.40 美元。该平台对 2030 年的长期 BTC/USD 预测预计该加密货币平均将飙升至 266,189.92 美元。

Lian 确实分享了对 BTC 兑美元预测的看涨情绪:

“比特币价格徘徊在 19,400 美元左右,上周上涨 1.9%。缩小,它在过去 30 天里上涨了 1%。除非我们看到标准普尔 500 指数跌至 3200 点,否则比特币可能跌破 13,000 美元区域,否则我认为未来几周它将继续横盘整理。”

然而,Lian 指出,要强调的一个积极方面是比特币的哈希率继续飙升。

请注意,BTC/USD 预测可能是错误的。不应使用分析师和基于算法的预测来替代您自己的研究。

始终在交易前对股票进行自己的尽职调查,查看最新消息、广泛的分析师评论、技术和基本面分析。请注意,过去的表现并不能保证未来的回报。永远不要交易你不能承受损失的钱。

在加密行业你想抓住下一波牛市机会你得有一个优质圈子,大家就能抱团取暖,保持洞察力。如果只是你一个人,四顾茫然,发现一个人都没有,想在这个行业里面坚持下来其实是很难的。

Source: https://www.sohu.com/a/592238863_121420475

The post 熊市依旧在前进,比特币(BTC)能否逆转下行趋势? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

çå¸ä¾æ§å¨åè¿ï¼æ¯ç¹å¸ï¼BTCï¼è½å¦é转ä¸è¡è¶å¿ï¼

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

çå¸ä¾æ§å¨åè¿ï¼æ¯ç¹å¸ï¼BTCï¼è½å¦é转ä¸è¡è¶å¿ï¼

èª 2021 å¹´ 11 æåä¸åå²æ°é«ä»¥æ¥ï¼ä¸çä¸æ大çå å¯è´§å¸æ¯ç¹å¸( BTC ) å·²è´¬å¼ 70% 以ä¸ï¼ä¸å¹¿æ³çå å¯è´§å¸å¸åºä¸è´ãä¸¥é ·çå å¯è´§å¸å¬å¤©æ¯ç±éèé£åãç»æµè¡°éæ 忧ä¸çé¿é©æ 绪以å TerraUSD (UST) 稳å®å¸çå´©çå¼åçã

å å¯è´§å¸å 驱ä¼å次åºç°åï¼æ们æ¥ççæ¨å¨ 2023 å¹´å以åç BTC/USD é¢æµçå ³é®å ç´ ã

ä»ä¹æ¯æ¯ç¹å¸ï¼

BTC/USD æ¯æ¯ç¹å¸å ç¾å çæ±çãBTC to USDè¡¡éè´ä¹°ä¸ä¸ªæ¯ç¹å¸éè¦å¤å°ç¾å ã

æ¯ç¹å¸åå»ºäº 2009 å¹´ï¼æ¯ç¬¬ä¸ä¸ªå»ä¸å¿åçæ°åè´§å¸ï¼å å½ç¹å¯¹ç¹æ¯ä»ç³»ç»ãå®ä¸ä½¿ç¨ä¸å¤®æºææé¶è¡æ¥ç®¡ç交æï¼èæ¯âç±ç½ç»å ±åç»ç»âã

å å¯è´§å¸æ¯ç±ååä¸æ¬èªçå¿å个人æä¸ç¾¤äººåæçãæ¤åï¼å®å·²æ为æå欢è¿çæ°åèµäº§ä¹ä¸ã第ä¸ä¸ª BTC 代å¸ï¼å³æè°çåä¸åºåï¼äº 2009 å¹´ 1 æå¼éã

æ¯ç¹å¸çåºåé¾ä½¿ç¨å·¥ä½éè¯æ ( PoW ) å ±è¯æºå¶ï¼ç±ç¿å·¥éªè¯ BTC 交æ以æ¢å BTC å¥å±æ¥ä¿æ¤ãè¿ä¸ªè¿ç¨è¢«ç§°ä¸ºå å¯ææã

è¿äºå¥å±å¨æ¯æåº 210,000 个åºåæ大约æ¯åå¹´ä¸æ¬¡ååäºä»¶åååï¼ä»èåå°æµéä¸çæ´ä½ BTC 代å¸æ°éï¼å¹¶éè¿åå°ä¾åºæ¥æé«å å¯è´§å¸çä»·æ ¼ã

æè¿çååäºä»¶åçå¨ 2021 å¹´ 5 æ 11 æ¥ï¼å½æ¶æ¯ç¹å¸çåºåå¥å±åå°å° 6.25BTCãä¸ä¸ä¸ªååäºä»¶ä¼°è®¡åçå¨ 2024 å¹´ã

é¤äºä½ä¸ºâçµåç°éçç¹å¯¹ç¹çæ¬âä¹å¤ï¼æ¯ç¹å¸ç°å¨è¿è¢«ç¨ä½ä»·å¼åå¨ãæ¯ç¹å¸çæ大ä¾åºé为 2100 ä¸ä¸ªä»£å¸ã

BTCä»·æ ¼åå²

èª 2009 å¹´æ¨åºä»¥æ¥ï¼BTC è±äºå¤§çº¦ 8 å¹´æ¶é´æé£åè³ 1,000 ç¾å 以ä¸ã2017 å¹´ï¼è¯¥å å¯è´§å¸è¡¨ç°è¯å¥½ï¼ä» 2017 å¹´ 1 æåç 1,044.4 ç¾å å° 2017 å¹´ 12 æ 20 æ¥ç 17,760.3 ç¾å ï¼å¨ä¸å¹´å ä¸æ¶¨äº 1,600% â ååå²æ°é«ã

ç¶èï¼2018 å¹´åçå¤§å¹ æå®å¹²æ°äºæ¯ç¹å¸çä»·æ ¼ï¼å° 2018 å¹´ 2 æ 8 æ¥ï¼æ¯ç¹å¸çä»·æ ¼è·è³ 7,637.86 ç¾å ãå° 2018 å¹´ 12 æ 10 æ¥ï¼æ¯ç¹å¸ç»§ç»ä¸è·è³ 3,000 ç¾å ã

å å¯è´§å¸å¨ 2019 å¹´ 7 æåå次达å°é¡¶å³°ï¼å¨çæ¶é´å è¶ è¿ 12,000 ç¾å ï¼éåæå¤±è¶ è¿ 58% çä»·å¼ï¼å° 2020 å¹´ 3 æ 13 æ¥è·è³ 5,000 ç¾å ã

2021 å¹´ï¼å å¯è´§å¸å次è¿æ¥äºåå²ä¸æ大ççå¸ãå° 2021 å¹´ 1 æ 8 æ¥ï¼è¯¥ä»£å¸çä»·å¼çº¦ä¸º 39,000 ç¾å ã2021 å¹´ 4 æ 16 æ¥ï¼æ¯ç¹å¸è¾¾å°äº 63,258.51 ç¾å ç第ä¸ä¸ªå³°å¼ââé£åäºçº¦ 62%ãBTC çä»·æ ¼ç»§ç»ä¸æ¶¨ï¼å¨ 2021 å¹´ 11 æ 9 æ¥è¾¾å° 67,549.74 ç¾å çåå²æ°é«ã

2022 å¹´ï¼è¯¥ä»£å¸ç»åäºè¿ä»ä¸ºæ¢æä¸¥é ·çå å¯å¬å¤©ä¹ä¸ï¼èª 2021 å¹´ 11 æçé«ç¹ä»¥æ¥ä¸è·äºè¿ 72ï¼ ï¼ç®åï¼10 æ 12 æ¥ï¼å¾å¾å¨ 19,000 ç¾å ãæ¯ä»ä¹å¡é äº BTC/USD çé¢æµï¼

å å¯è´§å¸å¸åºå¨ 2022 å¹´åå°å¤ç§å ç´ çå½±åï¼ä¾å¦ä¹å å °æäºãTerraUSD (UST) 稳å®å¸å´©çåéèä¸åãCastle Funds æ»è£å ¼é¦å¸æèµå® Peter Eberle åè¯ Capital.comï¼

â2022 å¹´ä¸å年对è¡ç¥¨ãåºå¸åå å¯å¸åºæ¥è¯´æ¯å¯æçãä¿ç½æ¯å ¥ä¾µä¹å å °ãç¾å½æ¿çå¶å®è ç¼æ ¢æè¯å°éèæ¯çå®çãç¶å积æ转åå æ¯ãä¸å½æ°å æ¿ç导è´çä¾åºé¾é®é¢çå®è§å ç´ çæ±åï¼é½å¯¼è´æ´ä¸ªå¸åºåºç°å¤§å¹ æå®ã â

Eberle è¡¥å 说ï¼Terra çâå´©çâ导è´å ¶å§å¦¹å å¯è´§å¸ LUNA éåä¸è·ï¼âé æè·¨å¤ä¸ªå¹³å°ç级èæ¸ ç®âï¼ä¸ä» å½±åäº BTC/USD ä»·æ ¼ï¼è¿å½±åäºå æ¬ä¸ç®èµæ¬åææ°åº¦å¨å çå¤å®¶å¯¹å²åºéç½ç»ã

6 æ 9 æ¥ï¼æ¯ç¹å¸ä¸åº¦çªç ´ 31,000 ç¾å ï¼ä½å¾å¿«å°±åæäºæå®ï¼å¯¼è´æ¯ç¹å¸æå¤±äº 90% 以ä¸çå°å¹ æ¶çï¼10 天åè·è³ 19,000 ç¾å ãä»é£æ¶èµ·ï¼BTC ä¸ç´å¨æ³¢å¨ï¼äº¤æä»·æ ¼å¨ 23,000 ç¾å è³ 19,000 ç¾å ä¹é´ã

âå¨ç¬¬äºå£åº¦æ«ï¼ä¸å 许å¤äººé½å¨çå¾ ä¼æå¨ç¥çâä¸ä¸åªéè¦æâï¼ä½å¹¸è¿çæ¯äºæ å¹³éäºä¸æ¥ï¼âEberle æåºã

èå¤ç产åç»ç»é¦å¸æ°å顾é®ããNFTï¼ä»é¶å°è±éãçä½è Anndy Lian 表示ï¼æ¯ç¹å¸çä»·æ ¼åå³äºç¾èå¨ ( Fed ) ä¼è®®çç»æåè´§å¸æ¿çæ¶ç´§çå³å®ï¼ä»¥åææ°çéèæ°æ®å¦ç产è ç©ä»·ææ°ï¼PPIï¼åæ¶è´¹è ç©ä»·ææ°ï¼CPIï¼ã

âä¸è¿ï¼æ并ä¸æ²è§ãç¿ä¸å ¬å¸ç»åäºè°é¾æ¶æã尽管åå¸çå¾é«ï¼ä½æ¯ç¹å¸çä»·æ ¼å¹¶æ²¡ææ¾çä¸æ¶¨ãè¿è¡¨æç¿å·¥ä»¬å¹¶æ²¡æéè¿å 积ç½ç»æ¥è·å¾æ¯ç¹å¸ç巨大æ¶çï¼ä»ä»¬ç¸ä¿¡ï¼ç±äºç½ç»å·²è¢«è¯æå ·ææä¹ åï¼æç¿ä¸å¡å°ä¼åå¾å¾å¥½ãâ

Capital.com çå£èæ§ç 究æ¾ç¤ºï¼ä»åå²ä¸çï¼10 æä¸ç´æ¯å å¯è´§å¸ç好æ份ï¼èª 2011 年以æ¥ï¼10 ææ¯ç¹å¸çä»·æ ¼ååå¹³åä¸æ¶¨äº 14.6% ãç¶èï¼äºå®è¯æä»å¹´ææä¸åãCastle Fund ç Eberle æåºï¼

â2022 年第ä¸å£åº¦ï¼å å¯å¸åºåºç°æ´åï¼èè¡ç¥¨ååºå¸ç»§ç»ä¸æ»ãéç¼æ¯å·¥ä¸å¹³åææ°ä¸è· 6.2%ï¼æ¯ç¹å¸ä¸è· 2%ï¼ä½æ³¢å¨æ§æ¾çéä½ï¼æ´å¹¿æ³çå å¯è´§å¸å¸å¼å¢é¿ 8.5%ãâ

Eberle è¡¥å 说ï¼æ¯ç¹å¸å ç¾å çé¢æµç®å主è¦å ³æ³¨å®è§äºä»¶ï¼ç¹å«æ¯ç¾èå¨çå©çå³å®ãä¿ç½æ¯-ä¹å å °å²çªçæªæ¥ç»æ以åå®äº 11 æ 8 æ¥ä¸¾è¡çç¾å½ä¸æé举ãæ¤å¤ï¼Eberle è¿æ·»å äºä¸äºå ³äºæ¯ç¹å¸è¿å»ååäºä»¶çåå²å±æï¼

â2015 å¹´ BTC å¨ååå 547 天触åºï¼è 2018 å¹´åå¨ 517 天å触åºãä¸ä¸ä¸ªåå估计åçå¨ 2024 å¹´ 4 ææ 5 æï¼å æ¤å¦æåå²éæ¼ï¼æ们åºè¯¥æ¥è¿ä¸ä¸ä¸ªçå¸çå¼å§ãâ

BTCé¢æµ 2022 å¹´å以å

尽管ææ°çä»·æ ¼èµ°å¿ä¸è·ï¼ä½åºäºç®æ³çé¢æµæå¡Wallet Investorå¨æ°åæ¬ææ¶ï¼10 æ 12 æ¥ï¼ç»åºäºç涨ç BTC/USD é¢æµã该ç½ç«æåºï¼BTC æ¯âä¸é¡¹é常好çé¿ææèµâã

æ ¹æ®å¯¹è¿å»ä»·æ ¼è¡¨ç°çåæï¼WalletInvestor é¢æµ BTC/USD å¯è½å¨ 2023 年交æä»·æ ¼ä¸º 25,373.90 ç¾å ï¼å¹¶å¨ 2027 å¹´é£åè³ 47,496.74 ç¾å ã

DigitalCoinPriceæ¯æ积æç BTC / USD é¢æµï¼ä½å¨æ¥ä¸æ¥çå å¹´ä¸å¢é¿é度æ´å¿«ï¼é¢è®¡å° 2022 å¹´åºè¯¥å å¯è´§å¸å°è¾¾å° 24,206.47 ç¾å ï¼å° 2023 å¹´åºè¾¾å° 43,340.43 ç¾å ã

å ¶å¯¹ 2025 å¹´ç BTC/USD é¢æµæ¾ç¤ºï¼è¯¥å å¯è´§å¸å¹³åè¾¾å° 77,238.07 ç¾å ï¼2027 å¹´è¾¾å° 94,929.40 ç¾å ã该平å°å¯¹ 2030 å¹´çé¿æ BTC/USD é¢æµé¢è®¡è¯¥å å¯è´§å¸å¹³åå°é£åè³ 266,189.92 ç¾å ã

Lian ç¡®å®å享äºå¯¹ BTC å ç¾å é¢æµçç涨æ 绪ï¼

âæ¯ç¹å¸ä»·æ ¼å¾å¾å¨ 19,400 ç¾å å·¦å³ï¼ä¸å¨ä¸æ¶¨ 1.9%ã缩å°ï¼å®å¨è¿å» 30 天éä¸æ¶¨äº 1%ãé¤éæ们çå°æ åæ®å° 500 ææ°è·è³ 3200 ç¹ï¼å¦åæ¯ç¹å¸å¯è½è·ç ´ 13,000 ç¾å åºåï¼å¦åæ认为æªæ¥å å¨å®å°ç»§ç»æ¨ªçæ´çãâ

ç¶èï¼Lian æåºï¼è¦å¼ºè°çä¸ä¸ªç§¯ææ¹é¢æ¯æ¯ç¹å¸çåå¸ç继ç»é£åã

请注æï¼BTC/USD é¢æµå¯è½æ¯é误çãä¸åºä½¿ç¨åæå¸ååºäºç®æ³çé¢æµæ¥æ¿ä»£æ¨èªå·±çç 究ã

å§ç»å¨äº¤æå对è¡ç¥¨è¿è¡èªå·±çå°½èè°æ¥ï¼æ¥çææ°æ¶æ¯ã广æ³çåæå¸è¯è®ºãææ¯ååºæ¬é¢åæã请注æï¼è¿å»ç表ç°å¹¶ä¸è½ä¿è¯æªæ¥çåæ¥ãæ°¸è¿ä¸è¦äº¤æä½ ä¸è½æ¿åæ失çé±ã

å¨å å¯è¡ä¸ä½ æ³æä½ä¸ä¸æ³¢çå¸æºä¼ä½ å¾æä¸ä¸ªä¼è´¨ååï¼å¤§å®¶å°±è½æ±å¢åæï¼ä¿ææ´å¯åãå¦æåªæ¯ä½ ä¸ä¸ªäººï¼å顾è«ç¶ï¼åç°ä¸ä¸ªäººé½æ²¡æï¼æ³å¨è¿ä¸ªè¡ä¸éé¢åæä¸æ¥å ¶å®æ¯å¾é¾çã

Source: https://www.sohu.com/a/592238863_121420475

The post çå¸ä¾æ§å¨åè¿ï¼æ¯ç¹å¸ï¼BTCï¼è½å¦é转ä¸è¡è¶å¿ï¼ appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 12, 2022

BTC / USD forecast: Can bitcoin reverse downward trend as crypto winter bites?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

BTC / USD forecast: Can bitcoin reverse downward trend as crypto winter bites?

Since its November 2021 all-time high, Bitcoin (BTC), the worldâs biggest cryptocurrency, has lost over 70% of its value, in line with the broad cryptocurrency markets. The harsh crypto winter was sparked by surging inflation, risk-off sentiment amid recession fears and the crash of the TerraUSD (UST) stablecoin.

Will the cryptocurrency pioneer ever resurface? We take a look at the key factors driving the BTC/USD forecast in 2023 and beyond.What is BTC/USD?BTC/USD is the exchange rate of bitcoin against the US currency. BTC to USD measures how many USD are required to purchase one bitcoin.

Created in 2009, Bitcoin, the first ever decentralised digital currency, acts as a peer-to-peer payments system. It uses no central authorities or banks to manage transactions, which are instead organised âcollectively by the networkâ.

The cryptocurrency was invented by an anonymous person or group of people under the pseudonym Satoshi Nakamoto. It has since established itself as one of the most popular digital assets. The first ever BTC token, the so-called genesis block, was mined in January 2009.

Bitcoinâs blockchain uses a Proof-of-Work (PoW) consensus mechanism, which is secured by miners verifying BTC transactions in exchange for BTC reward. The process is known as crypto mining.

These rewards are cut in half after every 210,000 blocks are mined, or approximately every four years, in halving events, thus reducing the amount of overall BTC coins in circulation and raising the cryptocurrencyâs price by cutting supply.

The most recent halving event took place on 11 May 2021, when bitcoinâs block reward was reduced to 6.25BTC. The next halving event is estimated to take place in 2024.

In addition to being a âpeer-to-peer version of electronic cashâ bitcoin is also now used as a store of value. Bitcoin has a maximum supply of 21 million tokens.

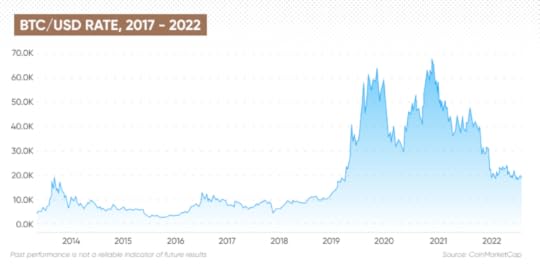

BTC/USD price historyIt has taken BTC to USD around eight years to surge past $1,000 since its launch in 2009. In 2017, the cryptocurrency saw a good run, rising by 1,600% within a year from $1,044.4 at the start of January 2017 to $17,760.3 by 20 December 2017 â a then all-time high.

However, a steep sell-off at the start of 2018 interfered, bringing the bitcoinâs price down to $7,637.86 by 8 February 2018. BTC continued to decline falling to $3,000 by 10 December 2018.

The cryptocurrency peaked once again in the beginning of July 2019, surpassing $12,000 for a brief time before losing over 58% of its value and dropping to $5,000 by 13 March 2020.

In 2021, the cryptocurrency enjoyed another bull run, the biggest in its history. By 8 January 2021, the token was valued at around $ 39,000. On 16 April 2021, bitcoin reached its first peak at $63,258.51 â a surge of around 62%. BTCâs price continued to rise, reaching the all-time high of $67,549.74 on 9 November 2021.

In 2022, the coin has been experiencing one of the harshest crypto winters yet, losing nearly 72% since the November 2021 highs, and is currently (12 October) hovering at $19,000.

Whatâs shaping the BTC/USD forecast?The cryptocurrency market has been affected by a number of factors in 2022 such as with the war in Ukraine, the collapse of the TerraUSD (UST)Â stablecoin and rising inflation. Peter Eberle, president and chief investment officer of Castle Funds, told Capital.com:

âThe first half of 2022 was horrible for equity, bond and crypto markets. A confluence of macro factors such as Russiaâs invasion of Ukraine, US Policy makers’ slow realisation that inflation was real, then the aggressive pivot to higher interest rates, supply chain issues due to Chinaâs Covid polices all led to a steep sell off across markets.âEberle added that Terraâs âmeltdownâ, which led to the subsequent fall of its sister cryptocurrency, LUNA, âcreated cascading liquidations across multiple platformsâ, affecting not only the BTC/USD price but also several hedge funds, including Three Arrow Capital and Celsius Network.

On 9 June, bitcoin briefly traded above $31,000, however, this soon turned into a selloff, which saw the cryptocurrency lose over 90% of its minor gains, falling to $19,000 10 days later. Since then, BTC has been fluctuating, trading between $23,000 and $19,000.

âAt the end of the 2nd quarter many in the industry were waiting for the proverbial ânext shoe to dropâ, but fortunately things calmed down,â Eberle noted.

Anndy Lian, chief digital advisor at the Mongolian Productivity Organisation and author of NFT: From Zero to Hero, said that bitcoinâs price depends on the outcomes of the Federal Reserve’s (Fed) meetings and decisions on monetary policy tightening, as well as latest inflation readings such as Producer Price Index (PPI) and the Consumer Price Index (CPI).

âHowever, I am not pessimistic. The mining companies have endured tough times. Despite the high hash rate, bitcoin’s price has not significantly increased. This signals that the miners are not piling the network to obtain big gains on bitcoin, they are confident that the mining business will do well now that the network has proven staying power.âHistorically, October has been a good month for cryptocurrencies, with bitcoinâs price change averaging at 14.6% gain in October since 2011, Capital.comâs seasonality research showed. Yet this year proves to be different. Castle Fundâs Eberle noted:

âThe third quarter of 2022 showed consolidation in the crypto market while equities and bonds continue to slump. The Dow Jones Industrial Average dropped 6.2%, Bitcoin dropped 2% but saw significantly lower volatility and the broader crypto market capitalization increased by 8.5%.âBitcoin to US dollar forecasts are currently focusing on macro events, Eberle added, specifically the Fedâs interest decisions, the future outcomes of the Russia-Ukraine conflict and the US midterm elections that are due to take place on 8 November. In addition, Eberle added some historical outlook concerning bitcoinâs past halving events:

âIn 2015 BTC bottomed 547 days before the halving and in 2018 is occurred 517 before. The next halving is estimated to happen in April or May of 2024 so if history repeats we should be nearing the beginning of the next bull market.âBTC/USD forecast 2022 and beyondDespite the latest downward price action, algorithm-based forecasting service Wallet Investor gave a bullish BTC/USD forecast at the time of writing (12 October). The site noted that BTC was âa very good long-term investmentâ.

Based on its analysis of past price performance, WalletInvestor predicted that BTC/USD could trade at $25,373.90 in 2023 and surge to $47,496.74 in 2027.

DigitalCoinPrice supported the positive BTC/USD forecast but saw a speedier pace of growth in the following years, expecting the cryptocurrency to reach $24,206.47 by the end of 2022 and $43,340.43 by the end of 2023.

Its BTC/USD forecast for 2025 showed the cryptocurrency reaching $77,238.07 on average and $94,929.40 in 2027. The platformâs long-term BTC/USD forecast for 2030 expected the cryptocurrency to surge to $266,189.92 on average.

Lian did share the bullish sentiment on BTC to USD forecast:

âBitcoin price hovers around $19,400, up 1.9% in the last week. Zooming out, it has gained 1% in value for the past 30 days. Unless we see the S&P 500 go down to 3200, bitcoin can go below the $13,000 region, else I think it will continue to trend sideways for the next few weeks.âHowever, Lian noted that a positive aspect to highlight would be bitcoinâs hash rate which continues to surge.

Note that BTC/USD predictions can be wrong. Analystsâ and algorithm-based predictions shouldnât be used as a substitute for your own research.

Always conduct your own due diligence on the stock before trading, looking at the latest news, a wide range of analyst commentary, technical and fundamental analysis. Note that past performance does not guarantee future returns. And never trade money you cannot afford to lose.

Source: https://capital.com/btc-usd-forecast-dollar-bitcoin-price

The post BTC / USD forecast: Can bitcoin reverse downward trend as crypto winter bites? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 11, 2022

TVCC Interviews Anndy Lian, Book Author of NFT: From Zero to Hero

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

TVCC Interviews Anndy Lian, Book Author of NFT: From Zero to Hero

TVCC, a South Korea-based media company interviewed Anndy Lian, book author of NFT: From Zero to Hero at TOKEN2049 week in Singapore. Anndy introduced his new book and why it is “Zero to Hero”.

NFTs took 2021 by storm. With billions traded over NFTs and a strong community behind the technology, weâre seeing NFTs adopted by industries as diverse as gaming, finance, art, and medicine. The sales volume for NFT has been declining for various reasons, but NFT is already deeply rooted in everyone’s mind.

The potential applications of NFTs are nearly endless. Some claim ten years from now, all purchases will be accompanied by NFTs. Others think smart contracts will replace legal documents. And while many think NFTs are a fad or too niche to become widely used, big players from Meta (formerly Facebook) to Twitter to Reddit and Visa are taking notice and are working to ensure they donât miss out on the NFT boom.

“The future these NFT trends depict is an interesting one. While many people are concerned about the implications of the metaverse and the rise of AI, itâs a future full of possibilities.

Itâs a future that bridges the gap between consumers and creators, gives value and security to digital assets, and one which, for better or for worse, will shake up the world.” Anndy Lian commented.

Anndy also mentioned his NFT book launch on Bybit NFT Marketplace. He believes that pricing is very important in the current market, and Bybit’s Grabpic program fits perfectly with what the market wants. Find out more about Anndy’s book on Bybit. Bybit- NFT Book: https://www.bybit.com/en-US/nft/collection/detail?code=1006691081657516032 (You can get more gifts here and surprises here. Sign up at https://partner.bybit.com/b/zerotohero)

You can also get Lian’s book on Amazon and Google Books too.

Amazon Books- Ebook and paperback: https://www.amazon.com/Anndy-Lian/e/B0BCK7W9BK

Google Books- Ebook: https://books.google.com.sg/books?id=OSqFEAAAQBAJ&pg

The post TVCC Interviews Anndy Lian, Book Author of NFT: From Zero to Hero appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

October 6, 2022

NFT Back to Basics: 5 + 5Ps of Marketing

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

NFT Back to Basics: 5 + 5Ps of Marketing

The 5 P’s of Marketing â Product, Price, Promotion, Place and People â are key marketing elements used to position a business strategically. Most of us, whilst still understanding what makes an NFT valuable, have forgotten that these are also the key elements for an NFT project to succeed. The industry is filled with people who are focusing on short-term hypes and price pumps. This is more obvious when the market is bullish; all kinds of projects get a price push upwards no matter what you launch and draw.

The NFT global sales figures for September are at $507 million. January sales figures were at their peak, at $4.7 billion. This is the 8th consecutive month of dips and almost a 90% dip from its peak. Having said so, the basics of marketing come in handy and timely. We will dive into the basics, 5Ps and an additional 5 more tailored to the NFT markets to make this a perfect 10.ProductIn the NFT era, tales say that you only need to make a nice profile picture, and you will sell them like hot cakes. Well, a nice picture would surely draw some form of attention to what you are offering, but it is not enough. You need to have a product and a theme behind what you are trying to do. If today, your NFT offering is a high-end membership, then apart from using the NFT to identify yourself, you need to offer maybe a members club venue at a high-end location to make it attractive. This is part of your product offering, and you need to fulfil it.

Take another example for discussion purposes. You are an NFTÂ yield product, and you promise all your holders that they can get a 30% yield per annual. Then the bare minimum thing you need to do is honour your product offering. It may sound simple to many of you right now, but in these current bearish times, many of such offerings cannot be fulfilled anymore.

PriceThe price element refers to setting prices for your NFTs and their services. Forget about selling your NFTs at 100 ETH at the current market conditions. You should know who your people are, and how much they are willing to pay for your NFTs. I would at times suggest putting up a survey to get your community to determine the price and not pure guessing.

Bybit NFT Marketplace launched its GrabPic programme, and it has received positive feedback from its users. They have good projects at a low starting price, attracting new users and aspiring projects together on their marketplace to grow with them. So far, all those who have listed on to their new program are all sold out. I have seen projects offering 5,000 to 10,000 pieces of NFTs, and all sold out. My book “NFT: From Zero to Hero” was the first to be launched on that program. The price point of $2.99 that was determined by Bybit works perfectly because they know their users. The secondary markets look healthy too with a total trading volume of $187,460. Therefore, I recommend to all price their NFTs according to your people instead of just looking at the market.

Place

Both place and placement are used to talk about this P. If you are a crypto native, your target audiences are mainly residing in your community. If you are a traditional brand going into the NFT space, you may be targeting a particular geographic area, the population of the area, the buying power of the area, and the spending patterns of people in the area. The most important question is, are those people willing to convert their money to cryptocurrency to buy it? Do they know how to use a decentralised wallet?

Again, using the above example again on the second P. I launched my NFT book on a centralised exchange as my followers and community members are mainly crypto natives, and they understand the process of buying an NFT using cryptocurrencies like USDT, BNB, ETH etc. Those not in the crypto space but keen to experience what an NFT book is like can register an account with the exchange using a user id and password. It is easy for them to navigate.

PromotionAfter you know where to promote your product, it’s time to turn ideas into action. NFTs are used in marketing strategies as advertising tools, PR strategies, events promotions and more. The promotion covers every strategy you use to sell your product, and it is what connects to revenue. Inbound marketing, direct sales, press launches, everything comes in the promotion.

Suppose you are a small-budget project, just like me. Focus your promotion around the community partners that you are familiar with. This is a win-win situation, especially in bearish times where everyone is trying their best to promote themselves. Coming together and staying united is an excellent way to create more buzz for everyone. Having said so, I know projects which are still spending hundreds of thousands on Twitter advertisement placements and promotions. If your target audiences are there and you get back good revenue, why not?PeopleTo truly stand out, NFTS must make customers and their long-term satisfaction the heart of everything they do. By winning the hearts of your community, you will grow better. People are one of the hardest to manage. You need to know their characteristics, behaviour, preferences and when to do the things that bring everyone together. I had good friends, but some of them are no longer friends, frankly. The typical failure for most of them is that they spent a lot of time talking- AMA, Twitter Spaces and 1-1 calls. There are a lot of big talks, but no actions. Community members are not dumb, and they can sense your sincerity.

The people factor is also amplified in the crypto space, where everything is 24/7 and global. Community expectations go higher than product features. They expect to be treated well, and available constantly, and they expect you to be listening to them if you are positioned as a ‘community-owned project’. Lastly, the synergy within your team. You must take into account your staff and their roles. It is very sad to see projects led by volunteer investors who are mostly not professionals, and they take time off and go MIA from time to time. Such a structure will not work in the long run and is not sustainable.

In some cases, the developers are anonymous. They used KYC documents of their community members, who are technically not the owners of the project. The problem will arise when the developers go AWOL, or the project goes south, and the person who did the KYC will be responsible for any wrongdoings. This is a significant risk for everyone. My sincere advice is- Do it right.

Apart from the traditional 5Ps that we know, I would like to add 5 more.

PatienceThe most expensive and most popular NFT art, then Beeple’s piece titled ‘Everydays â The First 5000 Days’. This collage masterpiece took 13 years to make, and more than 5,000 digital images are on it. It was sold for $69.3 million. He took 13 years to make the sale, which is reasonable, but in today’s NFT world, everyone is pampered, and they expect to flip them in days.

PositioningPositioning is very important. This is a term used to describe how a brand is seen by consumers, how it stands out from rivals’ products, and how it differs from the idea of brand awareness. A small-time author like myself needs to position my NFTs and relate to my community. A big-time exchange needs to position itself in many ways. NFT Exchanges, in particular, need to position themselves in the most strategic manner. NFT exchanges are the rising stars in the crypto market. It is the bridge for non-crypto users to us. In time to come, centralised NFT exchanges will be walking down the path of exclusivity. AAA games that will eventually get into the crypto space will decide which centralised exchange they will use exclusively to sell their gaming assets. I mentioned the word centralised a few times in this short paragraph because processing is faster, responsibility and customer satisfaction are stronger, the fees are lower, and there is no need to go on-chain for all the assets in the short term. Hence I will expect NFT marketplaces to grow very swiftly in the years to come.

PackagingAfter you have positioned yourself, you need to start packaging. To me, the packaging is the action item for your positioning and branding. If you are a project that is positioned to be a Green and Charitable NFT project. Then you need to pack yourself with all the related marketing, events and PR that link back to your brand.

ParticipationThis is closely related to the People element. There are many cases where there are 50,000 community members, but you cannot even sell 5 of their NFTs to them. This kind of outcome to me is zero participation. Your NFT may not be what they want, or maybe you have not done enough marketing to convince them that this NFT is worthy. The other wayside to this is over-participation. I have seen projects which promised the sky to their community, and their community works very hard to spread the word. The NFT sold well, with 1000% participation, but the fulfilment part is bad. Their game is not launched on time, or the NFT does not work in the game. Overall, over-participation is still a good thing.

PacingNFT projects have got to pace themselves in these current market conditions. Let’s say you have a good concept and the NFTs are all ready. You need to pace yourself with the market to get the best outcome for your project. If you choose to do it when the market is bad, you have to look into the 5Ps more carefully, and pricing is a sensitive one. Once you have already launched your NFT project; you should pace yourself to introduce new utilities and developments and not show all your hand at the start and do nothing after. Pacing is an art.

PumpedThis is the best-case scenario. If you have done the above in the right place, right timing, good product and so forth. Your NFT project is all pumped up in price, and your community is all-time active.

You need to maintain your lead and good results. Therefore, it is time for you to revisit all the 10 Ps again and go back to the basics.

Anndy Lian is the author of the book “NFT: From Zero to Hero“

Source: https://www.financemagnates.com/cryptocurrency/nft-back-to-basics-5-5ps-of-marketing/

The post NFT Back to Basics: 5 + 5Ps of Marketing appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.

Anndy Lian, Author “NFT: From Zero to Hero” Goes on Binance Live: How to be a Crypto and NFT Hero?

Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore

Anndy Lian, Author “NFT: From Zero to Hero” Goes on Binance Live: How to be a Crypto and NFT Hero?

Anndy Lian speaks to Diana on Binance Live, a live stream video hub by Binance about his new book titled “NFT: From Zero to Hero”.

Diana walks through all 9 Chapters of Anndy’s book.

Chapter 1: The Beginning, Web 1, 2, 3

Chapter 2: An Overview of the NFT Industry

Chapter 3: What Are the Necessary Tools Available?

Chapter 4: How To Spot A Good NFT Project?

Chapter 5: How To Make an NFT?

Chapter 6: Case Studies

Chapter 7: Predictions for the Future of Art NFTs

Chapter 8: NFT Trends Shaping the Future of NFTs

Chapter 9: Insights Into the Future

The future of NFT is still very bright. A number of countries are now actively working on regulatory frameworks for NFT assets, strengthening anti-fraud and anti-manipulation audits of projects, determining the business core of each platform, and solving financial security issues such as illegal fundraising and false fraud.

At the same time, major public chains are actively upgrading, expanding, and building their own ecological frameworks to provide underlying support for the production, confirmation, pricing, circulation, and traceability of NFT assets.

Due to the short development history of NFTs, we are still in the infancy of the industry, but we can still see its rapid development and gradual maturity. It is believed that under the transformation of the market, the improvement of supervision, and the gradual improvement of the ecosystem, then the future of NFTs will never be just about hype but will become an indispensable part of future technological life.

The NFT space is fast-changing. While writing this, new NFT projects are popping up every day. From the Busan Metropolitan Government in Korea announcing an NFT conference to the International Cricket Council launching cricket NFTs to CoinRunners crowdfunding a movie by selling NFTs.

“We should embrace technology and build the ecosystem together. Crypto is still young and we are all pioneers in this field. If you want to be an NFT Hero. Join me.” Anndy Lian

Binance is a cryptocurrency exchange which is the largest exchange in the world in terms of daily trading volume of cryptocurrencies. Changpeng Zhao, who goes by CZ, is the founder and CEO.

Find out more about NFT: From Zero to Hero by Anndy Lian on Amazon: https://www.amazon.com/NFT-Zero-Hero-Anndy-Lian/dp/9811850887/

Source: https://www.binance.com/en/live/video?roomId=2110403

The post Anndy Lian, Author “NFT: From Zero to Hero” Goes on Binance Live: How to be a Crypto and NFT Hero? appeared first on Anndy Lian | Inter-Governmental Blockchain Adviser | Book Author | Investor | Board Member | Singapore by Anndy Lian.